Valvoline Bundle

How Does Valvoline Thrive in Today's Automotive Market?

Valvoline, a titan in the automotive world for over 150 years, has strategically reshaped its focus, making it a fascinating case study for investors and industry watchers alike. Following a significant divestiture in 2023, the company has doubled down on its high-growth Retail Services segment. This shift underscores Valvoline's commitment to adapting and excelling in a competitive landscape.

This deep dive into the Valvoline SWOT Analysis will explore the company's business model, revealing how Valvoline generates revenue through its expansive network of service centers and innovative Valvoline products. Understanding Valvoline services and its operational intricacies is key to grasping its enduring success and future potential. Examining Valvoline's history and current strategies provides valuable insights for anyone interested in the automotive aftermarket and How Valvoline works.

What Are the Key Operations Driving Valvoline’s Success?

The core of how the Valvoline company operates revolves around its quick-lube service centers, primarily under the Valvoline Instant Oil Change (VIOC) brand. This network provides rapid oil change services, typically completed in about 15 minutes, catering to individual consumers. Beyond oil changes, the centers offer a range of preventative maintenance services designed to extend vehicle lifespan and optimize performance.

The value proposition of Valvoline lies in its ability to offer efficient and reliable automotive maintenance. This includes services like tire rotations, fluid exchanges, and battery checks. The company focuses on speed, convenience, and a standardized, high-quality service experience, setting it apart from traditional auto repair shops and smaller independent quick-lube operators.

The operational processes are highly streamlined, with a drive-through model to minimize wait times. Technicians are trained to perform multi-point inspections systematically. Supply chain management ensures the consistent availability of Valvoline-branded lubricants, filters, and other automotive parts. The company’s business model leverages a combination of company-owned stores and franchised locations.

Valvoline Instant Oil Change centers offer quick oil changes, tire rotations, fluid exchanges, and battery checks. These services are designed to be efficient and convenient, often completed without an appointment. The focus is on providing comprehensive vehicle maintenance to meet the needs of everyday drivers.

The drive-through model and trained technicians ensure quick service times. Supply chain management is critical for maintaining the availability of Valvoline products. The company’s hybrid model of company-owned and franchised stores supports both quality control and expansion.

Customers benefit from time savings, transparent service recommendations, and reliable vehicle maintenance. The standardized service experience ensures consistent quality across all locations. The convenience of no-appointment oil changes and other services is a key differentiator.

Valvoline uses a dual approach with both company-owned and franchised stores. This allows for direct control over service quality and accelerated expansion. The franchise model provides opportunities for entrepreneurs to invest in a well-established brand.

Valvoline distinguishes itself through speed, convenience, and a commitment to standardized, high-quality service. This approach contrasts with traditional auto repair shops and smaller quick-lube operators. The focus on customer satisfaction and efficient operations drives the company's success.

- Quick Oil Changes: Typically completed in about 15 minutes.

- Preventative Maintenance: Offering services beyond oil changes.

- Convenience: No-appointment service model.

- Brand Recognition: Leveraging the strong reputation of Valvoline lubricants.

To understand Valvoline's competitive position, it's helpful to look at the Competitors Landscape of Valvoline. The company's focus on speed, convenience, and a standardized service experience differentiates it in the market.

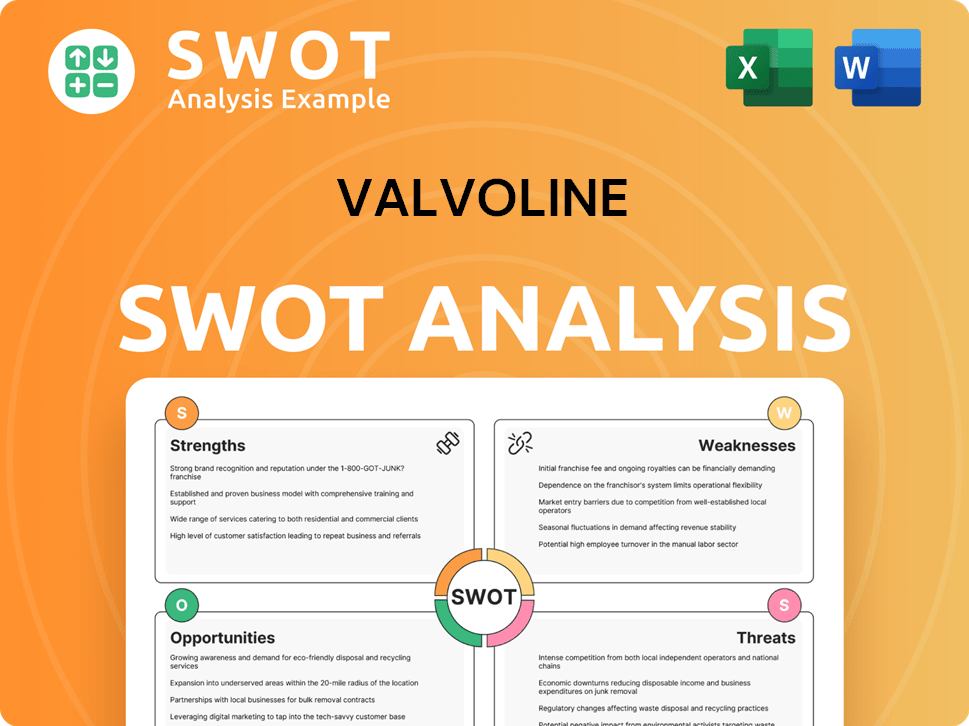

Valvoline SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Valvoline Make Money?

Understanding the revenue streams and monetization strategies of the Valvoline company is key to grasping its operational dynamics. The company's approach to generating income is multifaceted, focusing primarily on its service-based business model. This involves a combination of direct service sales and franchise operations, which contribute significantly to its financial performance.

Valvoline's revenue model is designed to maximize profitability through various service offerings and strategic partnerships. The company leverages its brand recognition and operational expertise to drive revenue growth. This includes a focus on customer retention and expansion through both company-owned and franchised locations.

The core of How Valvoline works revolves around its Retail Services segment, particularly the Valvoline Instant Oil Change (VIOC) service centers. This segment is the primary source of revenue, driven by services provided directly to customers and franchise royalties. The company's ability to generate income is closely tied to the efficiency and effectiveness of these service centers.

Valvoline's revenue streams are primarily generated through its Retail Services segment, which includes both company-owned and franchised Valvoline Instant Oil Change (VIOC) service centers. In fiscal year 2023, this segment reported revenue of approximately $1.5 billion. The company monetizes its services through a variety of strategies, including tiered pricing and bundled services.

- Direct Service Sales: Revenue from oil changes, tire rotations, and other vehicle maintenance services performed at company-owned VIOC locations.

- Franchise Royalties: Ongoing payments from franchisees, typically a percentage of gross sales, providing a steady revenue stream without direct operational costs.

- Product Sales: Though the manufacturing and broad distribution of Valvoline products are handled separately, the sale of these products within service centers contributes to revenue.

- Tiered Pricing: Different prices for various oil types (conventional, synthetic blend, full synthetic) allow for revenue optimization based on customer preferences and needs.

- Bundled Services: Offering packages that combine multiple services (e.g., oil change, filter replacement, and vehicle inspection) to increase the average transaction value.

- Cross-Selling: Recommending additional services based on vehicle inspections to address preventative maintenance needs and increase revenue per customer.

- Franchise Expansion: The company continues to grow its footprint, adding 130 new stores in fiscal year 2023, and planning to add 150-170 new stores in fiscal year 2024, expanding its service-based revenue.

For more insights into the company's strategic direction, consider reading Growth Strategy of Valvoline.

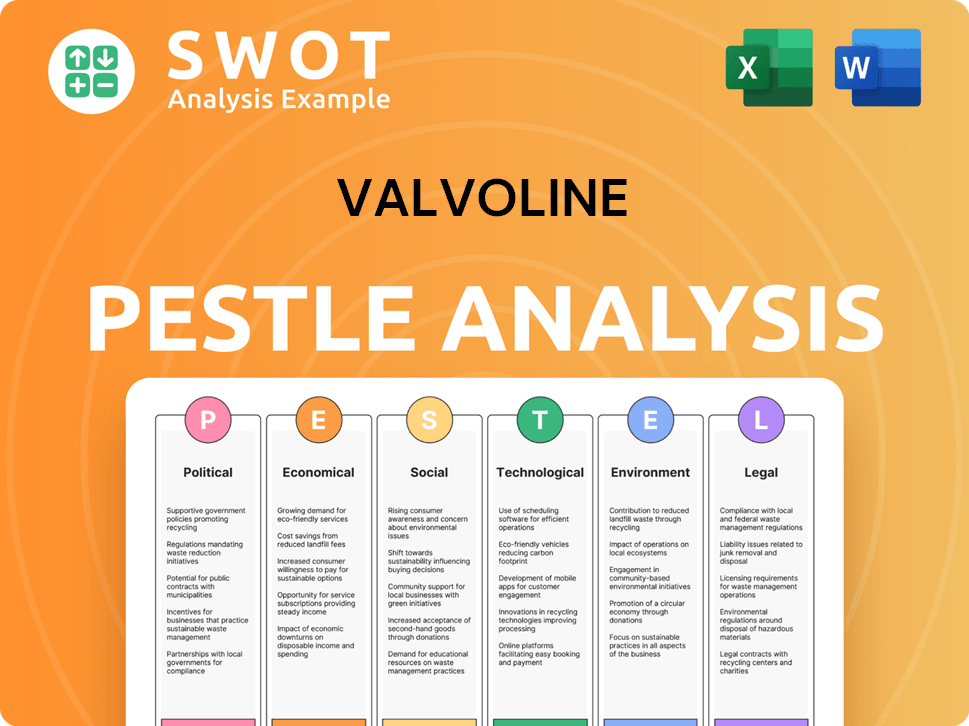

Valvoline PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Valvoline’s Business Model?

A significant turning point for the Valvoline company was the strategic sale of its Global Products division to Aramco in February 2023, a deal valued at $2.65 billion. This move allowed Valvoline to concentrate its resources solely on the Retail Services segment, which is geared towards higher growth. This strategic shift simplified operations and enabled a more focused approach on the quick-lube model, known for its profitability.

Operationally, Valvoline has consistently expanded its service center network. As of the fiscal year 2023, the company had approximately 1,900 locations across the U.S. and Canada. This expansion included the addition of 130 new stores during that fiscal year, reflecting a proactive response to the market's demand for accessible automotive maintenance services. The company's growth strategy is clearly focused on increasing its footprint and enhancing its service offerings.

Valvoline's competitive advantage stems from its strong brand recognition, built over more than 150 years, and its extensive network of service centers. The Valvoline Instant Oil Change (VIOC) brand benefits from high customer loyalty. This is due to its emphasis on speed, convenience, and a standardized service experience that customers trust. The 'stay-in-your-car' model offers a differentiated customer experience, saving time and increasing convenience. Furthermore, the company's large network allows for efficient supply chain management and marketing efforts.

The divestiture of the Global Products business in February 2023 for $2.65 billion was a major strategic move. This allowed Valvoline to focus on its Retail Services segment. The company has consistently expanded its service center network, reaching approximately 1,900 locations by the end of fiscal year 2023.

The company's focus on the Retail Services segment shows a strategic pivot towards higher-growth areas. Expansion of the service center network, with 130 new stores in fiscal year 2023, demonstrates a commitment to growth. This expansion strategy is in response to the increasing demand for convenient automotive maintenance.

Valvoline benefits from strong brand recognition built over 150 years. The Valvoline Instant Oil Change (VIOC) brand fosters high customer loyalty. The 'stay-in-your-car' model offers a differentiated customer experience. Economies of scale from its large network allow for efficient supply chain management.

Valvoline continues to adapt to new trends by focusing on preventative maintenance services. The company is catering to the increasing lifespan of vehicles. Ongoing expansion plans show a commitment to leveraging its competitive edge. For more insights into the company's financial performance, you can refer to Owners & Shareholders of Valvoline.

Valvoline's competitive strengths include its established brand and extensive service network. The company's focus on quick and convenient service enhances customer loyalty. Operational efficiency and economies of scale contribute to its market position.

- Strong Brand Recognition: Over 150 years of brand presence.

- Extensive Network: Approximately 1,900 service centers in the U.S. and Canada.

- Customer-Focused Service: Emphasis on speed, convenience, and trust.

- Operational Efficiency: 'Stay-in-your-car' model and efficient supply chain.

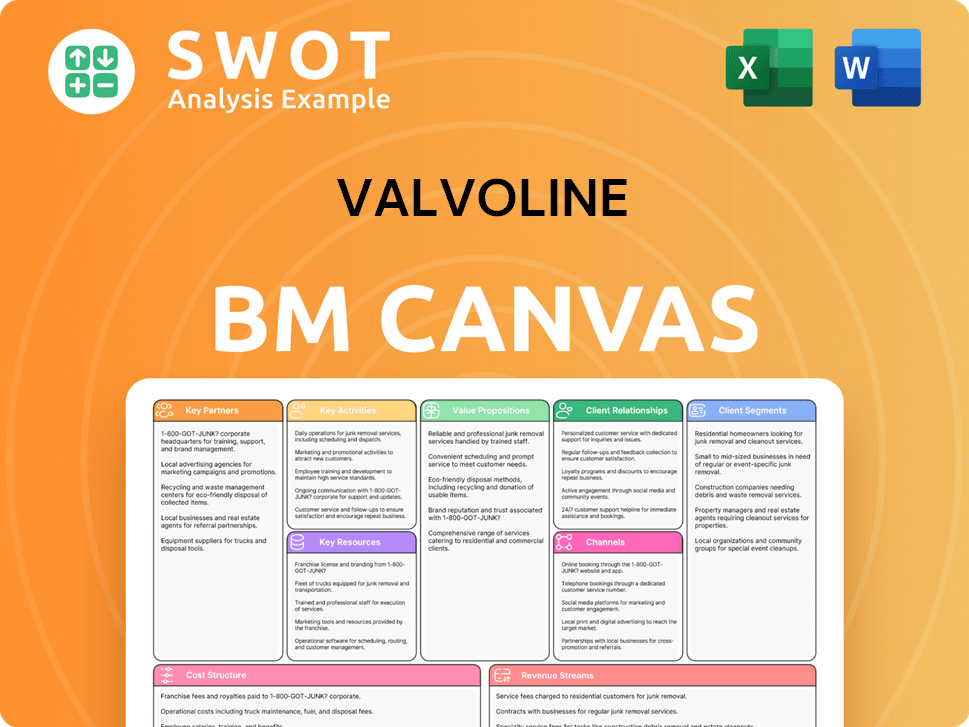

Valvoline Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Valvoline Positioning Itself for Continued Success?

The Valvoline company holds a significant position in the automotive aftermarket services sector. As the second-largest quick-lube operator in the U.S. by store count, with approximately 1,900 service centers, its brand recognition and customer loyalty are key assets. The company's focus is primarily on its Retail Services operations within the U.S. and Canada.

However, Valvoline faces several risks, including economic downturns affecting consumer spending, intense competition, and the shift towards electric vehicles (EVs). Regulatory changes and evolving vehicle technologies also present potential challenges. Despite these hurdles, Valvoline is actively pursuing strategic initiatives to maintain and expand its market position.

The company is the second-largest quick-lube operator in the U.S. by store count. Valvoline benefits from strong brand recognition and customer loyalty. Its Retail Services segment is primarily focused on the U.S. and Canada.

Economic downturns may impact consumer spending on vehicle maintenance. Intense competition from other quick-lube chains and independent shops exists. The rise of EVs poses a long-term risk to the company's core services.

Valvoline plans aggressive expansion of its service center network. The company focuses on enhancing customer experience through digital initiatives. It aims to expand service offerings to capture a larger market share.

The company is focused on adding 150-170 new stores in fiscal year 2024. It is committed to driving same-store sales growth. The focus is on being the preferred choice for car care.

The company's strategic initiatives are crucial for its future. Valvoline aims to maintain profitability through the expansion of its Retail Services segment and by adapting to changing vehicle technologies. The company also focuses on operational efficiency and a customer-centric approach. For more details, consider reading about the Growth Strategy of Valvoline.

- Expansion of Service Centers: Adding new stores to increase market presence.

- Digital Initiatives: Enhancing customer experience through online platforms.

- Service Expansion: Offering a broader range of preventative maintenance services.

- Adaptation to EVs: Exploring EV-related services to mitigate risks.

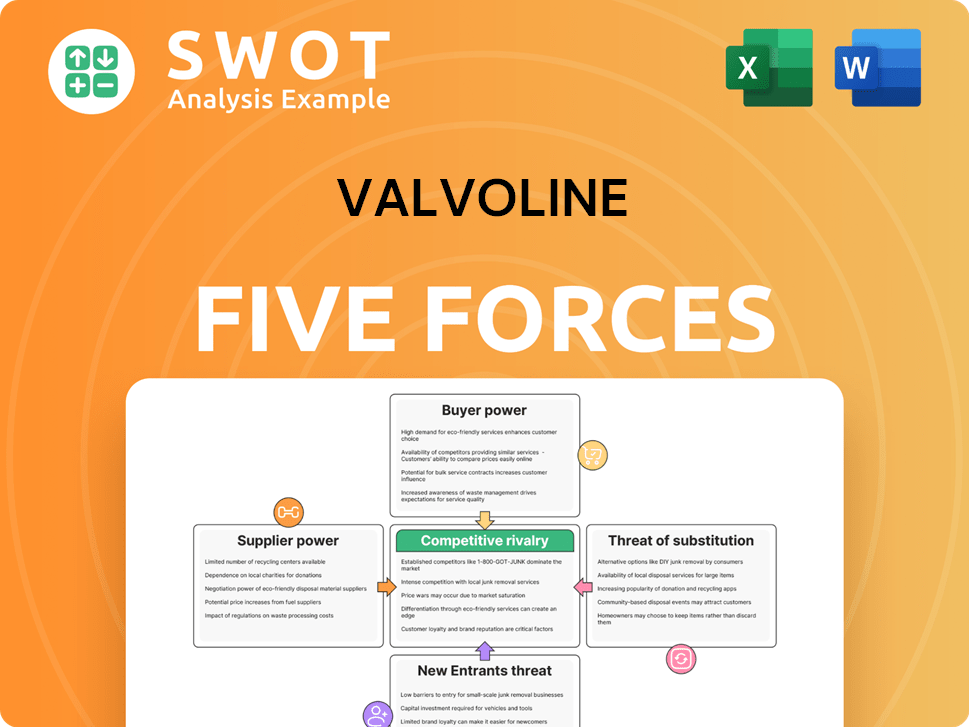

Valvoline Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Valvoline Company?

- What is Competitive Landscape of Valvoline Company?

- What is Growth Strategy and Future Prospects of Valvoline Company?

- What is Sales and Marketing Strategy of Valvoline Company?

- What is Brief History of Valvoline Company?

- Who Owns Valvoline Company?

- What is Customer Demographics and Target Market of Valvoline Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.