Valvoline Bundle

Can Valvoline Revitalize its Growth in the Evolving Automotive Landscape?

Valvoline, a titan in automotive maintenance for over a century, is navigating a dynamic industry. Following a significant strategic shift, including the divestiture of its Global Products business, Valvoline is now laser-focused on its quick-lube service model. This transformation raises critical questions about its Valvoline SWOT Analysis and future trajectory.

This in-depth analysis of the Valvoline growth strategy will explore its ambitious expansion plans and how it aims to maintain its Valvoline market share within a competitive environment. Understanding Valvoline's future prospects requires a close look at its innovative approaches and the challenges it faces in the rapidly changing automotive sector. We'll delve into a comprehensive Valvoline company analysis to provide actionable insights for investors and industry watchers alike.

How Is Valvoline Expanding Its Reach?

The company is actively pursuing a multi-faceted expansion strategy to drive future growth, focusing on accelerating network growth, entering new markets, and diversifying service offerings. This strategy is crucial for understanding the company's Valvoline growth strategy and its Valvoline future prospects.

A key component of this strategy is aggressive store expansion. The company aims to reach over 3,500 locations, supported by development commitments from large franchise partners. This expansion is a core element of the Valvoline company analysis, reflecting its commitment to increasing its market presence and accessibility.

A significant aspect of the company's expansion is its refranchising strategy. This approach allows the company to expand its footprint more rapidly by leveraging franchisee capital and operational expertise. This is part of the overall Valvoline business model, which includes both company-owned and franchised locations.

The company plans to add between 160 and 185 new stores in fiscal year 2025. This builds on the 158 net new stores added system-wide in fiscal year 2024, bringing the total to 2,010 locations. This rapid expansion is a key driver of the company's growth.

In fiscal year 2024, the company converted 28 company-owned stores to franchises in Las Vegas and Denver. In fiscal year 2025, the company planned to refranchise 38 service centers in Texas to a new franchisee, Velocity Auto Care. This strategy enhances the company's ability to expand.

The company is increasing non-oil change services, recognizing the significant potential for growth in this area. This includes services like tire rotations, battery replacements, and specialized maintenance for electric vehicles (EVs). The company is adapting to the changing automotive landscape.

The company's fleet business has shown strong growth, with system-wide fleet transactions increasing at a compounded annual growth rate of 14% over the past three years. This segment provides a significant opportunity for revenue growth.

The company Global Operations expanded its international presence by opening a new regional hub office in London in April 2025, strengthening its European footprint and global growth strategy. The acquisition of Breeze Autocare for $625 million in early 2025, which will add approximately 200 quick lube and maintenance service centers across 17 states, is another significant initiative to enhance market presence and drive future growth.

- The company's expansion into international markets is a key element of its long-term growth potential.

- The acquisition of Breeze Autocare is a strategic move to increase Valvoline market share.

- The company is focused on Valvoline expansion plans in both domestic and international markets.

- The company's Valvoline growth strategy in the automotive industry is multifaceted.

For further insights into the company's core values, you can read about the Mission, Vision & Core Values of Valvoline.

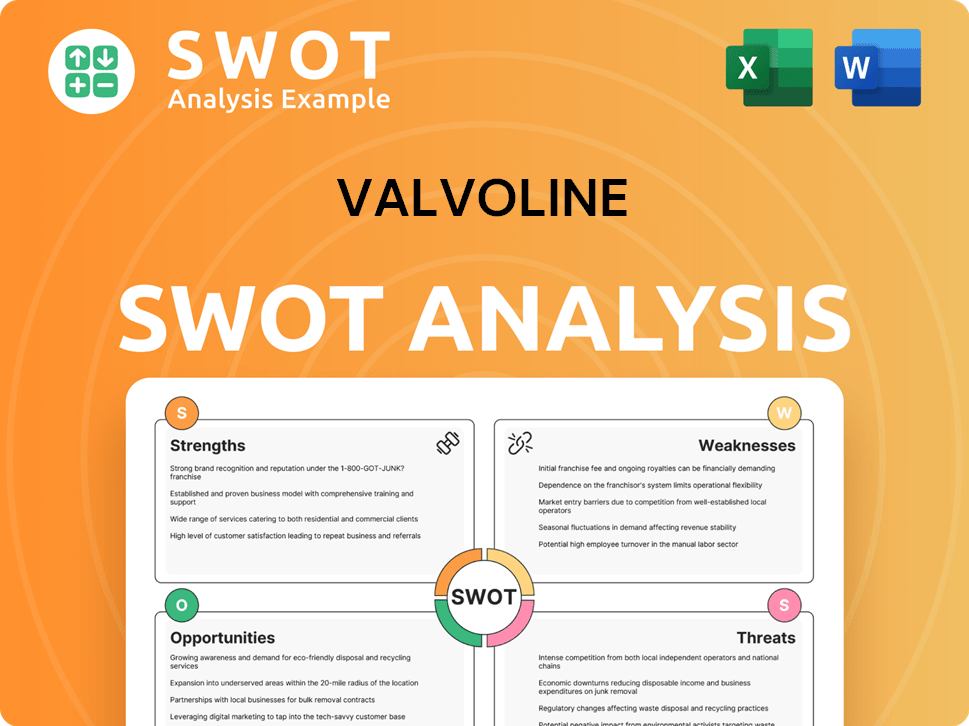

Valvoline SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Valvoline Invest in Innovation?

Innovation and technology are central to the Marketing Strategy of Valvoline, driving its growth and operational efficiency. The company invests heavily in research and development to create cutting-edge products. This includes developing fluids for electric vehicles (EVs) and advanced heat transfer solutions, demonstrating its commitment to adapting to future mobility trends.

Digital transformation is a key focus for the company, with the implementation of digital platforms to support its growth initiatives. This also involves the strategic application of AI and Machine Learning (ML) solutions to enhance supply chain resilience. Furthermore, the company is utilizing cloud-based and AI-enabled software to track carbon emissions and improve environmental reporting. These efforts underscore a commitment to sustainability and operational excellence.

Operational improvements are also a priority. The company aims to increase store efficiency, targeting service for 70 cars per day, up from 50, through operational enhancements and capacity expansion. Training programs are also emphasized to boost customer service and increase non-oil change revenue. The Aspiring Mechanics Program, established in 2024, reflects a proactive approach to addressing the global shortage of skilled technicians.

Focus on creating high-quality, innovative products. This includes motor oils and automotive chemicals. Adaptation to future mobility trends, like EVs, is a key area of focus.

Implementation of digital platforms to support growth. Utilizing AI and ML solutions for supply chain resilience. Employing cloud-based software for environmental reporting.

Increasing store efficiency, aiming for 70 cars serviced per day. Enhancing customer service through training programs. Boosting non-oil change revenue through improved service presentation.

Focus on training programs to enhance customer service and operational efficiencies. The Aspiring Mechanics Program is focused on educating and supporting future mechanics.

The company leverages technology to enhance service offerings and operational efficiency, which is crucial for its

- Developing specialized fluids for EVs and high-performance computing.

- Implementing digital platforms to support growth initiatives.

- Using AI and ML to improve supply chain resilience.

- Utilizing cloud-based solutions for environmental reporting and sustainability.

- Training programs to enhance customer service and operational efficiency.

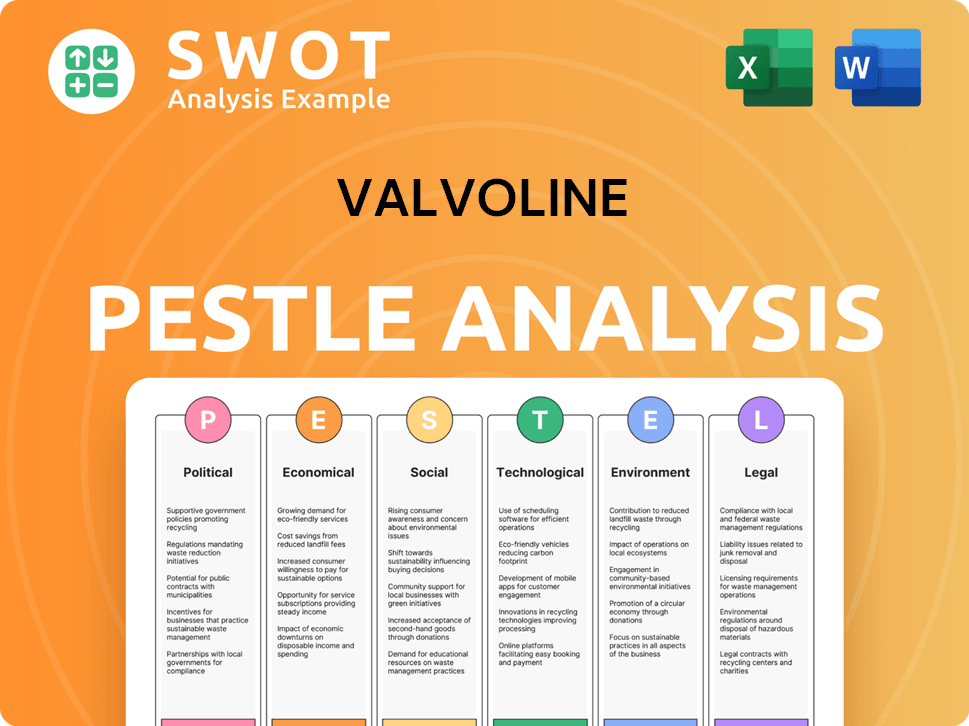

Valvoline PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Valvoline’s Growth Forecast?

The financial outlook for Valvoline reflects a strategy focused on sustained growth and strategic investments. The company's performance in fiscal year 2024 demonstrated strong revenue growth, with a 12% increase to $1.6 billion. This growth trajectory is expected to continue into fiscal year 2025, supported by expansion plans and operational efficiencies. The company is also focused on enhancing its market share and expanding its presence.

Valvoline's strategic investments are geared towards long-term growth, including technology upgrades, store enhancements, and expansion initiatives. These investments are designed to improve operational efficiency and support the company's growth strategy. The company's financial performance and future outlook are closely tied to its ability to execute these plans effectively.

For those interested in the company's origins, a Brief History of Valvoline provides valuable context.

Valvoline has reaffirmed its full-year EBITDA guidance, projecting between $450-$470 million. Net revenue guidance is set between $1.67-$1.73 billion. These projections reflect the company's confidence in its continued growth and strategic initiatives.

In the first quarter of fiscal year 2025, Valvoline reported net sales of $414 million, an 11% increase year-over-year. System-wide same-store sales grew by 8%. Adjusted EBITDA for Q1 2025 was $103 million, up 14% year-over-year, showing strong performance in the quick lube business.

The second quarter of fiscal year 2025 saw adjusted earnings per share (EPS) of $0.34. Revenue reached $403.2 million, slightly exceeding forecasts. The gross margin rate declined by 30 basis points to 37.3% in Q2 2025, reflecting the impact of strategic investments.

Valvoline anticipates capital expenditures of around $320 million in fiscal year 2025, an increase from $224 million in fiscal year 2024. This investment supports technology upgrades and expansion plans, crucial for long-term growth.

The company expects EBITDA margin to contract slightly to 28.4% in fiscal year 2025 due to investments. However, an improvement to around 31% is projected for fiscal year 2026. This indicates a focus on improving operational efficiency.

Valvoline maintains a robust gross profit margin of 38.37%, highlighting its operational efficiency. This strong margin contributes to the company's financial stability and supports its expansion plans. This is a key factor in Valvoline's competitive advantages in the market.

The company's return on assets is 10.72%, demonstrating efficient asset utilization. This metric reflects the company's ability to generate profits from its assets. This is a positive indicator for Valvoline's long-term growth potential.

Valvoline's expansion plans include new store additions and increased sales from existing stores. The company is actively pursuing growth through both organic expansion and acquisitions. These expansion plans are critical for Valvoline's future prospects.

The integration of the Breeze Autocare acquisition is a key part of Valvoline's growth strategy. This acquisition contributes to the company's expansion plans and strengthens its market position. This is an example of Valvoline's plans for mergers and acquisitions.

Challenges for Valvoline include managing costs and integrating acquisitions. Opportunities lie in expanding market share, particularly in international markets. The company's strategy for sustainable growth addresses these challenges.

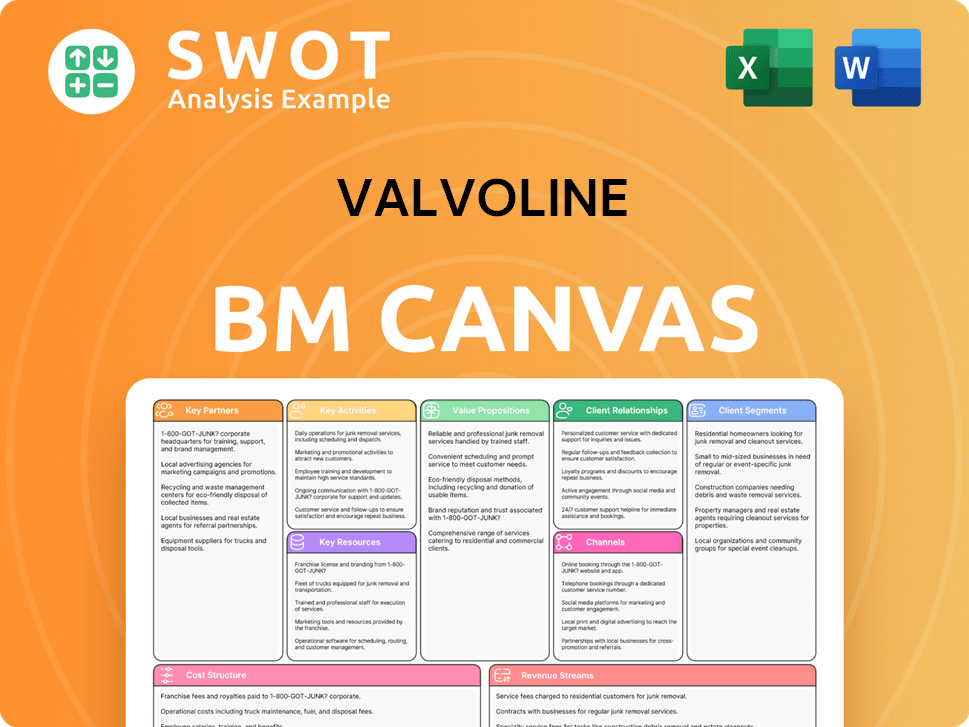

Valvoline Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Valvoline’s Growth?

The Valvoline growth strategy and its Valvoline future prospects are subject to several potential risks and obstacles. The automotive maintenance industry is highly competitive, and the company faces challenges from both large global brands and smaller regional players. Regulatory changes, technological disruptions, and internal operational issues further complicate its path forward.

A key aspect of the Valvoline company analysis involves understanding these challenges. The evolution of the automotive market, particularly the rise of electric vehicles (EVs), and the need to adapt service offerings pose significant considerations. Furthermore, the company must navigate supply chain vulnerabilities and internal resource constraints to maintain its growth trajectory.

The company's ability to successfully execute its expansion plans hinges on addressing these risks effectively. This includes adapting to technological shifts, navigating regulatory landscapes, and ensuring operational efficiency. Strategic responses, such as investments in EV services and supply chain resilience, are critical to mitigating these challenges and capitalizing on future opportunities.

The automotive maintenance market is intensely competitive. Valvoline market share is challenged by global integrated oil brands like Shell (Pennzoil, Quaker State), BP (Castrol), and ExxonMobil (Mobil1), as well as regional brands and automotive dealerships. Competitive factors include pricing, product technology, brand awareness, customer service, and marketing.

Regulatory changes and compliance present ongoing risks. The company must navigate evolving environmental regulations, including those related to low-carbon fuels. Staying compliant with these regulations is crucial for sustained operations and expansion.

Supply chain disruptions pose a significant risk. The need for innovative solutions to meet customer needs and investments in logistics and local sourcing is important for resilience. Addressing these vulnerabilities is critical to maintain service levels and manage costs effectively.

Technological advancements, particularly the rise of electric vehicles (EVs), present both challenges and opportunities. While EVs currently constitute less than 2% of vehicles in the U.S., their growing presence could impact demand for traditional oil change services. Adapting to this shift is essential.

Internal resource constraints and operational challenges can impede growth. Material weaknesses in IT general controls and the need to attract and retain skilled employees are important considerations. Addressing these internal challenges is crucial for supporting growth initiatives.

Refranchising efforts can impact EBITDA growth in the short term. The recent acquisition of Breeze Autocare introduces integration risks and an increase in leverage. S&P Global Ratings-adjusted leverage is projected to rise to 4.7x in fiscal 2025, though it is forecast to return below 4x in fiscal 2026.

The automotive maintenance industry's intense competition requires continuous innovation. Key competitors include global oil companies, regional brands, and dealerships. The Valvoline business model must adapt to factors like pricing, technology, and brand recognition. The company must continuously improve customer service and marketing to maintain and grow its market share.

The growing adoption of EVs presents a significant shift in the automotive landscape. While EVs currently represent a small percentage of vehicles, their increasing presence could decrease demand for traditional oil change services. Valvoline expansion plans must include specialized services for EVs, such as tire rotations, battery health checks, and thermal management fluid services.

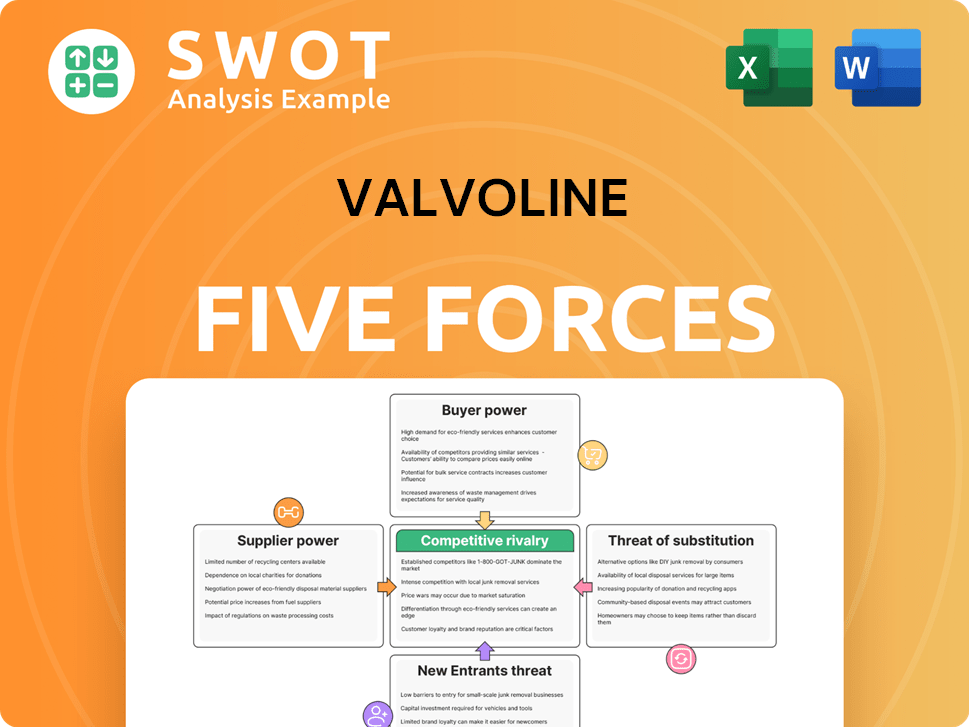

Valvoline Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Valvoline Company?

- What is Competitive Landscape of Valvoline Company?

- How Does Valvoline Company Work?

- What is Sales and Marketing Strategy of Valvoline Company?

- What is Brief History of Valvoline Company?

- Who Owns Valvoline Company?

- What is Customer Demographics and Target Market of Valvoline Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.