Valvoline Bundle

Who Really Owns Valvoline?

Unraveling the ownership structure of Valvoline is key to understanding its future in the automotive industry. Recent strategic shifts, including the sale of its Global Products business, have reshaped the company's focus and, consequently, its ownership dynamics. This deep dive explores the evolution of Valvoline SWOT Analysis and its ownership, from its origins to its current status as a pure-play service provider.

From its humble beginnings in 1866, Valvoline's journey has been marked by significant changes in its ownership and strategic direction. Understanding the Valvoline ownership structure is crucial for investors and analysts alike. This analysis will provide a comprehensive overview of the Valvoline parent company, its history, and the key players who shape its destiny, offering insights into the Valvoline company information.

Who Founded Valvoline?

The origins of the company, now known as Valvoline, began in 1866 with Dr. John Ellis. He founded the Continuous Oil Refining Company in Binghamton, New York. His discovery of the lubricating properties of distilled crude oil led to the creation of the world's first petroleum-based lubricant.

In 1868, Dr. Ellis rebranded his 'Binghamton Cylinder Oil' to 'Valvoline'. The company's trademark was officially registered in 1873. This marked a significant step in establishing the brand's identity and market presence. The early focus was on lubrication technology.

Dr. Ellis initially partnered with Ezekiel Crocker Leonard. Their collaboration, focused on manufacturing lubricating oil from petroleum for steam engines and other machinery, was key to the company's early development. While specific equity details are not publicly available, Dr. Ellis secured four patents for his innovative lubricant.

Dr. John Ellis's work led to the creation of the first petroleum-based lubricant. This innovation was crucial for the company's early success. The focus was on developing high-performance lubricants for various machinery.

The Continuous Oil Refining Company was formed through a partnership between Dr. John Ellis and Ezekiel Crocker Leonard. This collaboration was essential for the early operations and growth of the business.

The 'Valvoline' brand was established in 1868, and the trademark was secured in 1873. This branding was a critical step in differentiating the product in the market. The name became synonymous with quality lubricants.

The company initially focused on producing lubricants for steam engines and other machinery. The product range expanded to include petroleum jellies and kerosene illuminants. This diversification supported early revenue streams.

The company moved from Binghamton to Brooklyn, New York, and later to Shadyside, New Jersey. These moves reflected the company's growth and expansion. The changes were strategic for market access.

The early team's vision centered on innovation in lubrication technology. This focus drove the development of various petroleum products. This forward-thinking approach set the stage for future growth.

Understanding the initial ownership structure of the company provides insights into its early development. The company's history, from its founding to its evolution, is detailed in Brief History of Valvoline. Dr. Ellis's patents and the partnership with Leonard were critical to the early success. The company's relocation to Brooklyn and later to Shadyside marked significant steps in its expansion. The focus on innovation in lubrication technology was a key factor in its early market presence.

- Dr. John Ellis founded the company in 1866.

- Ezekiel Crocker Leonard partnered with Ellis.

- The company was initially named Continuous Oil Refining Company.

- The 'Valvoline' trademark was registered in 1873.

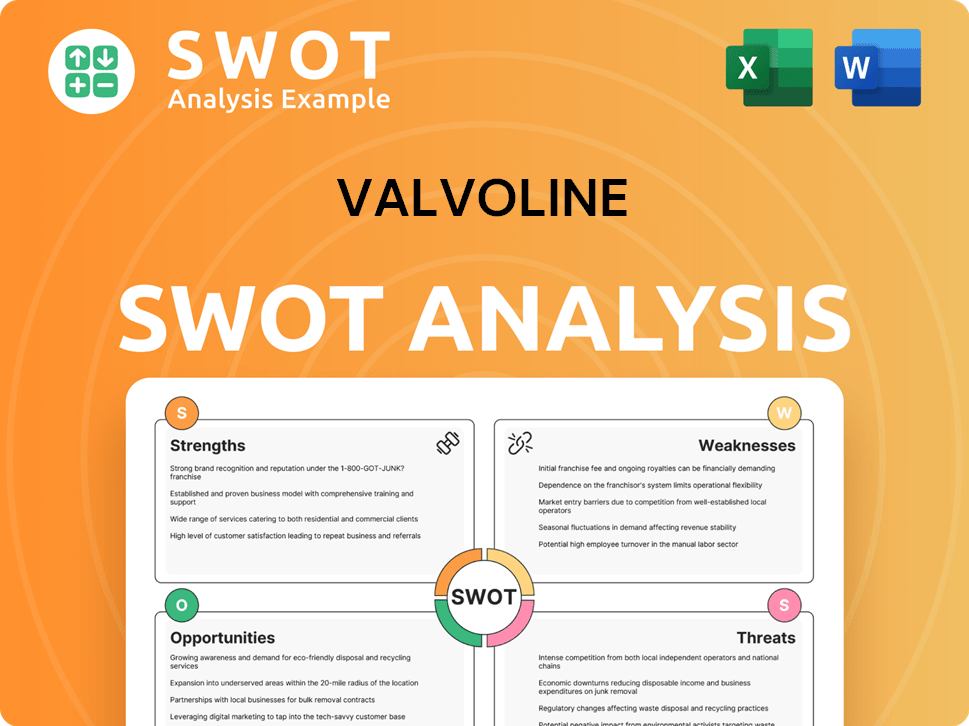

Valvoline SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Valvoline’s Ownership Changed Over Time?

The journey of Valvoline's ownership has been marked by significant transitions since its inception. Initially, in 1950, Ashland Oil Inc. of Kentucky took over Valvoline, setting the stage for decades of association. A pivotal shift occurred in 2016 when Ashland spun off Valvoline as an independent, publicly traded entity. This move culminated in an Initial Public Offering (IPO) on the New York Stock Exchange under the ticker 'VVV' on September 23, 2016. The IPO offered 30,000,000 shares to the public at $22.00 each, generating $660 million. Post-IPO, Ashland maintained a substantial stake, holding 170,000,000 shares, which represented 85% of Valvoline's outstanding common stock.

A major strategic realignment took place in 2022 when Valvoline finalized the sale of its Global Products business to Aramco for $2.65 billion. This transaction fundamentally altered Valvoline's business model, transforming it into a pure-play automotive service provider. This strategic pivot allowed Valvoline to concentrate exclusively on its retail service center operations, encompassing brands like Valvoline Instant Oil Change, Great Canadian Oil Change, and Valvoline Express Care.

| Event | Date | Impact |

|---|---|---|

| Acquisition by Ashland Oil Inc. | 1950 | Brought Valvoline under Ashland's ownership. |

| Spin-off and IPO | September 23, 2016 | Made Valvoline an independent, publicly traded company; raised $660 million. |

| Sale of Global Products to Aramco | 2022 | Transformed Valvoline into a pure-play automotive service provider. |

As a publicly traded entity, Valvoline's ownership is dispersed among a variety of institutional investors, mutual funds, index funds, and individual shareholders. The exact percentages held by major stakeholders fluctuate with market dynamics. Detailed information regarding Valvoline's ownership structure can be found in its SEC filings and annual reports. The 2025 Proxy Statement and the 2024 Annual Report are key resources for understanding the current ownership landscape. For more on the company's history, you can read more about Valvoline's [history and evolution](0).

Valvoline has evolved significantly, from being part of Ashland to an independent, publicly traded company.

- The IPO in 2016 marked a major shift, with Ashland initially retaining a significant ownership stake.

- The 2022 sale of the Global Products business to Aramco reshaped Valvoline's focus.

- Current ownership is distributed among institutional investors and individual shareholders.

- For the latest details, consult SEC filings and annual reports.

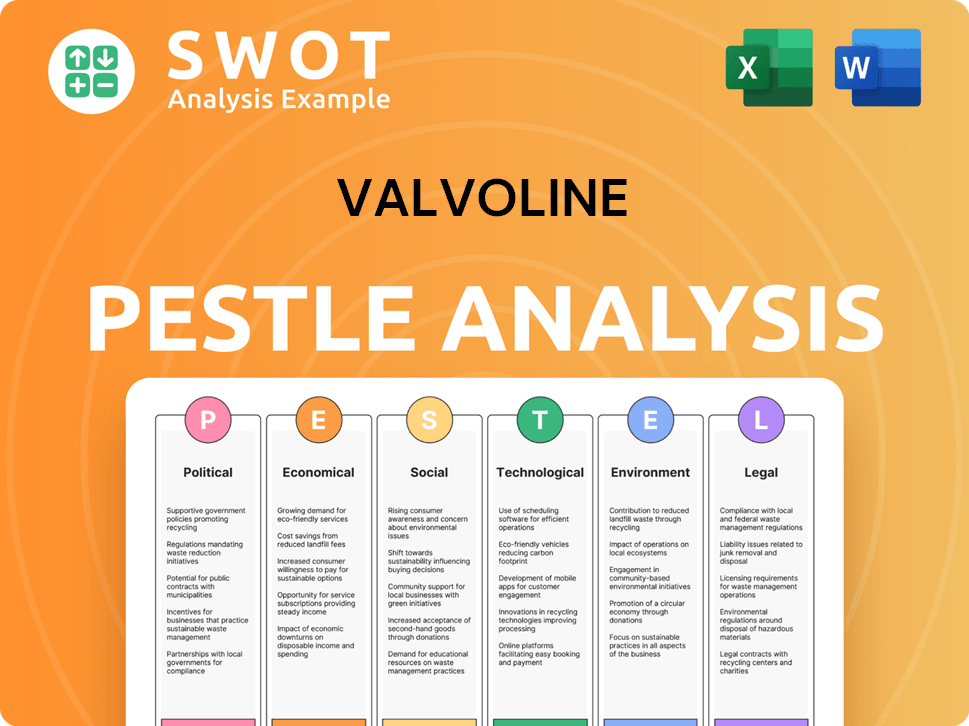

Valvoline PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Valvoline’s Board?

As of December 2, 2024, the Board of Directors of the company consists of nine members. The current board members nominated for election at the 2025 Annual Meeting include Gerald W. Evans, Jr., Lori A. Flees, Richard J. Freeland, Carol H. Kruse, Vada O. Manager, Patrick S. Pacious, Jennifer L. Slater, Charles M. Sonsteby, and Mary J. Twinem. Richard J. Freeland serves as the Chair of the Board. Lori Flees is the President and Chief Executive Officer and also serves as a director. Jennifer L. Slater, who has served as a director since July 2022, brings extensive knowledge of the automotive industry, including vehicle electrification.

The board's composition reflects a strategic focus on diverse expertise to guide the company's direction. The experience of the directors spans various fields, including finance, marketing, technology, and consumer goods, which is crucial for navigating the automotive industry. This diverse background supports the company's goals for strategic growth and profitability. Understanding the Growth Strategy of Valvoline is key to understanding the board's role.

| Board Member | Position | Key Expertise |

|---|---|---|

| Richard J. Freeland | Chair of the Board | Financial and Strategic Leadership |

| Lori A. Flees | President and CEO, Director | Executive Management, Automotive Industry |

| Jennifer L. Slater | Director | Automotive Industry, Vehicle Electrification |

The voting structure for the company's common stock is generally one-share-one-vote. As of May 5, 2025, there were 127,111,680 shares of the company's common stock outstanding and entitled to vote. In an uncontested election, a director nominee must receive the affirmative vote of a majority of votes cast to be elected to the Board. There is no indication of dual-class shares or special voting rights that would give individuals or entities outsized control.

The board's composition reflects a strategic focus on diverse expertise to guide the company's direction. The voting structure is straightforward, with each share generally carrying one vote.

- The board consists of nine members as of December 2, 2024.

- Directors are elected annually.

- The voting structure is one-share-one-vote.

- The board's expertise spans finance, marketing, and the automotive industry.

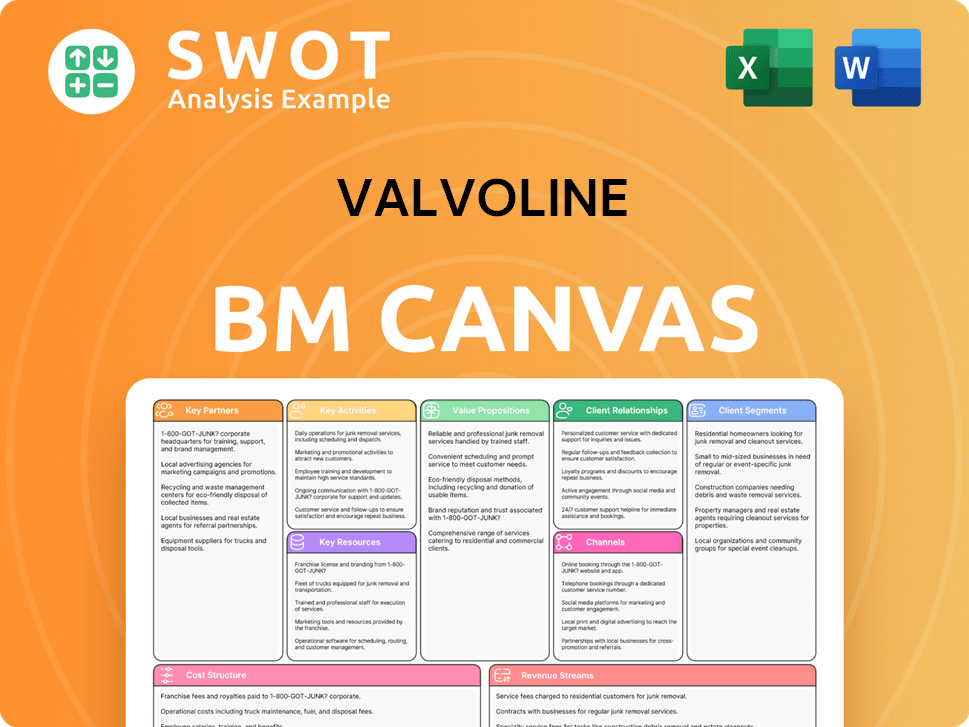

Valvoline Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Valvoline’s Ownership Landscape?

In recent years, the ownership structure of Valvoline has seen significant changes. The most notable shift was the sale of its Global Products business to Aramco in 2022 for $2.65 billion. This strategic move transformed Valvoline into a pure-play automotive retail services company, focusing on its quick-lube service center operations, including Valvoline Instant Oil Change.

This strategic realignment has allowed Valvoline to concentrate on expanding its service center network through new builds, acquisitions, and franchise partner development. The company is actively working to grow its presence, with a goal to reach over 3,500 locations. The company has also been refranchising some locations to accelerate network growth. Valvoline's focus on its core business and expansion strategy are key aspects of its current ownership and business model.

| Fiscal Year | Sales from Continuing Operations | Adjusted EBITDA |

|---|---|---|

| 2024 (ended September 30, 2024) | Increased by 12% to $1.6 billion | $443 million, up 17% year-over-year |

| Q1 FY25 (ended December 31, 2024) | $414 million, up 11% | N/A |

| Q2 FY25 (ended March 31, 2025) | $403 million, up 11% | N/A |

Financially, Valvoline has shown strong performance, particularly in its continuing operations. In fiscal year 2024, sales increased by 12% to $1.6 billion, and adjusted EBITDA reached $443 million, a 17% increase year-over-year. The company's commitment to returning value to shareholders is evident through its share repurchase programs. The company's financial health and strategic decisions are crucial for understanding the current Marketing Strategy of Valvoline.

The sale of the Global Products business to Aramco in 2022 for $2.65 billion significantly reshaped Valvoline's focus.

In fiscal year 2024, sales increased by 12% to $1.6 billion, with adjusted EBITDA of $443 million, up 17% year-over-year.

Valvoline returned $227 million to shareholders through share repurchases in fiscal year 2024. The company continued share repurchase program, returning $39 million to shareholders in Q1 FY25.

The company added 158 net new stores in fiscal year 2024, with a goal to expand to over 3,500 locations.

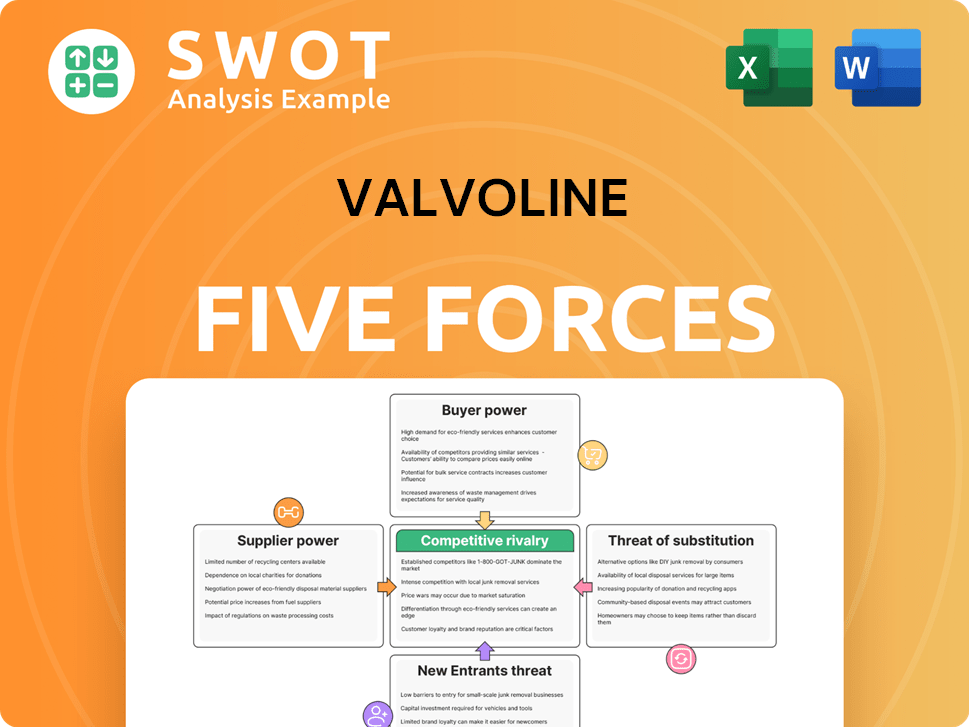

Valvoline Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Valvoline Company?

- What is Competitive Landscape of Valvoline Company?

- What is Growth Strategy and Future Prospects of Valvoline Company?

- How Does Valvoline Company Work?

- What is Sales and Marketing Strategy of Valvoline Company?

- What is Brief History of Valvoline Company?

- What is Customer Demographics and Target Market of Valvoline Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.