Vantiva Bundle

How Does Vantiva Stack Up in Today's Tech Arena?

Vantiva, formerly Technicolor, is a major player in the digital entertainment world, but how does it fare against its rivals? From its roots in the early days of cinema to its current focus on connected home solutions, Vantiva's journey has been one of constant adaptation. This evolution has positioned the company in a dynamic Vantiva SWOT Analysis, where understanding its competitive landscape is key.

To truly grasp Vantiva's potential, a deep dive into its Vantiva competitive landscape is essential. This analysis will explore Vantiva's market share analysis, key strengths and weaknesses, and strategic partnerships, offering insights into its Vantiva business strategy. Understanding Vantiva's competitive positioning and Vantiva competitors will help you assess its future outlook and navigate the challenges within the Vantiva industry.

Where Does Vantiva’ Stand in the Current Market?

The company operates primarily through two key segments: Connected Home and DVD Services. The Connected Home segment focuses on providing set-top boxes and modems to telecom operators and content providers globally. The DVD Services segment offers manufacturing, packaging, and distribution services for DVDs and Blu-ray discs, serving major Hollywood studios and independent content creators.

Vantiva's value proposition lies in its ability to deliver advanced connectivity solutions and media services. In the Connected Home segment, the company provides innovative products that enhance the consumer experience. In the DVD Services segment, it offers comprehensive solutions for physical media production and distribution. The company's strategic shift towards the Connected Home segment reflects its focus on growth within the broadband and video delivery technologies, aligning with the broader digital transformation trends.

The company's strategic emphasis on innovation and cost efficiency aims to maintain its competitive edge in a dynamic market, as highlighted in the Growth Strategy of Vantiva. Financially, Vantiva's scale, despite recent divestitures and restructuring, allows it to compete with larger industry players, leveraging its established customer relationships and global supply chain. For instance, in its Q3 2023 financial results, Vantiva reported a revenue of €517 million for the period, with the Connected Home segment showing resilience.

While exact market share data for 2024-2025 is not fully available due to the competitive landscape and confidential reporting, Vantiva has historically held a strong position in the Connected Home segment, especially in Europe and North America. The company’s focus on innovation and strategic partnerships contributes to its competitive positioning. The DVD Services segment faces a decline due to the shift towards digital distribution.

Vantiva has a global presence, serving customers across various regions. Its strongholds include Europe and North America, where it has established significant market share in the Connected Home segment. The company's global supply chain and customer base enable it to compete effectively in different markets. Vantiva's geographical diversification helps mitigate risks and capitalize on growth opportunities worldwide.

Key strengths include a strong position in the Connected Home segment, established customer relationships, and a global supply chain. Weaknesses involve the declining DVD Services segment and the need to adapt to rapid technological changes. The company's ability to innovate and manage costs is crucial for maintaining its competitive advantages. Vantiva's business strategy focuses on leveraging its strengths to overcome weaknesses.

Vantiva's competitive advantages include its diverse product portfolio, catering to various customer segments. The company's focus on innovation and cost efficiency helps it maintain a competitive edge in the market. Strategic partnerships and customer relationships also contribute to its ability to compete effectively against rivals. Vantiva's market analysis highlights these advantages.

Vantiva's financial performance is influenced by its two main segments: Connected Home and DVD Services. The Connected Home segment is a key revenue driver, with the DVD Services segment facing a decline. In Q3 2023, the company reported €517 million in revenue, with the Connected Home segment showing resilience. Revenue streams are diversified across product sales and service offerings.

- Connected Home segment revenue.

- DVD Services revenue.

- Focus on cost efficiency.

- Strategic partnerships.

Vantiva SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Vantiva?

Analyzing the Vantiva competitive landscape reveals a complex market environment. The company operates within segments that face both direct and indirect competition, requiring a nuanced understanding of its rivals and market dynamics. This analysis is crucial for assessing Vantiva's business strategy and its potential for future growth.

Understanding Vantiva's market analysis involves identifying key players and their strategies. The company's ability to adapt to evolving technological trends and competitive pressures will significantly impact its financial performance. This chapter provides a detailed overview of Vantiva competitors and their influence on the industry.

Vantiva faces a diverse array of competitors across its Connected Home and DVD Services segments. In the Connected Home market, direct competitors include major electronics manufacturers and telecommunications equipment providers. Companies such as CommScope (with its Arris and Ruckus brands), Sagemcom, and Huawei are significant rivals in the broadband gateway and video set-top box space. CommScope, for instance, offers a broad portfolio of network infrastructure and connectivity solutions, directly competing with Vantiva for contracts with large service providers. Sagemcom, a French company, is another strong contender, particularly in Europe, known for its extensive range of broadband terminals and set-top boxes. Huawei, despite geopolitical challenges, remains a formidable competitor globally, leveraging its scale and R&D capabilities in network equipment and consumer devices.

Direct competitors include major electronics manufacturers and telecommunications equipment providers.

These companies compete in the broadband gateway and video set-top box markets.

Offers network infrastructure and connectivity solutions.

Competes directly with Vantiva for contracts with large service providers.

A French company known for its broadband terminals and set-top boxes.

A strong contender, particularly in Europe.

A formidable global competitor in network equipment and consumer devices.

Leverages scale and R&D capabilities.

Smart TV manufacturers integrating advanced streaming capabilities.

Content providers offering direct-to-consumer streaming services.

Other disc replication and distribution companies.

Many have diversified or reduced operations in this area.

Indirect competition also arises from smart TV manufacturers integrating advanced streaming capabilities and from content providers offering direct-to-consumer streaming services, potentially reducing the reliance on traditional set-top boxes. In the DVD Services segment, while the market is shrinking, Vantiva still competes with other disc replication and distribution companies, though many have diversified or reduced their operations in this area. Emerging players in the broader entertainment technology landscape, particularly those focusing on cloud-based solutions, virtual reality, and augmented reality, could also pose future competitive challenges by disrupting traditional content delivery models. Mergers and alliances within the industry, such as acquisitions of smaller technology firms by larger players, constantly reshape the competitive dynamics, requiring Vantiva to remain agile and strategically responsive. For insights into how Vantiva can navigate these challenges, consider the Growth Strategy of Vantiva.

Vantiva's competitive position is influenced by several factors.

These include technological innovation, market share, and strategic partnerships.

- Technological Innovation: Continuous development of new products and services is crucial.

- Market Share: Maintaining and expanding market share in core segments.

- Strategic Partnerships: Collaborations with other companies to enhance offerings.

- Geographic Presence: Adapting to regional market demands and regulations.

- Customer Base: Understanding and meeting the needs of the customer base.

Vantiva PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Vantiva a Competitive Edge Over Its Rivals?

The competitive advantages of Vantiva are rooted in its extensive experience, technological innovation, and established relationships within the telecommunications and entertainment sectors. A core advantage is the company's proprietary technologies and intellectual property, particularly in video processing, broadband connectivity, and device interoperability. This technological foundation provides a solid base for its set-top boxes and gateways, creating a barrier to entry for competitors.

The company also benefits from a strong brand reputation, built on the legacy of its predecessor, which was synonymous with quality and innovation in visual entertainment. Furthermore, Vantiva leverages economies of scale in its manufacturing and global distribution networks, allowing for cost-effective production and delivery of its hardware solutions. Its well-established supply chain, developed over decades, enables efficient component sourcing and timely product delivery, essential in a high-volume market.

Deep-seated relationships with leading telecom operators and content providers globally are another significant advantage. These long-term partnerships, founded on trust and a proven track record, provide recurring revenue streams and insights into evolving customer needs. Vantiva also invests in its talent pool of engineers and R&D specialists, who are at the forefront of developing next-generation connectivity and entertainment technologies. This focus on innovation is critical for maintaining its competitive edge in the dynamic Vantiva competitive landscape.

Vantiva's intellectual property, particularly in digital video compression and content protection, creates a significant barrier to entry. This allows the company to develop advanced features in its products, enhancing its market position. The company's patent portfolio is a key element in its Vantiva competitive advantages.

The company's brand, built on a legacy of innovation, fosters customer loyalty. This historical reputation helps maintain strong relationships with long-standing clients. This legacy supports its Vantiva business strategy.

Economies of scale in manufacturing and a global distribution network enable cost-effective operations. Efficient supply chains ensure timely product delivery. These strengths are crucial in a high-volume market.

Strong relationships with telecom operators and content providers drive recurring revenue. These long-term partnerships provide insights into evolving customer needs. These partnerships are critical for Vantiva's market share analysis.

Vantiva's competitive advantages include its proprietary technology, brand equity, and global distribution network. The company's strategic partnerships with major telecom operators and content providers are also significant. These factors contribute to its strong market position in the Vantiva industry.

- Proprietary technology and intellectual property in video processing and broadband connectivity.

- Strong brand reputation and customer loyalty built over decades.

- Economies of scale in manufacturing and global distribution networks.

- Deep relationships with leading telecom operators and content providers.

Vantiva Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Vantiva’s Competitive Landscape?

Understanding the competitive landscape of Vantiva involves analyzing its industry position, the associated risks, and the future outlook. The company operates within a technology-driven market, facing rapid changes in consumer behavior and technological advancements. Vantiva’s ability to adapt to these shifts, particularly in the connected home and media solutions sectors, will be crucial for its financial performance.

The primary risks include intense competition, rapid technological obsolescence, and shifts in consumer preferences. However, the company also has significant opportunities for growth through innovation, strategic partnerships, and expansion into emerging markets. The future outlook depends on Vantiva's strategic agility, its investment in research and development, and its ability to anticipate and respond to market dynamics.

Key industry trends impacting Vantiva include the increasing demand for fiber optic broadband and Wi-Fi 6/7 technologies. The shift towards streaming services and the decline of traditional linear television are also significant. Regulatory changes in data privacy and cybersecurity further influence product development.

Anticipated challenges include the growth of cloud gaming and virtual reality, potentially redefining home entertainment. New market entrants leveraging AI and machine learning pose a threat. A decline in demand for physical media and intense price competition also present risks.

Growth opportunities exist in emerging markets with increasing broadband penetration and the expanding smart home ecosystem. Innovations in AI-powered gateways and enhanced cybersecurity features offer differentiation. Strategic partnerships with content providers and tech startups can expand offerings.

Vantiva's competitive positioning is evolving towards a more software and services-centric model. There will be a continued focus on high-performance, secure, and energy-efficient connected home devices. Strategic investments in R&D will be crucial for long-term resilience.

The competitive landscape for Vantiva is dynamic, influenced by technological advancements and market shifts. The company's ability to innovate and adapt will determine its success. Strategic decisions regarding product development, partnerships, and market expansion are critical.

- Market Analysis: The global broadband access equipment market is projected to reach $16.7 billion by 2027, growing at a CAGR of 3.5% from 2020 to 2027.

- Competitive Advantages: Vantiva can leverage its expertise in connectivity solutions and its established relationships with service providers.

- Innovation Strategies: Investments in AI, cybersecurity, and sustainable product designs are essential.

- Strategic Partnerships: Collaborations with content providers and tech startups can enhance market reach.

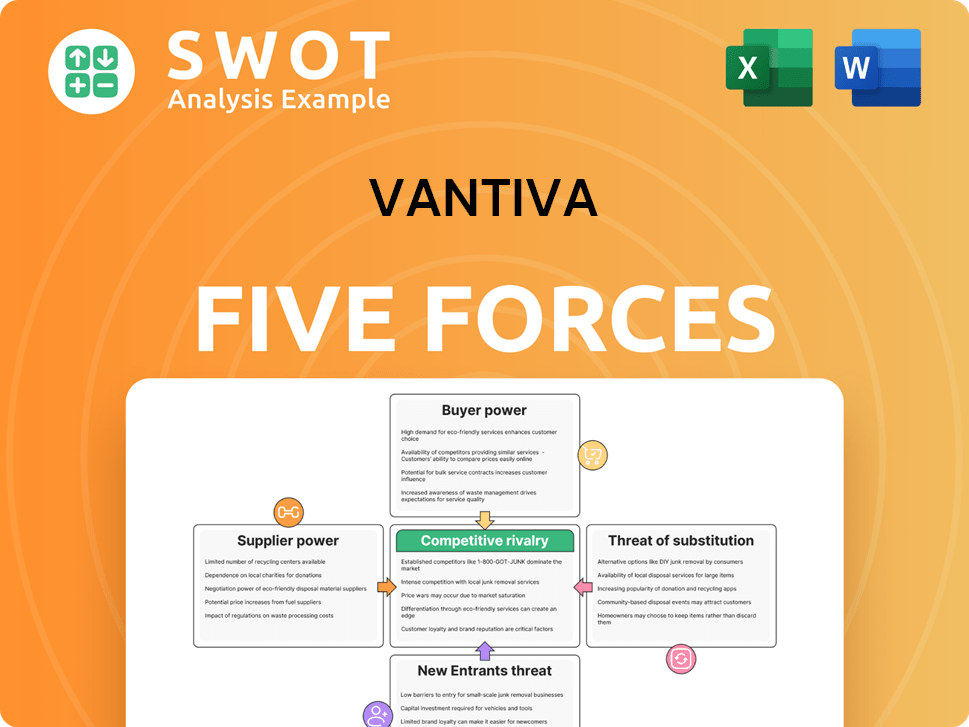

Vantiva Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Vantiva Company?

- What is Growth Strategy and Future Prospects of Vantiva Company?

- How Does Vantiva Company Work?

- What is Sales and Marketing Strategy of Vantiva Company?

- What is Brief History of Vantiva Company?

- Who Owns Vantiva Company?

- What is Customer Demographics and Target Market of Vantiva Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.