Vantiva Bundle

Who Does Vantiva Serve in the Connected World?

In today's fast-paced tech landscape, understanding Vantiva SWOT Analysis and its customer base is key to grasping its strategic moves. From its roots as Thomson Multimedia to its current iteration, Vantiva has continually redefined its focus. This evolution, especially after the 2022 rebranding, highlights the importance of pinpointing its ideal customers and understanding their needs.

This deep dive into Vantiva's customer demographics and target market will explore its shift towards 'Connected Home' solutions, including broadband and video equipment. We'll examine the Vantiva customer base analysis, geographical distribution, and the company's strategies for acquiring and retaining customers. This market analysis is crucial for anyone seeking to understand the company's trajectory and future growth potential, especially in light of its recent acquisition and evolving customer segmentation.

Who Are Vantiva’s Main Customers?

Understanding the Owners & Shareholders of Vantiva involves a deep dive into its primary customer segments. The company, formerly known as Technicolor, focuses on a Business-to-Business (B2B) model. Its customer base is primarily composed of Network Service Providers (NSPs) and businesses, with end-consumers being indirectly served through these NSPs.

The company's strategy is centered around providing essential hardware and software solutions to large telecommunication and pay-TV operators. This approach is particularly evident in its Connected Home segment. This segment supplies broadband modems, gateways, and set-top boxes to NSPs globally.

The company's revenue increased by 19.3% to 1,865 million euros in 2024, mainly due to the consolidation of the Home Networks activity. This growth highlights the significance of the Connected Home segment and its importance to Vantiva's overall financial performance.

NSPs are the primary direct customers. They seek reliable, high-speed internet and premium entertainment solutions. They are looking for advanced technologies like Wi-Fi 7, Fiber, and 5G FWA products.

Businesses are also a key customer segment. These solutions transform commercial spaces for enterprise and business markets. This includes high-definition satellite, off-air, and streaming headend solutions.

Vantiva's Android TV set-top boxes have achieved significant market penetration. They have sold 22 million units to date. They have a 25% global market share as of late 2023, demonstrating the scale of its B2B relationships.

The sale of the Supply Chain Solutions (SCS) division to Variant Equity in April 2025 shows a strategic shift. This shift is to focus entirely on its core connectivity businesses. This means the company's key customer segments are now in the broadband and video connectivity space.

The company's customer demographics are clearly defined by its focus on NSPs and commercial video solutions. The target market includes telecommunication companies, pay-TV operators, and businesses needing video solutions. Analyzing Vantiva's customer needs reveals a demand for advanced connectivity and video technologies.

- Focus on B2B relationships with NSPs.

- Emphasis on advanced technologies like Wi-Fi 7 and 5G FWA.

- Expansion into commercial video solutions for businesses.

- Strategic divestiture to concentrate on core connectivity businesses.

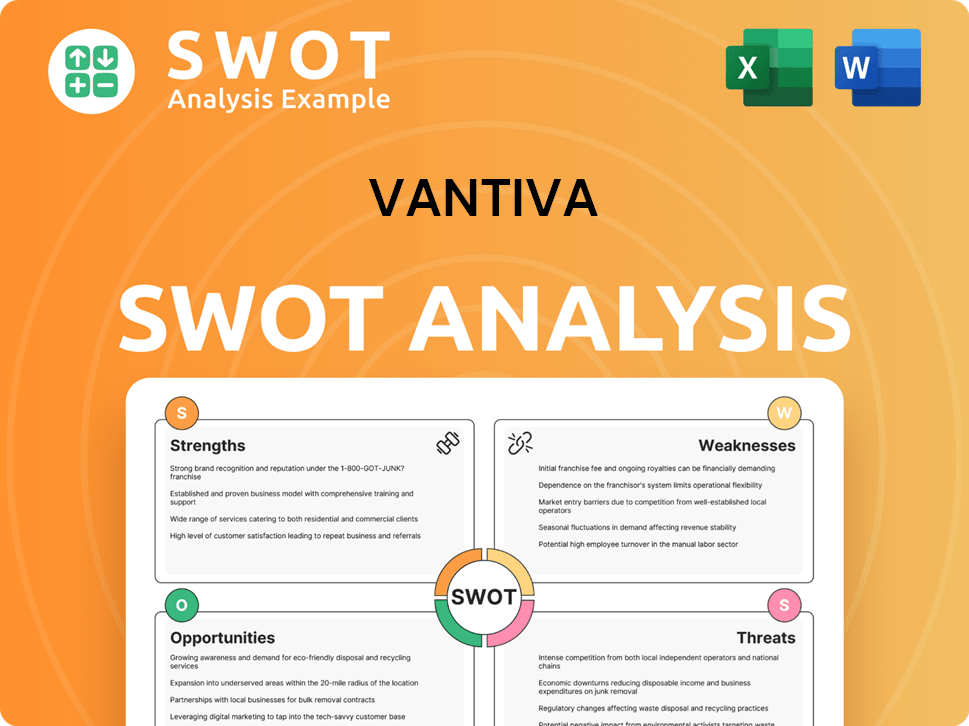

Vantiva SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Vantiva’s Customers Want?

Understanding the customer needs and preferences is crucial for any company, and for Vantiva, this centers around delivering high-performance connectivity, seamless entertainment, and advanced smart home capabilities. The company's success hinges on meeting the evolving demands of Network Service Providers (NSPs) and their end-users. This approach allows Vantiva to maintain its competitive edge in the market.

For NSPs, the focus is on providing cutting-edge broadband, video, and IoT solutions. They seek reliable Customer Premises Equipment (CPE) that supports multi-gigabit fiber speeds and easy transitions to new technologies. End-consumers, on the other hand, prioritize immersive entertainment, ease of use, and reliable home connectivity. Vantiva's products are designed to meet these diverse needs, ensuring customer satisfaction and loyalty.

This detailed analysis helps to define Vantiva's customer demographics and target market, providing insights into their purchasing behaviors and the pain points they aim to solve. By focusing on these key aspects, Vantiva can tailor its offerings to meet the specific demands of its customers, driving growth and innovation in the telecommunications sector.

Vantiva's primary customers, the NSPs, are driven by the need for advanced broadband, video, and IoT solutions. They require robust and reliable CPE to deliver high-speed internet and seamless entertainment experiences to end-users. This includes the ability to transition from older technologies to fiber-based PON technologies. For end-consumers, the focus is on ease of use, immersive entertainment, and reliable home connectivity. Vantiva addresses these needs by offering Android TV-powered set-top boxes and products supporting faster speeds and more reliable wireless connectivity.

-

NSPs' Priorities:

- Future-Proof Solutions: Adaptability to new technologies without frequent hardware updates.

- Integration Capabilities: Seamless management of traditional broadcast and OTT services.

-

End-Consumer Preferences:

- Immersive Entertainment: High-quality viewing experiences.

- Ease of Use: User-friendly interfaces and features.

- Reliable Connectivity: Consistent and fast internet access.

-

Key Solutions and Market Position:

- Android TV Set-Top Boxes: Vantiva has sold 22 million units and holds a 25% market share in this segment.

- Wi-Fi 7, Fiber, and 5G FWA Products: Addressing the demand for faster and more reliable connectivity.

- HomeSight: Remote care and monitoring services for smart homes.

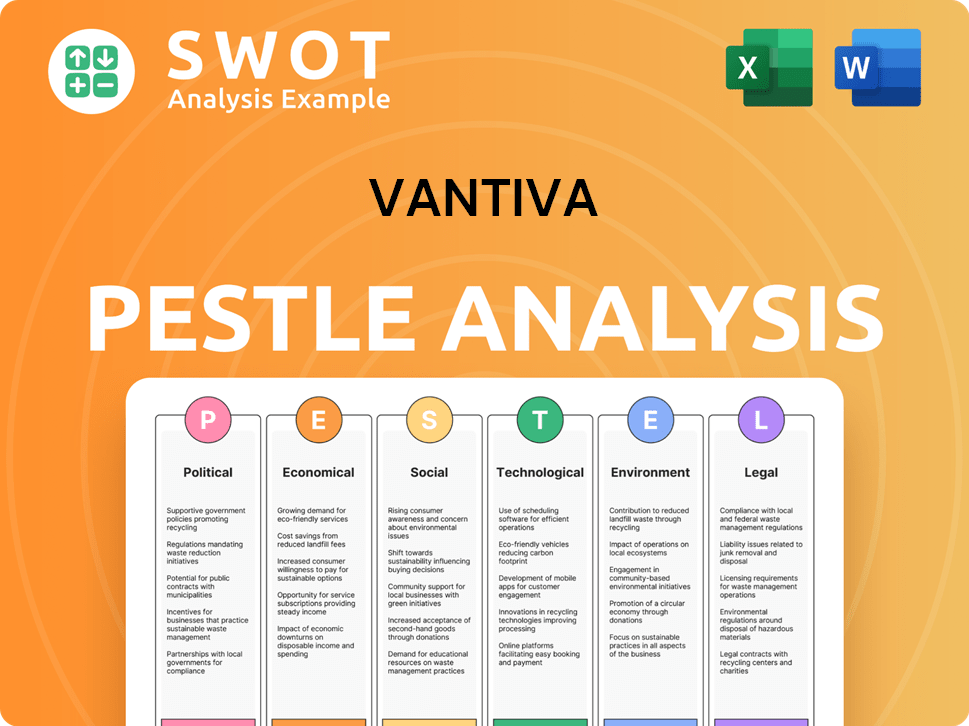

Vantiva PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Vantiva operate?

The geographical market presence of Vantiva is extensive, with a global footprint that serves a diverse customer base across several continents. Headquartered in Paris, France, the company strategically positions its major offices in key regions worldwide. This widespread international presence allows Vantiva to address different regional demands and market dynamics effectively.

Vantiva's key markets include North America, Asia, and parts of Europe, where its Wi-Fi 7, Fiber, and FWA 5G products have achieved commercial success. The company has established itself as a strategic partner for leading firms across various industries, particularly network service providers, in the Americas, Asia Pacific, and EMEA. This demonstrates Vantiva's strong market position and brand recognition in the Connected Home solutions sector.

The company’s ability to localize its offerings and partnerships is crucial for success in diverse markets. For example, Vantiva partnered with e& UAE to deploy the region's first eSIM-enabled 5G FWA gateway, which streamlines installation and enhances connectivity specifically for the UAE market. Similarly, a partnership with Orange Belgium led to the deployment of the Livebox, a customized DOCSIS 3.1 hybrid fiber coaxial gateway, showcasing Vantiva's capacity to meet specific operator needs within European markets. This approach allows Vantiva to tailor its products and services to meet the distinct needs of each region.

Vantiva's headquarters are located in Paris, France, serving as the central hub for its global operations.

Major offices are strategically positioned in Australia, Brazil, China, India, South Korea, the United Kingdom, and the United States.

Vantiva has seen strong commercial success with its Wi-Fi 7, Fiber, and FWA 5G products, particularly in North America, Asia, and Europe.

The company is recognized as a strategic partner by leading firms across various vertical industries, including network service providers, in the Americas, Asia Pacific, and EMEA.

The acquisition of CommScope's Home Networks business in January 2024 further strengthened Vantiva's global reach and commitment to innovation, boosting its presence across diverse markets. In 2024, Vantiva's sales increased by 19.3% to 1,865 million euros, primarily due to the consolidation of the Home Networks activity. Understanding the Revenue Streams & Business Model of Vantiva can provide additional insights into the company's financial performance and market strategies.

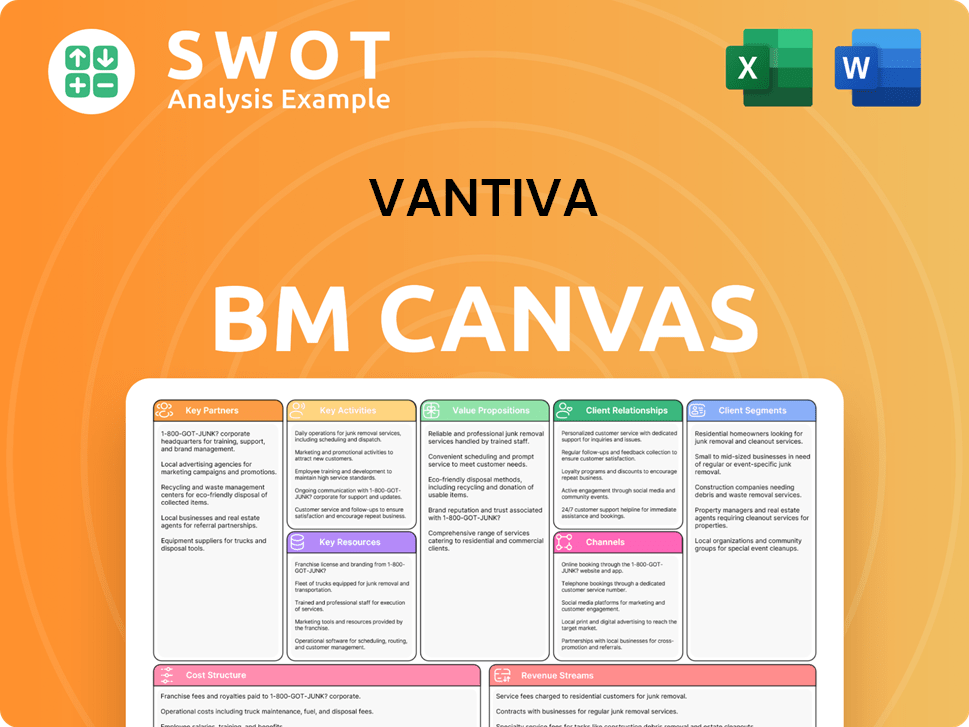

Vantiva Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Vantiva Win & Keep Customers?

focuses on a Business-to-Business (B2B) model, primarily targeting Network Service Providers (NSPs). Their approach to customer acquisition and retention is deeply rooted in technological innovation and strategic partnerships. This strategy allows them to provide cutting-edge solutions tailored to the specific needs of their clients, which is a key element in their customer acquisition strategy.

A core acquisition strategy involves strategic partnerships and offering innovative solutions. This is demonstrated by their collaborations, such as the launch of the region's first eSIM-enabled 5G FWA gateway with e& UAE. Additionally, their ability to provide high-quality, reliable products is a significant driver. For instance, the sale of 22 million Android TV set-top boxes, holding a 25% global market share, highlights their success in attracting NSPs with popular video solutions.

For customer retention, the company emphasizes long-term relationships and continuous innovation. They focus on providing 'future-proof' solutions, allowing partners to adapt to new technologies without frequent hardware updates. This is supported by ongoing development in advanced technologies like Wi-Fi 7 and FWA 5G products, ensuring their NSP customers remain competitive. This customer-centric approach, coupled with their decades of experience, results in high-quality solutions delivered at scale.

Strategic partnerships are key to acquiring new customers, as seen with collaborations like the one with e& UAE. These partnerships allow for the provision of innovative, localized solutions, attracting NSPs seeking advanced technologies.

The company's focus on research and development and its ability to deliver high-quality, reliable products are key acquisition drivers. Their success in the Android TV set-top box market, with a 25% global share, showcases their ability to attract NSPs with popular and well-supported video solutions.

Vantiva emphasizes long-term relationships by providing 'future-proof' solutions, enabling partners to adapt to new technologies without frequent hardware updates. This approach fosters loyalty among NSPs and ensures they remain competitive.

The company focuses on understanding and meeting the specific needs of its target market. This customer-centric approach, supported by decades of experience in software development and supply chain expertise, ensures customer satisfaction and high-quality solutions.

While specific details on loyalty programs or explicit CRM system usage are not extensively publicized, Vantiva's approach to retention is embedded in its product development and service delivery. The integration of CommScope's Home Networks business in January 2024 strengthened their portfolio and expertise, reinforcing customer relationships. In 2024, Vantiva's sales increased by 19.3% to 1,865 million euros, demonstrating their continued growth in acquiring and retaining customers. To learn more about the company's growth strategies, you can read the Growth Strategy of Vantiva.

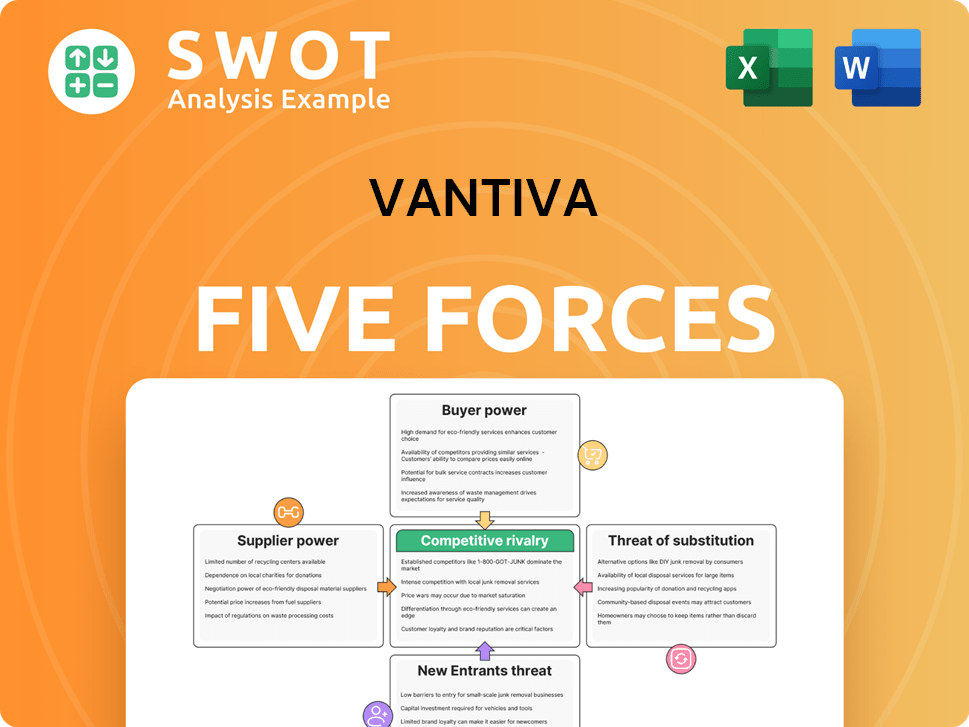

Vantiva Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Vantiva Company?

- What is Competitive Landscape of Vantiva Company?

- What is Growth Strategy and Future Prospects of Vantiva Company?

- How Does Vantiva Company Work?

- What is Sales and Marketing Strategy of Vantiva Company?

- What is Brief History of Vantiva Company?

- Who Owns Vantiva Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.