Vantiva Bundle

Who Really Controls Vantiva?

The story of Vantiva, formerly Technicolor, is a tale of transformation, innovation, and adaptation within the dynamic world of entertainment technology. Understanding the Vantiva SWOT Analysis is crucial to understanding the company. From its roots in pioneering color motion pictures to its current focus on connected home solutions, Vantiva's journey is deeply intertwined with its ownership structure.

Delving into Vantiva ownership reveals critical insights into its strategic direction and future prospects. Knowing who controls Vantiva and the influence of its Vantiva shareholders provides a clearer picture of the company's resilience and its capacity to navigate the ever-evolving technological landscape. This analysis will explore the Vantiva company’s history, its evolution, and the key players shaping its destiny, offering a comprehensive view of its corporate governance and strategic decision-making. Furthermore, we will explore the Vantiva parent company and its impact on the overall structure.

Who Founded Vantiva?

The story of Vantiva, formerly known as Technicolor Motion Picture Corporation, began in 1915. The company was founded by Herbert Kalmus, Daniel Comstock, and Burton Wescott. Their combined vision was to revolutionize the film industry through color technology.

Herbert Kalmus, a graduate of MIT, spearheaded the technical and strategic direction of the company. Daniel Comstock, also from MIT, played a key role in developing the early photographic and optical systems. Burton Wescott focused on refining the practical application of their patented two-color additive process. Understanding the early ownership structure of the Vantiva company requires looking back at its origins and the contributions of its founders.

The initial equity distribution among the founders is not fully detailed in available public records from that early era. However, it's known that Kalmus was the primary visionary and business leader, which likely influenced the distribution of control within the company. The evolution of Vantiva ownership has been shaped by various factors, including technological advancements and market dynamics.

Herbert Kalmus led technical innovations and business strategy.

Daniel Comstock contributed to photographic and optical systems.

Burton Wescott focused on applying and refining the two-color process.

Funding came from private investors and studios.

Specific initial equity splits are not readily available.

The founders aimed to revolutionize the motion picture industry with color.

Early funding for the company came from private investors and film studios, which were eager to adopt the new color film technology. These early backers were crucial in supporting the extensive research and development needed to perfect Technicolor's complex processes. For more details, you can explore the Brief History of Vantiva. There is no widely publicized information regarding initial ownership disputes or buyouts among the founders in the company's formative years. The founders' collective vision for revolutionizing the motion picture industry through color was intrinsically linked to the distribution of control, with Kalmus often cited as the primary visionary and business leader. As of early 2024, details on the current Vantiva ownership structure are subject to change.

Vantiva SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Vantiva’s Ownership Changed Over Time?

The Vantiva company, formerly known as Technicolor, has seen its Vantiva ownership structure evolve significantly over time. The company's journey includes a transition from its historical roots to becoming a publicly traded entity. The details of its initial public offering (IPO) date and initial market capitalization are complex due to corporate restructurings. However, the current ownership is transparent through regulatory filings. As of early 2025, Vantiva is listed on Euronext Paris.

The Vantiva parent company is now characterized by a dispersed ownership model. The shift towards a widely held public company has increased accountability to a diverse shareholder base. This emphasis on financial performance and shareholder value is a direct result of the evolution in its ownership structure. The company's strategy is now influenced by the need to meet the expectations of a broad range of investors. The recent changes also reflect the company's adaptation to the dynamics of the market.

| Ownership Aspect | Details | As of Early 2025 |

|---|---|---|

| Stock Exchange Listing | Euronext Paris | Publicly Traded |

| Major Shareholders | Institutional investors, mutual funds, individual investors | Diverse |

| Insider Ownership | Executive management and Board of Directors | Present |

Major institutional investors, including asset management firms and investment funds, hold substantial stakes in Vantiva. These firms collectively represent a significant portion of the outstanding shares. Individual insiders, including executive management and the Board of Directors, also hold shares, aligning their interests with the company's performance. The company's ownership is broadly dispersed among public shareholders. For more insights into Vantiva company and its goals, you can explore the Growth Strategy of Vantiva.

Vantiva ownership is primarily held by institutional investors and the public, ensuring a broad base of shareholders. This structure influences the company's strategic decisions, emphasizing financial performance. The shift to a public company model has increased accountability.

- Institutional investors hold significant shares, impacting strategic direction.

- Executive management and board members also hold shares.

- The company's focus is on shareholder value and financial results.

- The ownership structure is transparent through regulatory filings.

Vantiva PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Vantiva’s Board?

As of early 2025, the Board of Directors of Vantiva oversees the company's strategic direction and governance. The board includes independent directors and members from the company's executive management. The Chairman of the Board provides leadership, and committees such as the Audit Committee and the Nominations and Remuneration Committee manage specific operational and governance aspects. The board's structure aims to balance expertise and independent judgment, ensuring that decisions consider the interests of all shareholders. For anyone asking 'Who controls Vantiva,' the board plays a key role in that oversight.

The composition of the board reflects the company's commitment to transparency and adherence to corporate best practices. While specific individuals representing major shareholders aren't explicitly identified as controlling seats, the board's structure is designed to ensure a balance of expertise and independent judgment. The board's decisions are made with consideration for the interests of all shareholders, reflecting the dispersed ownership structure of the Vantiva company.

| Board Member | Role | Affiliation |

|---|---|---|

| To be updated with latest information | Chairman | To be updated with latest information |

| To be updated with latest information | Director | To be updated with latest information |

| To be updated with latest information | Director | To be updated with latest information |

Vantiva operates under a standard one-share-one-vote structure. This means each ordinary share has one voting right. There are no publicly disclosed dual-class shares or special voting rights that would give outsized control to any single entity. This structure promotes a more equitable distribution of voting power among the Vantiva shareholders. The governance framework prioritizes transparency. If you're looking for 'Vantiva stock information,' understanding this voting structure is crucial. Learn more about the company's financials and operations by reading Revenue Streams & Business Model of Vantiva.

The Board of Directors at Vantiva oversees strategic decisions and governance, ensuring a balance of expertise and independent judgment. The company uses a one-share-one-vote structure, promoting equitable voting power among shareholders.

- The board comprises independent directors and executive management members.

- Each ordinary share carries one vote, preventing outsized control.

- The governance framework emphasizes transparency and shareholder interests.

- Understanding the ownership structure is essential for anyone researching 'Vantiva ownership'.

Vantiva Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Vantiva’s Ownership Landscape?

Over the past few years, the Vantiva company has seen shifts that have indirectly affected its ownership. The rebranding from Technicolor to Vantiva in September 2022 marked a strategic focus on its Connected Home and DVD Services segments. This change involved a significant deleveraging plan and a capital increase. These events likely led to adjustments in the shareholder base, as new investors joined and existing ones modified their holdings. Although there haven't been any major announcements of share buybacks or secondary offerings in 2024-2025 that significantly altered ownership, market dynamics and institutional investment continually influence the shareholder register.

Industry trends, such as increased institutional ownership, are also relevant to Vantiva ownership. As a long-standing public entity, its ownership is primarily institutional, with investment funds and asset managers regularly adjusting their portfolios. No public statements in 2024-2025 from the company or analysts suggest an upcoming privatization or major change in its public listing status. The company continues to trade publicly, with its ownership subject to market fluctuations and the investment strategies of its diverse shareholders. Leadership changes, like new executive appointments, can subtly impact investor confidence and, consequently, ownership trends, although no significant founder departures affecting controlling stakes have been noted recently.

Vantiva operates as a publicly traded company. Its ownership is primarily institutional, with a diverse group of shareholders including investment funds and asset managers. The ownership structure is subject to market fluctuations and the investment strategies of its shareholders.

The 2022 rebranding from Technicolor to Vantiva was a key development. This change was followed by a deleveraging plan and capital increase. These strategic moves influenced the shareholder base as new investors joined and existing ones adjusted their holdings. No significant ownership-altering events have been reported in 2024-2025.

Institutional investors hold a significant portion of Vantiva's shares. These investors include various investment funds and asset managers that regularly adjust their portfolios. This constant turnover is a typical characteristic of mature public companies.

Market dynamics and investment flows continually influence Vantiva's shareholders. The company's stock performance and overall market conditions play a crucial role in determining investor behavior. These factors impact the shareholder register.

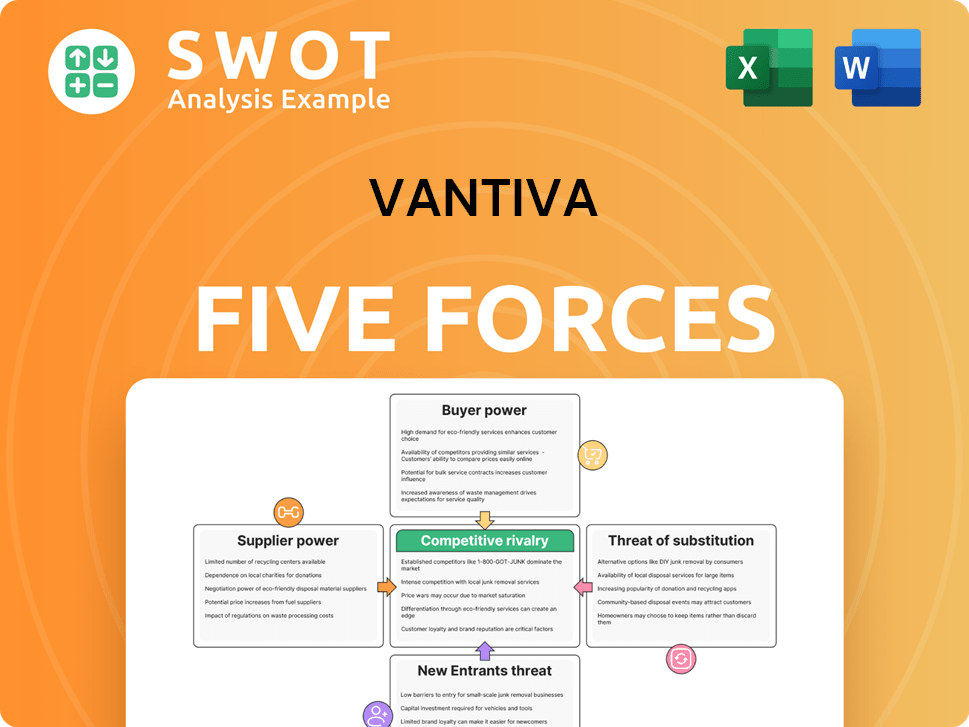

Vantiva Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Vantiva Company?

- What is Competitive Landscape of Vantiva Company?

- What is Growth Strategy and Future Prospects of Vantiva Company?

- How Does Vantiva Company Work?

- What is Sales and Marketing Strategy of Vantiva Company?

- What is Brief History of Vantiva Company?

- What is Customer Demographics and Target Market of Vantiva Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.