Voestalpine Bundle

How Does Voestalpine Navigate the Global Steel Arena?

In the dynamic world of industrial innovation, understanding the Voestalpine SWOT Analysis is crucial. This analysis dives into the competitive landscape, exploring how Voestalpine, a leader in high-quality steel, shapes its strategy. From its humble beginnings to its current global presence, Voestalpine's journey is a testament to its adaptability.

This exploration of the Voestalpine competitive landscape will provide a detailed Voestalpine market analysis, identifying key Voestalpine competitors and assessing its Voestalpine industry position. We'll examine the company's Voestalpine steel market strategies, including its Voestalpine financial performance and how it tackles challenges in the industry, offering insights into its Voestalpine key competitors analysis and Voestalpine market share comparison.

Where Does Voestalpine’ Stand in the Current Market?

Voestalpine AG maintains a strong market position within the global steel and technology sector, particularly in high-quality steel products and specialized solutions. The company's strategic focus on premium segments allows it to compete effectively. This approach has enabled it to establish itself as a leader in several niche markets.

The company's operations are divided into four divisions: Steel Division, High Performance Metals Division, Metal Engineering Division, and Metal Forming Division. Each division offers highly specialized products and services tailored to specific customer needs. Voestalpine has transformed from a general steel producer to a technology group, emphasizing innovation and value-added products.

Voestalpine has a global presence with production and sales sites in over 50 countries, serving diverse sectors such as automotive, aerospace, and railway infrastructure. The company's strategic shift towards specialized, high-value markets has been accompanied by significant investments in digital transformation, including advanced automation and data analytics. For more insights into the company's ownership structure, you can refer to Owners & Shareholders of Voestalpine.

Voestalpine's Voestalpine industry position is characterized by its focus on high-performance steel and technology solutions. The company is a global leader in its niche segments, particularly in tool steel and special materials within its High Performance Metals division. This strategic focus allows Voestalpine to maintain strong profitability margins compared to commodity steel producers.

The Voestalpine market analysis reveals a strong presence across Europe, North America, and Asia. The company has been expanding its footprint in North America and Asia, recognizing these regions as key growth drivers. Voestalpine serves diverse customer segments, including automotive, aerospace, energy, and railway infrastructure, indicating a diversified market approach.

The Voestalpine competitive landscape includes both global and regional players. Key competitors vary depending on the specific product segment, but generally include other specialized steel producers and technology companies. Voestalpine's focus on innovation, high-quality products, and customer-specific solutions provides a competitive edge.

Voestalpine financial performance reflects its strategic focus on high-value-added segments. The company reported revenue of 16.7 billion euros for the 2023/24 financial year. Its focus on high-performance segments contributes to higher profitability margins compared to commodity steel producers, demonstrating its financial strength within the industry.

Voestalpine's competitive advantages include its focus on high-quality steel products and specialized solutions. The company's strategic shift towards technology-driven solutions and digital transformation enhances its market position. Voestalpine's global presence and diversified customer base further contribute to its resilience and growth potential.

- Focus on high-value-added products.

- Strong presence in Europe, North America, and Asia.

- Investments in digital transformation and innovation.

- Diversified customer base across multiple sectors.

Voestalpine SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Voestalpine?

Understanding the Voestalpine competitive landscape requires a deep dive into its various segments, each facing unique challenges and rivals. The company's diverse portfolio, spanning high-performance metals, railway systems, and metal forming, positions it in a complex web of competition. This analysis is crucial for investors, analysts, and strategists seeking to understand the company's market position and future prospects.

Voestalpine market analysis reveals a competitive environment shaped by both direct and indirect rivals. Direct competitors offer similar products and services, while indirect competitors provide alternative solutions or compete in adjacent markets. The intensity of competition varies across different geographical regions and product lines, influencing the company's strategic decisions and financial performance.

Voestalpine competitors include both large, diversified industrial conglomerates and specialized niche players. These competitors employ various strategies, such as innovation, cost leadership, and global expansion, to gain market share. Analyzing these strategies provides insights into the competitive dynamics and helps assess Voestalpine's strengths and weaknesses.

In the high-performance metals sector, Voestalpine's key competitors include ThyssenKrupp AG and Allegheny Technologies Incorporated (ATI). These companies compete through proprietary alloys and global distribution networks.

The railway systems segment sees competition from Vossloh AG and various national railway suppliers. These competitors often challenge through cost-effectiveness and localized production.

In the automotive industry, Voestalpine's Metal Forming division competes with ArcelorMittal and SSAB. Competition focuses on price, innovation in lightweight materials, and supply chain efficiency.

Indirect competition comes from alternative materials like aluminum and composites, particularly in automotive and aerospace. Emerging players in specialized manufacturing also pose a threat.

Mergers and alliances among competitors can create larger, more integrated entities. Securing long-term supply contracts with major OEMs and infrastructure projects is a key battleground.

Competitors focus on innovation, cost leadership, and global expansion. Analyzing these strategies helps understand the competitive landscape and assess Voestalpine's position.

Voestalpine's competitive advantages include its specialized product portfolio, strong R&D capabilities, and global presence. However, the company faces challenges such as fluctuating raw material prices, intense competition, and the need to adapt to changing market demands. For example, in 2024, the steel industry faced challenges due to economic uncertainties, impacting demand and pricing. Further insights can be found in a detailed analysis of the company's financial performance and competitive positioning.

- Voestalpine's global market presence allows it to serve customers worldwide, but it also exposes it to currency fluctuations and regional economic downturns.

- The company's product portfolio overview reveals a focus on high-value-added products, which command higher margins but face competition from specialized manufacturers.

- Voestalpine's strategic alliances and partnerships are key to expanding its market reach and accessing new technologies, as seen in collaborations within the automotive sector.

- The impact of economic downturn is a significant factor, as seen in reduced demand during periods of economic uncertainty, particularly affecting the automotive and construction sectors.

Voestalpine PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Voestalpine a Competitive Edge Over Its Rivals?

Understanding the Voestalpine competitive landscape involves recognizing its multifaceted strengths, from technological prowess to global reach. The company's success is built on a foundation of continuous innovation, strategic investments, and a deep understanding of its customer's needs. This approach has allowed it to maintain a strong Voestalpine industry position.

Voestalpine's market analysis reveals a company deeply entrenched in high-value segments, such as automotive and aerospace, where its specialized products and solutions are in high demand. The company's ability to adapt to changing market dynamics and technological advancements is critical to its sustained competitive advantage. The company's focus on sustainability and environmental responsibility further enhances its appeal to a growing segment of customers.

The company's commitment to research and development is evident in its annual investment of approximately 160 million euros. This investment fuels the development of innovative materials and processing techniques, such as phs-ultraform® technology, which provides lightweight and safety solutions for the automotive industry. This dedication is a key component of its long-term growth strategy.

Voestalpine excels in proprietary technologies, particularly in advanced high-strength steels and specialized alloys. Continuous investment in R&D, amounting to approximately 160 million euros annually, enables the development of innovative materials and processing techniques. This focus on innovation is crucial for maintaining a competitive edge in demanding industries like automotive and aerospace.

The company has a strong brand reputation for quality and reliability, fostering long-term customer relationships. It offers high-quality products and customized solutions, providing technical support and co-developing solutions with customers. This customer loyalty is built on consistent performance and a commitment to meeting specific needs.

Voestalpine operates a global distribution network, ensuring timely delivery and local support to customers worldwide. Economies of scale in larger production facilities contribute to cost efficiencies. The company's integrated value chain, from steel production to specialized processing, provides greater control over quality and innovation.

The integrated value chain allows for greater control over quality and innovation throughout the production process. Supply chain strengths are evident in the ability to manage complex logistics and ensure the availability of raw materials. This integration is a key factor in the company's ability to respond effectively to market demands.

Voestalpine's competitive advantages are multifaceted, including technological leadership, strong customer relationships, and a global production network. The company's continuous investment in R&D, approximately 160 million euros annually, fuels innovation in materials and processing. Furthermore, its integrated value chain and supply chain strengths enhance its market position.

- Proprietary Technologies: Advanced high-strength steels (AHSS) and specialized alloys provide a significant advantage.

- Brand Reputation: Recognized for high-quality products and customized solutions.

- Global Network: Ensures timely delivery and local support worldwide.

- Integrated Value Chain: Provides greater control over quality and innovation.

For more insights into the specific market segments and customer demographics, explore the Target Market of Voestalpine. This analysis provides a deeper understanding of the company's strategic positioning and the industries it serves.

Voestalpine Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Voestalpine’s Competitive Landscape?

The Voestalpine competitive landscape is significantly shaped by industry trends, future challenges, and emerging opportunities. The steel and technology sector is experiencing rapid transformation due to technological advancements, regulatory changes, and evolving global economic dynamics. Understanding these elements is crucial for assessing Voestalpine's market position and future growth potential.

Voestalpine's industry position is influenced by its strategic focus on high-performance steel solutions and technological leadership. The company faces challenges from increasing competition and economic uncertainties, but also benefits from opportunities in sustainable steel production and expansion into high-growth sectors. The following sections provide a detailed analysis of these aspects.

Several key trends are reshaping the steel industry. Digitalization, automation, and additive manufacturing are optimizing production processes. Demand for lightweight materials is rising, driven by stricter emissions regulations. Regulatory changes, such as the EU's Green Deal, are pushing for sustainable practices.

Voestalpine leverages 'smart factory' initiatives and advanced analytics to improve operations. This includes investments in technologies that enhance product quality and efficiency. The company is focusing on innovations like high-strength steel for automotive and aerospace applications.

Voestalpine faces challenges from potential market slowdowns in sectors like automotive and construction. Competition from Asian producers with lower costs poses a threat. The rapid emergence of disruptive technologies requires continuous innovation.

Global economic shifts, supply chain disruptions, and geopolitical tensions can impact raw material prices. These factors introduce volatility, affecting demand and profitability. Adapting to these changes requires strategic agility.

Voestalpine has significant growth opportunities in emerging markets and high-growth sectors like renewable energy. Strategic partnerships and product innovations are key to capitalizing on these opportunities. The company is investing in green steel technologies.

- Market Expansion: Penetrating emerging markets with developing infrastructure.

- Product Innovation: Developing advanced materials for electric vehicles and renewable energy.

- Strategic Partnerships: Forming alliances for joint research and market expansion.

- Sustainability: Investing in green steel technologies to reduce carbon emissions.

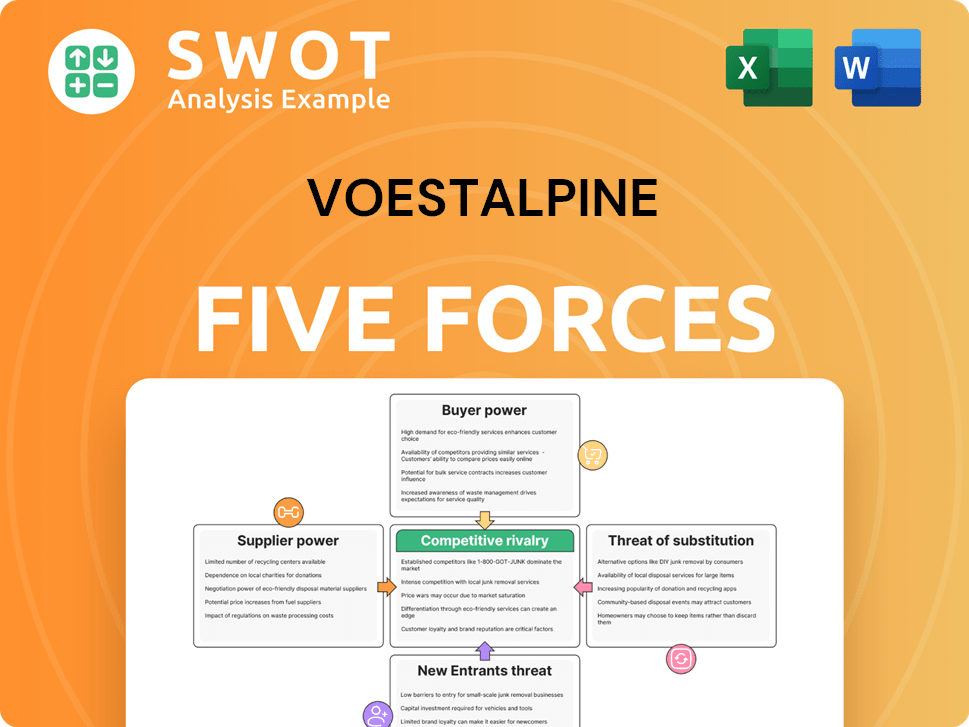

Voestalpine Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Voestalpine Company?

- What is Growth Strategy and Future Prospects of Voestalpine Company?

- How Does Voestalpine Company Work?

- What is Sales and Marketing Strategy of Voestalpine Company?

- What is Brief History of Voestalpine Company?

- Who Owns Voestalpine Company?

- What is Customer Demographics and Target Market of Voestalpine Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.