Voestalpine Bundle

How Does Voestalpine Thrive in the Global Market?

Voestalpine, a global titan in steel and technology, is reshaping industries from automotive to aerospace, fueled by innovation and a commitment to sustainability. Its strategic investments in green steel and advanced materials signal a bold move in a rapidly changing world. With a vast global presence and a workforce of 50,000, understanding how Voestalpine SWOT Analysis works is paramount for anyone seeking to understand the future of manufacturing.

This in-depth exploration will uncover the core operations of the Voestalpine company, its diverse revenue streams, and the strategic milestones that have shaped its trajectory. We'll examine its competitive advantages, including its prowess in steel production and manufacturing processes, and how these factors contribute to its financial performance and global presence. This analysis will provide a comprehensive understanding of how Voestalpine works, including its sustainability initiatives and key business segments, to create value in the global economy.

What Are the Key Operations Driving Voestalpine’s Success?

The core operations of the Voestalpine company revolve around producing and processing high-quality steel products and advanced material solutions. They serve a wide array of industries, including automotive, aerospace, energy, and railway systems. Their offerings range from lightweight components to specialized alloys, catering to diverse needs across various sectors.

The company's value proposition lies in its ability to deliver customized solutions and advanced materials that often surpass industry standards. This is achieved through highly integrated and technologically advanced operational processes. This includes raw material sourcing, steel production, and advanced manufacturing processes.

The Voestalpine supply chain is vertically integrated, from raw materials to finished products, ensuring efficient delivery and localized support. They leverage strategic partnerships and a global distribution network to serve their diverse customer base effectively. Their strong focus on research and development allows them to offer innovative solutions.

The Voestalpine utilizes state-of-the-art facilities for steel production, incorporating advanced manufacturing processes like hot and cold rolling. This ensures the production of high-quality steel products. Their manufacturing processes are designed for efficiency and precision.

The company focuses on providing customized solutions and materials that meet specific customer needs. This approach enhances product performance and efficiency. This customer-centric strategy helps differentiate Voestalpine in the market.

Voestalpine maintains a robust global distribution network to ensure efficient delivery of its products. They have a strong presence in key markets worldwide. This global reach allows them to serve customers effectively.

Investment in research and development is a core element of Voestalpine's strategy. This enables them to develop new materials and processing techniques. This commitment to innovation drives their competitive advantage.

The company's operations are characterized by vertical integration, from raw materials to finished products. They focus on advanced manufacturing and research to develop innovative materials. Their global presence and customer-focused approach are also key.

- Vertical Integration: From raw materials to finished products.

- Advanced Manufacturing: Utilizing state-of-the-art facilities.

- Research and Development: Driving innovation in materials.

- Global Distribution: Ensuring efficient delivery worldwide.

Voestalpine SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Voestalpine Make Money?

The Voestalpine company generates revenue primarily through the sale of its extensive range of steel products and customized material solutions. Its revenue streams are diversified across four main divisions, ensuring a broad market reach. In the first three quarters of the 2024/2025 business year, the Group reported revenue of EUR 11.2 billion, demonstrating its significant market presence.

The company's operations span across various sectors, including automotive, aerospace, and railway systems. This diversification helps mitigate risks and ensures a steady flow of revenue. The Voestalpine company's ability to serve multiple industries with specialized products is a key strength.

Voestalpine's monetization strategies involve value-added services and customized product development. The company focuses on long-term supply agreements with key industrial customers. This approach allows for premium pricing in certain segments, enhancing profitability.

Focuses on high-quality strip steel products. These are used in the automotive, white goods, and construction industries. This division is crucial for Voestalpine's revenue generation.

Specializes in tool steel and special alloys. These materials are used in demanding applications in aerospace, automotive, and oil & gas sectors. This division often contributes significantly to overall profitability.

A global leader in railway systems. It offers seamless tubes and welding consumables. This division plays a vital role in infrastructure projects worldwide.

Produces highly refined sections, tubes, and precision components. These are used in the automotive, construction, and agricultural industries. It supports various sectors with its specialized products.

Voestalpine provides tailored solutions and advanced technical support. This allows for premium pricing in certain segments. This strategy enhances the company's profitability.

The company secures long-term supply agreements with key industrial customers. This ensures a stable revenue stream. This strategy is crucial for financial stability.

For more detailed information about Voestalpine, including its financial performance and structure, you can refer to the article Owners & Shareholders of Voestalpine. The company's strong performance in the High Performance Metals and Metal Engineering divisions often highlights their significant contribution to overall profitability due to the specialized nature of their products. The Voestalpine company's strategic focus on value-added services and customized solutions supports its premium pricing strategy and overall financial success.

Voestalpine PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Voestalpine’s Business Model?

The operational and financial trajectory of the Voestalpine company has been significantly shaped by pivotal milestones and strategic decisions. The company's focus on innovation and sustainability has been a consistent theme, driving its evolution in the steel industry. Understanding these key elements is crucial to grasping how Voestalpine operates and maintains its competitive edge.

A major strategic move currently underway is the 'greentec steel' program, representing a substantial investment of approximately EUR 1.5 billion. This initiative is designed to transition to CO2-reduced steel production, aiming for a 30% reduction in CO2 emissions by 2025 and achieving carbon neutrality by 2050. This commitment positions Voestalpine as a leader in sustainable steel production, meeting both environmental regulations and the growing demand for eco-friendly products.

Navigating volatile raw material prices, geopolitical uncertainties, and global economic slowdowns has presented operational challenges for Voestalpine. The company has responded by optimizing its production processes, enhancing supply chain resilience, and focusing on high-value-added product segments. For instance, despite a challenging economic environment in the first three quarters of 2024/2025, the company achieved solid results, demonstrating its adaptability and strategic prowess.

Key milestones include significant investments in advanced technologies and sustainable practices. These investments have enabled Voestalpine to expand its product portfolio and improve operational efficiency. The company's ability to adapt to changing market conditions has been crucial to its success.

Strategic moves include the 'greentec steel' program and a focus on high-value-added products. These moves align with global sustainability goals and customer demands. Voestalpine also strategically manages its supply chain to mitigate risks and ensure operational continuity.

The company's competitive edge stems from its technological leadership and strong brand reputation. Voestalpine leverages its global presence and integrated production sites to enhance efficiency. Furthermore, its commitment to digitalization and advanced manufacturing technologies supports its market leadership.

The financial performance of Voestalpine is influenced by its strategic decisions and market conditions. The company's ability to adapt to economic fluctuations and maintain profitability is a key indicator of its success. For a deeper understanding of Voestalpine's financial strategy, consider reading about the Growth Strategy of Voestalpine.

Several factors contribute to Voestalpine's competitive advantages, including technological leadership and a strong brand reputation. The company's global presence and integrated production sites also play a crucial role. Voestalpine continues to invest in digitalization and sustainable production methods to maintain its market leadership.

- Technological leadership in advanced steel grades and processing techniques.

- Strong brand reputation for quality and reliability.

- Significant economies of scale as a global player.

- Integrated production sites and a global sales network.

Voestalpine Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Voestalpine Positioning Itself for Continued Success?

The Voestalpine company holds a strong market position in various specialized steel and technology segments. It differentiates itself through high-quality, customized solutions and advanced research and development, with significant market share in areas like railway systems and tool steel. Customer loyalty is fostered through long-term partnerships and a commitment to innovation and service, making it a key player in the global steel industry.

Key risks include fluctuations in raw material prices, geopolitical instability, and environmental regulations. The ongoing energy crisis and inflation present further challenges. Despite these, Voestalpine is focused on its 'greentec steel' roadmap and expanding its portfolio of high-performance materials. The company anticipates solid performance for the 2024/2025 business year.

Voestalpine is a leading global steel and technology group. It focuses on high-quality products and customized solutions. The company is a significant player in the automotive, railway, and aerospace industries.

Risks include raw material price volatility and geopolitical instability. Environmental regulations and energy costs also pose challenges. The company must navigate these factors to maintain profitability.

The company is committed to its 'greentec steel' roadmap. It aims to reduce its carbon footprint. Voestalpine plans to invest in research and development. The company anticipates solid performance in 2024/2025.

Voestalpine focuses on sustainable steel production. It aims to reduce emissions and improve energy efficiency. The company is committed to long-term environmental goals.

Voestalpine's strategy includes innovation, sustainability, and global expansion. The company focuses on niche markets and high-performance materials. Market dynamics include competition from other steel producers and the impact of global economic conditions. To understand the company's customer base, consider reading about the Target Market of Voestalpine.

- Focus on high-value products and services.

- Investment in research and development for new materials.

- Expansion in growing markets, particularly in Asia.

- Emphasis on sustainable production methods to meet environmental standards.

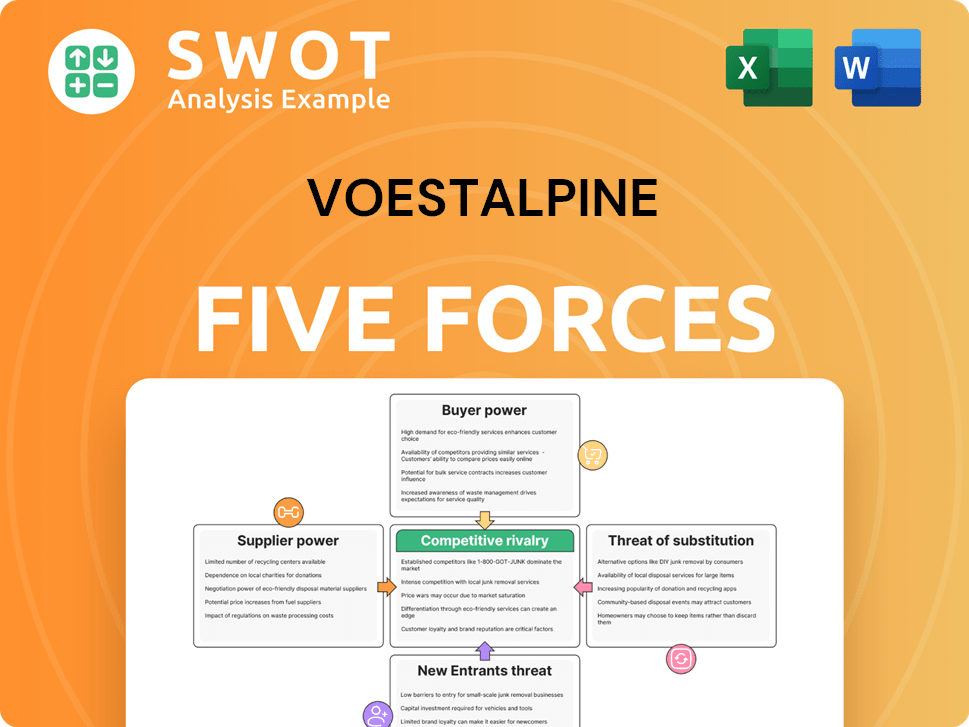

Voestalpine Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Voestalpine Company?

- What is Competitive Landscape of Voestalpine Company?

- What is Growth Strategy and Future Prospects of Voestalpine Company?

- What is Sales and Marketing Strategy of Voestalpine Company?

- What is Brief History of Voestalpine Company?

- Who Owns Voestalpine Company?

- What is Customer Demographics and Target Market of Voestalpine Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.