Volkswagen Group Bundle

Can Volkswagen Maintain Its Automotive Dominance?

The automotive world is in constant flux, with electric vehicles (EVs) and sustainability taking center stage. Volkswagen Group, a global automotive giant, faces intense competition in this dynamic environment. Founded in 1937, the company has grown from its humble beginnings into one of the world's largest automotive manufacturers.

This analysis dives deep into the Volkswagen Group SWOT Analysis, exploring its competitive landscape and the challenges it faces. We'll examine VW market analysis, including its main rivals and how it strategically positions itself in the global car market. Understanding Volkswagen's strategy is crucial for investors, analysts, and anyone interested in the automotive industry competition.

Where Does Volkswagen Group’ Stand in the Current Market?

The Volkswagen Group holds a prominent position in the global automotive industry, consistently ranking among the top manufacturers. In 2023, the group delivered a total of 9.24 million vehicles worldwide, reflecting a 12% increase compared to the previous year. This signifies the group's substantial global reach and its recovery from the challenges posed by the pandemic. Understanding the Volkswagen competitive landscape is crucial for assessing its market dynamics.

The group's diverse brand portfolio, which includes Volkswagen, Audi, Porsche, and others, allows it to cater to a broad spectrum of customer segments. This multi-brand strategy enables the Volkswagen Group to capture market share across various price points and consumer preferences, strengthening its position in the automotive industry competition. For a deeper dive into the company's strategic direction, consider exploring the Growth Strategy of Volkswagen Group.

In the European market, the Volkswagen Group's market share in 2023 was approximately 25.5%, solidifying its leadership in its home continent. In China, the group delivered 3.2 million vehicles in 2023, maintaining a strong presence despite intense local competition. These figures are vital for a thorough VW market analysis.

The Volkswagen Group's market share in Europe reached approximately 25.5% in 2023. Worldwide deliveries totaled 9.24 million vehicles, demonstrating a strong recovery and global presence.

The group's multi-brand strategy targets various segments, from mainstream to luxury. This allows for broader market coverage and competitive positioning across different consumer preferences.

In 2023, the Volkswagen Group reported a strong operating profit of €22.6 billion. The Automotive Division showed a solid net cash flow of €10.7 billion, highlighting its financial health.

The group aims for 50% of total deliveries to be battery electric vehicles (BEVs) by 2030. This strategic shift involves significant investments in electric mobility and digital transformation.

The Volkswagen Group faces intense competition in the global car market, especially in China, where it competes with local manufacturers and other global players. Its strategic focus on electric vehicles and digital transformation is critical for future growth.

- The group's diverse brand portfolio allows it to capture market share across various segments.

- The company is actively working to strengthen its position in emerging markets and further expand its EV footprint globally.

- Financial performance in 2023 underscores its scale and financial health compared to industry averages.

- The company is focusing on strategies for autonomous driving competition.

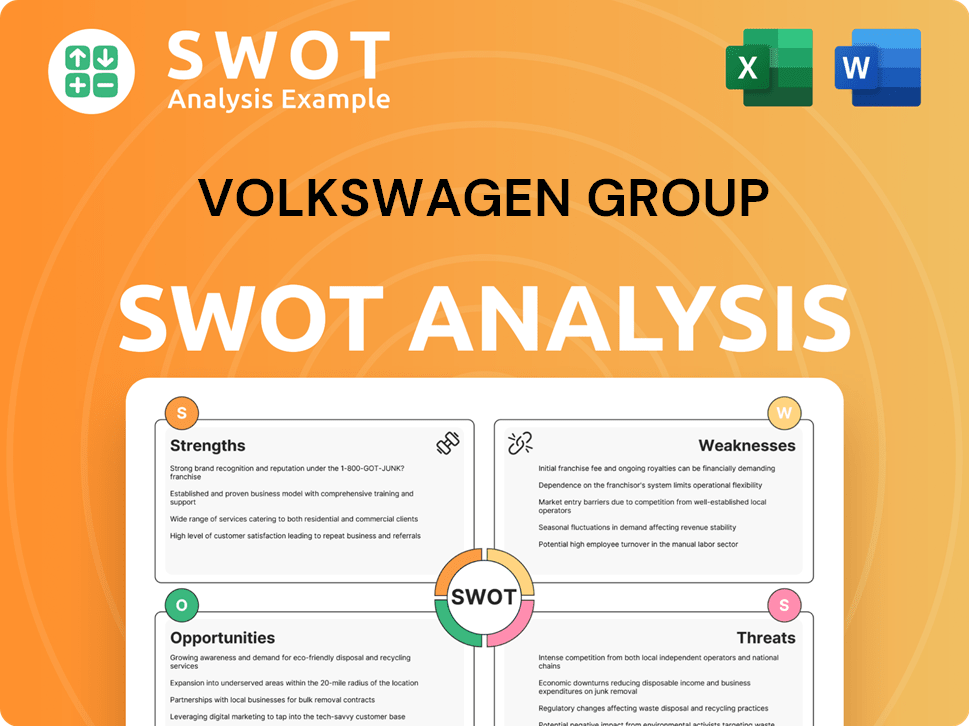

Volkswagen Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Volkswagen Group?

The Owners & Shareholders of Volkswagen Group face a dynamic and multifaceted competitive landscape. The automotive industry is characterized by intense rivalry, with companies constantly vying for market share, technological leadership, and consumer loyalty. Understanding the key competitors is crucial for assessing Volkswagen's strategic positioning and future prospects.

The Volkswagen competitive landscape is shaped by a variety of players, from established global automakers to emerging electric vehicle (EV) startups. These competitors challenge Volkswagen across different segments, including traditional internal combustion engine (ICE) vehicles, premium luxury cars, and the rapidly growing EV market. The intensity of competition necessitates continuous innovation, strategic partnerships, and adaptive business models.

The VW market analysis reveals a complex interplay of factors influencing competition, including technological advancements, changing consumer preferences, and global economic conditions. Volkswagen's ability to navigate this landscape will determine its long-term success and its capacity to maintain and grow its market share.

Volkswagen's primary direct competitors include major multinational automakers. These companies compete in the same segments and geographical markets, often vying for the top spots in sales and market share. These competitors have strong brand recognition and established global presences.

Toyota is a major competitor, consistently ranking among the top global vehicle sellers. Toyota's strength lies in its hybrid technology, robust supply chain, and strong presence in various markets. In 2024, Toyota's global sales reached approximately 10.3 million vehicles, highlighting its significant market share.

Stellantis, formed from the merger of FCA and PSA, offers a wide range of brands and competes across multiple segments. Stellantis challenges Volkswagen in both European and North American markets. Stellantis's diverse portfolio allows it to compete in various segments, including SUVs, trucks, and electric vehicles. In 2024, Stellantis reported global sales of around 6.2 million vehicles.

Hyundai-Kia has gained significant traction through competitive pricing, design, and a rapidly expanding EV lineup. They are rapidly increasing their market share, especially in the EV sector. Hyundai-Kia's focus on value and innovation makes them a formidable competitor. In 2024, Hyundai-Kia's combined global sales were approximately 6.3 million vehicles.

General Motors and Ford are key players in the North American market, competing directly with Volkswagen in various segments, including SUVs and trucks. These companies are also investing heavily in electric vehicle development. Both GM and Ford have substantial market shares in North America and are expanding their EV offerings. In 2024, General Motors sold approximately 6.2 million vehicles globally, while Ford sold around 4.1 million.

Volkswagen's Audi and Porsche brands compete in the premium segment, facing rivals with strong brand equity and technological prowess. These competitors focus on luxury, performance, and advanced features, attracting affluent consumers. The competition is intense, with each brand striving to offer the most innovative and desirable vehicles.

BMW and Mercedes-Benz offer luxury vehicles with strong brand loyalty and advanced technology. They are constantly innovating in performance and design, setting benchmarks in the premium segment. Both brands have a long history of success and a strong presence in global markets. In 2024, BMW sold approximately 2.5 million vehicles, and Mercedes-Benz sold around 2.0 million.

Tesla represents a formidable disruptor, leading in electric vehicle technology and challenging traditional automakers. Their software-centric approach and direct-to-consumer sales model set them apart. Tesla's focus on innovation and sustainability has made it a key player in the EV market. In 2024, Tesla delivered approximately 1.8 million vehicles globally.

The rise of Chinese automakers and new EV startups presents a significant challenge to Volkswagen. These companies are rapidly expanding their domestic and international presence, often offering competitive EV models at lower price points. They are challenging established market shares, particularly in the crucial Chinese EV market.

BYD, SAIC, Geely, and Nio are rapidly expanding their domestic and international presence, often offering highly competitive EV models at lower price points. These emerging players are challenging established market shares, particularly in the crucial Chinese EV market, where Volkswagen is intensifying its efforts to compete. BYD, for example, has seen significant growth in EV sales. In 2024, BYD sold approximately 3 million EVs.

The competitive landscape is further shaped by strategic alliances and joint ventures. Companies collaborate on technology development and market penetration to share costs and accelerate innovation. These partnerships enable companies to pool resources, reduce risks, and gain access to new markets and technologies.

Several factors drive competition in the automotive industry, influencing Volkswagen's strategy and performance. These factors include technological innovation, pricing strategies, brand perception, and market access. Understanding these factors is crucial for assessing Volkswagen's competitive position and future prospects.

- Technological Innovation: Advancements in electric vehicles, autonomous driving, and connectivity are key drivers of competition.

- Pricing Strategies: Competitive pricing is essential to attract customers and gain market share.

- Brand Perception: Brand image and reputation influence consumer choices and loyalty.

- Market Access: Expanding into new markets and strengthening existing presences is crucial for growth.

- Supply Chain Management: Efficient supply chains are essential for managing costs and ensuring production. The chip shortage of 2021-2023 significantly impacted the industry.

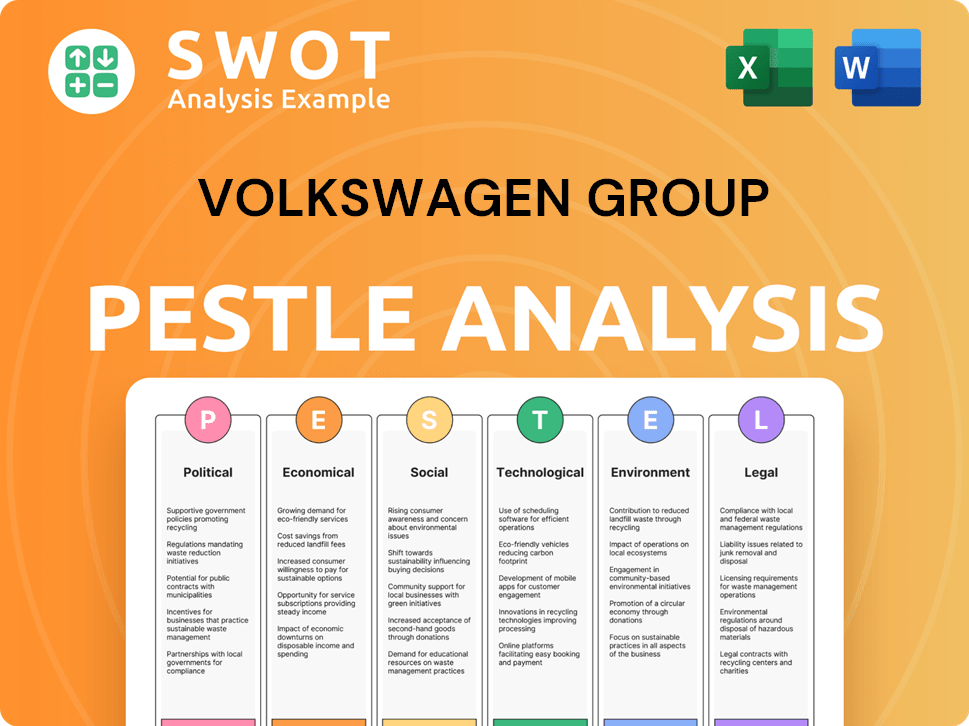

Volkswagen Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Volkswagen Group a Competitive Edge Over Its Rivals?

The Volkswagen competitive landscape is shaped by its extensive brand portfolio, economies of scale, and substantial investments in research and development. The group's strategy focuses on a diverse range of vehicles, from entry-level cars to luxury models, allowing it to target various market segments. This diversification helps mitigate risks and provides a broad customer base. Understanding the VW market analysis is crucial for assessing its position in the automotive industry competition.

As one of the world's largest automakers, the group benefits from significant purchasing power and efficient production processes. This scale allows for cost efficiencies in manufacturing and R&D, enabling substantial investment in future technologies. The Volkswagen Group competitors include other major players in the global car market. A deep dive into Volkswagen strategy will reveal how the company navigates these challenges.

The company leverages strong brand equity and customer loyalty, particularly for premium brands like Audi and Porsche. Volkswagen's reputation for engineering quality also contributes to its brand appeal. Its global production and sales network provides a significant distribution advantage. To understand the company's origins, one can explore the Brief History of Volkswagen Group.

Volkswagen Group's diverse brand portfolio, including Volkswagen, Audi, Porsche, Škoda, and SEAT, allows it to target nearly every segment of the automotive market. This strategy provides a wide customer base and mitigates risks associated with fluctuations in demand for any single segment. The group's ability to cater to various consumer preferences is a key competitive advantage.

As one of the largest automakers globally, Volkswagen Group benefits from massive purchasing power, optimized production processes, and efficient resource allocation. This scale enables cost efficiencies in manufacturing, research, and development. The group's commitment to modular production and shared platforms like MEB and PPE for electric vehicles further solidifies its manufacturing prowess.

Volkswagen Group invests heavily in future technologies such as electric powertrains, autonomous driving, and digitalization. In 2023, the company's research and development costs amounted to €18.9 billion, underscoring its commitment to innovation. This investment is critical for maintaining a competitive edge in the rapidly evolving automotive industry.

The extensive global production and sales network ensures widespread availability of Volkswagen Group's vehicles and services across key markets. This network provides a significant distribution advantage, allowing the group to reach customers worldwide. The group's transformation of its production network enhances efficiency and sustainability.

Volkswagen Group's competitive advantages include a diverse brand portfolio, economies of scale, significant investment in R&D, and a robust global production and distribution network. These factors enable the company to compete effectively in the global car market. The group's focus on electric vehicles and autonomous driving further strengthens its position.

- Brand Diversification: Targeting various market segments.

- Economies of Scale: Cost efficiencies in manufacturing and R&D.

- R&D Investment: Focus on future technologies.

- Global Network: Widespread vehicle availability.

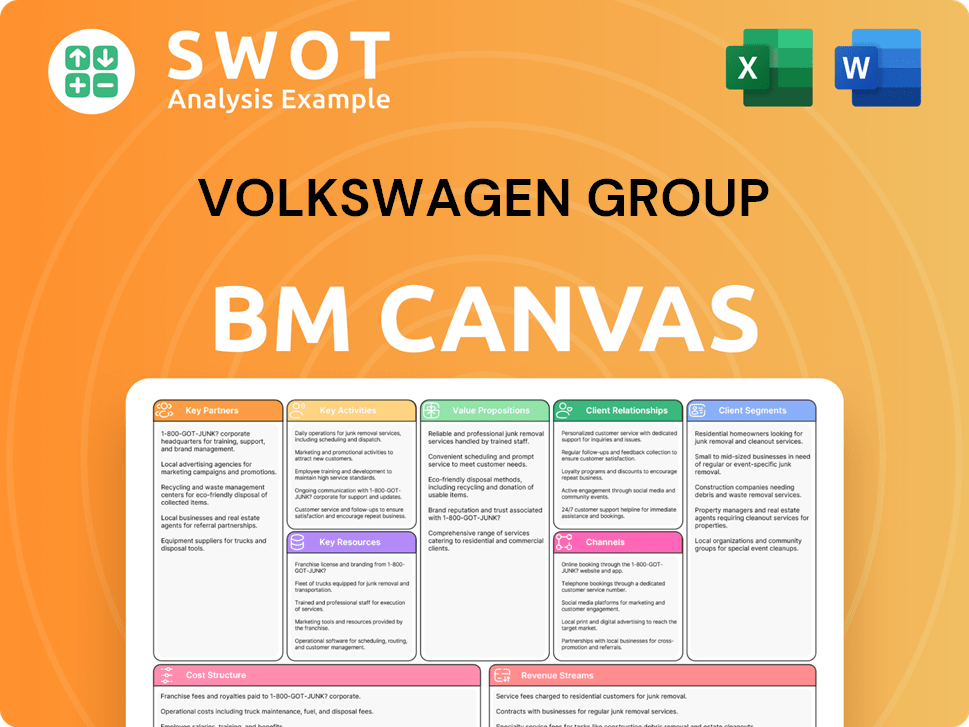

Volkswagen Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Volkswagen Group’s Competitive Landscape?

The automotive industry is undergoing a significant transformation, and the Target Market of Volkswagen Group is adapting to these changes. The company faces intense competition, especially from new EV entrants and established rivals. This competitive landscape requires strategic agility and innovation to maintain and grow market share. Risks include supply chain disruptions, regulatory changes, and evolving consumer preferences, while opportunities lie in the expansion of electric vehicle (EV) adoption and digital services.

The future outlook for Volkswagen Group depends on its ability to navigate these challenges and capitalize on emerging opportunities. This includes successful execution of its EV strategy, advancements in software and autonomous driving technologies, and effective management of global supply chains. The company's financial performance and strategic decisions will be critical in determining its long-term success in the dynamic global car market.

The automotive industry is currently shaped by the shift towards electric mobility. Stricter emission standards and consumer demand are driving this trend. Software and digitalization are also becoming increasingly important, with modern cars becoming 'software-defined'.

Key challenges include intense competition from EV pure-plays like Tesla and Chinese manufacturers. Geopolitical tensions and supply chain vulnerabilities also pose risks. Adapting to changing consumer preferences, such as mobility-as-a-service models, is also a challenge.

Opportunities exist in emerging markets, the expansion of charging infrastructure, and the development of new digital services. Autonomous driving technology also presents future revenue streams. Strategic partnerships can also create competitive advantages.

Volkswagen's strategy involves accelerating its EV offensive, strengthening its software capabilities, and exploring strategic partnerships. The company aims for BEVs to account for 50% of its total deliveries by 2030. This requires substantial retooling of production facilities and supply chain adjustments.

The

-

Competitive Landscape: The

includes Tesla, BYD, and other established automakers. - Market Share: In 2024, Volkswagen's global market share was approximately 11%, with variations across different regions.

- Financial Performance: Volkswagen's financial results in 2024 showed a strong focus on profitability, with significant investments in EVs and software.

-

Strategic Initiatives: The company is focusing on expanding its EV portfolio, developing software capabilities, and forming strategic partnerships to enhance its

.

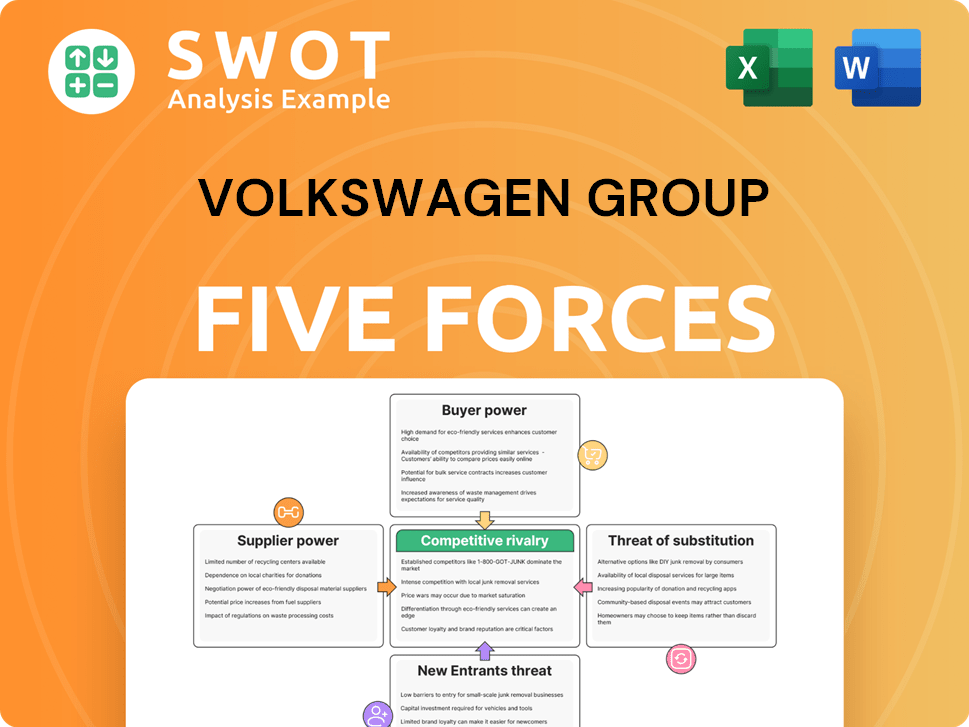

Volkswagen Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Volkswagen Group Company?

- What is Growth Strategy and Future Prospects of Volkswagen Group Company?

- How Does Volkswagen Group Company Work?

- What is Sales and Marketing Strategy of Volkswagen Group Company?

- What is Brief History of Volkswagen Group Company?

- Who Owns Volkswagen Group Company?

- What is Customer Demographics and Target Market of Volkswagen Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.