VTech Bundle

How does VTech navigate the cutthroat world of consumer electronics?

VTech, a global force in electronic learning products and cordless phones, has carved a significant niche in a competitive market. Founded in Hong Kong, the company has evolved from a startup to a multinational enterprise, demonstrating remarkable adaptability. This evolution underscores VTech's strategic prowess in identifying and capitalizing on lucrative market opportunities.

To truly understand VTech's trajectory, we must dissect its VTech SWOT Analysis and the broader VTech competitive landscape. This analysis will explore VTech's market position, its key competitors, and the strategies it employs to maintain its edge. We'll also delve into the VTech market analysis, examining its product portfolio and business strategy to assess its future prospects within the VTech industry.

Where Does VTech’ Stand in the Current Market?

As a leading player in the global market, VTech's core operations revolve around two primary segments: electronic learning products (ELPs) and telecommunications equipment. VTech's business model is built on product innovation, efficient manufacturing, and robust distribution networks. The company's value proposition centers on providing high-quality, educational, and technologically advanced products that meet the needs of both children and adults.

VTech's competitive landscape is shaped by its diversified product portfolio and global presence. The company leverages its strong brand reputation and extensive distribution channels to maintain a competitive edge. VTech's business strategy focuses on continuous innovation and market expansion, allowing it to adapt to changing consumer preferences and technological advancements.

VTech holds a prominent position in the ELP and cordless phone markets. Its market share fluctuates, but it consistently ranks among the top competitors. The company's strong brand recognition and diverse product range contribute to its sustained market presence. The company competes with major toy manufacturers and educational technology companies.

VTech's product portfolio includes DECT, Bluetooth, and 2.4 GHz cordless phones, as well as educational tablets, interactive toys, and learning systems. The company continuously updates its offerings to incorporate the latest technological advancements. This diversified product range allows VTech to cater to a wide range of consumer needs.

VTech has a strong global presence, with key markets in North America, Europe, and Asia. Its extensive distribution networks ensure broad market coverage. The company's ability to reach a diverse customer base is a key factor in its success. VTech's global footprint supports its overall market position.

VTech has diversified into contract manufacturing services, providing a stable revenue stream. The company maintains a healthy balance sheet, supporting R&D and market expansion. Financial stability allows VTech to invest in innovation and maintain a competitive edge. This diversification strategy helps mitigate risks.

Analyzing the VTech competitive landscape reveals several key aspects of its market position. VTech's strengths include its strong brand reputation, extensive distribution networks, and diversified product portfolio. However, the company faces challenges from competitors in both the ELP and telecommunications sectors. The VTech market analysis demonstrates that the company's success hinges on its ability to innovate and adapt to changing market dynamics. For more details on the VTech business strategy, consider reading the Marketing Strategy of VTech.

VTech's competitive advantages include its strong brand recognition, efficient manufacturing, and diversified product offerings. The company's focus on innovation and its global distribution network also contribute to its success. These factors allow VTech to maintain a strong position in the market.

- Strong Brand Reputation: Recognized for quality and innovation in ELPs and telecommunications.

- Efficient Manufacturing: Provides a cost advantage and supports product development.

- Global Distribution Network: Ensures broad market coverage and accessibility for consumers.

- Product Diversification: Reduces risk and caters to a wide range of consumer needs.

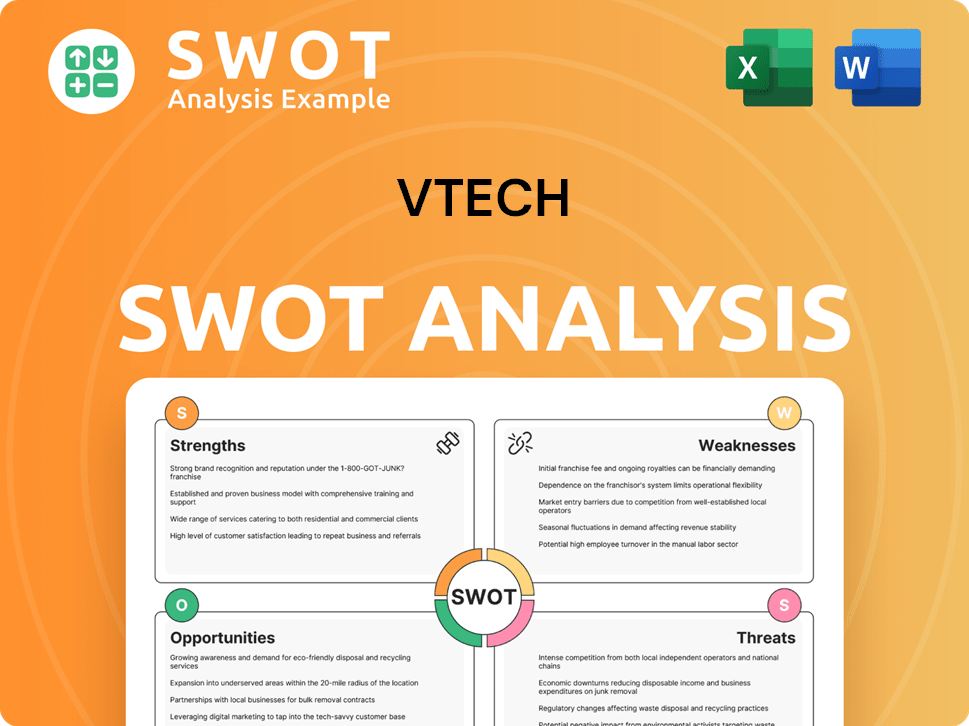

VTech SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging VTech?

The VTech competitive landscape is shaped by its diverse product offerings, spanning electronic learning products (ELPs) and telecommunications equipment. Understanding its key rivals is crucial for a comprehensive VTech market analysis. The company's strategies are heavily influenced by its competitors' actions and market trends.

VTech's business strategy involves navigating a competitive environment where innovation, brand recognition, and distribution capabilities are vital. The company's ability to maintain and grow its market share depends on its ability to differentiate itself from competitors and adapt to changing consumer preferences. A thorough understanding of its rivals is essential for assessing its overall performance.

VTech's product portfolio faces competition from both direct and indirect sources. The ELP segment competes with established toy manufacturers and digital content providers, while the telecommunications sector faces competition from major telecommunications equipment manufacturers. The company's success depends on its ability to innovate and respond effectively to market challenges.

In the ELP market, VTech's main rivals in the electronic learning toys market include major toy companies. These competitors often have strong brand recognition and extensive distribution networks. They compete on product features, pricing, and marketing strategies.

Key competitors in the ELP market include LeapFrog (now part of VTech), Mattel (Fisher-Price), Hasbro, and Spin Master. These companies compete directly with VTech in the children's tech and educational toy segments. They continuously introduce new products and features to capture market share.

Indirect competitors include companies offering screen-based educational content and apps. These competitors, such as Google Kids Space and Apple Arcade, compete for children's screen time and parental spending. They represent a shift in the market towards digital learning.

In the cordless phone market, VTech's key competitors in the US market include telecommunications equipment manufacturers. These companies compete on product features, pricing, and brand loyalty. The market has seen some decline due to the rise of mobile phones.

Key competitors in the cordless phone market include Panasonic, AT&T (through licensing agreements), and Uniden. These companies focus on providing reliable and feature-rich landline solutions. They compete for market share among consumers who still prefer landline options.

Emerging players include smaller startups focused on niche educational tech or smart home communication devices. These companies often leverage crowdfunding or direct-to-consumer models. They bring new innovations and competitive pressures to the market.

VTech's strengths and weaknesses analysis reveals the company's position in a dynamic market. Competitive advantages of VTech company include its established brand, innovative product development, and strong distribution networks. However, the company faces challenges such as changing consumer preferences and the rise of digital competitors. For further insights into VTech's strategic approach, consider reading about the Growth Strategy of VTech.

VTech's strategies for staying competitive involve product innovation, strategic acquisitions, and adapting to market trends. The company must continually evaluate its competitive position and adjust its strategies to maintain its market share. Analyzing VTech's competitive positioning in the smart toys sector requires a deep understanding of the market.

- Product Innovation: Continuously developing new and engaging products is essential.

- Strategic Acquisitions: Acquiring companies like LeapFrog can consolidate market share.

- Distribution Channels: Maintaining and expanding distribution networks to reach consumers.

- Market Analysis: Regularly assessing market trends and competitor activities.

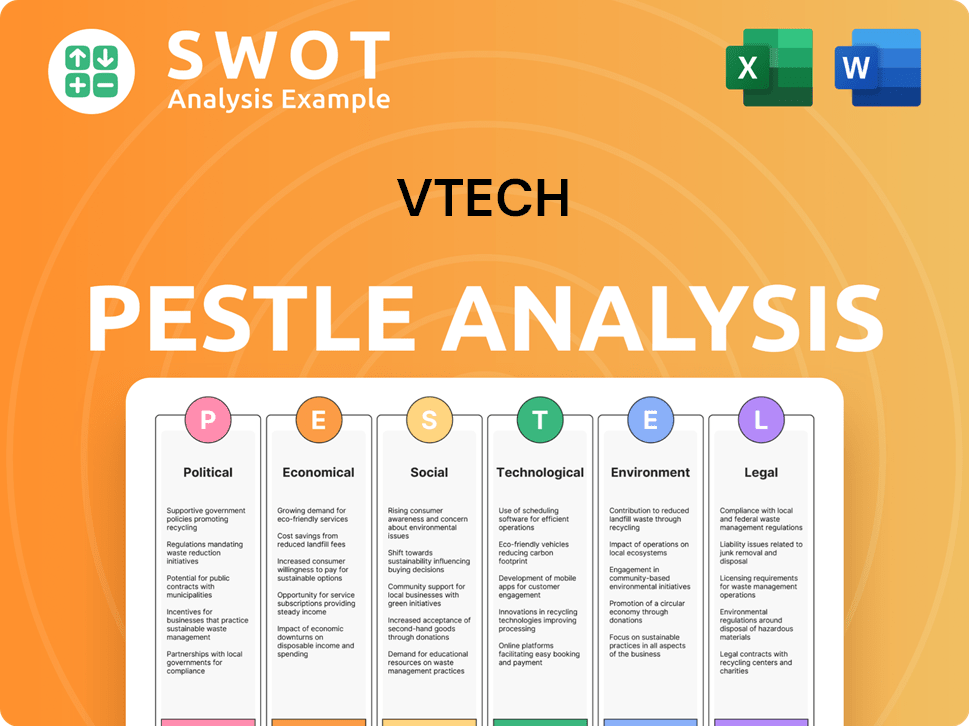

VTech PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives VTech a Competitive Edge Over Its Rivals?

Understanding the VTech competitive landscape involves analyzing its key strengths and how it differentiates itself in the market. VTech's business strategy focuses on innovation, brand recognition, and efficient operations. This approach has allowed it to maintain a strong position in the VTech industry, particularly in electronic learning products (ELP) and telecommunications.

VTech's product portfolio is a significant factor in its market presence. The company continuously updates its offerings to meet evolving consumer needs, including smart toys and baby monitors. Key strategic moves, such as the acquisition of LeapFrog in 2016, have strengthened its competitive edge and expanded its reach within the ELP sector. A deeper dive into the VTech market analysis reveals the importance of these strategic decisions.

The company's competitive advantages are multifaceted, contributing to its success in a dynamic market. These advantages are crucial for understanding VTech's strengths and weaknesses analysis and its ability to navigate the competitive environment.

VTech has built a strong brand reputation, especially in the ELP market. Parents and educators trust the brand for reliable, age-appropriate educational content. This trust translates into customer loyalty and lower acquisition costs. The brand's long-standing presence in the market has solidified its position.

VTech holds numerous patents related to its educational software, interactive features, and telecommunications technology. This intellectual property provides a barrier to entry for competitors. These patents protect its innovations and maintain its competitive edge in the market.

As a large-scale manufacturer, VTech benefits from optimized production processes and efficient supply chain management. This allows the company to offer competitive pricing while maintaining healthy profit margins. Economies of scale are crucial for cost-effectiveness.

VTech's integrated design, manufacturing, and distribution capabilities enable quicker time-to-market and better quality control. This streamlined approach allows for faster product launches and responsiveness to market demands. These capabilities are a key differentiator.

VTech's robust global distribution networks ensure widespread product availability. Its talent pool, particularly in engineering and educational content development, is crucial for continuous innovation. The acquisition of LeapFrog in 2016 expanded its product portfolio and intellectual property. For more information on how VTech has grown, see Growth Strategy of VTech.

VTech's competitive advantages are multifaceted, contributing to its success in a dynamic market. These advantages are crucial for understanding VTech's strengths and weaknesses analysis and its ability to navigate the competitive environment. The company's ability to innovate and adapt is key.

- Strong Brand Reputation: Trust and loyalty in the ELP market.

- Intellectual Property: Patents that protect innovations and create barriers to entry.

- Economies of Scale: Optimized production and efficient supply chain.

- Integrated Capabilities: Faster time-to-market and better quality control.

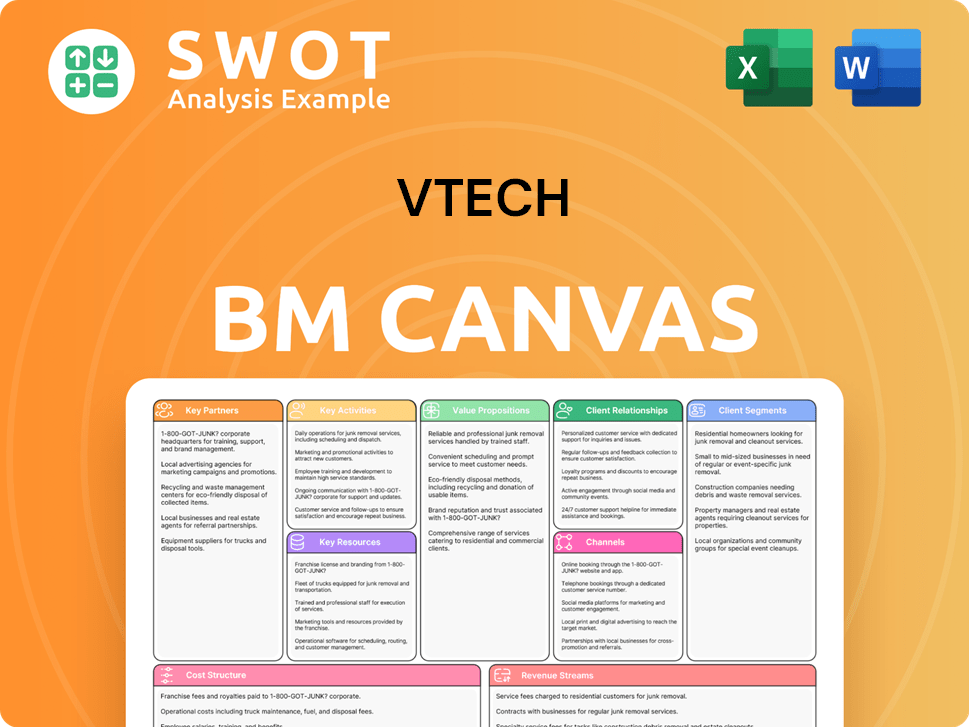

VTech Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping VTech’s Competitive Landscape?

The VTech competitive landscape is significantly influenced by technological advancements and evolving consumer preferences. The company operates within the electronic learning products (ELP) and telecommunications sectors, facing challenges from digital disruption and shifting market dynamics. Understanding the VTech industry trends and anticipating future challenges is crucial for maintaining a strong market position.

VTech market analysis reveals a need for continuous innovation to stay competitive. This includes adapting to regulatory changes, such as those concerning data privacy and product safety, and leveraging opportunities in emerging markets. To address these issues, VTech must focus on product innovation, strategic partnerships, and diversification to secure long-term growth.

The ELP market is seeing increased demand for interactive and screen-based learning experiences. Regulatory changes, such as COPPA in the US and GDPR in Europe, require continuous adaptation. The cordless phone market faces challenges from the rise of mobile-only households, but niche markets persist.

Potential disruptions include new tech sector entrants leveraging AI for educational tools. Declining demand in the cordless phone business presents a challenge. Increased competition in the ELP segment from companies with strong digital ecosystems is also a threat.

Significant growth opportunities exist in emerging markets due to rising disposable incomes and increased demand for educational toys. Product innovation, such as AI-powered learning toys and AR integration, can unlock new revenue streams. Strategic partnerships with educational institutions can enhance offerings.

VTech is likely to focus on continuous innovation in the ELP segment. Diversifying contract manufacturing services will be crucial. Exploring new applications for telecommunications expertise is also essential to adapt to market changes. Target Market of VTech provides insights.

VTech's business strategy involves several key initiatives to navigate the competitive landscape. The company is focusing on product innovation, particularly in the ELP segment, to meet changing consumer demands. Diversification and strategic partnerships are also vital.

- Product Innovation: Developing AI-powered learning toys and integrating AR to enhance the user experience.

- Market Expansion: Targeting emerging markets with increasing demand for educational toys.

- Strategic Partnerships: Collaborating with educational institutions to enhance product offerings.

- Diversification: Expanding contract manufacturing services and exploring new telecommunications applications.

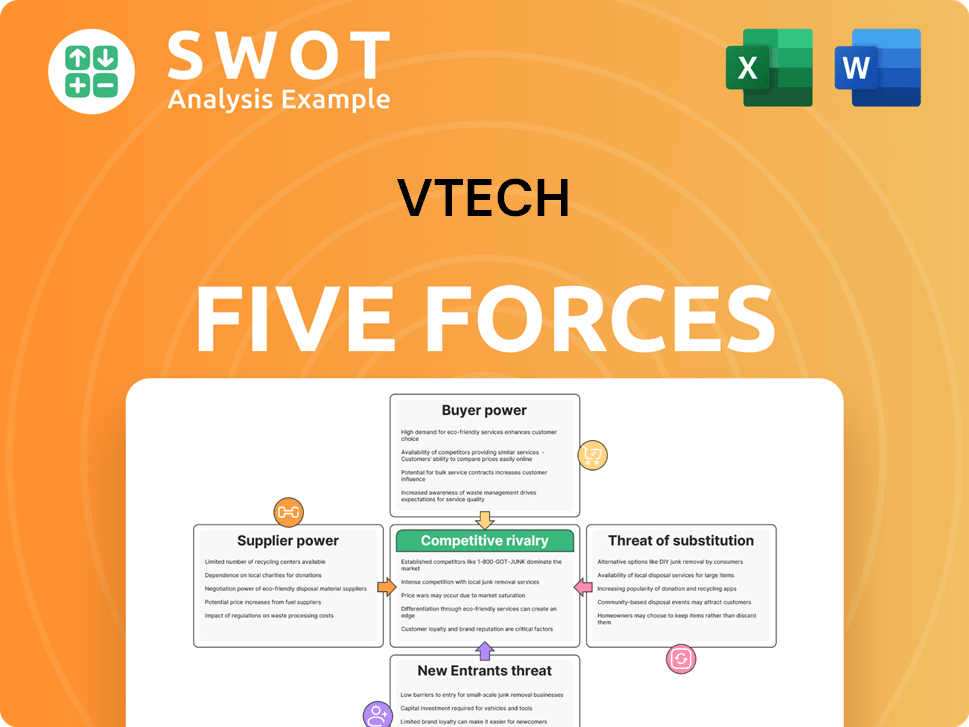

VTech Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of VTech Company?

- What is Growth Strategy and Future Prospects of VTech Company?

- How Does VTech Company Work?

- What is Sales and Marketing Strategy of VTech Company?

- What is Brief History of VTech Company?

- Who Owns VTech Company?

- What is Customer Demographics and Target Market of VTech Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.