VTech Bundle

How Does the VTech Company Thrive?

Since 1976, VTech has been a powerhouse in the consumer electronics world, particularly known for its innovative electronic learning products. From pioneering VTech SWOT Analysis in the electronic learning toy category, the company has consistently adapted to market changes. Beyond its popular VTech toys and electronics, the company has expanded into telecommunications, solidifying its global presence.

VTech's recent acquisition of Gigaset assets highlights its strategic agility, even amidst economic headwinds. The company's impressive revenue growth, despite global challenges, showcases its resilience and ability to capitalize on opportunities. Exploring VTech's operational strategies and diverse product lines, including VTech products, is key to understanding its sustained performance and future prospects in a competitive market.

What Are the Key Operations Driving VTech’s Success?

The core operations of the VTech company revolve around three primary business segments: Electronic Learning Products (ELPs), Telecommunication Products (TEL), and Contract Manufacturing Services (CMS). This diversified approach allows VTech to cater to a broad market, from educational toys for children to telecommunication solutions for homes and businesses. The company's strategy emphasizes integrating learning with play through innovative technology, ensuring its products remain relevant and competitive in the market.

The value proposition of VTech products lies in its ability to combine educational expertise with technological innovation. This is supported by a robust global manufacturing and distribution network. VTech offers high-quality, diverse products and services. The company's recent acquisition of Gigaset's assets has expanded its telecommunications offerings, particularly in residential phones and business telephony solutions.

Operational processes at VTech include design, manufacturing, sourcing, technology development, logistics, sales channels, and customer service. The company's commitment to Industry 4.0 manufacturing aims to enhance efficiency and cost-effectiveness. Its extensive network ensures broad market reach and responsiveness to regional demands. You can learn more about their target audience in this article: Target Market of VTech.

ELPs include a wide range of educational toys for infants, toddlers, and preschoolers under the VTech and LeapFrog brands. These products focus on integrating learning with play through innovative technology. The ELP segment is a significant contributor to VTech's revenue, driven by continuous innovation in educational content and interactive features.

The TEL segment designs, manufactures, and distributes cordless and corded phones for residential and commercial customers. This includes DECT, Bluetooth, and 2.4 GHz models. The acquisition of Gigaset's assets has expanded its offerings in residential phones and business telephony solutions. The TEL segment leverages VTech's manufacturing expertise to offer reliable and feature-rich communication devices.

CMS provides manufacturing services to various clients, leveraging VTech's global manufacturing footprint. This segment helps to manage supply chain complexities and mitigate tariff impacts. CMS contributes to VTech's overall revenue and profitability by utilizing its manufacturing capacity and expertise.

VTech maintains a global manufacturing footprint with facilities in mainland China, Malaysia, Germany, and Mexico. This extensive network of R&D centers, manufacturing operations, and sales subsidiaries across the Americas, Europe, and Asia ensures broad market reach. Partnerships with leading retailers and e-commerce companies in over 90 countries ensure broad market reach and responsiveness to regional demands.

VTech's operational success is underpinned by its strategic focus on innovation, quality, and global presence. The company continually invests in research and development to enhance its product offerings and maintain a competitive edge. VTech's commitment to Industry 4.0 manufacturing enhances efficiency and customer service.

- Global Manufacturing: Facilities in China, Malaysia, Germany, and Mexico.

- R&D Centers: Extensive network across the Americas, Europe, and Asia.

- Sales Channels: Partnerships with leading retailers and e-commerce companies in over 90 countries.

- Technology Integration: Emphasis on integrating learning with play through innovative technology in ELPs.

VTech SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does VTech Make Money?

The primary revenue streams for the VTech company are segmented into Electronic Learning Products (ELPs), Telecommunication Products (TEL), and Contract Manufacturing Services (CMS). These diversified segments allow VTech to cater to various markets, from consumer electronics to manufacturing solutions. For the fiscal year ending March 31, 2025, the company reported a total revenue of US$2,177.2 million, marking a 1.5% increase from the previous year.

VTech leverages its brand strength and product innovation to drive sales through various retail and e-commerce channels. The company's monetization strategies also include a comprehensive approach to manufacturing for other companies through its CMS segment. The strategic acquisition of Gigaset has significantly expanded its revenue sources, particularly in the telecommunications sector.

VTech's financial performance showcases its ability to adapt and grow in a competitive market. The company's focus on innovation and strategic acquisitions, as highlighted in Brief History of VTech, contributes to its sustained revenue generation and market presence.

During the six months ended September 30, 2024, Europe emerged as VTech's largest market, contributing 42.4% of the Group's revenue, equating to US$462.1 million. North America followed, accounting for 41.6% of the revenue, or US$453.1 million. The TEL products segment experienced significant growth, especially in Europe, with revenue increasing by 173.8% to US$211.4 million for the full fiscal year 2025.

- ELPs generated US$403.8 million globally during the six months ended September 30, 2024.

- TEL products brought in US$193.9 million during the same period.

- CMS contributed US$492.0 million during the same period.

- The acquisition of Gigaset led to residential phones accounting for approximately 46% of the total TEL products revenue in FY2025.

VTech PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped VTech’s Business Model?

The evolution of the VTech company showcases a blend of strategic acquisitions, operational adjustments, and a commitment to innovation. Recent key moves, such as the acquisition of Gigaset Communications GmbH, have significantly reshaped its market presence. These actions, coupled with its strong brand reputation, particularly in the electronic learning toys sector, highlight VTech's adaptability and competitive spirit.

VTech has navigated challenges like economic downturns and geopolitical uncertainties by optimizing its operations and supply chain. This includes relocating production to mitigate tariff impacts and maintaining a focus on profitability. The company's ability to integrate new acquisitions and adapt to changing market conditions underscores its strategic agility.

VTech products continue to be recognized for their innovation and quality. The company's focus on product development, combined with its economies of scale, supports its competitive edge in the global market. This approach allows VTech to maintain its leadership position and adapt to evolving consumer demands.

A significant milestone was the April 5, 2024, acquisition of Gigaset Communications GmbH, expanding manufacturing to Germany. This strategic move solidified VTech's position as a leader in residential phones. The integration of Gigaset's operations was on track for completion by the end of 2024.

VTech has responded to economic challenges by improving gross profit margins and managing expenses. The company is also accelerating the relocation of production for US-bound products from mainland China. This relocation began with CMS in 2018 and TEL products in 2020, with ELP production now in progress.

VTech's brand strength in electronic learning toys is a key advantage, holding leadership in key markets. The company's technology leadership is evident through innovative product development, such as award-winning products. Economies of scale and successful acquisitions further enhance its competitive position.

TEL products revenue increased by 173.8% to US$211.4 million in FY2025 due to the Gigaset acquisition. Despite a decline in revenue in FY2024, VTech managed to increase its profit by improving gross profit margins and managing operating expenses. For more details, explore the Owners & Shareholders of VTech.

VTech Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is VTech Positioning Itself for Continued Success?

The VTech company maintains a strong industry position, particularly in electronic learning products (ELPs) and residential phones. It faces risks from volatile tariffs, economic downturns, and changing consumer preferences. Its future outlook involves strategic initiatives to sustain growth and profitability, leveraging its financial strength and brand reputation.

VTech's performance is underpinned by its strong market positions, including leading shares in key product categories across major markets. Despite challenges, the company is focused on innovation, operational efficiency, and strategic market expansion to ensure long-term success.

VTech is the global leader in electronic learning products for infancy through preschool. It is also the world's largest supplier of residential phones. The company is the world's number one contract manufacturer of professional audio equipment. In the US, VTech is the number one cordless phone and baby monitor brand.

Key risks include volatile US tariffs, necessitating costly production facility relocations. The negative economic outlook, marked by high global interest rates and geopolitical tensions, affects consumer spending. Changing consumer preferences and technological disruptions pose ongoing challenges in the consumer electronics and telecommunications markets.

VTech is focused on strategic initiatives to sustain and expand profitability. The successful integration of Gigaset is expected to yield synergies and drive growth in the telecommunications segment. The company is accelerating its global production base diversification to mitigate tariff impacts.

While group revenue is forecast to increase for the full financial year 2025, driven by higher ELPs sales in the US and increased TEL product revenue from Gigaset integration, the volatile US tariff situation and negative economic outlook are projected to lead to a decline in group revenue in financial year 2026.

VTech is implementing several strategic initiatives to navigate challenges and capitalize on opportunities. These include integrating Gigaset, diversifying its global production base, and investing in Industry 4.0 technologies.

- Successful Gigaset integration is expected to boost telecommunications revenue.

- Diversifying the production base aims to mitigate the impact of tariffs.

- Investment in Industry 4.0 will enhance operational efficiency.

- Focus on innovation and operational excellence to drive performance.

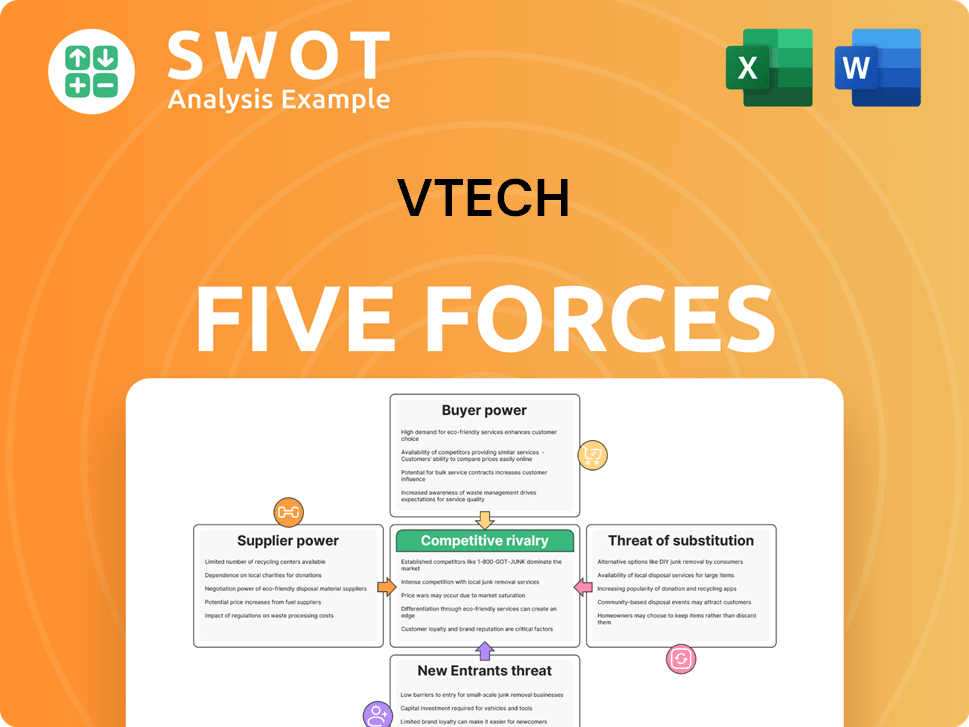

VTech Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of VTech Company?

- What is Competitive Landscape of VTech Company?

- What is Growth Strategy and Future Prospects of VTech Company?

- What is Sales and Marketing Strategy of VTech Company?

- What is Brief History of VTech Company?

- Who Owns VTech Company?

- What is Customer Demographics and Target Market of VTech Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.