Williams-Sonoma Bundle

How Does Williams-Sonoma Thrive in a Crowded Market?

In the ever-evolving world of home goods, understanding the Williams-Sonoma SWOT Analysis is key to grasping its market position. Founded in 1956, the company has evolved from a kitchenware retailer to a home furnishings giant. This journey reveals a strategic approach to navigating the competitive landscape and capitalizing on industry trends.

This analysis will dissect the Williams-Sonoma competitive landscape, identifying its Williams-Sonoma competitors and evaluating its Williams-Sonoma market analysis. We'll explore its Williams-Sonoma competitive advantages and delve into the factors that influence its success in the home goods industry. Understanding retail competition and the dynamics of the kitchenware market is crucial for investors and strategists alike.

Where Does Williams-Sonoma’ Stand in the Current Market?

The company, a key player in the home furnishings and cookware sector, strategically targets middle to high-end consumers. Its diverse brand portfolio, including Pottery Barn and West Elm, positions it as a leader in several key categories. The company's primary offerings span kitchenware, furniture, bedding, and outdoor living, catering to a wide array of home-related needs.

Geographically, the company primarily operates in North America, with a growing international presence through e-commerce and select retail locations. It has successfully embraced digital transformation, significantly investing in direct-to-consumer channels, which now represent a substantial portion of its sales. This digital-first approach allows it to reach a broader customer base and adapt to changing retail consumption patterns.

Financially, the company demonstrates robust health compared to many industry averages. For the fiscal year 2023, the company reported net revenues of $7.76 billion, indicating its substantial scale within the industry. This financial strength supports continued investment in product development, supply chain optimization, and customer experience initiatives. The company holds a particularly strong position in the premium and design-focused segments of the home furnishings market, leveraging its brand equity and curated product assortments.

Analyzing the Williams-Sonoma competitive landscape requires acknowledging the fragmented nature of the home goods industry. While specific market share figures for the entire sector can be difficult to pinpoint, the company's diverse brand portfolio allows it to capture significant portions of various sub-segments. The company's brands, such as Pottery Barn and West Elm, hold prominent positions in the furniture and home decor markets.

The company strategically positions itself in the premium and design-focused segments of the home furnishings market. This positioning is supported by its brand equity and curated product assortments. The company's customer base typically consists of middle to high-income individuals who value quality, style, and brand reputation. The company's customer demographics are crucial for understanding its Williams-Sonoma market analysis.

The company has significantly invested in its direct-to-consumer channels, with online sales representing a substantial portion of its revenue. This digital-first approach allows the company to reach a broader customer base and adapt to changing retail consumption patterns. The company's online presence is a key factor in its Williams-Sonoma business strategy.

For fiscal year 2023, the company reported net revenues of $7.76 billion. This financial strength enables continued investment in product development, supply chain optimization, and customer experience initiatives. The company's financial performance demonstrates its substantial scale within the home goods industry. Check out Growth Strategy of Williams-Sonoma for more information.

The company's competitive advantages include its strong brand equity, curated product assortments, and robust online presence. Its diverse brand portfolio caters to a wide range of customer preferences and price points. The company's focus on quality and design positions it favorably in the premium home furnishings market.

- Strong Brand Equity: Recognized and trusted brands like Pottery Barn and West Elm.

- Curated Product Assortments: High-quality products with a focus on design.

- Robust Online Presence: Significant investment in direct-to-consumer channels.

- Financial Stability: Strong revenue and financial performance.

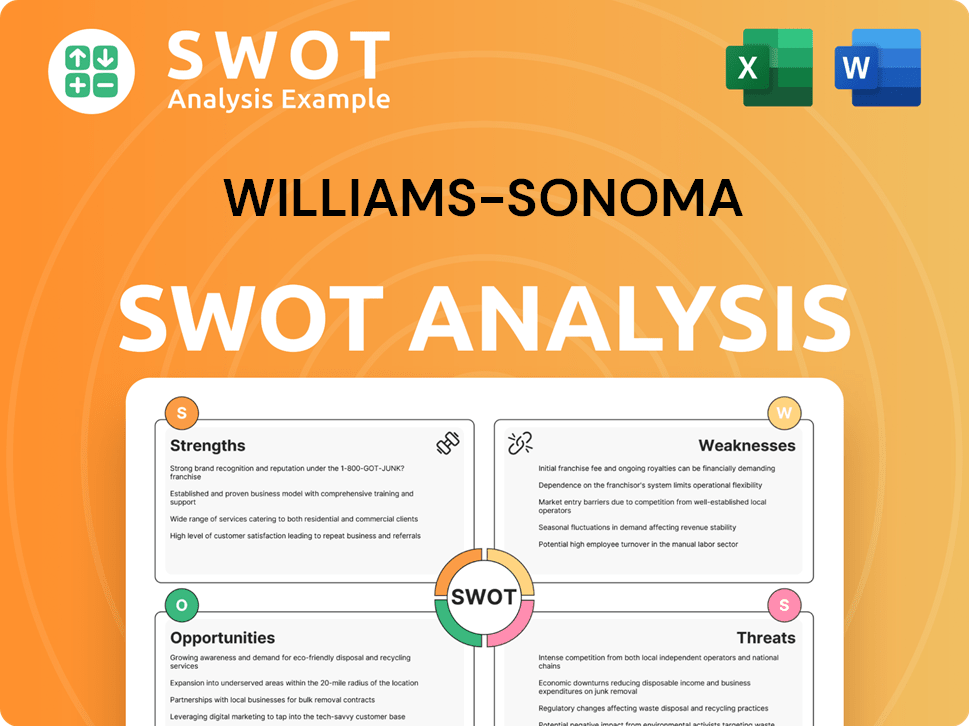

Williams-Sonoma SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Williams-Sonoma?

The Williams-Sonoma competitive landscape is complex, encompassing a variety of players across the home goods industry. Understanding the key competitors and their strategies is crucial for assessing the company's market position and future prospects. This analysis involves examining both direct and indirect competitors, as well as emerging trends that shape the retail competition.

A thorough Williams-Sonoma market analysis reveals that the company faces challenges from both traditional brick-and-mortar retailers and digitally native brands. The competitive environment is dynamic, with companies continually adapting their strategies to gain market share. This includes adjustments to pricing, product offerings, and distribution channels to cater to evolving customer preferences.

The home goods industry is highly competitive, with various players vying for market share. This section will explore the key competitors that impact Williams-Sonoma's performance, providing insights into their strategies and market positions. The analysis will cover direct competitors, such as those offering similar products and services, and indirect competitors, including mass merchandisers and online retailers.

Direct competitors offer similar products and target the same customer base. These companies often compete on brand identity, product quality, and customer experience.

RH is a major player in the luxury home furnishings market, known for its high-end products and gallery showrooms. RH's focus on premium quality and design places it directly against Williams-Sonoma's higher-end brands. In 2023, RH reported net revenues of approximately $3.5 billion.

Crate & Barrel offers a similar range of home furnishings and kitchenware, targeting a slightly more contemporary design aesthetic. Crate & Barrel competes directly with Williams-Sonoma's core brands in terms of product offerings and target demographic. Crate & Barrel's estimated annual revenue is around $1.2 billion.

At Home Group Inc. provides a broad assortment of home decor at various price points, competing with Williams-Sonoma's broader product range. At Home's strategy focuses on offering a wide selection and competitive pricing to attract a diverse customer base. At Home Group Inc. reported revenues of $1.5 billion in 2023.

Sur La Table is a specialty retailer focused on kitchenware and cooking classes, competing directly with Williams-Sonoma's kitchen-focused brands. Sur La Table's emphasis on culinary education and high-quality kitchen tools differentiates it in the market. Sur La Table's estimated annual revenue is around $300 million.

Pottery Barn is a direct competitor known for its home furnishings and decor. Pottery Barn's brand positioning and product offerings closely align with those of Williams-Sonoma, making it a significant competitor. Pottery Barn's estimated annual revenue is around $2.5 billion.

Indirect competitors offer similar products or services but may target a different customer segment or have a different business model. These companies can still impact Williams-Sonoma's market share.

- Target and Walmart: These mass merchandisers compete in the kitchenware and basic home goods segments, offering competitive pricing and convenience. Target's home decor sales in 2023 were approximately $15 billion, while Walmart's home goods sales were around $25 billion.

- Wayfair and Overstock (now part of Bed Bath & Beyond): These online retailers have disrupted the traditional retail landscape with extensive online catalogs and efficient delivery networks. Wayfair's revenue in 2023 was approximately $12 billion, and Bed Bath & Beyond's revenue was around $3.6 billion.

- Amazon: Amazon's vast marketplace offers a wide selection of kitchenware and home goods, competing on price and convenience. Amazon's overall home and kitchen sales are substantial, though specific figures for these categories are not always disclosed.

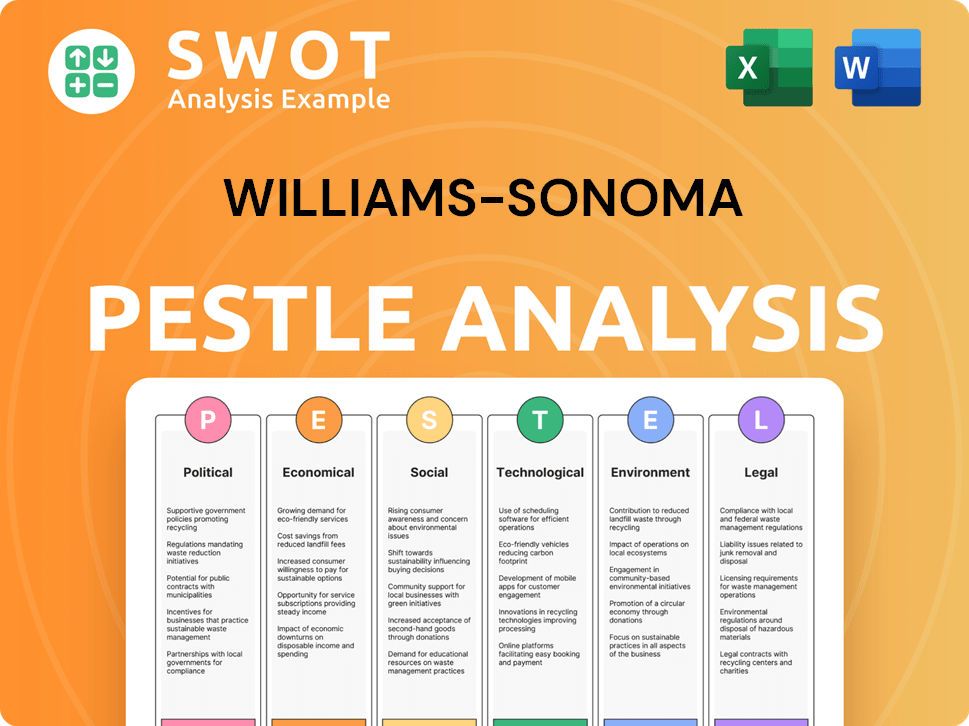

Williams-Sonoma PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Williams-Sonoma a Competitive Edge Over Its Rivals?

The competitive landscape for Williams-Sonoma is shaped by its strong brand equity, multi-brand portfolio, and dedication to quality and design. The company's diverse brand collection, including well-known names like Pottery Barn and West Elm, allows it to cater to various customer preferences and price points. This strategy fosters significant brand loyalty within each segment, creating a synergistic effect that enhances market penetration.

A key differentiator for the company is the perceived high quality and curated design of its products, resonating with consumers seeking premium home goods. This is supported by robust supply chain management, ensuring the sourcing of high-quality materials and efficient delivery. Furthermore, Williams-Sonoma leverages its robust direct-to-consumer capabilities, particularly its e-commerce platforms, which have become increasingly vital in the evolving retail landscape.

The company's investment in digital infrastructure and seamless omnichannel experiences allows it to reach a wider audience and provide convenient shopping options. Its customer service and in-store design expertise contribute to a superior customer experience, fostering repeat business and positive word-of-mouth. These advantages have evolved over time, with the company continually adapting its product offerings and retail strategies to meet changing consumer demands and technological advancements. For more insights, check out the Target Market of Williams-Sonoma.

Williams-Sonoma's multi-brand strategy, including brands like Pottery Barn and West Elm, allows it to target diverse customer segments. This approach enhances market reach and brand loyalty. The company's brand portfolio is a significant factor in the Williams-Sonoma competitive landscape.

The company is known for its high-quality products and curated designs, which attract consumers seeking premium home goods. This focus on quality and design is a key competitive advantage. This focus is crucial in the kitchenware market and the broader home goods industry.

Williams-Sonoma's e-commerce platforms and omnichannel experiences are vital in today's retail environment. These platforms allow the company to reach a wider audience and provide convenient shopping options. Online versus in-store sales are a key area of focus.

Superior customer service and in-store design expertise foster repeat business and positive word-of-mouth. These elements contribute to a strong customer experience. Customer demographics are also a key factor.

Williams-Sonoma's competitive advantages include a strong brand reputation, an extensive customer base, and operational efficiencies. These advantages create barriers to entry and allow the company to maintain its premium positioning. The company's business strategy leverages these advantages in marketing, product development, and partnerships.

- Multi-Brand Strategy: Catering to diverse customer segments with brands like Pottery Barn and West Elm.

- High-Quality Products: Offering premium home goods with curated designs.

- Direct-to-Consumer: Utilizing e-commerce and omnichannel experiences.

- Customer-Centric Approach: Providing excellent customer service and in-store design expertise.

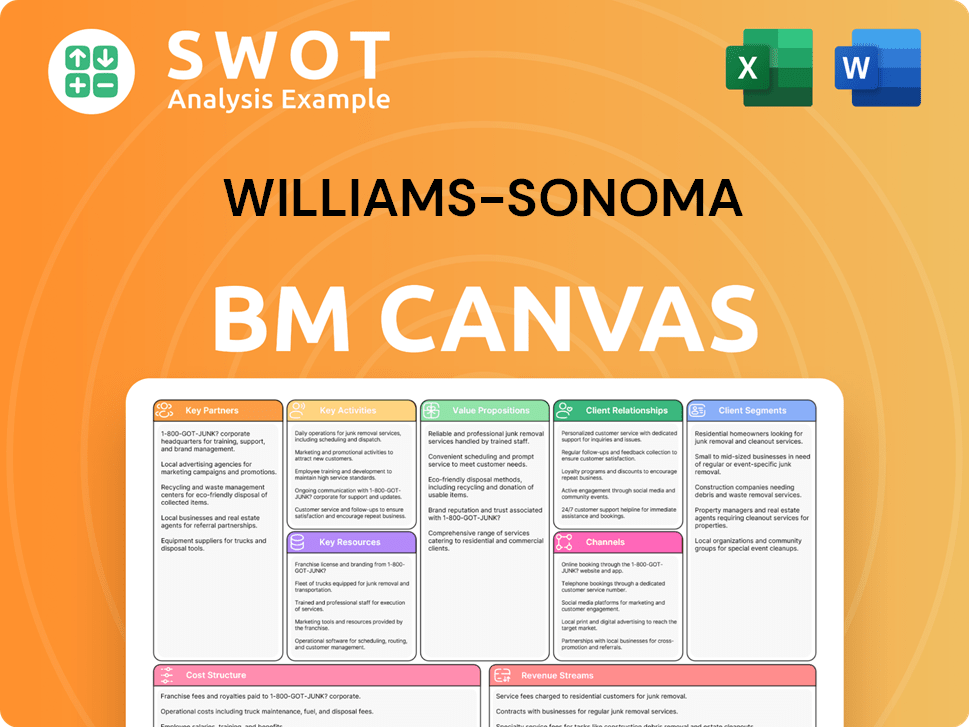

Williams-Sonoma Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Williams-Sonoma’s Competitive Landscape?

The home furnishings and cookware industry is currently experiencing significant shifts that are reshaping the competitive landscape for companies like Williams-Sonoma. These changes are driven by technological advancements, evolving consumer preferences, and economic factors. Understanding these dynamics is crucial for assessing Williams-Sonoma's future prospects and its ability to maintain a strong market position.

The company faces both immediate challenges and long-term opportunities. Supply chain disruptions, inflationary pressures, and increased competition from both traditional and online retailers are key concerns. However, the ongoing "home nesting" trend, expansion into international markets, and product innovation offer avenues for growth. Adapting to these changes requires strategic agility and a focus on customer-centric strategies.

Technological advancements, such as augmented reality (AR) and virtual reality (VR), are transforming the retail experience, allowing customers to visualize products in their homes. Sustainability and ethical sourcing are becoming increasingly important to consumers, driving demand for eco-friendly products. Personalized experiences and direct-to-consumer (DTC) models are also gaining traction.

Supply chain disruptions and inflationary pressures can impact product availability and pricing, affecting profitability. Increased competition from digitally native brands and mass-market retailers puts pressure on market share. Economic uncertainties and fluctuating consumer spending habits can influence demand, particularly for discretionary home goods.

The "home nesting" trend, where consumers invest in their living spaces, presents a favorable market environment. Expansion into emerging international markets, particularly those with growing middle classes, offers revenue growth potential. Product innovation, focusing on smart home devices and sustainable materials, attracts environmentally conscious consumers.

Enhancing omnichannel capabilities, expanding the reach of brands like West Elm, and investing in personalization are key strategies. Focusing on digital engagement, sustainable practices, and curated product assortments is crucial to meet consumer demands. Strategic partnerships with designers and influencers can boost brand visibility.

The competitive landscape for Williams-Sonoma is dynamic. The company's success hinges on its ability to adapt to these trends and challenges. For a deeper understanding of the company's origins and evolution, consider reading the Brief History of Williams-Sonoma. This historical context provides valuable insights into the company's strategies and its ability to navigate market changes. Williams-Sonoma's future depends on its ability to innovate, respond to consumer demands, and maintain a strong brand presence.

Williams-Sonoma's strategies include enhancing its omnichannel presence, expanding its brand portfolio, and investing in personalized customer experiences. These efforts aim to strengthen customer engagement and drive sales. The company continues to focus on digital innovation and sustainable practices to maintain a competitive edge.

- Investing in digital marketing and e-commerce platforms.

- Developing sustainable and eco-friendly product lines.

- Expanding into international markets with high-growth potential.

- Forming strategic partnerships to enhance brand visibility.

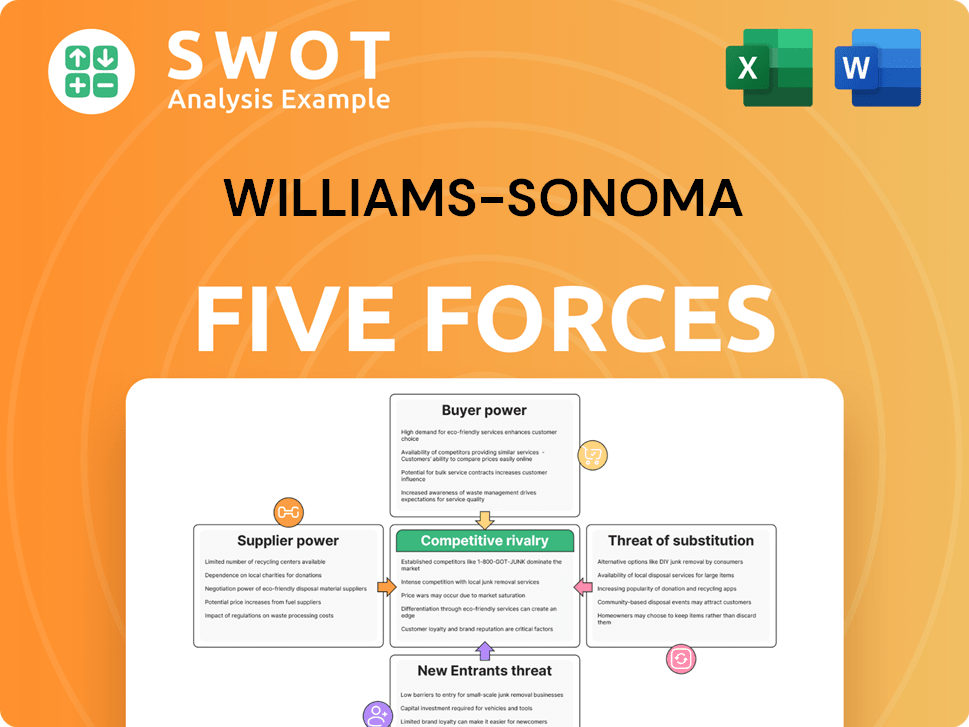

Williams-Sonoma Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Williams-Sonoma Company?

- What is Growth Strategy and Future Prospects of Williams-Sonoma Company?

- How Does Williams-Sonoma Company Work?

- What is Sales and Marketing Strategy of Williams-Sonoma Company?

- What is Brief History of Williams-Sonoma Company?

- Who Owns Williams-Sonoma Company?

- What is Customer Demographics and Target Market of Williams-Sonoma Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.