Williams-Sonoma Bundle

Who Really Owns Williams-Sonoma?

Ever wondered who steers the ship at Williams-Sonoma, the powerhouse behind Pottery Barn and West Elm? Understanding the Williams-Sonoma SWOT Analysis is just the beginning; knowing its ownership structure unlocks a deeper understanding of its strategic moves and market position. From its humble beginnings to its current status as a retail giant, the story of Williams-Sonoma's ownership is a fascinating journey.

This deep dive explores the Williams-Sonoma ownership landscape, from its founder's vision to the influence of today's Williams-Sonoma major shareholders. We'll uncover the evolution of its Williams-Sonoma company structure, examining how shifts in ownership have impacted its Williams-Sonoma brands and overall strategy. Discover the key players behind this iconic retailer and gain insights into its future, including its Williams-Sonoma stock performance and Williams-Sonoma financial information.

Who Founded Williams-Sonoma?

The story of Williams-Sonoma begins with Charles E. 'Chuck' Williams, who founded the company in 1956. He started with a single store in Sonoma, California, focusing on importing high-quality cookware from France. This marked the beginning of what would become a significant player in the retail industry.

Initially, Williams-Sonoma operated as a private venture. The specifics of the early equity split or initial shareholding percentages are not publicly available. Chuck Williams was the sole proprietor and driving force behind the company's early concept, shaping its identity and direction.

During its early stages, Williams-Sonoma's growth was fueled by its increasing popularity and the expanding market for gourmet cooking. There is no widely publicized information about early angel investors or friends and family acquiring significant stakes during this initial, private period. The company's expansion in its formative years was organic, driven by demand and Williams's entrepreneurial spirit.

Chuck Williams established the company in 1956. The first store was located in Sonoma, California.

The company started as a private venture. Early ownership details are not publicly available.

Chuck Williams personally curated the product selection. He focused on quality and customer service.

Expansion was driven by demand. There were no early external investors.

Early agreements, such as vesting schedules or buy-sell clauses, would have been internal to Williams's private ownership and are not publicly disclosed.

There are no notable reports of initial ownership disputes or buyouts involving the founder in the company's foundational years.

The initial focus on high-quality cookware and the founder's dedication to customer service set the stage for the future. For a deeper dive into the company's origins, check out this Brief History of Williams-Sonoma. The company's evolution from a single store to a publicly traded entity reflects significant changes in its ownership structure over time. The early years were defined by the founder's vision and direct control, shaping the company's core values and market approach.

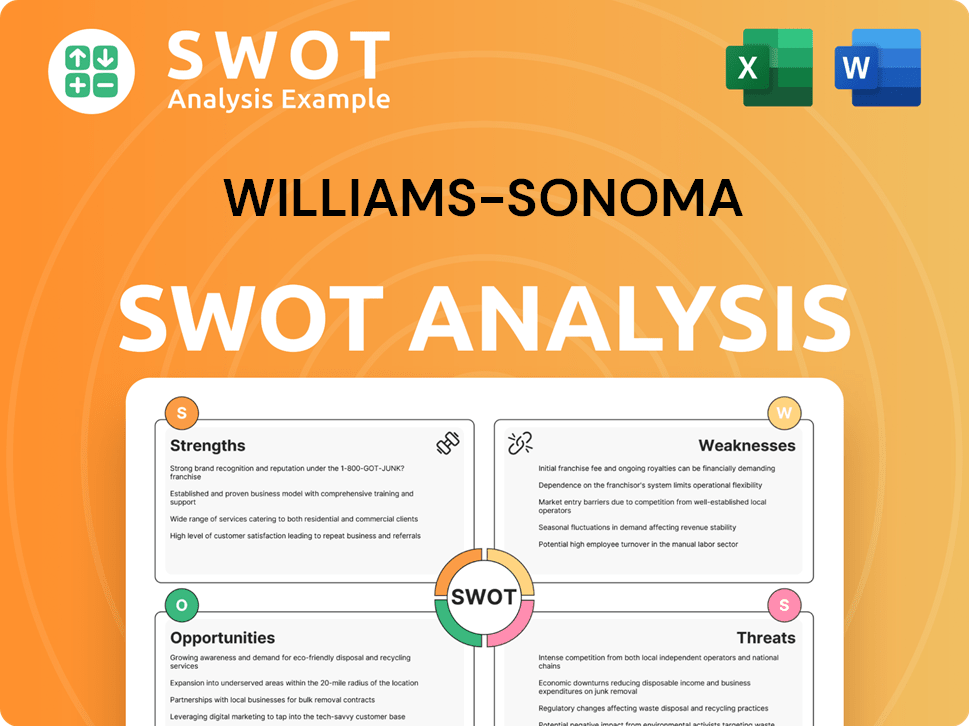

Williams-Sonoma SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Williams-Sonoma’s Ownership Changed Over Time?

The evolution of Williams-Sonoma's ownership structure began with its Initial Public Offering (IPO) in 1983. This pivotal event transformed the company from a privately held entity to a publicly traded one. The IPO facilitated access to public investment, providing capital for expansion and growth. This shift broadened the ownership base beyond the original founders and private investors.

Since the IPO, the ownership of the company has changed significantly. The initial private ownership transitioned to a structure dominated by institutional investors. This change has influenced the company's strategic direction, emphasizing financial performance and shareholder value.

| Event | Date | Impact on Ownership |

|---|---|---|

| Initial Public Offering (IPO) | 1983 | Transitioned from private to public ownership, enabling public investment. |

| Institutional Investment Growth | Ongoing | Increased ownership by institutional investors, influencing strategic focus. |

| Executive and Board Ownership | Ongoing | Alignment of interests between management and shareholders. |

As of early 2025, the major stakeholders in the company are primarily institutional investors, mutual funds, and index funds. These entities collectively hold a significant percentage of the company's stock. For example, in late 2024, Vanguard Group Inc. held approximately 11.5% of the common stock, while BlackRock Inc. held around 9.8%. This dispersed ownership structure among institutional investors underscores a focus on consistent financial performance and adherence to corporate governance best practices.

The company's ownership has evolved significantly since its IPO in 1983, shifting from private to public ownership.

- Institutional investors, such as Vanguard and BlackRock, are major shareholders.

- Executive and board members also hold shares, aligning their interests with shareholders.

- The ownership structure influences the company's strategic focus on financial performance and shareholder value.

- Understanding the ownership structure is crucial for investors and stakeholders.

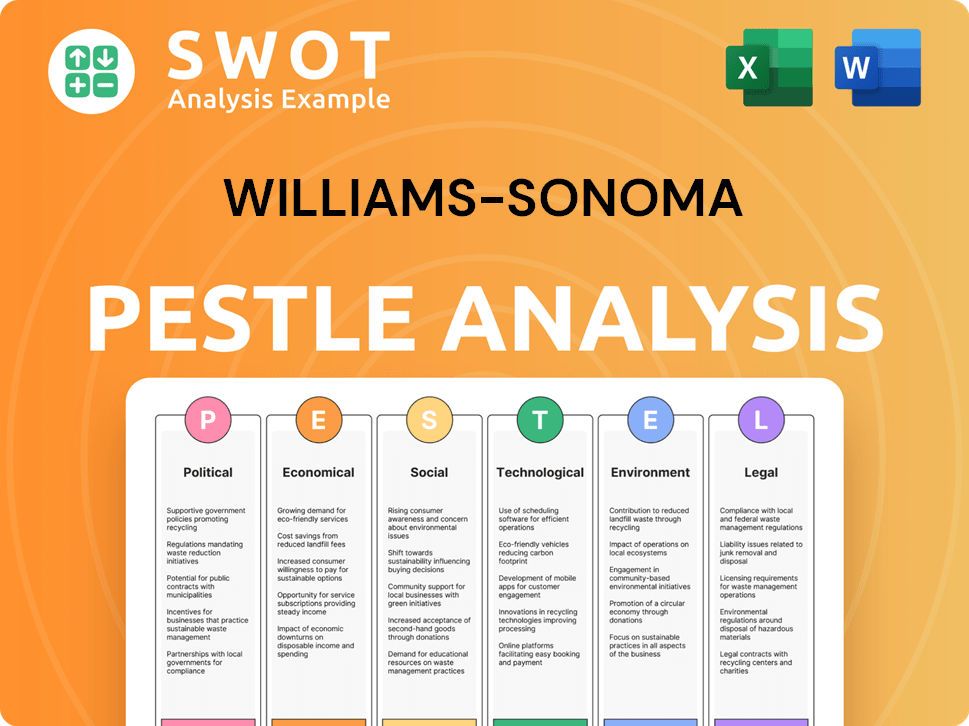

Williams-Sonoma PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Williams-Sonoma’s Board?

The current Board of Directors of Williams-Sonoma, Inc. includes a blend of independent directors and company executives. This structure aims to balance oversight with strategic leadership. As of early 2025, the board typically features the President and CEO alongside several independent directors. These independent directors bring expertise from various industries. The goal is to maintain a majority of independent directors to ensure objective decision-making. Directors representing major shareholders are less common, given the dispersed ownership among institutional investors. Board members are generally selected based on their business acumen and industry experience.

The board's composition is designed to support the company's strategic goals. While specific individuals may change, the focus remains on a mix of skills and perspectives. This approach reflects a commitment to sound corporate governance. The board's structure is crucial for guiding the company's long-term success. The board's role is to oversee the company's operations and ensure accountability to shareholders. The board's decisions have a direct impact on the company's performance and value.

| Board Member | Title | Affiliation |

|---|---|---|

| Laura Alber | President and CEO | Williams-Sonoma, Inc. |

| W. Howard Lester | Chairman Emeritus | Williams-Sonoma, Inc. |

| Other Independent Directors | Various | Various Industries |

Williams-Sonoma, Inc. operates under a one-share-one-vote voting structure. This is standard for most publicly traded companies in the United States. Each share of common stock carries one vote, providing proportional voting power. There are no dual-class shares or special voting rights. This democratic structure empowers institutional and individual shareholders. They can influence corporate governance through their voting power. Proxy battles and activist investor campaigns are possible, but Williams-Sonoma has not faced high-profile controversies recently. This voting structure ensures that all shareholders have a voice in the company's direction. For more details on the company's financial aspects, you can explore the Revenue Streams & Business Model of Williams-Sonoma.

Shareholders have proportional voting power based on their ownership stake.

- One share equals one vote.

- No special voting rights exist.

- Institutional and individual shareholders have influence.

- The structure supports democratic corporate governance.

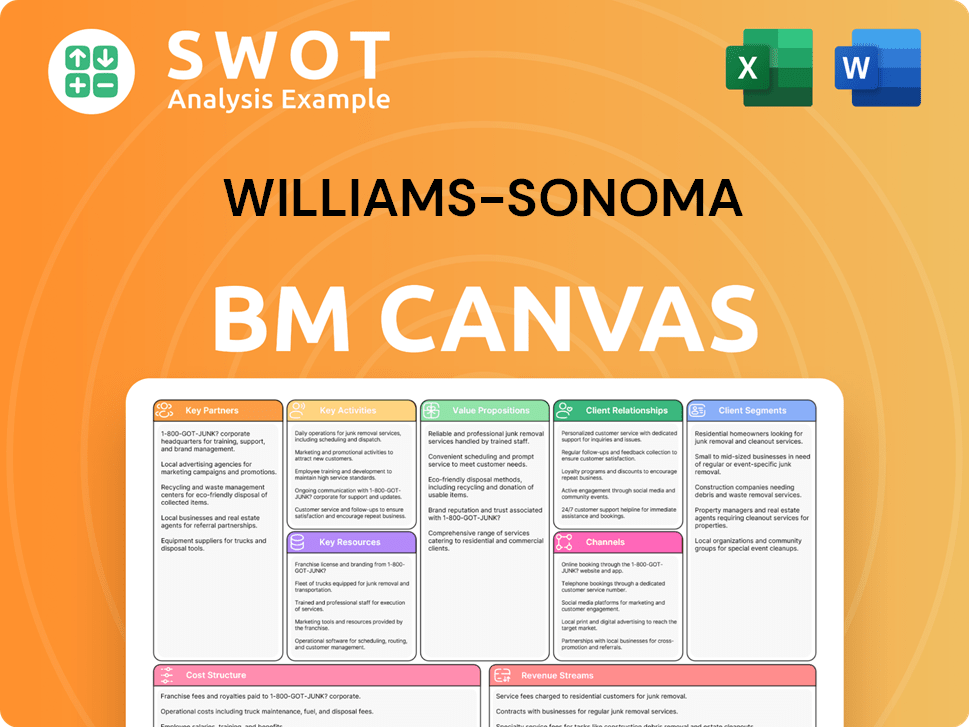

Williams-Sonoma Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Williams-Sonoma’s Ownership Landscape?

Over the past few years, the ownership structure of Williams-Sonoma has seen shifts influenced by both internal strategies and broader market trends. The company, a publicly traded entity, has actively engaged in share buyback programs. These programs are designed to return value to shareholders and can potentially boost earnings per share. In fiscal year 2024, significant share repurchases were authorized and executed, impacting the total number of outstanding shares.

Institutional ownership has also played a significant role. Large asset managers have either maintained or increased their stakes, reflecting confidence in the company's long-term performance. While the influence of the original founder's direct ownership has naturally diminished over time, the company's ownership base has diversified. Additionally, the rise of passive investing has led to greater ownership by index funds, which influences how Williams-Sonoma interacts with its shareholders. For insights into the competitive landscape, consider exploring the Competitors Landscape of Williams-Sonoma.

| Metric | Details | Recent Data |

|---|---|---|

| Share Repurchases | Impact on outstanding shares | Significant repurchases in fiscal year 2024 |

| Institutional Ownership | Asset managers' stake | Maintained or increased stakes |

| Passive Investing | Influence of index funds | Increased ownership by index funds |

The focus for Williams-Sonoma has largely been on optimizing its multi-channel retail strategy and expanding its market reach, rather than major ownership changes. The company's financial performance and strategic initiatives continue to be key drivers of its stock performance and investor interest.

Recent trends include share buybacks and increased institutional ownership. These actions reflect the company's commitment to returning value to shareholders. The company's ownership structure is influenced by broader market dynamics and strategic decisions.

The rise of passive investing has led to greater ownership by index funds. This shift impacts how Williams-Sonoma engages with its shareholders. Index funds often hold a significant portion of the company's stock.

Share buybacks are a common strategy to return value to shareholders. These programs reduce the number of outstanding shares. This can potentially boost earnings per share.

Institutional investors maintain or increase their stakes in Williams-Sonoma. This indicates confidence in the company's long-term performance. These investors often hold a substantial portion of the company's stock.

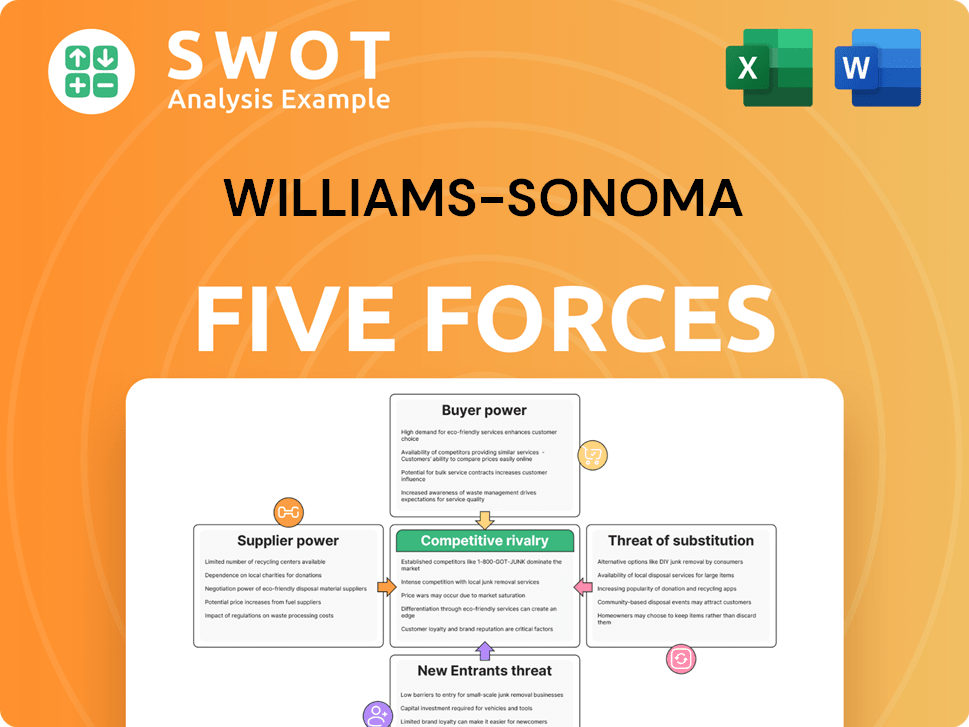

Williams-Sonoma Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Williams-Sonoma Company?

- What is Competitive Landscape of Williams-Sonoma Company?

- What is Growth Strategy and Future Prospects of Williams-Sonoma Company?

- How Does Williams-Sonoma Company Work?

- What is Sales and Marketing Strategy of Williams-Sonoma Company?

- What is Brief History of Williams-Sonoma Company?

- What is Customer Demographics and Target Market of Williams-Sonoma Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.