Williams-Sonoma Bundle

Can Williams-Sonoma Continue Its Reign in the Home Goods Market?

Founded in 1956, Williams-Sonoma, Inc. has transformed from a single store to a global leader in home furnishings and cookware. This evolution showcases the company's remarkable ability to adapt and thrive. Today, with brands like Pottery Barn and West Elm under its umbrella, Williams-Sonoma's Williams-Sonoma SWOT Analysis reveals the strategies driving its continued success.

This comprehensive analysis delves into Williams-Sonoma's growth strategy and future potential, examining its expansion plans, digital transformation, and sustainability initiatives within the context of current retail industry trends. We'll explore the company's e-commerce strategy and its position within the competitive home goods market, offering insights into its financial performance and market share. Understanding Williams-Sonoma's approach is crucial for investors and business strategists alike, seeking to navigate the complexities of the modern retail landscape.

How Is Williams-Sonoma Expanding Its Reach?

The growth strategy of Williams-Sonoma centers on expanding its market reach and diversifying revenue streams. This involves a multi-faceted approach that includes strengthening its presence in the Business-to-Business (B2B) segment, fostering growth within existing and emerging brands, and expanding geographically. This approach aims to capitalize on various opportunities within the retail industry and the home goods market.

A key element of Williams-Sonoma's future prospects involves leveraging its strong position as an omnichannel retailer. The company is focused on enhancing its e-commerce strategy and optimizing retail operations to improve customer service and increase market share. These efforts are supported by investments in technology and design services, all aimed at boosting spending per customer.

The company's expansion initiatives are designed to drive overall growth and enhance its competitive position. By focusing on key areas such as B2B sales, brand innovation, and international markets, Williams-Sonoma aims to sustain its financial performance and adapt to evolving retail industry trends. For an in-depth look at the company's ownership structure, you can refer to Owners & Shareholders of Williams-Sonoma.

Williams-Sonoma is actively growing its Business-to-Business (B2B) segment. This expansion aims to provide products for commercial and hospitality spaces, reaching new customer segments beyond individual consumers. The B2B segment showed strong growth, increasing by 8% in Q1 fiscal year 2025.

The company focuses on growth within its core brands and emerging brands. This strategy includes product innovation and compelling assortments to drive revenue. The Williams-Sonoma brand saw a significant 7.3% comparable growth in Q1 fiscal year 2025. Pottery Barn also improved in Q2 fiscal year 2025 due to strong product assortments.

Williams-Sonoma is expanding its presence in global markets. Key areas of focus include India, Canada, and Mexico. The company is seeing positive results from strategic initiatives in these regions. This international market expansion is part of a broader strategy to increase overall market share.

The company is enhancing its design services and investing in e-commerce technology. These efforts are designed to optimize retail operations and improve customer service metrics. This digital transformation strategy is crucial for maintaining a strong omnichannel retail approach.

Williams-Sonoma's growth strategy is built on several key drivers. These include expanding the B2B segment, fostering brand-specific growth through innovation, and expanding into international markets. The company is also focused on enhancing its e-commerce capabilities and optimizing retail operations.

- B2B Segment: Expanding sales to commercial and hospitality clients.

- Brand Innovation: Launching new products and curating compelling assortments.

- Geographic Expansion: Targeting growth in key international markets.

- E-commerce: Enhancing online capabilities and customer service.

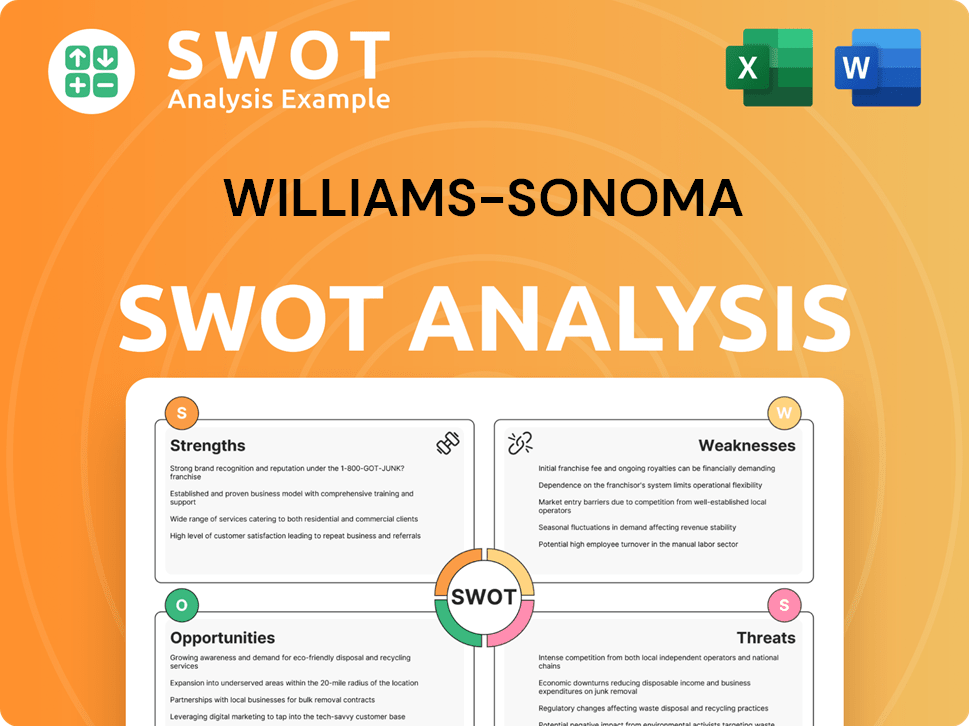

Williams-Sonoma SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Williams-Sonoma Invest in Innovation?

The Williams-Sonoma growth strategy for 2025 and beyond is heavily focused on leveraging innovation and technology to drive sustained expansion. The company is undergoing a significant digital transformation, integrating cutting-edge technologies to enhance efficiency, improve customer experience, and foster sales and margin growth. This strategic approach is designed to position the company favorably within the evolving retail industry trends.

A key element of this strategy involves the increased utilization of Artificial Intelligence (AI). The company is implementing AI across various operational areas to boost efficiency and reduce costs. This includes applications in call centers and back-office functions, aiming to offset headcount growth and improve overall savings. Furthermore, AI is being integrated into digital capabilities to personalize customer interactions and optimize sales processes.

Product innovation also plays a crucial role in Williams-Sonoma's future prospects. The company is committed to delivering core brand growth, supported by a robust pipeline of new products and compelling innovations. A significant advantage is the company's ability to differentiate itself through in-house design and a vertically integrated sourcing model, which allows them to offer high-quality products at exceptional value, particularly within the home goods market.

AI is being integrated into call centers and back-office functions to boost savings and offset headcount growth. This strategic move aims to improve operational efficiency and reduce costs. The company anticipates that AI will be a key factor in achieving record sales and margin.

AI is being used to enhance digital capabilities, including personalized emails and customized homepages. This improves the customer experience and optimizes sales and delivery speed. The goal is to create more engaging and efficient online interactions.

The company is focused on delivering core brand growth, supported by a strong pipeline of new products and compelling innovations. In-house design and a vertically integrated sourcing model offer a key advantage. This approach allows them to offer high-quality products at exceptional value, especially within the home goods market.

The company aims to be carbon neutral in its own operations by 2025. They are also working to reduce emissions across their value chain by 2030. This includes sourcing sustainable materials and improving packaging efficiency.

By 2025, the company aims to source 90% of its cotton and 50% of its wood from sustainable sources. This commitment to sustainable sourcing reflects a broader effort to integrate responsible practices into their business strategy. This is a part of the Williams-Sonoma sustainability initiatives.

The company is working to improve packaging efficiency and recycling programs. This includes reducing plastic and non-recyclable materials. These efforts support their commitment to environmental responsibility and reduce waste.

The company's approach combines technological advancements with a commitment to sustainability, aiming for long-term growth and market leadership. This includes significant investments in AI and a focus on sustainable practices.

- AI Integration: Implementing AI in call centers and back-office functions to enhance efficiency and reduce costs, with a focus on customer experience.

- Product Innovation: Focusing on core brand growth through new product development and in-house design, with a vertically integrated sourcing model.

- Sustainability Initiatives: Aiming for carbon neutrality by 2025 and reducing emissions across the value chain by 2030, with sustainable sourcing targets.

- E-commerce Strategy: Enhancing the online shopping experience through personalized interactions and optimized sales processes.

- Supply Chain Optimization: Improving packaging efficiency and recycling programs to reduce waste and promote environmental responsibility.

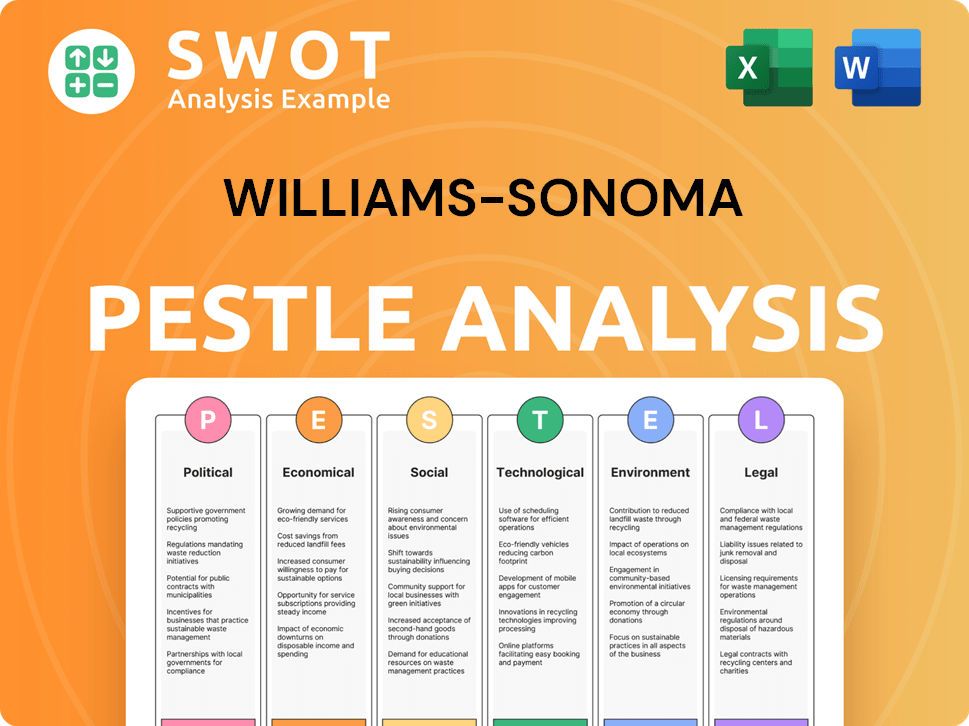

Williams-Sonoma PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Williams-Sonoma’s Growth Forecast?

The financial outlook for Williams-Sonoma reflects a strategic emphasis on returning to growth and improving profitability, even amidst economic uncertainties. For fiscal year 2025, the company projects annual net revenues to range from -1.5% to +1.5%. This forecast takes into account the effect of a 53rd week in fiscal year 2024, which boosted revenue growth by approximately 150 basis points and operating margin by 20 basis points.

The projected operating margin for fiscal year 2025 is between 17.4% and 17.8%. In the first quarter of fiscal year 2025, the company reported a comparable brand revenue increase of 3.4%, with an operating margin of 16.8% and diluted EPS of $1.85, surpassing analyst expectations. This performance was driven by strong top-line growth, enhanced customer service, and disciplined expense management. This demonstrates the company's ability to navigate the retail industry trends effectively.

The company's long-term financial goals include achieving mid-to-high single-digit annual net revenue growth with an operating margin in the mid-to-high teens. This commitment is supported by a strong financial position, including $1 billion in cash on hand at the end of Q1 fiscal year 2025 and no outstanding debt. The company's approach to Revenue Streams & Business Model of Williams-Sonoma is also key to its financial health.

Williams-Sonoma anticipates annual net revenues to be in the range of -1.5% to +1.5% for fiscal year 2025. This projection reflects the company's strategic focus on returning to growth. The comparable brand revenue growth is projected to be flat to +3.0%.

The operating margin for fiscal year 2025 is expected to be between 17.4% and 17.8%. This includes the impact of the 53rd week in fiscal year 2024. The company's focus on supply chain optimization contributes to maintaining healthy margins.

In Q1 fiscal year 2025, the company reported a comparable brand revenue increase of 3.4%. The operating margin was 16.8%, and diluted EPS was $1.85. This performance exceeded analyst expectations, showcasing effective e-commerce strategy.

Williams-Sonoma's long-term financial targets include mid-to-high single-digit annual net revenue growth. The company aims for an operating margin in the mid-to-high teens. This strategic focus is crucial for Williams-Sonoma's future prospects.

The company maintains a strong liquidity position, with $1 billion in cash on hand at the end of Q1 fiscal year 2025 and no outstanding debt. Williams-Sonoma returned nearly $1.1 billion to stockholders in fiscal year 2024 through stock repurchases and dividends. The quarterly dividend increased by 16% to $0.66 per share, marking the 19th consecutive annual increase, demonstrating a commitment to shareholder value and reflecting positive Williams-Sonoma company analysis.

- The company's financial performance review highlights its ability to manage costs effectively.

- The increase in the quarterly dividend shows confidence in the company's financial health.

- Stock repurchases contribute to the company's investor relations overview.

- The strong cash position supports the company's ability to invest in growth initiatives.

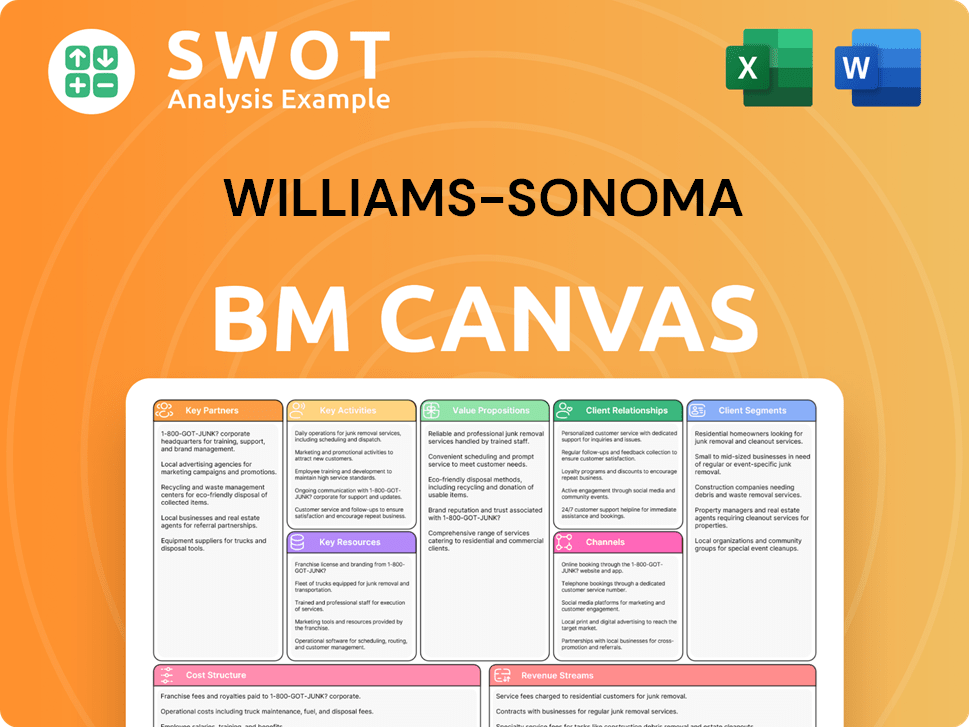

Williams-Sonoma Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Williams-Sonoma’s Growth?

The success of the Williams-Sonoma's growth strategy is subject to several risks and obstacles. These challenges range from external economic pressures to internal operational adjustments. Understanding these potential pitfalls is crucial for assessing the company's future prospects and its ability to maintain or improve its market position within the home goods market.

One of the main risks is the uncertain economic climate, which can significantly impact consumer spending. High interest rates and housing market fluctuations directly affect demand for home furnishings. The retail industry trends also show a decline in the home furnishings sector, increasing competition within the existing customer base.

Furthermore, Williams-Sonoma faces supply chain vulnerabilities and competitive pressures from various retailers. The company must also navigate the complexities of integrating new technologies and adapting to evolving consumer preferences. These factors collectively shape the company's ability to achieve its growth objectives and maintain its financial health.

The macroeconomic environment poses a significant risk to Williams-Sonoma. High interest rates and a slowing housing market can lead to decreased consumer spending on home furnishings. This could impact the company's sales and overall financial performance, potentially affecting its Williams-Sonoma financial performance review.

Tariffs, especially those related to imports from China, present a risk. While the company has a six-point mitigation plan, changes in tariff policies could impact sourcing costs and profit margins. The company has reduced its reliance on China for sourcing from 50% in 2020 to 23% currently, which is a part of its Williams-Sonoma supply chain optimization.

Supply chain vulnerabilities remain a challenge. Although Williams-Sonoma has focused on optimization, disruptions can still impact operations and lead to delays or increased costs. Addressing these issues is crucial for maintaining efficient operations and meeting customer demands. The Williams-Sonoma omnichannel retail approach is essential for mitigating these risks.

Williams-Sonoma faces competition from a fragmented market, including large department stores, discount retailers, and e-commerce platforms. This competitive landscape requires the company to continuously innovate and differentiate itself to maintain market share. The Williams-Sonoma competitive landscape is intense, requiring strategic agility.

While Williams-Sonoma is leveraging AI for efficiency, the early stages of adoption mean there are inherent risks in successful integration and realizing the full benefits. Effective implementation and management of AI technologies are critical for improving operational efficiency. The Williams-Sonoma digital transformation strategy is important for long-term success.

The home furnishings industry has shown declines. For example, Williams-Sonoma's Q4 fiscal year 2024 comparable sales were up 3.1%, while the industry declined by 2%. The company must continue to adapt to changing Retail industry trends to stay competitive. The company is trying to return to growth and enhance customer service amidst market volatility.

Williams-Sonoma is mitigating these risks through several strategies. This includes diversifying sourcing to reduce reliance on any single region or supplier. Enhancing operational efficiencies, such as through the use of AI, is also a key focus. The company is also leveraging its proprietary design capabilities to differentiate its products. Maintaining a strong balance sheet with substantial cash and no debt provides financial flexibility. The company focuses on what it can control: returning to growth, enhancing customer service, and driving earnings amidst volatility.

The company prioritizes actions within its control to navigate challenges. This includes enhancing customer service to improve customer loyalty and satisfaction. Driving earnings through effective cost management and sales strategies is also a key focus. The Williams-Sonoma brand positioning strategy is an important element of this approach. The company is focused on returning to growth and enhancing customer service amidst volatility.

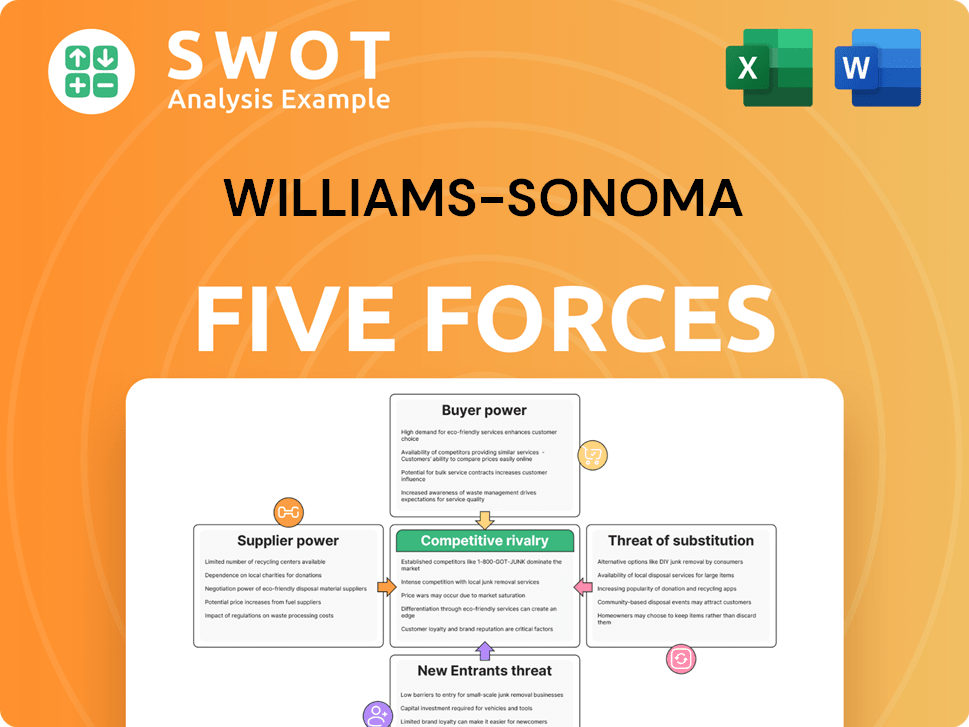

Williams-Sonoma Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Williams-Sonoma Company?

- What is Competitive Landscape of Williams-Sonoma Company?

- How Does Williams-Sonoma Company Work?

- What is Sales and Marketing Strategy of Williams-Sonoma Company?

- What is Brief History of Williams-Sonoma Company?

- Who Owns Williams-Sonoma Company?

- What is Customer Demographics and Target Market of Williams-Sonoma Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.