Williams-Sonoma Bundle

Decoding Williams-Sonoma: How Does This Retail Giant Thrive?

Williams-Sonoma, a leading home goods retailer, has consistently captivated consumers with its premium offerings and strategic brand management. From kitchenware to home furnishings, the company's diverse portfolio has solidified its position in a competitive market. Understanding the intricacies of Williams-Sonoma SWOT Analysis is key to grasping its enduring success.

As a prominent player in the home goods sector, Williams-Sonoma's operations and retail strategy have been pivotal to its financial performance. Exploring the Williams-Sonoma business model provides valuable insights into its ability to adapt to market trends and maintain profitability. This analysis is crucial for investors, customers, and industry observers alike, seeking a comprehensive understanding of this retail powerhouse and its future prospects, including its supply chain analysis and customer service reviews.

What Are the Key Operations Driving Williams-Sonoma’s Success?

The core operations of Williams-Sonoma, Inc. revolve around a multi-brand retail strategy, offering a curated selection of high-quality home furnishings and kitchenware. This home goods retailer operates through distinct brands, each targeting different aesthetics and price points. This approach allows the company to capture a broad customer base and maintain a strong market presence.

The company's value proposition lies in its ability to deliver premium products and a differentiated customer experience. This is achieved through meticulous operational processes, including global sourcing, sophisticated supply chain management, and advanced e-commerce platforms. The integration of physical retail stores, e-commerce websites, and catalogs provides customers with multiple avenues for engagement and purchase, enhancing overall accessibility.

Customer service is a key differentiator for Williams-Sonoma, with a focus on product knowledge and problem resolution. The company leverages centralized efficiencies in sourcing, logistics, and technology while maintaining distinct brand identities. This operational effectiveness translates into premium product offerings and a differentiated customer experience.

Williams-Sonoma's retail strategy is built on a multi-brand approach. This allows the company to cater to diverse customer segments. Each brand, such as Pottery Barn and West Elm, targets specific aesthetics and price points, maximizing market reach.

Operational efficiency is crucial for Williams-Sonoma. This includes streamlined supply chain management and robust e-commerce platforms. The company focuses on efficient inventory flow and timely delivery to enhance customer satisfaction.

The company prioritizes customer experience through multiple sales channels and excellent customer service. This includes physical stores, e-commerce, and catalogs. Product knowledge and problem resolution are key components of their customer service strategy.

Williams-Sonoma maintains distinct brand identities while leveraging centralized efficiencies. This approach allows each brand to resonate with its target audience. This strategy supports premium product offerings and a differentiated customer experience.

Williams-Sonoma's operational success is underpinned by several key elements. These include global sourcing, supply chain management, and technology integration. The company's ability to manage these aspects efficiently ensures a seamless customer experience and supports its financial performance.

- Global Sourcing: Emphasizes handcrafted and sustainable products.

- Supply Chain Management: Ensures efficient inventory flow and timely delivery.

- E-commerce Platforms: Enhances online shopping experiences.

- Customer Service: Focuses on product knowledge and problem resolution.

For more detailed insights into the company's structure, you can explore the information on Owners & Shareholders of Williams-Sonoma. As of the latest reports, Williams-Sonoma's net revenue for fiscal year 2023 was approximately $7.9 billion, demonstrating its strong market position. The company’s focus on operational excellence and customer experience continues to be key drivers of its financial success. The company’s strategic investments in e-commerce and supply chain improvements have also contributed to its ability to meet evolving customer demands and maintain its competitive edge in the home goods retailer market.

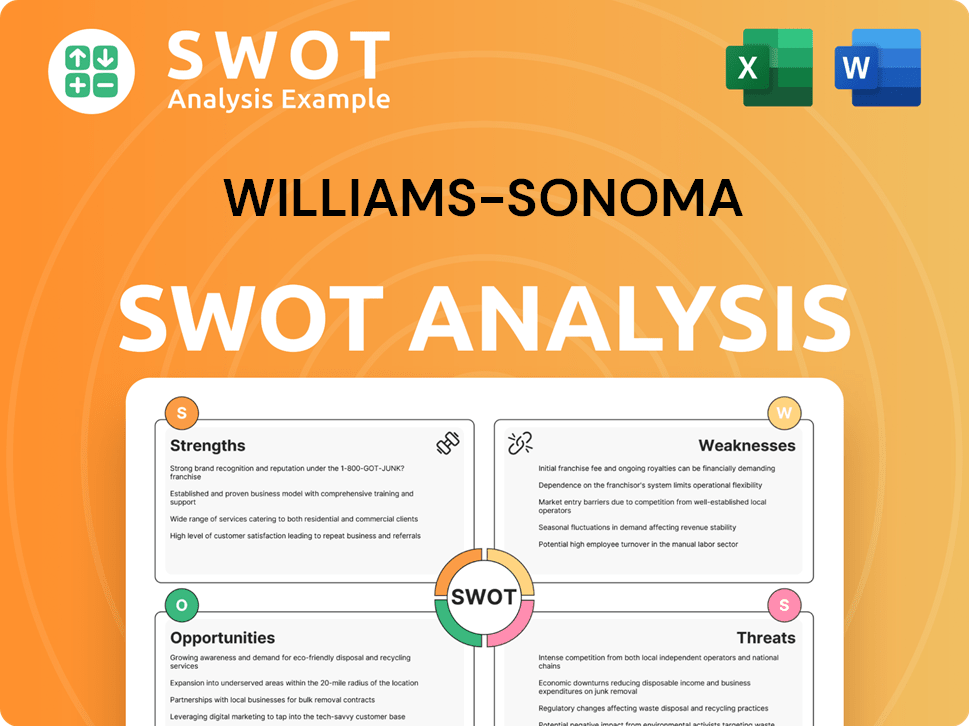

Williams-Sonoma SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Williams-Sonoma Make Money?

The primary revenue stream for Williams-Sonoma, a leading home goods retailer, is the sale of merchandise across its various brands. This includes a wide array of products such as furniture, kitchenware, home decor, and textiles. The company focuses on direct product sales, with a significant emphasis on its e-commerce channel.

In fiscal year 2023, Williams-Sonoma reported net revenues of $7.76 billion, demonstrating its substantial market presence. The company's strategy includes leveraging brand loyalty and customer data for targeted marketing and cross-selling opportunities. This approach helps to maximize revenue generation and enhance customer engagement across its brand portfolio.

The direct-to-consumer channel, especially e-commerce, is a crucial part of Williams-Sonoma's business model. For the full fiscal year 2023, e-commerce accounted for 67% of total revenues, highlighting its importance in the overall revenue strategy. The company continually assesses its product assortment and pricing strategies to optimize revenue generation in response to market demand and competitive pressures. For more insights, see Growth Strategy of Williams-Sonoma.

Williams-Sonoma employs several strategies to generate revenue and enhance customer engagement. These strategies include a focus on direct product sales, particularly through e-commerce, and leveraging brand loyalty for targeted marketing. The company also explores innovative approaches such as tiered pricing and exclusive collaborations.

- Direct Product Sales: The core of Williams-Sonoma's revenue model is the sale of merchandise, including furniture, kitchenware, and home decor.

- E-commerce: A significant portion of revenue is generated through the direct-to-consumer channel, with e-commerce representing 67% of total revenues in fiscal year 2023.

- Targeted Marketing: The company utilizes brand loyalty and customer data to implement targeted marketing and cross-selling strategies across its brand portfolio.

- Innovative Strategies: Williams-Sonoma explores tiered pricing, design services, and exclusive collaborations to boost sales and customer interest.

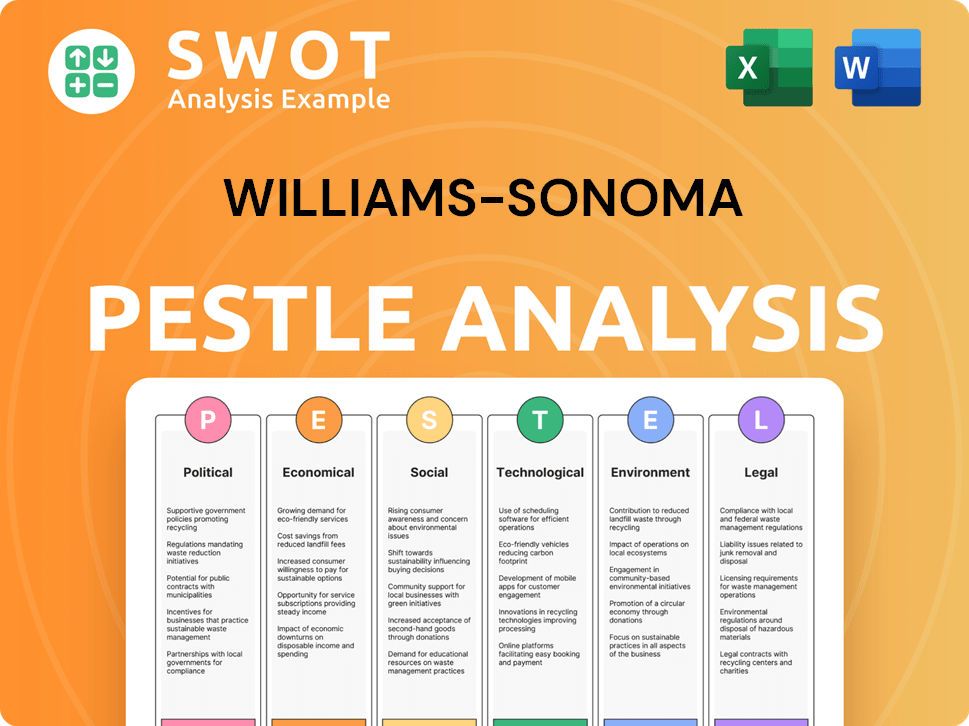

Williams-Sonoma PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Williams-Sonoma’s Business Model?

The journey of Williams-Sonoma has been marked by significant milestones and strategic decisions that have shaped its position as a leading home goods retailer. The company's evolution includes the establishment and expansion of its brand portfolio, such as Pottery Barn and West Elm, which have been pivotal in broadening its market reach and diversifying its product offerings. Early adoption of e-commerce in the late 1990s and early 2000s proved to be a critical strategic move, allowing the company to capitalize on the growing digital retail landscape.

Williams-Sonoma's operational strategies have adapted to address various challenges, including global supply chain disruptions, particularly during the COVID-19 pandemic. The company responded by strengthening supplier relationships, diversifying sourcing, and investing in logistics infrastructure to enhance resilience. These efforts reflect the company's commitment to maintaining operational efficiency and adapting to the changing retail environment.

Williams-Sonoma's competitive advantages are multifaceted, including a strong brand portfolio that fosters brand loyalty and distinct market positioning. The company's vertically integrated model, which includes in-house design and sourcing capabilities, provides control over product quality and cost. Economies of scale in purchasing and distribution further enhance its competitive edge. The company's commitment to quality products and exceptional customer service, coupled with its robust omnichannel retail presence, continues to sustain its Williams-Sonoma business model.

The establishment of Pottery Barn in 1986 and West Elm in 2002 were key strategic moves. Early investment in e-commerce was crucial for digital retail growth. The 'Grandmillennial' trend reflects adaptation to consumer preferences.

Expansion of brand portfolio to reach diverse markets. Continuous investment in e-commerce to meet digital demands. Focus on trends like 'Grandmillennial' to align with consumer tastes.

Strong brand portfolio with high brand loyalty. Vertically integrated model for quality and cost control. Commitment to quality products and customer service.

Navigating global supply chain disruptions, especially during the pandemic. Strengthening supplier relationships and diversifying sourcing. Investing in logistics to improve resilience.

Williams-Sonoma maintains a strong market position through its diverse brand portfolio and commitment to quality. The company's vertically integrated model provides control over product development and supply chain, enhancing its Williams-Sonoma operations. The company consistently adapts to new trends and leverages technology to enhance the customer experience.

- Brand Portfolio: Strong brand recognition and customer loyalty across various brands.

- Vertical Integration: In-house design and sourcing, ensuring quality control.

- Omnichannel Strategy: Robust online and in-store presence to enhance customer experience.

- Adaptation to Trends: Focus on sustainability and smart home integration.

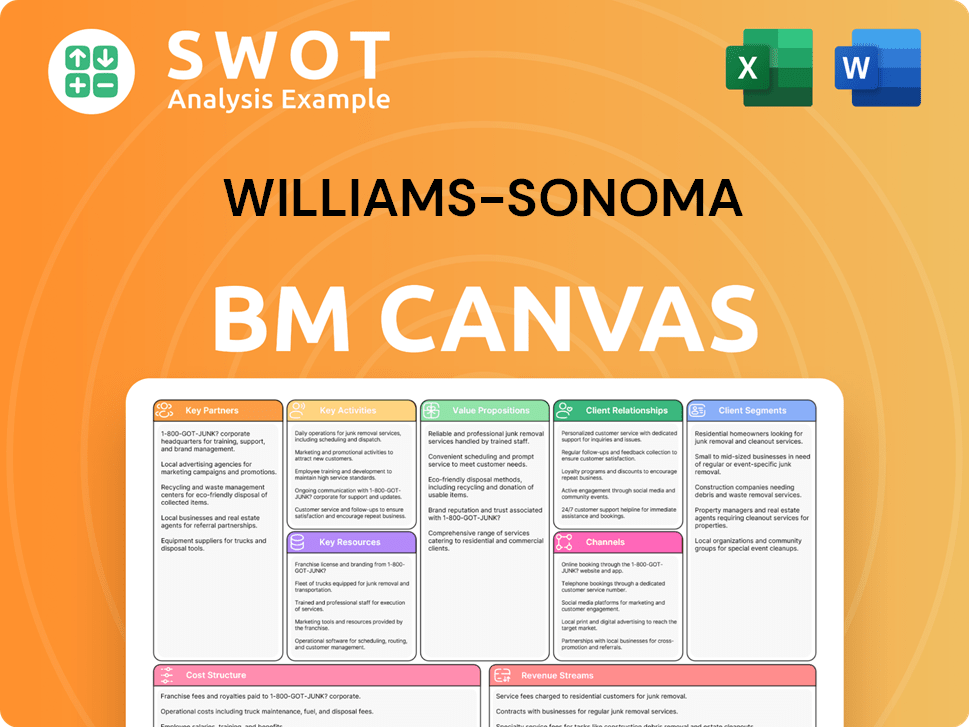

Williams-Sonoma Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Williams-Sonoma Positioning Itself for Continued Success?

The home goods retailer, holding a significant position, competes across various market segments. Their multi-brand approach, including brands like Pottery Barn and West Elm, caters to diverse customer preferences. With a strong brand presence and global operations, the company has established a solid industry standing. The Target Market of Williams-Sonoma is broad, focusing on consumers seeking quality home products.

Several risks and challenges could impact the company's performance. These include fluctuating consumer spending influenced by economic conditions and competition from online retailers. Supply chain disruptions and changing consumer preferences towards sustainability also pose challenges. The company's ability to adapt to these factors is crucial for future success.

The company is a leading home goods retailer, recognized for its strong brand recognition and diverse product offerings. It competes with both mass-market and specialty retailers. Their multi-brand strategy allows them to capture a significant market share across different price points and design aesthetics.

Economic downturns and inflation can significantly impact consumer spending. The competitive retail landscape, including e-commerce, poses a continuous challenge. Supply chain issues and rising raw material costs can affect profitability. Changes in consumer preferences towards sustainability also present both opportunities and risks.

The company focuses on e-commerce platforms, omnichannel capabilities, and expanding product assortments. They are committed to sustainability and responsible sourcing, which is increasingly important to their customer base. Operational efficiencies, data analytics for personalized experiences, and exploring new markets are key priorities.

In fiscal year 2023, net revenue was approximately $7.8 billion. The company's focus on digital sales remains crucial, representing a significant portion of total revenue. Gross margin percentages and operating income are key financial indicators that reflect the company's profitability and operational efficiency.

The company's strategic initiatives include enhancing e-commerce platforms and omnichannel capabilities. They are expanding product assortments to meet evolving consumer demands. They also focus on sustainability and responsible sourcing.

- Investments in e-commerce and digital platforms.

- Expansion of product offerings to align with consumer trends.

- Enhancing supply chain efficiency and sustainability practices.

- Leveraging data analytics for improved customer experiences.

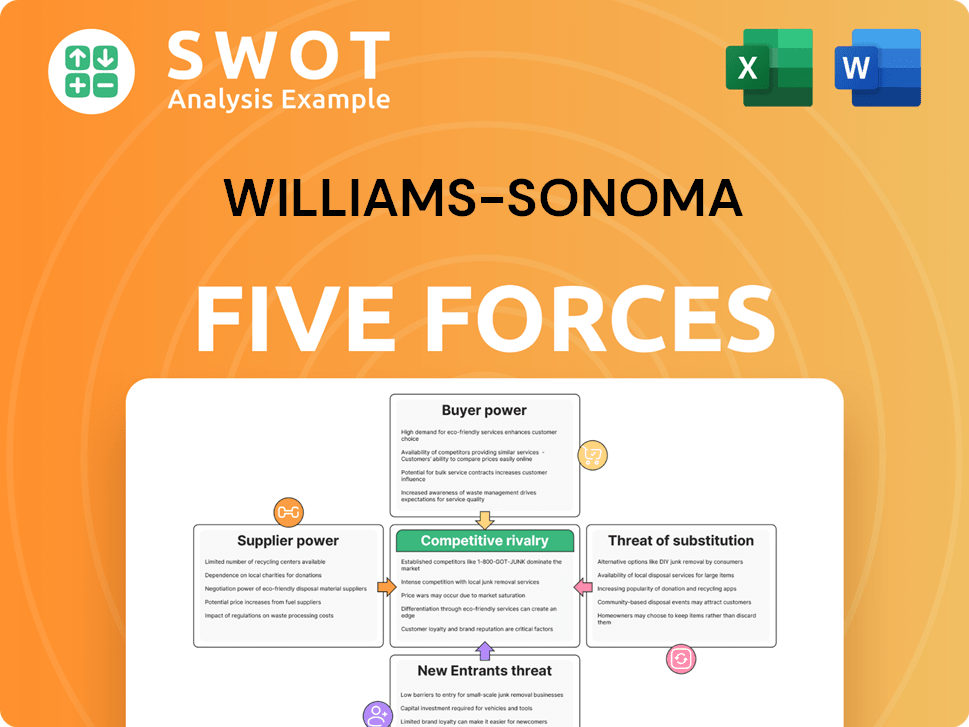

Williams-Sonoma Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Williams-Sonoma Company?

- What is Competitive Landscape of Williams-Sonoma Company?

- What is Growth Strategy and Future Prospects of Williams-Sonoma Company?

- What is Sales and Marketing Strategy of Williams-Sonoma Company?

- What is Brief History of Williams-Sonoma Company?

- Who Owns Williams-Sonoma Company?

- What is Customer Demographics and Target Market of Williams-Sonoma Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.