Zigup Bundle

How Does Zigup Stack Up in the Automotive Finance Arena?

The automotive financing world is rapidly evolving, with technology and consumer needs reshaping the landscape. Zigup has emerged as a key player, promising to simplify vehicle leasing and finance. This analysis dives deep into the Zigup SWOT Analysis, exploring its position in the market and its approach to vehicle acquisition.

This exploration of the Zigup competitive landscape will dissect its market position through a thorough Zigup market analysis. We'll identify Zigup competitors and evaluate Zigup's competitive advantages and disadvantages within the Zigup industry. Understanding Zigup's business strategy and its performance against its main rivals is crucial for anyone interested in the future outlook in the market.

Where Does Zigup’ Stand in the Current Market?

The core operations of Zigup revolve around facilitating vehicle leasing and finance, acting as a broker that connects customers with various vehicle options and financing plans. This approach simplifies the often complex process of finding and securing vehicle financing, catering to both individual consumers and businesses. Zigup's value proposition lies in its ability to streamline the vehicle acquisition process, offering a wide array of choices and competitive financing solutions.

Zigup's business model focuses on digital brokerage, providing a platform where customers can compare different vehicle options and financing plans. The company's success is tied to its ability to establish strong partnerships with lenders and dealerships, ensuring a broad selection and competitive rates for its customers. This model allows Zigup to serve a diverse customer base, including those seeking to lease or purchase vehicles.

The Growth Strategy of Zigup likely involves expanding its digital platform and broadening its partnerships to enhance user experience and reach. While specific market share data for Zigup is not publicly available, the growth of the online vehicle finance brokerage segment suggests a solid market position. The company's focus on customer-centric solutions and digital innovation positions it well within the competitive landscape.

Zigup's market presence is concentrated where its network of lenders and dealerships is strongest, providing widespread access to its platform. The company likely holds a strong position in regions where digital brokerage services are highly valued. Its customer segments include individuals and businesses looking for flexible and competitive vehicle financing solutions.

Zigup serves a broad spectrum of customers, including individuals and businesses seeking vehicle leasing or purchase options. The company's platform caters to those looking for convenience and competitive financing terms. This diverse customer base supports Zigup's position in the vehicle financing market.

Zigup's competitive edge may stem from its digital platform, extensive partnerships, and customer-focused approach. By offering a user-friendly experience and access to a wide range of financing options, Zigup differentiates itself in the market. The company's ability to adapt to market trends and customer needs further enhances its competitive positioning.

Zigup's market strategy likely involves refining its digital platform, expanding partnerships, and focusing on customer satisfaction. The company aims to provide a seamless and user-friendly experience. This strategy supports Zigup's growth in the competitive vehicle leasing and finance industry.

Zigup's competitive positioning is enhanced by its focus on digital brokerage, extensive partner network, and customer-centric approach. These elements help it stand out in the vehicle financing market. The company's strengths include its ability to provide a wide range of vehicle options and financing plans.

- Digital Platform: A user-friendly online platform that simplifies the vehicle financing process.

- Partner Network: Strong relationships with lenders and dealerships, providing access to diverse options.

- Customer Focus: Emphasis on providing competitive rates and a seamless customer experience.

- Market Adaptation: Ability to adapt to changing market trends and customer needs.

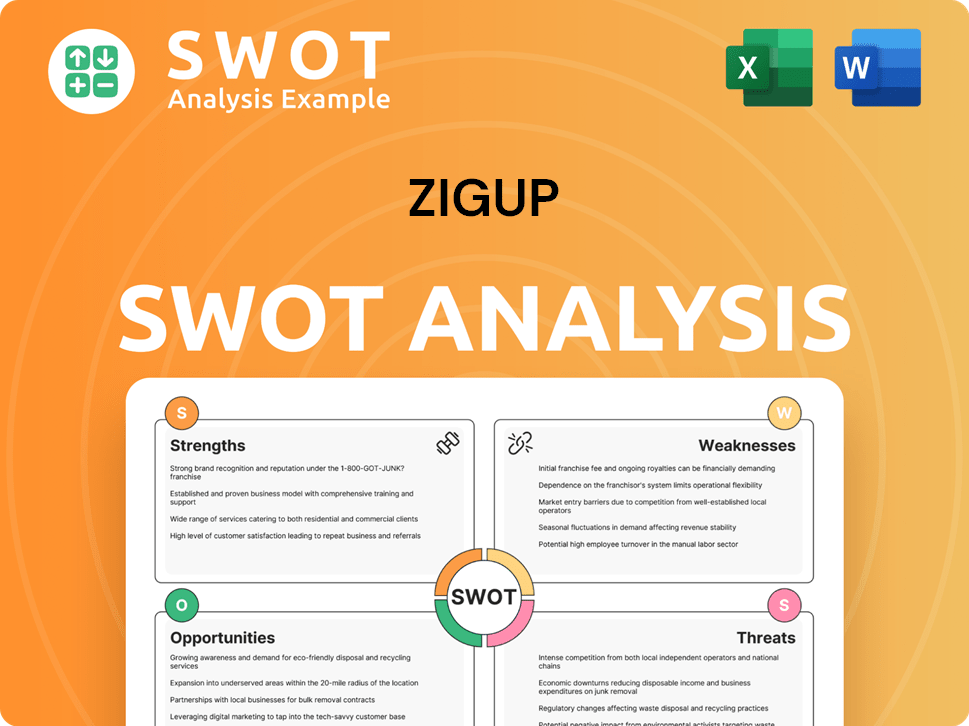

Zigup SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Zigup?

The vehicle leasing and finance market is a dynamic arena, and the Zigup competitive landscape is shaped by a diverse set of players. Understanding Zigup's competitors is crucial for assessing its market position and strategic opportunities. This analysis examines both direct and indirect competitors, highlighting the key challenges and competitive dynamics within the Zigup industry.

Zigup's market analysis reveals a landscape where success hinges on factors like pricing, brand recognition, and the ability to offer innovative financial solutions. The competitive environment is constantly evolving, with new entrants and strategic alliances reshaping the industry. Analyzing Zigup's business strategy requires a clear understanding of these competitive pressures and the strategies employed by rivals.

As you delve into the competitive environment, consider exploring the Target Market of Zigup to understand the specific customer segments and how competitors target them.

Direct competitors include online vehicle finance brokers and aggregators. These platforms provide vehicle comparisons and financing options, often partnering with lenders and dealerships. They compete on features like ease of use and a wide range of financing choices.

Major automotive manufacturers and large financial institutions offer in-house financing. These competitors leverage brand recognition and potentially offer more diversified financial products. They often have extensive marketing budgets.

Traditional brick-and-mortar dealerships provide their own financing solutions. They compete on personalized service and local expertise. They may offer specialized terms for specific credit profiles.

Independent finance companies specialize in vehicle loans. They may focus on specific niches or offer unique financing terms. They compete on factors like interest rates and loan flexibility.

Peer-to-peer lending platforms may cater to niche segments. These platforms offer alternative financing options. They compete on factors like speed of approval and potentially lower rates.

Fintech startups are constantly disrupting the traditional landscape. They introduce AI-driven matching services, blockchain-based financing, or subscription models for vehicles. They compete on technological innovation and user experience.

The competitive landscape is characterized by aggressive marketing campaigns, competitive interest rates, and the adoption of digital tools. Zigup's competitive advantages and disadvantages are influenced by these factors.

- Marketing and Branding: Competitors with larger marketing budgets and established brand recognition may have an advantage.

- Pricing and Interest Rates: Competitive interest rates are crucial for attracting customers.

- Digital Tools and User Experience: The ease of use and innovation in digital platforms are key differentiators.

- Product Diversification: Offering a wide range of financial products can attract a broader customer base.

- Partnerships and Alliances: Strategic alliances with financial institutions or automotive groups can provide a competitive edge.

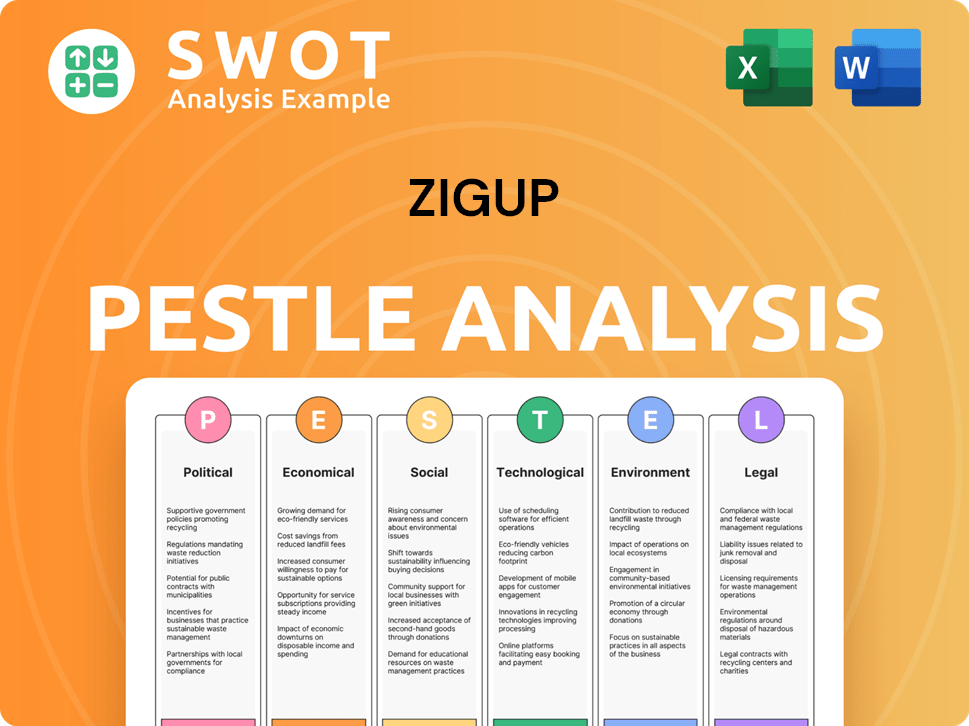

Zigup PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Zigup a Competitive Edge Over Its Rivals?

The core of the company's competitive advantages lies in its brokerage model and digital platform, designed to simplify vehicle leasing and financing. This approach allows the company to offer a diverse range of vehicle options and financing plans. This model provides customers with competitive deals and personalized services, a significant draw in the market. The company's strategic moves have been focused on enhancing its digital platform and expanding its partner network to maintain its competitive edge.

The company's digital platform is a proprietary advantage, streamlining the process of finding and financing a vehicle. This enhances the customer experience through user-friendly interfaces and efficient application processes. This operational efficiency and customer-centric design contribute to brand equity and foster customer loyalty. The company leverages these advantages in its marketing by emphasizing convenience, choice, and competitive rates, which is crucial for its Growth Strategy of Zigup.

These advantages have evolved over time, with the company refining its algorithms and expanding its partner ecosystem. Sustaining these advantages requires continuous innovation in platform technology and ongoing expansion of its partner network. The competitive landscape for the company involves navigating imitation from other brokers and industry shifts towards direct-to-consumer models. The company's ability to adapt and innovate will be key to maintaining its market position.

The company's partnerships with various lenders and dealerships are a key competitive advantage. This network allows the company to offer a diverse range of vehicle options and financing plans. This breadth of choice and competitive pricing is a significant draw for customers, differentiating it in the competitive landscape.

The digital platform simplifies the vehicle financing process, enhancing the customer experience. User-friendly interfaces, efficient application processes, and transparent information are key features. This operational efficiency and customer-centric design contribute to brand equity and foster customer loyalty, which is critical for the company's business strategy.

The company offers competitive deals and personalized services that might be difficult to obtain elsewhere. This is achieved through its extensive network and efficient digital platform. The ability to provide a wide range of options and financing plans is a significant advantage in the market analysis.

By simplifying the vehicle financing process, the company enhances the customer experience. This includes user-friendly interfaces and efficient application processes. This customer-centric approach is crucial for building brand loyalty and gaining a competitive edge in the Zigup industry.

The company's strengths include its extensive partner network, digital platform efficiency, and focus on customer experience. These advantages enable it to offer competitive pricing and a wide selection of vehicles and financing options. The company's ability to continuously refine its algorithms and expand its partner ecosystem is crucial for its future outlook in the market.

- Extensive partnerships with lenders and dealerships.

- User-friendly digital platform for efficient application processes.

- Competitive pricing and a wide selection of vehicles.

- Focus on enhancing the customer experience.

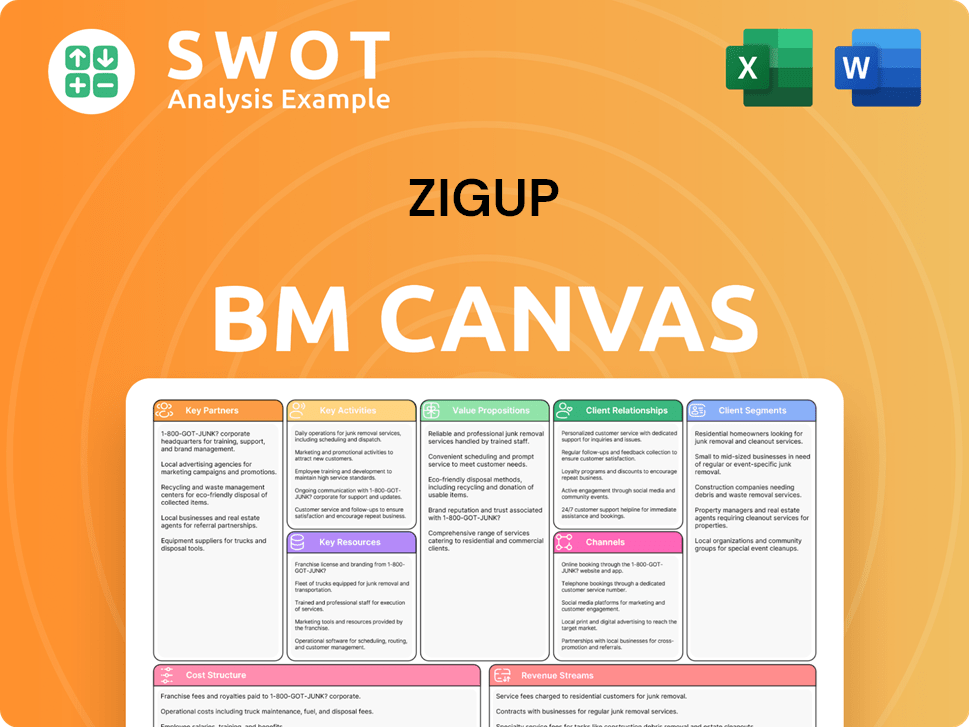

Zigup Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Zigup’s Competitive Landscape?

The vehicle leasing and finance sector is undergoing significant shifts, primarily driven by the rise of electric vehicles (EVs), the adoption of subscription-based mobility services, and the ongoing digital transformation of financial services. These trends shape the Zigup competitive landscape, presenting both challenges and opportunities for the company. Technological advancements, such as AI-driven credit assessments and blockchain for secure transactions, are poised to streamline processes, potentially increasing efficiency but also requiring significant investment in new technologies. Regulatory changes, consumer preferences, and global economic shifts further influence the industry's dynamics.

Zigup market analysis indicates that the company faces challenges from increased competition, including direct lenders offering competitive rates and the potential decline in traditional vehicle ownership. However, opportunities exist in emerging markets, the growing EV market, and strategic partnerships. To remain competitive, Zigup's business strategy is likely to evolve towards a more integrated mobility solutions provider. This evolution involves leveraging its brokerage model to offer a wider array of services beyond vehicle financing, aiming to capitalize on these evolving trends.

The vehicle leasing and finance industry is experiencing a surge in EV adoption, with EV sales projected to reach 25% of all new car sales globally by 2025, according to BloombergNEF. Subscription-based mobility services are also gaining traction, with the global market expected to grow to $12.8 billion by 2027, as per a report by Allied Market Research. Digital transformation is accelerating, with fintech investments in automotive finance increasing by 15% annually.

Increased competition from direct lenders and tech giants entering the automotive finance space poses a significant threat. Interest rate fluctuations and inflation, as seen in 2023 with rates hitting a two-decade high, directly impact financing costs, potentially decreasing demand. Regulatory changes, particularly in consumer protection and data privacy, demand constant adaptation and compliance. The shift towards shared mobility solutions could also reduce demand for traditional vehicle ownership.

Significant growth opportunities exist in emerging markets, particularly in regions with increasing vehicle ownership rates. Catering to the burgeoning EV market with specialized financing options is a major opportunity, driven by government incentives and consumer demand. Strategic partnerships with EV manufacturers and mobility service providers can expand service offerings and market reach. According to McKinsey, the global EV market could reach $800 billion by 2025.

To thrive, Zigup must diversify its offerings beyond traditional leasing. This includes offering flexible ownership models like short-term leases and vehicle subscriptions. Investing in technological advancements, such as AI-driven credit assessments, can enhance efficiency. Forming strategic partnerships with EV manufacturers and mobility service providers can broaden the company's market reach and service offerings. To learn more about the company's approach, consider reading about the Marketing Strategy of Zigup.

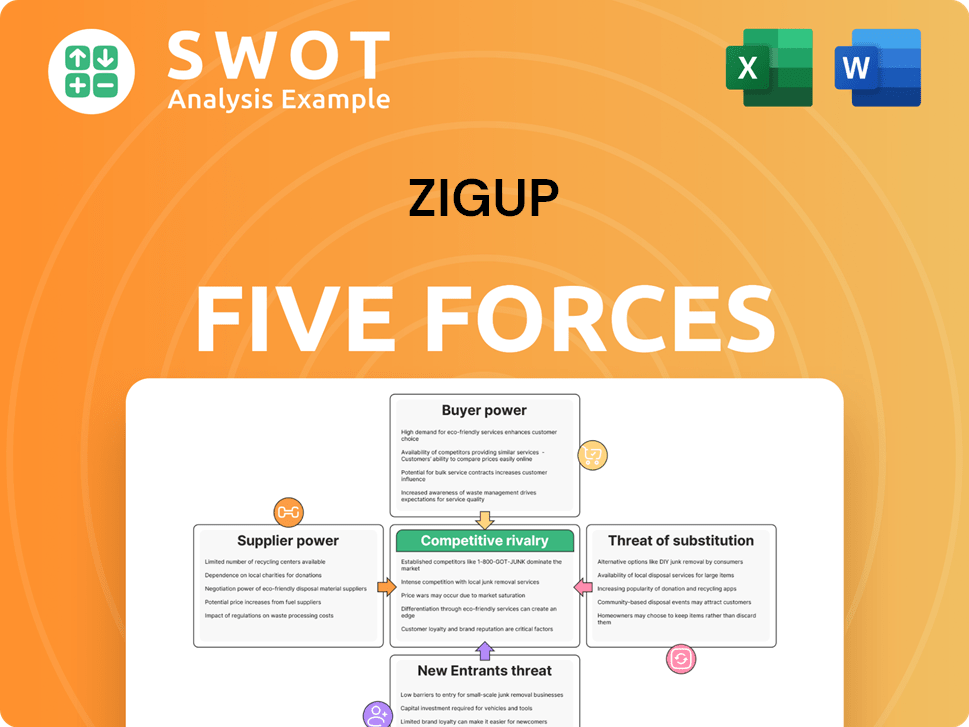

Zigup Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Zigup Company?

- What is Growth Strategy and Future Prospects of Zigup Company?

- How Does Zigup Company Work?

- What is Sales and Marketing Strategy of Zigup Company?

- What is Brief History of Zigup Company?

- Who Owns Zigup Company?

- What is Customer Demographics and Target Market of Zigup Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.