Zigup Bundle

Can Zigup Revolutionize Vehicle Finance and Drive Future Growth?

The vehicle leasing and finance sector is rapidly evolving, and Zigup SWOT Analysis reveals its strategic importance. This company is reshaping how individuals and businesses access vehicle financing. By acting as a broker, Zigup simplifies the vehicle acquisition process, offering diverse options and financing plans.

Zigup's current market position is built on simplifying vehicle leasing and finance, offering competitive deals and personalized services. This article will explore the Zigup growth strategy, examining Zigup future prospects within the dynamic vehicle finance landscape. We'll delve into the company's Zigup company analysis, including its business development Zigup plans and Zigup strategic planning for sustained success, considering factors like Zigup market position and the potential impact of AI on its future.

How Is Zigup Expanding Its Reach?

The future growth of the company, hinges on a multi-faceted expansion strategy. This strategy includes both market penetration and diversification. The company is looking at broadening its geographical reach. This could involve targeting untapped regional markets within its current operational countries. It might also explore entry into new international territories where vehicle leasing is gaining traction.

This expansion would be supported by establishing new partnerships. These partnerships would be with local dealerships and financial institutions. This would allow the company to offer a wider array of vehicle models and financing solutions. These would be tailored to regional demands. The company is also expected to enhance its product and service portfolio.

This could mean introducing specialized leasing options for electric vehicles (EVs). This reflects the global shift towards sustainable transportation. It could also mean developing flexible short-term leasing solutions. These would cater to evolving consumer needs for mobility. The company may also explore strategic mergers and acquisitions (M&A).

The company plans to expand its reach. This involves targeting new regional markets. They are also exploring entry into new international territories. This is part of the company's Zigup growth strategy. The goal is to increase its market share and customer base.

The company aims to enhance its offerings. This includes specialized leasing options for EVs. They are also developing flexible short-term leasing solutions. These initiatives are designed to meet evolving consumer needs. This is a key part of the company's Zigup strategic planning.

The company is focusing on forming new partnerships. These partnerships will be with local dealerships and financial institutions. The aim is to offer a wider variety of vehicle models and financing options. This will help in achieving the company's Zigup future prospects.

The company is considering strategic M&A opportunities. This is to integrate complementary services. They might also acquire smaller platforms. This will help in boosting technological capabilities. This is a part of the business development Zigup strategy.

The company has set specific goals for its expansion initiatives. These include increasing new customer acquisitions in targeted regions. They also plan to launch new specialized leasing products. These plans are crucial for the company's Zigup company analysis.

- Achieve a 15% increase in new customer acquisitions in targeted regions by late 2025.

- Launch two new specialized leasing products within the next fiscal year.

- Explore partnerships in at least three new international markets by the end of 2026.

- Increase the EV leasing portfolio by 20% by the end of 2025.

To support these initiatives, the company might need to secure additional funding. This could involve seeking further investments or exploring strategic partnerships. The company's ability to adapt to market changes is also critical. This includes embracing technological advancements and responding to evolving customer preferences. The company's commitment to sustainability is also important. Mission, Vision & Core Values of Zigup helps to guide the company's expansion efforts.

Zigup SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Zigup Invest in Innovation?

The sustained growth of the company hinges significantly on its commitment to innovation and a robust technology strategy. This approach is critical for understanding the Zigup growth strategy and its future trajectory.

The company is poised to invest heavily in research and development (R&D) to enhance its core platform. This focus is designed to leverage cutting-edge technologies like Artificial Intelligence (AI) and Machine Learning (ML) to refine its credit assessment models and personalize customer offerings. This is essential for a thorough Zigup company analysis.

Digital transformation and automation will remain central to operational efficiency. This strategy is crucial for understanding the Zigup future prospects.

The company will likely develop AI-powered recommendation engines. These engines will match customers with suitable vehicles and financing options based on their profiles and preferences. This streamlines the decision-making process, improving customer satisfaction.

Advanced automation tools will be implemented for document processing, contract generation, and customer onboarding. This is expected to significantly reduce processing times and operational costs. This strategy is key for business development Zigup.

The integration of blockchain technology could enhance the transparency and security of transactions. This is particularly relevant for verifying vehicle histories and ownership transfers. This strategic move impacts Zigup market position.

New digital platforms will be developed to offer enhanced self-service capabilities for customers. This includes online contract management and real-time application tracking. This supports Zigup strategic planning.

The company's innovation strategy will focus on continuous technological improvement and adoption of industry-leading solutions. This approach is crucial for maintaining its leadership in the vehicle finance brokerage space. This helps with Zigup company growth strategy 2024.

The company will prioritize customer needs by leveraging technology to improve the user experience. This includes personalized recommendations and streamlined processes. This is key to understanding the future of Zigup in the tech industry.

The company's commitment to technological advancement is crucial for its long-term success. For more insights, explore the Revenue Streams & Business Model of Zigup. While specific financial data for 2025 is not yet available, the company's strategic investments in technology and its focus on customer experience are expected to drive significant growth. This is crucial for Zigup financial performance analysis and understanding how to invest in Zigup stock.

The company will focus on several key technological strategies to maintain its competitive edge and drive growth. These include:

- AI-driven credit scoring models to enhance accuracy and reduce risk.

- Automation of key processes to improve efficiency and reduce operational costs.

- Development of user-friendly digital platforms for customer self-service.

- Integration of blockchain technology to enhance transaction security and transparency.

Zigup PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Zigup’s Growth Forecast?

The financial outlook for the company appears promising, supported by its strategic growth initiatives and the expanding vehicle leasing market. While specific financial details for the company are not publicly available, the broader market provides a positive backdrop for its operations. The company's brokerage model could potentially lead to higher profit margins compared to traditional leasing companies.

To support its ambitious plans, the company may seek further funding through rounds or strategic capital raises. This could involve attracting investments from venture capital firms or private equity funds interested in the fintech and automotive sectors. The ability to maintain competitive financing rates while ensuring operational efficiency will be crucial for achieving its long-term financial goals.

The company's financial strategy will likely focus on reinvesting profits into technological enhancements, market expansion, and talent acquisition to maintain its competitive advantage. The company's success hinges on its ability to capitalize on the projected market expansion and effectively manage its financial resources. Understanding the Target Market of Zigup is crucial for assessing its financial health.

The company's Zigup growth strategy is likely centered around expanding its market presence and enhancing its technological capabilities. This involves attracting investments, reinvesting profits, and focusing on operational efficiency. The strategic focus is on capitalizing on the expanding vehicle leasing market.

A Zigup financial performance analysis would likely highlight the company's ability to secure funding and manage its operational costs. The brokerage model could potentially lead to higher profit margins. The company's success depends on its ability to maintain competitive financing rates.

Zigup's expansion plans may include entering new geographic markets and broadening its service offerings. The company may target regions with high growth potential in the vehicle leasing sector. Strategic partnerships could also play a key role in its expansion strategy.

AI's impact on the company's future could be significant, with potential applications in customer service, risk assessment, and operational efficiency. AI could help streamline processes and enhance decision-making. The company may invest in AI-driven technologies to gain a competitive edge.

Business development Zigup will likely involve forming strategic partnerships and exploring new revenue streams. The company may focus on enhancing its technological infrastructure and expanding its service offerings. The company's ability to adapt to market changes will be crucial.

- Focus on technological enhancements.

- Strategic capital raises.

- Market expansion.

- Talent acquisition.

Zigup Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Zigup’s Growth?

Assessing the potential risks and obstacles is crucial for a comprehensive Zigup company analysis, ensuring sustainable growth. The company's Zigup growth strategy must navigate a landscape rife with challenges, from intense competition to rapid technological advancements. Understanding these potential pitfalls is essential for investors and stakeholders evaluating Zigup future prospects.

Market dynamics, regulatory changes, and supply chain vulnerabilities all pose significant threats. Furthermore, internal resource constraints, such as attracting and retaining top talent, could hinder business development Zigup. Proactive risk management and strategic foresight are therefore essential for mitigating these challenges.

The vehicle leasing and finance sector is highly competitive, with numerous established financial institutions and emerging fintech companies vying for market share. This competitive pressure can lead to pricing wars and the need for continuous innovation to maintain a strong Zigup market position. Regulatory changes, particularly in consumer credit and data privacy, present another significant risk. New regulations could necessitate substantial adjustments to Zigup's operational procedures and compliance frameworks, potentially increasing costs and complexity.

The vehicle leasing and finance market is intensely competitive. Established financial institutions and fintech startups are constantly vying for market share. This competitive environment can lead to pricing pressures and the need for continuous innovation.

Changes in consumer credit and data privacy regulations pose a substantial risk. New regulations could require significant adjustments to operational procedures and compliance frameworks. These changes can increase costs and add complexity to operations.

Supply chain disruptions can affect vehicle availability and pricing. The business model relies on a robust supply of vehicles from dealerships. Any disruption can impact the ability to offer competitive deals.

Rapid advancements in AI, blockchain, and other emerging technologies present both opportunities and risks. Failure to keep pace with these advancements could hinder growth. Continuous technological innovation is essential.

Attracting and retaining top talent in a competitive job market can be challenging. Resource constraints, including skilled personnel, could hinder growth initiatives. Investing in employee development is critical.

Economic downturns can lead to decreased consumer spending and reduced demand for vehicle leasing and financing. Economic instability can significantly impact financial performance. Diversification and financial resilience are key.

Zigup mitigates risks through continuous market analysis and robust risk management. Strategic diversification of partnerships is also crucial. Proactive adoption of new technologies and regulatory compliance are key.

Collaborating with various lenders and dealerships reduces dependence on a single partner. This approach cushions the impact of localized supply chain disruptions. Continuous monitoring of market trends is essential for adaptability.

For instance, the company might invest in advanced analytics to predict market trends and customer behavior, as highlighted in the Brief History of Zigup. This proactive approach to technology and regulatory compliance will be crucial in navigating potential obstacles and maintaining growth momentum. By focusing on these areas, Zigup can enhance its strategic planning and ensure long-term success.

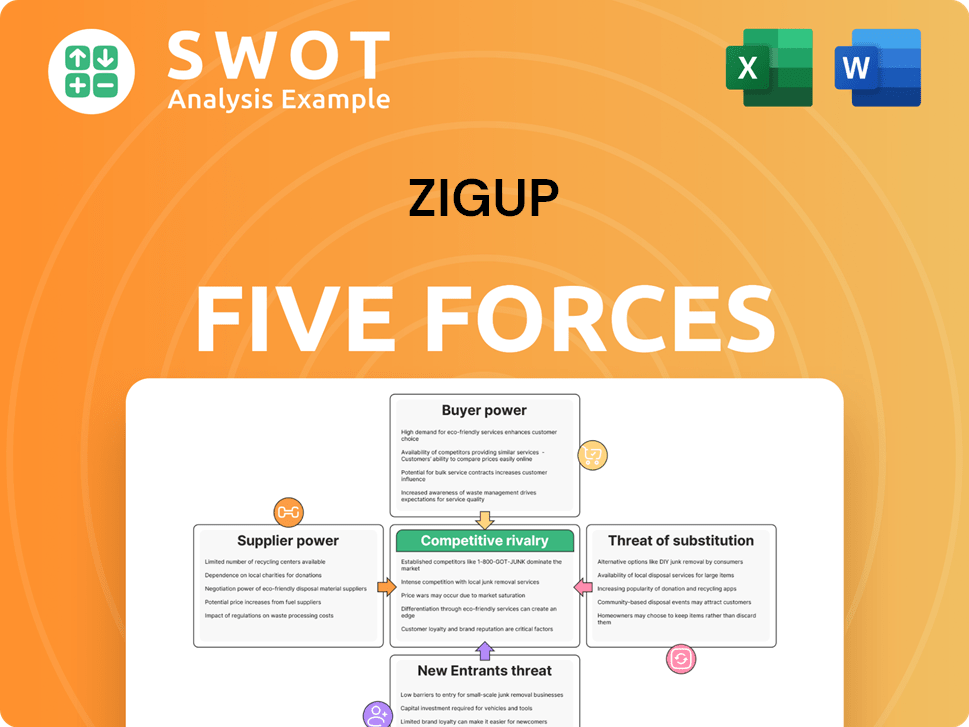

Zigup Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Zigup Company?

- What is Competitive Landscape of Zigup Company?

- How Does Zigup Company Work?

- What is Sales and Marketing Strategy of Zigup Company?

- What is Brief History of Zigup Company?

- Who Owns Zigup Company?

- What is Customer Demographics and Target Market of Zigup Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.