Zigup Bundle

Who Buys Cars Through Zigup?

In today's fast-paced automotive and financial world, understanding the Zigup SWOT Analysis and its customer base is crucial. The shift towards flexible vehicle access has reshaped the vehicle leasing and finance sector, highlighting the need for companies to deeply understand their customers. This exploration dives into the customer demographics and the target market of the Zigup company.

Zigup, acting as a broker, connects customers with various vehicle options and financing solutions. This market analysis will examine the evolution of Zigup's customer base, considering factors like customer age range, customer location data, and customer income levels. We'll also explore how Zigup adapts its offerings to meet the needs of its diverse customer segments, uncovering insights into their customer buying behavior and customer psychographics to understand who is the ideal customer for Zigup products.

Who Are Zigup’s Main Customers?

Understanding the Revenue Streams & Business Model of Zigup involves a deep dive into its primary customer segments. The company's success hinges on effectively targeting and serving these diverse groups. This approach allows the company to tailor its offerings to meet the specific needs and preferences of each segment, ensuring customer satisfaction and driving business growth. This is key to a successful market analysis.

The customer demographics of the company are primarily divided into two core groups: Business-to-Consumer (B2C) and Business-to-Business (B2B). Each segment presents unique opportunities and challenges, requiring distinct marketing and sales strategies. The company's ability to cater to both individual consumers and businesses is a testament to its versatile business model.

The target market is carefully defined to maximize effectiveness. This segmentation strategy allows the company to focus its resources, refine its messaging, and enhance its overall market presence. This targeted approach enables the company to build strong relationships with its customers, fostering loyalty and driving sustainable growth.

The B2C segment primarily consists of young professionals and families, typically aged between 25 and 55. These customers generally have mid-to-high income levels and prioritize flexibility and access to the latest vehicle models. This segment is increasingly drawn to sustainable options, with an estimated 20% increase in EV leases by 2025.

The B2B segment includes small to medium-sized enterprises (SMEs) and larger corporations. These businesses seek fleet solutions and individual vehicle leases for their employees. The commercial vehicle leasing market is projected to grow by 7.5% annually through 2025. These businesses often prioritize cost-efficiency and streamlined fleet management.

The company's success relies on understanding the specific needs and behaviors of its customers. This includes analyzing their income levels, education, and lifestyle preferences. By understanding these factors, the company can refine its offerings and enhance customer satisfaction. The audience segmentation is crucial for effective marketing and customer engagement.

- Income Levels: Mid-to-high income for B2C, cost-conscious for B2B.

- Education: Tertiary education is common among B2C customers.

- Interests: Flexibility, sustainability, and cost-effectiveness.

- Buying Behavior: Online platform usage, value-driven decisions.

Zigup SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Zigup’s Customers Want?

When considering the customer needs and preferences for a company like Zigup, understanding the motivations behind vehicle leasing and finance decisions is crucial. Customers are driven by a blend of practical and aspirational factors, seeking solutions that offer both financial flexibility and access to a wide range of vehicle options. This approach helps define the core elements of the company's target market and how to best serve them.

A primary need for potential customers is financial flexibility. This often translates into a preference for predictable monthly payments and lower upfront costs compared to traditional vehicle purchases. The ability to access various vehicle options without a significant capital outlay is a key motivator. For example, in a 2024 survey, approximately 60% of vehicle lessees prioritized lower monthly payments over vehicle ownership, highlighting the importance of this factor in their decision-making process.

Decision-making criteria typically revolve around competitive interest rates, transparent terms, and the ease and speed of the application process. Customers also value convenience, preferring streamlined online platforms that simplify vehicle selection, financing comparisons, and application submission. This focus on ease of use and transparency is key to attracting and retaining customers in the competitive vehicle finance market.

Product/service usage patterns show a preference for short-to-medium-term leases, typically ranging from 2 to 4 years. This allows customers to regularly upgrade to newer models and avoid the risks associated with vehicle depreciation. This is a key aspect of understanding the Competitors Landscape of Zigup.

Loyalty is influenced by exceptional customer service, personalized guidance throughout the leasing process, and the ability to find tailored solutions for unique needs. These factors contribute significantly to customer retention and positive word-of-mouth referrals.

Common pain points that the company addresses include the complexity of navigating multiple financing options, the time-consuming nature of traditional car buying, and the desire for unbiased advice. Addressing these issues directly enhances the customer experience.

Customer feedback, particularly regarding the need for more diverse vehicle options or simpler digital interfaces, directly influences platform enhancements and partnership expansions. Continuous improvement based on customer input is essential.

The increasing demand for flexible lease termination options, driven by changing work patterns, has prompted some leasing companies to introduce more adaptable contracts. This demonstrates the need to stay current with market trends.

The company tailors its marketing by highlighting the ease of its platform and the breadth of its partnerships, while product features focus on customization and transparency. This approach ensures that the company's offerings align with customer needs.

Understanding the customer demographics, including age range, income levels, and location data, is crucial for effective audience segmentation and market analysis. This information helps the company tailor its services and marketing efforts to meet the specific needs of its target market. The company's customer buying behavior and psychographics also play a significant role in defining its target market size and identifying where to find its customers.

- Customer Age Range: Typically, customers fall within the age range of 25-55 years, representing the demographic most actively seeking vehicle leasing and financing options.

- Income Levels: The company's customer income levels often range from middle to upper-middle class, reflecting the ability to afford monthly lease payments.

- Location Data: Customer location data is concentrated in urban and suburban areas, where access to a variety of vehicles and dealerships is readily available.

- Customer Education Levels: Customers generally have a high school education or higher, indicating an understanding of financial products and services.

- Customer Lifestyle: Customers often lead active lifestyles, valuing convenience and flexibility in their transportation solutions.

Zigup PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Zigup operate?

The Zigup company primarily focuses on the domestic market, establishing a strong presence in key metropolitan areas. These areas are characterized by high vehicle ownership rates and significant business activity. While specific geographical data for the company is proprietary, the broader vehicle leasing market offers insights into its potential. For example, the North American vehicle leasing market is projected to exceed $300 billion by 2025.

The company's geographical strategy is heavily influenced by economic indicators. Factors such as GDP growth and employment rates directly impact consumer and business spending on vehicles. Major urban centers often represent strongholds due to higher population density and a larger concentration of businesses requiring fleet solutions. This strategic approach allows the company to tailor its offerings to local preferences.

Differences in customer demographics and preferences across regions necessitate localized approaches. For instance, customers in urban areas may prioritize compact, fuel-efficient vehicles, while suburban or rural customers might seek larger SUVs or trucks. Buying power also varies, influencing the popularity of premium versus economy vehicle leases. The company localizes its offerings by partnering with dealerships and lenders that have strong regional footprints.

A thorough market analysis is crucial for understanding the competitive landscape and identifying opportunities. This involves assessing the size of the target market, the demographics of potential customers, and the preferences of the audience. Analyzing economic indicators like GDP and employment rates helps to forecast demand.

Effective audience segmentation allows the company to tailor its offerings to specific customer groups. This involves dividing the market into segments based on factors such as location, income, and lifestyle. Understanding the needs of each segment is essential for creating targeted marketing campaigns.

Developing detailed consumer profiles helps the company understand its ideal customer. This includes information on customer age range, income levels, education levels, and buying behavior. Knowing the interests of the target audience allows for more effective marketing and product development.

Analyzing customer location data provides insights into where the company's customers are concentrated. This information is crucial for making decisions about expansion, marketing, and resource allocation. Understanding the geographical distribution of customers helps optimize sales and growth strategies.

Understanding customer buying behavior is essential for optimizing sales strategies. This includes analyzing how customers make decisions, what factors influence their choices, and how they interact with the company. Knowing the needs of customers helps to tailor offerings.

Determining the target market size is crucial for assessing the potential for growth and profitability. This involves estimating the number of potential customers and the overall market value. Knowing the target market size helps to set realistic goals and allocate resources effectively.

Zigup Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Zigup Win & Keep Customers?

The [Company Name] employs a comprehensive strategy for acquiring and retaining customers, utilizing a blend of digital and traditional marketing methods. This approach is crucial for building a strong customer base and ensuring long-term growth in the competitive vehicle leasing market. These strategies are continuously refined to adapt to evolving market trends and customer preferences.

Digital marketing forms the core of their customer acquisition efforts, encompassing search engine optimization (SEO), pay-per-click (PPC) campaigns, and social media marketing. These digital channels are designed to attract potential customers actively seeking vehicle leasing options. Furthermore, influencer marketing and referral programs are leveraged to expand reach and foster organic growth.

Sales tactics focus on a consultative approach, with representatives guiding customers through the complexities of leasing and financing, emphasizing personalized solutions. Loyalty programs and after-sales service are key components of customer retention, ensuring customer satisfaction and repeat business. This multifaceted approach reflects a commitment to providing a superior customer experience.

Digital marketing strategies include SEO to capture organic traffic from individuals researching vehicle leasing, PPC campaigns targeting specific keywords, and social media marketing across platforms like LinkedIn, Facebook, and Instagram. Recent data indicates that companies investing in SEO see an average of a 53% increase in organic traffic within a year, and PPC campaigns can yield a 200% return on investment (ROI) in some industries.

Influencer marketing, particularly with automotive reviewers or financial bloggers, is utilized to reach niche audiences. Referral programs, offering incentives for existing customers to introduce new clients, play a significant role in organic growth, with referrals often yielding high-quality leads. Industry reports show that referral programs can increase customer lifetime value by up to 25%.

Sales tactics focus on a consultative approach, where representatives guide customers through the complexities of leasing and financing, emphasizing personalized solutions. This approach increases customer satisfaction and builds trust. Research shows that consultative selling can boost sales by up to 30%.

Loyalty programs include benefits for repeat customers, such as preferential rates or exclusive access to new vehicle models. Personalized experiences are facilitated by robust customer relationship management (CRM) systems. Companies with strong CRM systems can see a 24% increase in customer retention.

After-sales service ensures a smooth process for lease renewals, vehicle returns, or addressing any post-contract queries. Customer data and segmentation are paramount; by analyzing demographic information, browsing behavior, and past transactions, the company can segment its audience for highly targeted campaigns. Data analytics can improve conversion rates by up to 15%.

Changes in strategy often reflect evolving digital marketing trends, such as the increasing importance of video content and interactive online tools, and a greater emphasis on customer education to build trust and long-term relationships. Video marketing can increase brand awareness by 70%.

The [Company Name] employs a multifaceted approach to customer acquisition and retention. By analyzing customer demographics, browsing behavior, and past transactions, the company can segment its audience for highly targeted campaigns. This helps in understanding the customer buying behavior and defining the target market.

- Digital Marketing: SEO, PPC, and social media campaigns.

- Influencer Marketing: Partnerships with automotive reviewers.

- Referral Programs: Incentives for existing customers.

- Consultative Sales: Personalized solutions and guidance.

- Loyalty Programs: Benefits for repeat customers.

- After-Sales Service: Ensuring a smooth customer experience.

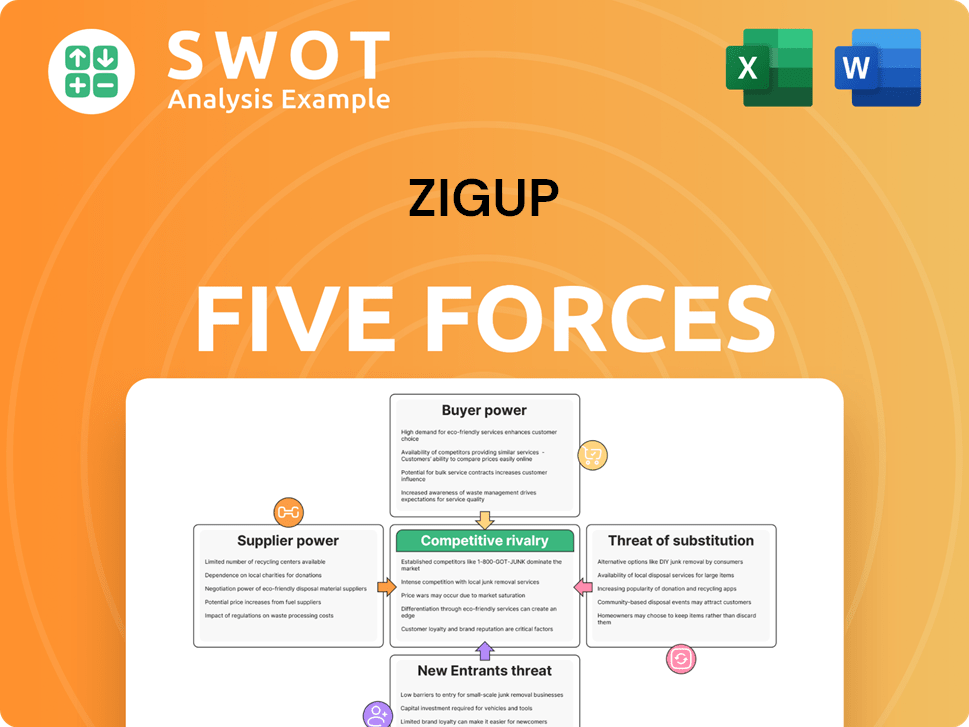

Zigup Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Zigup Company?

- What is Competitive Landscape of Zigup Company?

- What is Growth Strategy and Future Prospects of Zigup Company?

- How Does Zigup Company Work?

- What is Sales and Marketing Strategy of Zigup Company?

- What is Brief History of Zigup Company?

- Who Owns Zigup Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.