Zynex Bundle

Can Zynex Thrive Amidst Shifting Sands?

The medical device market is a battlefield, and Zynex, Inc. is currently navigating a complex terrain. Recent headwinds, including payer reimbursement challenges, are reshaping the Zynex SWOT Analysis, making a deep dive into its competitive landscape more crucial than ever. Understanding the competitive dynamics is key to assessing Zynex's future.

This analysis delves into the Zynex competitive landscape, dissecting its rivals and evaluating its market position. We'll explore the Zynex industry outlook, examining the company's Zynex financial performance and strategic responses to remain competitive. Uncover the Zynex competitors and the factors that will determine its success in the medical device market.

Where Does Zynex’ Stand in the Current Market?

Zynex's market position primarily focuses on pain management and patient monitoring technologies. The company's primary revenue stream comes from electrotherapy devices like the NexWave, as well as rehabilitation products. Zynex operates with a direct sales force, which totaled 450 representatives as of Q1 2024, to market its products.

In 2024, Zynex's financial performance showed a mixed picture. While net revenue reached $192.4 million, a 4% increase from the previous year, driven by a 16% growth in device orders, net income decreased to $3.0 million. Adjusted EBITDA for 2024 was $10.9 million, down from $22.3 million in 2023, indicating challenges in profitability despite revenue growth. This Owners & Shareholders of Zynex article gives a deeper view.

The company's product portfolio includes the M-Wave, a user-friendly NMES device, introduced in 2024, and the new TensWave device, which received FDA clearance. Zynex Medical, Inc. (ZMI) accounts for the majority of the company's revenue. However, Zynex has faced setbacks, including a temporary payment suspension from Tricare, impacting its financial results.

Zynex operates primarily in the medical device market, focusing on pain management and patient monitoring. Its core business involves the development, manufacturing, and sale of electrotherapy devices and rehabilitation products. The company uses a direct sales force to reach its customers.

Zynex offers innovative medical devices designed to improve patient outcomes. Its products provide non-invasive pain relief and patient monitoring solutions. The company's value lies in its focus on direct sales and customer service, aiming to build strong relationships with healthcare providers.

In 2024, Zynex reported net revenue of $192.4 million, a 4% increase. However, net income decreased to $3.0 million. Adjusted EBITDA was $10.9 million, down from $22.3 million in 2023. The company's financial health has been impacted by higher operating expenses and interest expenses.

Zynex faced challenges, including a temporary payment suspension from Tricare. This led to a net loss of $0.6 million in Q4 2024 and a net loss of $10.4 million in Q1 2025. In response, Zynex initiated cost-cutting measures, including a 15% workforce reduction, expected to save approximately $35 million annually.

Zynex operates within the medical device market, specifically targeting pain management and patient monitoring. The Zynex competitive landscape includes various companies offering similar or competing products. The company's market position is influenced by its product offerings, sales strategy, and financial performance.

- The company's primary products are electrotherapy devices and rehabilitation products.

- Zynex's direct sales force is a key component of its market strategy.

- Financial performance in 2024 showed revenue growth but a decrease in net income.

- The company has implemented cost-cutting measures to address financial challenges.

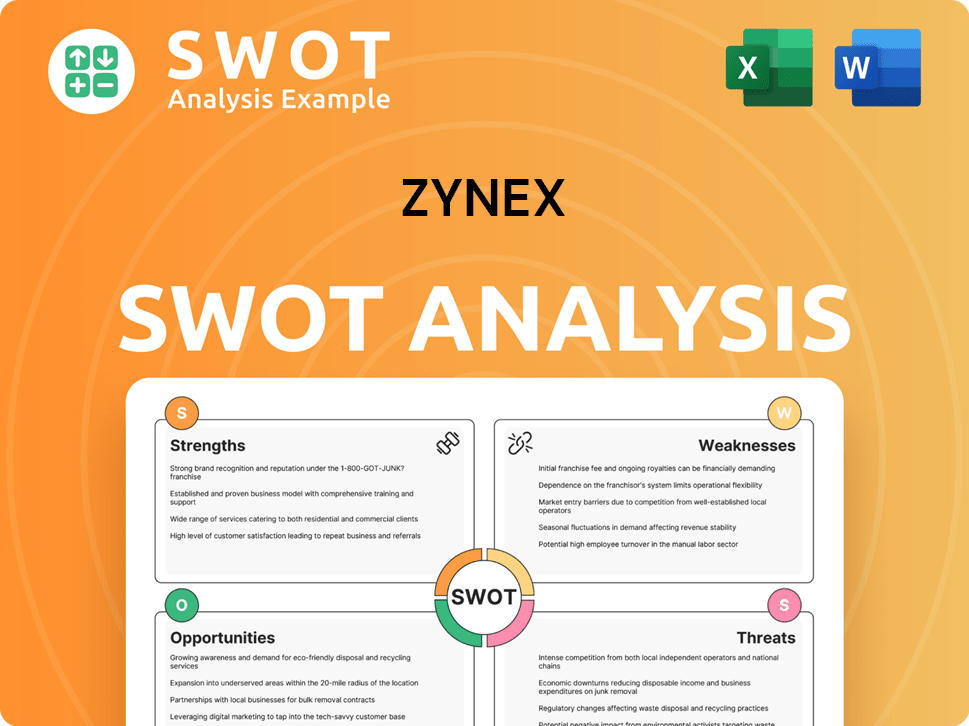

Zynex SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Zynex?

The Revenue Streams & Business Model of Zynex operates within the dynamic medical device market, facing a complex Zynex competitive landscape. This landscape includes both established and emerging companies. The company's financial performance and market position are significantly influenced by its ability to navigate this competitive environment.

The Zynex industry is characterized by constant innovation and evolving market dynamics. Understanding the competitive environment is crucial for assessing the company's strategic positioning and future growth potential. This requires a thorough Zynex market analysis to identify key players and their strategies.

Zynex competitors challenge the company through various strategies. These include pricing, innovation, brand recognition, and distribution. The company's reliance on reimbursement from health insurance companies, as seen with the Tricare situation, significantly impacts its revenue and market share. This highlights the importance of understanding the competitive pressures and regulatory environment.

Large, diversified medical device companies often compete with Zynex. These companies have established brand recognition and extensive distribution networks. They may offer a broader range of products, potentially allowing them to capture a larger share of the market.

New companies, especially those leveraging technological advancements like AI in medical technology, pose a competitive threat. These innovators can disrupt the market with novel products or services. Their agility and focus on niche markets can challenge established players.

Companies specializing in electrotherapy devices for pain management and rehabilitation are direct competitors. These companies offer similar products, often competing on features, pricing, and marketing. The specific market share figures for 2024-2025 are not available in the provided information.

Companies in the patient monitoring space also compete with Zynex, particularly if they offer overlapping product lines. These companies may have a broader product portfolio and established relationships with healthcare providers. This can create a significant competitive advantage.

Small, single-product vendors can also be competitors, especially in niche markets. These companies may focus on a specific product or technology, potentially offering specialized solutions. They can be agile and responsive to market changes.

Zynex's move to diversify its product mix, including lower-priced items, could increase competition. This could lead to pricing pressures in these new segments. The company must carefully manage its pricing strategy to maintain profitability.

Several factors influence the competitive dynamics in the medical device market. Understanding these factors is essential for assessing Zynex's position and potential challenges. These include pricing strategies, technological innovation, brand recognition, distribution networks, and regulatory compliance.

- Pricing Strategies: Competitors may use aggressive pricing to gain market share. Zynex needs to balance competitive pricing with maintaining profitability.

- Technological Innovation: The rapid pace of technological advancements, including AI, can disrupt the market. Zynex must invest in R&D to stay competitive.

- Brand Recognition: Established brands have a significant advantage. Building and maintaining brand recognition is crucial.

- Distribution Networks: Effective distribution networks are essential for reaching customers. Zynex needs to ensure its products are widely available.

- Regulatory Compliance: Compliance with healthcare regulations and reimbursement policies is critical. Changes in these areas can significantly impact revenue.

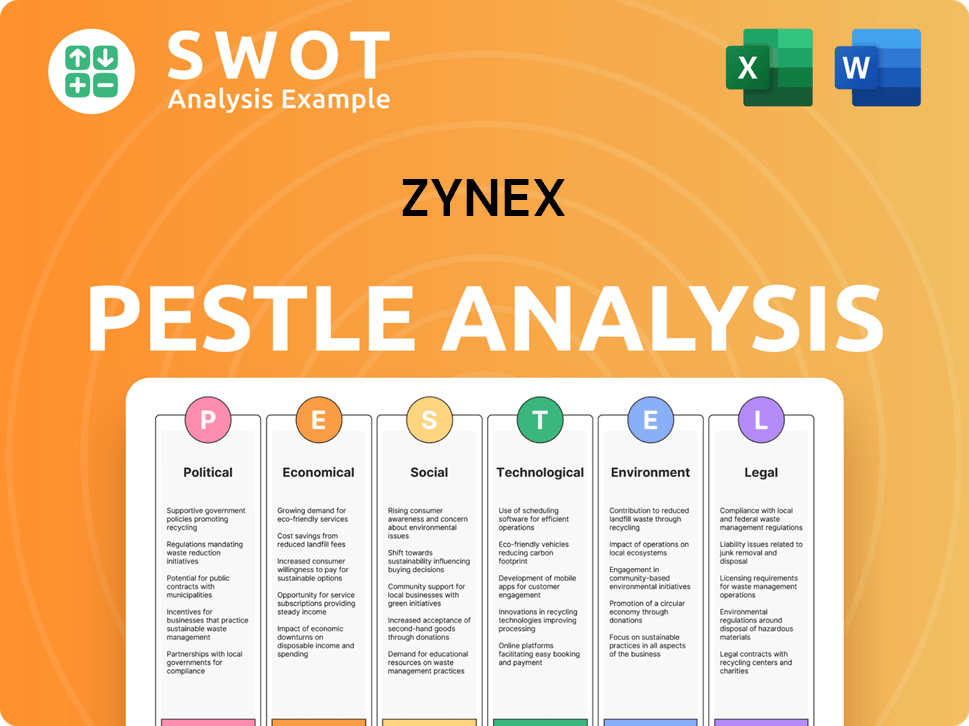

Zynex PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Zynex a Competitive Edge Over Its Rivals?

The competitive landscape for Zynex is shaped by its focus on non-invasive pain management and its direct sales model. The company's strategic moves include a strong emphasis on non-narcotic pain relief, positioning it well in a market increasingly wary of opioid risks. The development of proprietary technologies, such as the NexWave device, further enhances its competitive edge. For a deeper understanding of the company's marketing approach, consider exploring the Marketing Strategy of Zynex.

Zynex's competitive advantages are rooted in its product innovation and sales strategy. The company's devices, including the NexWave, offer unique features and benefits, leading to a strong market position. Furthermore, the direct sales force model fosters close relationships with prescribers, providing a significant competitive advantage. The company's financial performance also reflects these strengths.

The company's financial performance in 2024 highlights its strong competitive position. The direct sales force, numbering around 450 representatives in Q1 2024, contributed to a 22% increase in revenue per sales representative during the year. This operational strength is a key factor in Zynex's market success.

Zynex's proprietary technologies, such as the NexWave device, provide a competitive edge. The company is actively developing new products, including the NiCO CO-Oximeter and HemeOx Total Hemoglobin Oximeter, which utilize advanced laser-based pulse oximetry technology. These innovations address limitations of traditional devices, enhancing Zynex's market position.

The direct sales force, with approximately 450 representatives in Q1 2024, is a significant operational strength. This model allows for building strong relationships with prescribers, providing a competitive edge in customer service. The direct sales approach contributes to higher revenue per sales representative, as seen in 2024.

Zynex has maintained high gross margins, around 80% for the full year 2024. This indicates strong production efficiency and effective pricing strategies. These margins are a key indicator of the company's financial health and competitive advantage within the medical device market.

The company's strategic initiatives include a focus on sales productivity improvement and diversification of its product portfolio. These moves aim to strengthen Zynex's market position and drive future growth. The expansion into braces and cold therapy devices is part of this diversification strategy.

Despite its strengths, Zynex faces threats from imitation and industry shifts. Reimbursement challenges and rapid technological changes pose ongoing challenges. The company's reliance on third-party payers for reimbursement also presents a vulnerability, as highlighted by the recent temporary payment suspension by Tricare.

- Imitation of products by competitors.

- Reimbursement challenges from third-party payers.

- Need to keep pace with rapid technological changes.

- Potential impact of changes in healthcare regulations.

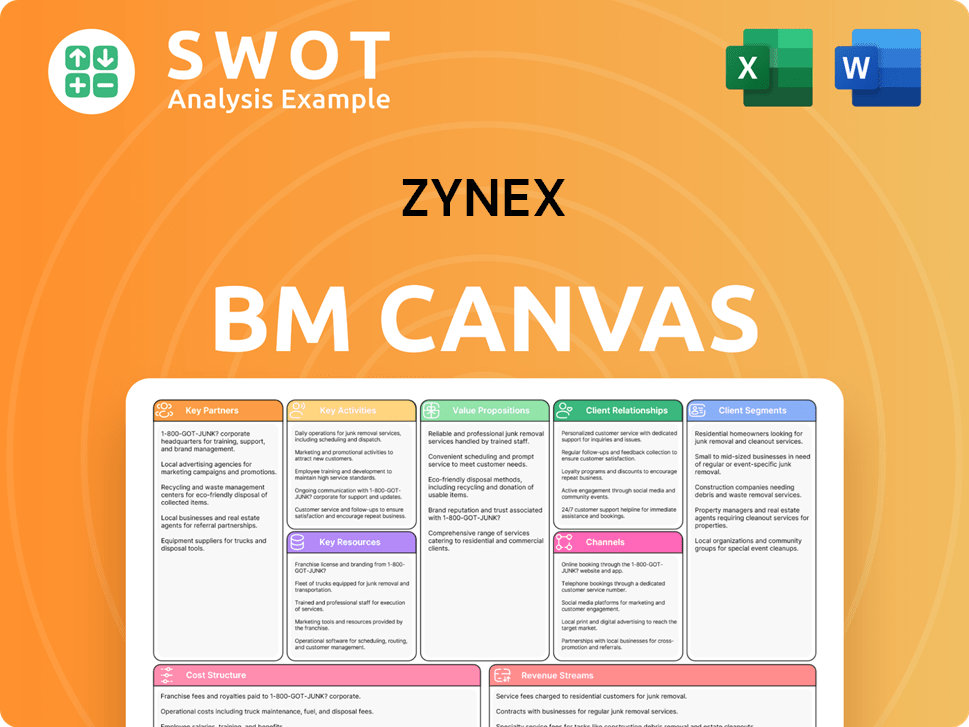

Zynex Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Zynex’s Competitive Landscape?

The competitive landscape for Zynex is significantly shaped by industry trends, regulatory changes, and consumer preferences. The company faces both opportunities and challenges, particularly in the medical device market. Understanding these dynamics is crucial for assessing Zynex's competitive position and future prospects. This analysis considers recent developments and anticipates future trends affecting the company.

Zynex's financial performance and strategic decisions reflect the pressures and opportunities within the medical device sector. Key factors include technological advancements, regulatory compliance, and the need for innovative product development. The company's ability to navigate these elements will determine its success in a competitive environment.

Technological advancements, such as the development of laser-based pulse oximeters, offer opportunities for improved accuracy. The increasing focus on remote patient monitoring aligns with Zynex's expertise. The company is also anticipating the commercialization of the NiCO device in the second half of 2025.

Compliance with healthcare laws and regulations is critical, with penalties for non-compliance. The temporary payment suspension by Tricare significantly impacted revenue. Zynex faces potential declines in demand if not managed effectively, along with increased regulatory pressures.

Growth opportunities exist in emerging markets and through product innovations. Zynex is actively developing new products within its Zynex Monitoring Solutions (ZMS) business. Strategic partnerships could also bolster its position in the medical device market.

Zynex is restructuring staff, including a 15% workforce reduction, to save approximately $35 million annually. The company is expanding its payer network to mitigate revenue challenges and improving sales force productivity. Zynex aims for 10-15% revenue growth and doubling EBITDA in 2025.

The Zynex competitive landscape is influenced by several factors. Recent financial results show a 43% revenue decline in Q1 2025 compared to Q1 2024, and increased net losses. This highlights the impact of regulatory scrutiny and changes in reimbursement policies. Understanding the Zynex industry outlook is crucial for investors and stakeholders.

- Regulatory Impact: The temporary payment suspension by Tricare significantly affected Zynex's revenue stream, emphasizing the importance of regulatory compliance.

- Financial Performance: The company's financial results in 2025 reflect the challenges, with revenue declines and increased losses.

- Strategic Initiatives: Zynex is implementing cost-saving measures and focusing on product innovation to address these challenges. Further insights can be found in the Growth Strategy of Zynex article.

- Future Outlook: The company aims for revenue growth and improved profitability through strategic initiatives and new product development.

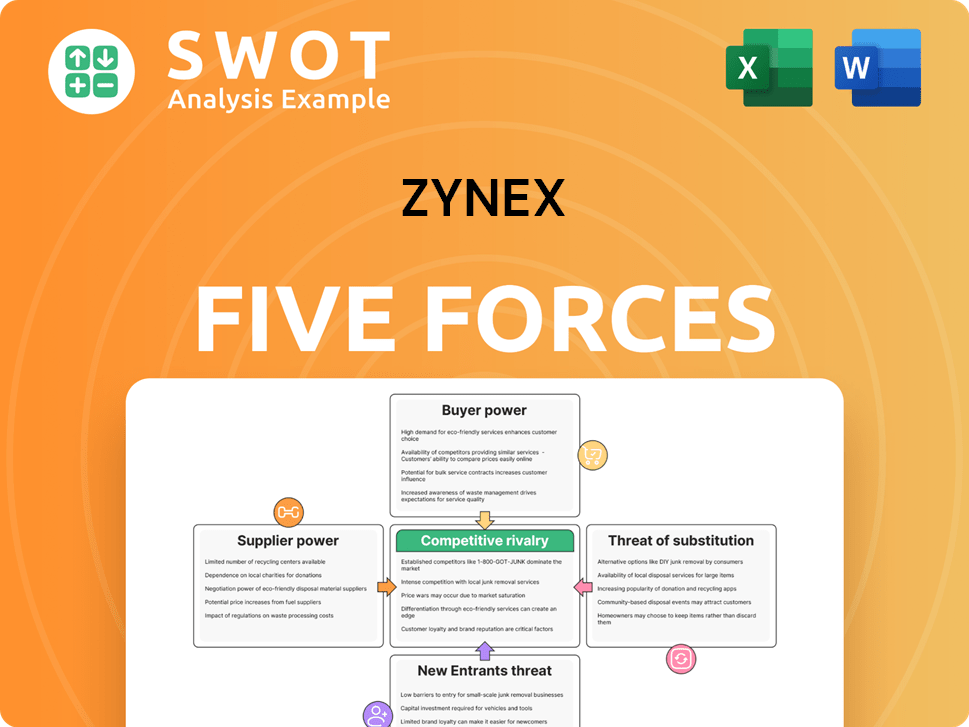

Zynex Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Zynex Company?

- What is Growth Strategy and Future Prospects of Zynex Company?

- How Does Zynex Company Work?

- What is Sales and Marketing Strategy of Zynex Company?

- What is Brief History of Zynex Company?

- Who Owns Zynex Company?

- What is Customer Demographics and Target Market of Zynex Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.