Zynex Bundle

Can Zynex Navigate Challenges and Thrive?

Zynex, a medical technology innovator, is at a critical juncture. Founded in 1996, the company specializes in non-invasive solutions, primarily electrotherapy devices, for pain management and rehabilitation. With a market cap of approximately $68.92 million as of April 2025, Zynex faces significant hurdles, including a recent payment suspension from Tricare, impacting its financial performance.

This Zynex SWOT Analysis dives deep into the Zynex growth strategy and future prospects, exploring its response to recent setbacks and its plans for future expansion. We'll examine the Zynex company analysis, including its financial performance, product portfolio, and competitive landscape within the medical device market. Understanding Zynex's revenue projections and market share analysis is crucial for assessing its long-term investment potential and navigating the dynamic market trends.

How Is Zynex Expanding Its Reach?

The company is actively pursuing several expansion initiatives as part of its Zynex growth strategy to foster future development. These initiatives focus on both market penetration and product diversification. A significant part of this strategy involves expanding its payer network to counteract recent revenue challenges and gain access to new customer bases. This expansion has been a key focus throughout 2024, with anticipated results expected in 2025.

Zynex future prospects are also tied to new product categories. The company has introduced several new products to its pain management division, including braces and a cold therapy product combined with compression, which is often used after orthopedic surgery. In its patient monitoring division, the company is developing a non-invasive, laser-based pulse oximeter (NiCO).

The company has completed positive clinical trials for the NiCO laser pulse oximeter at Duke University and the University of California, San Francisco. They have also received FDA clearance for their new TensWave device. This laser-based technology aims to address issues with existing technologies that may not work well for individuals with darker skin tones. Commercialization of the NiCO device is planned for the second half of 2025. The company also plans to submit an application for this device in the coming weeks, hoping to generate revenue from it in the latter half of 2025.

Expanding the payer network is a key strategy to increase market access. This initiative is designed to offset recent revenue challenges. The expansion efforts are expected to yield results in 2025, contributing to the company's overall financial performance. This will help to improve the Zynex financial performance.

The introduction of new products like braces and a cold therapy product enhances the pain management division. The NiCO laser pulse oximeter, with its innovative technology, represents a significant advancement. These Zynex new product launches are crucial for diversification.

The FDA clearance for the TensWave device is a major milestone. The anticipated commercialization of the NiCO laser pulse oximeter in the second half of 2025 is a key goal. These steps are vital for revenue generation and market share growth. This is part of the Zynex market share analysis.

Successful clinical trials at Duke University and UCSF validate the NiCO technology. The laser-based technology addresses limitations of existing devices, particularly for individuals with darker skin tones. These advancements position the company well within the medical device market.

The company's expansion plans include payer network growth and new product launches. The NiCO device's commercialization is planned for the second half of 2025. The company's focus on innovation and market access is central to its Zynex company analysis.

- Expanding the payer network to enhance market reach.

- Launching new products like the NiCO laser pulse oximeter.

- Targeting commercialization of the NiCO device in the second half of 2025.

- Leveraging technology to address unmet needs in the medical device market.

Zynex SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Zynex Invest in Innovation?

The cornerstone of the company's Zynex growth strategy lies in its dedication to technological innovation, primarily through in-house development and strategic product introductions. This approach enables the company to stay at the forefront of the medical device market, particularly in the domain of non-invasive medical devices.

The company's focus on electrotherapy for pain management exemplifies this strategy, with ongoing efforts to enhance its product offerings and address unmet needs. This commitment to innovation is crucial for maintaining a competitive edge and driving future growth within the evolving medical device landscape.

A significant innovation is the development of the NiCO laser pulse oximeter. This device uses advanced laser technology to measure fractional blood oxygenation levels. This is a notable advancement over traditional LED-based pulse oximeters, which have shown inaccuracies in certain populations, particularly those with darker skin pigmentation.

The NiCO laser pulse oximeter utilizes highly precise laser technology to measure fractional blood oxygenation levels, offering a more accurate alternative to traditional LED-based devices.

Positive clinical trials for the NiCO device at Duke University and the University of California, San Francisco, underscore its potential to capture market share in the patient monitoring segment.

The company's continued commitment to expanding its pain management product offerings is evident through the FDA clearance for its new TensWave device, showcasing new technological capabilities.

While the company is currently navigating financial constraints, these product innovations position the company for future growth by enhancing its product portfolio and addressing unmet needs in the medical device market.

The company's Zynex future prospects are closely tied to its ability to successfully commercialize these innovative products and expand its market share. The company's Zynex product portfolio is a key factor in its long-term investment potential.

The company's strategy hinges on leveraging technology and innovation to drive growth, specifically through in-house development and strategic product introductions. The company's focus on non-invasive medical devices, particularly electrotherapy for pain management, is a testament to this strategy.

- The NiCO laser pulse oximeter, which utilizes highly precise laser technology to measure fractional blood oxygenation levels, is a significant innovation.

- FDA clearance for the new TensWave device indicates a continued commitment to expanding its pain management product offerings.

- These product innovations position the company for future growth by enhancing its product portfolio and addressing unmet needs in the medical device market.

- The positive clinical trials for the NiCO device at Duke University and the University of California, San Francisco, underscore its potential to capture market share in the patient monitoring segment by offering more accurate measurements.

Zynex PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Zynex’s Growth Forecast?

The financial outlook for Zynex reflects a period of transition and adjustment. The company's Zynex growth strategy is currently navigating challenges, particularly concerning revenue streams and profitability. This situation impacts the Zynex future prospects, making it crucial to analyze the recent financial performance and strategic direction.

For the full year 2024, the company reported a 4% increase in net revenue, reaching $192.4 million. However, net income significantly decreased by 69% to $3.0 million. Operating cash flow also saw a reduction, dropping to $12.7 million from the previous year. This financial backdrop sets the stage for understanding the company's current position and future trajectory.

The first quarter of 2025 presented considerable headwinds for Zynex, mainly due to a temporary payment suspension from Tricare, which constitutes a significant portion of the company's revenue. This disruption has led to a notable decrease in net revenue and a reported net loss for the quarter. Despite these obstacles, Zynex is taking steps to stabilize its financial standing and prepare for future growth.

In Q1 2025, Zynex experienced a substantial downturn, with net revenue dropping to $26.6 million from $46.5 million in Q1 2024. The company reported a net loss of ($10.4) million, a significant shift from the net income of $10,000 in the same period last year. Gross profit margin also decreased to 69% from 80%.

For the full year 2024, Zynex achieved net revenue of $192.4 million, a 4% increase from $184.3 million in 2023. However, net income decreased by 69% to $3.0 million, or $0.09 per diluted share. Operating cash flow for 2024 was $12.7 million, down from $17.8 million in 2023.

For Q2 2025, Zynex anticipates net revenue of at least $27 million, with an expected EPS loss of $0.20 or better. These projections reflect the company's efforts to stabilize and recover from recent financial setbacks.

As of December 31, 2024, Zynex maintained a strong balance sheet with $39.6 million in cash and cash equivalents and working capital of $58.3 million. This financial stability provides a foundation for navigating current challenges and pursuing future opportunities.

Zynex's strategic focus includes managing the impact of the Tricare payment suspension and positioning itself for revenue growth throughout the year. The company is withholding full-year 2025 guidance due to the uncertainty surrounding the Tricare situation. Understanding the Zynex financial performance requires a close look at the medical device market trends and the company's ability to adapt. Further details on how Zynex generates revenue can be found in the article Revenue Streams & Business Model of Zynex.

Zynex expects Q1 2025 net revenue of at least $30 million with an expected loss per share of ($0.30) or better. This forecast indicates the company's immediate outlook and recovery efforts.

Due to the ongoing uncertainty with Tricare, Zynex has decided to withhold its full-year 2025 guidance. This decision reflects the need to assess the impact of the payment suspension on overall financial performance.

Zynex's strong balance sheet, with $39.6 million in cash and cash equivalents as of December 31, 2024, provides a financial cushion. This strength supports the company's ability to navigate current challenges.

The company anticipates quarterly revenues to increase throughout the year, reflecting typical seasonality. This expectation is a key factor in Zynex's financial planning and strategic outlook.

Zynex is making strategic adjustments to address the challenges, focusing on revenue stabilization and improving profitability. These adjustments are crucial for long-term sustainability.

Analyzing Zynex market trends and the broader medical device market is essential. This analysis helps in understanding the company's position and future prospects.

Zynex Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Zynex’s Growth?

The future trajectory of Zynex faces several potential risks and obstacles that could impact its Zynex growth strategy and overall success. These challenges span financial, operational, and market-related factors, which require careful navigation to ensure sustainable development. Understanding these risks is crucial for assessing the Zynex future prospects and making informed decisions.

One of the most pressing concerns is the temporary payment suspension from Tricare, a significant payer for Zynex. This suspension, which represents between 20% and 25% of the company's annual revenue, has already had a detrimental effect. This situation has led to a decline in revenue and a net loss in Q1 2025, prompting the company to take cost-cutting measures, including a 15% workforce reduction, which is expected to save approximately $35 million annually.

The medical device market is highly competitive and subject to regulatory changes, posing ongoing risks to Zynex. The company's reliance on reimbursement from health insurance companies makes it vulnerable to shifts in reimbursement policies. Rapid technological advancements in the medical device market necessitate continuous innovation to prevent product obsolescence. Furthermore, operational risks include supply chain vulnerabilities and dependence on third-party manufacturers.

The temporary halt in payments from Tricare is a major immediate challenge. This suspension, accounting for a significant portion of Zynex's revenue, directly impacts its financial performance and growth potential. The company has had to implement cost-cutting measures, including workforce reductions, to mitigate the financial impact.

The medical device industry is highly competitive and subject to stringent regulations, which constantly evolve. Changes in reimbursement policies by health insurance companies pose a significant risk, as they could directly affect Zynex's revenue streams. Staying ahead of technological advancements is also crucial.

Zynex relies on third-party manufacturers for its product production. This dependence creates operational risks, including potential supply chain disruptions, manufacturing delays, and the need to ensure products meet specifications. These factors can affect the company's ability to meet market demand.

Slower-than-normal payments from some payers and a decrease in sales headcount have affected Zynex's revenue. The company is addressing these issues through restructuring and expanding its payer network. These internal challenges can impact Zynex's Zynex financial performance and Zynex revenue projections.

A class-action lawsuit alleging revenue inflation through excessive shipments has added to the company's challenges. Legal and reputational risks can impact investor confidence and Zynex's overall business operations. The outcome of such litigation can significantly affect the company.

Analysts have expressed concerns that the Tricare situation could trigger a 'domino effect,' prompting other insurers to re-evaluate their reimbursement policies. This could lead to further revenue declines and increased financial pressure on Zynex. The company's ability to navigate these challenges will be critical.

Internally, Zynex faced challenges, including slower payments from certain payers and a decrease in sales headcount, which impacted Q4 2024 revenue. The company is working to mitigate these risks through restructuring and expanding its payer network. However, analysts have expressed concerns that the Tricare situation could trigger a 'domino effect,' leading other insurers to reassess their reimbursement policies. For a deeper dive into the company's origins and early strategies, consider exploring the Brief History of Zynex.

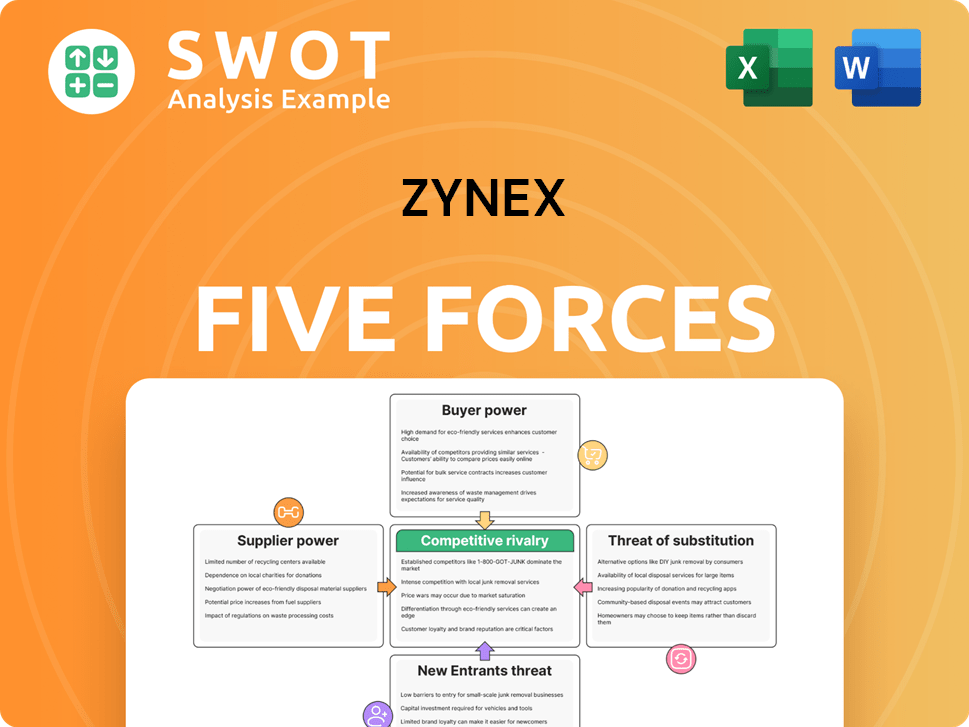

Zynex Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Zynex Company?

- What is Competitive Landscape of Zynex Company?

- How Does Zynex Company Work?

- What is Sales and Marketing Strategy of Zynex Company?

- What is Brief History of Zynex Company?

- Who Owns Zynex Company?

- What is Customer Demographics and Target Market of Zynex Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.