ADT Bundle

Can ADT Dominate the Smart Home Security Landscape?

ADT, a titan in the security industry since 1874, is aggressively pivoting towards the future with its innovative ADT+ platform, integrating seamlessly with Google Nest devices. This strategic move underscores a critical need for a robust ADT SWOT Analysis to understand its position. But, what does the future hold for this security giant?

This exploration delves into ADT's ADT growth strategy and its ADT future prospects, examining how it plans to navigate the dynamic home security market. We will dissect the ADT company analysis, considering its current market position and its response to evolving security industry trends. Furthermore, we'll analyze how ADT is adapting to changing consumer preferences and leveraging technology for growth, including exploring ADT's business model and its expansion strategies.

How Is ADT Expanding Its Reach?

The company is actively expanding through various initiatives, focusing on both its core residential professional installation business and optimizing its sales processes. This includes a strategic emphasis on the ADT+ platform and its partnership with Google Nest to enhance offerings. The company is strategically positioning itself to capture a larger share of the home security market, capitalizing on its existing infrastructure and brand recognition.

A key focus is the expansion of the ADT+ platform, which is expected to drive customer engagement and growth throughout 2025. This expansion is supported by the exclusive partnership with Google Nest, allowing the company to uniquely offer Nest Cams and other smart home devices within its security systems. This strategic move is designed to increase customer retention and attract new customers looking for integrated smart home solutions.

Furthermore, the company is exploring opportunities in the small business and aging-in-place markets. This diversification strategy aims to broaden its customer base and service offerings. The company is also refining its go-to-market approaches, including offer structure, bundling, pricing, and marketing messages to appeal to a wider range of customer segments. This multi-faceted approach is crucial for sustained growth in the competitive home security market.

The ADT+ platform is central to the company's growth strategy. The expansion of this platform is expected to increase customer engagement and drive revenue growth. The platform's features are designed to enhance the overall customer experience and provide greater value.

The exclusive partnership with Google Nest provides a competitive advantage. This partnership allows the company to offer Nest Cams and other smart home devices. This integration enhances the value proposition for customers seeking advanced security solutions.

The company is exploring opportunities in the small business and aging-in-place markets. This diversification helps to broaden the customer base. The aim is to reduce reliance on any single market segment and capture new revenue streams.

Refining go-to-market approaches is a key initiative. This includes offer structure, bundling, pricing, and marketing messages. The goal is to appeal to a wider range of customer segments. This strategy aims to improve customer acquisition and retention rates.

The company's partnerships extend beyond technology. The renewed partnership with the Miami Marlins, lasting through 2029, is an example of community engagement. This partnership includes a program to spotlight local small businesses, enhancing brand visibility and community ties.

- The company's military career fairs and base outreach in 2025 aim to connect with veterans and military families.

- These initiatives support talent acquisition and community engagement.

- The focus is on expanding its presence and strengthening community ties.

- This approach highlights a unique strategy for talent acquisition and community support.

A deeper understanding of the company's financial performance can be found in the Revenue Streams & Business Model of ADT. This offers insights into how these expansion initiatives are expected to impact the company's financial outlook and overall growth trajectory.

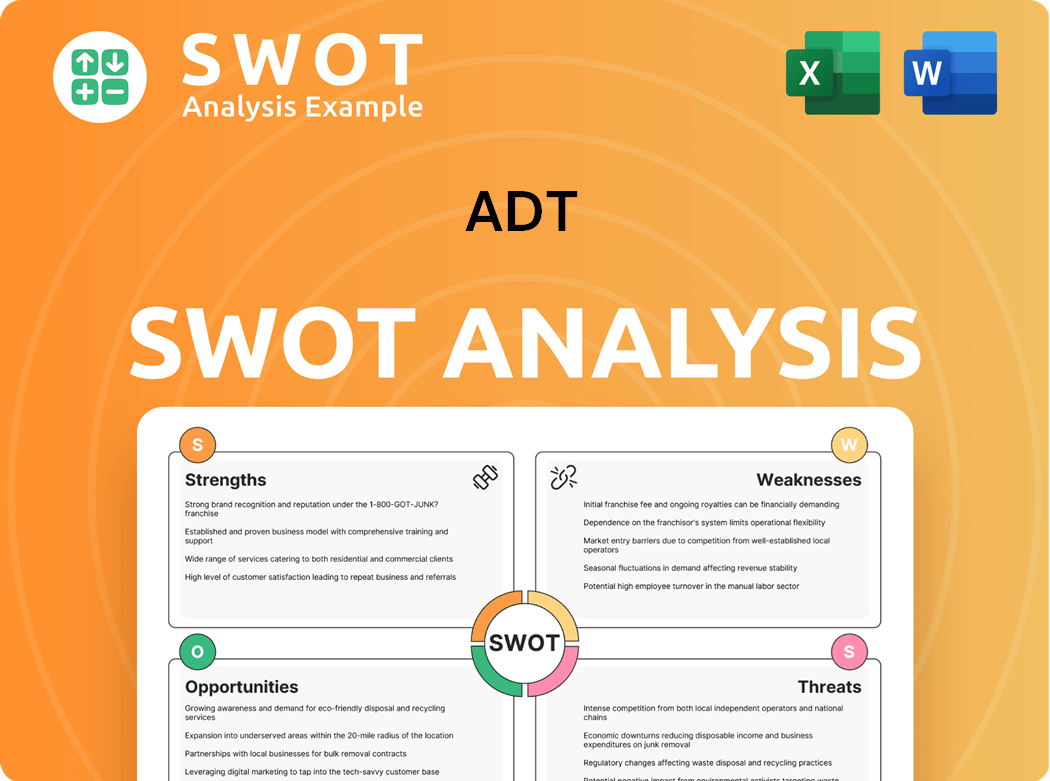

ADT SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does ADT Invest in Innovation?

The innovation and technology strategy of ADT is focused on leveraging advanced solutions to improve its security and smart home offerings, which is a key component of its ADT growth strategy. A central element of this strategy is the ADT+ platform, which integrates ADT's proprietary technology with Google Nest devices, offering a unified interface for security, automation, and monitoring. This platform incorporates AI-powered insights, real-time alerts, and 24/7 professional monitoring.

The partnership with Google is crucial to ADT's technology strategy, especially in using Google's AI platform to boost operational efficiency, such as through expected significant call deflection in call centers. ADT is also using Google's AI recognition technology for features like Trusted Neighbor, which allows secure access granting to trusted individuals based on facial recognition with Nest Cams and Yale smart locks.

ADT is investing in its product and experience ecosystem to develop differentiated customer offerings, which is essential for navigating security industry trends and the home security market. The company's focus on developing new features and integrating advanced technologies like AI and IoT is evident in its recent product launches and partnerships.

Launched in 2024, the ADT+ platform integrates ADT's technology with Google Nest devices. It provides a unified interface for security, automation, and monitoring, incorporating AI-powered insights and real-time alerts.

The collaboration with Google is critical, utilizing Google's AI for improved operational efficiency. This includes features like Trusted Neighbor, which uses facial recognition for secure access.

ADT is actively integrating AI and IoT to develop new features and enhance customer offerings. This is evident in recent product launches and partnerships, focusing on innovation.

The Remote Assistance program, supporting over 3 million customers since 2021, showcases the use of technology for customer convenience and operational efficiency. In 2024, it helped eliminate over 50% of vehicle service trips.

The Trusted Neighbor feature was recognized as the Home Security Innovation of the Year at the Internet of Things Breakthrough Awards, highlighting ADT's leadership in the field.

While specific figures for overall R&D investment were not readily available, the company's focus on developing new features and integrating advanced technologies like AI and IoT is evident in its recent product launches and partnerships.

ADT's technology strategy focuses on integrating advanced solutions to enhance its offerings and drive growth. This approach includes the development of the ADT+ platform and strategic partnerships.

- ADT+ Platform: A unified interface for security, automation, and monitoring, integrating ADT's technology with Google Nest devices.

- AI Integration: Utilizing Google's AI for operational efficiency, including call deflection in call centers, and features like Trusted Neighbor.

- IoT and Smart Home: Developing new features and integrating technologies like AI and IoT to enhance customer offerings.

- Remote Assistance Program: Supporting over 3 million customers since 2021, and in 2024, it helped eliminate over 50% of vehicle service trips.

- Innovation Awards: Recognition for innovations like the Trusted Neighbor feature, demonstrating ADT's leadership in the field.

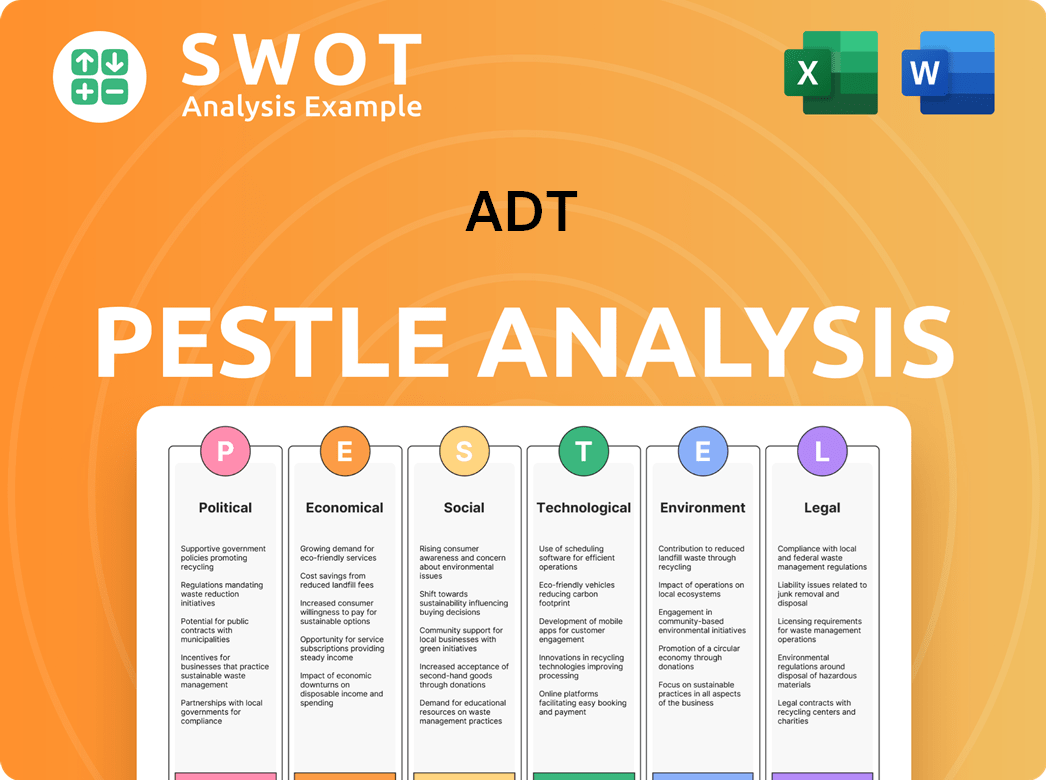

ADT PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is ADT’s Growth Forecast?

The financial outlook for ADT in 2025 points towards continued growth, building on a solid performance in 2024. The company's projections indicate a positive trajectory, supported by strategic initiatives and operational efficiencies. A key focus remains on leveraging technology and adapting to evolving consumer preferences within the home security market.

In 2024, ADT demonstrated robust financial health with a 5% year-over-year increase in total revenue, reaching $4.9 billion. Adjusted net income surged by 25% to $685 million. These results highlight the effectiveness of ADT's business model and its ability to capitalize on security industry trends. The company's strong performance in 2024 sets a positive foundation for future growth and expansion.

ADT's guidance for full-year 2025 anticipates total revenue between $5.025 billion and $5.225 billion, reflecting approximately 5% growth. Adjusted EBITDA is projected to be between $2.65 billion and $2.75 billion, also increasing by about 5%. Furthermore, adjusted earnings per share are expected to rise by 8%, ranging from $0.77 to $0.85. Adjusted free cash flow is forecast to grow by 14%, reaching $800 million to $900 million. These projections highlight ADT's commitment to sustainable financial performance and its strategic approach to the home security market.

ADT projects total revenue between $5.025 billion and $5.225 billion.

Adjusted EBITDA is expected to be in the range of $2.65 billion to $2.75 billion.

Adjusted earnings per share are anticipated to increase by 8%.

Adjusted free cash flow is projected to grow by 14%.

ADT's strong cash flow generation supports its capital allocation strategy, which includes investing in the business, strengthening the balance sheet, and returning capital to shareholders. The company has reduced its leverage from 3.9x in 2022 to 2.9x in 2024. Shareholder returns have increased, with the quarterly dividend raised by 57% to $0.055 per share in January 2024, along with significant share repurchases. These actions reflect ADT's commitment to delivering value to its shareholders and its confidence in its long-term growth prospects. For more insights into ADT's approach, explore the Marketing Strategy of ADT.

Key drivers include new customer acquisitions and recurring monthly revenue.

Focus on improving operational efficiency, leading to strong free cash flow.

Prioritizing investments in the business, balance sheet strengthening, and shareholder returns.

Maintaining strong customer retention rates to ensure sustainable revenue streams.

Leveraging partnerships to expand market reach and enhance service offerings.

Investing in technology to provide innovative security solutions.

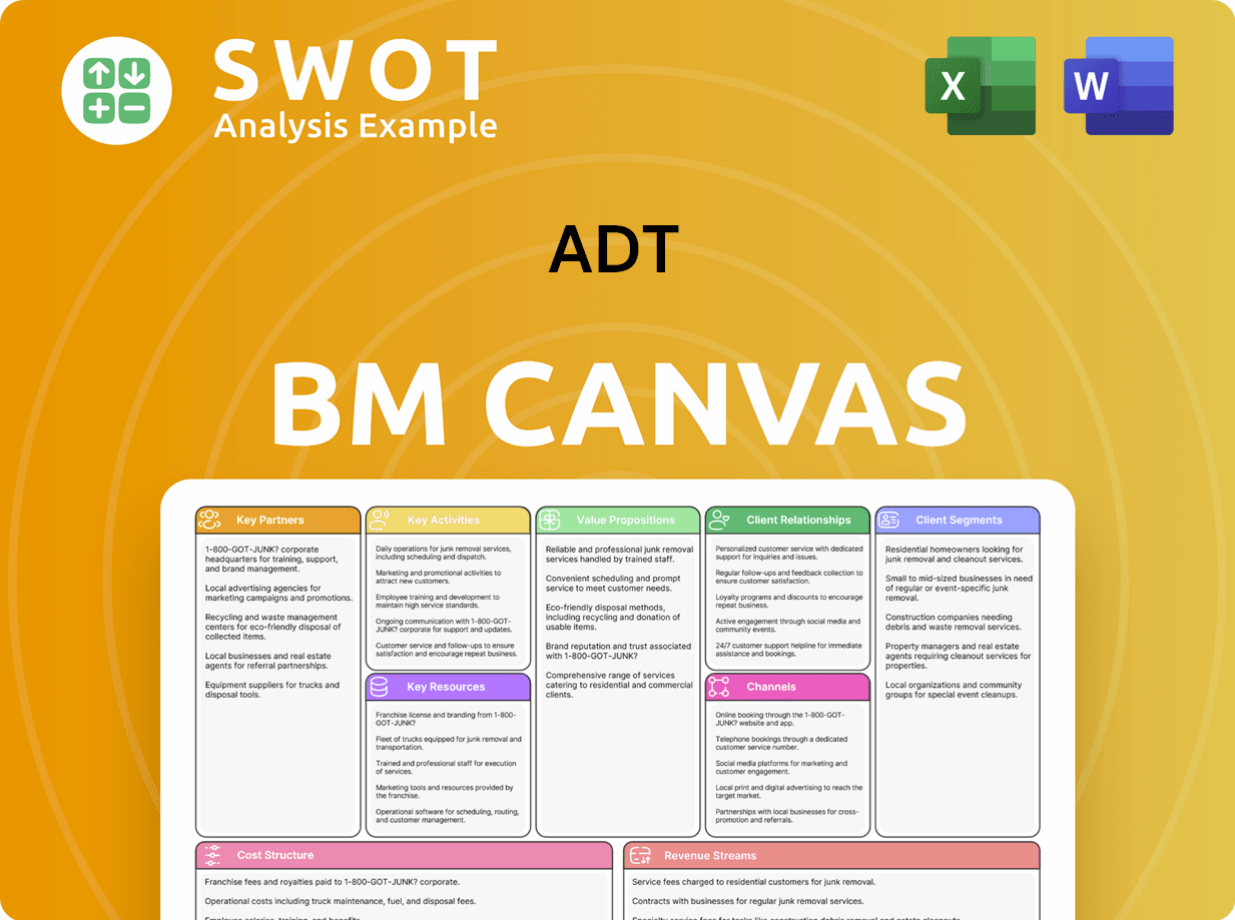

ADT Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow ADT’s Growth?

The path to ADT's future, as outlined in this ADT company analysis, is not without its hurdles. The home security market, a key component of ADT's business model, is fiercely competitive and subject to rapid technological shifts. Economic downturns and shifting consumer spending patterns can also affect demand for security systems, creating potential headwinds for ADT's growth.

Technological advancements present a continuous need for innovation, requiring ADT to remain agile and adaptable. Regulatory changes and the evolving landscape of cybersecurity also introduce potential risks and operational adjustments. Furthermore, internal challenges such as managing customer acquisition costs and addressing customer churn rates, which were notably higher than industry averages in 2023, require focused attention.

Supply chain vulnerabilities, while not explicitly detailed as a major risk in the provided search results for 2024-2025, and potential tariff impacts on equipment costs are considerations that ADT is monitoring and planning to mitigate through strategies like supplier negotiations and inventory management. The company's transition to becoming a cash taxpayer could present challenges to cash flow despite overall expected growth.

The home security market is highly competitive, with numerous players vying for market share. Companies must constantly innovate to stay ahead. This competition impacts ADT's ability to maintain and grow its customer base.

Rapid technological advancements, particularly in areas like AI and IoT, require continuous adaptation. ADT must invest in research and development to remain competitive and offer cutting-edge solutions to its customers.

Economic fluctuations can influence consumer spending on security systems. Recessions or economic downturns can lead to decreased demand, impacting ADT's revenue and growth trajectory. Understanding Brief History of ADT can provide context.

Managing customer acquisition costs and addressing customer churn rates are ongoing challenges. High churn rates can erode the customer base, impacting long-term revenue and profitability. ADT's ability to acquire and retain customers is crucial.

Changes in regulations can affect operational costs and market dynamics. Compliance with new standards and requirements can be costly and may require adjustments to ADT's business practices. These may affect the ADT growth strategy.

As ADT expands its use of AI and connected devices, robust cybersecurity safeguards and governance platforms are essential. Emerging security threats require continuous investment and adaptation to protect customer data and systems.

ADT aims to mitigate these risks through a focus on customer retention, operational efficiency, and a diversified approach to market segments. The company's strong brand recognition and established customer relationships provide a competitive advantage. ADT's consistent revenue growth and strong cash flow generation in 2024 and early 2025 demonstrate resilience.

ADT's financial performance and outlook are critical indicators of its ability to navigate challenges. The company's ability to maintain revenue growth and strong cash flow generation, as seen in 2024 and early 2025, is a positive sign. However, the transition to being a cash taxpayer could impact cash flow.

ADT Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.