ADT Bundle

Who Really Owns ADT?

Understanding the ADT SWOT Analysis is crucial, but have you ever wondered who calls the shots at ADT, the leading name in home security? The ADT company, a titan in the security industry, has a fascinating ownership history that has shaped its trajectory. From its humble beginnings to its current market position, ADT's ownership structure has undergone significant transformations, impacting its strategic direction and market performance.

The ADT ownership structure, including the influence of private equity and institutional investors, provides critical insights into the ADT security giant's operations. Knowing who owns ADT is essential for anyone looking to invest, partner, or simply understand the dynamics of this prominent ADT corporation. This exploration will uncover the key players and events that have defined the ADT history, including its ADT headquarters location and its evolution.

Who Founded ADT?

The origins of the ADT company, initially known as American District Telegraph, date back to 1874. Tracing the exact founding ownership and initial equity split is challenging due to the company's long history and numerous structural changes. The company has evolved significantly since its inception, transforming from its early form to its modern corporate structure.

Over the years, ADT has experienced multiple ownership changes, reflecting its growth and adaptation to market dynamics. These shifts have shaped its current status as a major player in the security industry. Understanding this history is crucial for grasping the company's evolution and its present-day position within the market.

One pivotal change in ADT's structure occurred in 2012. It was spun off from Tyco International Ltd., becoming an independent, publicly traded entity. This move distributed ADT's common stock to Tyco's shareholders, marking a significant shift in its ownership before its eventual acquisition by Apollo Global Management.

Founded in 1874 as American District Telegraph, the company's early focus was on telegraph-based services. The initial ownership structure is difficult to pinpoint due to limited public records from that era. This early period set the foundation for ADT's future in security solutions.

Over time, ADT's ownership changed through acquisitions, mergers, and spin-offs. These changes reflect the company's adaptation to market demands and technological advancements. The company's history is marked by strategic moves aimed at strengthening its market position.

In 2012, ADT was spun off from Tyco International Ltd. This event made ADT an independent, publicly traded company. The spin-off was a key moment in ADT's ownership history, allowing it to operate separately and pursue its own strategic goals.

Following its period as a publicly traded company, ADT was acquired by Apollo Global Management. This acquisition further reshaped ADT's ownership and strategic direction. The acquisition by Apollo marked a significant change in the ADT ownership structure.

During its time as a publicly traded company, ADT's stock symbol was 'ADT'. This period allowed for public investment and increased visibility in the market. The public listing provided ADT with access to capital and enhanced its corporate profile.

Currently, ADT is primarily owned by Apollo Global Management. This ownership structure influences ADT's strategic decisions and operational focus. The current ownership reflects the company's long-term strategic direction and market positioning.

Understanding ADT's ownership history provides insights into its corporate evolution and strategic shifts. From its inception as American District Telegraph to its current structure, ADT's ownership has significantly influenced its growth and market position. The company's journey reflects its adaptation to technological advancements and market changes. For a deeper dive into the company's marketing strategies, check out the Marketing Strategy of ADT.

- ADT's origins date back to 1874, with early ownership details being less accessible.

- The spin-off from Tyco in 2012 was a crucial event, making ADT a publicly traded company.

- Apollo Global Management currently holds a significant stake in ADT.

- The ADT security system parent company has evolved through acquisitions and strategic moves.

- The ADT corporation's history is marked by its ability to adapt and grow within the security industry.

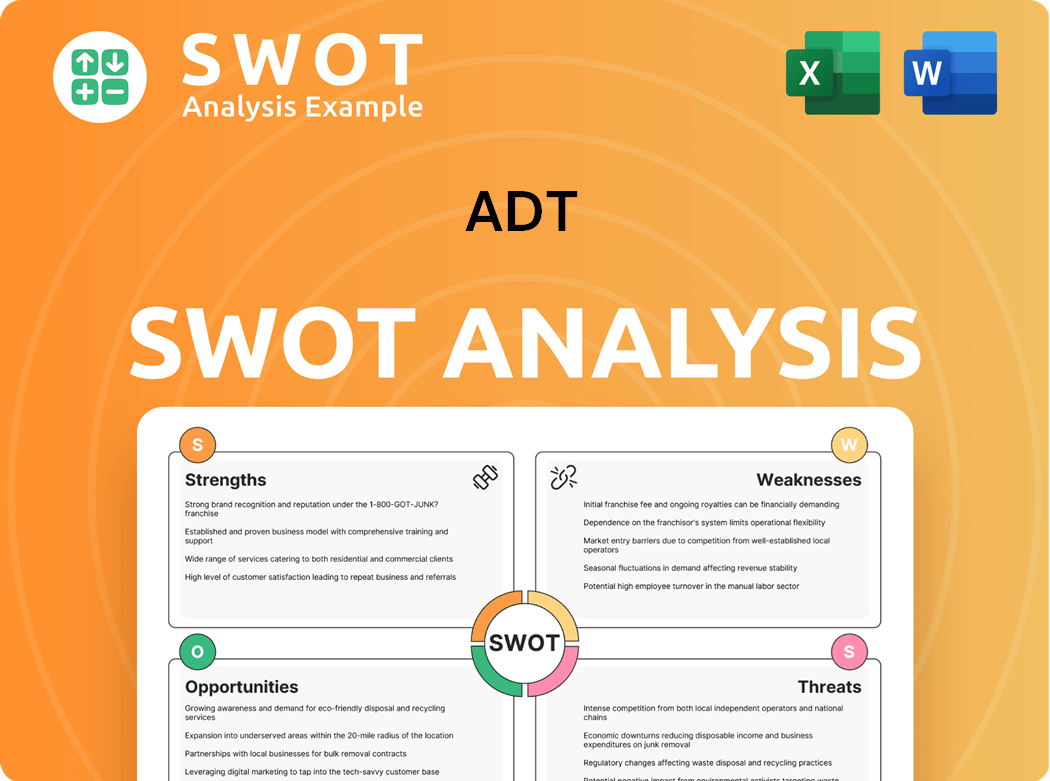

ADT SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has ADT’s Ownership Changed Over Time?

The ADT company's ownership has undergone significant changes over time. After separating from Tyco in 2012, ADT operated as an independent public company. In February 2016, Apollo Global Management, a private equity firm, acquired ADT for approximately $6.9 billion. This acquisition led to a merger with Protection 1, another home security firm owned by Apollo, resulting in a combined entity valued at around $15 billion.

In January 2018, ADT Inc. became a public company again, listed on the New York Stock Exchange under the ticker symbol ADT. While Apollo Global Management held a majority share in ADT as of 2023, its ownership stake decreased by March 19, 2024, causing ADT to no longer be considered a 'controlled company' under NYSE rules. Understanding the Target Market of ADT is crucial to evaluate its strategic direction.

| Key Dates | Ownership Events | Stakeholders Involved |

|---|---|---|

| 2012 | Spin-off from Tyco | ADT |

| February 2016 | Acquisition by Apollo Global Management | Apollo Global Management, ADT |

| January 2018 | Initial Public Offering (IPO) | ADT Inc. |

As of May 2025, ADT Inc. has 667 institutional owners and shareholders holding a total of 851,061,301 shares. Major shareholders include Apollo Management Holdings, L.P., State Farm Mutual Automobile Insurance Co, Vanguard Group Inc, and BlackRock, Inc. Insider ownership of ADT stood at 1.69% as of June 10, 2025. Google invested $450 million in ADT in August 2020, acquiring a 6.6% equity stake.

The ADT ownership structure has evolved significantly, from being a public company to private equity ownership and back to public. Apollo Global Management remains a significant shareholder, but its influence has decreased over time.

- Apollo Global Management initially acquired ADT in 2016.

- ADT went public again in 2018.

- Google is a significant shareholder.

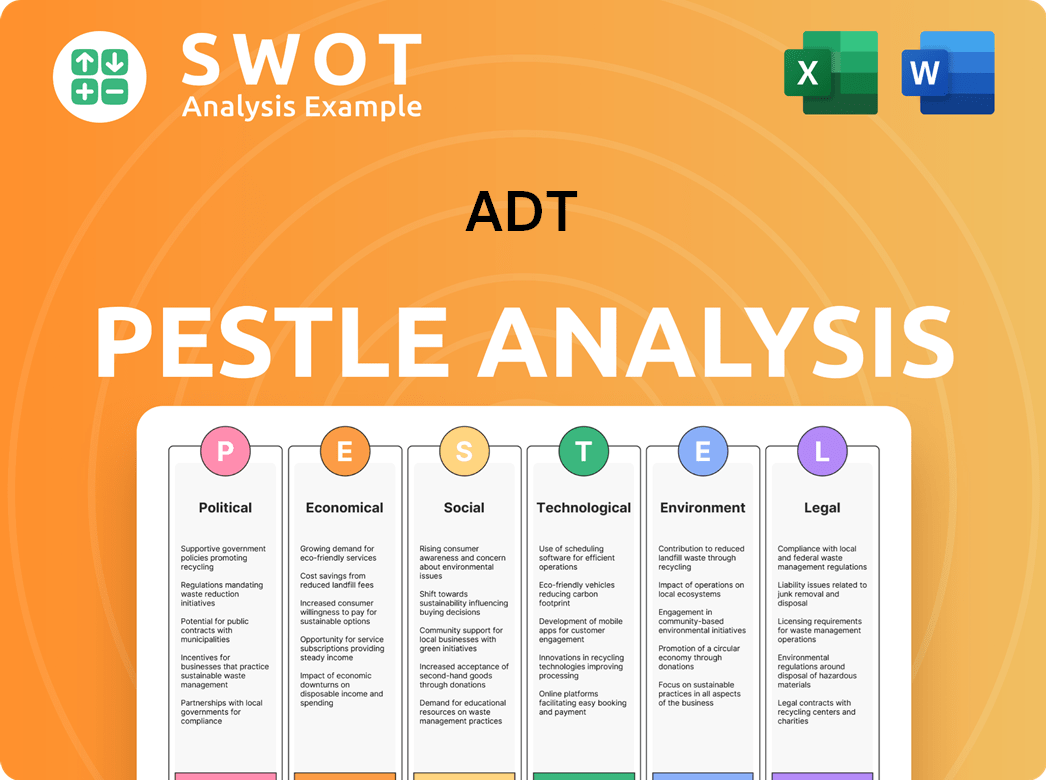

ADT PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on ADT’s Board?

As of April 7, 2025, the ADT Board of Directors comprises 13 members, with the flexibility to increase the number to a maximum of 15. The Board's primary responsibilities include overseeing and approving management's strategic and business plans, financial plans, and monitoring the execution of corporate objectives. This structure ensures that the ADT security company operates under robust governance, with a focus on long-term value creation.

A pivotal shift in governance occurred on March 19, 2024, when ADT corporation ceased to be a 'controlled company' under NYSE rules. This change resulted in Apollo Global Management's voting power regarding the election of directors decreasing to 49.5%. Consequently, by March 19, 2025, ADT's Nominating and Corporate Governance Committee and Compensation Committee were mandated to be composed entirely of independent directors. This transition underscores ADT's commitment to enhanced corporate governance and aligns with best practices in the industry, ensuring greater accountability and transparency in its operations.

| Director | Title | Age |

|---|---|---|

| James D. Bartlett | Director | 61 |

| R. David Yost | Director, President and Chief Executive Officer | 60 |

| Paul B. Zepf | Director | 64 |

For the 2025 Annual Meeting, common stockholders are entitled to vote on the re-election of Class II directors. Class B Common Stockholders, however, do not have voting rights for the election of directors but can vote on other matters. This structure reflects the complexities of ADT ownership and the distribution of voting power among different classes of shareholders. Understanding these nuances is crucial for anyone looking to understand the dynamics of the ADT company.

The Board of Directors at ADT is currently composed of 13 members, with the potential to increase to 15. This structure is designed to provide effective oversight of the company's operations. The shift away from being a controlled company has significantly impacted governance, with Apollo Global Management's voting power reduced to 49.5%.

- Common stockholders vote on Class II director elections.

- Class B stockholders vote on other matters, but not director elections.

- The transition to independent committees enhances governance.

- For more on ADT's strategic direction, see Growth Strategy of ADT.

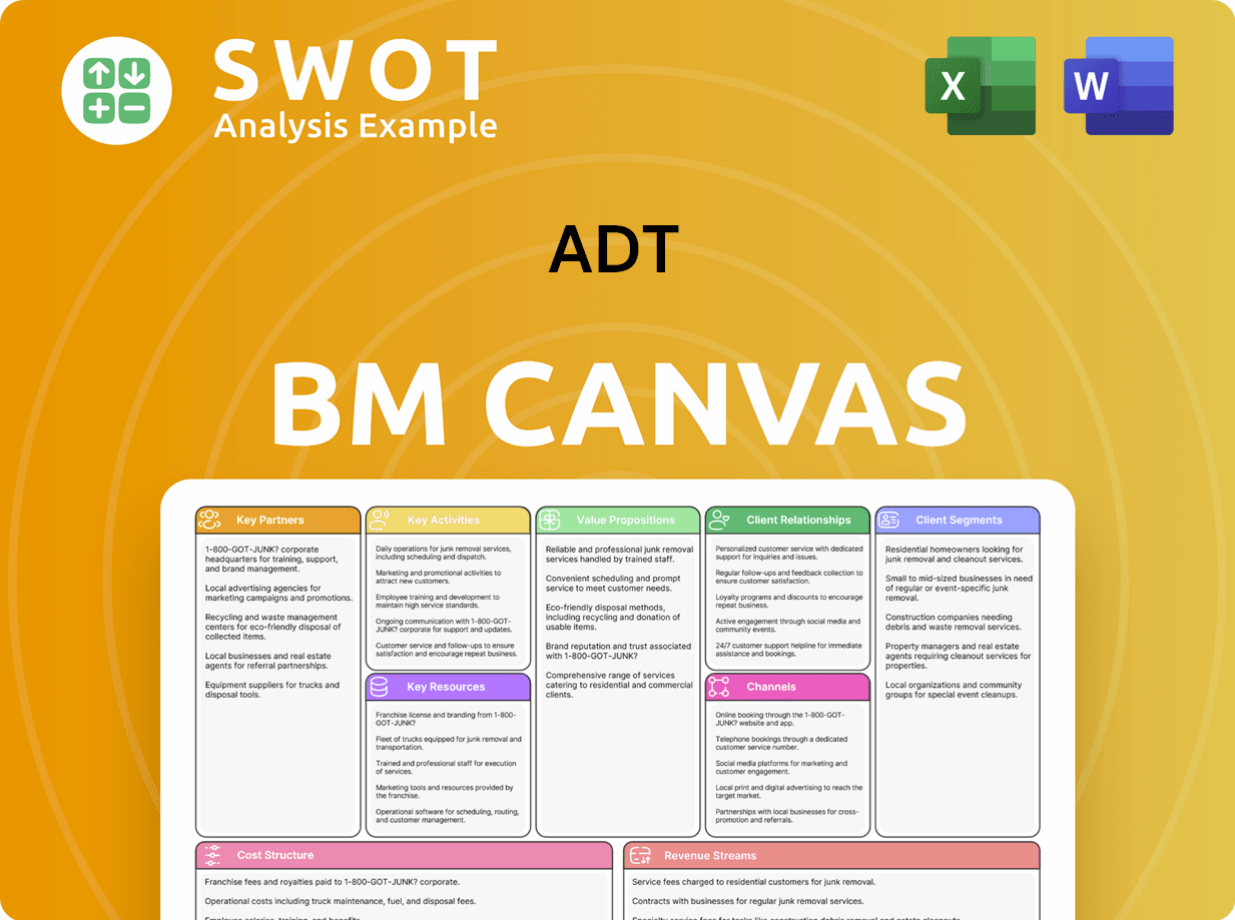

ADT Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped ADT’s Ownership Landscape?

Over the past few years, the ADT company has seen significant shifts in its ownership structure and strategic initiatives. In January 2024, the board approved a share repurchase plan of up to $350 million, scheduled to conclude by January 29, 2025. This commitment reflects the company's ongoing efforts to manage its capital and enhance shareholder value. During the first quarter of 2025, ADT repurchased and retired 53 million shares of its common stock for an aggregate price of $397 million.

A notable transaction occurred in May 2025, where Apollo Management Holdings GP sold 50,000,000 shares of ADT stock at an average price of $8.02, indicating strategic adjustments in its investment. Furthermore, ADT has been actively involved in mergers and acquisitions to strengthen its market position and expand its service offerings. Recent acquisitions include Apex Integrated Security Solutions in January 2024, Portland Safe in January 2024, and Newtech Systems in December 2023. These moves highlight ADT's commitment to growth and market consolidation.

| Metric | Value | Date |

|---|---|---|

| Institutional Ownership | 90.52% | June 10, 2025 |

| Share Repurchases (Jan 2024 - May 2025) | 51 million shares | May 2025 |

| Share Repurchase Cost (Jan 2024 - May 2025) | $345 million | May 2025 |

Industry trends show an increase in institutional ownership within the security and smart home sectors, with ADT's institutional ownership reaching 90.52% as of June 10, 2025. The company has also announced a cash dividend of $0.055 per share, set for distribution on July 8, 2025. ADT is maintaining its financial guidance for 2025, projecting solid growth in cash flow and earnings per share. For more information about ADT's history, you can check out this article about the company's evolution.

ADT initiated a share repurchase program, demonstrating its commitment to returning value to shareholders and managing its capital efficiently.

The ADT corporation has been active in mergers and acquisitions, expanding its market presence and service offerings through strategic purchases. Recent acquisitions include Apex, Portland Safe, and Newtech Systems.

Institutional ownership in ADT security has increased, reflecting confidence from major investors and a trend towards institutional involvement in the security and smart home sectors. As of June 10, 2025, it is 90.52%.

ADT has announced a cash dividend and is maintaining its financial guidance for 2025, indicating a stable financial outlook and commitment to shareholder returns.

ADT Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of ADT Company?

- What is Competitive Landscape of ADT Company?

- What is Growth Strategy and Future Prospects of ADT Company?

- How Does ADT Company Work?

- What is Sales and Marketing Strategy of ADT Company?

- What is Brief History of ADT Company?

- What is Customer Demographics and Target Market of ADT Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.