American Eagle Bundle

Can American Eagle Outfitters Maintain Its Momentum?

American Eagle Outfitters (AEO) has become a retail powerhouse, captivating the youth market with its trendy and affordable apparel. From its humble beginnings in 1977, the company has evolved into a multi-brand retailer with a significant global footprint. But what does the future hold for this iconic brand?

This analysis dives deep into the American Eagle SWOT Analysis, examining the American Eagle growth strategy and its future prospects. We'll explore American Eagle company analysis, including its brand positioning and financial performance, to understand how AEO plans to navigate the competitive landscape and capitalize on emerging opportunities. Understanding American Eagle's expansion plans, online sales strategy, and sustainable fashion initiatives is crucial for investors and strategists alike.

How Is American Eagle Expanding Its Reach?

The expansion initiatives of American Eagle Outfitters (AEO) are primarily focused on amplifying its core brands and exploring new market opportunities. This strategy includes strategic store expansions, particularly for the high-growth Aerie brand, and leveraging international licensing agreements to broaden its global footprint. These efforts are designed to access new customer segments and diversify revenue streams, enhancing the company's competitive position.

A key aspect of AEO's growth strategy involves continued investment in its physical retail presence. The company plans to open new stores and remodel existing locations to enhance the overall customer experience. Simultaneously, AEO is focusing on expanding its international presence through licensing agreements, making its merchandise available in numerous countries. This multi-faceted approach aims to capitalize on both domestic and international market opportunities.

The company is also focused on elevating its key businesses and expanding into 'right-to-win adjacencies' for American Eagle, while fueling the 'AerieReal movement' in underpenetrated markets and accelerating OFFLINE's potential in activewear. This includes a strategic focus on reinvigorating AE Men's, and growing Aerie's soft apparel and activewear categories. These initiatives are designed to access new customer segments, diversify revenue streams, and maintain a competitive edge in the evolving retail landscape.

For fiscal year 2025, AEO plans to open approximately 5 to 15 American Eagle stores and approximately 25 to 40 Aerie and OFFLINE stores. This includes a mix of stand-alone and Aerie side-by-side locations. The company will also remodel around 90 to 100 American Eagle and Aerie stores in the U.S. and Canada to improve the customer experience.

AEO is expanding its international presence through licensing agreements. The company's merchandise is available in over 30 countries. This strategy allows for broader market penetration and revenue diversification. This approach contributes to the company's overall Mission, Vision & Core Values of American Eagle.

The company is focused on reinvigorating AE Men's and growing Aerie's soft apparel and activewear categories. These initiatives are designed to access new customer segments and maintain a competitive edge. AEO aims to expand into 'right-to-win adjacencies' for American Eagle.

AEO is also focusing on its online sales strategy. The company is investing in e-commerce growth strategies to enhance its online presence and improve customer experience. This includes digital marketing strategy and social media marketing campaigns.

AEO's expansion plans for 2024 and beyond involve a multi-pronged approach. This includes strategic store openings and remodeling, international market growth through licensing, and a focus on key brand initiatives. The company is also concentrating on digital marketing and e-commerce growth to reach a wider audience.

- Expanding the Aerie brand with new store openings and side-by-side locations.

- Increasing international presence through licensing agreements in over 30 countries.

- Reinvigorating AE Men's and growing Aerie's soft apparel and activewear categories.

- Enhancing the customer experience through store remodeling initiatives.

American Eagle SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does American Eagle Invest in Innovation?

The company is actively employing innovation and technology to foster sustained growth and improve customer experiences. This approach is crucial for engaging its target demographic and capitalizing on the growing importance of e-commerce. A key component of this strategy involves investing in digital platforms and store remodels, which are significant elements of its capital expenditures for 2025.

Digital transformation is a core focus, with investments in mobile technology, digital marketing, and enhancing the overall digital customer journey. The company's 'Powering Profitable Growth' strategy underscores its commitment to 'leveraging new technologies to maximize ongoing efficiencies and deliver the very best and innovative experiences for our customers'. This strategic focus is essential for maintaining a competitive edge in the evolving retail landscape.

Furthermore, the company is dedicated to sustainability initiatives, aligning with evolving consumer values and contributing to its brand image and long-term growth objectives. This commitment is demonstrated through initiatives like the 'Real Good' label for nearly all of its jeans, reflecting higher environmental standards and the use of sustainable materials.

The company is heavily investing in digital capabilities. This includes mobile technology, digital marketing, and improving the overall digital customer journey to engage its target demographic. This is a key part of their American Eagle company analysis.

Store remodels and digital platforms are key components of capital expenditures for 2025. These investments aim to enhance the shopping experience and align with the evolving retail landscape. This strategy supports the company's overall American Eagle growth strategy.

The company is committed to sustainability, with nearly all jeans produced under the 'Real Good' label. This reflects higher environmental standards and the use of sustainable materials. This focus aligns with consumer values and supports long-term growth.

The company aims to leverage new technologies to maximize efficiencies and deliver innovative customer experiences. This includes digital marketing and e-commerce strategies to boost online sales. This is part of their American Eagle future prospects.

E-commerce remains a critical area, with strategies focused on enhancing the digital customer journey. This involves improving online platforms and digital marketing efforts. The company's American Eagle market share is heavily influenced by its e-commerce performance.

The company is dedicated to improving the customer experience through digital enhancements and store remodels. This includes mobile technology and digital marketing to engage the target demographic. This strategy supports American Eagle brand positioning.

The company's innovation strategy involves a multi-faceted approach to drive growth and enhance customer experience. This includes digital transformation initiatives and sustainability efforts. The company's American Eagle financial performance is tied to the success of these strategies.

- Digital Transformation: Investments in mobile technology, digital marketing, and improving the digital customer journey.

- Store Remodels: Enhancing physical store experiences to align with digital strategies.

- Sustainability: Initiatives such as the 'Real Good' label to meet consumer demand for sustainable products.

- E-commerce Growth: Strategies to boost online sales and improve the digital customer experience.

- Technology Integration: Leveraging new technologies to maximize efficiency and deliver innovative customer experiences.

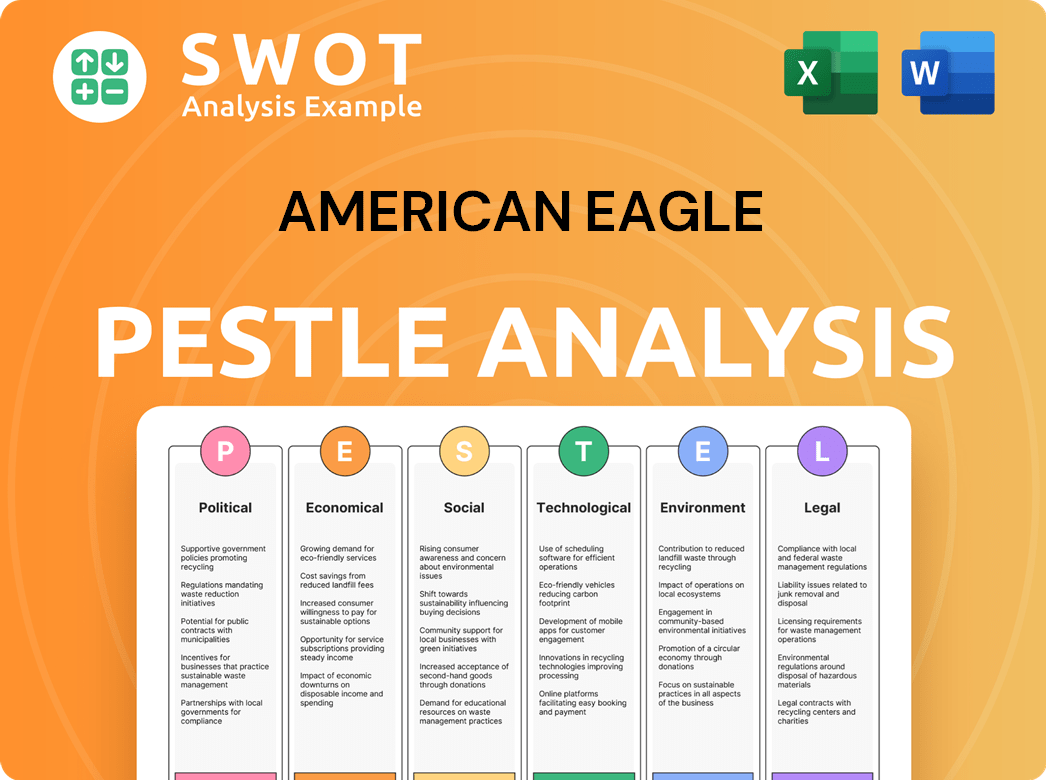

American Eagle PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is American Eagle’s Growth Forecast?

The financial outlook for American Eagle Outfitters (AEO) reflects a mixed performance with both successes and challenges. The company's fiscal year 2024, which concluded on February 1, 2025, showed a 1% increase in total net revenue, reaching $5.3 billion. This growth was supported by a 4% rise in total comparable sales, indicating positive trends in consumer spending and brand appeal. AEO also achieved an adjusted operating profit of $445 million, a significant 19% increase from the previous year, with an operating margin improvement of 120 basis points to 8.3%.

Despite the positive results in fiscal year 2024, the beginning of fiscal year 2025 presented some hurdles. The first quarter of 2025 saw a 5% decrease in net revenue, totaling $1.1 billion, and a 3% decline in comparable sales. Consequently, AEO reported a GAAP operating loss of $(85) million and an adjusted operating loss of $(68) million for the first quarter of fiscal 2025. Because of these results and the uncertain economic outlook, the company has withdrawn its fiscal year 2025 guidance.

For the second quarter of fiscal 2025, AEO anticipates a 5% decrease in revenue and a 3% decline in comparable sales. The company projects an operating income between $40 million and $45 million. Capital expenditures for 2025 are planned to be approximately $275 million, a reduction from the initial guidance of $300 million. These investments will be directed towards store improvements, information technology upgrades, and enhancements to e-commerce and supply chain operations. The company's Brief History of American Eagle provides insights into the brand's evolution and strategies.

AEO aims to deliver mid-to-high teens annual operating income expansion on 3-5% annual revenue growth over the next three years. This growth strategy is part of their 'Powering Profitable Growth' plan, targeting an approximate 10% operating margin. The company's focus is on sustainable growth and profitability despite current market challenges. This strategy is crucial for the company's future prospects.

In 2024, AEO returned over $280 million to shareholders through buybacks and dividends, demonstrating a commitment to shareholder value. In March 2025, a $200 million accelerated share repurchase program was announced, slated for completion in the second quarter. These financial maneuvers highlight the company's confidence in its financial stability and future. The company's financial performance is a key factor in its market share.

Capital expenditures for 2025 are expected to be around $275 million. These investments will focus on enhancing stores, improving information technology, and boosting e-commerce and supply chain capabilities. These investments are essential for long-term growth and adapting to changing consumer behavior trends. The company is also focusing on its digital marketing strategy.

The company has withdrawn its fiscal year 2025 outlook due to economic uncertainties. For the second quarter of 2025, AEO anticipates a decline in revenue and comparable sales. The company's ability to navigate these challenges and adapt its strategies will be critical for its American Eagle future prospects. Analyzing the competitive landscape analysis is also important.

AEO returned over $280 million to shareholders through buybacks and dividends in 2024. A $200 million accelerated share repurchase program was announced in March 2025. These actions demonstrate the company's commitment to enhancing shareholder value. This is a key aspect of the American Eagle company analysis.

AEO's 'Powering Profitable Growth' strategy aims for mid-to-high teens annual operating income expansion on 3-5% annual revenue growth over the next three years. The company targets an approximate 10% operating margin. This strategic focus is essential for achieving long-term success. The company is also exploring American Eagle expansion plans 2024.

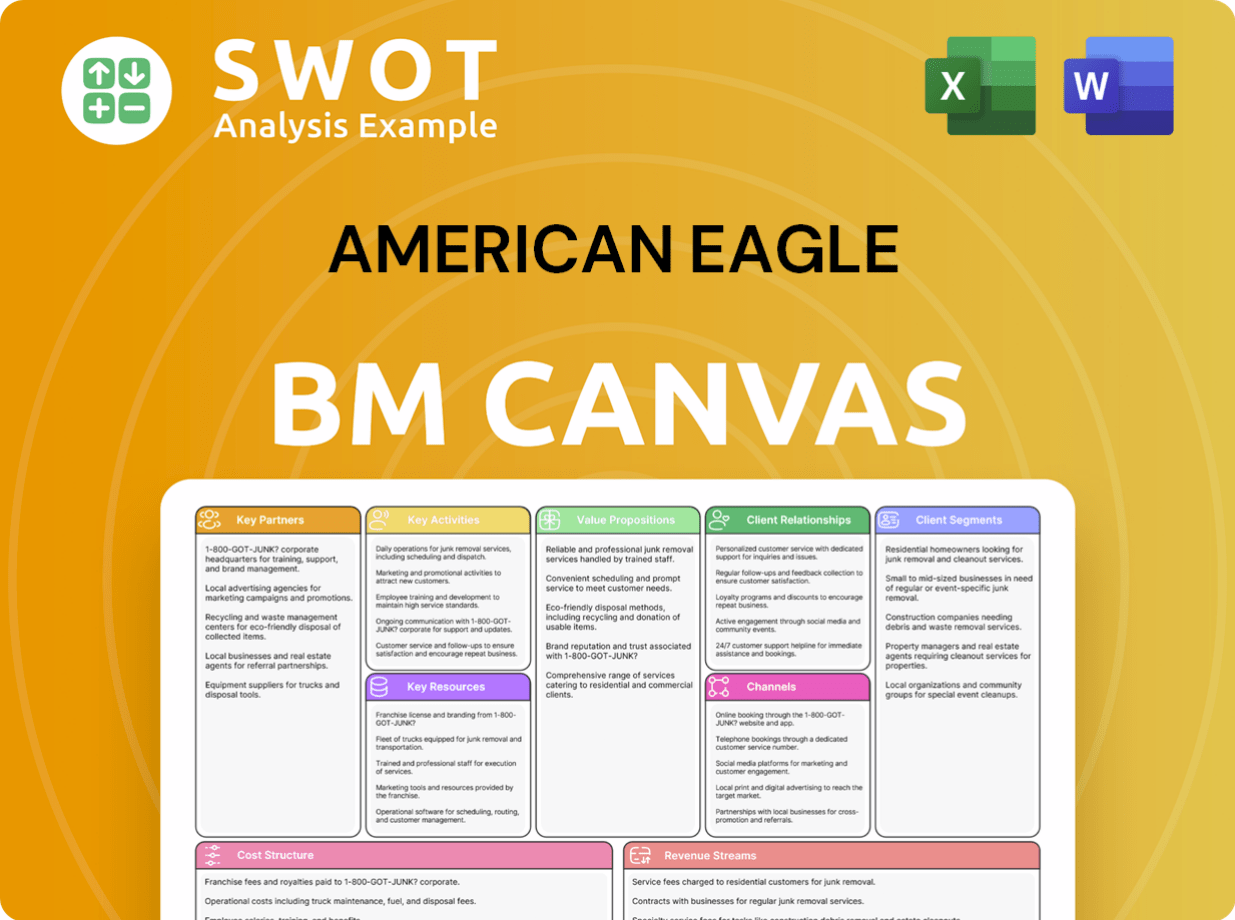

American Eagle Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow American Eagle’s Growth?

The path to growth for American Eagle Outfitters (AEO) isn't without its obstacles. The company faces several strategic and operational risks that could impact its ability to achieve its growth goals. Understanding these potential challenges is crucial for assessing the overall outlook for the company.

AEO's reliance on discretionary consumer spending makes it vulnerable to economic downturns and shifts in consumer preferences. These factors can significantly impact sales and financial performance. For instance, macroeconomic factors, including consumer uncertainty, have already affected sales, contributing to a slower start in early 2025.

Market competition is another significant challenge, with rivals expanding activewear lines and impacting pricing and promotions. AEO must navigate these competitive pressures to maintain its market share and brand positioning. For a deeper understanding of the brand's target audience, you can explore the Target Market of American Eagle.

Economic downturns can lead to reduced consumer spending on discretionary items like apparel. This can directly impact AEO's sales and profitability, as consumers may prioritize essential purchases over fashion items. The company's financial performance is closely tied to the overall economic health.

Consumer preferences evolve rapidly, and shifts in fashion trends can affect AEO's product demand. The company must stay agile and adapt its offerings to meet changing tastes. Failure to do so could lead to inventory issues and decreased sales.

Supply chain disruptions, including those related to sourcing and logistics, can increase costs and impact product availability. AEO's efforts to reduce reliance on specific regions and optimize its supply chain are ongoing, but vulnerabilities remain. Changes in trade policies and tariffs can also affect the cost of goods sold.

The apparel market is highly competitive, with rivals constantly innovating and expanding their product lines. This competition can lead to pricing pressures and the need for increased promotional activities. AEO must differentiate itself through brand positioning and product innovation to maintain its market share.

Macroeconomic conditions, such as consumer confidence and inflation, can influence purchasing behavior. Unfavorable economic conditions can lead to reduced consumer spending and affect the company's financial performance. The company needs to monitor these factors closely and adjust its strategies accordingly.

Effective inventory management is crucial to avoid excess inventory and associated markdown pressure. AEO is taking proactive steps to manage inventory carefully and control expenses to uphold profitability amidst economic uncertainty. Strategic inventory rebalancing is essential to align with demand trends and avoid margin pressure.

AEO is actively working to reduce its supply chain's vulnerabilities. Efforts include diversifying sourcing and optimizing logistics. The company has also undertaken asset impairment and restructuring charges related to its supply chain network optimization project, including shutting down two distribution centers. These actions aim to enhance efficiency and reduce costs.

To mitigate risks, AEO focuses on disciplined expense management and operational efficiencies. This includes careful inventory management to avoid markdowns and strategic investments in areas like e-commerce and marketing. The company's financial performance is closely monitored to adapt to changing market conditions. In early 2025, the company is closely watching consumer behavior trends.

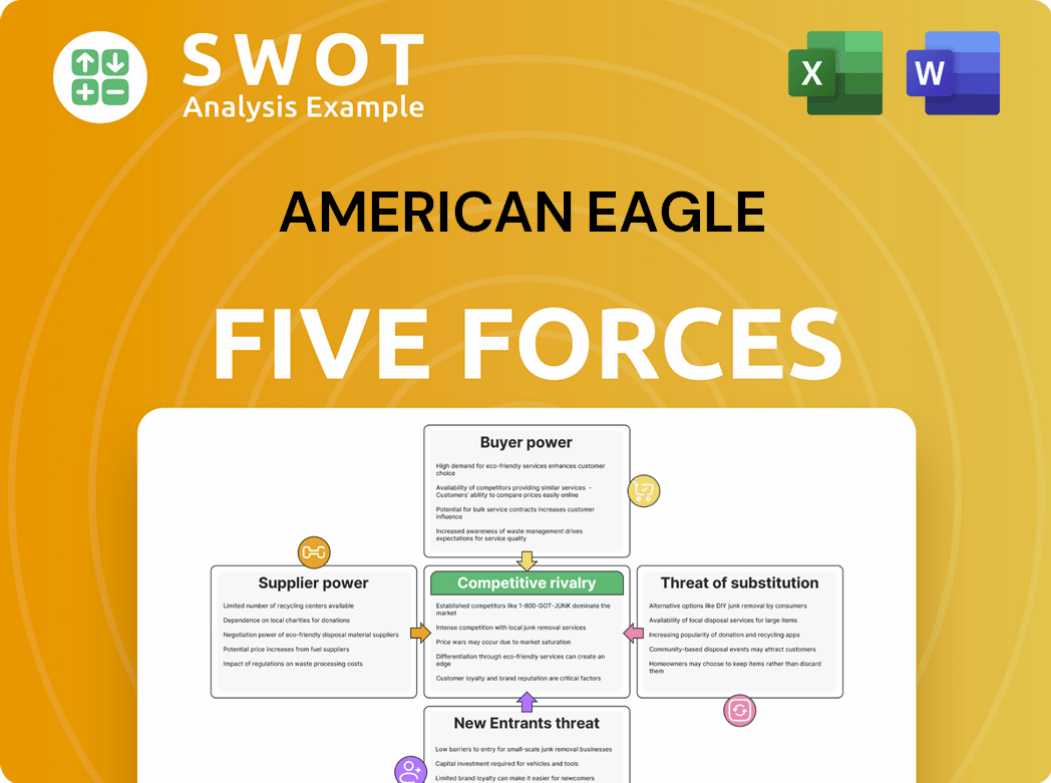

American Eagle Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of American Eagle Company?

- What is Competitive Landscape of American Eagle Company?

- How Does American Eagle Company Work?

- What is Sales and Marketing Strategy of American Eagle Company?

- What is Brief History of American Eagle Company?

- Who Owns American Eagle Company?

- What is Customer Demographics and Target Market of American Eagle Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.