American Eagle Bundle

How Does American Eagle Thrive in the Fashion Retail World?

American Eagle Outfitters (AEO) has become a powerhouse in the casual apparel market, captivating young consumers with its trendy and affordable offerings. Founded in 1977, the American Eagle SWOT Analysis reveals the strategies behind its success, particularly its flagship American Eagle brand and the booming Aerie brand. With record revenue in fiscal year 2024, understanding AEO's operations is key to appreciating its market dominance.

This exploration dives into the mechanics of the American Eagle Company, examining its revenue streams, strategic initiatives, and ability to adapt to market changes. From its extensive network of American Eagle stores and online platforms to its commitment to body positivity through Aerie, AEO's business model is a fascinating case study. Whether you're researching American Eagle history, or interested in American Eagle stock price, this analysis offers valuable insights.

What Are the Key Operations Driving American Eagle’s Success?

The American Eagle Company (AE) creates value by offering casual apparel, accessories, and personal care products. The company operates primarily under the American Eagle and Aerie brands. These brands cater to a younger demographic, focusing on items like denim, specialty apparel, activewear, intimates, and swimwear.

Aerie, in particular, stands out with its body positivity and inclusivity messaging. This brand offers lingerie, apparel, and activewear that resonates strongly with young women. The company's focus on diverse product offerings and inclusive marketing helps it maintain a strong position in the competitive apparel market.

AEO's operational processes are designed to support its value proposition. These processes include a sophisticated supply chain and an omnichannel retail approach. The company aims to provide a seamless shopping experience through both its physical stores and online platforms.

AEO's supply chain is designed to quickly respond to fashion trends and consumer demand. The company actively invests in its supply chain to improve efficiency and reduce costs. Efforts are also made to diversify sourcing and reduce reliance on any single country, with a goal to reduce its China exposure.

AEO integrates physical stores and online platforms to offer a seamless shopping experience. As of Q1 2025, the company operated approximately 1,176 consolidated stores. Online platforms, such as ae.com and aerie.com, are crucial for reaching customers.

Vertical integration allows for quick identification of popular products and efficient reordering. This agility helps increase sales and minimize unsold merchandise. This operational advantage, combined with strong brand recognition, is a key factor in their success.

AEO focuses on digital marketing and social media engagement to connect with its target audience. Aerie's 'Real' marketing campaign, featuring unretouched models, builds a loyal customer base. This authenticity fosters an emotional connection with consumers, setting the brand apart.

The success of American Eagle is underpinned by several key factors. These include a strong brand identity, effective supply chain management, and a commitment to customer engagement through digital marketing and social media. Aerie's focus on body positivity and inclusive marketing is a significant differentiator.

- Vertical integration enables quick response to market trends.

- Omnichannel strategy provides a seamless shopping experience.

- Digital marketing and social media engagement build customer loyalty.

- Aerie's 'Real' campaign fosters emotional connections.

American Eagle SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does American Eagle Make Money?

The American Eagle Company (AE) generates revenue primarily through the sale of apparel, accessories, and personal care products. This includes sales from its various brands such as American Eagle, Aerie, OFFL/NE by Aerie, Todd Snyder, and Unsubscribed. The company uses an omnichannel approach, selling through retail stores, online platforms, and a mobile app.

For fiscal year 2024, the company reported a record total net revenue of $5.3 billion, marking a 1% increase compared to fiscal year 2023. Comparable sales increased by 4% for the fiscal year. Aerie's revenue exceeded $1.7 billion in 2024, with comparable sales increasing 5%. American Eagle comparable sales increased 3% in fiscal year 2024.

However, the beginning of fiscal year 2025 has shown a decrease in revenue. For the first quarter of fiscal year 2025 (ended May 3, 2025), total net revenue decreased by 5% to $1.1 billion, with total comparable sales declining 3%. Aerie comparable sales decreased 4%, and American Eagle comparable sales declined 2%. The company reported a GAAP operating loss of $85 million for Q1 2025, with an adjusted operating loss of $68 million.

The company employs several strategies to drive revenue and customer loyalty. These include the Real Rewards loyalty program, strategic promotions, discount codes, and bundled offerings. Furthermore, the company has expanded its revenue sources by introducing new brands and investing in its digital channels, which have shown stronger performance than in-store sales in certain periods. To learn more about the company's strategic direction, you can read about the Growth Strategy of American Eagle.

- Real Rewards: A loyalty program designed to increase customer retention and drive repeat purchases.

- Strategic Promotions: Utilizing promotions, discount codes, and bundled offerings to engage customers.

- Digital Channels: Investing in online platforms and mobile apps to boost sales.

- Brand Expansion: Introducing new brands like OFFL/NE by Aerie and Todd Snyder to diversify revenue streams.

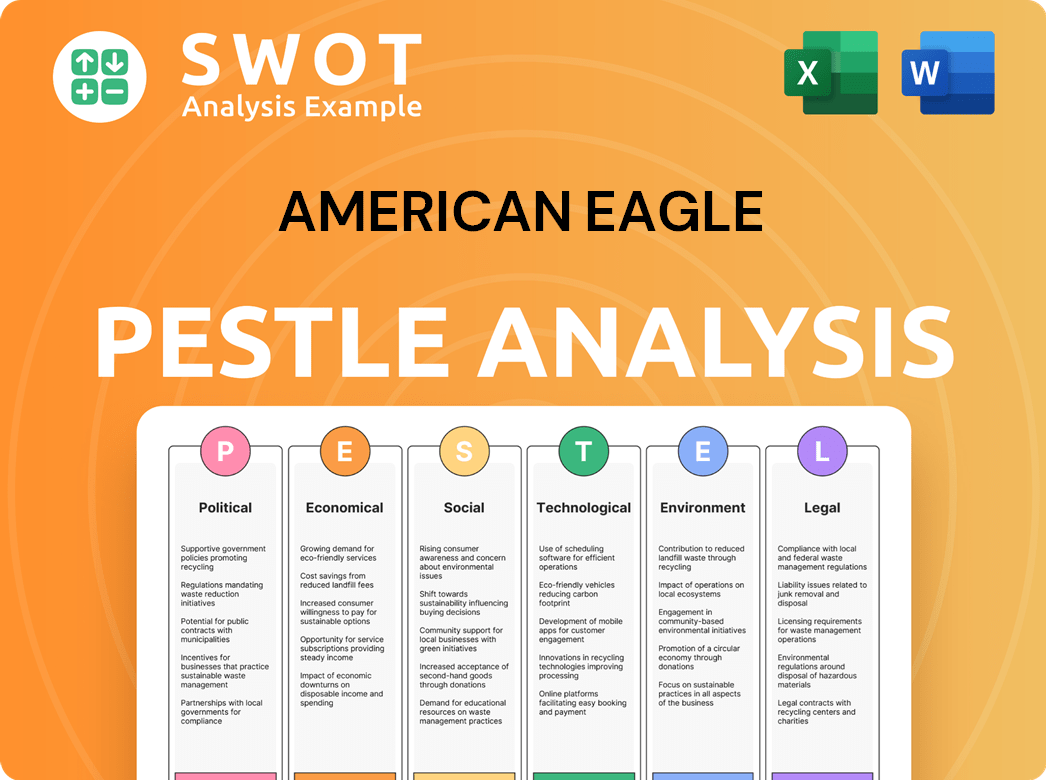

American Eagle PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped American Eagle’s Business Model?

American Eagle Outfitters (AE) has navigated several key milestones and strategic shifts to maintain its position in the competitive apparel market. A significant initiative is the 'Powering Profitable Growth' plan, launched in 2024. This plan aims for mid-to-high teens annual operating income expansion on 3-5% annual revenue growth over the next three years, with a target of approximately a 10% operating margin.

In early 2025, the company faced challenges, including a softer consumer environment and unfavorable weather conditions. This led to a slower start to the fiscal year. The first quarter of fiscal year 2025 saw a 5% revenue decline and a $75 million inventory write-down. This resulted in a significant drop in gross margins to 29.6% in Q1 2025, compared to 40.6% the previous year.

Despite these obstacles, AE has taken proactive steps to adapt. This includes supply chain optimization and efforts to diversify sourcing, reducing reliance on China. Additionally, AE initiated a $200 million accelerated share repurchase program in March 2025, demonstrating confidence in its financial position.

The 'Powering Profitable Growth' plan, initiated in 2024, is a central strategy. The company reported a 'disappointing' first quarter for fiscal year 2025, with a 5% revenue decline. AE has withdrawn its full-year 2025 guidance due to macroeconomic uncertainty.

Supply chain optimization includes closing two distribution centers to save an estimated $5 million annually. AE is diversifying its sourcing to reduce reliance on China to under 10% by late 2025. A $200 million accelerated share repurchase program was initiated in March 2025.

AE benefits from strong brand recognition and customer loyalty. Its robust omnichannel presence provides customer convenience. The Aerie brand has been a significant differentiator, outperforming competitors in intimates and activewear. AE maintains its #1 ranking in denim.

Gross margins decreased to 29.6% in Q1 2025 from 40.6% the previous year. The company is focused on achieving mid-to-high teens annual operating income expansion. AE is adapting to new trends by focusing on product innovations, such as incorporating active looks and performance fabrics in men's apparel.

AE's competitive advantages stem from its strong brand recognition and customer loyalty, especially among its target demographic. The company's robust omnichannel presence, combining physical stores and a strong online platform, enhances customer convenience. The success of the Aerie brand, known for body positivity and inclusivity, has significantly differentiated AE, allowing it to excel in the intimates and activewear markets. For more insights into AE's history, you can read about it in this article about American Eagle's history.

- Strong brand recognition and customer loyalty.

- Robust omnichannel presence.

- Successful Aerie brand.

- Focus on product innovation and adapting to trends.

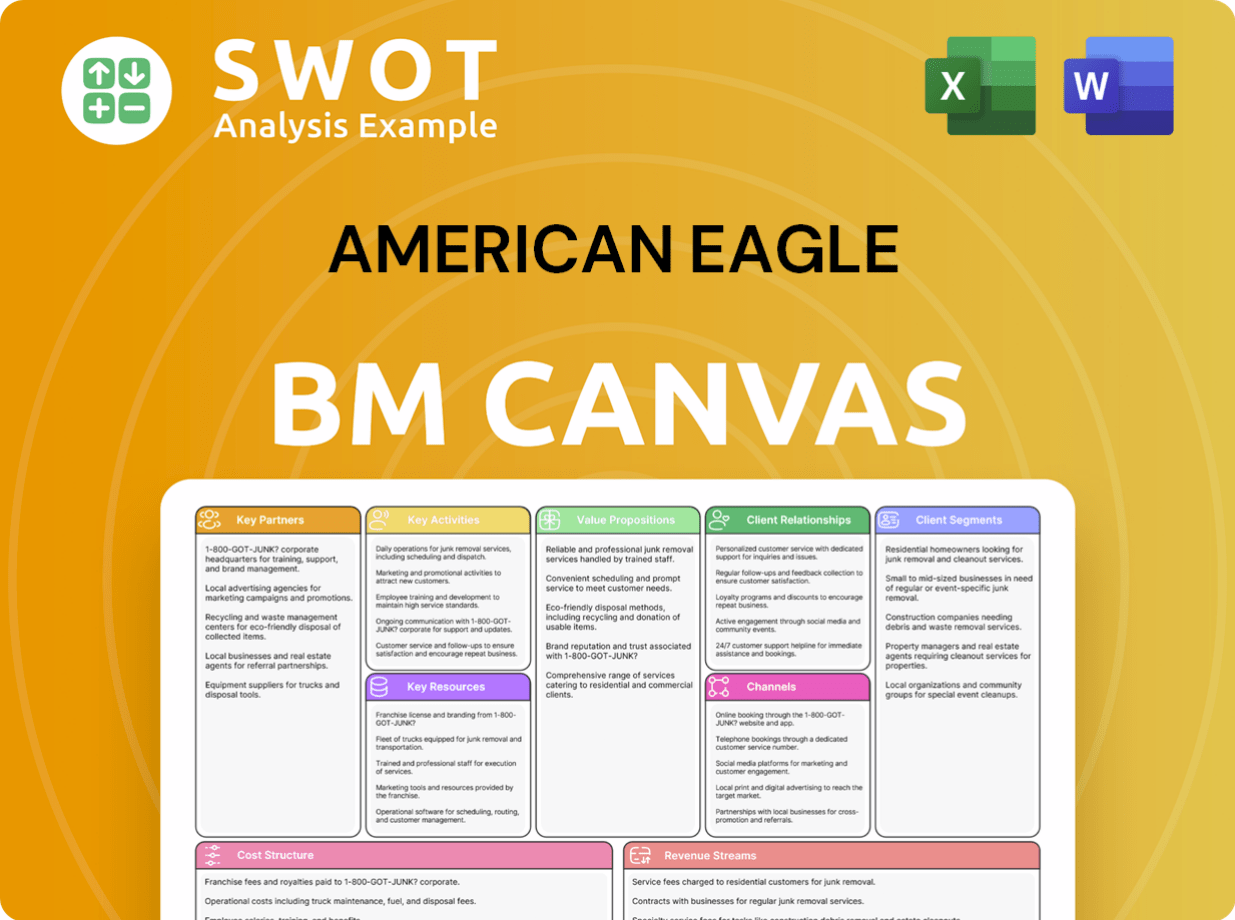

American Eagle Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is American Eagle Positioning Itself for Continued Success?

Understanding the industry position, risks, and future outlook of the American Eagle Company is crucial for investors and stakeholders. The company, also known as AE, holds a significant presence, especially in the youth apparel market. As of April 2025, its market capitalization was approximately €1.69 billion, reflecting its established market value and investor confidence.

Despite its strong position, AE faces various challenges. Consumer uncertainty and macroeconomic factors impact demand. The company's performance in Q1 2025, with a 5% revenue decline and a $68 million adjusted operating loss, highlights these pressures. Furthermore, external factors such as tariffs and currency fluctuations can affect product costs and margins.

AE maintains a strong position in the youth apparel market. In the 15-25 age group, AE holds the #1 position in jeans. Aerie, a subsidiary, is #3 in intimates, and OFFL/NE by Aerie holds the #2 position in leggings for the 15-35 age demographic, according to Circana retail tracking data from May 2024 to April 2025. Brand recognition and a loyal customer base contribute to its success.

AE faces risks from consumer uncertainty and a less robust macroeconomic environment. The Q1 2025 results, showing a revenue decline and operating loss, highlight these pressures. Changes in the operating landscape, including tariffs and currency fluctuations, could negatively impact costs and margins. Declining mall traffic and e-commerce disruptions are also ongoing sector risks.

AE is implementing strategic initiatives to sustain and expand profitability. The 'Powering Profitable Growth' strategy aims for mid-to-high teens annual operating income expansion on 3-5% annual revenue growth over the next three years. The company is focusing on product performance, inventory management, and expense reduction. This includes supply chain investments and digital innovations.

AE is focusing on strengthening product performance, managing inventory, and reducing expenses. This includes continued investment in its supply chain for efficiency, reducing reliance on China for sourcing, and ongoing store remodels and digital innovations. The company also plans to re-energize Aerie intimates and accelerate growth in Aerie's soft apparel and activewear.

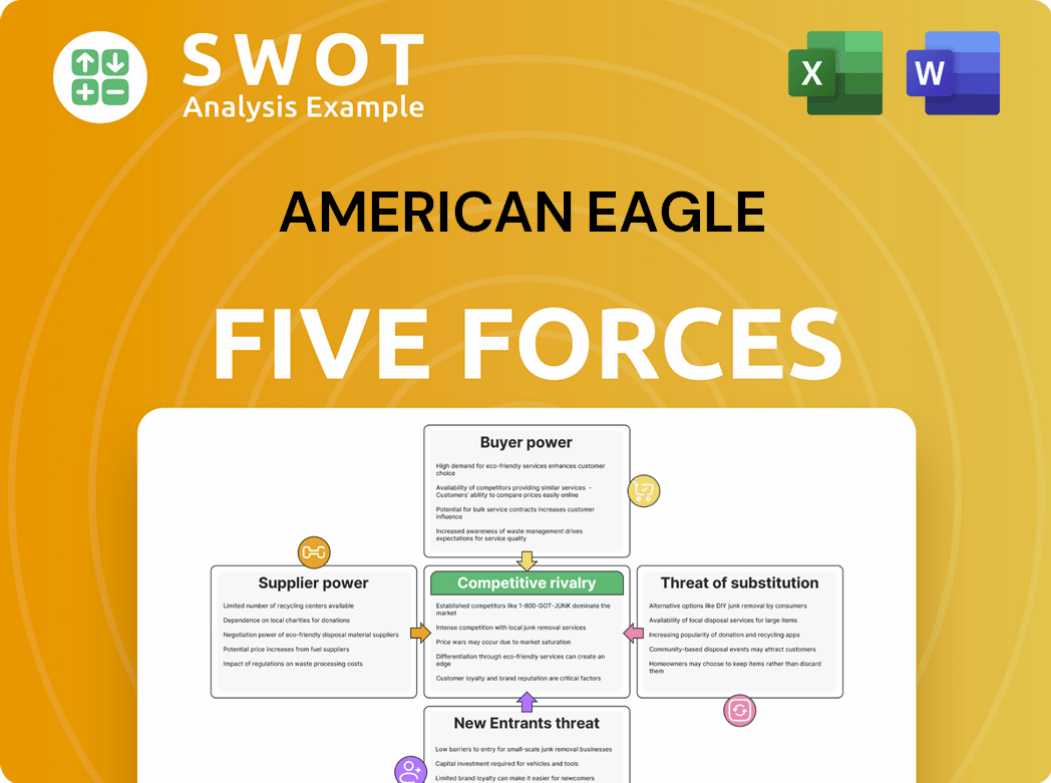

American Eagle Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of American Eagle Company?

- What is Competitive Landscape of American Eagle Company?

- What is Growth Strategy and Future Prospects of American Eagle Company?

- What is Sales and Marketing Strategy of American Eagle Company?

- What is Brief History of American Eagle Company?

- Who Owns American Eagle Company?

- What is Customer Demographics and Target Market of American Eagle Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.