Burns & McDonnell Bundle

Can Burns & McDonnell Sustain Its Impressive Growth Trajectory?

Burns & McDonnell's recent announcements in the energy and environmental sectors signal a strategic commitment to future growth. This Burns & McDonnell SWOT Analysis reveals the company's proactive approach within the competitive engineering and construction landscape. Founded in 1898, the company has evolved from a small firm to a global leader, making it a compelling case study in strategic planning.

As a leading Engineering Firm, Burns & McDonnell's strategic initiatives are crucial for understanding its future prospects. This article delves into the company's growth strategy, exploring market analysis, expansion plans, and financial outlook. The analysis will highlight how Burns & McDonnell plans to navigate the evolving industry and capitalize on emerging opportunities, providing valuable insights for investors and industry professionals alike.

How Is Burns & McDonnell Expanding Its Reach?

The growth strategy of Burns & McDonnell heavily emphasizes strategic expansion. This approach targets both new geographical markets and diversified service offerings. The goal is to access new customers and enhance revenue streams, solidifying its position as a global leader in integrated design and construction solutions. This strategic focus is crucial for navigating the evolving landscape of the engineering and construction industry.

A key element of their expansion involves strengthening their presence in the burgeoning renewable energy sector. This includes a focus on solar, wind, and battery storage projects. For instance, the company has been actively involved in significant utility-scale solar projects across the United States, demonstrating a commitment to supporting the energy transition. This strategic initiative aligns with the growing demand for sustainable energy solutions.

Furthermore, Burns & McDonnell is expanding its reach in critical infrastructure development. This includes projects related to aviation, water, and wastewater treatment. This expansion responds to increasing demands for modern and resilient public services. The company's ability to adapt and grow in these areas highlights its commitment to long-term sustainability and market relevance.

Burns & McDonnell is actively involved in utility-scale solar projects. They are also focusing on wind energy and battery storage projects. This strategic move supports the global energy transition. This focus is critical for the company's future growth.

The company is expanding its reach in aviation, water, and wastewater treatment projects. These projects address the growing need for modern public services. This expansion is essential for long-term growth.

The company is focusing on regions with high growth potential, such as Latin America and the Middle East. This includes large-scale engineering and construction projects. This strategy leverages their established expertise.

Burns & McDonnell continuously evaluates opportunities for strategic mergers and acquisitions. This enhances their capabilities and expands their client base. This inorganic growth complements organic expansion efforts.

Burns & McDonnell's strategic planning includes a focus on both organic and inorganic growth. This approach allows for rapid market entry and diversification. The company's ability to adapt and grow is key to its future. Further insights into the company's business model can be found in this article about Revenue Streams & Business Model of Burns & McDonnell.

- Expansion into the renewable energy sector, including solar, wind, and battery storage.

- Development of critical infrastructure projects, such as aviation and water treatment.

- International expansion, focusing on regions with high growth potential.

- Strategic mergers and acquisitions to enhance capabilities and market reach.

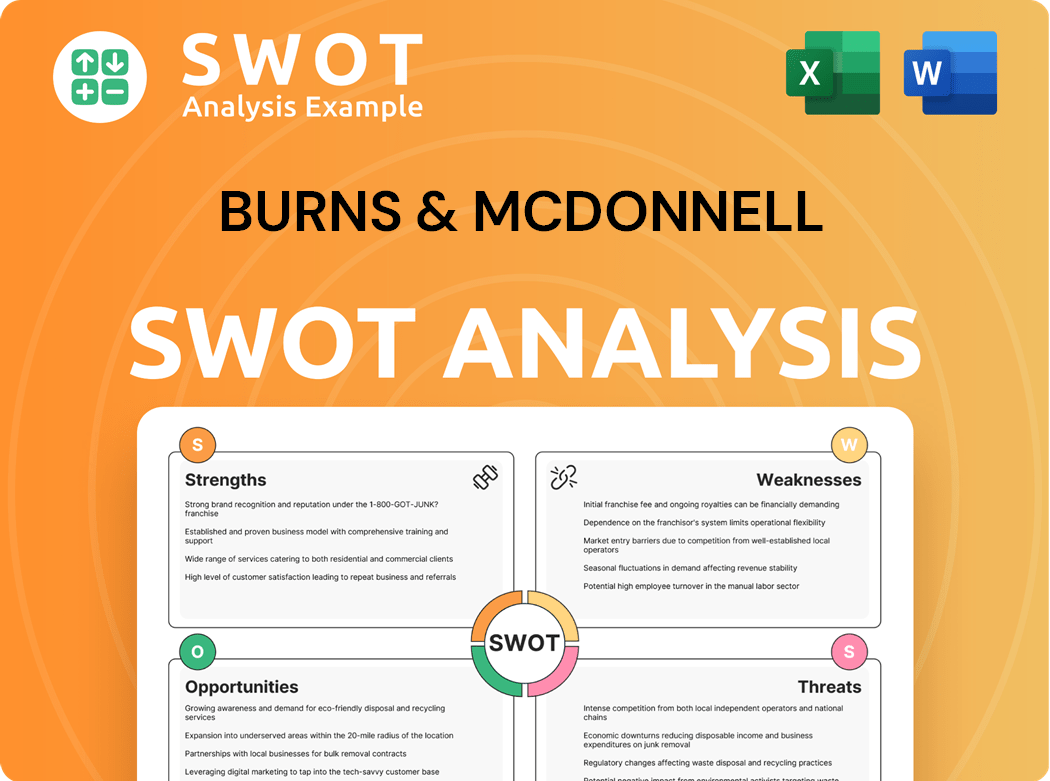

Burns & McDonnell SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Burns & McDonnell Invest in Innovation?

The core of the Burns & McDonnell (B&McD) Growth Strategy centers on innovation and technology, driving project delivery improvements, efficiency gains, and the development of new service offerings. This approach is crucial for the Company Future, especially in a rapidly evolving industry. Their commitment to digital transformation, including Building Information Modeling (BIM) and advanced data analytics, is a key component of this strategy.

B&McD invests heavily in research and development, often through in-house initiatives and collaborations. The firm's strategic use of technologies like Artificial Intelligence (AI) and the Internet of Things (IoT) for predictive maintenance in industrial facilities and smart infrastructure development directly supports its growth objectives. This focus enables more efficient project execution, cost reduction, and the provision of sophisticated, data-driven solutions to clients.

Sustainability initiatives are also a major focus. B&McD develops innovative approaches to renewable energy integration, energy efficiency, and environmental remediation. This commitment not only addresses environmental concerns but also opens up new market opportunities. Their consistent ranking among top design firms and involvement in pioneering projects underscore their leadership in technological innovation within the industry, which is discussed in detail in the Marketing Strategy of Burns & McDonnell.

B&McD has widely adopted Building Information Modeling (BIM), advanced data analytics, and project management software. This optimizes design and construction processes, leading to significant improvements in project timelines and cost efficiency.

The utilization of drone technology for site surveys and progress monitoring streamlines operations. This leads to improved data accuracy on complex projects, allowing for better decision-making and resource allocation.

Integrating Artificial Intelligence (AI) and the Internet of Things (IoT) into solutions is a key area of focus. This is especially true for predictive maintenance in industrial facilities and smart infrastructure development, enhancing operational efficiency.

B&McD places a strong emphasis on sustainability, developing innovative approaches to renewable energy integration, energy efficiency, and environmental remediation. This supports environmental goals and creates new business opportunities.

Significant investment in research and development is a cornerstone of their strategy. This often involves in-house initiatives and collaborations with academic institutions and technology partners to stay at the forefront of innovation.

The integration of cutting-edge technologies enables more efficient project execution. This leads to reduced costs and the ability to offer clients more sophisticated and data-driven solutions, enhancing their competitive edge.

B&McD's commitment to innovation is evident through its adoption of advanced technologies and strategic partnerships, which have helped to secure its strong position in the market. These advancements contribute significantly to the company's long-term growth and market leadership.

- BIM Implementation: Reduces project costs by up to 20% and improves project timelines by 15%.

- AI and IoT Applications: Predictive maintenance can decrease downtime by up to 30% and reduce maintenance costs by 25%.

- Renewable Energy Projects: B&McD has been involved in over 500 renewable energy projects, supporting the global shift towards sustainable energy sources.

- Digital Transformation: The firm has invested over $100 million in digital transformation initiatives, enhancing operational efficiency and client service.

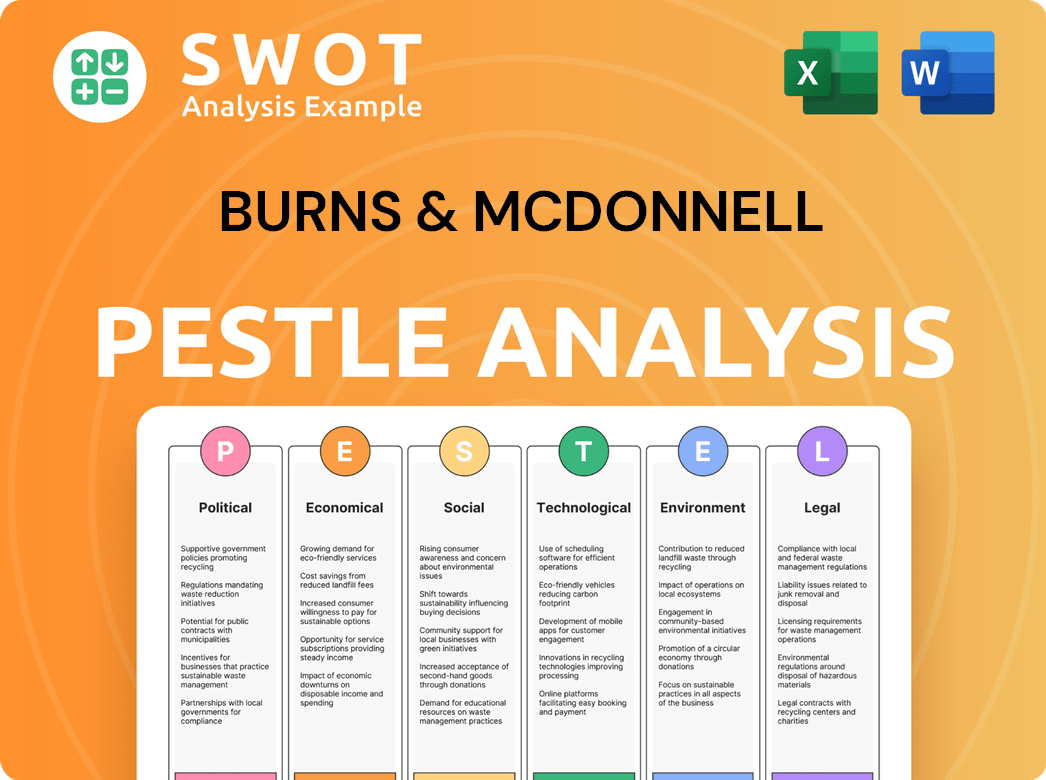

Burns & McDonnell PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Burns & McDonnell’s Growth Forecast?

The financial outlook for Burns & McDonnell, a leading Engineering Firm, appears robust, though specific financial details are not publicly available due to its private ownership. The company's consistent performance and ranking among the top design and construction firms suggest a healthy financial position. Their strategic focus on long-term growth, including reinvesting earnings and expanding into new markets, indicates a positive trajectory for future financial health.

Burns & McDonnell's financial strategy is centered on sustainable growth, supported by its employee-ownership model, which fosters a long-term perspective. This approach allows the company to make strategic investments in technology, talent acquisition, and market diversification. The company's ability to secure and execute large-scale, complex projects further underscores its financial stability and capacity for expansion.

The Company Future for Burns & McDonnell looks promising, driven by its strategic initiatives and market position. Their continued investment in innovation and their focus on key sectors, such as renewable energy and infrastructure, position them well for future growth. The company's commitment to employee ownership also contributes to a stable financial foundation, supporting long-term growth and strategic planning.

Burns & McDonnell consistently ranks among the top engineering and construction firms. In 2024, the company's revenue was estimated to be over $7 billion, reflecting a strong market position. This sustained revenue growth is a key indicator of their financial success and strategic effectiveness.

The company is actively investing in new technologies and market expansions. These investments are crucial for maintaining a competitive edge and driving future growth. This includes significant investments in digital transformation and sustainable energy solutions.

Burns & McDonnell operates under an employee-ownership model, which fosters a long-term perspective on investment and growth. This structure aligns the interests of employees with the company's financial performance. This ownership model contributes to stability and sustained growth.

Strategic Planning includes diversifying into new markets, particularly in renewable energy and infrastructure. This diversification strategy helps mitigate risks and capitalize on emerging opportunities. Their expansion into new sectors is a key element of their Growth Strategy.

Burns & McDonnell's focus on sustainability and renewable energy projects is a significant factor in its Company Future. Their commitment to these areas positions them well to capitalize on the growing demand for sustainable solutions. For a broader view of the competitive landscape, you can explore the Competitors Landscape of Burns & McDonnell.

Burns & McDonnell has demonstrated consistent revenue growth over the past several years. This growth is fueled by strategic project wins and expansion into new markets. Revenue growth is a key indicator of their financial health.

The company maintains a substantial project backlog, providing a strong foundation for future revenue. A robust project backlog ensures a steady stream of work and revenue. This backlog reflects their ability to secure large-scale projects.

Burns & McDonnell is actively expanding its presence in key markets, including renewable energy and infrastructure. This expansion is a core component of their Growth Strategy. They are focusing on both geographic and sector-specific growth.

Investment in technological advancements is a priority for Burns & McDonnell. This includes adopting new digital tools and innovative engineering solutions. These advancements enhance efficiency and competitiveness.

The company is committed to sustainability, with a focus on renewable energy projects and environmentally friendly practices. These initiatives align with market trends and contribute to long-term growth. Sustainability is a key driver of their Strategic Planning.

Burns & McDonnell's financial stability is supported by its employee-ownership model and a focus on long-term investments. This stability allows the company to navigate market fluctuations and pursue strategic opportunities. Their financial health is a key strength.

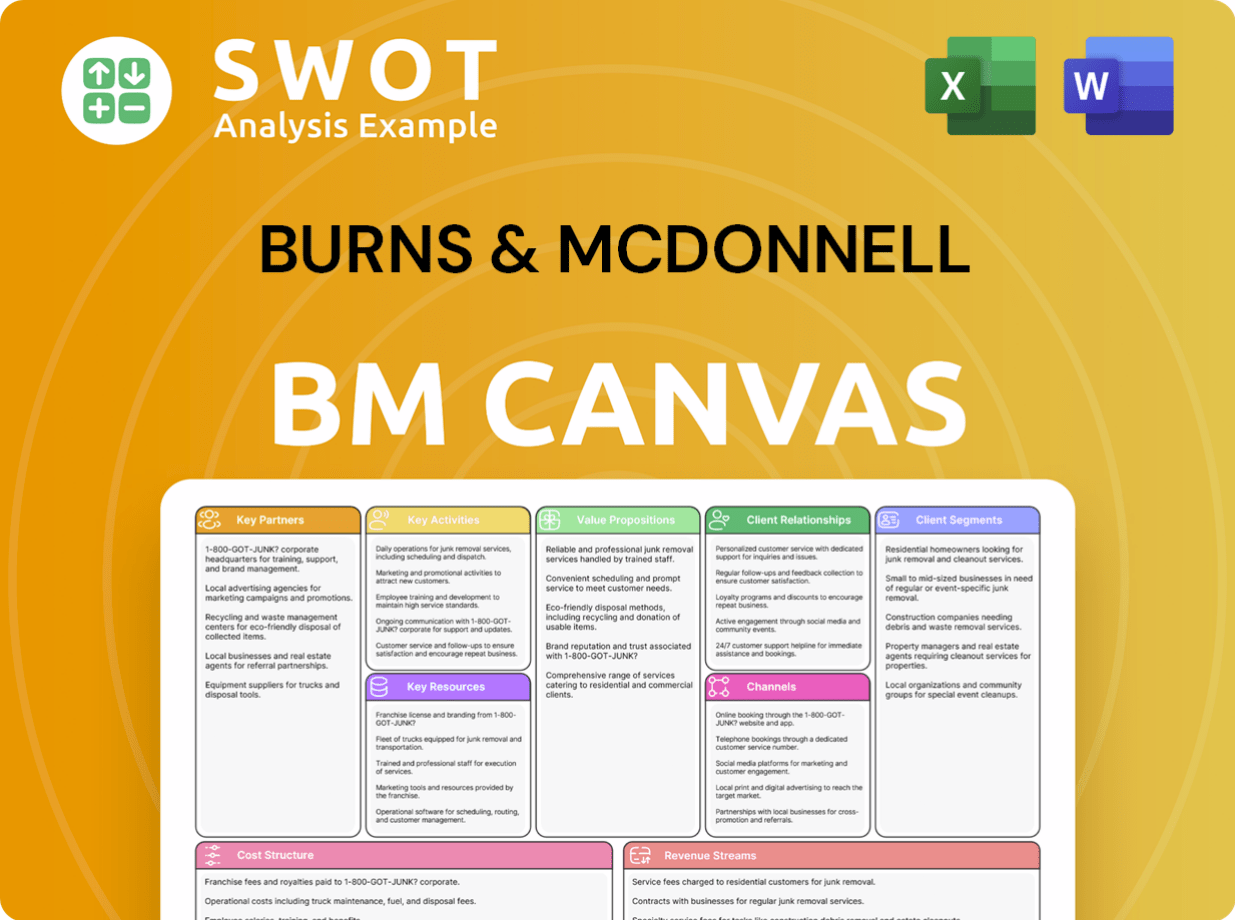

Burns & McDonnell Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Burns & McDonnell’s Growth?

The path to growth for Burns & McDonnell, an Engineering Firm, is not without its challenges. The company's ambitious plans are subject to various strategic and operational risks inherent in the engineering and construction industry. Understanding these potential pitfalls is crucial for evaluating the company's long-term prospects and strategic planning.

Market dynamics, regulatory changes, and supply chain issues are among the key areas of concern. The company must navigate intense competition and adapt to evolving industry standards. A thorough market analysis is essential for sustained success.

Burns & McDonnell's ability to mitigate these risks will significantly influence its future trajectory. This involves proactive measures in risk management, talent development, and technological adaptation. The company's strategic initiatives are designed to address these challenges effectively.

The engineering and construction sector is highly competitive, with numerous firms vying for major projects. Intense bidding processes and pressure on profit margins are constant challenges. Maintaining a competitive edge requires continuous innovation and efficiency improvements.

Changes in environmental regulations, energy policies, and other industry standards can impact project viability and timelines. Adapting to these changes requires flexibility and investment in new technologies and expertise. Staying ahead of regulatory shifts is crucial for long-term sustainability.

Global events can disrupt supply chains, leading to material shortages, price volatility, and project delays. Diversifying suppliers and implementing robust inventory management systems can help mitigate these risks. Effective supply chain management is critical for project success.

The availability of skilled labor, particularly in specialized engineering and construction trades, can impact project delivery. Investing in training programs and competitive compensation packages is essential. Attracting and retaining top talent is key to maintaining project quality and timelines.

The rapid pace of technological change necessitates continuous investment in new tools and expertise. Embracing innovation and staying current with industry trends is vital for maintaining a competitive advantage. Integrating new technologies can improve efficiency and project outcomes.

Economic downturns can lead to reduced project demand and increased financial risks. Diversifying its project portfolio and geographic presence can help mitigate these risks. A diverse portfolio provides stability during economic fluctuations.

Burns & McDonnell employs several strategies to mitigate these risks, including diversification of services and markets. This approach helps spread risk across different sectors and geographic regions. The company's long-standing history, as explored in detail in this article about the Target Market of Burns & McDonnell, demonstrates its ability to navigate various economic cycles and industry-specific challenges.

The company utilizes robust risk management frameworks, including scenario planning and contingency measures. This proactive approach allows Burns & McDonnell to anticipate and prepare for potential challenges. These frameworks help ensure project success and financial stability.

A strong emphasis on talent development and retention is crucial for maintaining a skilled workforce. Investing in training programs and competitive compensation packages helps attract and retain top talent. This ensures the company can deliver high-quality projects and meet client needs.

The company is committed to embracing innovation and integrating new technologies to stay competitive. This includes investing in new tools, software, and expertise. Staying at the forefront of technological advancements is essential for long-term growth and success.

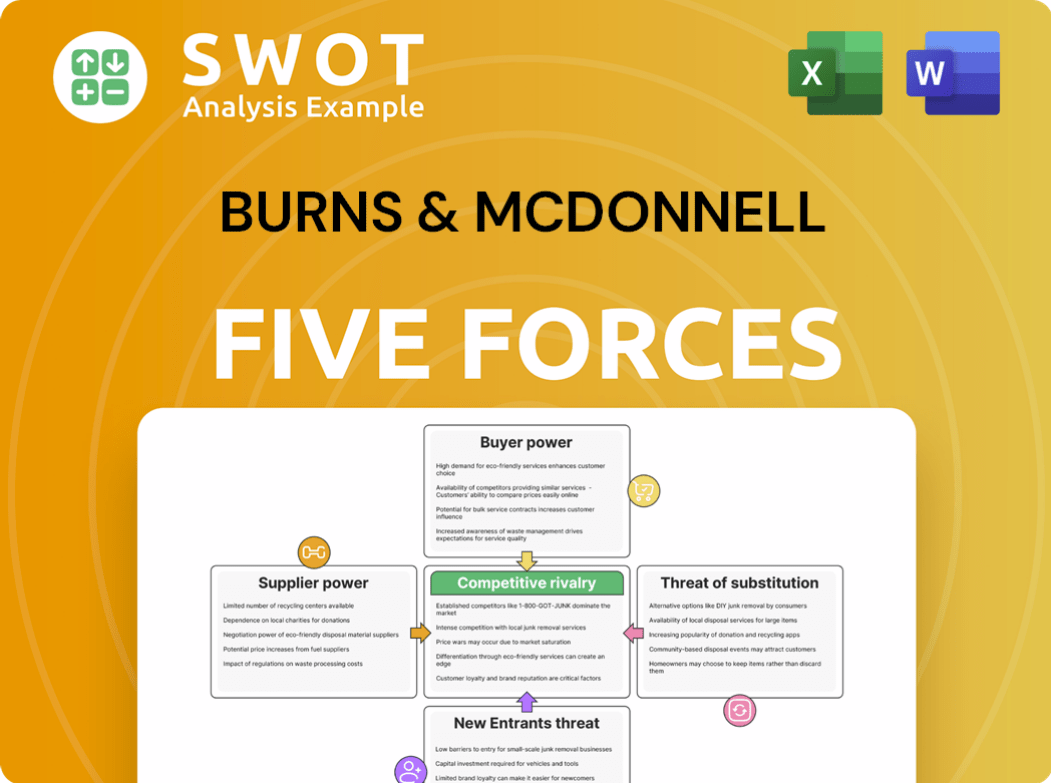

Burns & McDonnell Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Burns & McDonnell Company?

- What is Competitive Landscape of Burns & McDonnell Company?

- How Does Burns & McDonnell Company Work?

- What is Sales and Marketing Strategy of Burns & McDonnell Company?

- What is Brief History of Burns & McDonnell Company?

- Who Owns Burns & McDonnell Company?

- What is Customer Demographics and Target Market of Burns & McDonnell Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.