Burns & McDonnell Bundle

How Does Burns & McDonnell Thrive in a $7.2 Billion Market?

As a leading global engineering and construction company, Burns & McDonnell SWOT Analysis reveals the inner workings of a firm consistently ranked among the industry's elite. With a legacy dating back to 1898 and a robust $7.2 billion in revenue in 2024, Burns & McDonnell's success is a testament to its strategic approach. This deep dive explores the firm's unique employee-ownership model and integrated service offerings, providing insights into its sustained growth and market leadership.

Understanding the operational dynamics of Burns & McDonnell, an established engineering firm, is crucial for anyone interested in infrastructure projects and the construction company's impact. This analysis will explore how Burns & McDonnell manages projects, its company history, and the range of services it offers. Moreover, insights into its employee reviews, career opportunities, and company culture will be provided, offering a comprehensive view of this industry leader.

What Are the Key Operations Driving Burns & McDonnell’s Success?

The core operations of the Burns & McDonnell Company revolve around providing integrated engineering, architecture, construction, environmental, and consulting solutions. The company's value proposition lies in its ability to offer a full suite of services, from initial planning and design to construction, program management, and commissioning, tailored to diverse industries.

This comprehensive approach enables Burns & McDonnell to serve a wide array of clients across sectors like power, aviation, mining, and telecommunications. Their integrated design and construction mindset is central to their operational processes, ensuring client success through every project phase. This includes meticulous attention to supply chain management and risk mitigation, which was particularly critical in 2024 due to industry-wide supply chain disruptions.

A key differentiator for Burns & McDonnell is its 100% employee-ownership model. This structure fosters a culture of accountability and collaboration, contributing to high employee retention rates. This unique model is designed to translate directly into customer benefits, particularly in terms of safety and quality. For example, in 2024, the company maintained a Total Recordable Incident Rate (TRIR) below the industry average, reflecting their strong commitment to safety.

Offers a full range of services, including consulting, design, construction, and commissioning. This integrated approach allows for comprehensive project management from start to finish. The company's expertise spans various sectors, ensuring tailored solutions for each client.

Operates under a 100% employee-ownership model, fostering a culture of accountability and collaboration. This structure promotes high employee retention, ensuring experienced teams for projects. The employee-owner model enhances commitment to project success and client satisfaction.

The company's operational success is reflected in its consistent performance and industry recognition. Burns & McDonnell has maintained its No. 1 position in the Power category for a decade, as of 2025. The company is also ranked among the top firms in telecommunications and other sectors.

- Focus on mitigating risks, such as supply chain disruptions, which were prevalent in 2024.

- Commitment to safety, with a TRIR below the industry average in 2024.

- Emphasis on building long-term client relationships through reliable project delivery.

- Continuous improvement through innovation and employee development.

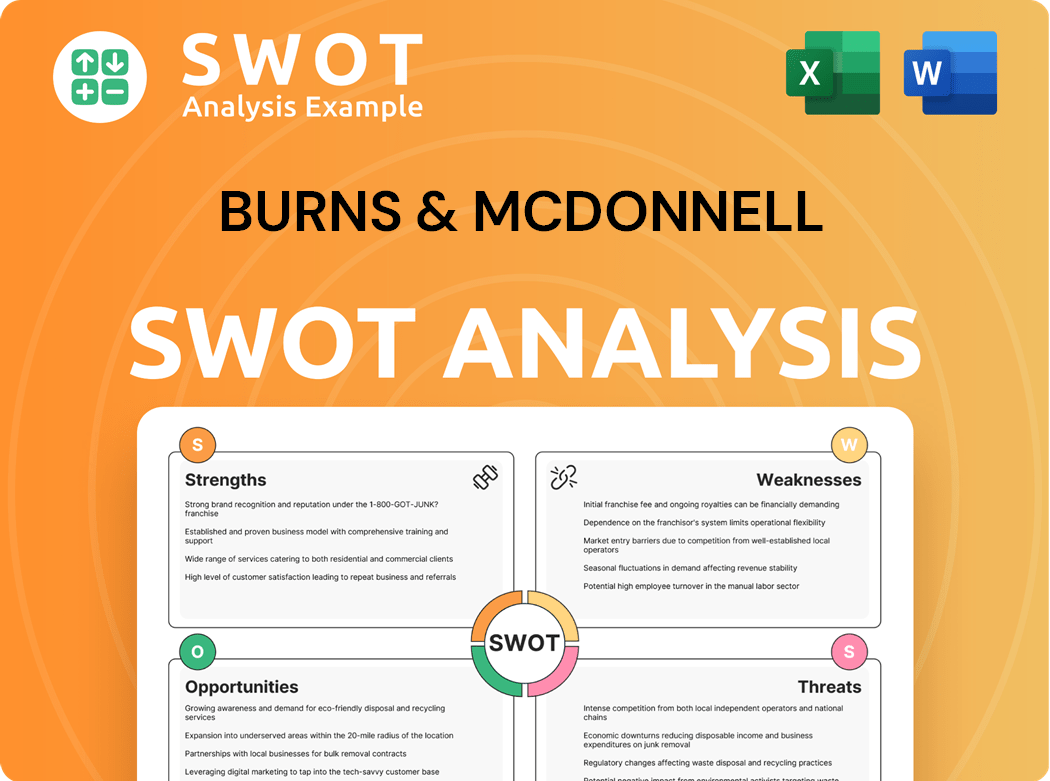

Burns & McDonnell SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Burns & McDonnell Make Money?

The primary revenue streams for the Burns & McDonnell Company stem from its comprehensive engineering, architecture, construction, environmental, and consulting services. In 2024, the firm reported a substantial $7.2 billion in revenue, primarily from design services completed the previous year. This revenue was generated across more than 24,000 projects globally, showcasing the company's extensive reach and diverse project portfolio.

The company's monetization strategy centers on securing comprehensive contracts that cover the entire project lifecycle. This approach, known as EPC (engineering, procurement, and construction), enables them to capture value across various phases of a project. Their employee-owned business model also contributes to their financial performance, fostering accountability and collaboration.

While specific breakdowns by revenue stream are not publicly quantified with recent data, the firm's diversified service offerings across various sectors indicate multiple avenues of monetization. The company's engagement in critical infrastructure projects, such as energy storage facilities and data centers, further diversifies its income.

The Burns & McDonnell generates revenue through a variety of services and project types, ensuring a diversified income stream. The company's focus on EPC contracts allows them to maximize profitability across all project phases.

- Design and Build Services: This includes comprehensive services from initial design to construction and commissioning, which is a significant revenue generator.

- Power Infrastructure: They consistently rank as a top firm in this area, contributing significantly to their revenue.

- Telecommunications and Industrial Projects: Projects in telecommunications, industrial process/oil & gas, and manufacturing also contribute substantially.

- Environmental Solutions: Providing environmental consulting and remediation services adds to their revenue streams.

- Employee-Owned Model: Their employee-owned structure fosters accountability and collaboration, which positively impacts financial performance.

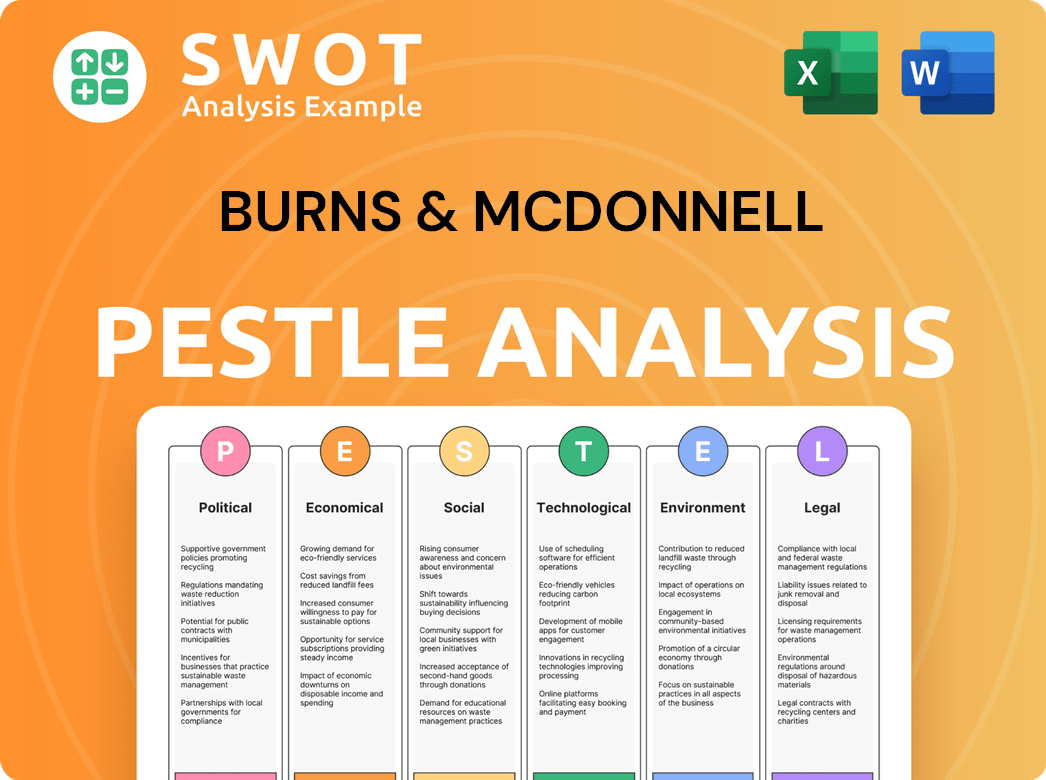

Burns & McDonnell PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Burns & McDonnell’s Business Model?

The evolution of Burns & McDonnell, an engineering firm and construction company, showcases a history of strategic foresight and adaptation. Key milestones have shaped its trajectory, including a pivotal shift in 1985 when employees purchased the company from Armco Steel. This transition to a 100% employee-owned model has been a cornerstone of its success, fostering a culture of accountability and collaboration. This structure significantly impacts project success and financial performance, contributing to its sustained growth and market leadership.

The company's strategic moves have consistently aligned with market demands, particularly in renewable energy and infrastructure projects. In 2024, Burns & McDonnell reported revenue of $7.2 billion, reflecting its robust performance and strategic positioning. This financial strength supports its ability to undertake complex projects and maintain a competitive edge in the industry. The firm's focus on innovation, including the implementation of cloud-first strategies and the exploration of AI, further enhances its operational efficiency and project outcomes.

Burns & McDonnell's competitive advantages are multifaceted, encompassing a strong brand reputation built over 125 years, a comprehensive integrated service model, and its unique employee-ownership structure. These factors, combined with a steadfast commitment to safety and quality, solidify its market leadership and ability to deliver complex projects. The company's ability to adapt to challenges, such as supply chain disruptions, has allowed it to maintain its operational resilience and continue its growth trajectory, as detailed in Growth Strategy of Burns & McDonnell.

Employee ownership in 1985 transformed the company's structure and culture.

Over 125 years of experience has built a strong brand reputation.

The company consistently adapts to market trends, particularly in renewable energy and infrastructure.

Focus on renewable energy projects, including energy storage facilities.

Implementation of a cloud-first strategy and exploration of AI to enhance project efficiency.

Integrated service model offering comprehensive solutions.

Employee-ownership model fosters a culture of accountability and collaboration.

Strong brand reputation and commitment to safety and quality.

Comprehensive integrated service model provides end-to-end solutions for clients.

Successful execution of a 1,000MWh energy storage facility in Arizona in 2024.

Involvement in Georgia Power's 500MW battery storage program.

Continued expansion in infrastructure and renewable energy projects.

Burns & McDonnell's success is built on several key advantages that set it apart in the industry.

- Employee Ownership: Fosters a culture of accountability and collaboration, leading to high employee retention and project success.

- Integrated Services: Offers comprehensive solutions, from design to construction, streamlining project delivery.

- Market Adaptation: Consistently adapts to market trends, such as renewable energy and infrastructure development.

- Financial Strength: Reported $7.2 billion in revenue in 2024, demonstrating robust financial performance.

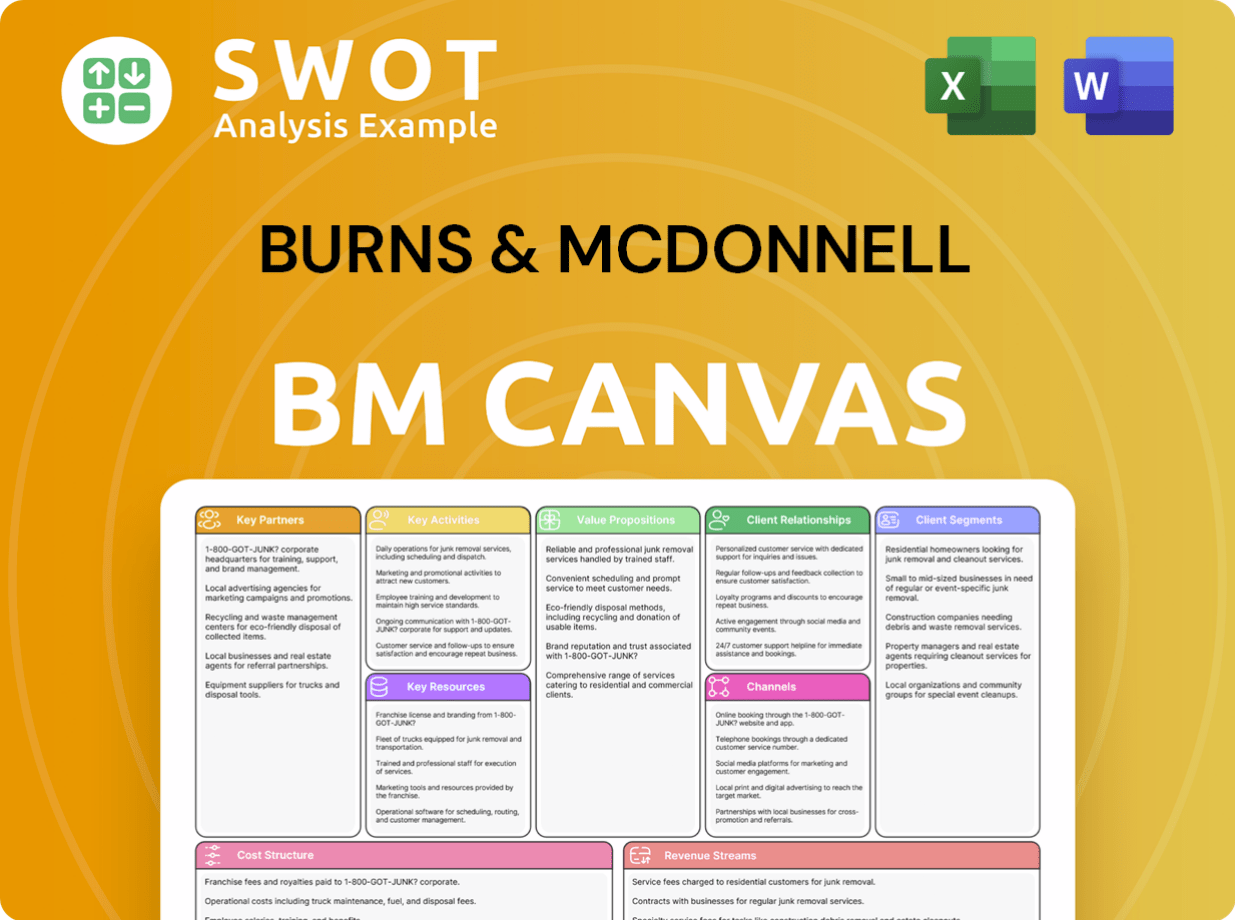

Burns & McDonnell Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Burns & McDonnell Positioning Itself for Continued Success?

The industry position, risks, and future outlook of Burns & McDonnell are crucial for understanding the company's trajectory. As a leading engineering firm, it consistently ranks among the top design firms globally. The company's strategic initiatives and market positioning are key to its continued success.

Understanding the risks and opportunities is essential. While the construction and engineering sectors face cyclical challenges, Burns & McDonnell's focus on innovation and infrastructure projects positions it for growth. The company's financial health and strategic planning will play a vital role in its future.

Burns & McDonnell holds a strong industry position, consistently ranking as a top design firm. For the third consecutive year, the company maintained its No. 7 spot on Engineering News-Record's (ENR) 2025 Top 500 Design Firms list. They also hold the No. 1 position in the Power category for the tenth year in a row.

The company excels in various sectors, including telecommunications (No. 2), industrial process/oil & gas (No. 5), and manufacturing (No. 12). Their global reach is expanding, with over 75 offices worldwide. Their employee-ownership model contributes to customer loyalty.

Key risks include market sensitivity to the cyclical nature of construction and engineering sectors. There are also potential resource management challenges with significant growth. Cybersecurity threats are a concern, with projected cybercrime costs reaching $10.5 trillion by 2025.

The outlook remains positive, with Burns & McDonnell poised to leverage increased infrastructure spending. The US infrastructure market is projected to reach $2.6 trillion by 2025. The firm plans to sustain and expand its profitability through strategic initiatives.

Burns & McDonnell is focusing on sustained growth through several key strategies. These include continued investment in STEM education to build a future workforce and a focus on innovative solutions in areas like renewable energy and data centers. Their commitment to safety and quality, along with their integrated service offerings, positions them to capitalize on future growth opportunities.

- Continued investment in STEM education.

- Focus on innovative solutions in renewable energy.

- Integrated service offerings to capitalize on growth.

- Emphasis on safety and quality.

For more insights into the ownership structure and financial aspects, consider reading about Owners & Shareholders of Burns & McDonnell.

Burns & McDonnell Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Burns & McDonnell Company?

- What is Competitive Landscape of Burns & McDonnell Company?

- What is Growth Strategy and Future Prospects of Burns & McDonnell Company?

- What is Sales and Marketing Strategy of Burns & McDonnell Company?

- What is Brief History of Burns & McDonnell Company?

- Who Owns Burns & McDonnell Company?

- What is Customer Demographics and Target Market of Burns & McDonnell Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.