Burns & McDonnell Bundle

Who Truly Owns Burns & McDonnell?

Ever wondered about the inner workings of a global engineering powerhouse? Understanding the Burns & McDonnell SWOT Analysis is just the beginning. Unlike many industry giants, Burns & McDonnell operates under a unique ownership model that shapes its strategic direction and company culture. This deep dive unravels the fascinating story behind the Burns & McDonnell Company Ownership and its evolution.

This isn't your typical corporate tale; discover how a pivotal decision in 1985 transformed Burns & McDonnell into an Employee-Owned Engineering Company. From its humble beginnings in 1898, providing essential infrastructure solutions, to its current status as a global leader, the Company Structure of Who owns Burns & McDonnell has played a crucial role. Explore the details of its governance, strategic decisions, and how this model influences its overall company culture, providing a unique perspective on the business.

Who Founded Burns & McDonnell?

The story of Burns & McDonnell began in 1898, a venture launched by two Stanford University engineering graduates. Clinton Sumner Burns and Robert Emmett McDonnell, after working together in Palo Alto, decided to establish their firm in Kansas City, Missouri. The location was chosen due to the growing need for water and power systems in the area, setting the stage for the Engineering Company's initial focus.

Robert E. McDonnell took on the role of promoting the firm to municipalities, while Clinton S. Burns concentrated on the technical aspects of their engineering projects. Their combined expertise helped them secure early projects in sewer systems and waterworks. The early years were marked by their direct involvement and ownership, shaping the foundation of what would become a significant player in the industry.

Details about the precise equity split or initial ownership percentages at the company's start are not available publicly. The company operated under the ownership of its founders and their successors for several decades. The firm's ownership structure underwent a notable change in 1971 when it was acquired by Armco Steel, a steel company based in Ohio.

The shift from founder-led ownership to being part of a larger corporation marked a significant transition for Burns & McDonnell. This change in Company Ownership was a key moment in the firm's history. The acquisition by Armco Steel in 1971 introduced a new phase in the company's evolution. The impending sale of Burns & McDonnell by Armco Steel during the early 1980s, due to Armco's financial difficulties, created uncertainty for the company.

- The acquisition by Armco Steel in 1971 was a major shift from its original founder ownership.

- The early 1980s saw Armco Steel facing financial challenges, leading to the potential sale of Burns & McDonnell.

- This period of uncertainty was crucial for the company's future and its Company Structure.

- The sale of the company by Armco Steel presented a pivotal moment for the firm.

Burns & McDonnell SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Burns & McDonnell’s Ownership Changed Over Time?

The most significant shift in the ownership of Burns & McDonnell, an engineering company, occurred in 1985. Faced with a potential sale by Armco Steel to a German manufacturing company, a management team of 10 individuals decided to pursue an employee buyout. This pivotal decision, financed by a loan from United Missouri Bank, led to the company becoming 100% employee-owned through an Employee Stock Ownership Plan (ESOP) in 1986. This move was driven by the desire to secure the company's long-term future under the control of its active employees and to prevent future external acquisitions. This is a key aspect of understanding who owns Burns & McDonnell.

Today, the company maintains its 100% employee-owned status. The ESOP holds 98% of the company's shares, with the remaining 2% allocated to the board and executive team. All employees are eligible to participate in the ESOP, receiving shares based on their annual compensation, up to a cap of $265,000. This structure ensures no single individual owns more than 1.5% of the ESOP shares, fostering a culture of shared ownership and accountability. The value of employee shares in this private company is assessed annually. This employee-owned model is considered a key factor in the company's high workforce efficiency and low employee turnover.

| Aspect | Details | Year |

|---|---|---|

| Ownership Structure | 100% Employee-Owned | 2024 |

| ESOP Ownership | 98% of Shares | 2024 |

| Revenue | $7.2 billion | 2024 |

The company's revenue has shown substantial growth under this ownership model, increasing from $41 million in 1985 to $5.7 billion by 2022 and $7.2 billion in 2024. The number of employee-owners also grew from 600 in 1985 to over 14,000 by 2024. This growth and stability are directly attributed to the ESOP, which encourages reinvestment in the company and provides retirement security for its employees. Understanding the Competitors Landscape of Burns & McDonnell can also provide insights into its market position.

The company is 100% employee-owned, fostering a strong culture of shared ownership.

- The ESOP owns 98% of the company.

- Employee turnover is low, around 4%, significantly below the national average.

- Revenue has grown substantially, reaching $7.2 billion in 2024.

- The employee-owned structure promotes long-term stability and employee commitment.

Burns & McDonnell PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Burns & McDonnell’s Board?

The board of directors at Burns & McDonnell operates within the context of its 100% employee-owned framework. While specific details on the full composition of the board and the exact representation of major shareholders (beyond the collective employee-owners) are not extensively detailed in public information, the company emphasizes that its employee-owners are the ones who decide how the company operates. This structure ensures that the board's decisions are fundamentally aligned with the collective interests of its employee-owners, reinforcing the principles of an employee-owned model.

In April 2023, Leslie Duke took over as Chair and CEO, succeeding Ray Kowalik, which shows the leadership transition within the employee-owned firm. Renita Mollman became the company's first female board member in 2021, overseeing key areas like human resources and marketing. The voting structure is closely linked to the Employee Stock Ownership Plan (ESOP), where employees' ownership stakes are held in individual investment accounts. The distributed control model is highlighted by the fact that no single individual owns more than 1.5% of the ESOP shares.

| Board Member | Title | Year Joined |

|---|---|---|

| Leslie Duke | Chair and CEO | 2023 |

| Renita Mollman | Board Member | 2021 |

| Ray Kowalik | Former Chair and CEO | N/A |

The ownership structure of Burns & McDonnell, as an employee-owned company, significantly impacts its governance and operational approach. The distributed ownership model, where no single individual holds a dominant share, promotes a collaborative decision-making environment. This approach, detailed further in Revenue Streams & Business Model of Burns & McDonnell, fosters a sense of shared responsibility and accountability among all employee-owners. This structure is designed to empower all employee-owners to problem-solve and make informed decisions, fostering a sense of accountability and shared success. There is no public information available regarding recent proxy battles, activist investor campaigns, or governance controversies, which is consistent with its private, employee-owned structure.

Burns & McDonnell is an Engineering Company that is entirely employee-owned, ensuring decisions align with employee interests.

- Leslie Duke is the current Chair and CEO, leading the firm.

- Renita Mollman is the first female board member.

- The ESOP structure distributes ownership, preventing any single individual from having excessive influence.

- The company's private status means there are no public proxy battles or activist investor campaigns.

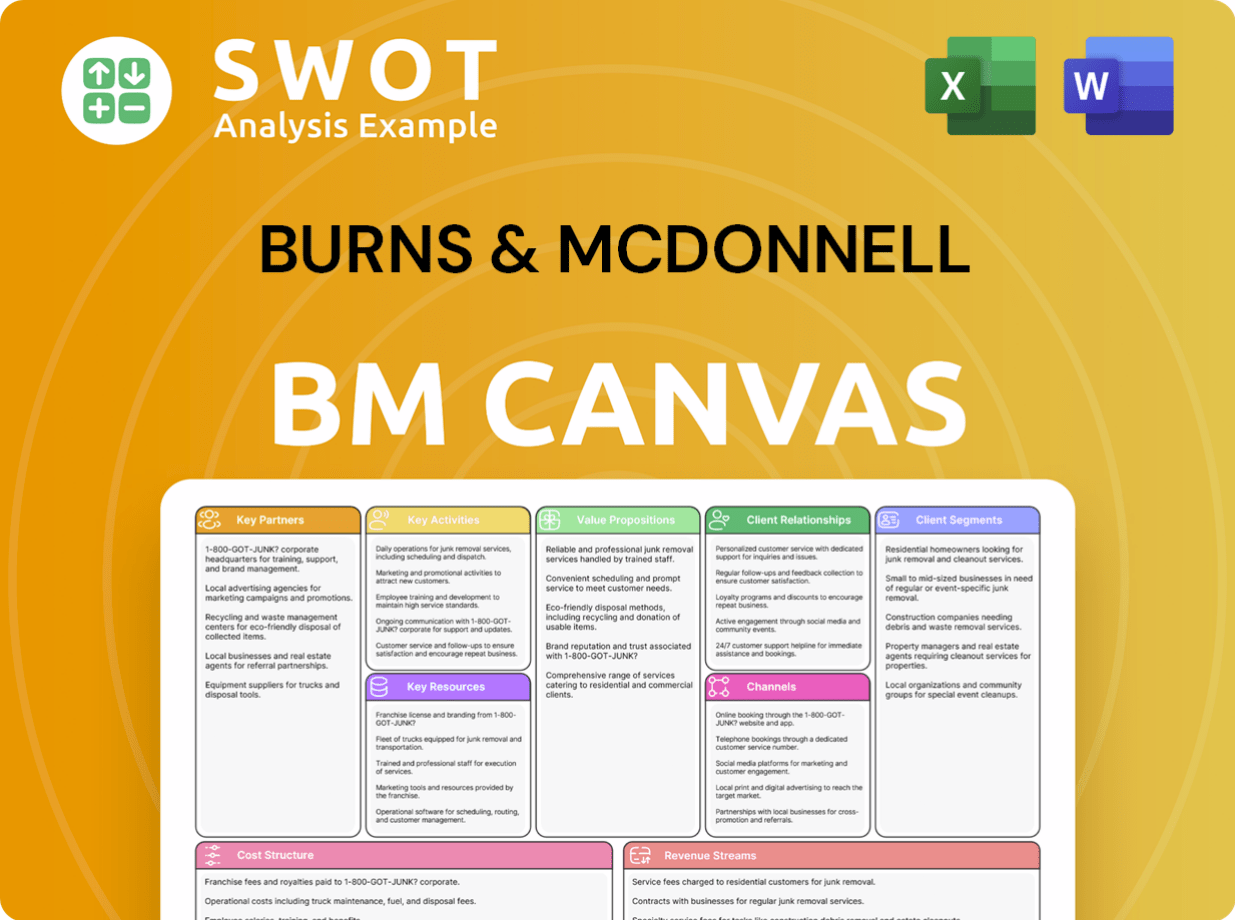

Burns & McDonnell Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Burns & McDonnell’s Ownership Landscape?

Over the past few years, Burns & McDonnell has maintained its employee-owned status, demonstrating consistent growth. The company reported a revenue of $7.2 billion in 2024, and by May 2024, its workforce had expanded to over 14,000 professionals. This growth reflects the stability and success of its employee-owned model.

Leadership transitions have also occurred internally. Leslie Duke took over as Chair and CEO at the end of 2023, succeeding Ray Kowalik. This internal succession highlights the continuity within the employee-owned structure. The company continues to rank high in the industry, securing the No. 7 position on Engineering News-Record's (ENR) 2024 and 2025 Top 500 Design Firms list for the third consecutive year, and remaining No. 1 in the Power category for a decade. This demonstrates the strength of the company structure.

| Metric | Value | Year |

|---|---|---|

| Revenue | $7.2 billion | 2024 |

| Workforce | Over 14,000 professionals | May 2024 |

| ENR Ranking | No. 7 Top 500 Design Firms | 2024 & 2025 |

The employee-owned model of Burns & McDonnell aligns with industry trends showing increased interest in such structures. The company's commitment to its Employee Stock Ownership Plan (ESOP), where contributions are made to employee-owners' accounts to purchase shares, reinforces this. This approach promotes long-term thinking and ties employee retirement savings to the company's success. There have been no public statements about potential privatization or a public listing, as the employee-owned structure remains central to its business model and culture.

The company is fully employee-owned, fostering a culture of ownership and engagement. This model contributes to higher workforce efficiency and strong financial performance. Annual contributions are made to employee accounts to purchase shares.

Leslie Duke became Chair and CEO at the end of 2023, succeeding Ray Kowalik. This internal transition highlights the continuity and stability of the company’s leadership. The leadership transition has been seamless.

The company reported $7.2 billion in revenue in 2024. The workforce has grown to over 14,000 professionals by May 2024. Burns & McDonnell continues to demonstrate strong financial health.

The company ranked No. 7 on ENR's Top 500 Design Firms list for 2024 and 2025. It has maintained its position as No. 1 firm in the Power category for a decade. This showcases industry recognition.

Burns & McDonnell Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Burns & McDonnell Company?

- What is Competitive Landscape of Burns & McDonnell Company?

- What is Growth Strategy and Future Prospects of Burns & McDonnell Company?

- How Does Burns & McDonnell Company Work?

- What is Sales and Marketing Strategy of Burns & McDonnell Company?

- What is Brief History of Burns & McDonnell Company?

- What is Customer Demographics and Target Market of Burns & McDonnell Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.