Burns & McDonnell Bundle

Who are Burns & McDonnell's Key Clients?

In the competitive world of engineering and construction, understanding your customer is everything. For a firm like Burns & McDonnell, a deep dive into their customer demographics and target market reveals the core of their strategic success. This analysis is crucial for investors, competitors, and anyone seeking to understand the company's trajectory. Let's explore the client profile that fuels Burns & McDonnell's impressive growth.

Delving into the specifics of Burns & McDonnell's customer base provides valuable insights for Burns & McDonnell SWOT Analysis. This market analysis helps identify the firm's strengths, weaknesses, opportunities, and threats. Understanding the company's target market allows for a more informed assessment of its future potential and investment viability. Exploring the customer demographics of this leading engineering company is essential.

Who Are Burns & McDonnell’s Main Customers?

Understanding the customer demographics and target market of Burns & McDonnell involves recognizing its business-to-business (B2B) focus. Unlike companies that sell directly to consumers (B2C), Burns & McDonnell serves a diverse range of industries through its engineering, architecture, construction, and consulting services. This B2B model means their client profile is defined by organizational needs and project requirements rather than individual consumer characteristics.

The company's primary customer segments are broad and reflect its comprehensive service offerings. These segments include power, infrastructure, industrial process/oil & gas, manufacturing, aviation, and federal sectors. Each segment represents a specific area where Burns & McDonnell provides specialized expertise and solutions. The target market analysis reveals a focus on large-scale projects and long-term partnerships with businesses and governmental entities.

The company's ability to adapt to changing market dynamics is crucial. The increasing emphasis on renewable energy and infrastructure development has led Burns & McDonnell to align its expertise with emerging market demands. This strategic alignment ensures the company remains competitive and continues to meet the evolving needs of its target market. For a deeper dive into the company's strategic approach, consider exploring the Growth Strategy of Burns & McDonnell.

Burns & McDonnell has consistently ranked as the No. 1 firm in the Power category. This segment encompasses battery storage, transmission and distribution, fossil fuel, and solar power projects. The renewable energy market is projected to reach $1.977 trillion by 2030. In 2024, they completed significant projects, such as a 1,000MWh energy storage facility in Arizona.

This segment includes transportation, water, and telecommunications. The U.S. infrastructure market is projected to reach $2.6 trillion by 2025. Burns & McDonnell holds a No. 2 ranking in Telecommunications and is also strong in Sewer and Waste, and Water services.

Burns & McDonnell is ranked among the top firms in this sector, including chemical plants, pharmaceuticals, and food and beverage industries.

The company serves clients in manufacturing, including the aerospace sector. They are ranked No. 2 in Aerospace Design Firms.

Burns & McDonnell provides engineering and construction services for airport and military facilities. Their work in aviation was recognized with an Excellence in Construction award in 2024.

- The company's focus is on large-scale organizations and governmental entities.

- The rapid growth in renewable energy and infrastructure spending has prompted shifts in their target segments.

- They align their expertise with emerging market demands.

- Their customer acquisition strategy involves building long-term partnerships.

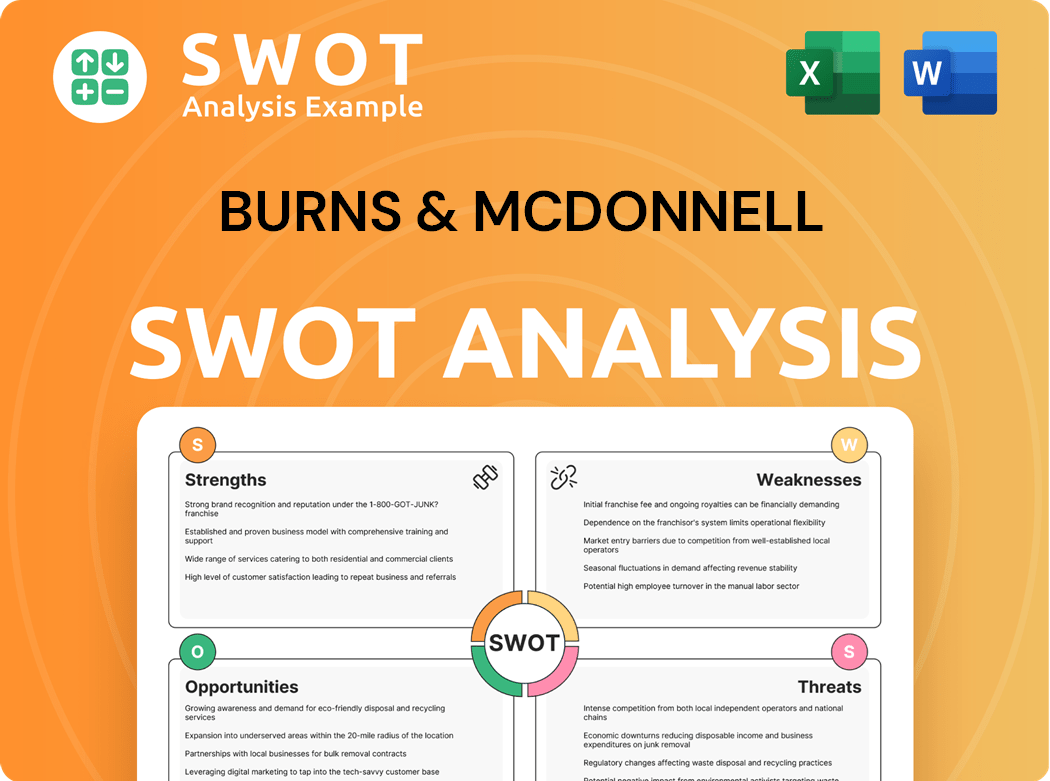

Burns & McDonnell SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Burns & McDonnell’s Customers Want?

Understanding the customer needs and preferences is crucial for any business, and for an engineering company like Burns & McDonnell, it's especially important. Their clients, who form a significant part of their target market, typically seek comprehensive solutions for complex infrastructure projects. These clients have specific needs and preferences that influence their decisions when selecting an engineering partner.

The purchasing behaviors of clients engaging with Burns & McDonnell are driven by several key factors. These include a need for reliability and expertise, integrated project delivery, a strong focus on safety and quality, innovative and sustainable solutions, and a commitment to client success. These factors shape the company's approach and service offerings.

By focusing on these aspects, Burns & McDonnell positions itself to meet the demands of its customer base effectively. This approach is reflected in their project delivery model and the diverse services they offer across various sectors.

Clients value Burns & McDonnell's extensive history and reputation. The company has over 125 years of experience. This long-standing presence and expertise are key factors in client decision-making.

The full-service, engineer-procure-construct (EPC) approach streamlines projects. This integrated approach aims to improve efficiency and reduce delays, which can be costly for clients.

Clients prioritize safety and quality, essential for infrastructure projects. Burns & McDonnell has received recognition as a top safety company. Their dedication to safety is ingrained in their culture.

Clients increasingly seek innovative and sustainable solutions. Burns & McDonnell invests in research and development. They prioritize environmentally friendly practices, such as their work on direct air capture (DAC) hubs and renewable energy projects.

The company focuses on making clients successful by solving complex challenges. This includes addressing regulatory changes, managing supply chain disruptions, and optimizing project timelines.

Burns & McDonnell tailors its approach through a client-focused delivery model and diversified services. Their continuous engagement with clients and responsiveness to market trends influence their service offerings and project development. For further insights, explore the Marketing Strategy of Burns & McDonnell.

The primary needs of Burns & McDonnell's clients include reliable expertise, integrated project delivery, a strong focus on safety and quality, innovative and sustainable solutions, and a commitment to client success. These needs drive their purchasing decisions and shape the company's service offerings.

- Reliability and Expertise: Clients seek a proven track record and deep technical knowledge.

- Integrated Project Delivery: The EPC approach streamlines projects for efficiency.

- Safety and Quality: A commitment to safety is crucial for project success.

- Innovation and Sustainability: Clients want cutting-edge and environmentally friendly solutions.

- Problem-Solving: Addressing complex challenges and ensuring client success is paramount.

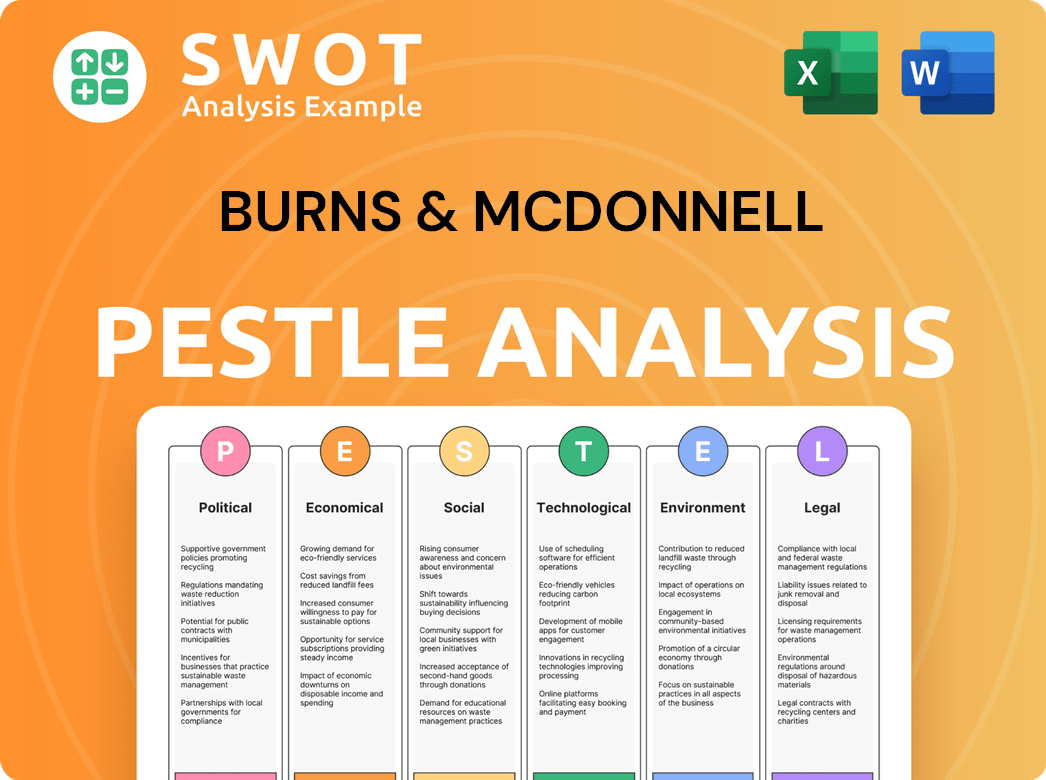

Burns & McDonnell PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Burns & McDonnell operate?

The geographical market presence of Burns & McDonnell is extensive, with over 75 offices globally. This widespread network allows the company to serve a diverse range of clients and projects. Their operations are primarily concentrated in the United States, but they also have a significant international presence.

Within the U.S., Burns & McDonnell has offices in more than 50 cities, which enables them to cater to a wide array of clients across the country. They strategically expand their footprint to capitalize on thriving economies and specific industries. This expansion includes a strong presence in the Pacific Northwest and other key regions.

Their international reach includes branches in locations like Dubai, the United Kingdom, and India. This global presence allows them to engage in projects worldwide, demonstrating their commitment to international growth and market diversification. This global strategy is crucial in understanding the Competitors Landscape of Burns & McDonnell.

The company's strong presence in the U.S. allows them to focus on localized offerings. This includes tailored marketing strategies and partnerships to address specific regional needs. Their presence in the Pacific Northwest, with offices in cities like Portland, Vancouver, and Seattle, is a key part of this strategy.

International revenue accounted for approximately 15% of the company's total revenue in 2024, showcasing successful global expansion. Strategic growth is evident in new office openings in key regions. This global presence enables them to serve clients worldwide and diversify their project portfolio.

Differences in customer demographics and preferences are addressed through localized offerings. The Muskegon Solar Energy Center project in Michigan exemplifies this approach, involving close collaboration with local and Michigan-based union labor. This approach ensures that projects meet the specific needs of each region.

Strategic growth is also evident in new office openings in key regions, which increased by 20% in Q1 2024. This expansion is part of their strategy to meet the growing demand for their services. This growth is supported by their ability to adapt to various market conditions.

Their geographical presence is strategically designed to serve diverse clients. This includes a strong focus on the U.S. market and targeted international expansion. This approach allows them to meet the specific needs of clients in different locations.

- Pacific Northwest: Offices in Portland, Vancouver, and Seattle.

- International: Offices in Dubai, the United Kingdom, and India.

- U.S. Cities: Presence in over 50 cities across the United States.

- Revenue Growth: Projected at 15% in the Pacific Northwest in 2024.

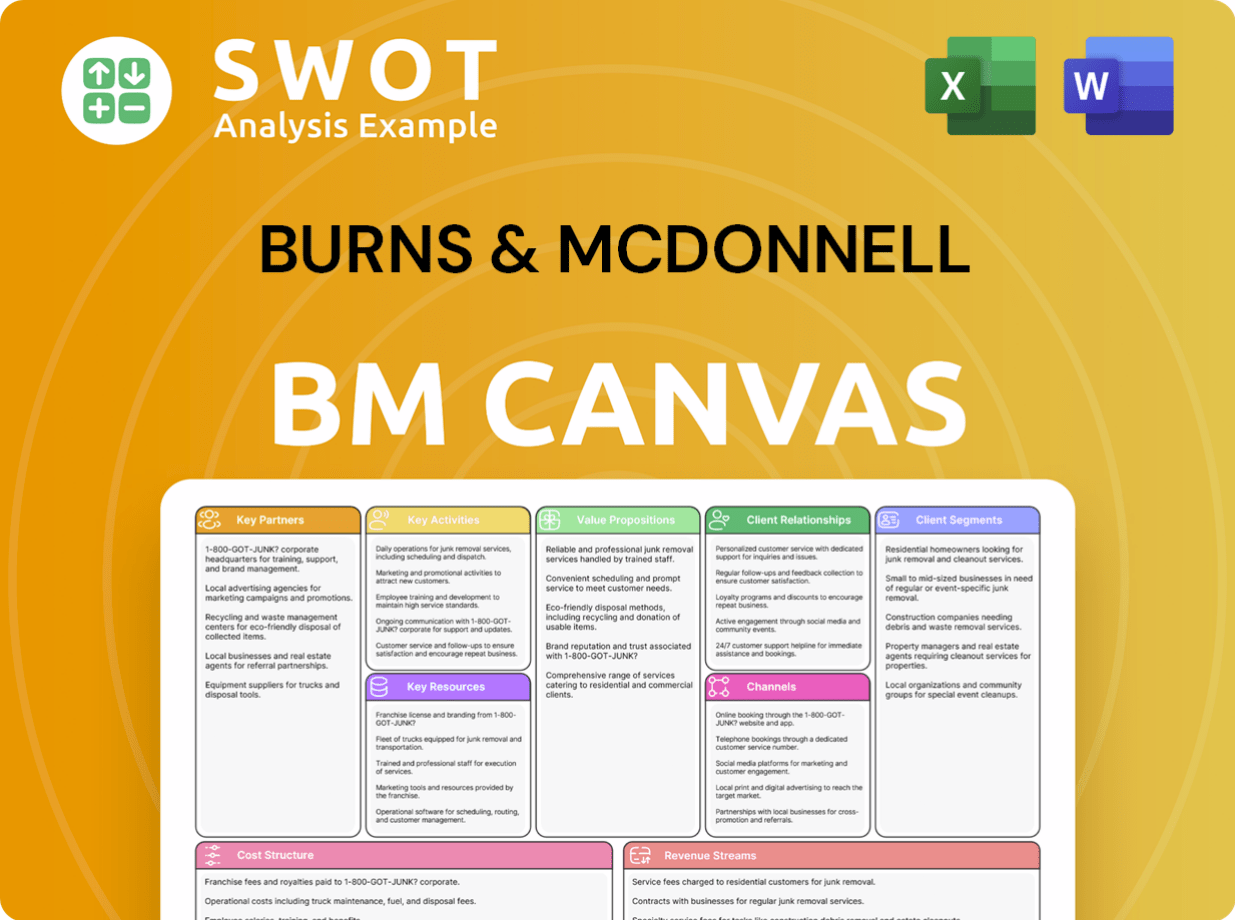

Burns & McDonnell Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Burns & McDonnell Win & Keep Customers?

To effectively analyze the customer acquisition and retention strategies of an engineering company like Burns & McDonnell, it's crucial to understand how they attract and maintain their client base. This involves examining the approaches they use to gain new customers and the methods they implement to ensure those clients remain loyal over time.

This analysis will delve into the key strategies employed by Burns & McDonnell, highlighting their relationship-driven approach, thought leadership initiatives, and employee-centric culture. It will explore how these elements contribute to their ability to secure new contracts and maintain a robust project backlog. Understanding these strategies provides valuable insights into their overall business success.

The focus will be on the practical tactics used by the firm, supported by data and real-world examples. This includes their digital marketing efforts, their community involvement, and their commitment to innovation. These factors collectively shape their client relationships and drive their growth in a competitive market. Additionally, the article Revenue Streams & Business Model of Burns & McDonnell provides additional insights into their business operations.

Burns & McDonnell prioritizes building strong, long-term client relationships. This approach is fundamental to both acquiring and retaining customers. The company's consistent ranking among top firms and its commitment to safety and quality are key contributors to its strong reputation.

The company actively shares its expertise to establish industry leadership. This includes engaging with trade publications and utilizing content marketing to promote their brand to relevant audiences. The global content marketing spend is projected to reach $200 billion by 2024, highlighting the importance of this strategy.

Burns & McDonnell focuses on digital and online channels, including social media platforms, for targeted advertising. This approach is designed to engage and promote their brand effectively. Their ad spend increased by 15% year-over-year in 2024, indicating a successful digital presence.

As a 100% employee-owned firm, Burns & McDonnell fosters a culture of ownership and commitment. This directly impacts client success and retention. The company's low employee turnover rate ensures continuity and deep institutional knowledge for clients.

Burns & McDonnell's comprehensive strategy for customer acquisition and retention is multifaceted. It includes leveraging its reputation, employee ownership, and strategic communication to build strong relationships with clients. A diverse range of service offerings and continuous innovation are also key components. Community involvement, particularly in STEM education, enhances their public image and aligns with client values, contributing to their ability to secure over $7 billion in new contracts in 2024, and increasing their backlog by 10% in the last fiscal year.

By offering a full range of design and construction services across diverse industries, Burns & McDonnell can meet a wide array of client needs. This fosters repeat business and long-term partnerships. Their focus on innovation, particularly in sustainable solutions and advanced technologies, keeps them competitive.

Burns & McDonnell's active community involvement contributes to a positive public image and aligns with the values of many clients. In 2024, employee-owners contributed over $11 million to communities nationwide. The foundation committed $1.5 million in grants over three years to support Project Lead The Way, reaching over 20,000 students.

The company uses a blend of marketing and relationship-building to attract new clients. Their efforts include thought leadership, targeted digital advertising, and participation in industry events. These strategies are designed to reach potential clients and showcase their expertise.

Key to client retention is the company's focus on delivering high-quality services and fostering strong relationships. This includes maintaining a highly engaged workforce and providing innovative solutions. Their employee-ownership model also plays a crucial role.

The employee-ownership model fosters a culture of commitment and ownership, which enhances client satisfaction and retention. This model ensures that employees are invested in the success of projects and the long-term relationships with clients. This structure is a key differentiator.

The company's digital marketing efforts, including targeted advertising on social media, have proven effective. Increased ad spend and a growing number of LinkedIn followers demonstrate the success of their online presence. These efforts help in reaching potential clients.

Burns & McDonnell Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Burns & McDonnell Company?

- What is Competitive Landscape of Burns & McDonnell Company?

- What is Growth Strategy and Future Prospects of Burns & McDonnell Company?

- How Does Burns & McDonnell Company Work?

- What is Sales and Marketing Strategy of Burns & McDonnell Company?

- What is Brief History of Burns & McDonnell Company?

- Who Owns Burns & McDonnell Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.