Colruyt Group Bundle

How is Colruyt Group Navigating the Future of Retail?

Colruyt Group, a Belgian retail giant, is strategically evolving in the dynamic Colruyt Group SWOT Analysis, adapting its growth strategy to stay ahead. Founded in 1928, the company's commitment to offering quality products at competitive prices has been a cornerstone of its success. This exploration delves into Colruyt Group's journey from a wholesale business to a major European retail player.

This analysis will unpack Colruyt Group's current market position, highlighting its robust presence in food and non-food retail, along with its wholesale operations. We'll examine its unique approach, including its lowest-price guarantee and efficient logistics, which have fueled its competitive edge. Furthermore, the focus will be on its expansion plans, innovation, and strategic initiatives aimed at solidifying its leadership in the retail industry, ensuring sustainable growth and enhancing company performance.

How Is Colruyt Group Expanding Its Reach?

The Colruyt Group's growth strategy is centered on a multi-pronged approach, aiming to strengthen its core retail operations while simultaneously exploring new avenues for expansion. This includes optimizing the existing store network and strategically expanding into new geographical areas. The company's commitment to innovation and adaptability is evident in its varied initiatives, designed to navigate the evolving retail landscape and maintain a competitive edge.

A critical component of the Colruyt Group's strategy involves the continuous improvement and expansion of its store network. This involves both opening new stores and renovating existing ones, particularly under its established formats like Colruyt Lowest Prices and OKay. The company's expansion also includes a strong emphasis on online retail and home delivery services, reflecting the broader industry shift towards e-commerce and adapting to changing consumer behaviors.

Colruyt Group is also focused on diversifying its revenue streams through strategic acquisitions and partnerships. For instance, the acquisition of a majority stake in Newpharma in 2022 bolstered its presence in the online health and well-being market. These moves are designed to access new customer segments and leverage digital platforms, contributing to the company's overall growth and market share.

The company actively opens new stores and renovates existing ones, focusing on formats like Colruyt Lowest Prices and OKay. In France, the focus is on measured, profitable expansion. This includes strategic site selection and efficient store layouts to enhance the customer experience and operational efficiency.

Colruyt Group has a strong emphasis on online retail and home delivery services. This reflects the broader industry shift towards e-commerce. The company continues to invest in its online platforms to meet evolving consumer demands and maintain a competitive position in the market.

Acquisitions, like the majority stake in Newpharma in 2022, are key to diversification. These moves allow Colruyt Group to access new customer segments and leverage digital platforms. This approach supports the company's overall growth strategy and enhances its market presence.

The company invests in renewable energy projects, such as wind farms and solar panels. This reduces its environmental footprint and creates new business models. This commitment to sustainability is a key part of Colruyt Group's long-term strategy.

Colruyt Group's expansion strategy is focused on both physical and digital channels. The company aims to expand its store network while also growing its online presence. The focus is on sustainable growth and adapting to changing consumer behaviors.

- Expansion of store formats, including Colruyt Lowest Prices and OKay.

- Continued investment in online retail platforms and home delivery services.

- Strategic acquisitions to diversify revenue streams and enter new markets.

- Focus on sustainable initiatives, such as renewable energy projects.

For more detailed insights into the company's marketing strategies, you can refer to Marketing Strategy of Colruyt Group. This article provides a comprehensive overview of the strategies that drive the company's success.

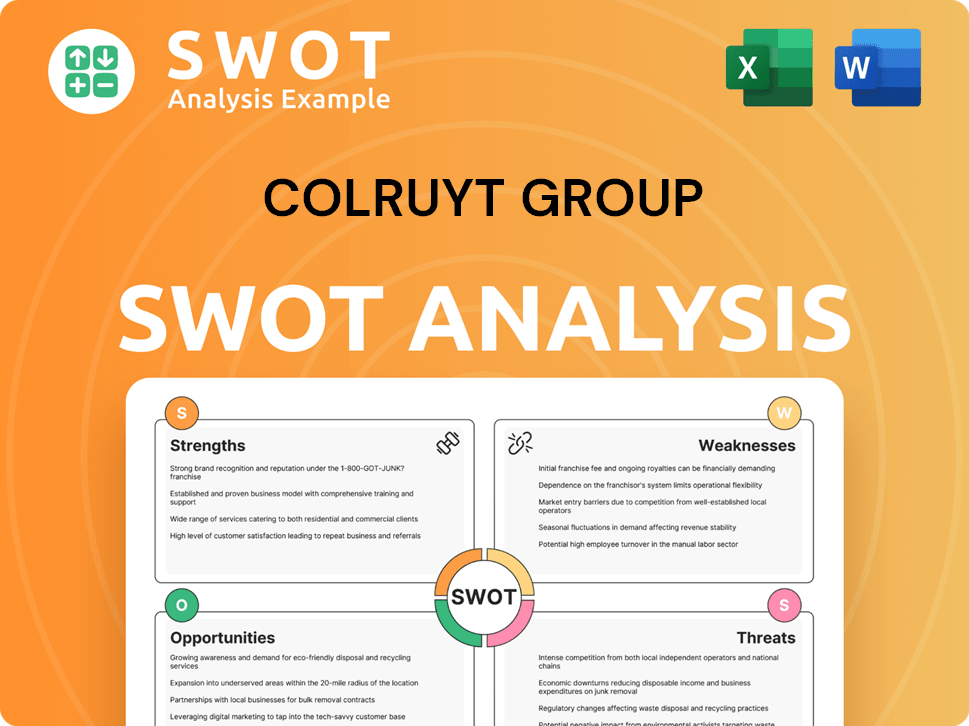

Colruyt Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Colruyt Group Invest in Innovation?

The Colruyt Group strategically integrates innovation and technology to drive its growth strategy and enhance operational efficiency within the retail industry. This approach is crucial for maintaining a competitive edge and achieving sustained company performance. The company's investments in digital transformation and sustainable practices reflect its commitment to adapting to evolving consumer needs and market dynamics.

Technological advancements play a vital role in the Colruyt Group's ability to optimize its supply chain, personalize customer experiences, and reduce operational costs. These efforts are essential for navigating the complexities of the modern retail landscape and securing its position in the market. The company's forward-thinking approach ensures it remains resilient and responsive to future challenges and opportunities.

The Colruyt Group focuses on leveraging technology to improve various aspects of its operations, from in-store experiences to supply chain management. This includes electronic shelf labels to improve pricing accuracy and operational efficiency. The company's commitment to innovation is evident in its exploration of automation, AI, and sustainable practices, which are key components of its long-term growth outlook.

The Colruyt Group has been actively investing in its e-commerce platforms to enhance online retail strategy. This includes improving user experience, expanding product offerings, and optimizing delivery services to meet the growing demand for online grocery shopping.

Data analytics is a core component of the Colruyt Group's strategy. The company uses data to personalize customer experiences, optimize marketing campaigns, and improve inventory management. This data-driven approach supports better decision-making and operational efficiency.

The Colruyt Group is exploring automation in its distribution centers to streamline logistics and reduce labor costs. This includes implementing automated picking and packing systems to improve efficiency and speed up order fulfillment. Automation is a key aspect of the Colruyt Future.

AI is being considered for various applications, such as demand forecasting and personalized marketing campaigns. AI helps the company to make data-driven decisions, improve customer experiences, and optimize operations. This is part of the Colruyt Group's innovation in retail.

The company is committed to sustainability, using technology to achieve its environmental goals. This includes investments in energy-efficient infrastructure like heat pumps and solar panels. Sustainability is a key focus for the Colruyt Group.

The Colruyt Group focuses on developing private-label brands that meet consumer demands for quality, health, and sustainability. This is a key element of the company's product offerings and its approach to business expansion.

The Colruyt Group employs a multi-faceted approach to innovation and technology, focusing on digital transformation, automation, and sustainability. These strategies are crucial for maintaining its competitive edge and achieving long-term growth. The company's commitment to these areas is evident in its investments and initiatives.

- E-commerce Expansion: Continuous investment in online platforms to improve the customer experience and expand market reach.

- Data-Driven Decision Making: Utilizing data analytics for personalized marketing and supply chain optimization.

- Automation and Efficiency: Implementing automation in distribution centers to reduce costs and improve logistics.

- Sustainability Initiatives: Investing in energy-efficient infrastructure and sustainable product ranges.

- Private-Label Development: Developing brands that meet evolving consumer demands for quality and sustainability.

The Colruyt Group's commitment to innovation and technology is integral to its growth strategy. By embracing digital transformation, automation, and sustainability, the company aims to improve operational efficiency, enhance customer experiences, and ensure its long-term competitiveness. This approach is supported by the company's strong financial performance and its focus on creating value for its stakeholders. To learn more about the core values that guide the company's operations, explore the Mission, Vision & Core Values of Colruyt Group.

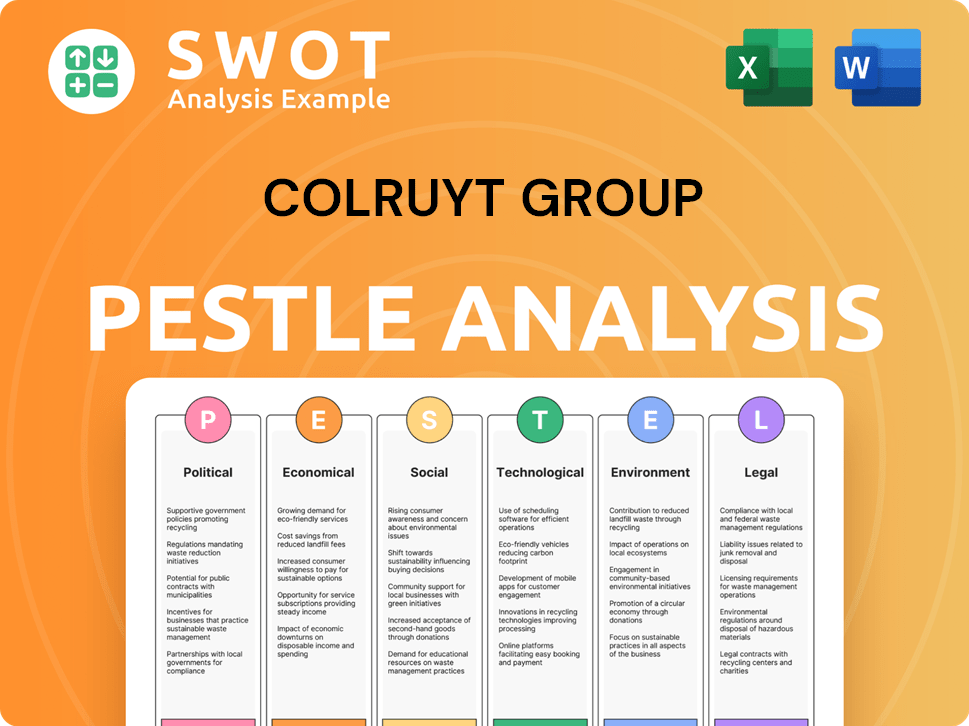

Colruyt Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Colruyt Group’s Growth Forecast?

The financial outlook for Colruyt Group centers on a strategy that balances maintaining its competitive pricing model with investments geared towards future growth. The company anticipates improved results, including an increase in recurring EBITDA, for the financial year 2023/2024. This performance is supported by its strong position in Belgium and its measured expansion efforts in France. The Retail Industry continues to evolve, and Colruyt Group is adapting to these changes through strategic financial planning.

Recent financial reports highlight a solid performance, with the company effectively managing inflationary pressures and energy cost fluctuations. Colruyt Group's sustained investment levels are crucial, particularly in digitalization, store network optimization, and sustainable energy projects. The company's approach involves prudent capital allocation to support its long-term growth ambitions, including potential mergers and acquisitions that align with its sustainable business practices. This approach is key to understanding the Colruyt Future.

The financial narrative emphasizes steady, controlled growth, prioritizing long-term value creation while maintaining a healthy balance sheet. This approach is essential for the Company Performance and its ability to navigate the complexities of the Retail Industry. The company's financial strategy is designed to ensure sustainable profitability by optimizing operational efficiency and expanding its market share through both physical and online channels. For more insights, consider reading this article about the company's market strategies: Colruyt Group's Market Strategies.

Colruyt Group aims for consistent revenue growth, focusing on both organic expansion and strategic acquisitions. The company's financial plans support its Business Expansion efforts. The company's financial performance is closely tied to its ability to adapt to market changes and consumer preferences.

Maintaining and improving profitability is a key focus for Colruyt Group. The company's strategies include optimizing operational efficiency and managing costs effectively. The goal is to achieve sustainable profitability through various initiatives. The company is focused on Colruyt Future.

Colruyt Group continues to invest in key areas such as digitalization, store network optimization, and sustainable energy projects. These investments are crucial for long-term growth and competitiveness. The company's investment decisions are aligned with its broader strategic objectives.

Prudent capital allocation is a key element of Colruyt Group's financial strategy, supporting both organic growth and potential acquisitions. This approach ensures that resources are used efficiently to maximize shareholder value. The company's financial planning includes careful consideration of capital allocation.

Colruyt Group focuses on several key financial metrics to measure its performance and guide its future strategies. These metrics provide insights into the company's financial health and growth potential. The company's financial performance is closely monitored to ensure that it meets its strategic objectives.

- Revenue Growth: The company aims for consistent revenue growth through various initiatives.

- EBITDA: Recurring EBITDA is a key indicator of profitability and operational efficiency.

- Capital Expenditure: Investments in digitalization, store optimization, and sustainable energy projects.

- Net Profit: The company focuses on maintaining and improving its net profit.

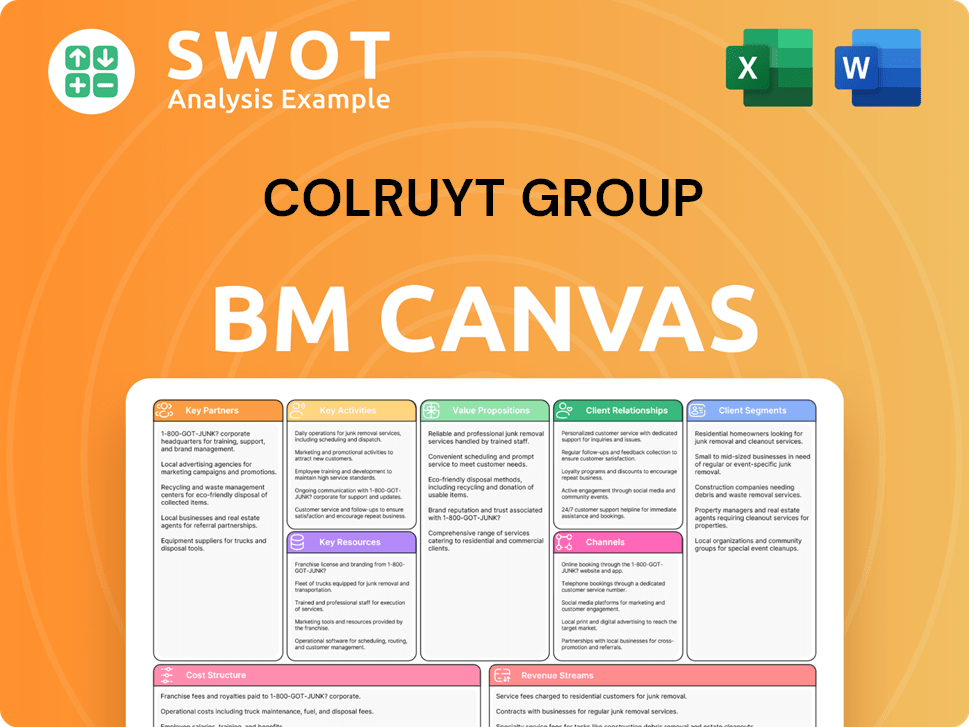

Colruyt Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Colruyt Group’s Growth?

The Colruyt Group, like any major player in the Retail Industry, faces several potential risks and obstacles in its pursuit of Growth Strategy and future success. These challenges range from intense competition to the need for continuous adaptation to market changes. Understanding these risks is crucial for evaluating the Colruyt Future and its long-term prospects.

One of the primary hurdles is the highly competitive nature of the retail market, especially from discounters and online retailers. The company's commitment to a lowest-price guarantee also puts pressure on margins, particularly during periods of economic instability. Navigating these challenges requires strategic agility and a focus on operational efficiency.

Furthermore, the company must also address regulatory changes, supply chain vulnerabilities, and the rapid pace of technological advancements. These factors, combined with internal challenges related to workforce management, pose significant risks. The Colruyt Group must employ robust risk management strategies to mitigate these potential impacts.

The Colruyt Group competes with numerous retailers, including established supermarket chains, discounters like Aldi and Lidl, and online platforms. This intense competition necessitates a constant focus on offering competitive pricing and value to maintain and grow its market share. The company's ability to differentiate itself and adapt to evolving consumer preferences is critical.

The company's lowest-price guarantee strategy can squeeze profit margins, especially during periods of rising inflation or increased supplier costs. Maintaining profitability while adhering to this commitment requires efficient operations, cost control, and strategic sourcing. The Colruyt Group needs to carefully balance its pricing strategy with its financial performance.

Regulatory changes, particularly in areas like environmental sustainability, labor laws, and food safety, can necessitate significant operational adjustments and investments. The company must stay compliant with evolving regulations, which may increase operational costs. Adapting to new rules is essential for maintaining its license to operate and its reputation.

Supply chain vulnerabilities, as demonstrated by recent global events, pose a significant risk. Disruptions can lead to stockouts, increased logistics costs, and reduced customer satisfaction. The Colruyt Group mitigates this through robust supply chain management, diversification of sourcing, and investments in efficient logistics infrastructure. These measures help to ensure product availability and control costs.

Technological advancements in retail, such as e-commerce and automated checkouts, require continuous adaptation and investment. The Colruyt Group must innovate to remain competitive and meet evolving consumer expectations. Failure to embrace new technologies could lead to a loss of market share. The company is investing in its online retail strategy to compete effectively.

Managing a large workforce and ensuring consistent service quality across various formats can be an obstacle. Maintaining employee satisfaction, training, and efficient operations are crucial. The Colruyt Group addresses these risks through a comprehensive risk management framework, scenario planning, and continuous market analysis. Effective workforce management is key to maintaining operational efficiency.

The Colruyt Group employs several strategies to mitigate these risks. These include robust supply chain management, diversification of sourcing, and investments in efficient logistics infrastructure. The company also focuses on continuous market analysis and scenario planning. The company's long-standing experience in the retail sector provides a strong foundation for navigating potential hurdles. For additional insights into the company's target market, explore the Target Market of Colruyt Group.

Financial performance is constantly monitored to ensure the company remains competitive. The company's ability to maintain profitability while expanding into new markets is a critical factor. Any analysis must consider the impact of inflation, interest rates, and economic conditions on the company's performance. The Colruyt Group's financial health is central to its Business Expansion plans.

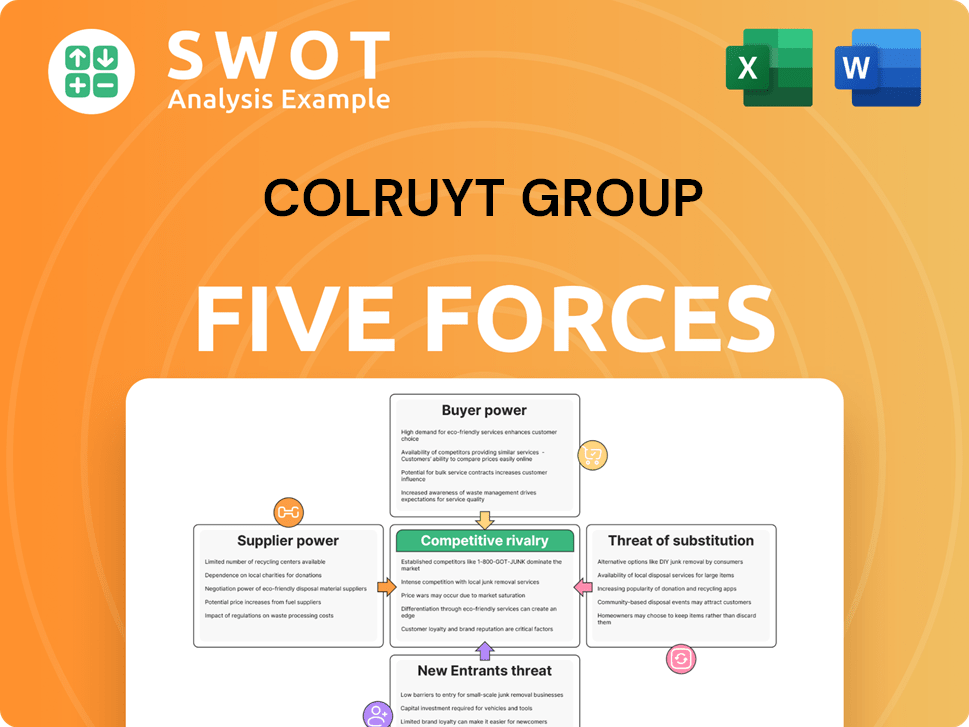

Colruyt Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Colruyt Group Company?

- What is Competitive Landscape of Colruyt Group Company?

- How Does Colruyt Group Company Work?

- What is Sales and Marketing Strategy of Colruyt Group Company?

- What is Brief History of Colruyt Group Company?

- Who Owns Colruyt Group Company?

- What is Customer Demographics and Target Market of Colruyt Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.