Colruyt Group Bundle

Who Really Owns Colruyt Group?

Understanding the ownership of a company is crucial for grasping its strategic direction and future prospects. With a legacy dating back to 1928, Colruyt Group's evolution from wholesale to retail giant offers a fascinating case study in corporate governance. This exploration dives deep into the Colruyt Group SWOT Analysis, unraveling its intricate ownership structure and the impact of its shareholders.

From its humble beginnings, Colruyt Group has become a significant player in the European retail market. The company's history, shaped by its founders' vision of value and efficiency, continues to influence its operations. This analysis will examine the key stakeholders and the evolution of Colruyt Group ownership, offering insights into its sustained success and strategic decisions. Understanding the Colruyt Group structure is key.

Who Founded Colruyt Group?

The foundational ownership of the company, now known as Colruyt Group, traces back to its founder, Franz Colruyt. The company's inception in 1928 as a wholesale business, 'Colruyt, Leson & Co.', marked the beginning of a long-standing tradition of family involvement in the company's ownership and management. While specific initial equity details are not readily available in public records, the early ownership structure was primarily held by Franz Colruyt and potentially a small group of initial partners or family members.

As the company transitioned from a wholesale operation to a retail enterprise, the ownership remained largely within the Colruyt family. The early agreements, though not publicly detailed, likely focused on maintaining family control and ensuring the long-term vision of the founder was upheld. The company's history reflects a commitment to family ownership, which has been a key factor in its strategic decisions and long-term growth. The company's structure has evolved over time, but the core ownership has remained within the family.

The early years of the company did not involve significant external investors or public offerings. The focus was on building a solid foundation through efficient distribution and providing value, which was directly tied to the family's direct control and investment in the company's growth. The family's commitment to these principles has shaped the company's culture and approach to business. The family's vision has been instrumental in the company's success and its ability to adapt to changing market conditions.

The company began as a wholesale business in 1928. Franz Colruyt was the primary founder.

Ownership remained largely within the Colruyt family as the company grew. Family control was key to the company's vision.

Initial capital came from Franz Colruyt and potentially a small circle of partners. No significant external investors were involved early on.

The early strategy focused on efficient distribution and providing value. This was directly tied to the family's control.

Public records do not provide detailed information about early equity splits. The early ownership was not subject to significant changes.

The founding team's vision of efficient distribution and providing value was inherently tied to the family's direct control and investment in the company's growth.

Understanding the early ownership of the company is crucial for grasping its long-term strategy. The company's structure and values have been shaped by its family ownership. For more insights into the company's growth, you can explore the Growth Strategy of Colruyt Group.

- The company's early ownership was primarily within the Colruyt family.

- The focus was on building a solid foundation through efficient distribution.

- No significant external investors were involved during the initial phase.

- Family control has been a key factor in the company's strategic decisions.

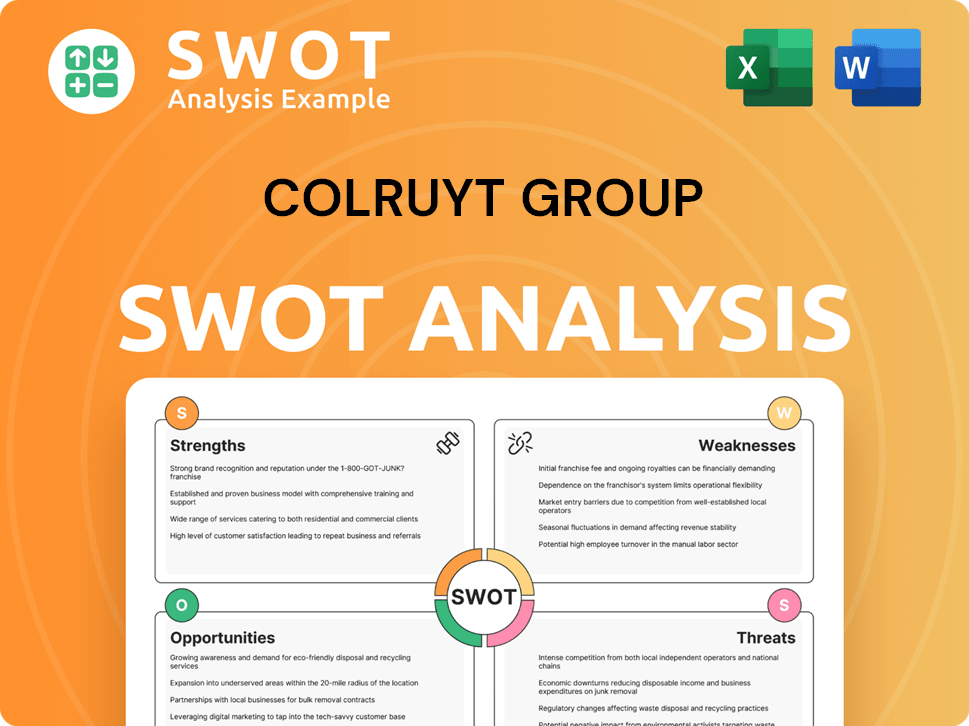

Colruyt Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Colruyt Group’s Ownership Changed Over Time?

The ownership structure of Colruyt Group has seen key shifts since its inception, primarily driven by its evolution into a publicly traded entity while maintaining strong family control. A pivotal moment was its initial public offering (IPO), which broadened public participation while allowing the Colruyt family to retain a controlling interest. This transition marked a significant change in the Colruyt Group ownership landscape, shaping its future trajectory.

The company's journey from a privately held business to a publicly listed one reflects strategic decisions aimed at growth and capital access. The IPO facilitated this growth, providing the company with access to capital markets and enabling expansion. The Colruyt Group structure has thus been influenced by these shifts, balancing the need for public investment with the desire to preserve the family's influence.

| Key Event | Impact on Ownership | Year |

|---|---|---|

| Founding of the Company | Initial private ownership by the Colruyt family. | 1928 |

| Initial Public Offering (IPO) | Introduction of public shareholders, while the Colruyt family retained a significant stake. | Information not available |

| Formation of Korys | The Colruyt family's investment company, consolidating family holdings and ensuring continued influence. | Information not available |

Currently, the Colruyt family, through Korys, remains the dominant shareholder, ensuring control over strategic decisions and the long-term direction of the company. As of recent reports, Korys holds a substantial stake, solidifying its position as the major stakeholder. Other significant shareholders include institutional investors and mutual funds, holding shares as part of their diversified portfolios. These Colruyt Group shareholders collectively represent a considerable portion of the publicly traded shares, influencing the company's governance and strategic direction. The sustained family control has profoundly impacted the company's strategy, often allowing for long-term sustainable strategies. For detailed Colruyt Group ownership details, recent financial reports and SEC filings provide precise figures on the current breakdown of institutional versus family ownership.

The Colruyt Group history includes a transition from private to public ownership, maintaining family control. The Colruyt family, through Korys, is the primary shareholder, ensuring long-term strategic vision. Other major stakeholders include institutional investors and mutual funds.

- The IPO allowed for broader public participation.

- Korys ensures the family's continued influence.

- Institutional investors hold a significant portion of shares.

- This structure supports long-term sustainable strategies.

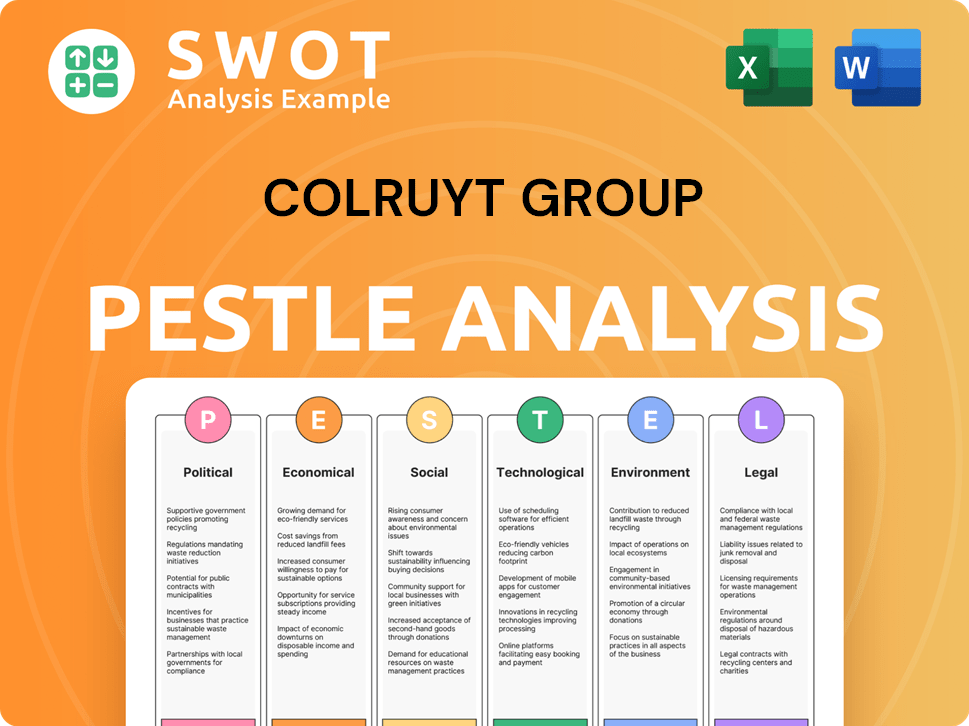

Colruyt Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Colruyt Group’s Board?

The Board of Directors of the Colruyt Group reflects the company's ownership structure, with a significant presence from the Colruyt family. The board typically includes descendants of the founder or individuals closely associated with Korys, the family's investment arm, which holds a controlling stake. Independent directors also serve on the board, bringing external perspectives and expertise to corporate governance. Understanding the Colruyt Group ownership structure is key to grasping the board's composition.

The specific details of the board's current composition are subject to change. However, the influence of the Colruyt family, through Korys, remains a constant. The family's significant shareholding ensures their influence over key decisions, including board appointments and the company's strategic direction. This structure is a characteristic of many family-controlled public companies. For more insights, consider exploring the Revenue Streams & Business Model of Colruyt Group.

| Board Member | Role | Notes |

|---|---|---|

| Jef Colruyt | Chairman | Represents the Colruyt family's interests. |

| Joachim De Vos | CEO | Oversees the company's operations. |

| Independent Directors | Various | Provide external expertise and perspectives. |

The Colruyt family's control over the company, maintained through Korys, generally mitigates external pressures. This allows for consistent strategic execution aligned with the family's long-term vision. The Colruyt Group shareholders, therefore, operate within a stable ownership structure. The influence of the family is a key aspect of understanding Who owns Colruyt.

The Board of Directors is heavily influenced by the Colruyt family, reflecting their significant ownership stake.

- The family's investment arm, Korys, plays a crucial role in maintaining control.

- Independent directors provide external perspectives and expertise.

- The stable ownership structure allows for consistent strategic execution.

- The family's influence is a central aspect of the Colruyt Group structure.

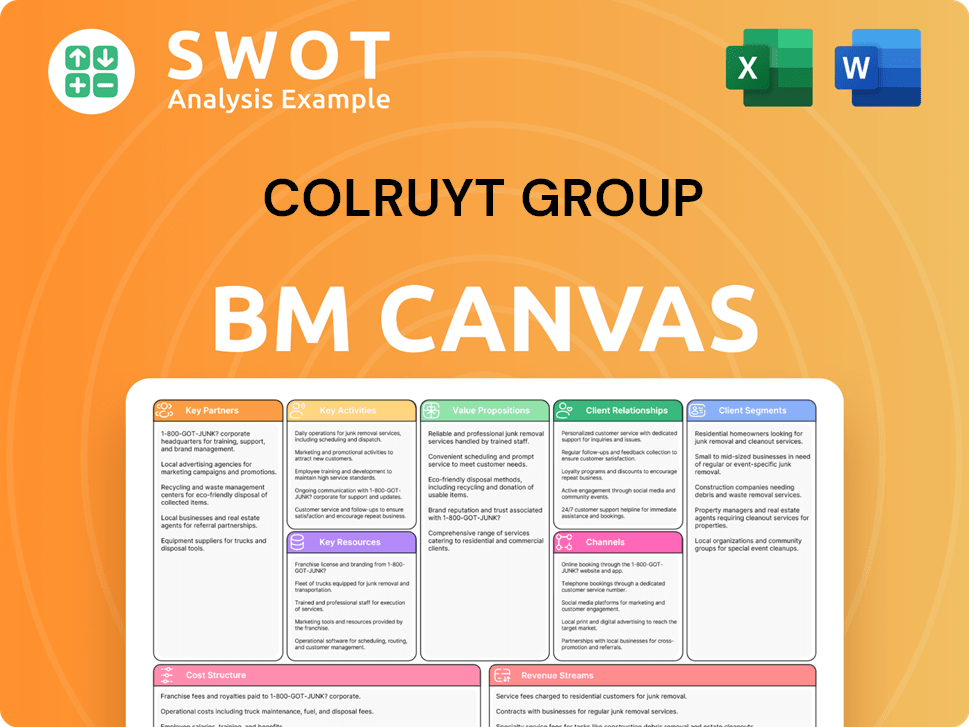

Colruyt Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Colruyt Group’s Ownership Landscape?

Over the past three to five years, the ownership structure of Colruyt Group has largely remained consistent, with the Colruyt family maintaining significant influence through Korys. This stability is a key feature of the company's profile. While there haven't been major shifts in share ownership through buybacks or secondary offerings, the company's strategic investments and operational expansions continue to influence its valuation and market perception. Leadership changes, such as CEO transitions, have occurred within the existing ownership framework, often involving family members or long-standing executives.

Industry trends, such as increasing institutional ownership, also apply to Colruyt Group, with institutional investors holding a portion of its publicly traded shares. However, the family's foundational control acts as a counterbalance to potential founder dilution or activist investor influence. There have been no public statements suggesting a planned succession that would fundamentally alter the family's controlling stake, nor indications of privatization or a significant change in its public listing status. This suggests a continuation of the established ownership structure, supporting Colruyt Group's long-term business model. For further insights into the company's strategic direction, consider reading about the Target Market of Colruyt Group.

The Colruyt family, through Korys, maintains a strong controlling stake. Institutional investors hold a portion of the publicly traded shares. No significant changes are expected in the near future regarding the family's control.

The primary shareholders are the Colruyt family and institutional investors. The family’s influence is primarily exerted through Korys. Institutional ownership provides a degree of market liquidity.

Leadership transitions have been managed internally, preserving family influence. Strategic investments and operational expansions continue. No significant changes in the ownership structure have been observed.

The trend suggests a continuation of the established ownership structure. This supports Colruyt Group's long-term, sustainable business model. No major shifts in the family's controlling stake are anticipated.

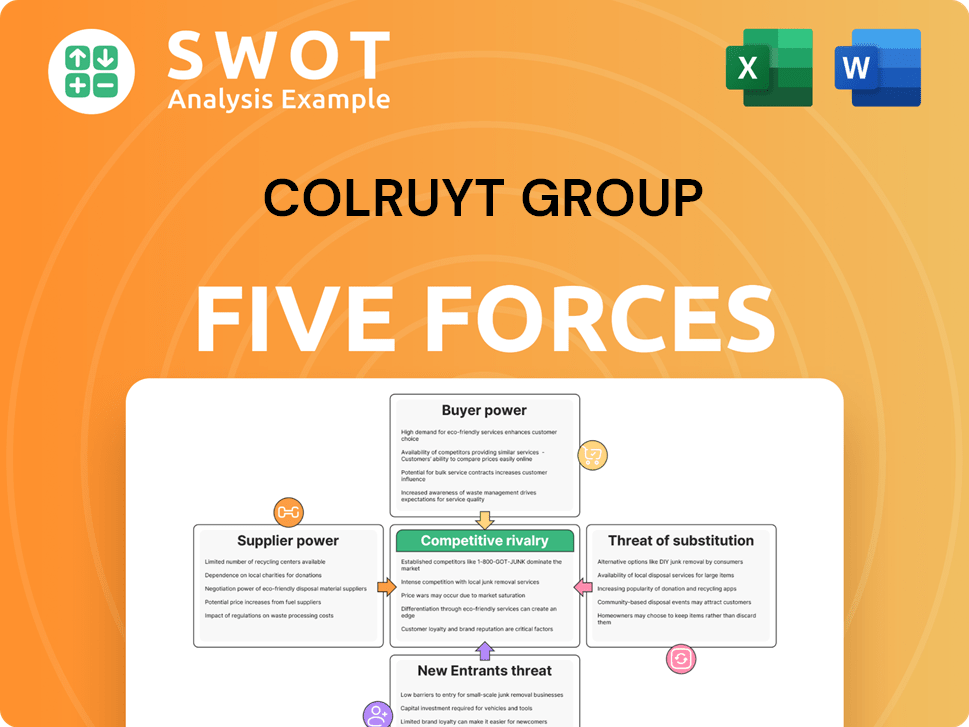

Colruyt Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Colruyt Group Company?

- What is Competitive Landscape of Colruyt Group Company?

- What is Growth Strategy and Future Prospects of Colruyt Group Company?

- How Does Colruyt Group Company Work?

- What is Sales and Marketing Strategy of Colruyt Group Company?

- What is Brief History of Colruyt Group Company?

- What is Customer Demographics and Target Market of Colruyt Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.