Colruyt Group Bundle

Unpacking Colruyt Group: How Does This Retail Giant Thrive?

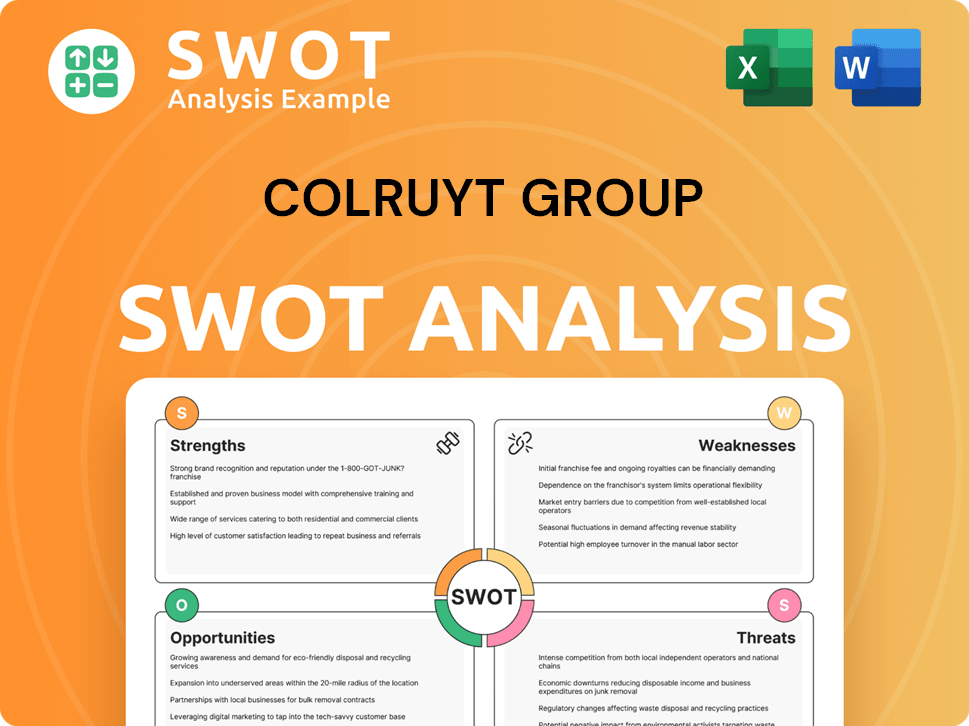

Ever wondered how a Colruyt Group SWOT Analysis reveals the secrets behind a leading retail company? Colruyt Group, a prominent Belgian supermarket and discount grocery store, has built a reputation for efficiency and low prices. But how does this Belgian supermarket actually work, and what drives its consistent success in a competitive market?

This exploration of the Colruyt business model will uncover the core strategies that allow Colruyt to maintain its competitive edge. We'll delve into its supply chain, pricing strategies, and expansion plans, providing a comprehensive view of how Colruyt Group operates its stores. Understanding these elements is crucial for anyone seeking insights into the dynamics of the retail sector and the keys to long-term sustainability.

What Are the Key Operations Driving Colruyt Group’s Success?

The core operations of Colruyt Group revolve around its multi-format retail strategy. This retail company offers a diverse range of products and services through various store formats. These formats are designed to cater to different customer segments and shopping preferences, making Colruyt a versatile player in the market.

Colruyt Group manages a significant portion of its supply chain. This includes sourcing, processing, logistics, and distribution, which allows for greater control over quality and cost. The company's focus on efficiency and vertical integration is a key aspect of its Colruyt business model. This approach helps maintain its commitment to offering 'lowest prices' to customers.

The value proposition of Colruyt Group centers on providing affordability, convenience, and a trusted shopping experience. This is achieved through meticulous cost control, efficient inventory management, and a strong emphasis on private label products. The company's commitment to sustainability also differentiates it in the market, appealing to environmentally conscious consumers.

Colruyt Group operates various supermarket chains, including Colruyt Lowest Prices, OKay, Bio-Planet, and Spar. It also has specialized stores like DreamLand and DATS 24. These stores offer a wide range of products, from food items and fresh produce to household goods and non-food assortments, catering to a broad customer base.

The company's operational processes are characterized by a strong emphasis on efficiency and vertical integration. This includes managing a significant portion of its supply chain, from sourcing and processing to logistics and distribution. Advanced warehousing and transportation systems ensure timely delivery and minimize waste.

Colruyt Group is known for its 'lowest prices' strategy, particularly in its flagship Colruyt stores. This is achieved through meticulous cost control and efficient inventory management. The extensive private label range offers quality products at competitive prices, enhancing the value proposition for customers.

Colruyt Group differentiates itself through its commitment to sustainability, investing in renewable energy and responsible sourcing practices. This translates into direct customer benefits such as affordability, convenience, and a trusted shopping experience. This approach contributes to market differentiation in a competitive retail landscape.

Colruyt Group employs several key strategies to maintain its competitive edge. These include a focus on cost control, efficient supply chain management, and a commitment to sustainability. The company continually adapts to evolving consumer shopping habits by expanding its online platforms.

- Cost Leadership: The company's primary strategy is to offer the lowest prices, achieved through rigorous cost control and operational efficiency.

- Vertical Integration: Colruyt Group manages a significant portion of its supply chain, from sourcing to distribution, to maintain control over costs and quality.

- Sustainability Initiatives: The company invests in renewable energy and responsible sourcing, appealing to environmentally conscious consumers.

- Multi-Format Retail: Colruyt operates various store formats to cater to different customer segments and shopping preferences.

Colruyt Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Colruyt Group Make Money?

The Colruyt Group's revenue streams are primarily driven by product sales across its diverse retail formats. The company operates a multi-format retail strategy, encompassing food retail, non-food retail, and wholesale activities. The Colruyt business model is centered around offering a wide range of products at competitive prices, focusing on efficiency and cost management to maximize profitability.

As a leading retail company, Colruyt Group generates significant revenue from its food retail segment, including stores like Colruyt, OKay, and Bio-Planet. Non-food retail, through stores such as DreamLand, also contributes to the company's financial performance. The company's wholesale activities and energy division, DATS 24, further diversify its revenue sources.

In the fiscal year 2023/2024, Colruyt Group reported a net revenue of €10.8 billion, reflecting a 7.5% increase compared to the previous year. The Belgian supermarket chain consistently emphasizes its 'lowest prices' guarantee, driving high sales volumes and customer loyalty. This strategy, combined with a strong private label offering, supports its overall revenue generation.

Food retail remains the cornerstone of Colruyt Group's revenue, with Colruyt stores being a major contributor. OKay and Bio-Planet supermarkets also play a significant role in this segment.

DreamLand and Dreambaby stores contribute to the overall revenue, offering a variety of products beyond groceries.

Wholesale activities supply goods to independent retailers, while DATS 24 provides fuel and energy solutions, diversifying revenue streams.

The 'lowest prices' guarantee is a key monetization strategy, attracting customers and driving sales. This is particularly evident in their discount grocery store format.

A strong private label strategy supports attractive margins and fosters customer loyalty, contributing significantly to profitability.

Loyalty programs and the expansion of online retail platforms, including click-and-collect services, enhance customer engagement and provide additional revenue channels.

The Colruyt Group employs several monetization strategies to maximize revenue and profitability. These include competitive pricing, a strong private label strategy, and the expansion of online retail. The company's focus on efficiency and customer loyalty further supports its financial performance. For more details, see the Growth Strategy of Colruyt Group.

- Competitive Pricing: The 'lowest prices' guarantee is a core strategy.

- Private Label: Offers attractive margins and fosters customer loyalty.

- Loyalty Programs: Incentivize repeat purchases and gather customer data.

- Online Retail: Expansion of online platforms and click-and-collect services.

- Energy Division: Diversification into electric charging stations and hydrogen.

- Cross-Selling: Leveraging diverse retail formats to capture consumer spending.

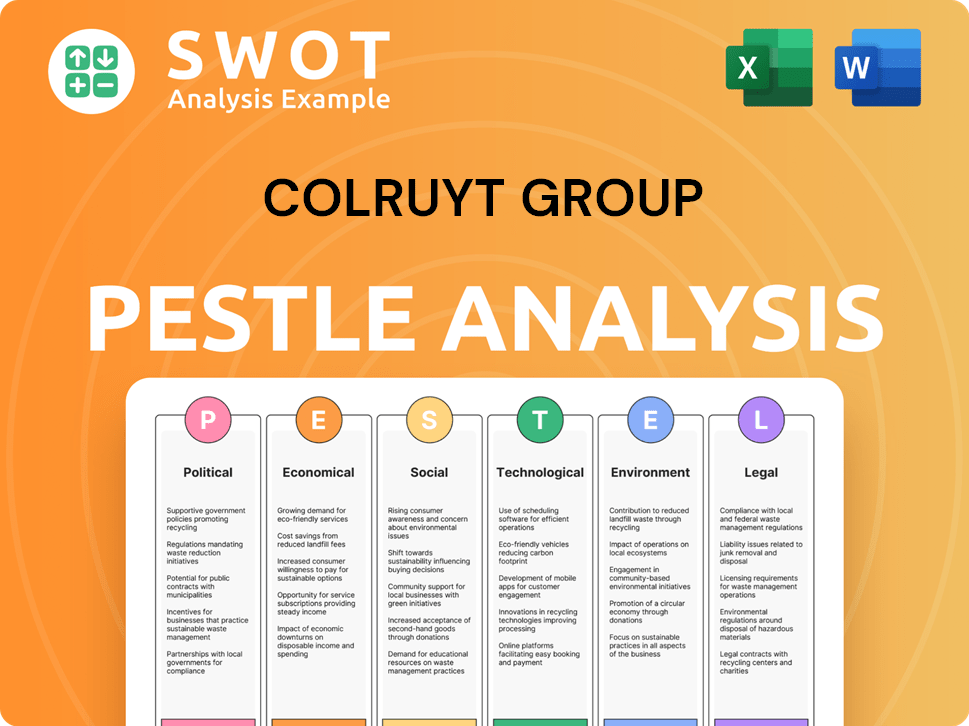

Colruyt Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Colruyt Group’s Business Model?

The evolution of the Colruyt Group has been marked by strategic expansions and operational refinements. The company's journey includes significant milestones in its retail portfolio and geographic reach. A core element of its strategy involves maintaining a 'lowest prices' approach, supported by efficient logistics and a strong private label offering. The Colruyt business model emphasizes cost leadership and operational excellence to maintain its competitive edge in the retail sector.

Key strategic moves include the expansion into France and Luxembourg, broadening its market presence. Operational challenges, such as intense price competition and evolving consumer preferences, have driven the company to adapt. Colruyt Group has invested heavily in e-commerce and sustainable product offerings, demonstrating its commitment to meeting changing market demands. The company's adaptability is evident in its investments in digitalization and energy solutions.

Colruyt Group's competitive advantages are multifaceted, including a strong brand reputation, a vertically integrated supply chain, and economies of scale. The company's focus on innovation in logistics and energy solutions, such as DATS 24, further enhances its market position. The Retail company continues to adapt by investing in digitalization, optimizing its physical store network, and exploring new energy solutions to ensure its business model remains robust against competitive threats and market shifts.

Colruyt Group has expanded its multi-format retail portfolio to target diverse customer segments. The company has consistently refined its 'lowest prices' strategy. Strategic geographic expansions, particularly into France and Luxembourg, have broadened its market reach.

Investments in e-commerce capabilities and sustainable product lines, such as Bio-Planet, highlight its response to evolving consumer preferences. Colruyt Group has invested in its distribution network and retail infrastructure, with a recent announcement of €500 million for the 2024/2025 fiscal year. This investment aims to enhance efficiency and improve customer experience.

The brand strength of Colruyt, particularly its reputation for value, fosters strong customer loyalty. Its vertically integrated supply chain provides cost advantages and quality control. Economies of scale, derived from its extensive store network, enhance competitive pricing.

The company faces intense price competition in the retail sector. Adapting to evolving consumer preferences, such as the growing demand for online shopping and sustainable products, is crucial. Maintaining profitability while offering low prices requires continuous efficiency improvements and supply chain optimization. For more insights, check out the Competitors Landscape of Colruyt Group.

Colruyt Group's success is built on a foundation of cost leadership, operational efficiency, and strategic expansion. The company's commitment to offering the lowest prices has cultivated strong customer loyalty. Its vertically integrated model and economies of scale further strengthen its market position.

- Focus on Lowest Prices: The company's core strategy revolves around offering the lowest prices to customers.

- Efficient Supply Chain: A vertically integrated supply chain reduces costs and enhances control over product quality.

- Multi-Format Retail: Operating different store formats to cater to diverse customer segments.

- Sustainability Initiatives: Investments in sustainable practices and products to meet evolving consumer demands.

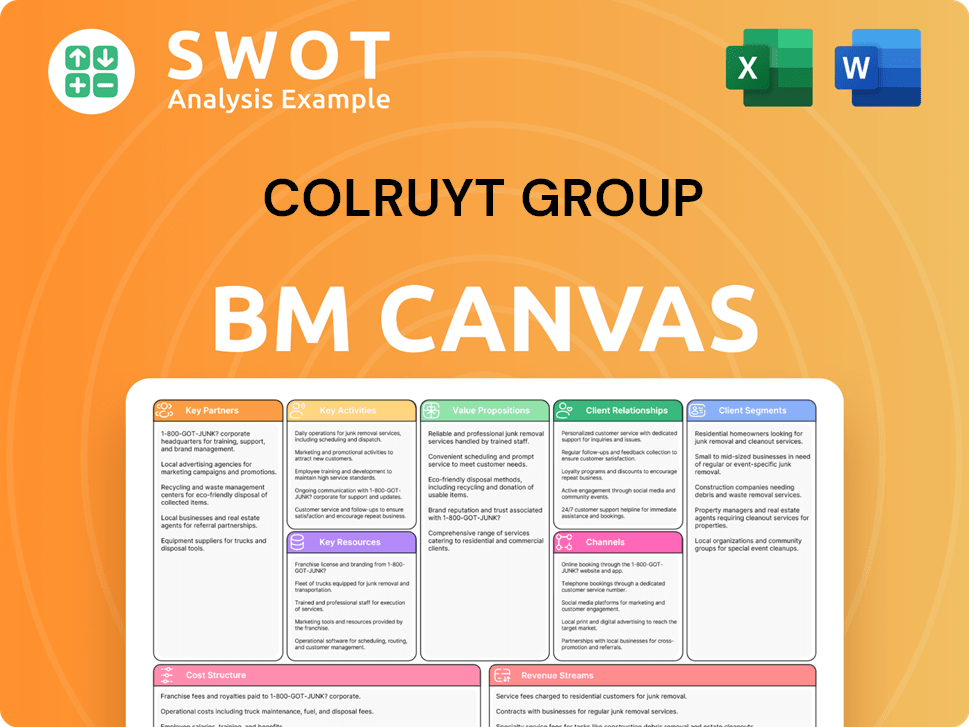

Colruyt Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Colruyt Group Positioning Itself for Continued Success?

The Colruyt Group, a prominent retail company, holds a strong position within the Belgian retail market. It also maintains a significant presence in France and Luxembourg. Its success is largely attributed to its Colruyt Lowest Prices format, which emphasizes competitive pricing and a streamlined shopping experience. The company's focus is on deep market penetration within the Benelux region and parts of France, rather than broad international expansion.

Despite its established market position, Colruyt Group faces several challenges. These include intense competition, regulatory changes, economic fluctuations, and the need to adapt to technological advancements. The company must navigate these risks while continuing to innovate and maintain its commitment to customer satisfaction and operational efficiency.

The company is a leading player in the Belgian retail sector. It has a substantial market share, driven by its discount grocery store format. Its focus is primarily on the Benelux region and parts of France.

Intense competition from traditional and online retailers is a major challenge. Regulatory changes and economic downturns can also impact operations. Technological disruption necessitates continuous investment.

The company is focused on optimizing operational efficiency and enhancing customer experience. Expansion of its online presence and click-and-collect services is a priority. Sustainability initiatives offer potential for cost savings and new revenue streams.

Investments in logistics and the customer experience are ongoing. The company is expanding its online presence. Sustainability efforts include energy initiatives.

The Colruyt Group is focused on maintaining its competitive edge through several key strategies. These strategies are designed to address market dynamics and ensure long-term profitability. For more insights, consider exploring the Marketing Strategy of Colruyt Group.

- Optimizing operational efficiency across all formats.

- Expanding its online presence and enhancing click-and-collect services.

- Investing in sustainable practices and energy initiatives.

- Focusing on customer loyalty through consistent pricing and a streamlined shopping experience.

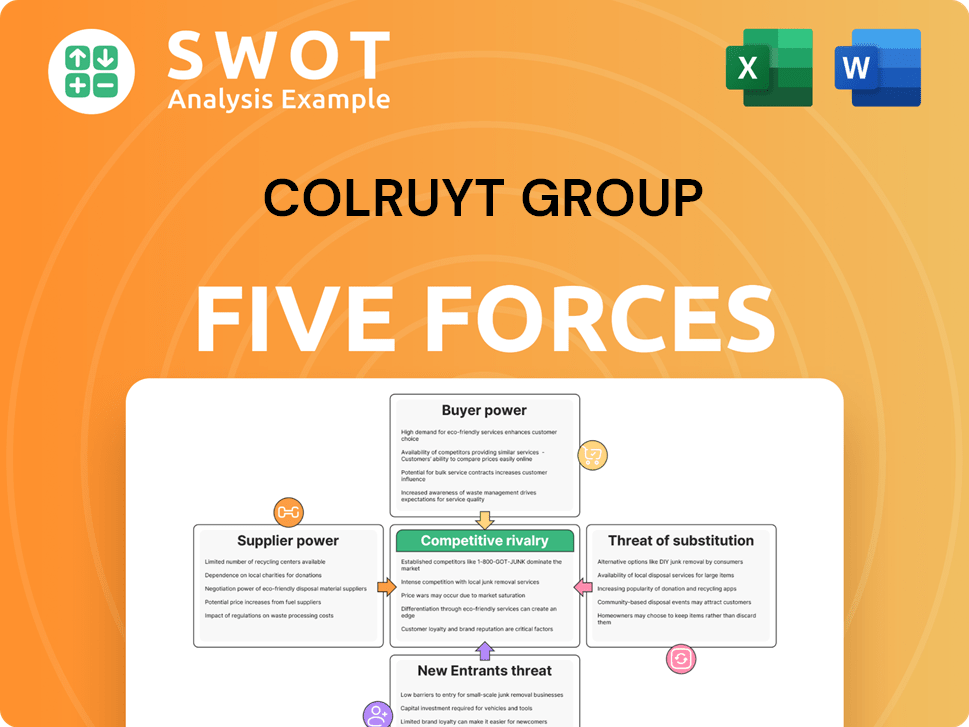

Colruyt Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Colruyt Group Company?

- What is Competitive Landscape of Colruyt Group Company?

- What is Growth Strategy and Future Prospects of Colruyt Group Company?

- What is Sales and Marketing Strategy of Colruyt Group Company?

- What is Brief History of Colruyt Group Company?

- Who Owns Colruyt Group Company?

- What is Customer Demographics and Target Market of Colruyt Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.