Dominion Energy Bundle

Can Dominion Energy Power Up Your Portfolio?

As the energy landscape rapidly evolves, understanding the Dominion Energy SWOT Analysis is crucial for investors and strategists alike. Dominion Energy, a leading Energy Company, is aggressively pursuing a Growth Strategy centered on Renewable Energy and infrastructure development. With a market capitalization of $47.47 billion as of January 2025, the company's future hinges on its ability to navigate climate regulations and consumer demands.

This exploration delves into Dominion Energy's Future outlook, examining its ambitious expansion plans and strategic plan to meet growing energy demands, particularly from data centers. We'll analyze their Dominion Energy growth initiatives and commitment to a sustainable energy future, providing insights into potential Dominion Energy investment opportunities. Furthermore, we will explore the Dominion Energy renewable energy projects and how they align with the company's long term strategy, offering a comprehensive perspective on this Utility Company.

How Is Dominion Energy Expanding Its Reach?

Dominion Energy is aggressively pursuing expansion initiatives to meet the rising demand for electricity and capitalize on growth opportunities. These initiatives are primarily driven by the increasing need for power, especially from the rapidly expanding data center sector in Virginia. The company's strategic plan focuses on significant investments in infrastructure and renewable energy sources to ensure a sustainable and reliable energy supply.

The company's commitment to renewable energy is a cornerstone of its expansion strategy. This involves substantial investments in offshore wind, solar energy, and battery storage. These projects are designed not only to diversify the company's energy portfolio but also to align with state-level mandates for clean energy generation. The company aims to achieve 100% carbon-free electricity by 2045 in Virginia, demonstrating a strong commitment to sustainability.

Dominion Energy's expansion plans are supported by strategic partnerships and market entries. These include exploring small modular reactors (SMRs) and expanding electric vehicle (EV) charging infrastructure. These initiatives are designed to meet growing energy demand, diversify revenue streams, and align with state-level renewable energy mandates. For more insights, consider exploring Owners & Shareholders of Dominion Energy.

Dominion Energy plans to invest a substantial amount from 2025 to 2029. This investment is a significant increase from previous estimates, reflecting the scale of the expansion projects. The company is focused on building a robust and sustainable energy infrastructure to meet the growing demand for electricity.

The company's Integrated Resource Plan (IRP) projects the addition of 20 GW of carbon-free power generation over the next 15 years. This includes significant contributions from offshore wind, solar energy, and battery storage. These projects are essential for achieving the company's goal of 100% carbon-free electricity in Virginia by 2045.

The data center sector in Virginia is experiencing rapid growth, increasing the demand for electricity. The company's data center power capacity under contract nearly doubled from 21 GW in July 2024 to 40 GW in December 2024. This growth necessitates significant investments in infrastructure to meet the increasing power needs.

Dominion Energy is forming strategic partnerships to expand its operations and diversify its offerings. The company acquired the Kitty Hawk North Wind offshore wind lease from Avangrid for approximately $160 million in the fourth quarter of 2024. The company is also partnering with Blue Whale EV to expand electric vehicle (EV) charging infrastructure across Virginia.

Dominion Energy's expansion initiatives are multifaceted, focusing on infrastructure investment, renewable energy, and strategic partnerships. The company's investment from 2025 to 2029 is projected to be $50.1 billion, a significant increase from the previous estimate of $43.2 billion. This reflects the scale of the planned projects and the company's commitment to growth.

- Coastal Virginia Offshore Wind (CVOW): A $10 billion project with 176 offshore wind turbines expected to power 650,000 homes by late 2026.

- Solar Energy Expansion: Adding 12 GW of solar energy capacity by expanding the company's current solar capacity from 4.75 GW.

- Battery Storage: Deploying 4.5 GW of battery storage by 2039.

- Small Modular Reactors (SMRs): Exploring SMR development at Dominion's North Anna plant in partnership with Amazon.

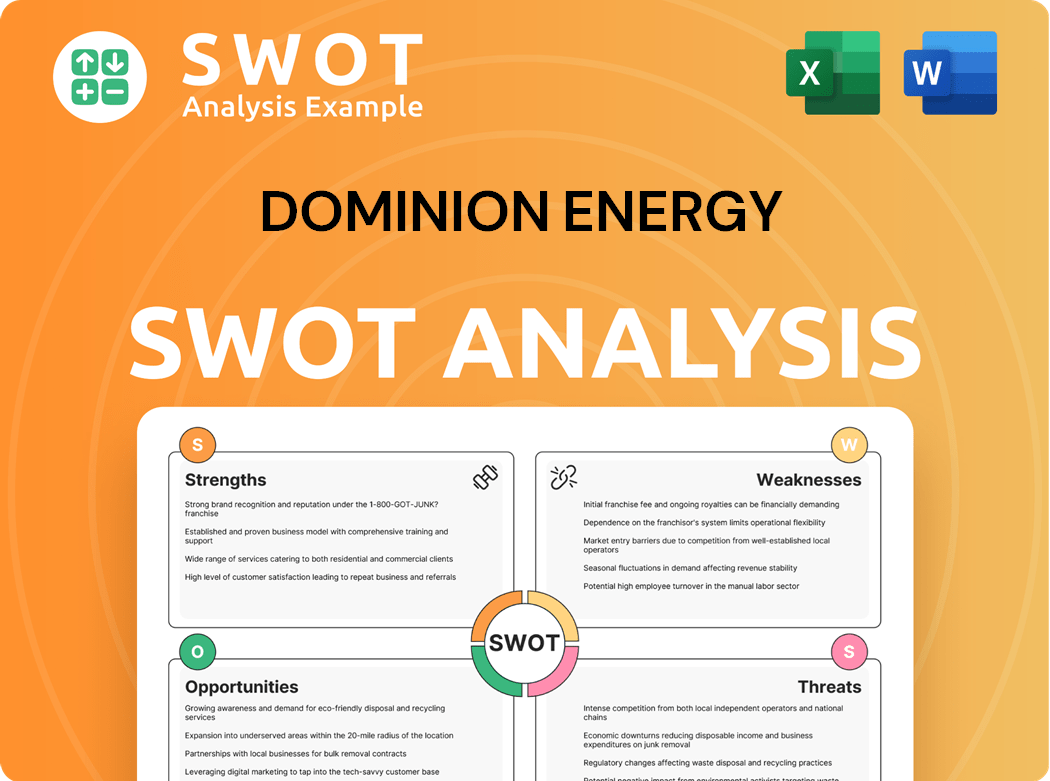

Dominion Energy SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Dominion Energy Invest in Innovation?

Dominion Energy is strategically leveraging innovation and technology to drive its growth and adapt to the evolving energy landscape. This approach is crucial for the company to meet the increasing demands for reliable and sustainable energy solutions. The company's commitment to digital transformation and grid modernization is a key element of its long-term strategy.

The company's focus on integrating cutting-edge energy solutions and enhancing its infrastructure underscores its commitment to providing efficient and environmentally responsible services. These initiatives are designed to improve operational efficiency, reduce costs, and support the transition to a cleaner energy future. This strategy is essential for maintaining a competitive edge in the utility sector.

Dominion Energy's growth strategy includes significant investments in grid modernization and the integration of renewable energy sources. The company is actively working to enhance the reliability and resilience of its grid infrastructure, which is vital for meeting customer needs and supporting the growth of renewable energy. For more on the company's foundational principles, see Mission, Vision & Core Values of Dominion Energy.

The Grid Transformation Plan involves substantial capital investments. Phase III of the plan, spanning 2024-2026, includes approximately $1 billion in investments. This phase focuses on 'grid hardening' projects to reduce customer outages, improving the reliability of the energy supply.

A new Phase IIIB of the Grid Transformation Plan was filed in March 2025. This phase proposes an additional $278.3 million in capital investment. It also includes $4.5 million in operations and maintenance for main feeder hardening and a new outage management system.

Dominion Energy is modernizing distribution stations. This involves upgrading components to improve reliability and maintain voltage stability. These upgrades also increase overall visibility of grid operations, which contributes to faster outage response times.

The company is enhancing physical security at substations. These measures are designed to mitigate emerging threats and protect against cyber and physical attacks. This is a critical step in ensuring the resilience of the energy infrastructure.

The 2024 Integrated Resource Plan outlines the addition of 4.5 GW of battery storage by 2039. This expansion is crucial for ensuring grid reliability as renewable energy sources become more prevalent. Battery storage helps balance the intermittent nature of renewables.

Dominion Energy is exploring the use of small modular nuclear reactors (SMRs). This initiative aims to diversify energy sources and provide consistent carbon-free power. A memorandum of understanding was signed with Amazon in October 2024 to explore SMR development.

Dominion Energy is implementing digital tools to enhance operational efficiency and reduce costs. These tools include sensors and data acquisition systems for real-time monitoring and control of production, logistics, and energy consumption. The data collected is used in an interactive platform for analysis and reporting.

- Predictive Maintenance: Digital tools facilitate predictive maintenance programs.

- Data-Driven Decision-Making: Dashboards and reports enable analysis of progress and adherence to KPIs.

- ESG Goals: These digital initiatives contribute to the company's ESG goals and aim to reduce emissions.

- Cost Reduction: The overall goal is to achieve cost reductions and improve decision-making through data analysis.

Dominion Energy PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Dominion Energy’s Growth Forecast?

The financial outlook for Dominion Energy is shaped by its strategic focus on regulated assets and clean energy initiatives. Despite recent challenges, the company is positioning itself for sustained growth. The company's commitment to infrastructure investments and its shift towards a pure-play, regulated utility model are key drivers of its future financial performance.

For the full year 2024, Dominion Energy reported GAAP net income of $2.44 per share and operating earnings (non-GAAP) of $2.77 per share. The company's financial strategy involves significant capital expenditure, particularly in its regulated utility businesses, to meet the growing energy demands of its service territories. This focus on regulated assets provides a stable foundation for earnings growth.

Looking ahead, Dominion Energy has narrowed its 2025 operating earnings per share (EPS) guidance range to $3.28 to $3.52, maintaining the original midpoint of $3.40 per share. Furthermore, the company reaffirmed its long-term operating EPS growth guidance of 5% to 7% through 2029, based on the 2025 operating EPS midpoint excluding RNG 45Z ($3.30 per share). This demonstrates confidence in its long-term growth prospects.

In the first quarter of 2025, Dominion Energy reported GAAP net income of $646 million, or $0.75 per share, a significant increase from $441 million, or $0.50 per share, in Q1 2024. Operating earnings (non-GAAP) for Q1 2025 were $803 million, or $0.93 per share, up from $485 million, or $0.55 per share, in Q1 2024. Operating revenue also increased to $4.076 billion from $3.632 billion in the previous year.

To meet growing energy demands, Dominion Energy plans to spend $50.1 billion from 2025 to 2029 on infrastructure investments, an increase from a previous estimate of $43.2 billion. This substantial investment is a key driver for projected earnings growth. The company's focus on regulated assets and clean energy projects is expected to support long-term value creation.

While the dividend yield of 5.06% is attractive, the high payout ratio of 121.36% raises questions about sustainability. However, the long-term goal is to return to dividend growth, supported by the projected 5% to 7% earnings growth. Recent asset sales, such as the gas distribution operations and a stake in the Coastal Virginia Offshore Wind project, have strengthened the balance sheet.

In 2024, Dominion Energy completed the sale of its gas distribution operations to Enbridge Inc. for $14 billion (CAD 19 billion), strengthening its balance sheet. The sale of a 50% noncontrolling equity interest in the Coastal Virginia Offshore Wind (CVOW) project to Stonepeak Partners, LLC for $2.6 billion further reduced debt by $2.1 billion and secured a partner for construction costs.

The financial performance and outlook of Dominion Energy are shaped by key factors. These include strategic investments, earnings growth, and asset sales. The company's focus on clean energy and regulated assets positions it for long-term success. For a more detailed analysis, consider reading about the company's growth strategy.

- Operating earnings per share (EPS) guidance for 2025: $3.28 to $3.52.

- Long-term operating EPS growth guidance: 5% to 7% through 2029.

- Capital investment plan (2025-2029): $50.1 billion.

- Dividend yield: 5.06%.

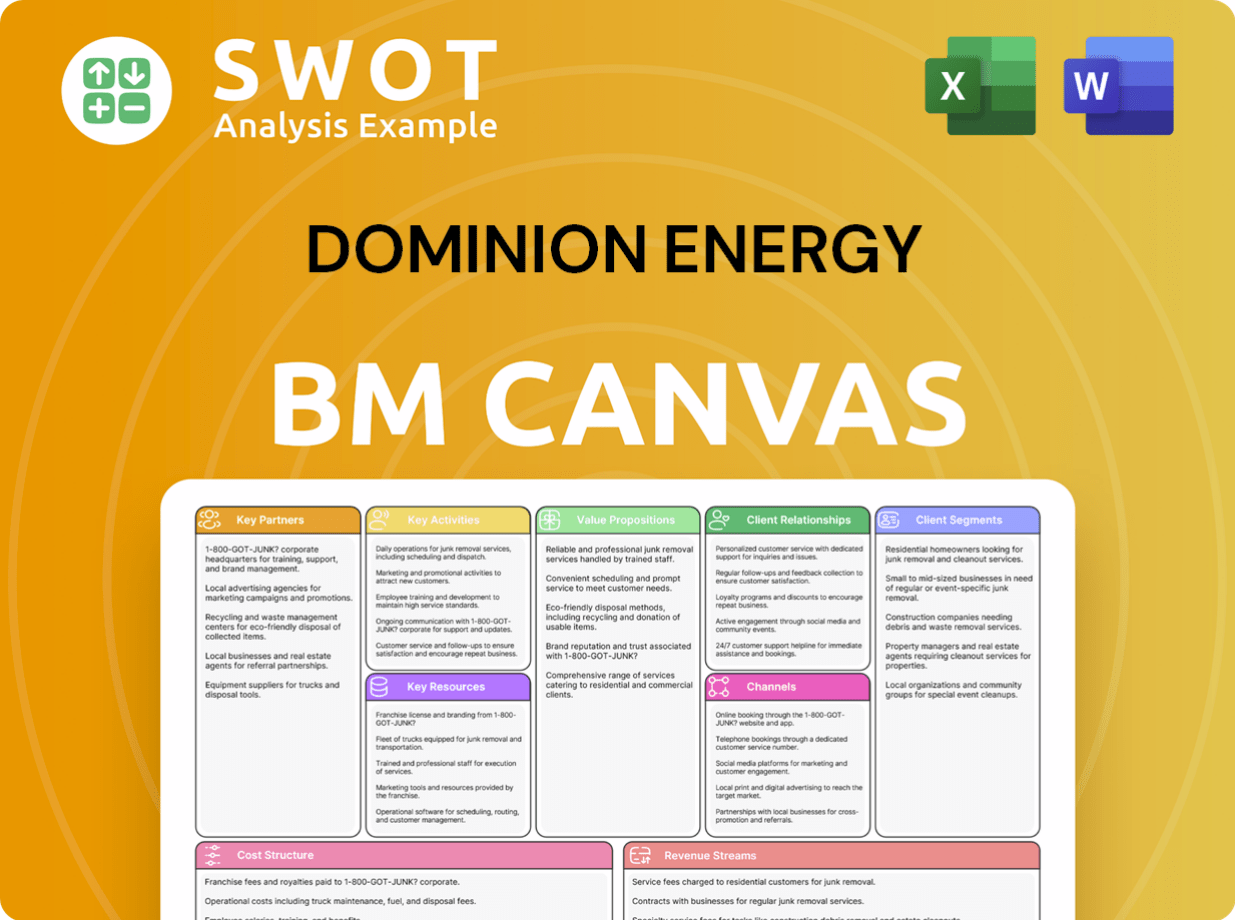

Dominion Energy Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Dominion Energy’s Growth?

The growth strategy of Dominion Energy, a prominent Energy Company, faces several risks and obstacles. Market competition and regulatory changes significantly influence its operations and investment decisions. The company's financial performance is also affected by rising project costs and supply chain vulnerabilities.

Regulatory scrutiny, particularly from bodies like the Virginia State Corporation Commission (SCC), impacts rate adjustments and energy efficiency targets. Proposed rate increases and the associated public and regulatory scrutiny can create challenges for the company. The company's focus on regulated assets is a key part of its Dominion Energy Future plans.

Additionally, Dominion Energy must navigate investor scrutiny and a substantial debt burden. The sustainability of its dividends and the need to manage rising project costs pose further hurdles. The company is actively engaging in risk management frameworks and strategic financial management to mitigate these challenges.

The energy sector is highly competitive, with various players vying for market share. This competition influences Dominion Energy's ability to attract and retain customers, especially in the evolving landscape of Renewable Energy. The company's Growth Strategy must account for these competitive pressures.

The energy industry is heavily regulated, and changes in regulations can significantly impact Dominion Energy. The Virginia SCC regularly reviews rate adjustments and energy efficiency targets. These regulatory shifts can affect the company's investment decisions and operational strategies.

Rising project costs are a major obstacle, as seen with the Coastal Virginia Offshore Wind (CVOW) project. The estimated cost increased by 9%, from $9.8 billion to $10.7 billion. These increases, combined with potential tariff impacts, could negatively affect the company's financial performance.

Supply chain vulnerabilities pose risks to project timelines and costs. Disruptions in the supply chain can delay projects and increase expenses. These vulnerabilities require careful management to minimize their impact on Dominion Energy's operations and financial results.

Reliance on natural gas generation may face pressure from environmental groups. These groups advocate for cleaner energy sources, potentially affecting the company's long-term energy mix. This could impact the company's Dominion Energy Future and its strategic planning.

Investor scrutiny is another significant risk, with investigations into potential securities fraud violations related to the CVOW project. The company's high debt burden of $43 billion is a major concern. Addressing these issues is crucial for maintaining investor confidence and financial stability.

To mitigate these risks, Dominion Energy focuses on regulated assets and contracted energy to improve cash flows. The company also actively engages in risk management frameworks and scenario planning. The sale of a 50% noncontrolling interest in the CVOW project to Stonepeak for $2.6 billion in October 2024 was a risk mitigation strategy, reducing debt and securing a partner to share construction costs.

The company seeks regulatory approvals for its projects, such as the Golden-Mars 500-230 kV Electric Transmission Project, to support growth. Despite community protests, Dominion Energy aims to address its debt burden and manage rising project costs through strategic financial management. For more insights, you can read about the Brief History of Dominion Energy.

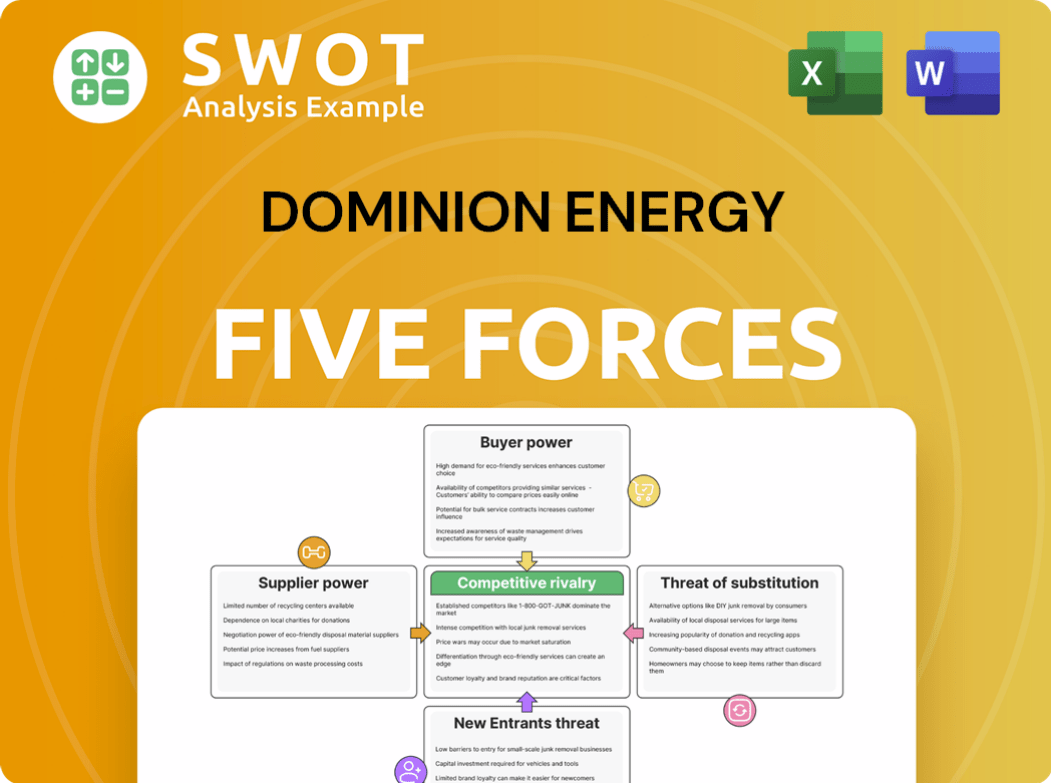

Dominion Energy Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Dominion Energy Company?

- What is Competitive Landscape of Dominion Energy Company?

- How Does Dominion Energy Company Work?

- What is Sales and Marketing Strategy of Dominion Energy Company?

- What is Brief History of Dominion Energy Company?

- Who Owns Dominion Energy Company?

- What is Customer Demographics and Target Market of Dominion Energy Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.