Dominion Energy Bundle

Who Really Owns Dominion Energy?

Ever wondered who pulls the strings at one of America's energy giants? Understanding the Dominion Energy SWOT Analysis reveals a lot about its strategic positioning. Recent shifts, like the 2024 divestment of its natural gas distribution businesses, have dramatically reshaped the company. This exploration will uncover the core of Dominion Energy ownership.

Dominion Energy's story, from its roots in 1909 to its current status as a leader in renewable energy, is a fascinating study in corporate evolution. Knowing who the Dominion Energy shareholders are and understanding the Dominion Energy parent company provides crucial insights. This deep dive into Dominion Energy ownership will reveal the key players and their influence on the company's future, including the role of Dominion Energy executives.

Who Founded Dominion Energy?

The story of Dominion Energy begins with its earliest corporate ancestor, the Virginia Railway & Power Company (VR&P). Founded by Frank Jay Gould on June 29, 1909, this marked the initial step in what would become a major player in the energy sector. VR&P later acquired Virginia Passenger & Power, setting the stage for future developments.

In 1925, a significant shift occurred when a syndicate led by Stone & Webster, Inc., a New York-based engineering and consulting firm, acquired VR&P. Following this acquisition, the company was renamed the Virginia Electric and Power Company (VEPCO). This transition highlights the evolving ownership and strategic direction of the company during its early years.

While specific details about Frank Jay Gould's initial equity or shareholding percentages are not available, his founding role is clear. The company's focus in its early years, particularly as VEPCO, was firmly on electric power generation, laying the foundation for its future as a utility company. The evolution of Dominion Energy ownership can be traced through these key moments.

The early history of Dominion Energy reveals a transformation from its roots in the Virginia Railway & Power Company. Frank Jay Gould's founding of VR&P in 1909 was a pivotal moment. The subsequent acquisition by Stone & Webster, Inc., in 1925 and the renaming to VEPCO marked significant changes in the company's ownership structure and strategic direction. To learn more about the company's history, you can read Brief History of Dominion Energy.

- Frank Jay Gould founded the Virginia Railway & Power Company (VR&P) in 1909.

- VR&P later acquired Virginia Passenger & Power.

- Stone & Webster, Inc. acquired VR&P in 1925.

- VR&P was renamed Virginia Electric and Power Company (VEPCO) after the Stone & Webster acquisition.

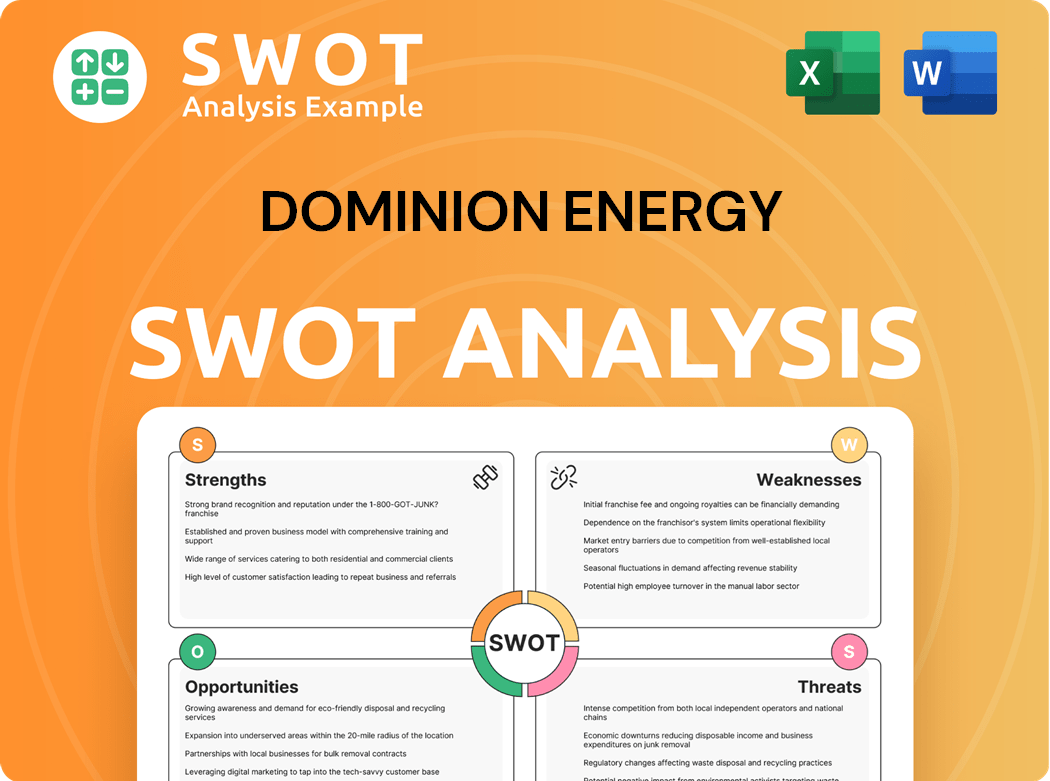

Dominion Energy SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Dominion Energy’s Ownership Changed Over Time?

The ownership structure of Dominion Energy has evolved significantly since its inception. Initially, the company reorganized as Dominion Resources in 1983. A pivotal moment came in 2000 when it rebranded to Dominion following the acquisition of Consolidated Natural Gas Company (CNG). These changes reflect the company's growth and strategic shifts over time, shaping its current position in the energy sector. Understanding this evolution provides insight into the company's present-day structure and strategic direction.

As of June 12, 2025, Dominion Energy, Inc. demonstrates a strong institutional ownership profile. The company is listed on the NYSE under the ticker 'D'. With 2,242 institutional owners and shareholders, holding a total of 818,557,834 shares, the ownership is largely institutional. This structure highlights the confidence major financial institutions place in Dominion Energy. The company's strategic decisions, including recent divestitures, further shape its ownership landscape and future prospects.

| Key Event | Date | Impact on Ownership |

|---|---|---|

| Reorganization as Dominion Resources | 1983 | Restructured the company's operational framework. |

| Acquisition of CNG and Rebranding | 2000 | Expanded the company's portfolio and market presence. |

| Sale of Natural Gas Distribution Businesses to Enbridge Inc. | 2024 | Strengthened the balance sheet and shifted focus. |

| Sale of 50% Stake in CVOW Project to Stonepeak Partners | October 2024 | Reflected a strategic shift towards regulated electric utility operations and renewable energy investments. |

Major institutional shareholders include Vanguard Group Inc, BlackRock, Inc., and State Street Corp. BlackRock, Inc. increased its holdings by 3,011,693 shares on December 31, 2024, bringing its total to 69,476,083 shares, representing 8.30% of their portfolio. Dodge & Cox is a significant holder among investment firms. These entities play a crucial role in shaping the company's strategic direction and financial performance. For more details on how the company operates, you can review Revenue Streams & Business Model of Dominion Energy.

Dominion Energy's ownership structure is primarily institutional, with significant holdings by major investment firms.

- The company's history includes key events like reorganizations and acquisitions that shaped its current form.

- Recent divestitures reflect a strategic focus on regulated electric utility operations and renewable energy.

- Understanding the major shareholders and their investment decisions is crucial for assessing the company's future.

- The company's stock is traded on the NYSE under the ticker 'D'.

Dominion Energy PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Dominion Energy’s Board?

The current board of directors at Dominion Energy plays a critical role in the company's governance and strategic direction. At the 2025 Annual Meeting of Shareholders, held on May 7, all 11 director nominees were re-elected. This shows shareholder confidence in the current leadership. The 2025 Proxy Statement, available around March 28, 2025, provides details on the director nominees and corporate governance. The board includes members with expertise in mergers and acquisitions, financial and accounting, and public company experience.

Mr. Rigby, a board member, has experience in advancing policy and legislative initiatives, along with financial and accounting expertise from his time as CFO of PHI. This board composition is designed to provide a range of perspectives and skills to guide the company. The board's structure and the re-election of all nominees at the annual meeting highlight the stability and shareholder support for the current leadership. Understanding the board's composition is key to understanding the direction of Dominion Energy's Growth Strategy.

| Board Member | Role | Relevant Experience |

|---|---|---|

| Mr. Rigby | Board Member | Financial and Accounting Expertise |

| Director Nominees | Various | Mergers and Acquisitions, Public Company Experience |

The voting structure generally follows a one-share-one-vote principle for common stock, as is typical for publicly traded companies like Dominion Energy (NYSE: D). The approval of key proposals with a high degree of shareholder support underscores this structure. The company's compensation philosophy emphasizes pay for performance, with a substantial portion of executive compensation being equity-based or subject to performance. In 2024, the CEO's long-term incentive awards were 100% performance-based, with 93% of the payout tied to relative total shareholder return or cumulative operating earnings per share. A shareholder proposal to eliminate climate-linked incentives from executive pay was rejected at the May 7, 2025, annual meeting, showing the board's and shareholders' commitment to the company's decarbonization strategy.

The board of directors at Dominion Energy is crucial for its governance and strategic direction. The company follows a one-share-one-vote principle.

- All director nominees were re-elected in 2025.

- Executive compensation is heavily performance-based.

- Shareholders support the company's decarbonization strategy.

- The board includes members with financial expertise.

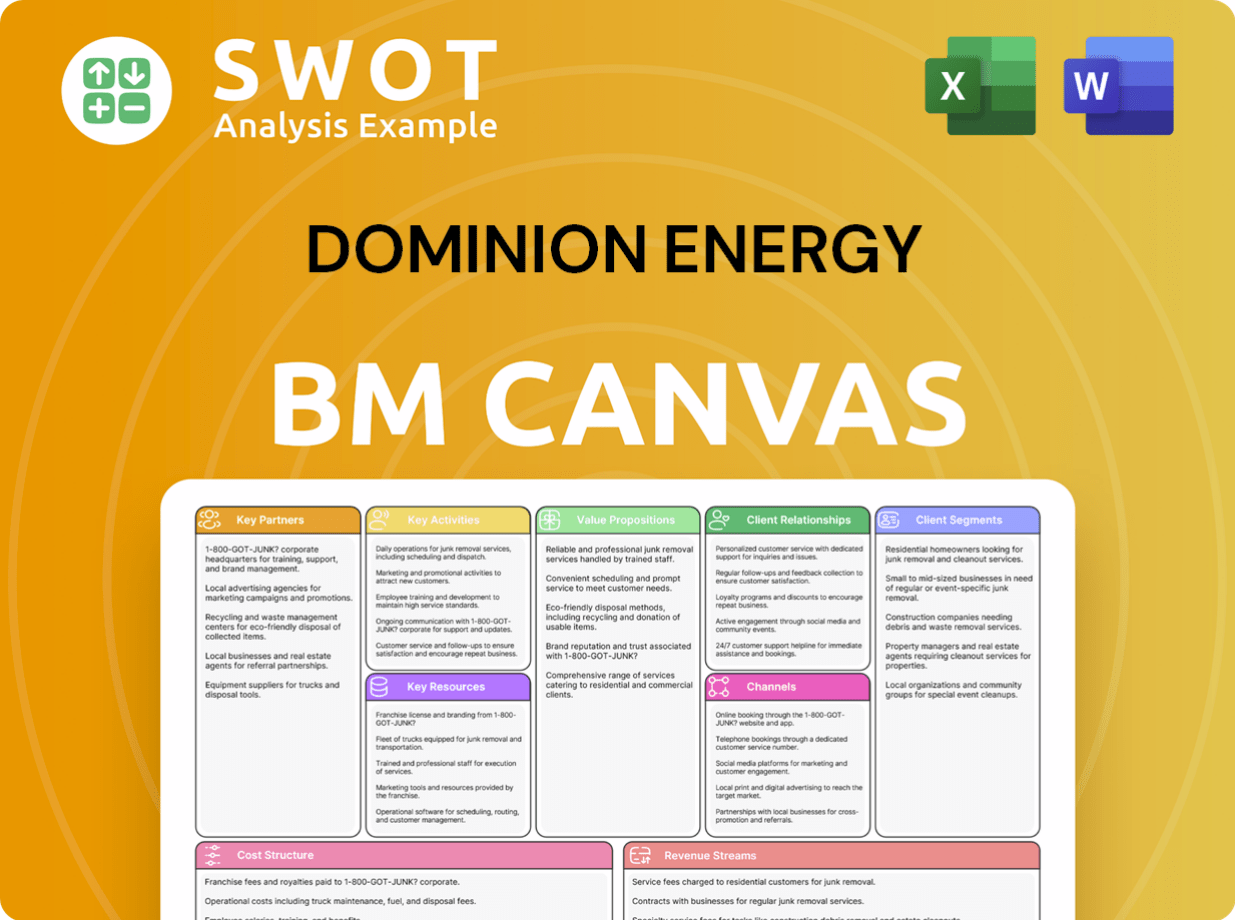

Dominion Energy Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Dominion Energy’s Ownership Landscape?

Over the past few years, significant shifts have occurred in the ownership structure and strategic direction of Dominion Energy. A major move was the divestiture of its natural gas distribution businesses, including The East Ohio Gas Company and Questar Gas Company, to Enbridge Inc. in 2024. This strategic decision aimed to streamline Dominion Energy into a pure-play, regulated utility holding company, focusing on its core operations.

In 2024, the company also repurchased common stock, totaling $801 million. Furthermore, Dominion Energy projects a consistent annual operating earnings growth of 5-7% through 2029, supported by substantial capital investments, particularly in its Virginia operations. These developments reflect a strategic pivot towards a more focused operational model and commitment to shareholder value.

| Ownership Aspect | Details | Date |

|---|---|---|

| Institutional Ownership | 2242 institutional owners | June 12, 2025 |

| Shares Held by Institutions | Over 818 million shares | June 12, 2025 |

| Stock Repurchases | $801 million | 2024 |

Executive changes were announced in late 2024 and became effective June 1, 2025. These changes include Edward H. Baine taking over utility operations and Eric S. Carr leading the nuclear fleet and contracted energy assets. Carlos M. Brown transitioned to Executive Vice President, Chief Administrative and Projects Officer, and Corporate Secretary. These leadership adjustments are designed to strengthen the company's focus on renewable energy, nuclear operations, and cost discipline. For more insights into the company's strategic positioning, consider exploring the Target Market of Dominion Energy.

Edward H. Baine now leads utility operations. Eric S. Carr leads Dominion's nuclear fleet. Carlos M. Brown is now Executive Vice President, Chief Administrative and Projects Officer.

Full-year 2025 operating earnings are affirmed at $3.28 to $3.52 per share. The midpoint of the guidance is $3.40. The company projects 5-7% annual operating earnings growth through 2029.

BlackRock, Inc. increased its stake in December 2024. Institutional ownership remains a significant factor. Dominion Energy shareholders include a large number of institutional investors.

The company is focusing on renewable energy and nuclear operations. Cost discipline is a key priority. Dominion Energy is streamlining its operations.

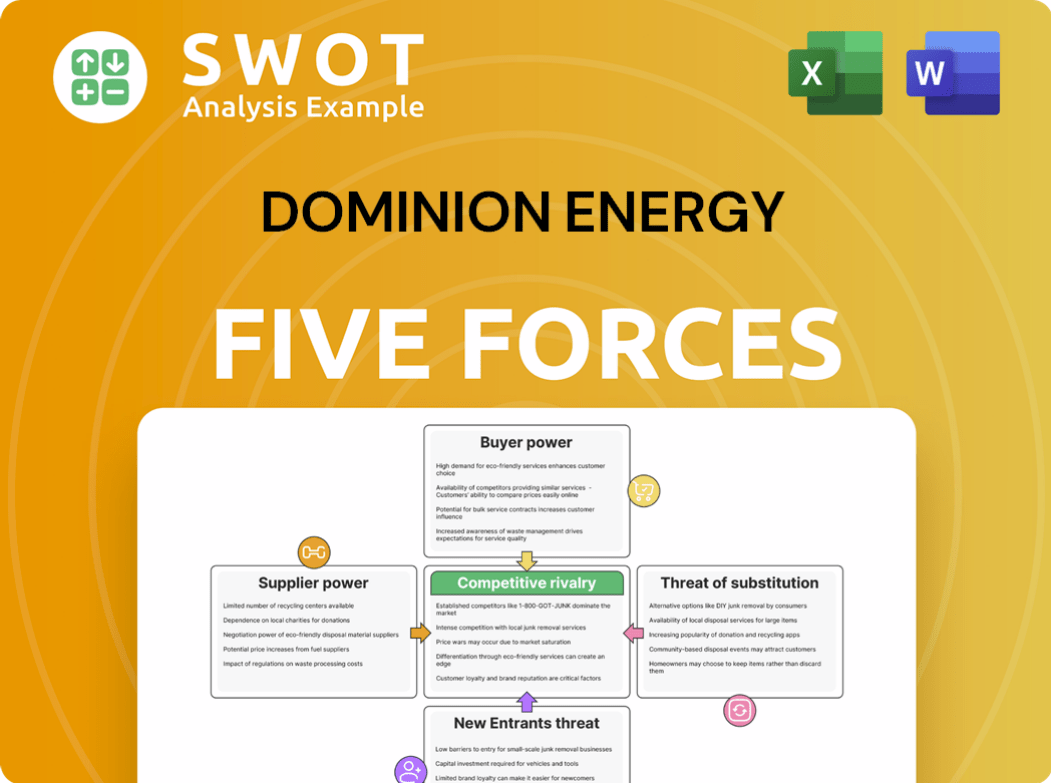

Dominion Energy Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Dominion Energy Company?

- What is Competitive Landscape of Dominion Energy Company?

- What is Growth Strategy and Future Prospects of Dominion Energy Company?

- How Does Dominion Energy Company Work?

- What is Sales and Marketing Strategy of Dominion Energy Company?

- What is Brief History of Dominion Energy Company?

- What is Customer Demographics and Target Market of Dominion Energy Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.