Dominion Energy Bundle

How Does Dominion Energy Power Our World?

Dominion Energy Company, a major player in the energy sector, delivers essential services to millions. As a leading energy provider, it's crucial to understand how this utility company operates. This exploration examines Dominion Energy's core functions and strategic direction in a changing market.

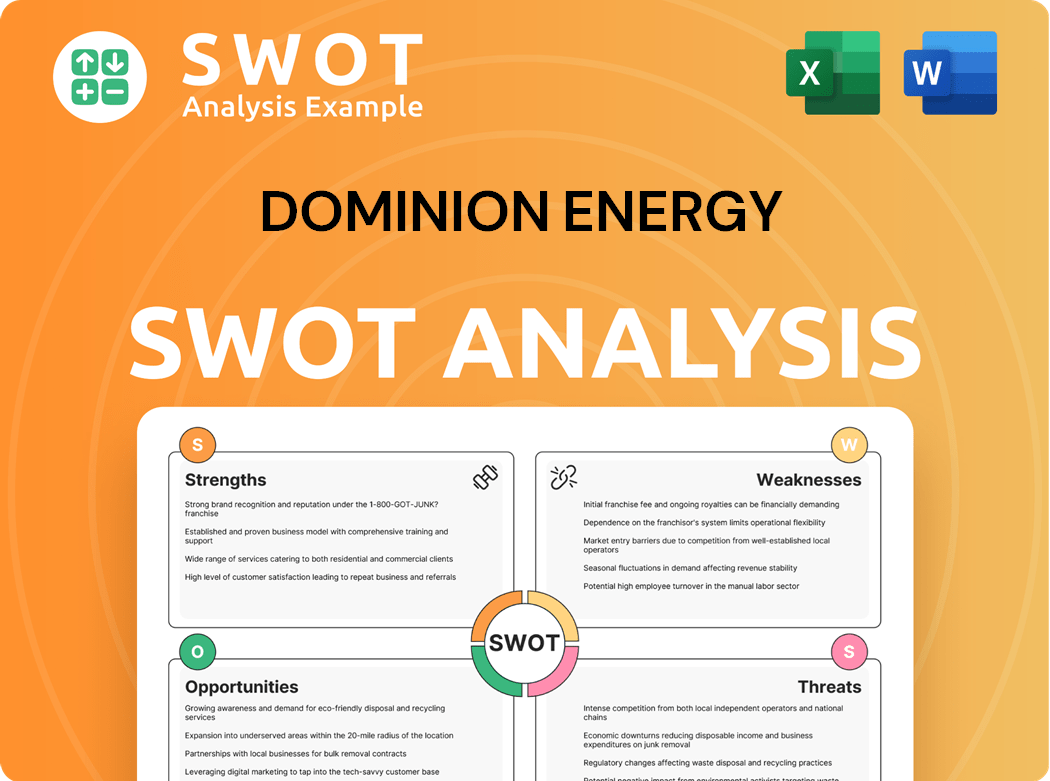

Dominion Energy services a wide area, focusing on both traditional and renewable energy sources. Its commitment to cleaner energy, including significant investments in offshore wind, is reshaping the energy landscape. For a deeper understanding of its strategic position, consider a Dominion Energy SWOT Analysis to assess its strengths, weaknesses, opportunities, and threats within the energy sector.

What Are the Key Operations Driving Dominion Energy’s Success?

The core operations of the Dominion Energy Company revolve around the generation, transmission, and distribution of electricity and natural gas. As an energy provider, the company supplies electricity to residential, commercial, and industrial customers. It also distributes natural gas for heating and other uses, serving approximately 7 million customers across 15 states.

The company's value proposition lies in providing reliable and sustainable energy solutions. It achieves this through a vertically integrated model that includes power generation from diverse sources such as nuclear, natural gas, hydro, and renewables. This integrated approach, combined with a focus on infrastructure upgrades and renewable energy projects, positions Dominion Energy to meet both current energy demands and future environmental goals.

Key operational processes involve the generation of electricity, its transmission through high-voltage lines, and distribution via local grids to end-users. For natural gas, this involves sourcing, processing, transportation through pipelines, and local distribution. Dominion Energy's supply chain is robust, leveraging long-term contracts for fuel and equipment, ensuring reliable delivery. The company's ongoing grid transformation efforts aim to enhance reliability and integrate more renewable energy sources. If you're interested in how Dominion Energy compares to others in the energy sector, you might find insights in the Competitors Landscape of Dominion Energy.

The company generates electricity from a diverse mix of sources, including nuclear, natural gas, hydro, and renewables. This electricity is then transmitted through high-voltage lines and distributed to customers via local grids. Dominion Energy services millions of customers across multiple states, ensuring a reliable power supply.

Dominion Energy also distributes natural gas for heating and other uses. This involves sourcing, processing, transporting through pipelines, and distributing gas to residential, commercial, and industrial customers. The company maintains extensive distribution networks to ensure consistent delivery.

Dominion Energy is actively involved in renewable energy projects, including the Coastal Virginia Offshore Wind project. This commitment to clean energy helps reduce carbon emissions and supports sustainable energy practices. The company is investing in renewable energy to meet future energy demands.

Continuous infrastructure upgrades are a key part of Dominion Energy's operations. These upgrades enhance reliability, security, and enable the integration of more renewable energy sources. Grid modernization efforts are ongoing to improve service and sustainability for customers.

A key differentiator for Dominion Energy Company is its significant investment in regulated assets, which provide stable and predictable returns. The company has a strong focus on clean energy, demonstrated by its renewable energy projects. Its extensive distribution networks and robust supply chain ensure reliable energy delivery to its customers.

- Investment in regulated assets provides stable returns.

- Commitment to clean energy and renewable projects.

- Extensive distribution networks and reliable supply chain.

- Ongoing infrastructure upgrades for improved service.

Dominion Energy SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Dominion Energy Make Money?

The revenue streams and monetization strategies of the company are primarily centered around its regulated electric and natural gas utility operations. As a leading energy provider, the company generates a stable income through these regulated services. The company's financial performance is significantly influenced by its ability to manage and optimize these core operations.

The electric utility segment, particularly through Dominion Energy Virginia, is a major contributor to revenue. This segment operates under regulated rates approved by state utility commissions, covering the costs of electricity generation, transmission, and distribution. The Gas Distribution segment also provides a significant revenue stream, delivering natural gas to various customer segments.

The company's monetization strategy focuses on its regulated asset base. Investments in infrastructure, such as new power plants and pipelines, are added to the rate base, allowing the company to earn a regulated return. This model encourages capital investment for system improvements and expansion. The company also engages in non-regulated activities, though these typically represent a smaller portion of overall revenue. For instance, in the first quarter of 2024, the company reported operating revenues of $3.6 billion.

The company's financial model is built on regulated operations, providing a predictable income stream. This approach allows for long-term growth through infrastructure modernization and the integration of renewable energy sources. The company's commitment to regulated utility operations ensures financial stability and supports strategic investments.

- Regulated Electric Utility: Revenue from generation, transmission, and distribution of electricity through regulated rates.

- Gas Distribution: Revenue from delivering natural gas to residential, commercial, and industrial customers, also through regulated rates.

- Infrastructure Investments: Investments in new power plants, transmission lines, and gas pipelines increase the rate base, allowing for regulated returns.

- Non-Regulated Activities: While a smaller portion, these activities contribute to overall revenue and can include energy-related services.

Dominion Energy PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Dominion Energy’s Business Model?

Dominion Energy has undergone significant strategic shifts in recent years, primarily focusing on its regulated utility businesses. A key move was divesting its natural gas transmission and storage assets in 2020, a strategic decision aimed at de-risking the company. This shift allowed Dominion Energy to concentrate on its core operations and renewable energy initiatives, enhancing its financial stability.

A major focus for Dominion Energy has been investing in renewable energy, particularly offshore wind. The Coastal Virginia Offshore Wind (CVOW) project, estimated to cost $9.8 billion, is a key initiative. This commitment to clean energy and large-scale infrastructure projects highlights Dominion Energy's adaptation to evolving energy demands.

Dominion Energy's competitive edge lies in its substantial regulated asset base, which provides stable cash flows. The company's economies of scale and strong brand recognition further enhance its position. Its ongoing focus on renewable energy and grid modernization positions it to meet evolving regulatory requirements and maintain its competitive standing within the energy sector.

One of the most significant milestones for Dominion Energy was the sale of its natural gas transmission and storage assets to Berkshire Hathaway in 2020. This strategic move allowed Dominion Energy to streamline its operations. The company's focus shifted towards its regulated utility businesses, enhancing its financial stability.

A key strategic move has been the accelerated investment in renewable energy, especially offshore wind. The Coastal Virginia Offshore Wind (CVOW) project is a significant undertaking. Dominion Energy is also investing heavily in grid modernization to enhance reliability and resilience.

Dominion Energy's competitive edge stems from its substantial regulated asset base, ensuring stable cash flows. The company benefits from economies of scale and strong brand recognition. The focus on renewable energy and grid modernization positions it well for the future.

In 2024, Dominion Energy's total operating revenue was approximately $16.3 billion. The company's net income for the same period was around $2.1 billion. Capital expenditures for the year were approximately $6.1 billion, reflecting significant investments in infrastructure and renewable energy projects.

Dominion Energy's strategic focus on regulated utilities and renewable energy has reshaped its business model. The company's commitment to offshore wind, like the CVOW project, underscores its dedication to clean energy. For more details, consider reading Brief History of Dominion Energy.

- Divestiture of non-core assets to focus on regulated utilities.

- Significant investment in renewable energy, particularly offshore wind.

- Emphasis on grid modernization to enhance reliability.

- Strong financial performance with substantial revenue and net income.

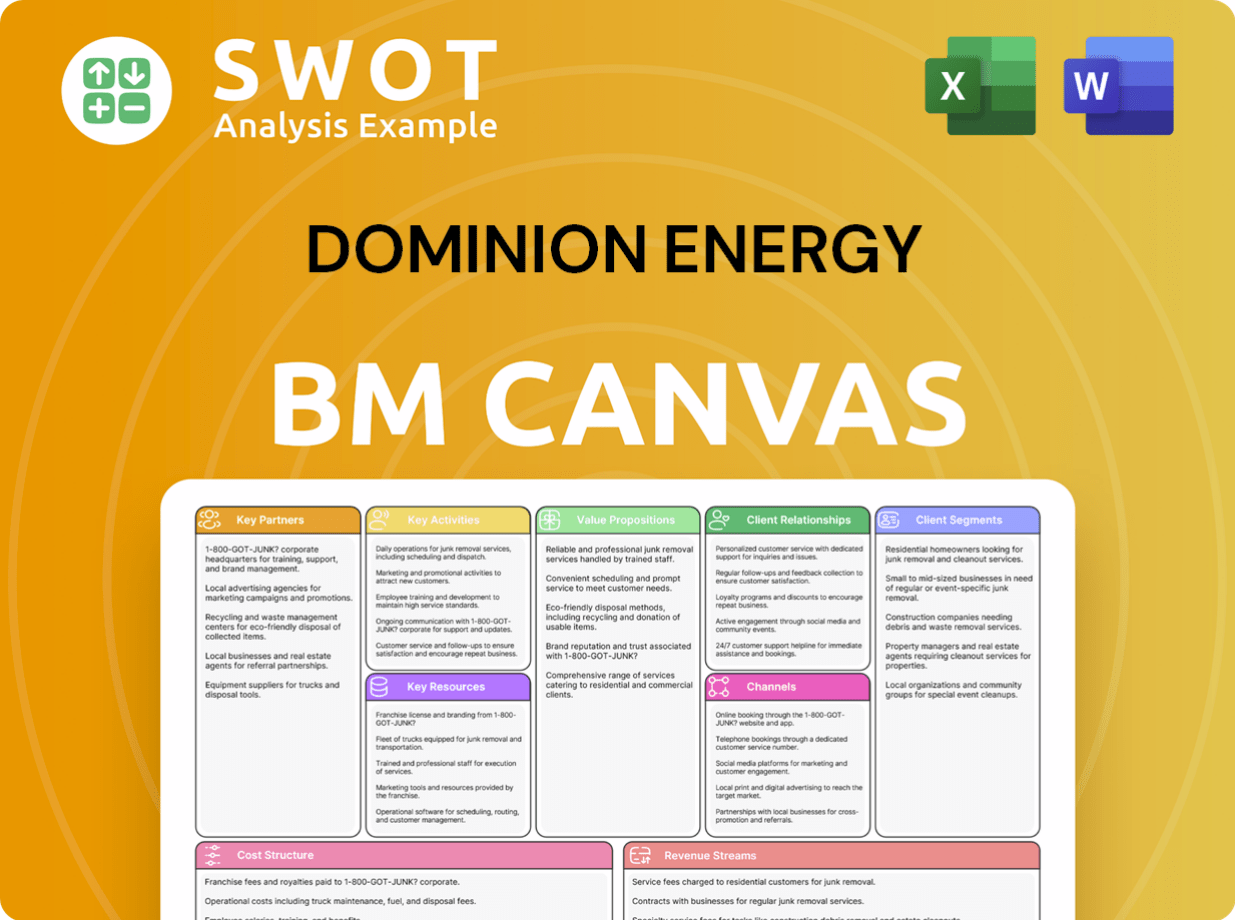

Dominion Energy Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Dominion Energy Positioning Itself for Continued Success?

As a major player in the energy sector, Dominion Energy holds a strong industry position, functioning as a significant energy provider in the United States. The company's market share is substantial within its regulated service territories, where it often operates as the primary utility company for electricity and natural gas. This position is fortified by its regulated status, which provides a degree of stability and customer loyalty due to the essential nature of the services it offers.

The company's operations and financial performance are subject to several risks, including regulatory changes, particularly concerning environmental policies and rate case outcomes. These can influence profitability. Moreover, rising capital costs and supply chain disruptions, especially for renewable projects like offshore wind, pose challenges. Extreme weather events, intensified by climate change, also present operational and financial risks related to infrastructure damage and service restoration.

Dominion Energy is one of the largest electric and natural gas utilities in the U.S., serving a broad customer base. It benefits from a strong regional presence, particularly in the Mid-Atlantic and Southeast. The company's regulated status provides a degree of stability and customer loyalty, essential for the energy sector.

Regulatory changes, especially those concerning environmental policies and rate cases, can affect profitability. Rising capital costs and supply chain issues, particularly for renewable projects, are also significant. Extreme weather events pose operational and financial risks.

Dominion Energy is focused on decarbonization, grid modernization, and disciplined capital allocation. The company aims to achieve net-zero emissions by 2050. Strategic initiatives include renewable energy projects and grid enhancements.

The company is investing in renewable energy, especially offshore wind and solar projects. Grid hardening and smart grid technologies are also key. Leadership emphasizes long-term shareholder value through stable earnings growth.

Dominion Energy plans to sustain and expand its asset base, leveraging favorable regulatory frameworks and capitalizing on growing demand for clean energy solutions. The company is committed to achieving net-zero emissions from its electric generation operations by 2050. The company's strategic focus includes investments in renewable energy and grid modernization to enhance reliability and integrate more distributed energy resources.

- $1.4 billion in capital expenditures in 2023 for Virginia electric operations.

- Targeted $4.5 billion in capital investments for 2024.

- Approximately $2.4 billion of earnings from regulated businesses in 2023.

- Aims to reduce carbon emissions by 70% by 2030 (from 2005 levels) and achieve net-zero emissions by 2050.

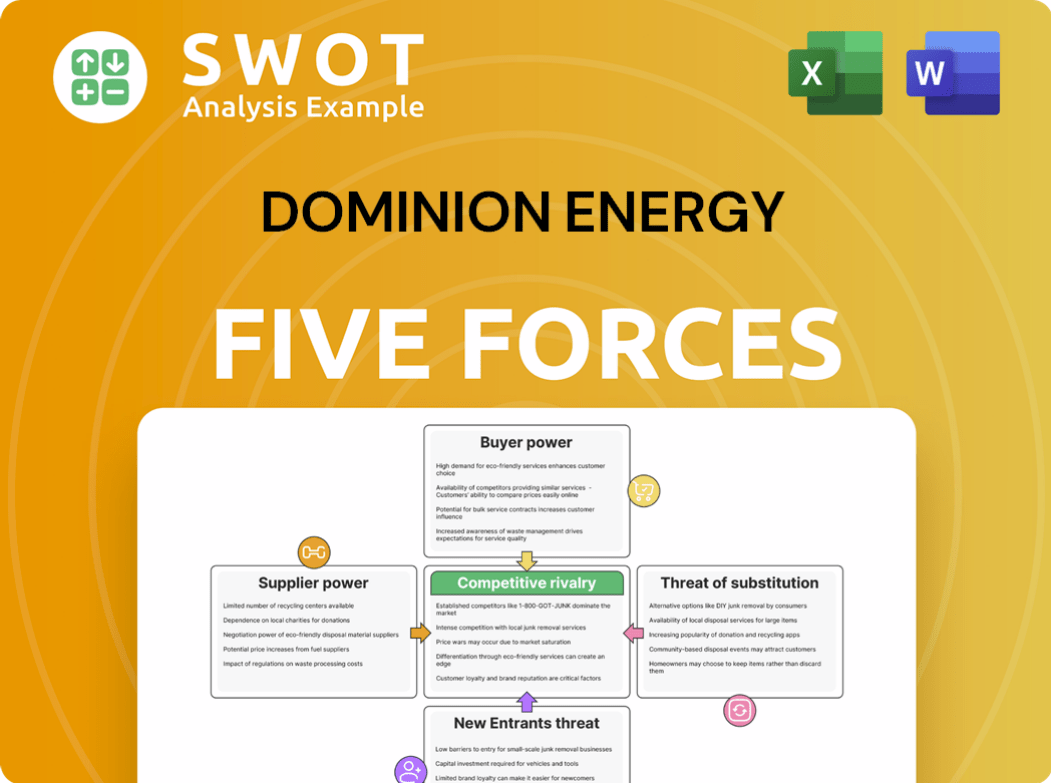

Dominion Energy Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Dominion Energy Company?

- What is Competitive Landscape of Dominion Energy Company?

- What is Growth Strategy and Future Prospects of Dominion Energy Company?

- What is Sales and Marketing Strategy of Dominion Energy Company?

- What is Brief History of Dominion Energy Company?

- Who Owns Dominion Energy Company?

- What is Customer Demographics and Target Market of Dominion Energy Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.