e.l.f. Cosmetics Bundle

Can e.l.f. Cosmetics Continue Its Beauty Industry Dominance?

e.l.f. Beauty's recent acquisition of Rhode, Hailey Bieber's skincare brand, for a potential $1 billion, has sent shockwaves through the cosmetics industry. This bold move signals a strategic shift towards premium skincare and underpenetrated markets. But what does this mean for the future of e.l.f. Cosmetics, a brand already known for its disruptive value proposition and strong performance?

This analysis dives deep into the e.l.f. Cosmetics SWOT Analysis, exploring its growth strategy and future prospects. We'll examine e.l.f. Cosmetics's impressive financial performance, including its remarkable 77% sales increase in fiscal year 2024, and how it plans to navigate the ever-evolving cosmetics industry trends. Understanding e.l.f. Cosmetics's market share, product innovation, and expansion plans is crucial for investors and strategists alike.

How Is e.l.f. Cosmetics Expanding Its Reach?

The company is actively executing several expansion initiatives to drive its business forward. These initiatives focus on both expanding its geographical footprint and diversifying its product categories. A significant part of its international expansion strategy involves collaborations with leading global retailers and distributors.

In the first quarter of Fiscal Year 2025, non-U.S. markets accounted for 16% of the company's total net sales. International net sales saw a remarkable 91% year-over-year growth, demonstrating the effectiveness of its global strategy. This growth is a key indicator of the company's future prospects and its ability to compete in the cosmetics industry.

The company's expansion plans include re-entering Mexico with a debut in dozens of Sephora Mexico locations in the fall of 2024. Furthermore, the company is strengthening its presence in the UK, where it is the fourth most popular mass makeup brand, by expanding into several hundred Boots and Superdrug locations in the fall of 2024. These moves are part of the company's broader strategy to increase its e.l.f. Cosmetics market share.

The company is expanding its presence in key international markets. This includes entering new retail locations and strengthening existing partnerships. These initiatives support the company's e.l.f. Cosmetics growth strategy by increasing its reach and brand visibility.

The company is also expanding its product portfolio through strategic acquisitions. The acquisition of Naturium LLC in 2023 enhanced its skincare presence. This diversification is a key element of its long term growth potential.

Collaborations with leading retailers and distributors are crucial for rapid market penetration. These partnerships ensure a strong and immediate impact in new markets. The company's ability to form and leverage these partnerships is vital for its success.

The company's acquisition of Rhode, a fast-growing beauty brand, is a significant move. This acquisition aims to strengthen and diversify the company's portfolio. This strategy will help the company capitalize on the rising demand for clean, community-driven brands.

The company's international expansion includes re-entering Mexico with a debut in dozens of Sephora Mexico locations in the fall of 2024. In Germany, the company is undertaking its largest international retail launch to date, expanding into 1,600 Rossmann locations nationwide. The company is also strengthening its presence in the UK, where it is the fourth most popular mass makeup brand, by expanding into several hundred Boots and Superdrug locations in the fall of 2024. In Italy, which entered Douglas in autumn 2023, plans to double its current store space by expanding into hundreds of additional Douglas locations and will launch on Amazon in Italy in the fall of 2024. Furthermore, the company has expanded its existing distributor relationship in Australia by launching in Coles, marking its first venture into the country's grocery channel, and will expand its presence in Priceline in the fall of 2024. The company also plans to launch in the Nordic region before the end of 2024, partnering with SÆTHER as its exclusive distributor, with new launches anticipated in retailers like H&M, Matas, Kicks, Vita, Sokos, and Lyko. For more insights, you can explore the Owners & Shareholders of e.l.f. Cosmetics.

The company is set to acquire Rhode, a multi-category beauty brand. This acquisition is expected to close in the second quarter of Fiscal Year 2026. This strategic move is designed to enhance the company's portfolio and capitalize on the growing demand for innovative beauty products.

- The acquisition of Rhode is valued at $800 million at closing.

- Potential earnout consideration could reach up to $200 million based on future growth.

- This acquisition aligns with the company's strategy to diversify its brand portfolio.

- The acquisition enhances the company's ability to capitalize on cosmetics industry trends.

e.l.f. Cosmetics SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does e.l.f. Cosmetics Invest in Innovation?

The company's growth strategy hinges on continuous innovation and leveraging technology to meet evolving consumer needs. This approach is crucial in the dynamic cosmetics industry, where trends shift rapidly. The ability to quickly adapt and introduce new products is key to maintaining market share and attracting new customers.

Understanding consumer preferences is central to the company's strategy. The company focuses on providing premium-quality products at accessible prices, appealing to a broad customer base. Digital engagement and data-driven strategies further enhance the company's ability to meet consumer demands.

The company's commitment to sustainability is also a significant factor in its strategy. By focusing on eco-friendly practices, the company aligns with consumer values and contributes to long-term brand loyalty. This commitment is particularly important in today's market, where consumers increasingly prioritize environmental responsibility.

The company consistently launches new products to stay ahead of beauty trends. Recent introductions include the e.l.f. Glow Reviver Lip Oil, e.l.f. Cosmetics Power Grip Primer, and e.l.f. SKIN Bronzing Drops. These products are designed to offer high quality at affordable prices, which helps the company maintain its competitive edge.

Digital transformation is a core element of the company's strategy, focusing on digital platforms and influencer collaborations. The company uses social media, particularly platforms like TikTok, to enhance brand visibility. Data-driven strategies also help optimize consumer journeys and loyalty programs.

The company's marketing campaigns, especially on social media, have been highly successful. The #eyeslipsface TikTok campaign generated 5 million user-generated videos and nearly 10 billion views. This demonstrates the effectiveness of the company's digital marketing strategies in reaching a wide audience.

The Beauty Squad Loyalty Program shows strong digital engagement. As of Q1 FY2025, the program had over 5 million members. Enrollment in the program grew by 30% year-over-year, indicating the effectiveness of the company's loyalty initiatives.

The company is committed to sustainability, as highlighted in its annual Impact Report released in October 2024. The company aims to eliminate 400 tons of packaging per year through lightweighting. By 2030, the company plans for 50% of all plastic packaging to contain recycled or responsibly sourced bio-based content.

The company ensures its products are made in Fair Trade Certified facilities. Over 2,500 ingredients are excluded from their formulations to meet and exceed FDA and EUCR restrictions. This focus highlights the company's commitment to ethical sourcing and product safety.

The company's future prospects are promising, driven by its innovation and technology strategies. The company's ability to adapt to evolving consumer preferences and industry trends is key to its long-term success. Further expansion and market penetration are likely, supported by its strong digital presence and commitment to sustainability. To learn more about the company's origins, consider reading a Brief History of e.l.f. Cosmetics.

- Continued product innovation to meet current beauty trends.

- Enhanced digital marketing strategies to boost brand visibility.

- Expansion of the Beauty Squad Loyalty Program.

- Further sustainability initiatives to align with consumer values.

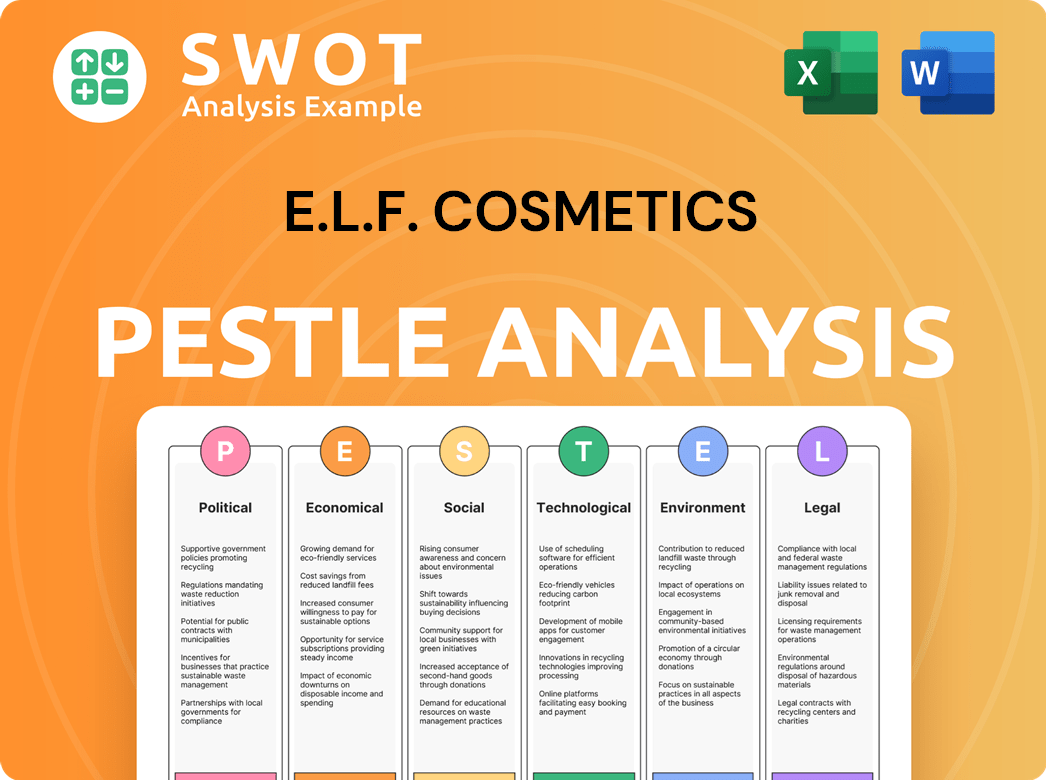

e.l.f. Cosmetics PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is e.l.f. Cosmetics’s Growth Forecast?

The financial performance of e.l.f. Beauty reflects a strong upward trajectory, showcasing robust growth across various channels and markets. For the fiscal year ending March 31, 2025, the company reported a significant increase in net sales, driven by solid performance in both retail and e-commerce sectors, as well as in the U.S. and international markets. This growth underscores the effectiveness of e.l.f. Cosmetics' strategies in capturing market share and expanding its consumer base.

The company's financial health is further supported by an increase in gross margin, which reached 71% in fiscal 2025. This improvement is attributed to favorable foreign exchange impacts on goods purchased from China and cost-saving initiatives. These factors have positively influenced profitability, allowing e.l.f. Cosmetics to invest further in its growth strategies. The adjusted EBITDA also saw a substantial rise, indicating efficient operational management and a strong financial foundation.

Despite the positive results, e.l.f. Beauty adjusted its full-year outlook for fiscal 2025 downwards in February 2025, citing economic uncertainties and softer-than-expected demand in the mass beauty category, particularly in January 2025. Net sales were expected to reach between $1.3 billion and $1.31 billion, down from the previous forecast. Profit expectations were also lowered, with adjusted diluted earnings per share projected at $3.27 to $3.32, compared with the earlier estimate of $3.47 to $3.53.

e.l.f. Beauty experienced a 28% year-over-year increase in net sales for fiscal 2025, reaching $1,313.5 million. This growth was fueled by strong performance across retail and e-commerce channels, as well as in both U.S. and international markets. This demonstrates the effectiveness of the company's market strategies.

The gross margin for fiscal 2025 increased by approximately 50 basis points to 71%. This improvement was driven by favorable foreign exchange impacts and cost savings. The enhanced gross margin reflects efficient cost management and strategic sourcing.

Adjusted EBITDA for fiscal 2025 reached $296.8 million, or 23% of net sales, marking a 26% year-over-year increase. This growth underscores the company's strong operational performance and profitability. This is a key indicator of financial health.

The company's online store, elfcosmetics.com, generated annual sales of $153 million in 2024. It is projected to grow at a rate of 5-10% in 2025. This highlights the importance of digital channels in the company's growth strategy.

At the end of fiscal 2025, e.l.f. Beauty held $148.7 million in cash and cash equivalents, with $256.7 million in total debt. The company entered 2025 with $149 million in cash and $115 million in annual free cash flow, up from $108 million in 2024. This strong financial position provides flexibility for strategic initiatives.

- A $500 million revolving credit facility provides financial flexibility for further acquisitions or market expansion.

- The acquisition of Rhode, with a total investment of $1 billion, aligns with e.l.f.'s strategy to expand into premium skincare.

- These investments are designed to support the company's long-term growth potential and expand its market presence.

e.l.f. Cosmetics Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow e.l.f. Cosmetics’s Growth?

The Marketing Strategy of e.l.f. Cosmetics faces several risks that could influence its growth. These challenges include intense competition within the beauty industry, supply chain vulnerabilities, and potential economic impacts. The company must navigate these obstacles to sustain its expansion and maintain its market position.

One of the key challenges is the competitive landscape, where the company competes with many brands. Additionally, the company's reliance on third-party suppliers, particularly in China, presents risks related to tariffs and geopolitical factors. Internal challenges, such as managing consumer trends and potential legal issues, also require careful attention.

The company's future prospects depend on its ability to mitigate these risks effectively. This involves diversifying its supply chain, adapting to changing consumer preferences, and proactively managing potential legal and economic challenges. Strategic responses will be crucial for achieving long-term growth.

The beauty industry is highly competitive, featuring large multinational companies and emerging brands. Maintaining shelf space in retail stores and potential price reductions could affect profitability. However, the company has gained U.S. market share for 25 consecutive quarters, showing its ability to compete.

Reliance on third-party suppliers, mainly in China, poses challenges. Approximately 75% of production occurs in China, making the company susceptible to tariff impacts. A 55% tariff could add $50 million in annual costs, and higher rates would further strain margins. The company plans to diversify production.

Geopolitical factors, such as tariffs and trade disputes, can significantly affect operational costs. The company's heavy reliance on Chinese manufacturing exposes it to these risks. Strategic diversification of the supply chain is crucial to mitigate these impacts and ensure stable operations.

Changes in regulations and economic factors, such as inflation and interest rate fluctuations, can impact consumer spending and operational costs. A slowdown in the global beauty industry could lead to retailers reducing inventories due to weaker demand, affecting the company's sales.

Potential legal challenges, such as class-action lawsuits, can arise. These may involve allegations of misleading investors about financial health. Lawsuits can lead to stock price drops and reputational damage. The company must address these challenges through legal defense and transparency.

Accurately predicting consumer trends and adapting to technological changes are crucial. The future of platforms like TikTok, which is essential for the company's digital engagement, could impact marketing strategies. Continuous innovation and digital adaptation are necessary for success.

The company is diversifying its production away from China, with production outside China growing from 0% in 2019 to 25% currently. This diversification is a key strategy to reduce supply chain risks. The company also implemented a $1 price hike across global products in August 2025, its third in 21 years, which has historically been absorbed by consumers.

Potential tariff impacts could add $50 million in annual costs if a 55% tariff is imposed. Higher rates (145%) would further strain margins. Lawsuits alleging overstated revenue by $135–$190 million over three quarters led to a stock price drop of nearly 47% by March 2025 from its pre-Muddy Waters peak. The company's ability to manage costs is essential.

e.l.f. Cosmetics Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of e.l.f. Cosmetics Company?

- What is Competitive Landscape of e.l.f. Cosmetics Company?

- How Does e.l.f. Cosmetics Company Work?

- What is Sales and Marketing Strategy of e.l.f. Cosmetics Company?

- What is Brief History of e.l.f. Cosmetics Company?

- Who Owns e.l.f. Cosmetics Company?

- What is Customer Demographics and Target Market of e.l.f. Cosmetics Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.