e.l.f. Cosmetics Bundle

How is e.l.f. Cosmetics Revolutionizing the Beauty Industry?

e.l.f. Beauty, Inc. isn't just another cosmetics company; it's a market disruptor. Achieving over $1 billion in net sales in fiscal year 2024, the e.l.f. Cosmetics SWOT Analysis reveals a company that's mastered the art of delivering high-quality, affordable e.l.f. makeup. This remarkable growth, fueled by strong performance across retail and e-commerce, signals a significant shift in consumer preferences. The e.l.f. brand has quickly become a favorite.

This exploration will dissect the core strategies behind e.l.f. Cosmetics' success, from its innovative product development process to its savvy marketing strategy and robust distribution channels. We'll examine how the e.l.f. company has cultivated a loyal following, particularly among Gen Z and Millennials, and how its focus on value and inclusivity has propelled it to the forefront of the beauty industry. Discover how e.l.f. cosmetics makes money and what the future holds for this dynamic brand.

What Are the Key Operations Driving e.l.f. Cosmetics’s Success?

The core of e.l.f. Beauty's success lies in its ability to offer high-quality, inclusive, and ethical cosmetics and skincare at accessible prices. This strategy, often described as 'luxury for less,' has resonated strongly with its target demographic, particularly Gen Z and Millennial consumers. The company's diverse brand portfolio, including e.l.f. Cosmetics, e.l.f. SKIN, Naturium, Well People, and Keys Soulcare, allows it to cater to a wide range of consumer preferences and needs.

Operationally, e.l.f. Beauty has built an agile and asset-light supply chain. This approach enables the company to quickly develop and launch new products, staying ahead of beauty trends. The company's distribution strategy combines its own e-commerce platforms with partnerships with major retailers such as Target, Walmart, and Ulta Beauty, ensuring broad product availability.

e.l.f. Cosmetics provides value by offering affordable, high-quality, and ethical beauty products. This appeals to consumers seeking value without compromising on product performance or ethical standards. The brand's commitment to inclusivity and cruelty-free practices further enhances its appeal.

The e.l.f. company operates with an agile supply chain and an omnichannel distribution strategy. This allows for rapid product development and efficient market reach. It leverages both e-commerce and partnerships with major retailers to ensure products are easily accessible to consumers.

e.l.f. makeup primarily targets Gen Z and Millennial consumers. These demographics prioritize value, quality, and ethical considerations. The brand's marketing and product development strategies are tailored to resonate with these consumer preferences.

e.l.f. products are distributed through a combination of e-commerce and retail partnerships. The e-commerce channels include the company's websites and mobile apps. Retail partnerships include major stores such as Target, Walmart, and Ulta Beauty.

In fiscal year 2024, e.l.f. Beauty generated 84% of its revenue from national and international retailers, highlighting the importance of its retail partnerships. The company's e-commerce channels accounted for 16% of its revenue during the same period. The 'Beauty Squad' loyalty program has over 5.3 million members, driving nearly 80% of the brand's sales on ElfCosmetics.com and 95% of its app transactions. For a deeper dive into the company's strategic growth, consider reading about the Growth Strategy of e.l.f. Cosmetics.

- Agile supply chain for fast product development.

- Omnichannel distribution strategy for wide market reach.

- Strong digital engagement through loyalty programs.

- Focus on affordable, high-quality, and ethical products.

e.l.f. Cosmetics SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does e.l.f. Cosmetics Make Money?

e.l.f. Beauty, the e.l.f. Cosmetics company, generates revenue primarily through the sale of its makeup and skincare products. The company has demonstrated significant growth, with net sales reaching $1.02 billion in fiscal year 2024. This reflects a strong business model and effective strategies within the competitive beauty market.

The company's revenue streams are diverse, utilizing a multi-channel approach to reach consumers. This includes retail partnerships, e-commerce, and international sales. The e.l.f. brand has successfully expanded its market presence, driving impressive financial results.

For the trailing 12 months ending March 31, 2025, e.l.f. Beauty's revenue reached $1.31 billion, showing a 28.28% year-over-year increase. This growth underscores the effectiveness of its strategies and the popularity of its products within the beauty industry. To understand the competitive environment, consider the Competitors Landscape of e.l.f. Cosmetics.

e.l.f. Cosmetics employs a multi-channel approach to generate revenue. This strategy includes retail partnerships, e-commerce, and international expansion. The company also utilizes innovative programs like its 'Beauty Squad' loyalty program to boost sales.

- Retail Partnerships: This is the largest revenue contributor, with 84% of FY2024 revenue coming from national and international retailers. Key partners in the U.S. include Target (25% of FY2024 revenue), Walmart (17%), and Ulta Beauty (16%).

- E-commerce: Direct-to-consumer online sales, including its own websites and mobile applications, accounted for 16% of revenue in FY2024. Digital sales were over 60% of e.l.f.'s net sales in 2024. The 'Beauty Squad' loyalty program drives nearly 80% of sales on its e-commerce site and 95% of app transactions.

- International Sales: While the U.S. is the primary market, accounting for 85% of revenue in FY2024, international markets contributed 15%. International net sales grew by 60% in fiscal 2025. The company is expanding into new international markets, such as Germany and Sephora Mexico.

- Pricing Strategy: e.l.f. plans to implement a $1 price increase on its entire product assortment globally, effective August 1, to partially mitigate the impact of tariffs.

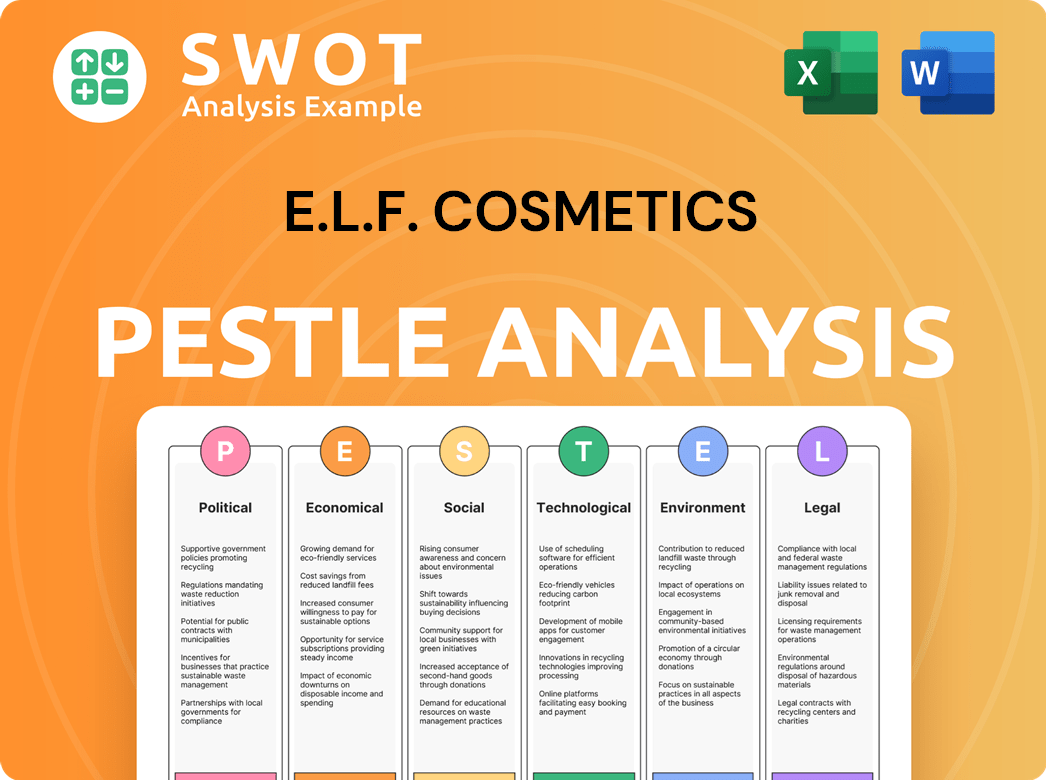

e.l.f. Cosmetics PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped e.l.f. Cosmetics’s Business Model?

The success of e.l.f. Beauty stems from strategic moves and key milestones. A significant early step was expanding beyond e-commerce to include national retailers, starting with Target in 2007. This omnichannel approach has been crucial, with retail partnerships accounting for a substantial portion of its revenue.

A major achievement for the e.l.f. company was exceeding $1 billion in annual net sales in fiscal year 2024, marking its strongest year of net sales growth on record with a 77% increase. This also marked its 21st consecutive quarter of both net sales growth and market share gains. In Q1 FY2025, the company reported a remarkable 50% revenue growth, driven by increased unit volumes and strong digital engagement.

Strategic acquisitions have also played a role in the company's expansion. For example, the acquisition of Naturium, a rapidly growing skincare brand, for $333 million in October 2023. More recently, e.l.f. Beauty entered into a definitive agreement to acquire Rhode, a high-growth beauty brand, for $1 billion.

The e.l.f. brand faces operational challenges, including potential tariff impacts due to its reliance on China for approximately 75% of its global production. Higher container costs due to Red Sea disruptions have also impacted the company. A decline in social media engagement on platforms like TikTok, crucial for e.l.f.'s digital strategy, presents another challenge.

In response to these challenges, the e.l.f. company is diversifying its supply chain to reduce its dependence on China. The company plans a global $1 price increase. The company continues to adapt by investing in marketing and digital strategies, expanding internationally, and focusing on product innovation across color cosmetics and skincare.

The e.l.f. brand has several competitive advantages that drive its success in the beauty industry. These factors include accessible pricing, an agile supply chain, strong brand equity, and a commitment to ethical practices.

- Accessible Pricing: The average product price of around $6 makes e.l.f. makeup accessible to a broad audience, significantly undercutting mass-market and prestige competitors.

- Agile Supply Chain and Innovation: The company's asset-light supply chain enables rapid product development and quick response to market trends, allowing it to be first-to-market with innovations.

- Strong Brand Equity and Digital Marketing: e.l.f. has cultivated a strong brand image associated with quality, affordability, and inclusivity, leveraging digital and social media to build recognition and loyalty. Its 'Beauty Squad' loyalty program is a key driver of sales and engagement.

- Commitment to Clean and Cruelty-Free: Its focus on ethical sourcing and excluding over 2,500 ingredients beyond regulatory restrictions resonates with conscious consumers.

e.l.f. Cosmetics Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is e.l.f. Cosmetics Positioning Itself for Continued Success?

The e.l.f. Cosmetics company has carved out a strong position in the beauty industry, especially in the mass-market segment. This success is fueled by its commitment to affordability, quality, and inclusivity. The company's strategy has led to consistent market share gains, reflecting its robust performance and effective business model.

However, e.l.f. Beauty faces several risks, including intense competition and regulatory changes. The company's reliance on China for production introduces tariff and supply chain uncertainties. Additionally, shifts in consumer behavior and digital engagement, particularly on platforms like TikTok, pose challenges for its marketing strategies. Despite these hurdles, e.l.f. Beauty is optimistic about its future and is taking strategic steps to sustain its growth.

e.l.f. Cosmetics has achieved a strong market position in the beauty industry, especially within the mass-market segment. The company's focus on affordability, quality, and inclusivity has driven its success. This has resulted in consistent market share gains, showcasing its effective business model.

The cosmetics industry is highly competitive, and e.l.f. faces risks from both established and emerging brands. Regulatory changes and tariff uncertainties, particularly due to its reliance on China for manufacturing, pose challenges. Shifts in consumer behavior and social media engagement also impact sales.

e.l.f. Beauty anticipates continued growth, with projected net sales between $1.31 billion and $1.35 billion for fiscal year 2025, representing a 20% to 22% increase. Strategic initiatives include international expansion, increased investment in marketing and digital channels, and product innovation. The acquisition of Rhode is a strategic move to diversify its brand portfolio.

The company has achieved its 25th consecutive quarter of net sales growth and market share gains in fiscal 2025. e.l.f. gained 190 basis points of market share in the U.S., 170 basis points in Canada, and 270 basis points in the UK. International net sales grew 60% in fiscal 2025.

e.l.f. Cosmetics is focusing on several key strategies to maintain its growth and market position. These include expanding internationally, enhancing marketing efforts, and innovating with new products. The company is also working on diversifying its supply chain to mitigate risks.

- Continued International Expansion: Entering new markets like Germany and Mexico.

- Investment in Marketing: Strengthening digital channels and social media presence.

- Product Innovation: Developing new products to meet evolving consumer preferences.

- Supply Chain Diversification: Reducing reliance on China for manufacturing.

e.l.f. Cosmetics Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of e.l.f. Cosmetics Company?

- What is Competitive Landscape of e.l.f. Cosmetics Company?

- What is Growth Strategy and Future Prospects of e.l.f. Cosmetics Company?

- What is Sales and Marketing Strategy of e.l.f. Cosmetics Company?

- What is Brief History of e.l.f. Cosmetics Company?

- Who Owns e.l.f. Cosmetics Company?

- What is Customer Demographics and Target Market of e.l.f. Cosmetics Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.