e.l.f. Cosmetics Bundle

Who Really Owns e.l.f. Cosmetics?

Ever wondered who steers the ship behind the wildly popular e.l.f. Cosmetics SWOT Analysis brand? The e.l.f. company, a powerhouse in the beauty industry, has captivated consumers with its accessible yet high-quality products. Understanding the e.l.f. Cosmetics ownership structure is key to grasping its strategic direction and future growth. This exploration unveils the ownership journey of e.l.f. Beauty, Inc., from its inception to its current standing.

From its humble beginnings, the e.l.f. brand has experienced significant shifts in its ownership landscape. This evolution, marked by an IPO and subsequent market dynamics, provides critical insights into the e.l.f. Cosmetics parent company's trajectory. Discover the major shareholders and understand the impact of these changes on the company's strategies and market performance. Delving into the e.l.f. Cosmetics ownership details offers a comprehensive view of its past, present, and future in the competitive beauty market, including any potential e.l.f. acquisition.

Who Founded e.l.f. Cosmetics?

The story of e.l.f. Cosmetics, a popular brand, began in 2004. The company was founded by Joseph Shamah, Scott Vincent Borba, and Alan Shamah. Their vision was to offer high-quality makeup at affordable prices, making beauty accessible to everyone.

Early details about the exact ownership split among the founders are not widely available. However, the company quickly gained traction by selling directly to consumers through its website. This direct-to-consumer approach helped keep costs down, allowing for competitive pricing and rapid growth.

The initial years were focused on building a strong brand and expanding the product range. This reflected the founders' commitment to making beauty both affordable and inclusive. While specific early investors aren't widely publicized, the company's quick success showed it had strong backing and a clear market opportunity.

Joseph Shamah, Scott Vincent Borba, and Alan Shamah founded e.l.f. Cosmetics in 2004.

The company focused on a direct-to-consumer model to offer affordable makeup.

e.l.f. Cosmetics quickly expanded its product offerings and brand presence.

The founders aimed to make beauty affordable and inclusive.

The company's rapid growth indicated strong early financial support.

The main goal was to establish a strong brand and expand the product range.

The founders' vision for accessible beauty was central to the company’s initial strategy and growth. For more insights into the strategies that fueled its expansion, you can explore the Growth Strategy of e.l.f. Cosmetics. The company's success reflects a changing beauty market, with a focus on value and inclusivity. As of 2024, e.l.f. Cosmetics continues to innovate and expand its reach.

e.l.f. Cosmetics was founded in 2004 with a focus on affordable, high-quality makeup.

- The founders were Joseph Shamah, Scott Vincent Borba, and Alan Shamah.

- The direct-to-consumer model was key to early success.

- The company prioritized building a strong brand and expanding its product range.

- Early backing and a clear market opportunity fueled rapid growth.

e.l.f. Cosmetics SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has e.l.f. Cosmetics’s Ownership Changed Over Time?

The ownership structure of e.l.f. Beauty, Inc. has evolved significantly since its inception. A major turning point was the Initial Public Offering (IPO) on September 22, 2016. The IPO transformed the company from a privately held entity to a publicly traded one, listed on the New York Stock Exchange under the ticker symbol 'ELF'. This move broadened the ownership base, introducing a diverse group of investors.

The transition to a public company brought about increased transparency and regulatory compliance, impacting how the company operates. This shift necessitated adherence to Securities and Exchange Commission (SEC) regulations, influencing strategic reporting and investor relations. This change also opened the door for greater institutional investor involvement, which continues to shape the company's governance and strategic direction.

| Event | Date | Impact on Ownership |

|---|---|---|

| Initial Public Offering (IPO) | September 22, 2016 | Transitioned from private to public ownership, increasing the shareholder base. |

| Ongoing Market Activity | Continuous | Institutional investors and other shareholders adjust their holdings based on market performance and strategic decisions. |

| Regulatory Compliance | Ongoing | Requires adherence to SEC regulations, influencing reporting and investor relations. |

As of early 2025, e.l.f. Cosmetics Ownership is primarily held by institutional investors. Key players include The Vanguard Group, Inc. and BlackRock, Inc., which often hold substantial stakes due to their broad market index fund holdings. As of March 31, 2024, The Vanguard Group, Inc. held 10.97% of e.l.f. Beauty shares, while BlackRock, Inc. held 9.87%. Other significant shareholders include State Street Corp. and Geode Capital Management, LLC. These major shareholders significantly influence the company's governance through their voting power. To learn more about the company's business model, you can read Revenue Streams & Business Model of e.l.f. Cosmetics.

e.l.f. Cosmetics is a publicly traded company with a diverse ownership structure.

- The IPO in 2016 marked a significant shift from private to public ownership.

- Institutional investors like Vanguard and BlackRock are major shareholders.

- Ownership changes are influenced by market activity and investor strategies.

- The company's operations are subject to SEC regulations.

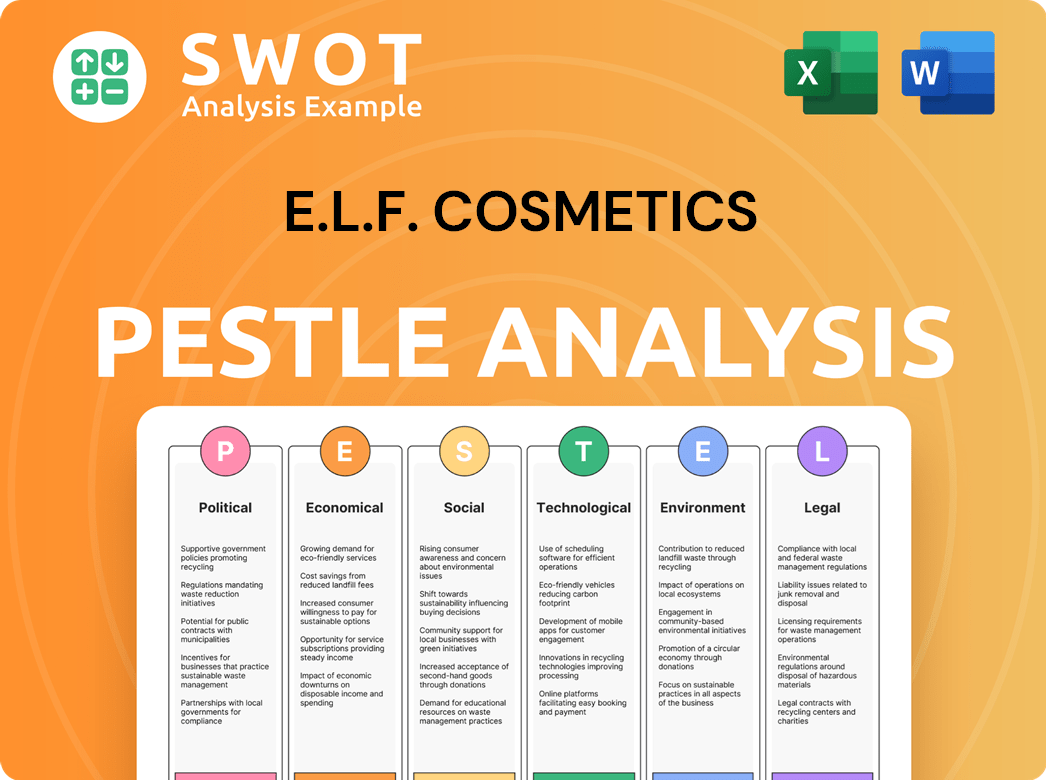

e.l.f. Cosmetics PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on e.l.f. Cosmetics’s Board?

The Board of Directors of e.l.f. Beauty, Inc. oversees the company's strategic direction and represents shareholder interests. As of early 2025, the board includes independent directors and individuals with connections to major shareholders or the executive team. The makeup of the board reflects a commitment to diverse expertise, including consumer goods, finance, and digital marketing. This structure is crucial for ensuring effective governance and informed decision-making within the company.

Major institutional investors like Vanguard and BlackRock, while not necessarily having direct board representation, wield significant influence through their substantial voting power. The company adheres to a one-share-one-vote structure, which means each share of common stock typically carries one vote in shareholder matters, including the election of directors. This standard voting system enables institutional investors to significantly impact corporate decisions and the composition of the board. There are no indications of dual-class shares or special voting rights that would grant outsized control to specific entities.

| Director | Title | Affiliation |

|---|---|---|

| Tarang Amin | Chairman, President & CEO | e.l.f. Beauty, Inc. |

| Scott D. McHugh | Lead Independent Director | Former CFO, The Estée Lauder Companies Inc. |

| Gayle S. Boss | Independent Director | Former CEO, Bath & Body Works |

The current ownership structure of e.l.f. Cosmetics, with its emphasis on a one-share-one-vote system, allows significant shareholders to influence the company's direction. This structure is a key aspect of understanding who owns e.l.f. and how decisions are made. For more detailed information about the company, including its history and financial performance, you can refer to this article about e.l.f. Cosmetics.

The Board of Directors at e.l.f. Beauty, Inc. is responsible for governance and strategic oversight. Institutional investors like Vanguard and BlackRock have significant influence through their voting power.

- The company operates under a one-share-one-vote structure.

- The board includes independent directors and those with ties to major shareholders.

- The focus is on expertise in consumer goods, finance, and digital marketing.

- This structure ensures shareholder interests are represented in corporate decisions.

e.l.f. Cosmetics Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped e.l.f. Cosmetics’s Ownership Landscape?

Over the past few years, the ownership profile of e.l.f. Cosmetics has been influenced by its robust financial performance. The company reported a significant net sales increase of 71% to $279.2 million in Q3 of fiscal year 2024. This growth makes the company an attractive investment, potentially leading to increased institutional ownership. This strong performance also contributes to fewer significant founder dilutions as the company expands organically and through strategic acquisitions. Understanding the evolution of the e.l.f. brand and its ownership is key for investors.

Industry trends show a rise in institutional ownership across the market, with e.l.f. Beauty aligning with this trend as large asset managers expand their portfolios. While there haven't been any large-scale share buybacks or secondary offerings directly impacting ownership percentages in 2024-2025, the company's financial health allows for such strategic capital allocation decisions if deemed beneficial. The beauty industry is also experiencing consolidation, positioning e.l.f. Beauty as a potential target for, or an acquirer in, future mergers and acquisitions, which could significantly alter its ownership structure. The company’s focus on Gen Z and Millennial consumers and its digital-first approach are key drivers of its continued success and appeal to investors.

The focus on the Gen Z and Millennial consumer base and the digital-first approach are critical for the company's success. These strategies are a major factor in attracting and retaining investors. The company’s ability to innovate and adapt to changing consumer preferences will continue to shape its ownership structure.

e.l.f. Cosmetics has seen its ownership profile evolve due to strong financial performance and industry trends. Institutional investors are increasingly involved.

The company's Q3 fiscal year 2024 saw a net sales increase of 71% to $279.2 million. This strong performance attracts investors and supports strategic decisions.

The beauty industry's consolidation could affect e.l.f. Cosmetics. This could lead to changes in the company’s ownership structure through mergers or acquisitions.

e.l.f. Cosmetics targets Gen Z and Millennial consumers. Its digital-first approach is a key driver of its success and a significant factor for investor appeal.

e.l.f. Cosmetics Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of e.l.f. Cosmetics Company?

- What is Competitive Landscape of e.l.f. Cosmetics Company?

- What is Growth Strategy and Future Prospects of e.l.f. Cosmetics Company?

- How Does e.l.f. Cosmetics Company Work?

- What is Sales and Marketing Strategy of e.l.f. Cosmetics Company?

- What is Brief History of e.l.f. Cosmetics Company?

- What is Customer Demographics and Target Market of e.l.f. Cosmetics Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.