Extra Space Storage Bundle

Can Extra Space Storage Continue Dominating the Self-Storage Industry?

Extra Space Storage, a leading Self-Storage Company, made waves with its $12.7 billion acquisition of Life Storage in 2023, reshaping the storage industry. This strategic move cemented its position as a dominant force, significantly expanding its footprint across the nation. But what does the future hold for this Real Estate Investment Trust (REIT) giant?

This analysis delves into Extra Space Storage's Growth Strategy, examining its ambitious expansion plans and innovative approaches to maintain its competitive edge. We'll explore the company's market share, financial performance, and investment potential, providing a comprehensive market analysis of the Self-Storage Industry. Furthermore, we will look into the Extra Space Storage SWOT Analysis to understand its strengths, weaknesses, opportunities, and threats in a dynamic market.

How Is Extra Space Storage Expanding Its Reach?

Extra Space Storage, a leading Self-Storage Company, is aggressively pursuing expansion to solidify its market position and capitalize on the rising demand for storage solutions. The company's growth strategy is multifaceted, encompassing significant acquisitions, new store development, and third-party management initiatives. This approach aims to increase its footprint, enhance operational efficiencies, and diversify revenue streams within the Storage Industry.

A core element of Extra Space Storage's expansion strategy involves integrating the Life Storage Inc. portfolio. This strategic move added over 1,200 stores to its network, significantly boosting its presence across key markets. The company is focused on standardizing management practices and leveraging its technological platforms to optimize performance across this expanded portfolio. This integration is expected to yield greater economies of scale and improve brand recognition.

Beyond acquisitions, Extra Space Storage is committed to organic growth through new store development, focusing on high-growth areas with strong population density. The company also utilizes a third-party management platform, overseeing over 900 stores for other owners. This strategy provides recurring fee income and potential acquisition opportunities. Furthermore, Extra Space Storage is exploring ancillary services to enhance customer value and diversify revenue.

The acquisition of Life Storage Inc. was a pivotal move, adding over 1,200 stores. This strategic acquisition significantly increased Extra Space Storage's market share and operational capacity. The integration process focuses on standardizing operations and leveraging technology for optimal performance.

Extra Space Storage is actively developing new facilities in high-growth areas. This organic growth strategy allows the company to build modern, efficient facilities tailored to local market needs. The focus is on markets with strong population density and favorable demographic trends.

The company manages over 900 stores for third-party owners. This platform generates recurring fee income and expands Extra Space Storage's operational reach. It also provides potential acquisition opportunities in the future.

Extra Space Storage is exploring opportunities to expand its ancillary services. This includes offering moving supplies, insurance, and potentially last-mile logistics solutions. The goal is to diversify revenue streams and enhance customer value.

Extra Space Storage's expansion strategy is designed to maintain its leadership in the self-storage market. The company's approach combines strategic acquisitions, organic growth, and third-party management to maximize its footprint and operational efficiency. This strategy, coupled with a focus on customer value, positions Extra Space Storage for continued success in the Storage Industry. For more insights into their marketing efforts, consider reading about the Marketing Strategy of Extra Space Storage.

Extra Space Storage's expansion strategy is multifaceted, focusing on acquisitions, organic growth, and third-party management to enhance its market position and revenue streams. These strategies are designed to capitalize on the growing demand for self-storage solutions.

- Acquisition of Life Storage Inc., adding over 1,200 stores.

- New store development in high-growth areas.

- Third-party management of over 900 stores.

- Expansion of ancillary services to diversify revenue.

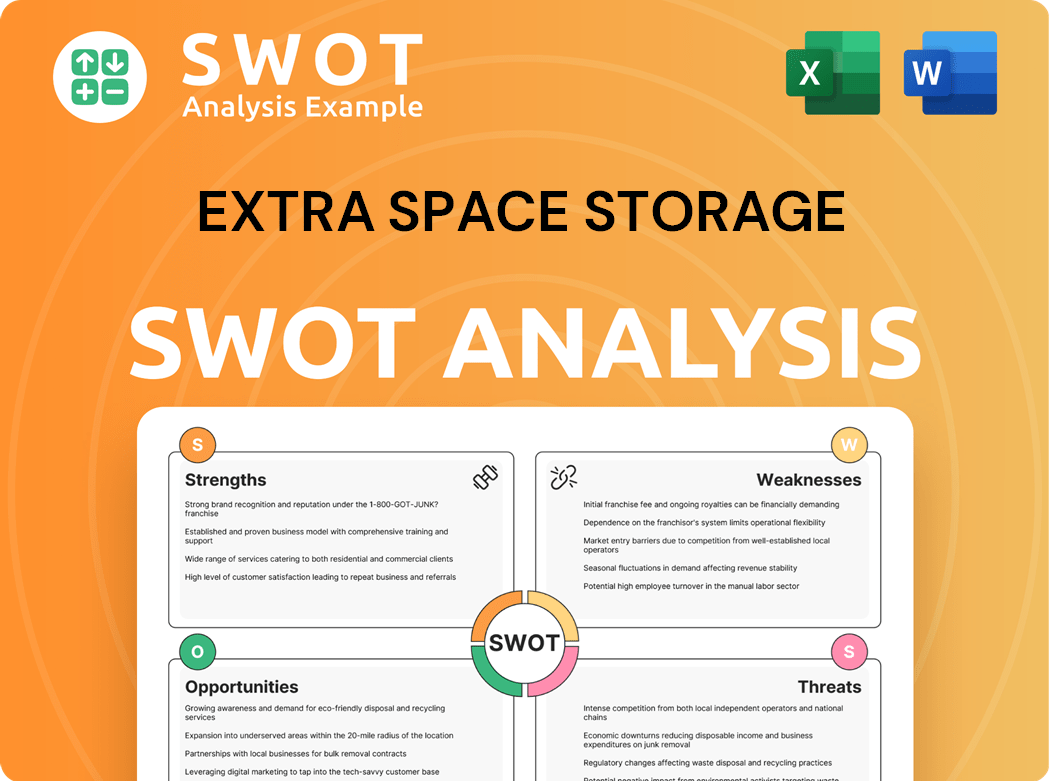

Extra Space Storage SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Extra Space Storage Invest in Innovation?

Extra Space Storage, a leading self-storage company, strategically integrates innovation and technology to enhance its growth strategy. This approach focuses on improving customer experience, optimizing operational efficiency, and driving sustainable practices within the storage industry. The company's commitment to technological advancement is evident in its continuous efforts to upgrade its proprietary management software, which integrates various operational aspects, from property management to customer relationship management.

The company leverages technology to streamline the rental process, facilitate online payments, and provide seamless customer service. This digital transformation aims to offer a convenient and intuitive experience for customers, from initial inquiry to move-out. Extra Space Storage's investment in digital platforms, including its website and mobile applications, reflects its commitment to meeting evolving customer needs and preferences in the self-storage market.

As of 2024, Extra Space Storage operates over 3,600 locations across the United States, demonstrating its significant market presence. The company’s focus on technology is a key element of its expansion plans and its ability to maintain a competitive edge within the self-storage industry. The company's commitment to technological advancement is evident in its continuous efforts to upgrade its proprietary management software, which integrates various operational aspects, from property management to customer relationship management.

Extra Space Storage has invested heavily in its digital infrastructure, including its website and mobile apps. These platforms are designed to simplify the rental process and provide easy online payment options. The goal is to offer a user-friendly experience from start to finish.

The company is integrating smart technologies within its facilities. This includes smart access systems that allow remote unit access for customers. Advanced surveillance and security measures are also being implemented to enhance safety.

Extra Space Storage uses data analytics and artificial intelligence (AI) to optimize pricing strategies. AI helps in dynamically adjusting rental rates based on real-time market conditions and occupancy levels. This also aids in predicting customer demand and personalizing marketing efforts.

Sustainability is a key focus, with the company incorporating energy-efficient lighting, solar panels, and water conservation practices. These initiatives not only support environmental responsibility but also reduce operational costs. This aligns with broader industry trends toward eco-friendly practices.

Extra Space Storage continuously upgrades its proprietary management software. This software integrates various operational aspects, including property management and customer relationship management. This ensures streamlined operations and improved service delivery.

The company prioritizes a customer-centric approach, using technology to improve the overall customer experience. This includes making the rental process more convenient and providing excellent customer service. This focus helps Extra Space Storage maintain a strong customer base.

Extra Space Storage employs a multifaceted approach to technology and innovation. This includes enhancing digital platforms, integrating smart technologies, using data analytics, and focusing on sustainability. These strategies are designed to improve operational efficiency, enhance customer experience, and drive growth within the self-storage market.

- Digital Transformation: Upgrading websites and mobile apps to streamline rentals and payments.

- Smart Facilities: Implementing smart access systems and advanced security measures.

- Data-Driven Decisions: Utilizing AI for dynamic pricing and demand forecasting.

- Sustainability: Incorporating eco-friendly practices to reduce costs and environmental impact.

- Operational Efficiency: Continuously improving proprietary management software.

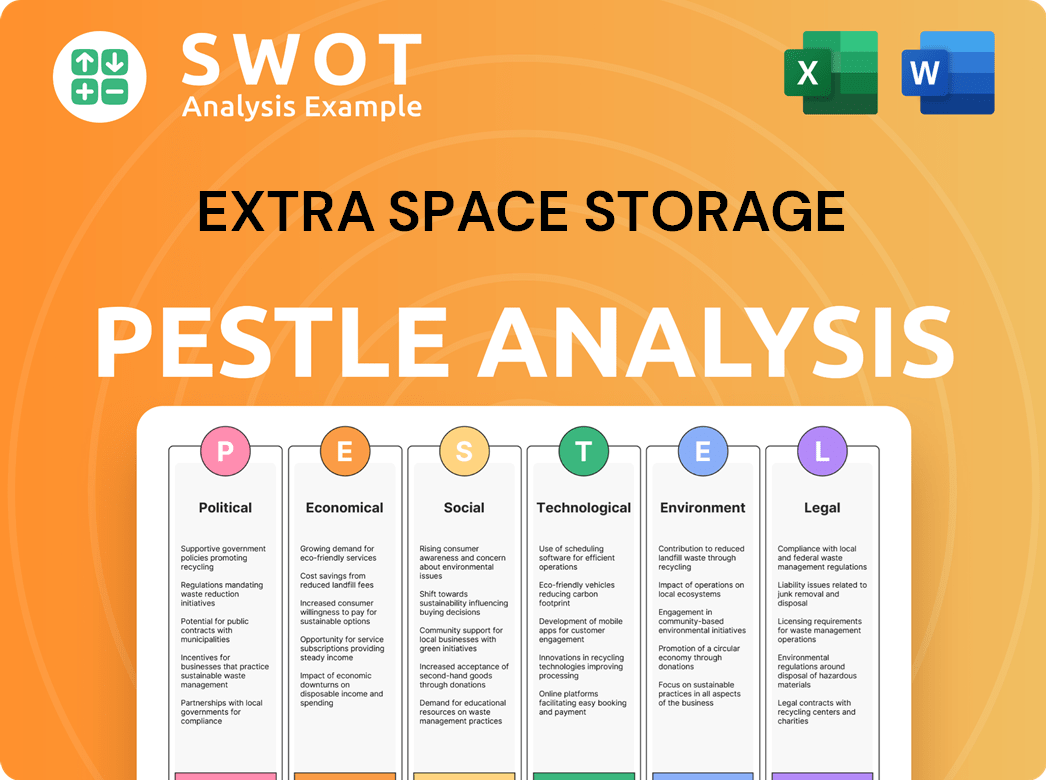

Extra Space Storage PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Extra Space Storage’s Growth Forecast?

The financial outlook for Extra Space Storage, a prominent self-storage company, appears robust, supported by its consistent revenue growth and strategic financial management. The company's recent acquisition of Life Storage is expected to significantly boost its financial performance in 2024 and beyond. This strategic move, coupled with the ability to increase street rates in a favorable market, positions the company for continued expansion and enhanced profitability within the storage industry.

Analysts project sustained revenue growth for Extra Space Storage, driven by both the expanded portfolio and the company's ability to capitalize on market opportunities. The company's focus on maintaining a strong balance sheet and prudent debt management further supports its growth initiatives. The company's commitment to a stable dividend policy also remains a key factor for investors, reflecting its reliable cash flow generation as a Real Estate Investment Trust (REIT).

Extra Space Storage's financial strategy includes optimizing property performance, controlling operating expenses, and exploring accretive capital deployment opportunities. These efforts are aimed at maximizing shareholder returns and reinforcing the company's long-term financial stability. For the full year 2024, the company anticipates Funds From Operations (FFO) per share in the range of $8.20 to $8.50, indicating a strong financial trajectory. For a deeper dive into the company's origins, consider reading a brief history of Extra Space Storage.

Extra Space Storage is expected to experience continued revenue growth, driven by strategic acquisitions and the ability to increase rates. The expanded portfolio, including the integration of Life Storage, contributes significantly to this growth. Market analysis suggests that the self-storage sector remains favorable, supporting the company's revenue projections.

The company maintains strong occupancy rates, reflecting the demand for self-storage solutions. High occupancy levels are a key indicator of financial health and operational efficiency. These strong rates contribute to the company's overall financial performance and stability.

Extra Space Storage demonstrates a disciplined approach to capital allocation, focusing on strategic investments and prudent debt management. The company's financial strategy prioritizes maintaining a strong balance sheet and liquidity. Investment levels are expected to remain significant as the company integrates the Life Storage portfolio and pursues new development opportunities.

The company's dividend policy remains a key attraction for investors, reflecting its stable cash flow generation. This consistent dividend payout underscores the company's financial stability and commitment to shareholder returns. As a REIT, Extra Space Storage's dividend is a significant factor for investors.

Extra Space Storage's financial performance is characterized by several key factors that contribute to its strong outlook. The company's strategic initiatives, including acquisitions and efficient operations, are designed to drive long-term value. The company's focus on the self-storage industry trends also plays a crucial role in its financial success.

- FFO per Share: Projected FFO per share for 2024 is in the range of $8.20 to $8.50.

- Revenue Growth: Continued growth is anticipated, driven by portfolio expansion and rate increases.

- Occupancy: High occupancy rates reflect strong demand and operational efficiency.

- Debt Management: Prudent debt management and access to capital markets support growth.

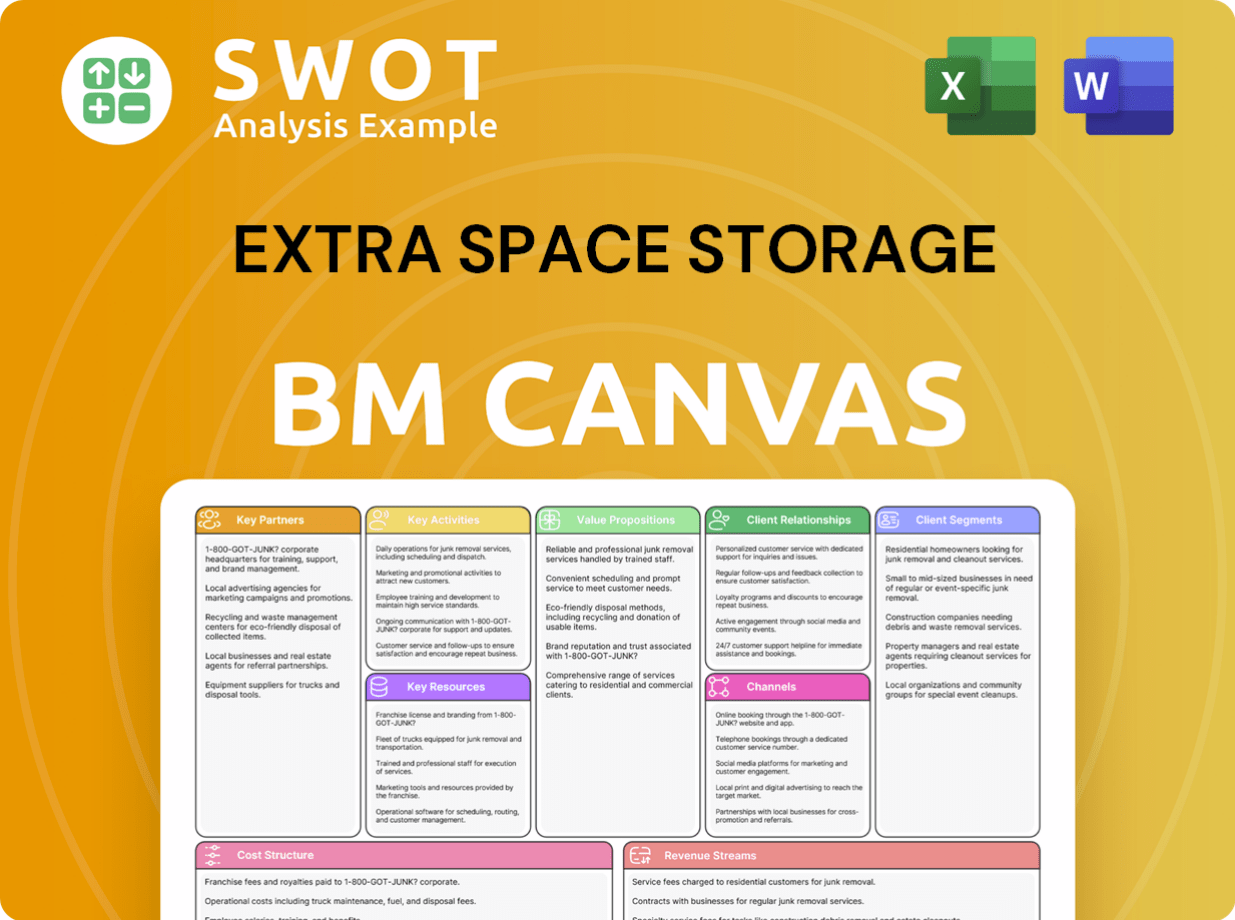

Extra Space Storage Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Extra Space Storage’s Growth?

The Extra Space Storage faces several potential risks and obstacles that could affect its strategic goals. These challenges include competition within the self-storage industry and potential economic downturns. Successful navigation of these risks is crucial for the Extra Space Storage's continued success and growth.

Market competition poses a significant challenge, given the fragmented nature of the Storage Industry. Intense competition can lead to pricing pressures and impact occupancy rates, especially in oversupplied markets. Regulatory changes and supply chain issues can also affect expansion plans.

Internal factors, such as integrating acquisitions, also present operational complexities. Economic downturns could lead to decreased demand for self-storage units. The company's ability to adapt to market shifts and successfully integrate acquired assets demonstrates its preparedness to navigate future challenges.

The Self-Storage Company operates in a highly competitive market. Numerous regional and local operators, along with other large REITs, create pricing pressures and impact occupancy rates. This competitive landscape requires continuous adaptation and strategic initiatives.

Changes in zoning laws and development permits can hinder new facility construction and expansion. Navigating these regulatory hurdles requires proactive engagement and compliance strategies. These factors are critical for the Growth Strategy.

Supply chain issues can affect construction timelines and costs for new developments and upgrades. Effective supply chain management is essential for controlling expenses and ensuring project completion. These challenges can impact the Extra Space Storage's financial performance.

The company must keep pace with evolving customer expectations for digital services. Failure to adapt to new, more efficient storage models could pose a risk. This area requires continuous investment and innovation.

Integrating large acquisitions, such as Life Storage, presents operational complexities. Merging IT systems, harmonizing corporate cultures, and optimizing staffing levels are crucial. This strategic move requires careful planning and execution.

Economic downturns can reduce consumer spending and business activity, leading to decreased demand for self-storage units. Diversification across geographies and property types can mitigate this risk. This is essential for the Extra Space Storage's long-term success.

Extra Space Storage addresses these risks through diversification, robust risk management, and operational efficiency. Diversifying across geographies and property types helps spread risk. A strong emphasis on customer service helps maintain a competitive edge.

In 2024, the self-storage sector's performance varied across different markets, reflecting the impact of economic conditions and supply dynamics. The Real Estate Investment Trust (REIT) sector, including Extra Space Storage, closely monitors these trends to adapt its Growth Strategy. For example, the company's proven track record of adapting to market shifts and successfully integrating acquired assets demonstrates its preparedness to navigate future challenges. For more information about the company, visit Owners & Shareholders of Extra Space Storage.

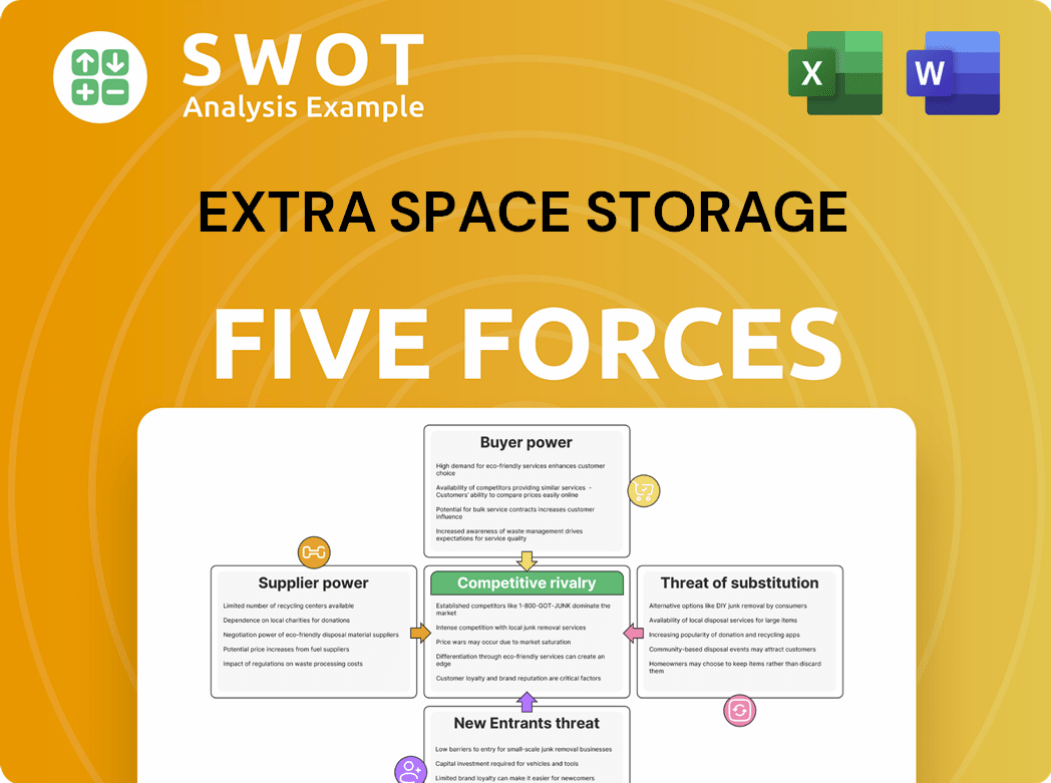

Extra Space Storage Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Extra Space Storage Company?

- What is Competitive Landscape of Extra Space Storage Company?

- How Does Extra Space Storage Company Work?

- What is Sales and Marketing Strategy of Extra Space Storage Company?

- What is Brief History of Extra Space Storage Company?

- Who Owns Extra Space Storage Company?

- What is Customer Demographics and Target Market of Extra Space Storage Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.