Extra Space Storage Bundle

Unlocking the Secrets of Extra Space Storage: How Does It Thrive?

Extra Space Storage, a leading Extra Space Storage SWOT Analysis, isn't just about Storage Solutions; it's a powerhouse in the self-storage industry. This Storage Company has consistently demonstrated impressive growth, making it a compelling subject for anyone interested in real estate investment or business strategy. Understanding its inner workings reveals valuable insights into market dynamics and successful operational models.

Whether you're curious about Extra Space Storage unit sizes, lease terms, or even Extra Space Storage near me options, this analysis breaks down the core elements. We'll explore how this Self Storage giant generates revenue and maintains its competitive edge, offering a comprehensive view for investors and strategists alike. Delving into topics like Extra Space Storage customer reviews and Extra Space Storage move in specials will further enrich your understanding.

What Are the Key Operations Driving Extra Space Storage’s Success?

The core of Extra Space Storage's operations centers on owning, managing, and operating self-storage facilities. They offer secure and accessible storage units in various sizes, designed to meet the needs of individuals, families, and businesses. These storage units serve a range of purposes, from personal moves and decluttering to business inventory and document storage. Their operational approach is streamlined to ensure a smooth customer experience.

Extra Space Storage focuses on providing convenient and reliable storage solutions. This includes online reservations, automated gate access, and on-site management. The company's success is built on a network of well-maintained facilities and a commitment to customer service. They use technology to manage properties efficiently, including digital rental agreements and online payment options.

The value proposition of Extra Space Storage lies in its ability to offer secure, convenient, and flexible storage solutions. They differentiate themselves through technology-driven efficiency, a proactive acquisition strategy, and strong brand recognition. This approach translates into benefits for customers, such as a wide selection of unit sizes, robust security features, and various payment options.

Extra Space Storage utilizes technology for efficient property management. This includes online rental agreements and payment portals. They also implement sophisticated security systems to protect customer belongings. These technologies enhance the overall customer experience and streamline operations.

The company emphasizes excellent customer service through on-site management and responsive support. They aim to make the storage process as easy as possible for their customers. This includes providing assistance with move-in, move-out, and any other storage-related needs.

Extra Space Storage collaborates with third-party management companies and insurance providers. These partnerships enhance service offerings and expand their reach. They help to ensure that customers have access to a comprehensive range of storage solutions.

A key aspect of Extra Space Storage's strategy is acquiring and developing prime real estate locations. They focus on constructing new storage facilities and renovating existing ones. This growth strategy ensures they can meet the increasing demand for storage solutions.

Extra Space Storage distinguishes itself in the competitive self storage market through several key factors. Their commitment to technology-driven efficiency, aggressive acquisition strategies, and strong brand recognition sets them apart. This focus allows them to deliver superior value to their customers.

- Technology Integration: Utilizing digital tools for rentals, payments, and security.

- Strategic Growth: Expanding the portfolio through acquisitions and new developments.

- Customer-Centric Approach: Prioritizing convenience, security, and a wide range of storage options.

- Strong Brand Recognition: Building trust and loyalty among customers.

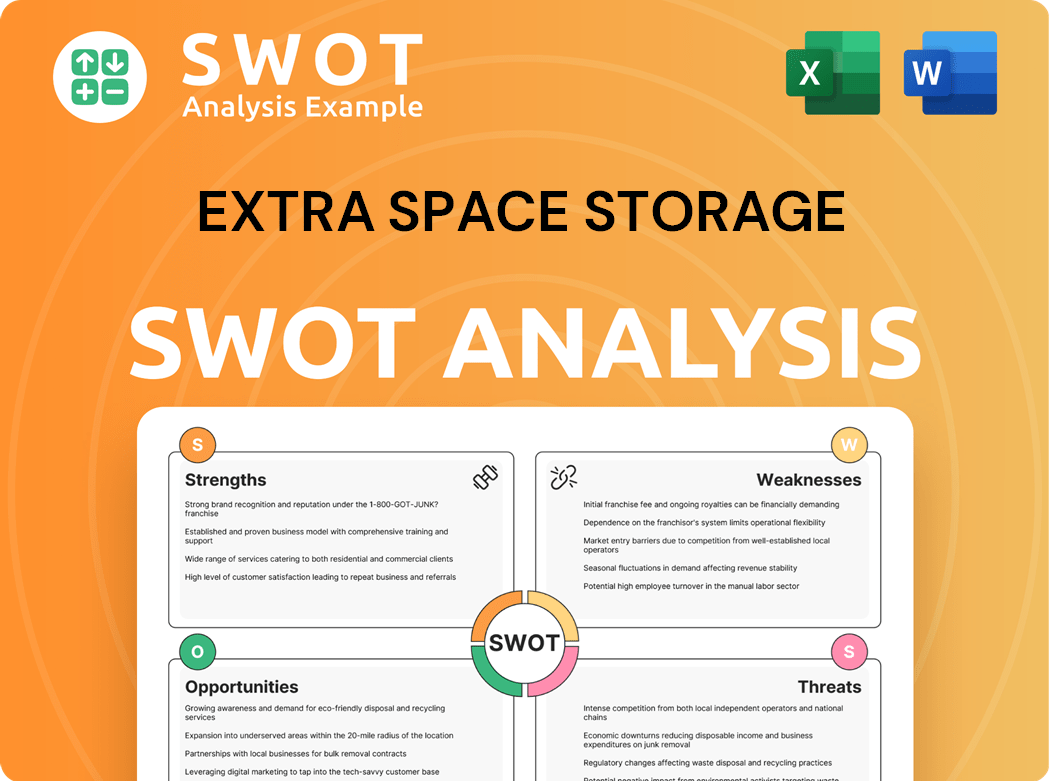

Extra Space Storage SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Extra Space Storage Make Money?

The primary revenue streams and monetization strategies of Extra Space Storage, a leading self storage company, are centered around its core business of providing storage solutions. The company generates the bulk of its revenue from renting out storage units to customers, with pricing adjusted based on factors like unit size, location, and demand. This approach ensures a consistent revenue flow, crucial for the company's financial performance.

Extra Space Storage employs a multifaceted approach to generate revenue. The company enhances its income through various ancillary services and strategic initiatives. These efforts not only boost revenue but also improve customer satisfaction and brand loyalty.

For the fiscal year ending December 31, 2024, the company projected total revenues to be between $2.64 billion and $2.68 billion, demonstrating its strong financial standing and market position.

The main source of revenue comes from renting out storage units. Pricing is determined by unit size, location, and market demand. This core business model provides a stable and predictable income stream for the company.

Additional revenue is generated from selling moving and packing supplies. Tenant insurance, offered through partnerships, also contributes to revenue. These services enhance the customer experience and provide extra income streams.

The company manages self-storage facilities for other owners, earning management fees. This expands the brand's presence without requiring direct capital investment. This diversification strategy helps to bolster revenue.

Extra Space Storage uses dynamic pricing models to adjust rental rates based on real-time demand and occupancy levels. This strategy helps optimize revenue generation. It ensures that the company can maximize its income.

The company utilizes online platforms and digital marketing to attract and retain customers. This approach contributes to consistent revenue growth. Digital strategies are key to reaching a wider audience.

Extra Space Storage focuses on providing excellent customer service to drive repeat business. This includes offering various storage unit sizes and a brief history of Extra Space Storage, as well as convenient lease terms and payment options. Customer satisfaction is a priority.

Extra Space Storage's revenue model is built on several key drivers. These elements work together to ensure financial stability and growth. The company's success is a result of its strategic approach to revenue generation.

- Rental Income: The primary source, driven by unit size, location, and demand.

- Ancillary Sales: Revenue from moving supplies and tenant insurance.

- Management Fees: Income from managing third-party facilities.

- Dynamic Pricing: Adjusting rates to maximize revenue based on market conditions.

- Digital Marketing: Utilizing online platforms to attract and retain customers.

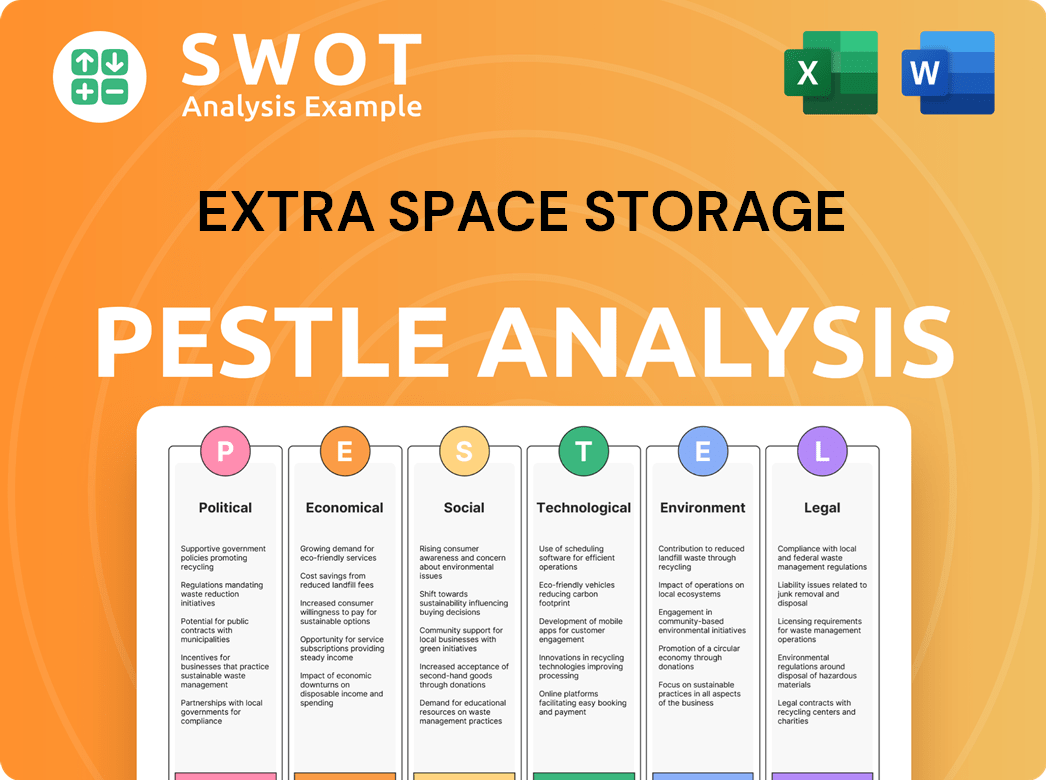

Extra Space Storage PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Extra Space Storage’s Business Model?

Extra Space Storage, a leading player in the self-storage industry, has achieved significant milestones that have shaped its operational and financial performance. Strategic moves, particularly its aggressive acquisition strategy, have been pivotal in its growth. The company's focus on technology and customer experience has also been a key factor in maintaining its competitive edge.

The company's journey includes substantial investments in technology upgrades for its facilities, enhancing customer experience and operational efficiency. Extra Space Storage has consistently adapted to market changes, focusing on digital channels for customer engagement and exploring new technologies to optimize facility management and security. This proactive approach has enabled the company to maintain its position as a leader in the self-storage sector.

Operational challenges have included managing the integration of large acquisitions, ensuring consistent service quality across a growing portfolio, and navigating fluctuating real estate market conditions. The company has responded to these challenges through robust integration plans, standardized operational procedures, and leveraging its scale for cost efficiencies. These efforts have helped Extra Space Storage maintain its competitive advantage.

A pivotal strategic move has been its aggressive acquisition strategy, significantly expanding its portfolio of self-storage facilities. The acquisition of Life Storage in 2023 for approximately $12.7 billion was a transformative event. This move substantially increased its market share and geographic reach. Extra Space Storage has also consistently invested in technology upgrades for its facilities, enhancing customer experience and operational efficiency.

The acquisition of Life Storage created the largest self-storage operator by number of locations and customers. The company has focused on digital channels for customer engagement and exploring new technologies to optimize facility management and security. These moves have been central to its growth strategy. Extra Space Storage continues to adapt to new trends by focusing on digital channels for customer engagement.

Extra Space Storage benefits from extensive brand recognition and significant economies of scale from its vast network of properties. Its strong balance sheet and access to capital markets provide a competitive edge in pursuing further acquisitions and developments. The company's technological leadership in property management and customer service also contributes to its competitive advantage. For more details, check out the Marketing Strategy of Extra Space Storage.

Operational challenges have included managing the integration of large acquisitions and ensuring consistent service quality across a growing portfolio. The company has responded to these challenges through robust integration plans and standardized operational procedures. Extra Space Storage leverages its scale for cost efficiencies.

In 2024, Extra Space Storage demonstrated strong financial performance, reflecting its strategic initiatives and market position. The company's ability to navigate market dynamics and integrate acquisitions effectively has been key to its success.

- Revenue: Reported a significant increase in revenue, driven by same-store revenue growth and contributions from recent acquisitions.

- Occupancy Rates: Maintained high occupancy rates across its portfolio, indicating strong demand for its storage units.

- Net Operating Income (NOI): Showed a healthy increase in NOI, reflecting efficient operations and effective management of its properties.

- Acquisitions: Continued to expand its portfolio through strategic acquisitions, further solidifying its market leadership.

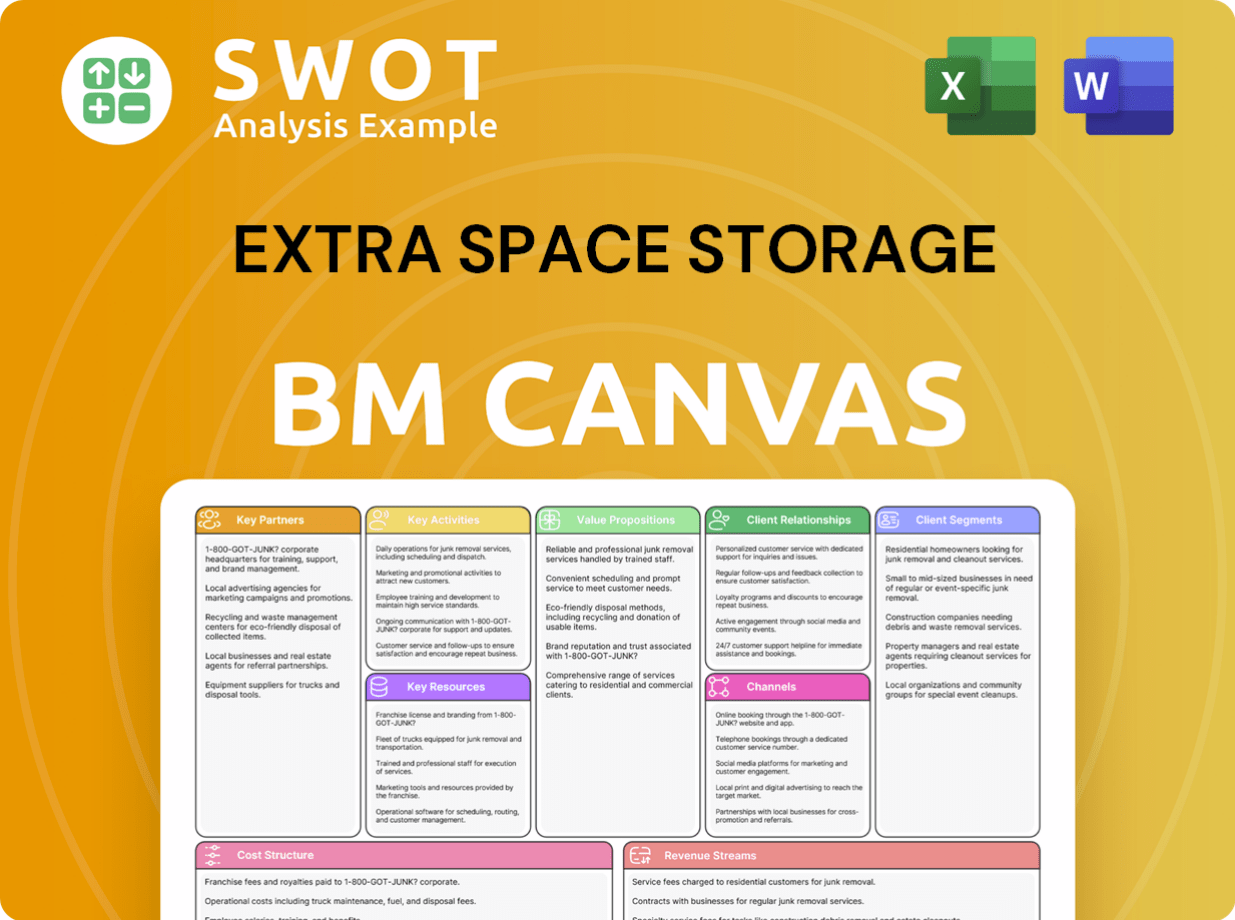

Extra Space Storage Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Extra Space Storage Positioning Itself for Continued Success?

As a leading Storage Company, Extra Space Storage holds a prominent position in the self-storage industry. The company's strategic moves, including the acquisition of Life Storage, have solidified its status as a major player, boasting the largest number of locations and customers. This expansion has significantly boosted its market share, providing competitive advantages such as enhanced brand recognition and operational efficiencies.

The company benefits from strong customer loyalty, driven by convenience, security, and consistent service quality across its extensive portfolio. However, it faces potential risks, including economic downturns that could impact demand, rising interest rates affecting borrowing costs, and increased competition from other self-storage operators. Regulatory changes and technological disruptions also pose long-term challenges.

Extra Space Storage is the largest self-storage operator by number of locations and customers, following its acquisition of Life Storage. This has significantly boosted its market share. The company benefits from strong brand recognition and operational efficiencies.

Key risks include economic downturns reducing demand, rising interest rates impacting borrowing costs, and increased competition. Regulatory changes and technological disruptions, such as advanced home organization solutions, also pose challenges. The company's ability to navigate these risks will be crucial for sustained success.

The future outlook for Extra Space Storage is positive, with ongoing strategic initiatives focused on portfolio expansion and optimizing existing assets. The company aims to leverage technology to enhance customer experience and operational efficiency. Leadership emphasizes sustainable growth and maximizing shareholder value.

The company focuses on expanding its portfolio through acquisitions and development. It also emphasizes optimizing existing assets and leveraging technology to improve customer experience. These initiatives aim to sustain market leadership.

In 2024, Extra Space Storage reported strong financial results, reflecting its market leadership. The company continues to focus on strategic acquisitions and development to expand its portfolio. For more details, you can explore the Competitors Landscape of Extra Space Storage.

- The company's revenue growth in 2024 was approximately 7%.

- Extra Space Storage has a significant market capitalization, reflecting its strong position.

- Occupancy rates remain high, indicating robust demand for Storage Units.

- The company is actively investing in technology to improve operational efficiency and customer experience.

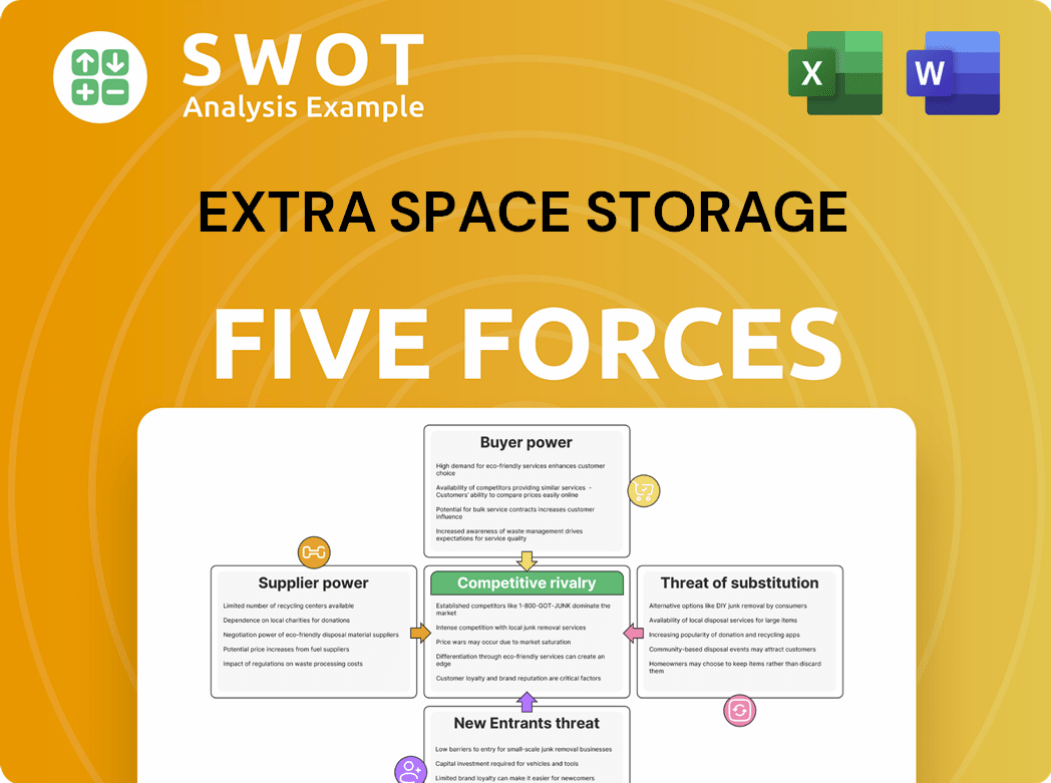

Extra Space Storage Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Extra Space Storage Company?

- What is Competitive Landscape of Extra Space Storage Company?

- What is Growth Strategy and Future Prospects of Extra Space Storage Company?

- What is Sales and Marketing Strategy of Extra Space Storage Company?

- What is Brief History of Extra Space Storage Company?

- Who Owns Extra Space Storage Company?

- What is Customer Demographics and Target Market of Extra Space Storage Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.