Extra Space Storage Bundle

Who Really Owns Extra Space Storage?

Understanding the ownership structure of a company is crucial for investors and strategists alike, as it directly impacts its direction and market performance. The self-storage industry witnessed a landmark event in July 2023 when Extra Space Storage Inc. merged with Life Storage, reshaping the competitive landscape. This article unravels the intricate ownership of Extra Space Storage, offering vital insights for informed decision-making.

Founded in 1977 by Kenneth Woolley, Extra Space Storage has evolved into a self storage powerhouse. As of December 31, 2024, the company boasts an impressive portfolio of over 4,000 storage facilities. To gain a deeper understanding of Extra Space Storage's strategic positioning, consider exploring a detailed Extra Space Storage SWOT Analysis. This exploration will delve into the key players and shareholders that have shaped the storage company ownership and its journey to becoming a leader in the self storage sector.

Who Founded Extra Space Storage?

The story of Extra Space Storage begins in 1977, with its founding by Kenneth Woolley and Sterling Jones. Initially known as Extra Space Development Company, the company's roots trace back to Woolley's early involvement in the self-storage industry.

Woolley, a real estate developer, constructed his first self-storage property in Billings, Montana, in May 1977. His venture followed research conducted during his graduate studies at Stanford University. While specific details on the initial equity split or exact shareholding percentages at the company’s inception are not readily available, Woolley's initial focus was on developing small projects with small partners.

The early ownership structure of Extra Space Storage evolved significantly over time, with key partnerships and strategic moves shaping its trajectory. This included a pivotal alliance with Prudential Real Estate Investors in 1998, facilitated by Diane Olmstead of Arthur Anderson Real Estate Capital Markets Group. Spencer Kirk joined as a partner around this time, focusing on team building, while Woolley concentrated on acquisitions, development, and financing.

Kenneth Woolley, the co-founder, focused on developing small self-storage projects. This approach marked the initial strategy of the company.

In 1998, Extra Space Storage partnered with Prudential Real Estate Investors. This partnership was facilitated by Diane Olmstead.

The initial public offering (IPO) in 1998 on the New York Stock Exchange under the ticker symbol EXR was a crucial step. It allowed the company to raise capital for expansion.

Extra Space Storage Inc., a Maryland corporation, officially took over on April 30, 2004, to continue the business of Extra Space Storage LLC.

Spencer Kirk joined as a partner, focusing on team building. Woolley concentrated on acquisitions, development, and financing.

The first property was constructed in Billings, Montana. This marked the beginning of the company's expansion.

The company's evolution from its early private ownership to a publicly traded entity marked a significant shift. For more details, you can explore the Brief History of Extra Space Storage. As of early 2024, Extra Space Storage operates over 3,600 locations across the United States, with a market capitalization exceeding $30 billion. The company's financial performance continues to be strong, with revenues in 2023 reaching over $2.1 billion, reflecting its sustained growth and strategic acquisitions within the self-storage industry.

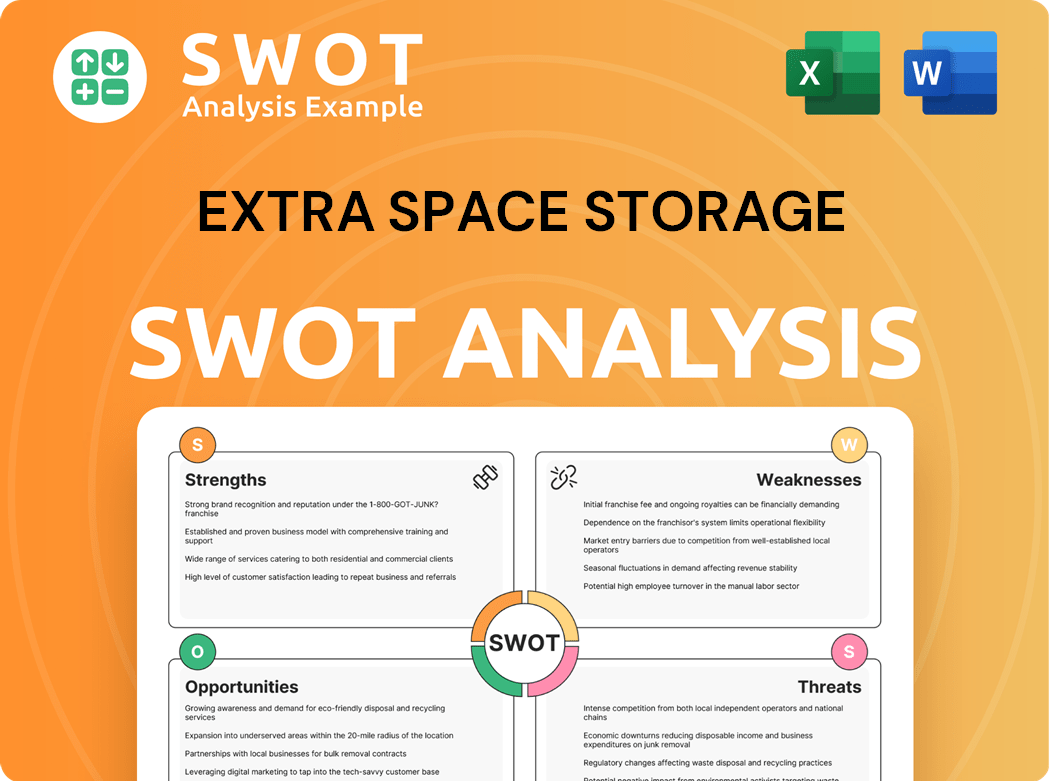

Extra Space Storage SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Extra Space Storage’s Ownership Changed Over Time?

The evolution of Extra Space Storage's ownership structure has been marked by key strategic moves since its initial public offering (IPO) in 1998. The company, which formally re-formed as a Maryland corporation on April 30, 2004, operates as a publicly traded REIT. A pivotal moment in its history was the 2004 acquisition of Storage USA from General Electric for roughly $2.3 billion, significantly expanding its portfolio and market presence. Further growth came with the 2013 acquisition of SmartStop Self Storage, boosting its management portfolio. The company's inclusion in the S&P 500 in January 2016 also highlighted its increasing prominence in the market.

Extra Space Storage's ownership structure is primarily composed of institutional investors. The company's strategic use of joint ventures and third-party management has enabled it to broaden its reach and scale operations with reduced capital investment. As of December 31, 2024, the company had ownership interests in 2,436 operating stores, with 460 in unconsolidated joint ventures. This approach has been instrumental in its expansion strategy, allowing for efficient growth and market penetration.

| Ownership Category | Percentage (as of March 31, 2025) | Approximate Number of Shares |

|---|---|---|

| Institutional Investors | 90.90% | |

| Insider Ownership | 0.97% | |

| Public Companies/Individual Investors | 8.13% |

As of March 31, 2025, the largest institutional shareholders of Extra Space Storage include Vanguard Group Inc. (16.02%), BlackRock, Inc. (8.236%), Cohen & Steers Capital Management, Inc. (7.091%), and State Street Corporation (6.354%). Spencer Kirk, a notable individual shareholder, held 10.21 million shares, representing 4.81% of the company's ownership as of 2025. The company's ownership structure, detailed in its financial reports, reflects a robust institutional backing, supporting its strategic initiatives and market position. To understand more about the company's growth trajectory, consider reading about the Growth Strategy of Extra Space Storage.

Extra Space Storage is predominantly owned by institutional investors, reflecting strong market confidence.

- The company's strategic acquisitions, like Storage USA and SmartStop, have significantly expanded its footprint.

- Joint ventures and third-party management are key strategies for growth.

- Major shareholders include Vanguard, BlackRock, and Cohen & Steers.

- Spencer Kirk is a significant individual shareholder.

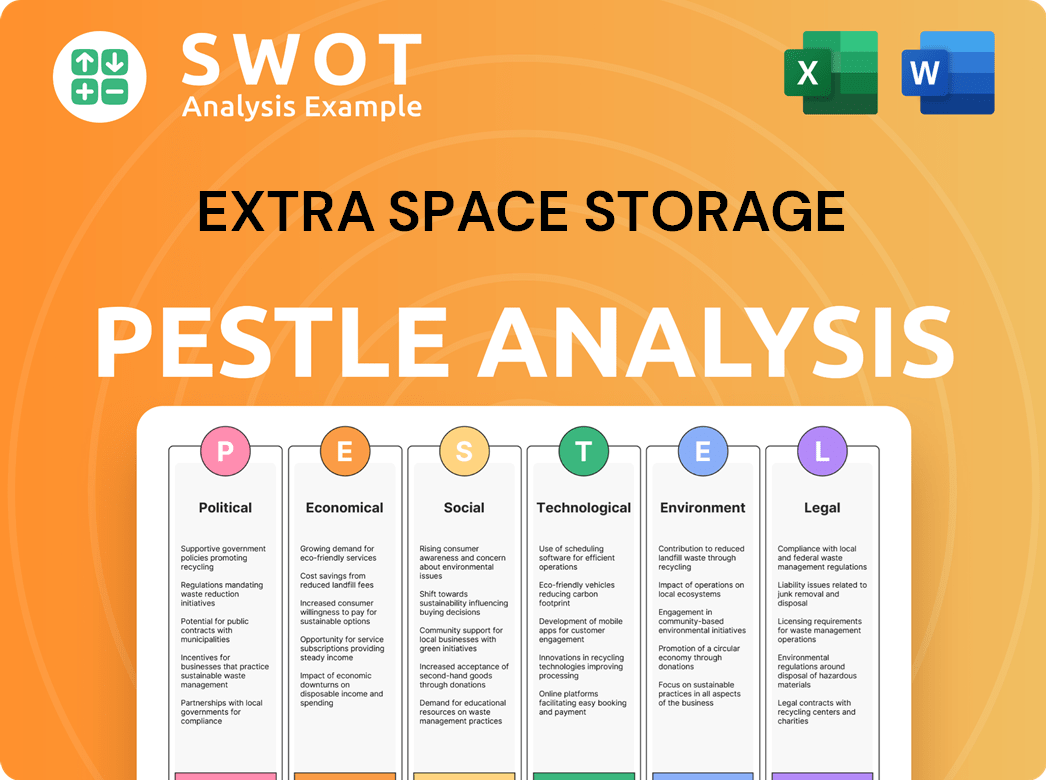

Extra Space Storage PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Extra Space Storage’s Board?

The current board of directors of Extra Space Storage plays a significant role in the company's governance. Kenneth M. Woolley, the founder, serves as the Chairman. Joseph D. Margolis holds the position of Chief Executive Officer. The board includes members representing various interests, such as major shareholders and independent seats. This structure ensures diverse perspectives in decision-making. Understanding the company's corporate structure is key to understanding its operations and future. For more insights, you can explore the Growth Strategy of Extra Space Storage.

The board's composition reflects a balance of experience and shareholder representation. The presence of the founder, Kenneth Woolley, provides continuity and strategic direction. The board's decisions influence the company's strategic direction and financial performance. The company's commitment to corporate governance is also evident through its Code of Business Conduct and Ethics and Corporate Governance Guidelines, available on its investor relations website.

| Board Member | Title | Key Role |

|---|---|---|

| Kenneth M. Woolley | Chairman of the Board | Provides strategic direction and oversight. |

| Joseph D. Margolis | Chief Executive Officer | Manages daily operations and implements strategic plans. |

| Other Directors | Various | Represent shareholders and provide independent oversight. |

The voting structure for Extra Space Storage common stock is generally one-share-one-vote. Stockholders do not have cumulative voting rights. The election of directors and other matters are decided by the affirmative vote of at least a majority of the stockholders present in person or represented by proxy. Institutional ownership, particularly by entities like Vanguard and BlackRock, grants them substantial voting power, influencing governance through their voting decisions.

The board of directors is led by the founder and CEO, ensuring experienced leadership. Institutional investors hold significant voting power, influencing corporate decisions. Understanding the ownership structure is crucial for investors.

- The founder, Kenneth M. Woolley, is the Chairman.

- Joseph D. Margolis is the CEO.

- Institutional investors like Vanguard and BlackRock have substantial voting power.

- The company follows a one-share-one-vote system.

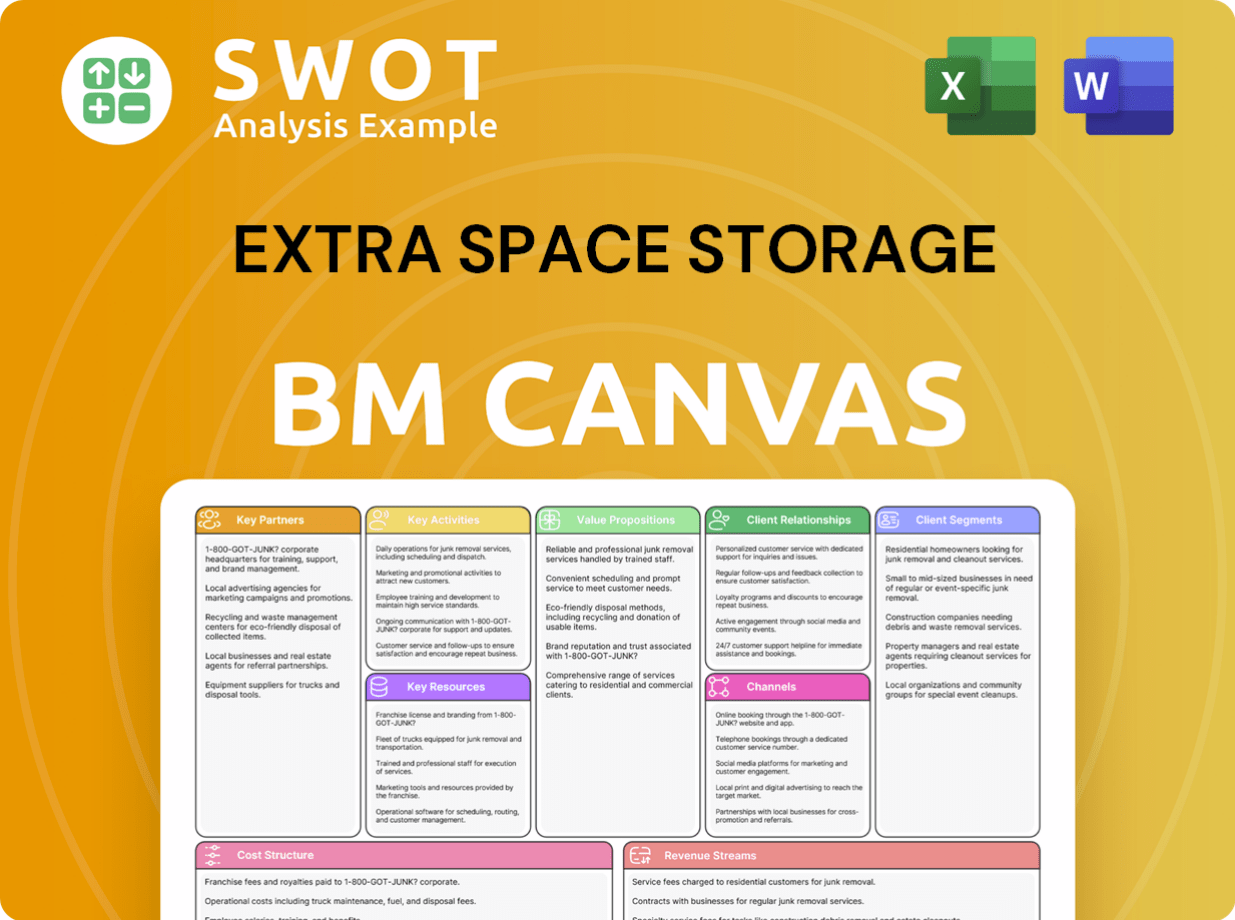

Extra Space Storage Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Extra Space Storage’s Ownership Landscape?

In the last few years, significant developments have reshaped the ownership landscape of Extra Space Storage. A key event was the merger with Life Storage, Inc., finalized in July 2023. This merger, approved by both companies' stockholders, created the largest self-storage operator in the U.S., expanding Extra Space Storage's portfolio substantially. As of March 31, 2025, the company owned and/or operated 4,099 self-storage properties, reflecting its continued growth and market dominance. The company continues to expand its footprint through a mix of internal development and acquisitions, including joint ventures, which remain a key part of its strategy for expanding its footprint and leveraging capital.

Extra Space Storage has also been active with share buybacks. As of December 31, 2024, the company had authorization to repurchase shares with an aggregate value up to $500.0 million. Subsequent to March 31, 2025, the company repurchased 68,585 shares of common stock for $8.6 million at an average price of $125.60 per share. Leadership changes are also occurring, with P. Scott Stubbs set to retire as CFO on December 31, 2025, and Jeff Norman succeeding him on July 1, 2025. The company acquired 38 operating stores for approximately $359.7 million in 2024. These moves highlight the dynamic nature of the self storage industry and the ongoing evolution of Extra Space Storage's corporate structure. For more details, you can explore the Target Market of Extra Space Storage.

The company's strategy includes both acquisitions and joint ventures to fuel expansion. In 2024, Extra Space Storage acquired 38 operating stores for approximately $359.7 million and invested $251.2 million to increase its ownership interest in two existing joint venture partnerships to 49.0%. In February 2025, the company invested $100.0 million in convertible preferred stock of Strategic Storage Growth Trust III, Inc. These strategic investments demonstrate the company's commitment to growth and its ability to leverage diverse financial instruments to expand its portfolio and market presence. Institutional investors hold a dominant stake in the company, reflecting a broader trend of institutional ownership within the REIT sector.

| Metric | Value | Year |

|---|---|---|

| Properties Owned and/or Operated | 4,099 | March 31, 2025 |

| Share Repurchases (Subsequent to March 31, 2025) | 68,585 shares | 2025 |

| Share Repurchase Cost | $8.6 million | 2025 |

| Average Price Per Share Repurchased | $125.60 | 2025 |

| Operating Stores Acquired | 38 | 2024 |

| Acquisition Cost of Operating Stores | $359.7 million | 2024 |

| Investment in Joint Ventures | $251.2 million | 2024 |

| Investment in Convertible Preferred Stock | $100.0 million | February 2025 |

The leadership team at Extra Space Storage includes key figures such as the CEO and the soon-to-be-retired CFO, P. Scott Stubbs, and his successor, Jeff Norman.

Extra Space Storage is a publicly traded REIT, with a significant portion of its ownership held by institutional investors.

The company's financial strategy includes share buybacks and strategic investments in both acquisitions and joint ventures to enhance shareholder value.

The self storage sector is seeing increased institutional investment and consolidation, with Extra Space Storage at the forefront of these changes.

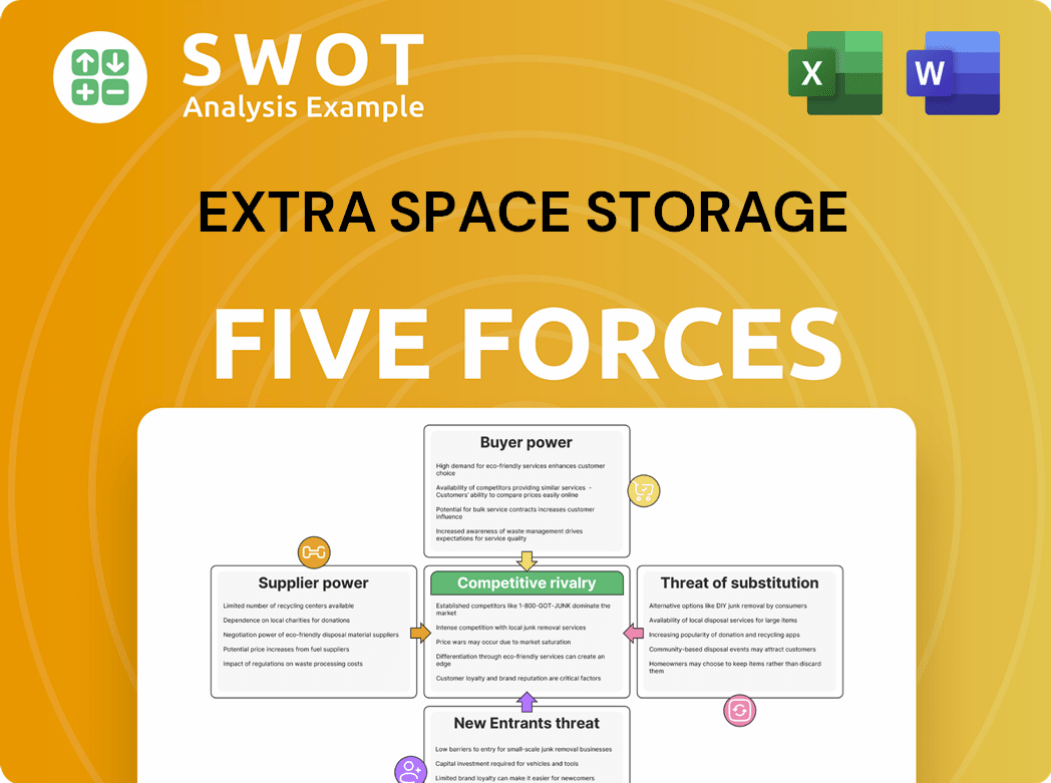

Extra Space Storage Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Extra Space Storage Company?

- What is Competitive Landscape of Extra Space Storage Company?

- What is Growth Strategy and Future Prospects of Extra Space Storage Company?

- How Does Extra Space Storage Company Work?

- What is Sales and Marketing Strategy of Extra Space Storage Company?

- What is Brief History of Extra Space Storage Company?

- What is Customer Demographics and Target Market of Extra Space Storage Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.