Finnair Bundle

Can Finnair Soar to New Heights?

Finnair, the Finnish flag carrier, has strategically refocused on Asia-Europe routes, capitalizing on its Helsinki hub. Founded in 1923, the airline has evolved from a small operation to a significant global player, particularly excelling in the competitive long-haul market. Understanding Finnair's journey and its strategic shifts is crucial for anyone analyzing the Finnair SWOT Analysis and its future in the dynamic airline industry.

This exploration into Finnair's growth strategy and future prospects will dissect its expansion plans, innovation, and financial outlook. We'll also examine the challenges and opportunities facing Finnair, including its market position, competitive landscape, and the impact of external factors. A thorough Finnair company analysis is essential to understanding its potential for long-term success, providing valuable insights for investors and industry professionals alike, considering its long-term strategic goals.

How Is Finnair Expanding Its Reach?

The core of the Finnair growth strategy involves adapting to the changing landscape of the airline industry, especially concerning its Asia-Europe routes. The company is actively working to rebuild and strengthen its network, which was significantly impacted by geopolitical events, particularly the closure of Russian airspace. This situation has led to longer flight times on many Asian routes, prompting strategic adjustments.

Finnair's future prospects are closely tied to its ability to optimize routes and partnerships. The airline is focusing on maximizing its existing fleet and exploring its cargo operations to diversify revenue streams. These initiatives are crucial for maintaining a competitive edge in the market. The company is also focusing on strategic partnerships and codeshare agreements to extend its reach and offer more comprehensive travel options to customers.

The company's expansion plans for 2024 and beyond are centered on strategic adjustments to its network. This involves optimizing routes to destinations like Tokyo, Seoul, and Shanghai, considering altered flight paths. The airline is also focused on maximizing the utilization of its existing fleet, particularly its wide-body aircraft, to meet demand and improve efficiency. While specific new market entries or large-scale mergers and acquisitions are not prominently featured in recent announcements, the emphasis is on strategic partnerships and codeshare agreements to extend its reach and offer more comprehensive travel options to customers.

Finnair is adapting its flight schedules to accommodate longer flight times due to the closure of Russian airspace. This includes adjusting routes to key Asian destinations such as Tokyo, Seoul, and Shanghai. The airline is focusing on maintaining its competitive edge by exploring new traffic flows and partnerships.

The company focuses on maximizing the utilization of its existing fleet, particularly its wide-body aircraft. This strategy aims to improve efficiency and meet passenger demand. Efficient fleet management is crucial for profitability in the airline industry.

Finnair is emphasizing strategic partnerships and codeshare agreements to extend its reach. These collaborations help the airline offer more comprehensive travel options to customers. Partnerships are essential for expanding market presence and enhancing customer service.

The airline is exploring opportunities within its cargo operations to diversify revenue streams. This includes leveraging the increased importance of cargo services. Expanding cargo operations can provide a significant boost to overall financial performance.

Finnair's expansion strategy is multifaceted, focusing on route network optimization, fleet utilization, strategic partnerships, and cargo operations. These initiatives are designed to enhance its market position and improve financial performance. The airline's approach reflects a proactive response to the challenges and opportunities in the current airline industry landscape.

- Adjusting flight schedules to accommodate longer flight times on Asian routes.

- Maximizing the use of existing fleet, especially wide-body aircraft, to meet demand.

- Forming strategic partnerships and codeshare agreements to broaden its network.

- Exploring opportunities within cargo operations to diversify revenue streams.

Finnair SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Finnair Invest in Innovation?

The airline's innovation and technology strategy is pivotal for its Finnair growth strategy and achieving its Finnair future prospects. This approach focuses on enhancing operational efficiency, improving customer experience, and driving sustainable growth within the airline industry. Technological advancements are key to navigating the complexities of the aviation sector.

Digital transformation is at the forefront, with initiatives aimed at streamlining processes from booking to baggage handling. These efforts are designed to improve personalized services for passengers. Sustainability is a major driver of innovation, influencing many of the technological investments and strategic decisions.

While specific details on R&D investments or new patents are not widely publicized, the airline's commitment to technology is evident in its sustainability efforts. This is a key element in its Finnair company analysis, reflecting its long-term strategic goals.

The airline is actively exploring and investing in sustainable aviation fuels (SAF) to reduce its carbon emissions. This is a core part of its Finnair sustainable aviation strategy. The goal is to achieve carbon neutrality by 2045.

The airline participates in industry-wide initiatives and collaborations. These partnerships are aimed at accelerating the development and adoption of SAF. This collaborative approach is vital for achieving sustainability targets.

The airline is likely exploring the use of data analytics and AI. These technologies are used to optimize flight operations. They also personalize customer offerings and enhance predictive maintenance for its fleet.

Technology investments contribute to improving cost efficiency. This is a key factor in maintaining a strong Finnair market position. Digital tools streamline various aspects of operations.

Focus on technology enhances customer satisfaction through personalized services. This includes improvements in booking, in-flight entertainment, and baggage handling. The goal is to create a seamless travel experience.

Investments in sustainable technologies improve environmental performance. This aligns with global efforts to reduce carbon emissions. Sustainable practices are central to the airline's strategy.

The airline's continuous efforts in these areas contribute to its long-term growth objectives by improving cost efficiency, customer satisfaction, and environmental performance. For a deeper understanding of the airline's origins and development, you can explore the Brief History of Finnair. These initiatives are critical for addressing Finnair challenges and opportunities in a competitive market. The airline's focus on innovation is also influenced by factors such as Finnair impact of fuel prices and Finnair impact of geopolitical events.

The airline's technology strategy focuses on several key areas to enhance its operations and customer experience. These initiatives are crucial for its Finnair expansion plans 2024 and long-term success.

- Digital Transformation: Streamlining processes from booking to baggage handling.

- Sustainable Aviation Fuels (SAF): Investing in SAF to reduce carbon emissions.

- Data Analytics and AI: Optimizing flight operations and personalizing customer offerings.

- Predictive Maintenance: Enhancing fleet maintenance through data analysis.

- Customer Experience: Improving in-flight entertainment and personalized services.

Finnair PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Finnair’s Growth Forecast?

The financial outlook for Finnair reflects a period of recovery and strategic adaptation, particularly following the disruptions of recent global events. The company is focused on restoring profitability and strengthening its financial position. A key element of the Finnair growth strategy involves managing costs and improving operational efficiency to support its financial ambitions.

In the first quarter of 2024, Finnair reported a comparable operating result of -6.0 million euros, a significant improvement compared to the -143.7 million euros in Q1 2023. This positive trend indicates progress towards recovery. The airline's revenue for Q1 2024 increased by 13.9% to 663.7 million euros compared to the previous year, showcasing a positive trajectory in its financial performance. The airline industry is undergoing significant changes, and Finnair's ability to adapt is crucial.

The company anticipates a comparable operating profit for the full year 2024, although the precise outcome will depend on various factors, including fuel prices and demand. Finnair's long-term financial goals include achieving sustainable profitability and maintaining a robust liquidity position to support future investments and withstand market fluctuations. A detailed Finnair company analysis reveals the complexities of its current position.

In Q1 2024, Finnair's revenue reached 663.7 million euros, a 13.9% increase year-over-year. The comparable operating result improved to -6.0 million euros from -143.7 million euros in Q1 2023. These figures highlight the progress in the Finnair financial performance review.

Finnair focuses on cost reduction and operational efficiency to achieve its financial goals. The airline is also working on route network optimization as part of its Finnair business model. Investment in new aircraft is also a key aspect of the Finnair expansion plans 2024.

The airline industry faces challenges and opportunities, including geopolitical events and economic conditions. Analyst forecasts generally point towards continued recovery in passenger traffic and revenue. Understanding the Finnair market position is crucial for investors.

Finnair aims for sustainable profitability and a strong liquidity position. The company is also focused on its long-term strategic goals, including sustainable aviation strategy. These goals are essential for the Finnair future prospects.

Several factors influence Finnair's financial outlook, including fuel prices and demand. The impact of fuel prices is a significant factor. Geopolitical events also play a role in shaping the airline's performance.

- Fuel price volatility

- Geopolitical stability

- Economic conditions

- Passenger demand

For more detailed insights into Finnair's strategic moves and market position, you can refer to a comprehensive analysis of the airline's strategies and future prospects, available in this article: Finnair's Strategic Outlook.

Finnair Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Finnair’s Growth?

The Finnair company analysis reveals several potential risks and obstacles that could affect its growth strategy. These challenges span market competition, regulatory changes, geopolitical instability, supply chain issues, and economic downturns. Understanding these risks is crucial for assessing Finnair's future prospects and its ability to achieve its long-term strategic goals.

Intense competition in the airline industry, especially on key routes, poses a continuous threat. Furthermore, the need to adapt to evolving environmental policies and the impact of geopolitical events, such as airspace closures, add complexity. These factors require careful management to maintain profitability and operational efficiency.

The aviation sector is inherently vulnerable to economic fluctuations, which can impact travel demand. Managing these various risks effectively is essential for Finnair's business model to remain resilient and competitive. The company actively employs strategies like network diversification and fuel hedging to mitigate these impacts.

The airline industry is highly competitive, with established carriers vying for market share. This competition can lead to pressure on pricing and margins, especially on key routes. Competition can also impact route network optimization and profitability.

Regulatory changes, particularly those related to environmental policies and carbon emissions, present significant challenges. Compliance requires substantial investment in sustainable practices and alternative fuels. These changes can affect operational costs and sustainable aviation strategy.

Geopolitical events, such as the closure of Russian airspace, continue to affect Finnair's expansion plans 2024. This forces longer flight times and increased fuel consumption, impacting profitability. These events can also disrupt cargo business strategy and operational efficiency.

Supply chain issues, including the availability and cost of sustainable aviation fuels and aircraft parts, can disrupt operations. Disruptions can lead to increased costs and operational delays. These vulnerabilities require careful management and strategic planning.

Economic downturns can significantly reduce travel demand. This impacts Finnair's financial performance review and overall profitability. Economic fluctuations require proactive measures to mitigate impacts on passenger growth forecast.

Fluctuations in fuel prices can significantly affect operational costs. Hedging strategies are crucial to manage this risk effectively. Fuel price volatility directly impacts the impact of fuel prices on profitability.

To address these risks, Finnair's market position is strengthened through network diversification, hedging strategies, and continuous dialogue with regulators. The company has shown resilience in adapting to past crises, such as the pandemic and airspace closures, by adjusting its operational models. These strategies support Finnair's long-term strategic goals.

Understanding the Finnair competitive landscape analysis is vital for effective risk management. This involves analyzing competitors' strategies and market positions. Strategic partnerships and alliances also play a crucial role in enhancing competitiveness.

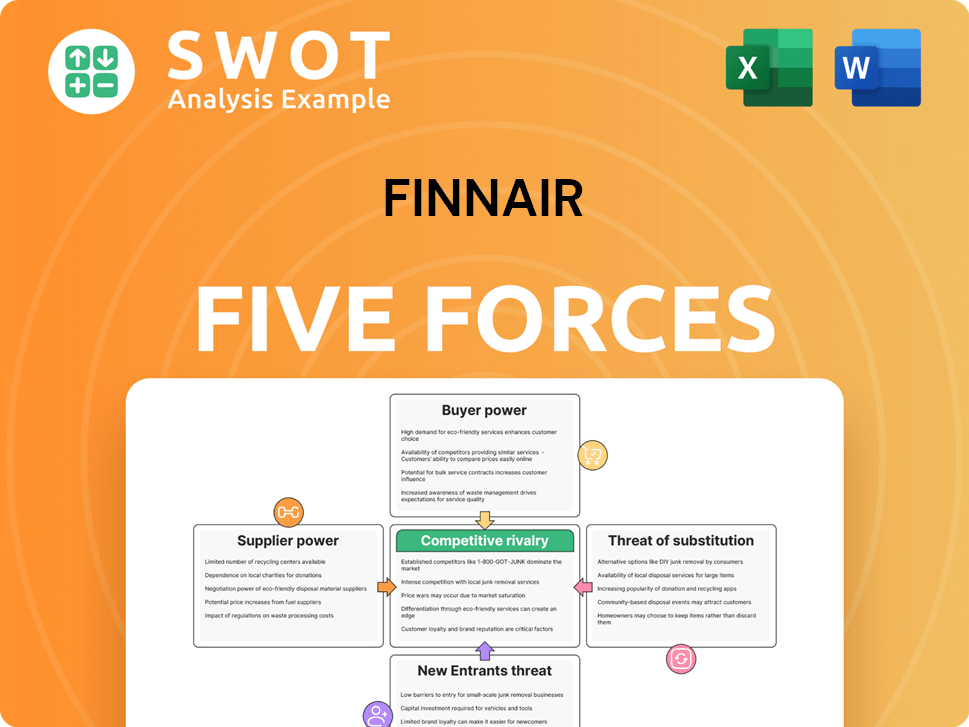

Finnair Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Finnair Company?

- What is Competitive Landscape of Finnair Company?

- How Does Finnair Company Work?

- What is Sales and Marketing Strategy of Finnair Company?

- What is Brief History of Finnair Company?

- Who Owns Finnair Company?

- What is Customer Demographics and Target Market of Finnair Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.