Finnair Bundle

Who Really Owns Finnair?

Understanding a company's ownership is crucial for grasping its strategic direction and future prospects. Finnair, Finland's flagship carrier, offers a compelling case study in how ownership impacts operational focus and resilience. Delving into the Finnair SWOT Analysis can provide further insights into its strategic positioning.

This exploration of Finnair ownership will reveal the Finnair owner and the evolution of its Finnair parent company. We'll examine the Finnair shareholders and their influence, exploring questions like "Who is the majority shareholder of Finnair?" and "Who owns Finnair?" to understand the company's trajectory. Analyzing the Finnair stock and the Finnair stock price history provides valuable context for its financial performance and strategic decisions, especially regarding its relationship with the Finnish government and its major stakeholders.

Who Founded Finnair?

The genesis of Finnair, initially known as Aero O/Y, dates back to its founding on November 1, 1923. The early ownership of the airline was significantly shaped by the Finnish government, which played a pivotal role in its establishment. This governmental backing was crucial for the nascent aviation industry in Finland.

The initial ownership structure of Finnair was primarily influenced by the Finnish government and key individuals. Detailed equity splits for all early individual founders aren't readily available in public records. However, the Finnish state held a substantial stake in the airline from its inception, underscoring its strategic importance to the nation.

The arrival of the first aircraft, a Junkers F 13, in March 1924, marked the beginning of Finnair's operational history. The government's role in funding and developing the airline was a common practice among national carriers during that era. Over time, private investors acquired stakes, but the government's influence remained constant, guiding the airline's long-term vision.

The Finnish government provided essential capital and support. This backing was critical for the early development of air travel infrastructure.

The government's significant stake highlighted the strategic importance of the airline. This ensured alignment with national interests.

The first aircraft, a Junkers F 13, was acquired in March 1924. This marked the start of Finnair's operational history.

Early agreements focused on routes, aircraft, and regulations. These were heavily influenced by government objectives.

While private investors later joined, the government maintained a strong influence. This ensured continuity in strategic direction.

The government's role in funding was a common practice for national carriers. This supported early infrastructure development.

Understanding the Marketing Strategy of Finnair is crucial to understanding its current market position. The early ownership structure of Finnair, with significant government involvement, set the stage for its long-term strategic direction. The Finnish government's initial investment and ongoing influence have been critical to the airline's stability and growth. As of the latest available data, the ownership structure has evolved, but the government's historical role remains a key factor in understanding who owns Finnair and its strategic priorities.

The Finnish government was the primary backer of Finnair from its inception.

- The government's initial investment was crucial for the airline's early development.

- The state's influence shaped Finnair's strategic direction and long-term vision.

- Early agreements were heavily influenced by the government's strategic objectives.

- This early structure has significantly impacted Finnair's evolution and current operations.

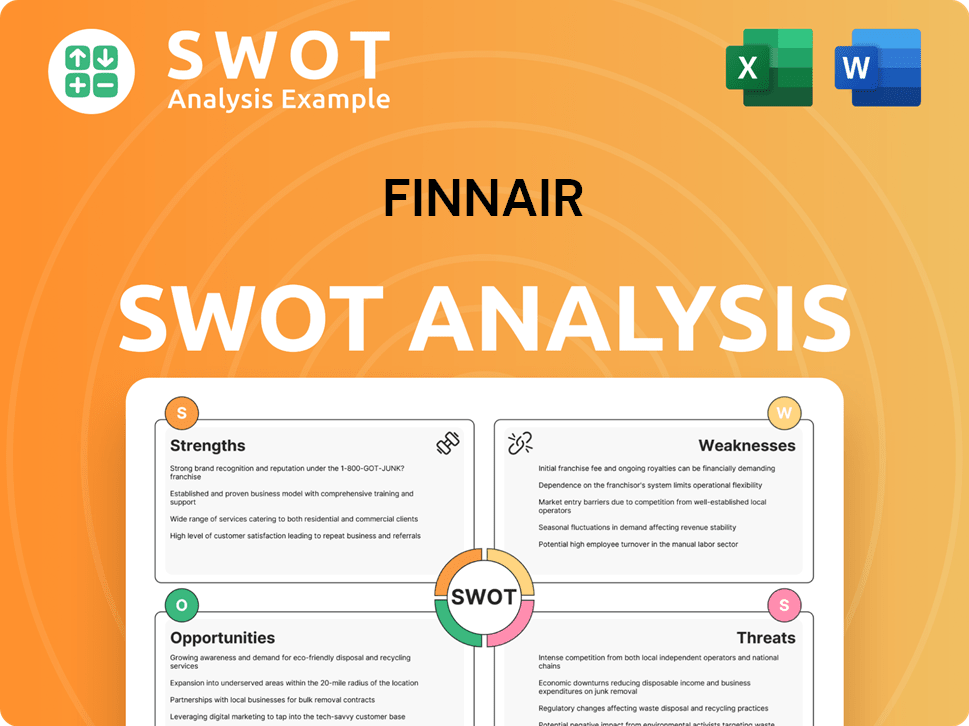

Finnair SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Finnair’s Ownership Changed Over Time?

The evolution of Finnair's ownership reflects a blend of state control and public market participation. Initially, the Finnish state held a dominant position, a strategy designed to maintain a national airline. This has evolved over time, particularly with the company's listing on the Helsinki Stock Exchange. The transition to a publicly listed company allowed for the introduction of institutional and individual investors, influencing the ownership structure and the company's strategic direction.

The Finnish state's role has been pivotal, especially during economic challenges. The state's commitment to maintaining air connections for Finland and supporting the economy is evident through its continued majority ownership. This ownership structure has provided stability and strategic backing, particularly during crises such as the COVID-19 pandemic, when the government provided substantial financial support to the airline. The presence of institutional investors also ensures a level of market scrutiny and accountability.

| Shareholder | Shareholding Percentage (as of March 31, 2024) | Notes |

|---|---|---|

| State of Finland (Prime Minister's Office) | 55.8% | The largest single shareholder, reflecting the state's strategic interest. |

| Ilmarinen Mutual Pension Insurance Company (May 2024) | 2.59% | One of the significant institutional investors. |

| Varma Mutual Pension Insurance Company (May 2024) | 1.45% | Another key institutional investor. |

| Elo Mutual Pension Insurance Company (May 2024) | 1.15% | Contributing to the free float. |

The ownership structure of Finnair, with the Finnish state as the primary owner, has a significant impact on the airline's strategic decisions and operational stability. The presence of institutional investors, such as pension funds, adds another layer of influence, ensuring market oversight and potentially impacting long-term strategies. This balance between state control and public market participation shapes Finnair's approach to financial performance, market positioning, and responses to industry challenges.

The Finnish state is the majority shareholder of Finnair, with approximately 55.8% of shares as of March 31, 2024. This ownership structure ensures the airline's role as a national carrier. Institutional investors hold a significant portion of the remaining shares, contributing to the company's free float and market dynamics.

- Finnair is a publicly traded company on the Helsinki Stock Exchange.

- The State of Finland, through the Prime Minister's Office, is the majority shareholder.

- Major institutional investors include pension funds like Ilmarinen, Varma, and Elo.

- This ownership structure affects Finnair's strategic decisions and financial stability.

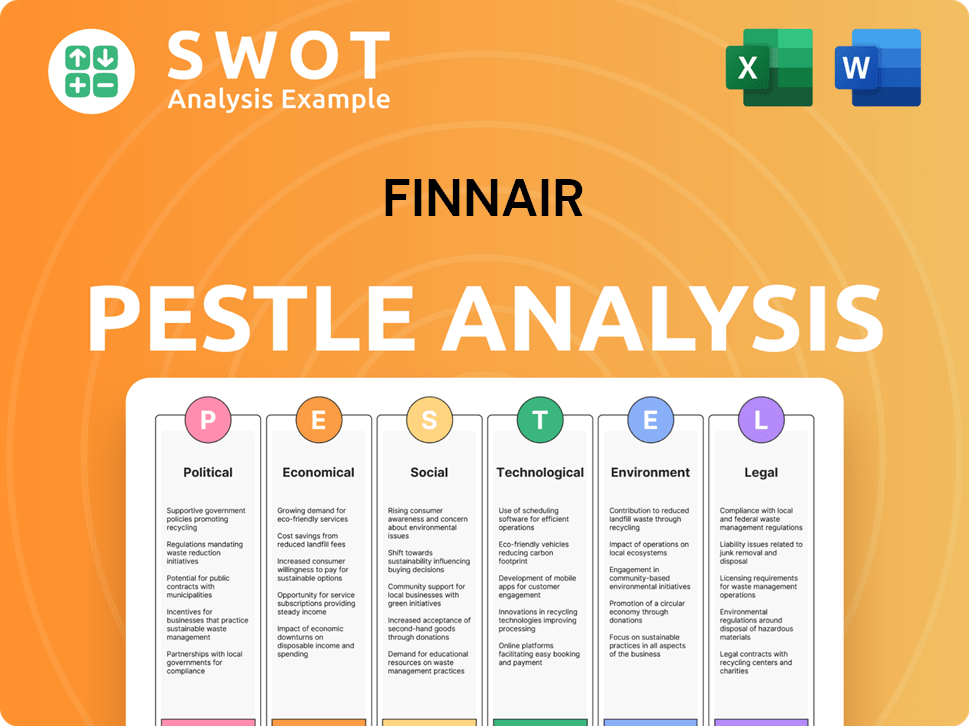

Finnair PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Finnair’s Board?

The Board of Directors of Finnair is structured to represent a diverse shareholder base, with the Finnish state holding a significant influence as the majority owner. The board typically includes independent directors and individuals with experience in the aviation industry and corporate governance. As of April 2024, the Chairman of the Board was Jouko Karvinen. Other board members included Jukka Erlund, Tiina Herlin, Hannele Jakosuo-Jansson, Simon Large, Catherine Palmer, and Veli-Matti Saarinen.

The selection of board members generally aims to ensure a balance of perspectives and competencies. While specific board members may not directly represent a single major shareholder other than the state, their roles are crucial in overseeing the company's management, approving strategic plans, and ensuring compliance with regulatory requirements. This ensures the interests of all shareholders are considered within the framework of the Finnish state's majority ownership. Understanding the target market of Finnair can also provide insights into the strategic decisions influenced by the board.

| Board Member | Position | As of April 2024 |

|---|---|---|

| Jouko Karvinen | Chairman of the Board | April 2024 |

| Jukka Erlund | Board Member | April 2024 |

| Tiina Herlin | Board Member | April 2024 |

Finnair operates under a one-share-one-vote principle, which means each share has equal voting rights. There are no known dual-class shares or special voting rights that grant disproportionate control to any single entity. This structure allows the Finnish state, with its majority holding, to maintain significant control over key decisions. The board's role is to oversee the company's management and ensure compliance, balancing the interests of all shareholders within the framework of the Finnish state's majority ownership. The influence of the state as a majority shareholder inherently shapes decision-making, often aligning with national interests.

The Board of Directors at Finnair includes a mix of independent directors and industry experts.

- The Finnish state, as the majority owner, significantly influences strategic decisions.

- Each share has equal voting rights, ensuring a fair voting structure.

- The board balances shareholder interests while aligning with national objectives.

- The board oversees management, approves plans, and ensures regulatory compliance.

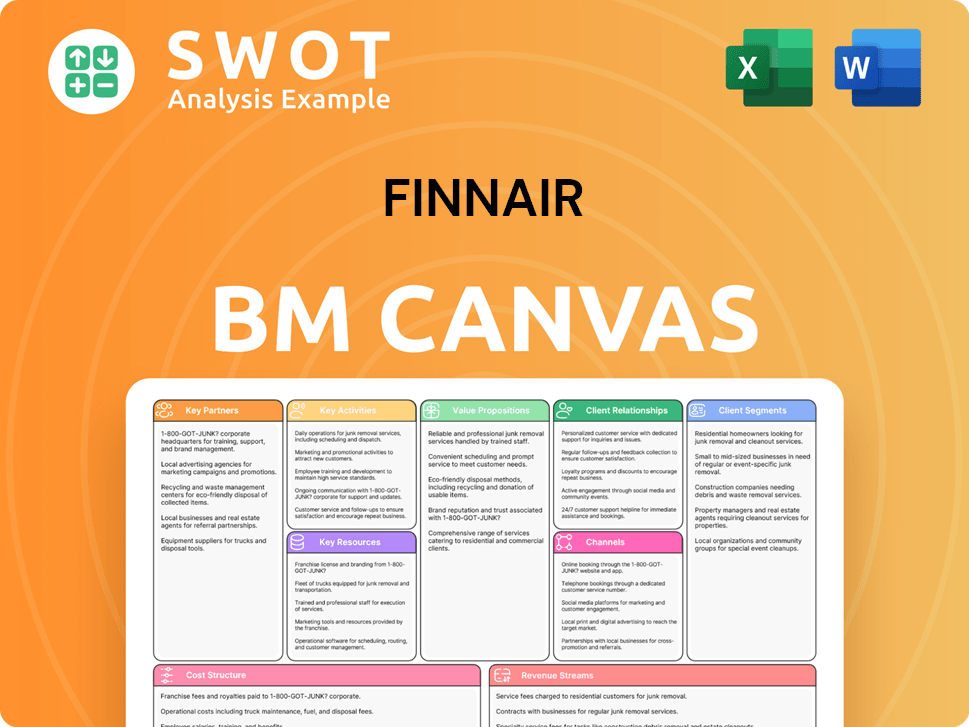

Finnair Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Finnair’s Ownership Landscape?

Over the past few years (2022-2025), the ownership of Finnair, and its strategic direction have been significantly influenced by global events, including the COVID-19 pandemic and geopolitical shifts. A key development has been the Finnish state's continued support, often involving capital injections and share subscriptions. In 2022, the Finnish state largely subscribed to a rights issue, reinforcing its majority ownership. This demonstrates the state's commitment to maintaining its stake and providing stability. Understanding who owns Finnair is crucial for investors and stakeholders alike.

Industry trends, like increased institutional ownership and ESG investing, also influence Finnair. Institutional investors are increasingly focused on sustainability, prompting Finnair to invest in fuel-efficient aircraft and sustainable aviation fuels. While founder dilution isn't a major factor, the airline has faced consolidation pressures. There have been discussions about the optimal level of state ownership. The Finnish state has reaffirmed its commitment, but the long-term trend in some European countries is toward partial or full privatization. Given its strategic importance, a significant reduction in state ownership seems unlikely soon. The company has also adapted to the altered geopolitical landscape, particularly the closure of Russian airspace, impacting its Asia strategy and requiring a re-evaluation of its network and fleet utilization. To learn more about the company's strategic direction, consider exploring the Growth Strategy of Finnair.

| Key Development | Impact | Timeline (Approximate) |

|---|---|---|

| State Support (Capital Injections, Share Subscriptions) | Maintained financial stability; reinforced state ownership. | 2022-2025 |

| Increased Institutional Ownership | Focus on sustainability efforts, investment in fuel-efficient aircraft. | Ongoing |

| Geopolitical Shifts (Closure of Russian Airspace) | Necessitated re-evaluation of network and fleet utilization, particularly impacting Asia strategy. | 2022-Present |

As of late 2024, the Finnish government remains the majority shareholder, solidifying its control over the airline's strategic decisions. The ownership structure reflects the airline's role in Finland's national infrastructure and connectivity. Understanding the Finnair owner is essential for grasping its long-term trajectory. The airline's financial performance and stock price history are influenced by its ownership structure and strategic decisions.

The Finnish government is the majority shareholder. Institutional investors also hold significant shares. This ownership structure impacts the airline's strategic decisions.

The airline is adapting to geopolitical changes, particularly the closure of Russian airspace. Sustainability efforts are also a major focus.

The airline's financial results are influenced by its ownership structure and market conditions. Recent reports indicate a focus on cost management and revenue optimization.

Those interested in investing in Finnair should monitor its financial performance and ownership developments. Investor relations provide detailed information.

Finnair Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Finnair Company?

- What is Competitive Landscape of Finnair Company?

- What is Growth Strategy and Future Prospects of Finnair Company?

- How Does Finnair Company Work?

- What is Sales and Marketing Strategy of Finnair Company?

- What is Brief History of Finnair Company?

- What is Customer Demographics and Target Market of Finnair Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.