Finnair Bundle

How Does Finnair Soar in the Airline Industry?

Finnair, Finland's flag carrier, isn't just about flights; it's a strategic bridge connecting Europe and Asia. Its hub at Helsinki Airport is a crucial component of its business model, facilitating efficient connections and competitive advantages. In a global aviation market facing constant change, understanding Finnair operations is key to grasping its success.

This exploration of Finnair will uncover how it navigates the complexities of the Finnair SWOT Analysis, manages its extensive route network, and maintains its competitive edge. From understanding Finnair's fleet size to analyzing its financial performance, we'll delve into the core elements that define its operations. Whether you're curious about Finnair flights, sustainability initiatives, or customer service, this analysis provides a comprehensive view of a leading airline.

What Are the Key Operations Driving Finnair’s Success?

Finnair's core operations focus on providing passenger and cargo air transport services. Its value proposition centers on its efficient Helsinki hub, offering fast connections between Europe and Asia. The airline caters to business travelers, leisure travelers, and cargo clients.

The Finnair business model is built upon a modern fleet, including Airbus A350 and A330 aircraft for long-haul routes. This ensures a comfortable travel experience. In 2023, the airline carried approximately 13.3 million passengers, which is an 18.5% increase compared to 2022.

Key operational processes include flight planning, ground handling, maintenance, and customer service. Strategic partnerships with aircraft manufacturers and fuel suppliers are essential. Distribution occurs through direct channels like its website and mobile app, as well as indirect channels such as global distribution systems and travel agencies.

Finnair operations are unique due to its 'Northern route' strategy. This offers shorter flight times between many European and Asian cities via Helsinki. This geographical advantage provides a competitive edge.

Finnair prioritizes punctuality and service quality, leading to reduced travel times and a seamless journey for customers. In 2023, Finnair's punctuality rate was 81.3%. This focus differentiates it from competitors.

Understanding Finnair operations involves examining its core processes and strategic advantages. The airline leverages its geographical location and focuses on customer experience.

- Efficient Helsinki hub for quick connections.

- Modern fleet with Airbus A350 and A330 aircraft.

- Emphasis on punctuality and service quality.

- Strategic partnerships and distribution networks.

Finnair SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Finnair Make Money?

Finnair's revenue streams are primarily built on passenger ticket sales, cargo operations, and ancillary services. These diverse sources support the overall Finnair business model, ensuring financial stability and growth. The airline industry is highly competitive, and understanding these revenue streams is crucial for assessing Finnair's financial health and strategic direction.

Passenger traffic is the most significant revenue driver for Finnair operations. The company also leverages cargo operations, especially utilizing the belly capacity of its passenger flights. Additionally, ancillary services, such as extra baggage and seat selection, play a key role in boosting revenue.

In 2023, Finnair's total revenue reached 2,987.9 million euros, a notable increase from 2,408.0 million euros in 2022. Passenger revenue contributed 2,654.4 million euros to this total. Cargo revenue, though smaller, was still significant at 203.2 million euros in 2023.

Finnair employs several strategies to maximize revenue and adapt to market changes. These include tiered pricing, ancillary services, and loyalty programs.

- Tiered Pricing: Finnair offers various fare classes, from basic economy to business class, to cater to different customer needs and willingness to pay.

- Ancillary Services: Revenue is generated from extra baggage fees, seat selection, in-flight meals, and travel insurance.

- Loyalty Programs: The Finnair Plus program helps retain customers and generate additional revenue through points redemption and co-branded credit cards.

- Market Adaptation: Finnair has adjusted its route strategy in response to geopolitical events, focusing on new markets and optimizing ancillary offerings.

Finnair PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Finnair’s Business Model?

Navigating the complexities of the airline industry, Finnair has marked several key milestones and strategic shifts. The airline's operational and financial trajectory has been shaped by its commitment to the Asia-Europe market, leveraging Helsinki's strategic geographical advantage. This focus, combined with operational enhancements, has positioned Finnair within the competitive landscape.

A significant strategic move involved focusing on routes connecting Asia and Europe, using Helsinki as a key hub. The introduction of modern, fuel-efficient aircraft, such as the Airbus A350, has enhanced operational efficiency and passenger comfort. These initiatives underscore Finnair's commitment to adapting to market changes and improving its overall performance.

Finnair's ability to adapt to challenges is crucial. For instance, the closure of Russian airspace in 2022 significantly impacted its Asian routes. This led to a strategic pivot, including rerouting flights, increasing capacity on existing routes, and exploring new destinations through partnerships. Despite these hurdles, Finnair reported a comparable operating result of 172.6 million euros in 2023, a notable improvement from a loss of 163.9 million euros in 2022.

Finnair has seen significant growth and adaptation, particularly in its route network and fleet modernization. The airline has strategically used Helsinki Airport as a hub, connecting Europe with Asia. It has consistently invested in fuel-efficient aircraft, enhancing its operational capabilities.

The airline's strategic moves include a strong focus on the Asia-Europe market, leveraging Helsinki's geographical position. Another key move was the introduction of modern aircraft, like the Airbus A350, to improve fuel efficiency. Furthermore, partnerships and route adjustments have helped Finnair navigate challenges.

Finnair's competitive advantages include strong brand recognition in its home market and its strategic Helsinki hub. The airline's focus on operational efficiency and customer service also contributes to its edge. Investments in digitalization and sustainability further enhance its competitiveness.

The closure of Russian airspace presented a major challenge, leading to route adjustments and partnerships. Finnair has responded by rerouting flights and exploring new destinations. Despite these issues, the airline has shown resilience, as seen in its improved operating results in 2023.

Finnair's business model centers on connecting Europe and Asia through its Helsinki hub, providing shorter flight times. The airline's strategic location offers a competitive advantage, complemented by investments in fuel-efficient aircraft and digital platforms. These moves are crucial for maintaining its position in the competitive Competitors Landscape of Finnair.

- Helsinki Airport: A key hub for connecting Europe and Asia, offering shorter flight times.

- Fleet Modernization: Ongoing investments in fuel-efficient aircraft to improve operational efficiency.

- Digitalization: Focus on digital platforms to enhance customer experience and streamline operations.

- Sustainability: Initiatives aimed at reducing emissions and promoting sustainable practices.

Finnair Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Finnair Positioning Itself for Continued Success?

As Finland's flag carrier, Finnair holds a strong position in the airline industry, particularly in the Nordic region and its Asian routes. Its customer loyalty is supported by the Finnair Plus program. However, the airline operates in a highly competitive global environment, facing challenges from major European and Middle Eastern carriers, as well as low-cost airlines. The company must navigate these conditions while managing its Finnair operations effectively.

Key risks affecting Finnair include fluctuating fuel prices, geopolitical instability, economic downturns, and intense competition. The airline is also focused on fleet modernization and sustainable aviation practices. The company's future outlook involves leveraging its brand, optimizing its network, and investing in customer experience and sustainable solutions. The airline is adapting to changes in the geopolitical landscape and focusing on cost efficiency.

Finnair is a key player in the airline industry, especially in the Nordic region. It faces competition from major European and Middle Eastern carriers. The airline's strong brand and customer loyalty, supported by the Finnair Plus program, are crucial to its market position.

Finnair faces risks such as volatile fuel prices, geopolitical instability, and economic downturns. Intense competition and pricing pressures are also significant challenges. The need for fleet modernization and sustainable aviation practices adds further complexity.

Finnair aims to achieve carbon neutrality by 2045. The company is focused on profitable growth, cost efficiency, and flexibility to respond to market changes. The airline anticipates a comparable operating profit in 2024, similar to 2023.

The airline is optimizing its network, enhancing digital services, and continuing sustainability efforts. Finnair is adapting to the changed geopolitical landscape. The company is focused on maintaining its strong brand and optimizing its network for profitability.

Finnair's strategic focus includes profitable growth and cost efficiency. The company is actively working to optimize its network and enhance customer experience. These efforts are crucial for navigating the competitive Airline industry.

- Finnair aims to maintain its position by leveraging its brand and optimizing its network for profitability.

- The airline is investing in customer experience and sustainable solutions.

- The company expects a comparable operating profit in 2024 to be at the same level as in 2023.

- Finnair continues to adapt to the changing geopolitical landscape, ensuring its operational flexibility.

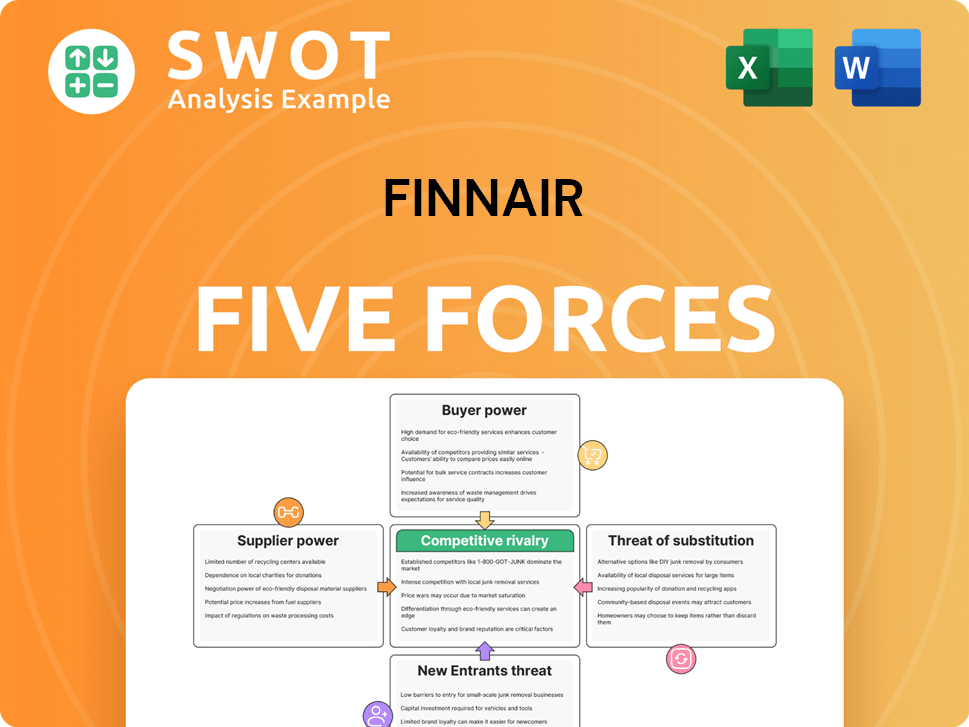

Finnair Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Finnair Company?

- What is Competitive Landscape of Finnair Company?

- What is Growth Strategy and Future Prospects of Finnair Company?

- What is Sales and Marketing Strategy of Finnair Company?

- What is Brief History of Finnair Company?

- Who Owns Finnair Company?

- What is Customer Demographics and Target Market of Finnair Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.