First Quantum Minerals Bundle

Can First Quantum Minerals Continue Its Ascent in the Copper Market?

First Quantum Minerals, a titan in copper production, has strategically navigated the global mining landscape since its inception in 1996. This First Quantum Minerals SWOT Analysis reveals the company's journey from a small mining venture to a global powerhouse, driven by a clear vision and strategic growth initiatives. Its evolution underscores the critical role of strategic planning in the capital-intensive and cyclical mining industry.

This exploration delves into First Quantum Minerals' Growth Strategy and Future Prospects, examining its expansion plans, innovation strategies, and financial outlook. Understanding the company's approach to navigating market complexities and leveraging opportunities is crucial for anyone interested in the future of copper production. The analysis will also address potential risks and the impact of the copper price on First Quantum Minerals, providing a comprehensive view of its investment potential and long-term sustainability within the mining industry.

How Is First Quantum Minerals Expanding Its Reach?

The core of First Quantum Minerals' strategy revolves around aggressive expansion initiatives. The company is focused on increasing its copper production capacity and diversifying its asset base to meet the rising global demand for copper. This strategic approach is crucial for long-term growth and maintaining a competitive edge in the mining industry.

First Quantum Minerals is actively pursuing several expansion initiatives to bolster its global copper production and diversify its asset base. A key focus for the company is the ongoing development and optimization of its existing operations, particularly the Cobre Panama mine, which is a significant contributor to its overall production. These initiatives are driven by the strong long-term demand outlook for copper, fueled by global electrification and decarbonization trends.

The company's strategic planning includes evaluating opportunities for brownfield expansions at existing sites, such as the Sentinel mine in Zambia, to extend mine life and increase production capacity. Beyond organic growth, First Quantum is also exploring potential new market entries and strategic partnerships. These expansion initiatives are crucial for First Quantum to maintain its competitive edge, secure future revenue streams, and meet the growing global demand for critical minerals.

First Quantum Minerals prioritizes maximizing throughput and recovery rates at existing operations like Cobre Panama. In 2024, the company continued to advance operational efficiency, aiming to improve production metrics. This focus on optimization is a key component of their growth strategy, ensuring efficient use of resources and maximizing output.

The company is evaluating brownfield expansion opportunities at existing sites, such as the Sentinel mine in Zambia. These expansions aim to extend mine life and increase production capacity. Such expansions offer a cost-effective way to grow production by leveraging existing infrastructure and expertise.

First Quantum Minerals consistently assesses opportunities to acquire or develop new projects in copper and nickel. The company's strategy includes maintaining strong relationships with host governments and local communities. This approach ensures the long-term viability of operations and supports sustainable growth.

First Quantum Minerals has been engaged in discussions regarding the future of its operations in Panama, highlighting the dynamic nature of its market engagement. This demonstrates the company's proactive approach to adapting to changing market conditions and ensuring operational sustainability. The company's focus on strategic planning is evident in its proactive approach to market dynamics.

The company is focused on ensuring the long-term viability of its operations and meeting the growing global demand for critical minerals. For example, in 2023, Cobre Panama produced approximately 350,000 tonnes of copper, demonstrating its significant contribution to First Quantum's overall production. The Mission, Vision & Core Values of First Quantum Minerals highlight the company's commitment to sustainable practices and responsible resource management, which are integral to its expansion initiatives.

First Quantum Minerals' growth strategy includes optimizing existing operations, pursuing brownfield expansions, and evaluating strategic partnerships. These initiatives are designed to increase copper production capacity and diversify the company's asset base. The company's focus on strategic planning and market engagement is crucial for its future prospects.

- Operational Efficiency: Maximizing throughput and recovery rates at existing mines.

- Brownfield Expansions: Extending mine life and increasing production capacity at current sites.

- Strategic Partnerships: Exploring new market entries and project acquisitions.

- Market Engagement: Maintaining strong relationships with host governments and local communities.

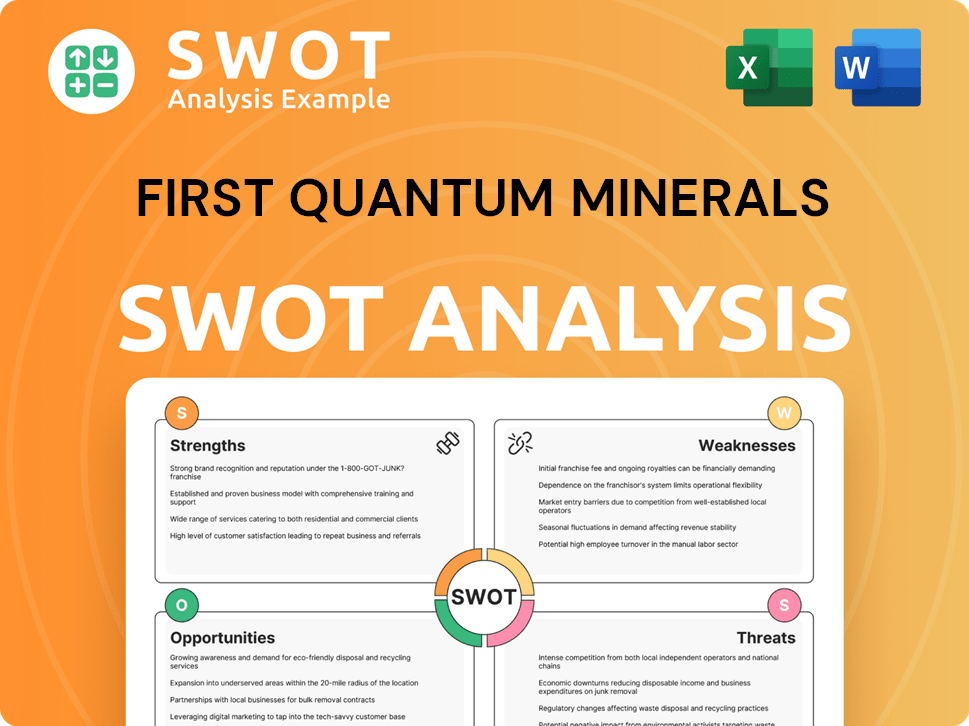

First Quantum Minerals SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does First Quantum Minerals Invest in Innovation?

The growth strategy of First Quantum Minerals heavily relies on innovation and technology to boost operational efficiency and promote sustainable practices. The company's dedication to technological advancements is evident in its continuous efforts to enhance operational performance and responsible resource management. These initiatives are crucial for maintaining a competitive edge and attracting investors.

First Quantum Minerals is actively investing in research and development to optimize its mining and processing techniques. This focus includes automation, data analytics, and artificial intelligence to streamline operations. Digital transformation is a key element of their strategy, integrating real-time data across operations to enhance decision-making and predictive maintenance.

Sustainability is a core focus, with the company exploring and implementing technologies to reduce its environmental impact. This includes initiatives to lower greenhouse gas emissions and improve water management. The exploration of renewable energy sources aligns with global efforts towards a greener mining industry, positioning the company as a leader in sustainable practices.

First Quantum Minerals is implementing automation in its mining operations to improve efficiency and safety. This includes the use of autonomous vehicles and remote-controlled equipment. The goal is to reduce operational costs and enhance productivity.

Data analytics and artificial intelligence are being used to optimize processes and predict equipment failures. These technologies enable better decision-making and improve metal recovery rates. Predictive maintenance reduces downtime and lowers maintenance costs.

Advanced process control systems are deployed at concentrators to improve metal recovery and reduce energy consumption. These systems help in achieving higher efficiency and lower environmental impact. This directly contributes to cost savings.

Digital transformation efforts include integrating real-time data across operations. This integration enables informed decision-making and supports predictive maintenance strategies. The aim is to create a more connected and efficient operational environment.

The company is exploring the use of renewable energy sources to reduce its carbon footprint. This includes investigating solar and wind power options for its operations. Such initiatives are crucial for long-term sustainability.

Sustainability initiatives also involve reducing greenhouse gas emissions and improving water management. These efforts align with global environmental goals and enhance the company's reputation. Responsible resource management is a key focus.

First Quantum Minerals' commitment to innovation and technology is a cornerstone of its growth strategy. These advancements not only improve operational efficiency but also position the company as a leader in sustainable mining practices. This approach is increasingly important for attracting investment and maintaining a social license to operate. The company's focus on technology and sustainability aligns with the evolving demands of the copper market and the broader mining industry.

- Process Optimization: Implementing advanced process control systems to improve metal recovery and reduce energy consumption.

- Data-Driven Decision Making: Utilizing real-time data and analytics to enhance operational efficiency and make informed decisions.

- Sustainability Focus: Investing in technologies to reduce environmental impact, including lower emissions and improved water management.

- Cost Efficiency: Technological advancements contribute to cost savings, improving the company's financial performance.

- Competitive Advantage: Positioning the company as a leader in sustainable mining practices, attracting investment and maintaining a social license to operate.

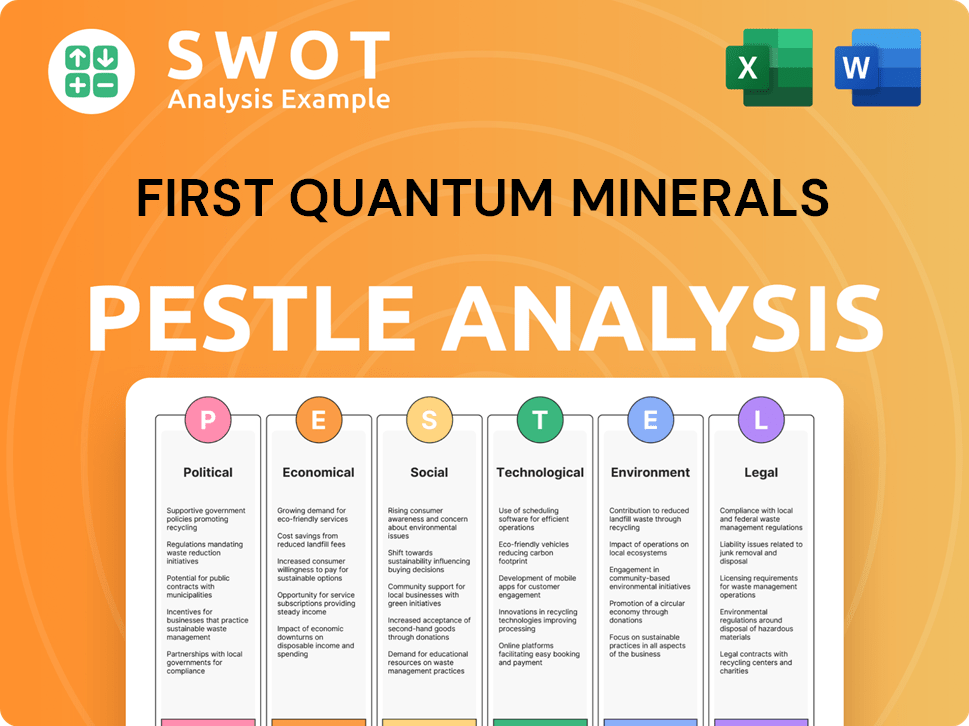

First Quantum Minerals PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is First Quantum Minerals’s Growth Forecast?

The financial outlook for First Quantum Minerals is significantly influenced by global copper prices and the operational efficiency of its key mining sites. In the first quarter of 2024, the company reported a copper production of 130,000 tonnes and nickel production of 6,000 tonnes, reflecting its current production capabilities. This performance directly impacts the company's revenue and profitability, as demonstrated by the $1.0 billion in total revenue reported for the same period.

The company's financial health, including its ability to manage debt and invest in growth, is crucial for its long-term success. For 2024, First Quantum Minerals has set its capital expenditure between $1.3 billion and $1.4 billion, primarily targeting sustaining capital and growth projects. The company's strategic planning also involves managing its debt levels and optimizing its capital structure to support its expansion plans.

The company's financial performance and future prospects are closely tied to its ability to achieve production targets and manage costs effectively. The company anticipates its cash costs (C1) for copper to be between $1.90-$2.10 per pound. The article Owners & Shareholders of First Quantum Minerals provides further insights into the company's financial structure and ownership.

First Quantum Minerals expects copper production to be in the range of 370,000-420,000 tonnes for the year 2024. This production guidance is a key indicator of the company's operational capacity and its ability to capitalize on market demand.

The company anticipates nickel production to be between 20,000-25,000 tonnes in 2024. This production contributes to the company's diversification and overall revenue streams.

As of the first quarter of 2024, First Quantum Minerals reported total debt of approximately $6.6 billion. The company's cash balance stood at $1.5 billion, providing a measure of financial flexibility.

For the first quarter, the company's gross profit was $225 million, and it reported an adjusted EBITDA of $428 million. These figures are critical indicators of the company's profitability and operational efficiency.

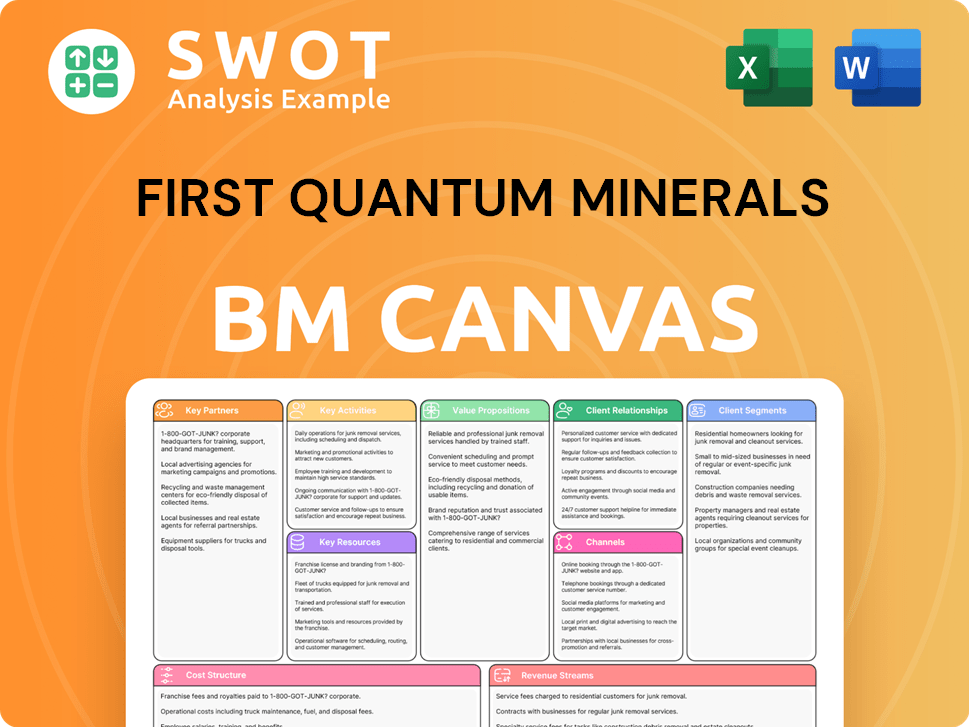

First Quantum Minerals Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow First Quantum Minerals’s Growth?

The future of First Quantum Minerals and its growth strategy is subject to a variety of risks and obstacles. These challenges range from market dynamics and geopolitical factors to operational and internal constraints. Understanding these potential pitfalls is crucial for evaluating the company's future prospects and its ability to deliver on its strategic goals.

First Quantum Minerals, as a mining company, faces inherent risks associated with its industry. These include fluctuating commodity prices, particularly for copper, and the complexities of operating in diverse regulatory environments. Furthermore, the company must navigate supply chain disruptions and technological advancements to maintain its competitive edge.

A comprehensive look at these challenges reveals the multifaceted nature of the risks First Quantum Minerals must manage to ensure its sustained growth and success in the copper production sector.

The mining company operates in a competitive market, with other major copper producers vying for market share. This necessitates continuous efforts to improve efficiency and secure new resource opportunities. Competition affects First Quantum Minerals' ability to set prices and maintain profitability.

Copper prices are subject to significant fluctuations, directly impacting First Quantum Minerals' revenue. For instance, a sharp decrease in copper prices can significantly affect the company's financial performance. The company's financial results are closely tied to these market dynamics.

Operating in various countries exposes First Quantum Minerals to geopolitical instability and regulatory changes. The situation concerning the Cobre Panama mine illustrates the potential for unexpected government actions. These factors can lead to production disruptions and financial losses.

Disruptions in the supply chain can hinder production and increase costs. Delays in obtaining critical equipment, materials, or logistics can have a significant impact. The company must manage its supply chains effectively to mitigate these risks.

Failing to adapt to new mining techniques or processing methods can pose a risk. Competitors may gain advantages through technological innovation. Investing in research and development is essential for staying competitive.

A shortage of skilled labor or technical expertise can impede project development and operational efficiency. Addressing these internal constraints is crucial for achieving First Quantum Minerals' strategic goals. Effective resource management is key.

First Quantum Minerals actively addresses these risks through a combination of strategies. Diversifying its asset base, implementing robust risk management frameworks, and engaging proactively with stakeholders are key approaches. For example, the company's efforts and discussions regarding the Cobre Panama situation demonstrate its commitment to mitigating potential impacts. Additionally, the increasing pressure for sustainable and ethical mining practices necessitates ongoing investment in environmental and social governance (ESG) initiatives to maintain its social license to operate and attract responsible investment. For more insights, consider the Marketing Strategy of First Quantum Minerals.

First Quantum Minerals' financial performance is heavily influenced by copper prices. For example, in 2024, a significant drop in copper prices could lead to a substantial decrease in revenue. The company's financial results are closely tied to these market dynamics. It is important to review the First Quantum Minerals quarterly earnings reports to assess the impact of these factors.

Operational challenges, such as supply chain disruptions, can significantly impact the company's production capacity. Delays in receiving critical equipment or materials can lead to production bottlenecks. The First Quantum Minerals must continuously monitor and mitigate these operational risks to maintain efficiency. Addressing these challenges is crucial for the company's strategic planning.

Geopolitical instability and regulatory changes in the countries where First Quantum Minerals operates pose significant risks. Unexpected government actions or policy changes can disrupt operations. The company needs to proactively manage these risks through strong stakeholder relationships and compliance strategies. The First Quantum Minerals expansion plans are often affected by these external factors.

Increasing pressure for sustainable and ethical mining practices requires continuous investment in ESG initiatives. Investors and stakeholders are increasingly focused on environmental and social governance. First Quantum Minerals must maintain its social license to operate and attract responsible investment by addressing these concerns. This is a critical aspect of the company's future prospects.

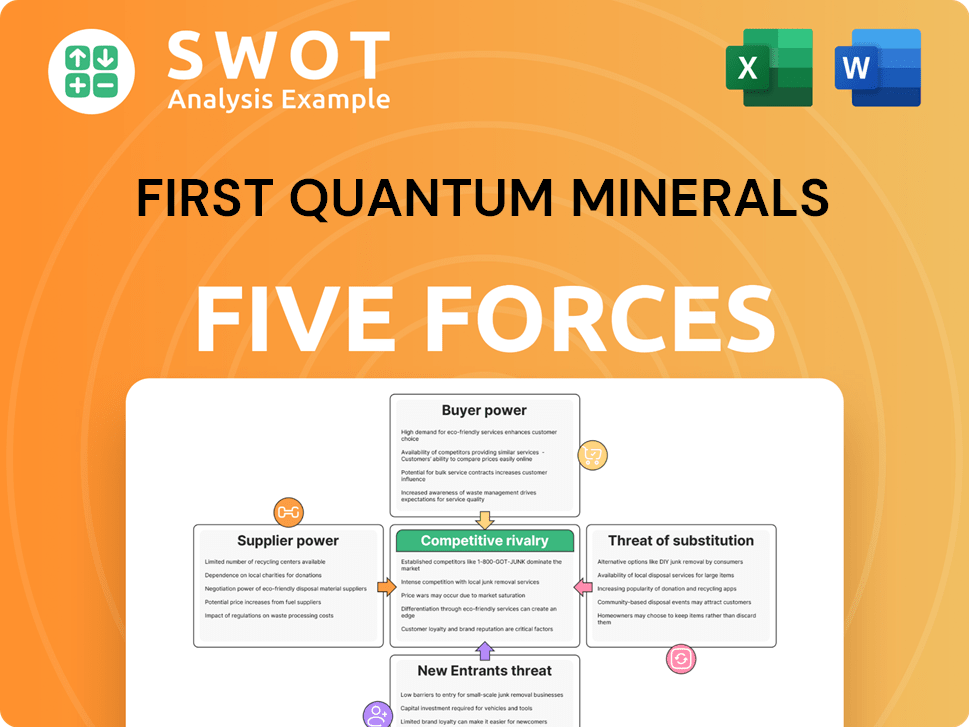

First Quantum Minerals Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of First Quantum Minerals Company?

- What is Competitive Landscape of First Quantum Minerals Company?

- How Does First Quantum Minerals Company Work?

- What is Sales and Marketing Strategy of First Quantum Minerals Company?

- What is Brief History of First Quantum Minerals Company?

- Who Owns First Quantum Minerals Company?

- What is Customer Demographics and Target Market of First Quantum Minerals Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.