First Quantum Minerals Bundle

How Does First Quantum Minerals Conquer the Copper Market?

First Quantum Minerals (FQM), a titan in the copper mining industry, has consistently adapted to the ever-changing global market. From its humble beginnings to its current status as a top-tier copper producer, FQM's journey is a masterclass in strategic adaptation. Understanding the First Quantum Minerals SWOT Analysis is key to grasping their approach.

This exploration into First Quantum Minerals' sales and marketing strategy unveils the intricate methods behind its success. We'll dissect how this mining company markets its products, analyzes its target market, and maintains its competitive edge. Furthermore, we'll examine key marketing campaign examples and sales performance reviews to provide a comprehensive view of their approach within the mining industry sales landscape.

How Does First Quantum Minerals Reach Its Customers?

The sales strategy of First Quantum Minerals centers on direct sales channels, a common approach in the mining industry. This strategy is primarily used to sell its products, including copper concentrate, copper anode, and copper cathode, directly to industrial customers worldwide. This direct approach is essential given the nature of the commodities the company produces.

First Quantum Minerals' marketing strategy is closely aligned with its operational footprint, which spans multiple countries. The company focuses on optimizing logistics and supply chain efficiency to deliver bulk commodities to its customers. The company's sales and marketing approach involves securing off-take agreements and managing the complexities of international shipping and trade regulations for large volumes of minerals.

The primary customers of First Quantum Minerals are smelters, refiners, and other industrial buyers who purchase through long-term contracts and spot sales. An example of this is the additional $500 million prepayment from Jiangxi Copper Company Limited in April 2025, which highlights the direct sales model with key partners. The company also explores strategic partnerships and minority stake sales in its larger assets, which could influence future sales and distribution dynamics.

First Quantum Minerals primarily uses direct sales channels. This approach allows the company to maintain close relationships with key customers. These channels are crucial for managing the sale of large volumes of copper and nickel.

The company's main customers include smelters and refiners. Long-term contracts and spot sales are the primary methods of sale. Strategic partnerships, like the one with Jiangxi Copper, are vital for sales.

Sales are directly linked to mining operations in multiple countries. The output from mines like Kansanshi and Sentinel in Zambia directly feeds into these sales channels. The Enterprise mine in Zambia, which declared commercial nickel production on June 1, 2024, also contributes.

Optimizing logistics and supply chain efficiency is a key focus. Managing international shipping and trade regulations is crucial for large volumes of minerals. The approval to export copper concentrate from Cobre Panamá in May 2025 supports sales.

First Quantum Minerals actively seeks strategic partnerships. These partnerships are crucial for expanding its sales network and ensuring stable revenue streams. The company's approach includes exploring minority stake sales in its larger assets, such as potential investments in its Zambian business.

- Direct sales to industrial customers.

- Long-term contracts and spot sales.

- Focus on logistics and supply chain.

- Strategic partnerships and off-take agreements.

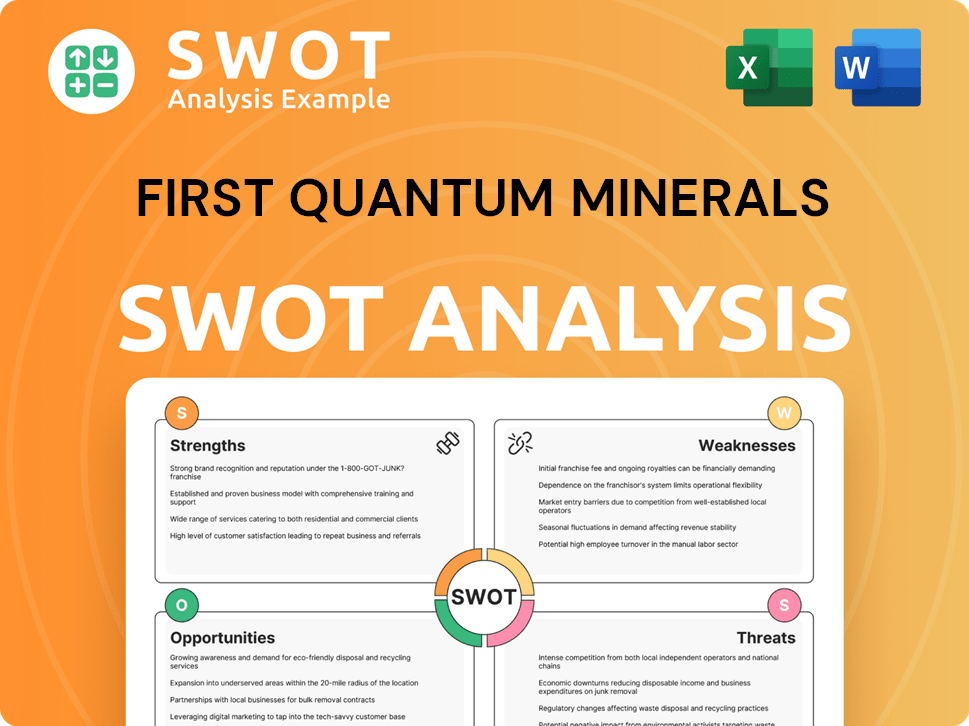

First Quantum Minerals SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Marketing Tactics Does First Quantum Minerals Use?

The marketing tactics of First Quantum Minerals (FQM) are primarily business-to-business (B2B) focused, designed to engage with investors, stakeholders, and industry partners. The approach emphasizes transparency and building trust through detailed reporting and direct communication, rather than mass-market advertising. This strategy is crucial for a company operating in the mining sector, where reputation and stakeholder relationships are paramount.

FQM's sales and marketing approach centers on providing comprehensive information through its official website and participation in industry events. Digital platforms and data analysis play a significant role in informing production and sales strategies. The company's focus on sustainability and responsible mining practices is also a key component of its marketing efforts, highlighted through detailed reports and environmental initiatives.

The company's strategy is data-driven, with market trends directly influencing operational decisions. For instance, the decision to scale back operations at Ravensthorpe in May 2024 was a direct response to low nickel prices, demonstrating a proactive approach to market conditions. FQM also utilizes hedging programs to protect against spot copper price movements, which is communicated to stakeholders to highlight financial stability and risk management.

FQM uses its official website as a central hub for financial information, sustainability reports, and operational updates. This approach is designed to build trust and demonstrate a commitment to responsible mining practices. The company publishes detailed reports, such as the 2024 Environment, Social and Governance Report, Climate Change Report, and Tax Transparency and Economic Contributions Report, all released in May 2025.

FQM participates in industry events and conferences to engage with potential buyers, investors, and regulatory bodies. This allows for direct communication and relationship-building within the mining industry. These events provide opportunities to showcase projects and demonstrate commitment to responsible mining practices.

The company analyzes market trends for copper and nickel to inform production and sales strategies. For example, the decision to scale back mining operations at Ravensthorpe in May 2024 due to low nickel prices. This demonstrates a direct response to market data and a proactive approach to market conditions.

FQM utilizes hedging programs to protect against spot copper price movements. Approximately half of planned production and sales in 2025 and 40% of planned production and sales for the first half of 2026 are protected. This financial strategy is communicated to stakeholders to highlight financial stability and risk management.

Technology platforms and analytics tools are crucial for operational efficiency and environmental monitoring. The deployment of Kunak AIR Pro stations at Cobre Panamá in 2024 for real-time air quality monitoring supports their environmental responsibility strategy. This is communicated as part of their broader commitment.

The primary target market includes investors, analysts, partners, and regulatory bodies. Customer relationship management focuses on maintaining strong relationships with key stakeholders. This approach ensures that the company's message is effectively communicated to the right audience.

FQM's

- Investor Relations: Providing detailed financial reports and updates to investors.

- Sustainability Reporting: Publishing comprehensive reports on environmental, social, and governance (ESG) performance.

- Data Analysis: Using market data to inform production and sales strategies.

- Industry Events: Participating in conferences and events to engage with potential buyers and partners.

- Hedging Programs: Implementing financial strategies to mitigate market risks.

- Technology Integration: Utilizing technology for operational efficiency and environmental monitoring.

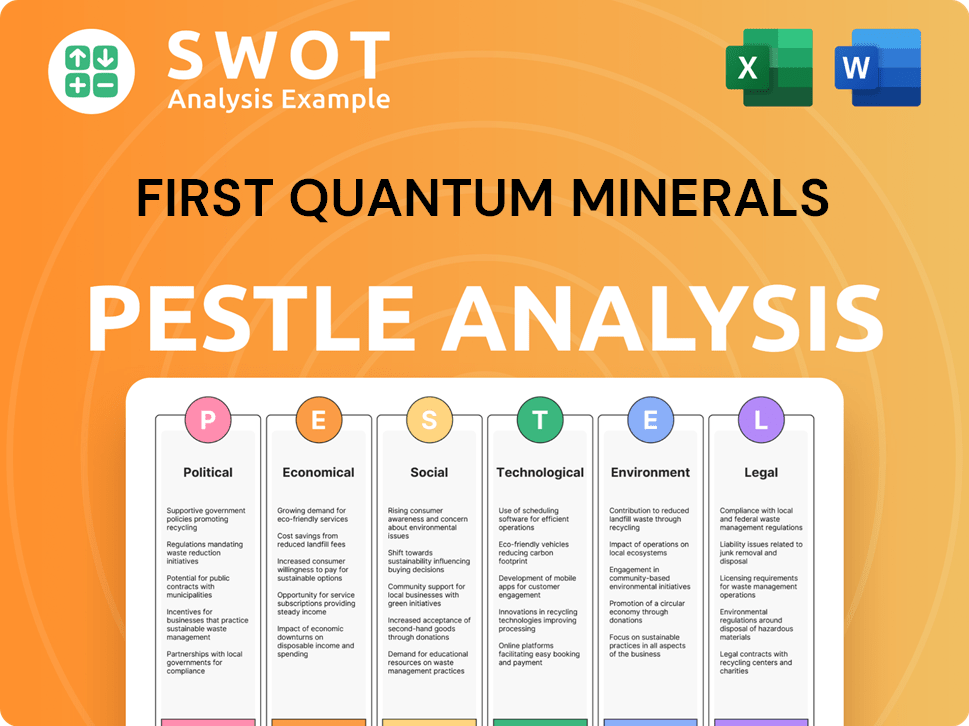

First Quantum Minerals PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

How Is First Quantum Minerals Positioned in the Market?

First Quantum Minerals' brand positioning centers on being a leading global copper producer, emphasizing its commitment to responsible and sustainable mining practices. This strategy is crucial in a world increasingly reliant on copper for renewable energy and electric vehicles. The company's core message highlights its ability to deliver essential materials, backed by specialist technical skills and a 'can-do' attitude, to develop and operate complex mining projects.

The company differentiates itself through its diversified operational base and technical expertise, along with a strong project pipeline. This approach is designed to attract investors and stakeholders who prioritize environmental, social, and governance (ESG) factors. First Quantum's brand identity reflects a professional and authoritative image, crucial for its industrial nature and long-term commitments.

First Quantum's brand positioning strategy is reinforced by its sustainability reports, published in May 2025, which showcase its response to shifts in consumer sentiment and regulatory expectations regarding environmental impact. This approach is designed to attract investors and stakeholders who prioritize environmental, social, and governance (ESG) factors. The company's ongoing investment in the Kansanshi S3 Expansion, projected to increase annual copper production by 60,000 tonnes starting in 2025, further solidifies its market standing as a growth-oriented and innovative leader.

First Quantum Minerals emphasizes its dedication to sustainability, contributing over $3.5 billion in 2024 through taxes, wages, local procurement, and community investment. This commitment is a key element of its brand strategy, appealing to investors focused on ESG criteria. The company's focus on responsible mining is a critical aspect of its Revenue Streams & Business Model of First Quantum Minerals.

The company highlights its specialist technical and engineering skills as a core differentiator. This expertise enables First Quantum to develop and operate complex mines and mineral processing plants efficiently. Ongoing projects like the Kansanshi S3 Expansion, which will boost copper production, demonstrate its innovative approach.

First Quantum's diversified operational base is a key element of its brand strategy. This global presence, coupled with a robust project pipeline, helps mitigate risks and ensures a steady supply of copper. The company's ability to operate in various regions is a strategic advantage.

The company targets investors and stakeholders who prioritize ESG factors. Its messaging focuses on delivering essential materials for a copper-constrained world, particularly in the context of renewable energy and electric vehicles. First Quantum's brand consistently reflects its industrial nature.

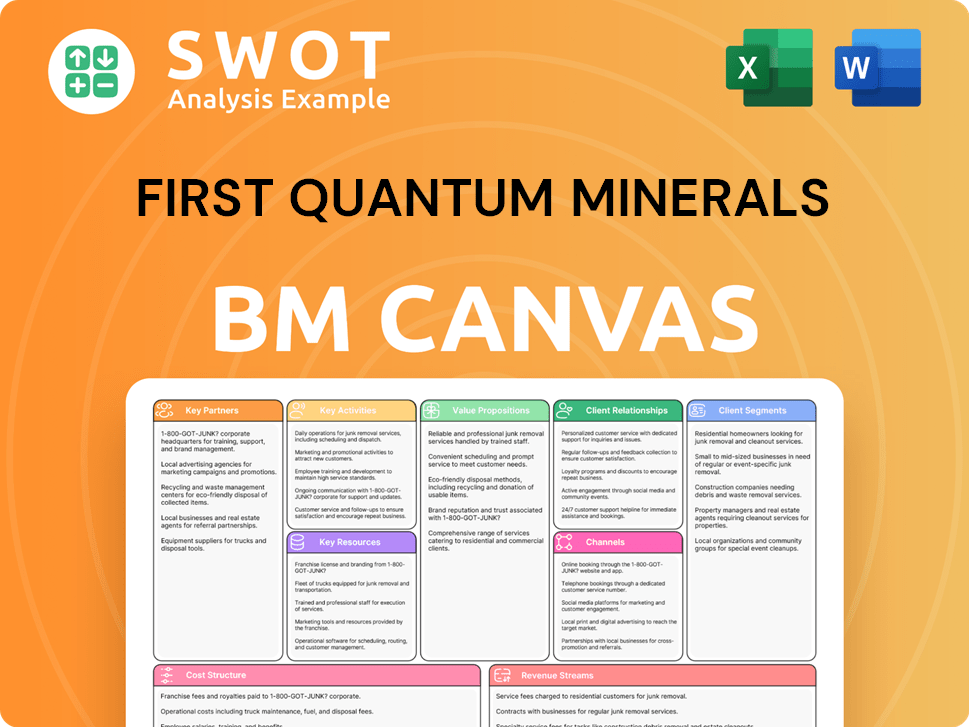

First Quantum Minerals Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are First Quantum Minerals’s Most Notable Campaigns?

While the term 'campaign' typically refers to consumer-facing marketing, the strategies employed by First Quantum Minerals, particularly following operational challenges, serve a similar purpose: to communicate with stakeholders, manage perceptions, and ensure financial stability. The company's approach to sales and marketing strategy is heavily influenced by its position in the mining industry and its interactions with investors, governments, and local communities. Key initiatives are often communicated through investor reports and press releases, which are essential for maintaining transparency and trust. The company uses a multifaceted approach to communicate its value proposition.

A significant part of First Quantum Minerals' strategy involves transparent communication regarding its financial health and operational achievements. This is particularly crucial in times of uncertainty or disruption. For example, following the suspension of operations at the Cobre Panamá mine in November 2023, the company launched initiatives to reassure stakeholders and stabilize its balance sheet. These efforts are designed to highlight the company's resilience and its commitment to long-term value creation. These efforts are designed to reinforce the company's commitment to responsible management.

Another crucial aspect of First Quantum Minerals' strategy is highlighting future growth and operational excellence. The Kansanshi S3 Expansion project in Zambia is a prime example of this, with completion expected in mid-2025 and first production in the second half of 2025. This project is frequently mentioned in quarterly reports and investor presentations, showcasing the company's commitment to long-term growth. The communication surrounding this project is designed to attract investors and demonstrate the company's ability to increase its annual copper production, projected to increase by 60,000 tonnes.

Following the Cobre Panamá mine suspension, First Quantum Minerals implemented several financial strategies. These included a $500 million copper prepay agreement with Jiangxi Copper in January 2024, a $1.6 billion bond offering, and a $1.15 billion equity bought deal offering. These were crucial to stabilize the company's balance sheet and demonstrate its financial resilience. These actions were communicated through investor reports and press releases.

In May 2025, First Quantum Minerals received approval to export 121,000 dry metric tonnes of copper concentrate from Cobre Panamá. The proceeds from these exports are earmarked for preservation and safe management activities. This illustrates the company's commitment to responsible management during challenging times. This enhances the company's brand positioning strategy.

The Kansanshi S3 Expansion project is central to First Quantum Minerals' strategy for future growth. Scheduled for completion in mid-2025, with first production expected in the second half of 2025, the project is expected to increase annual copper production by 60,000 tonnes. This project is frequently highlighted in investor presentations and quarterly reports. This is a key component of the company's sales strategy.

The company's 2024 sustainability reports, published in May 2025, are a crucial element of its communication strategy. These reports detailed over $3.5 billion in direct economic contributions to host countries in 2024. They also included revised climate targets, highlighting the company's commitment to ESG principles, essential for attracting ethically conscious investors. This enhances the company’s sustainability marketing efforts.

First Quantum Minerals' sales and marketing approach focuses on several key objectives.

- Maintaining financial stability through strategic initiatives.

- Highlighting future growth through projects like Kansanshi S3.

- Demonstrating commitment to ESG principles through sustainability reports.

- Building and maintaining trust with investors, governments, and local communities.

- Ensuring transparency and responsible management in its operations.

These campaigns and communication efforts are essential for First Quantum Minerals to maintain its competitive position within the mining industry. By focusing on financial resilience, operational excellence, and sustainability, the company aims to build long-term value. For a deeper understanding of the competitive environment, it's helpful to look at the Competitors Landscape of First Quantum Minerals, which provides context for the company’s strategic choices.

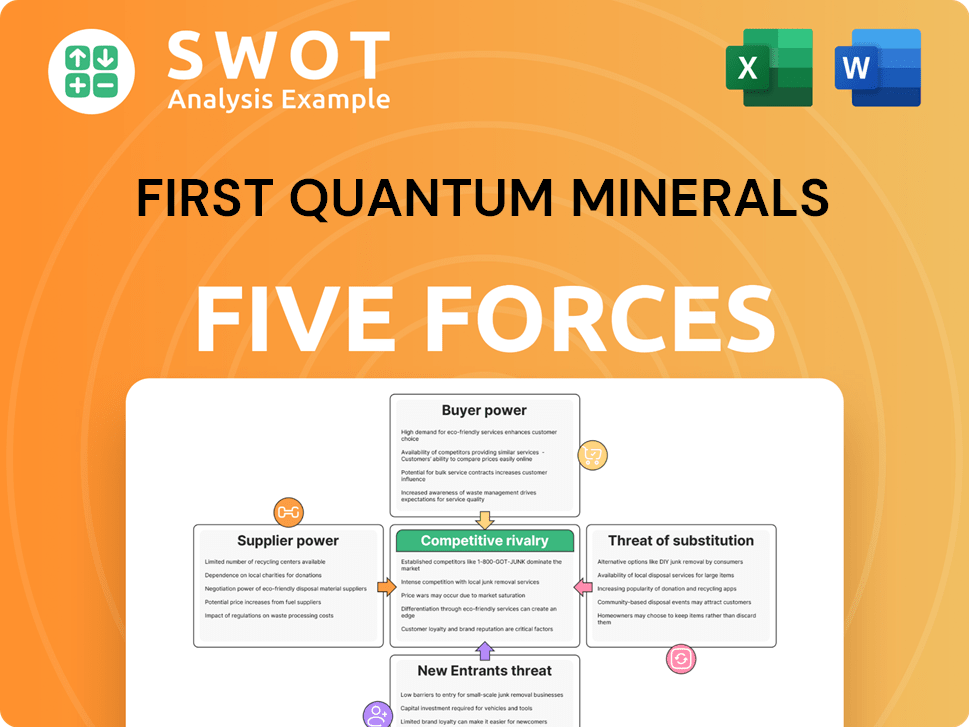

First Quantum Minerals Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of First Quantum Minerals Company?

- What is Competitive Landscape of First Quantum Minerals Company?

- What is Growth Strategy and Future Prospects of First Quantum Minerals Company?

- How Does First Quantum Minerals Company Work?

- What is Brief History of First Quantum Minerals Company?

- Who Owns First Quantum Minerals Company?

- What is Customer Demographics and Target Market of First Quantum Minerals Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.