First Quantum Minerals Bundle

Who Buys Copper from First Quantum Minerals?

In the complex world of mining, understanding who buys your product is essential for success. For First Quantum Minerals (FQM), a global copper giant, identifying its First Quantum Minerals SWOT Analysis is crucial. This exploration dives deep into the company's customer base and target market, revealing the dynamics that drive its business.

Unlike consumer-facing businesses, FQM's Customer Demographics are centered around industrial buyers and commodity traders within the Mining Industry. This Target Market Analysis is critical for FQM's strategic planning. Understanding the needs and behaviors of these key players, from geographic location to purchasing power, allows FQM to optimize its operations and maintain a competitive edge. Analyzing the FQM customer profile is key.

Who Are First Quantum Minerals’s Main Customers?

When examining the Customer Demographics and Target Market Analysis for First Quantum Minerals (FQM), it's essential to recognize its Business-to-Business (B2B) operational model. FQM primarily serves industrial clients, not individual consumers. This means the company's focus is on supplying raw materials to other businesses rather than selling directly to the public. This B2B approach significantly shapes how FQM defines and engages with its customer base.

The primary customer segments for First Quantum Minerals are global manufacturers, industrial processors, and commodity traders. These entities require copper concentrate, copper anode, copper cathode, and nickel products for their operations. These customers are defined by their industry, scale, location, and their need for raw materials. Understanding these characteristics is crucial for FQM's strategic planning and market positioning. For a deeper dive into the company's structure, consider exploring Owners & Shareholders of First Quantum Minerals.

The Mining Industry, in which FQM operates, is heavily influenced by global economic trends and technological advancements. The company's target market is driven by the demand for its key products, copper and nickel, which are vital inputs for industries such as electronics, construction, automotive, and renewable energy. The increasing demand from the electric vehicle sector and the push for sustainable energy solutions are key drivers for FQM's growth and market strategy.

First Quantum Minerals' key customers include large-scale manufacturers, industrial processors, and global trading houses. These entities purchase copper concentrate, copper anode, copper cathode, and nickel products. They are vital for sectors like electronics, construction, and automotive.

The demand for copper and nickel is driven by the growth of the electric vehicle market and the expansion of renewable energy infrastructure. The global copper market is valued at approximately $100 billion. The market is projected to grow at a compound annual growth rate (CAGR) of 5% over the next five years.

FQM's strategic expansion into the battery metals market, with the Enterprise nickel mine in Zambia, which began commercial production in June 2024, caters to the growing demand from electric vehicle manufacturers. This expansion is a key element of FQM's growth strategy.

FQM's geographic focus is on regions with significant mining operations and access to key markets. The company's operations in Zambia and other locations are strategically positioned to serve its customer base efficiently. This strategic positioning is crucial for market share.

Market Segmentation for FQM involves identifying and targeting specific industries that use copper and nickel. This includes the automotive, construction, and renewable energy sectors. FQM's Target Market Size is substantial, given the global demand for copper and nickel.

- Customer Behavior Analysis reveals that FQM's clients are driven by the need for reliable supply and competitive pricing.

- Geographic Segmentation is essential, as FQM focuses on regions with high demand and efficient logistics.

- FQM's Market Share Analysis is influenced by its production capacity and ability to meet the needs of large-scale manufacturers.

- Impact of Global Events, such as economic downturns or supply chain disruptions, can significantly affect FQM's target market.

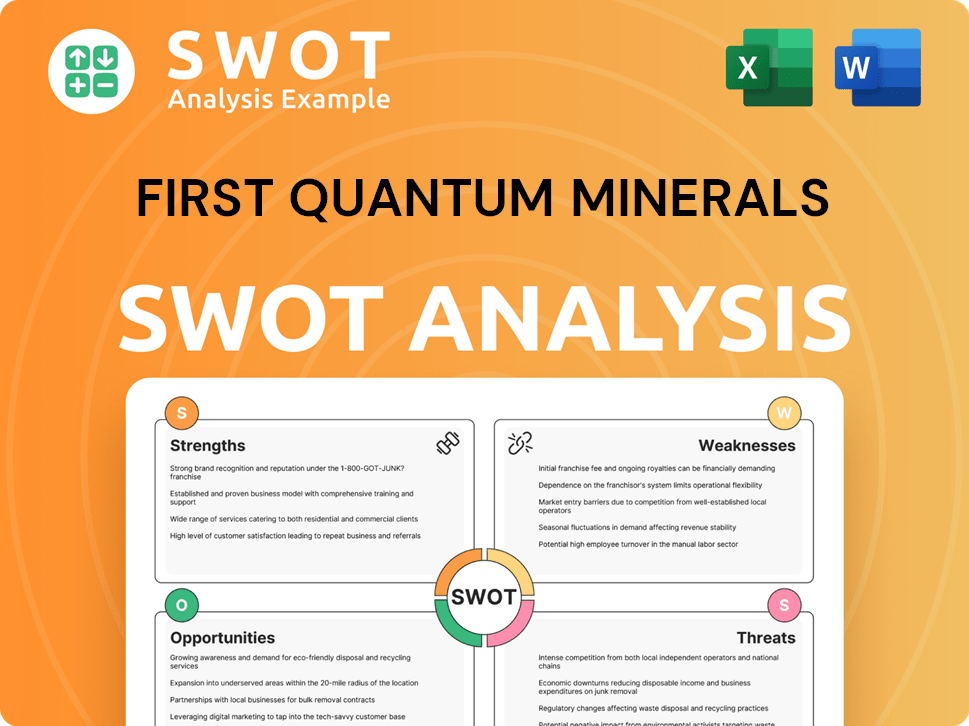

First Quantum Minerals SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do First Quantum Minerals’s Customers Want?

Understanding the customer needs and preferences is crucial for First Quantum Minerals (FQM). Their primary customers are industrial buyers in the mining industry, seeking reliable supply, consistent quality, and competitive pricing. This focus is essential for effective target market analysis.

The key drivers for these customers include production schedules, global market prices, and the stability of the supply chain. FQM's clients prioritize metal purity, product volume, delivery logistics, and the supplier's reputation. Revenue Streams & Business Model of First Quantum Minerals provides insights into how FQM operates to meet these demands.

Psychological and practical factors for choosing FQM revolve around a secure supply of essential raw materials. Aspirational drivers are increasingly linked to sustainability and ESG performance, which is a growing concern for many end-product manufacturers.

Customers need a consistent supply of raw materials to maintain their production lines. FQM's investment in projects like the Kansanshi S3 Expansion, expected to be completed by mid-2025, aims to increase production capacity and ensure future supply.

Buyers prioritize the purity of the metal, such as LME grade 'A' copper cathode. FQM's reputation for delivering high-quality products is crucial for maintaining customer satisfaction within the mining industry.

Customers seek competitive pricing to manage their costs effectively. FQM's hedging programs, like the zero-cost copper collar contracts outstanding for 272,775 tonnes as of April 23, 2025, help provide price stability.

Increasingly, customers demand responsible sourcing, including sustainability and ESG performance. FQM's 2024 sustainability reports demonstrate its commitment to these factors.

Customers need transparent reporting on production and sustainability. FQM's commitment to providing this information helps build trust and supports long-term relationships.

FQM's contribution to the economies of its host countries, with over $3.5 billion in direct economic contribution in 2024, including supplier spend with nationally registered suppliers, is a key factor.

FQM addresses customer pain points by ensuring consistent supply, managing price volatility, and providing transparent reporting. This is critical for customer retention and market share analysis.

- Consistent Supply: The Kansanshi S3 Expansion aims to increase production capacity.

- Price Volatility: Hedging programs like zero-cost copper collar contracts help stabilize prices.

- Transparent Reporting: Providing clear information on production and sustainability builds trust.

- Ethical Sourcing: Focus on local suppliers and sustainable practices.

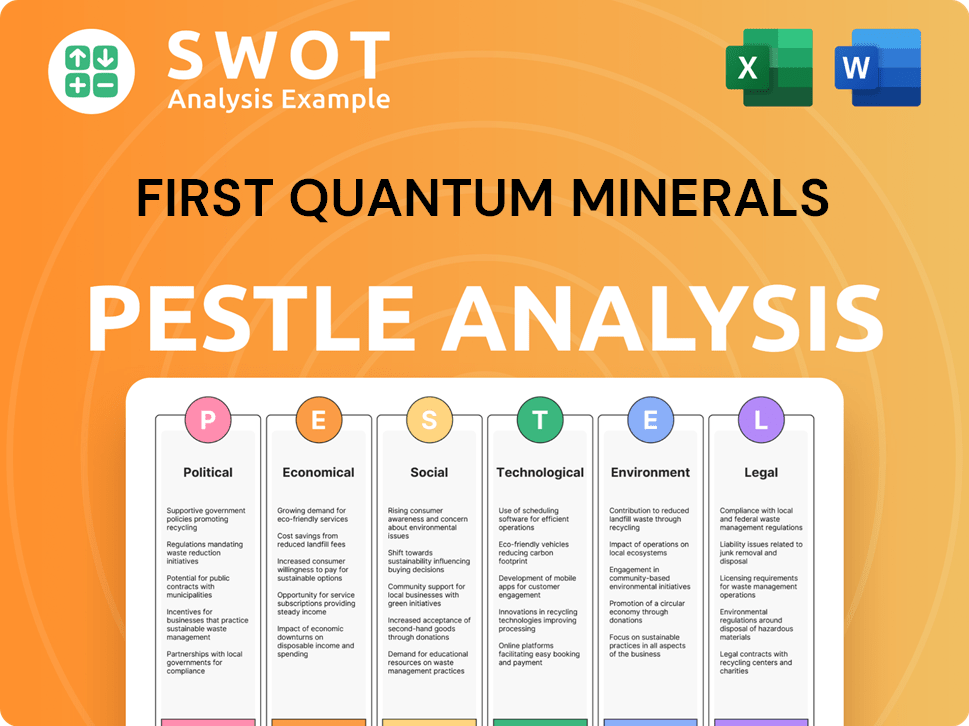

First Quantum Minerals PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does First Quantum Minerals operate?

First Quantum Minerals (FQM) maintains a significant global geographical market presence, with operating mines and development projects spanning four continents. Its major markets are primarily defined by the locations of its mines and the global demand centers for copper and nickel. Key operating locations include Zambia, Türkiye, Mauritania, and formerly Panama. The company's strategic focus is on copper and nickel production, with a strong emphasis on its assets in Africa.

Zambia is a cornerstone of FQM's operations, housing the Kansanshi copper-gold mine and the Sentinel copper mine, which are significant assets. Kansanshi is the largest copper mine in Africa. The company also operates the Enterprise nickel mine in Zambia, which achieved commercial production in June 2024 and is set to become Africa's biggest nickel operation. Development projects are also underway in Argentina and Peru, expanding the company's footprint.

While FQM is a global producer, the primary focus of its target market analysis lies in the industrial demand for copper and nickel, rather than direct consumer preferences. The company's customer base is largely composed of businesses and industries that utilize these metals. The geographic distribution of sales is influenced by global commodity markets, with copper production in Q1 2025 at 99,703 tonnes and total copper sales at 101,960 tonnes. Nickel production in Q1 2025 was 4,649 tonnes.

FQM's key operating locations include Zambia, Türkiye, and Mauritania. These locations are central to the company's production of copper and nickel. The company's strategic focus is on expanding its operations in these regions.

FQM has development projects in Argentina and Peru. These projects are part of the company's strategy to increase its production capacity. These projects will contribute to the company's future growth.

The demand for copper, particularly in Asia, significantly impacts the global copper market. FQM's customer base is largely businesses and industries that utilize these metals. Understanding these dynamics is crucial for FQM's strategic planning.

Recent expansions include the ramp-up of the Enterprise nickel mine in Zambia. Strategic withdrawals include the Cobre Panamá mine in Panama being placed into a phase of Preservation and Safe Management in November 2023, and the Ravensthorpe mine in Australia being placed into care and maintenance in May 2024.

FQM's customer base is primarily determined by the industrial demand for copper and nickel. The company's geographic segmentation is influenced by the location of its mines and the global demand centers for these metals. For more insights into FQM's overall strategy, consider reading about the Growth Strategy of First Quantum Minerals.

- Key operating locations include Zambia, Türkiye, and Mauritania.

- Development projects are underway in Argentina and Peru.

- The demand for copper in Asia, particularly China, significantly influences the global copper market.

- FQM's customer base includes businesses and industries that utilize copper and nickel.

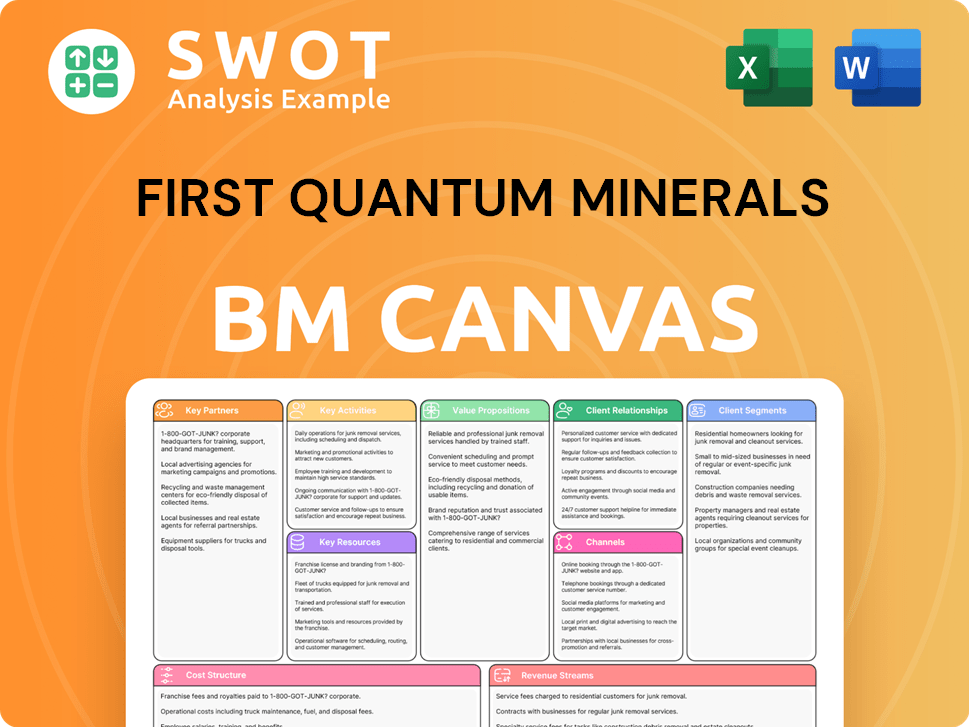

First Quantum Minerals Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does First Quantum Minerals Win & Keep Customers?

Customer acquisition and retention strategies for First Quantum Minerals (FQM) in the B2B mining sector center on long-term relationships and reliable supply. Unlike consumer markets, FQM's approach prioritizes consistent production capacity, competitive pricing, and adherence to quality standards to attract and retain buyers of its mineral products. This focus is crucial for the company's success within the mining industry.

The primary method for acquiring new customers involves demonstrating consistent production capacity, competitive pricing, and adherence to quality standards. Direct sales agreements with large industrial consumers and participation in global commodity markets are key. FQM's operational excellence, such as its 2024 annual copper production of 431 thousand tonnes, exceeding its guidance, is a significant draw for potential buyers.

Retention strategies are built on providing a stable, high-quality supply of copper and nickel, which are critical raw materials for clients. This reliability is supported by consistent output from mines and strategic financial planning.

Consistent output from mines like Kansanshi and Sentinel is crucial for customer retention. The Kansanshi S3 Expansion, expected to be completed in mid-2025, aims to further enhance production and long-term supply. This directly addresses the 'What is the target market for copper production' question.

FQM uses hedging programs to protect against commodity price volatility. As of April 23, 2025, approximately half of planned production and sales in 2025, and 40% for the first half of 2026, are protected from spot copper price movements through zero-cost copper collar contracts. This strategy provides price stability to buyers.

Producing LME grade 'A' copper cathode and other high-quality products ensures FQM meets the stringent requirements of its industrial clients, which is a critical aspect of its 'First Quantum Minerals customer profile'.

With increasing global focus on ESG factors, FQM's commitment to sustainable mining practices is becoming increasingly important for retaining customers who prioritize responsible supply chains. This aligns with the 'Demographic analysis of FQM's consumers' in terms of values.

FQM engages with stakeholders, including local governments and communities, to ensure stable operating environments, supporting reliable supply for its customers. This approach influences the 'First Quantum Minerals target market size'.

Greater emphasis on financial flexibility and balance sheet strength is crucial, especially after challenges like the suspension of operations at Cobre Panamá. Initiatives like refinancing strategies help secure the company's financial position and ensure consistent supply.

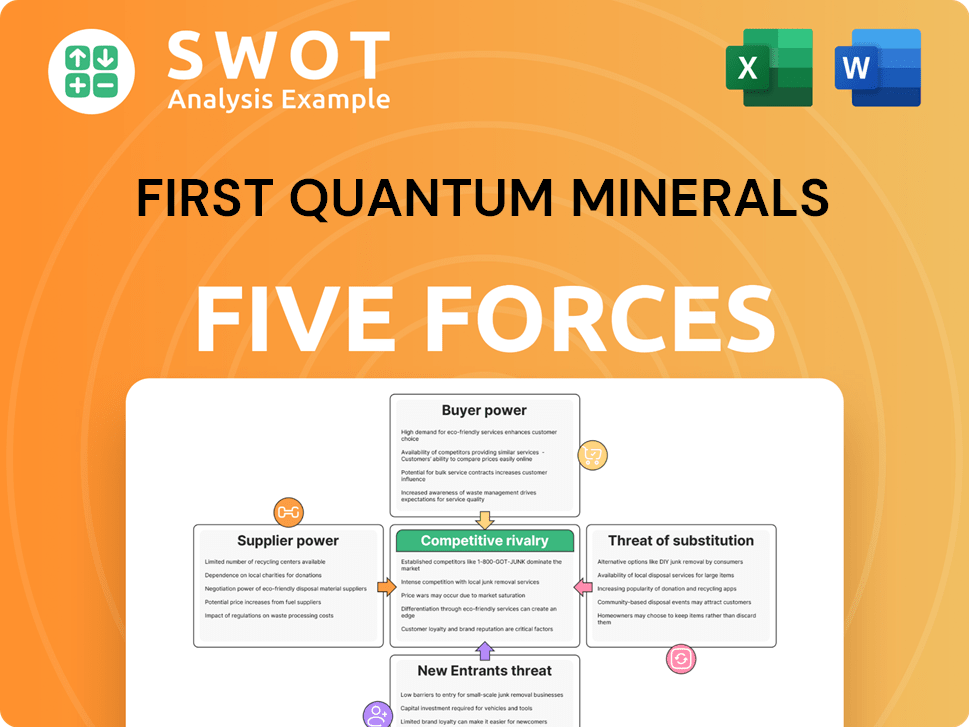

First Quantum Minerals Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of First Quantum Minerals Company?

- What is Competitive Landscape of First Quantum Minerals Company?

- What is Growth Strategy and Future Prospects of First Quantum Minerals Company?

- How Does First Quantum Minerals Company Work?

- What is Sales and Marketing Strategy of First Quantum Minerals Company?

- What is Brief History of First Quantum Minerals Company?

- Who Owns First Quantum Minerals Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.