General Electric Bundle

Can GE Soar Again?

General Electric (GE), a titan of industry, has undergone a dramatic transformation. Its strategic shift, including the spin-off of key businesses, signals a bold new chapter in its storied history. This deep dive explores GE's General Electric SWOT Analysis, examining its growth strategy and the exciting future prospects that lie ahead.

From its roots in electrification to its current focus on aviation, healthcare, and power, understanding the GE growth strategy is crucial. This analysis will dissect GE's future prospects, evaluating its strategic plan, and assessing its potential for long-term growth. We'll explore how General Electric is navigating challenges and capitalizing on opportunities in a rapidly evolving global market, examining its Business strategy and Company outlook.

How Is General Electric Expanding Its Reach?

The expansion initiatives of General Electric (GE) are primarily centered on strategic divestitures and a focused approach on high-growth sectors. This strategic realignment aims to streamline operations and capitalize on emerging opportunities, particularly in aviation and healthcare. The core of GE's current strategy involves a sharpened focus on its most promising business segments, positioning the company for sustained growth.

A significant step in this strategic shift was the spin-off of GE Vernova in April 2024. This move created an independent, publicly traded entity dedicated to power generation and renewable energy solutions. This allows the remaining GE Aerospace to concentrate on its core aviation business. This focus is expected to drive substantial growth, fueled by the increasing demand in global air travel and defense spending.

GE's future prospects are closely tied to its ability to execute these strategic initiatives effectively. By concentrating resources and expertise in high-potential areas, GE aims to enhance its market position and deliver value to its stakeholders. The company's strategic plan emphasizes innovation, partnerships, and sustainable practices to ensure long-term success.

GE Aerospace is prioritizing the expansion of its product pipeline, including next-generation aircraft engines and services. The company is heavily investing in sustainable aviation technologies, such as hybrid-electric propulsion and sustainable aviation fuels (SAFs). These investments are crucial for meeting the industry's evolving environmental standards and ensuring long-term competitiveness.

Collaborations with airlines and original equipment manufacturers (OEMs) are essential for developing and deploying advanced technologies. GE Aerospace is working on programs like CFM RISE (Revolutionary Innovation for Sustainable Engines). These partnerships are key to driving innovation and expanding market reach.

GE HealthCare, though now a separate entity, provides insights into the broader GE portfolio's expansion strategy. GE HealthCare is expanding its precision health capabilities through acquisitions and strategic partnerships. This includes enhancing its imaging, ultrasound, and patient care solutions to address unmet clinical needs and improve patient outcomes globally.

In 2023, GE Aerospace reported revenues of approximately $32.6 billion, with a strong focus on aftermarket services, which accounted for a significant portion of its revenue. The company's focus on innovation and strategic partnerships is expected to drive future growth. The company is also focused on improving its operational efficiency to boost profitability.

GE's expansion is driven by strategic divestitures and a focus on aviation and healthcare. The spin-off of GE Vernova allows GE Aerospace to concentrate on its core business. Partnerships and investments in sustainable technologies are crucial for future growth.

- Focus on Aviation: Expanding product pipelines and investing in sustainable aviation technologies.

- Strategic Partnerships: Collaborating with airlines and OEMs for technology deployment.

- Healthcare Expansion: Enhancing precision health capabilities through acquisitions and partnerships.

- Financial Performance: Strong revenue in 2023, with a focus on aftermarket services.

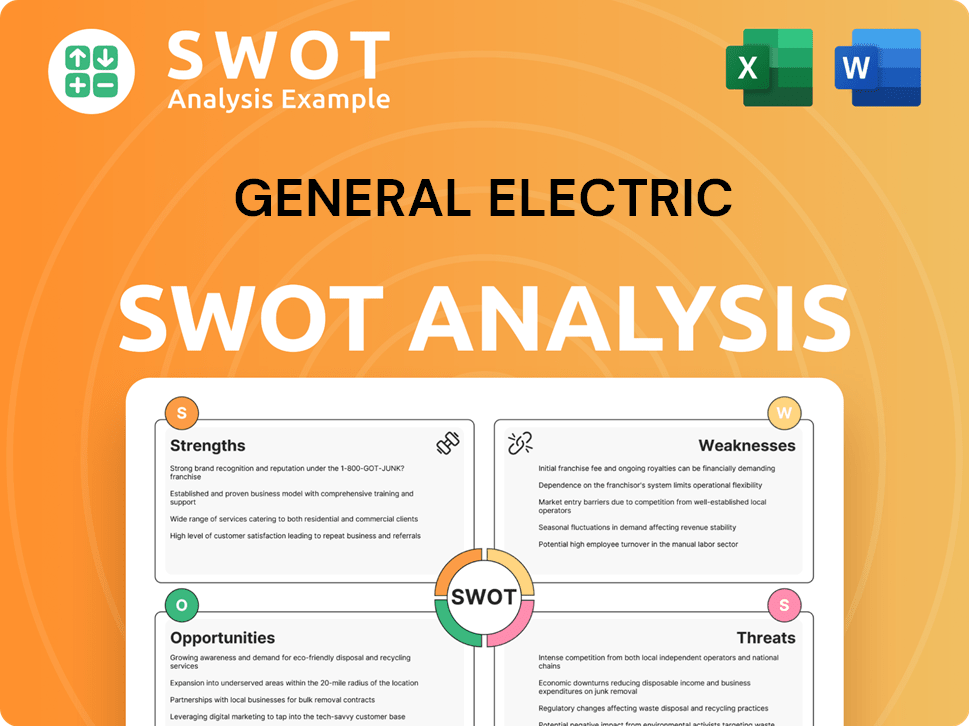

General Electric SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does General Electric Invest in Innovation?

The innovation and technology strategy of General Electric (GE) is primarily focused on its GE Aerospace segment, with substantial investments in research and development (R&D). This strategy aims to drive advancements in propulsion systems and sustainable aviation technologies, which is a key aspect of GE's growth strategy. The company is also leveraging digital transformation to optimize operations and enhance customer value.

GE's approach involves embracing digital solutions, including data analytics, artificial intelligence (AI), and the Internet of Things (IoT). These technologies are deployed to improve product performance, enable predictive maintenance, and boost operational efficiency. Sustainability is another critical driver, with GE exploring new materials and manufacturing processes to reduce environmental impact throughout the product lifecycle.

The strategic focus on aviation allows for a more concentrated and impactful approach to innovation within this critical sector, thereby shaping the company outlook. The company is working on open fan architectures, compact core engine designs, and aircraft electrification to reduce fuel consumption and emissions.

GE allocates significant resources to R&D, particularly within GE Aerospace. This commitment supports the development of advanced technologies and maintains its competitive edge in the industry. These investments are crucial for driving innovation and achieving long-term growth.

Digital transformation is a key enabler across GE's operations. GE uses data analytics, AI, and IoT to optimize product performance, enhance predictive maintenance, and improve operational efficiency. Digital solutions are integrated into engine health monitoring and fleet management to provide real-time insights.

GE is committed to sustainability, exploring sustainable aviation fuels, new materials, and manufacturing processes. These efforts aim to reduce environmental impact throughout the product lifecycle. This approach aligns with global trends towards greener technologies.

The strategic focus on aviation allows for a more concentrated and impactful approach to innovation. GE is working on open fan architectures, compact core engine designs, and aircraft electrification. This focus enhances GE's ability to drive innovation in a critical sector.

GE is actively involved in developing advanced propulsion systems. These systems are designed to improve fuel efficiency and reduce emissions. GE's innovations in this area are essential for the future of aviation.

GE is exploring future technologies, including aircraft electrification. The company is also developing compact core engine designs. These innovations are aimed at enhancing the performance and sustainability of its products.

GE's technological advancements are central to its business strategy and future success. The company's innovation efforts are geared towards creating more efficient and sustainable solutions.

- Advanced Propulsion Systems: Development of open fan architectures and compact core engine designs to improve fuel efficiency.

- Aircraft Electrification: Research into electric propulsion systems to reduce emissions and enhance sustainability.

- Digital Solutions: Implementation of data analytics, AI, and IoT for predictive maintenance and operational efficiency.

- Sustainable Aviation Fuels: Exploration of alternative fuels to reduce environmental impact.

- New Materials and Manufacturing: Focus on innovative materials and processes to improve product lifecycle sustainability.

For more insights, you can read about Owners & Shareholders of General Electric.

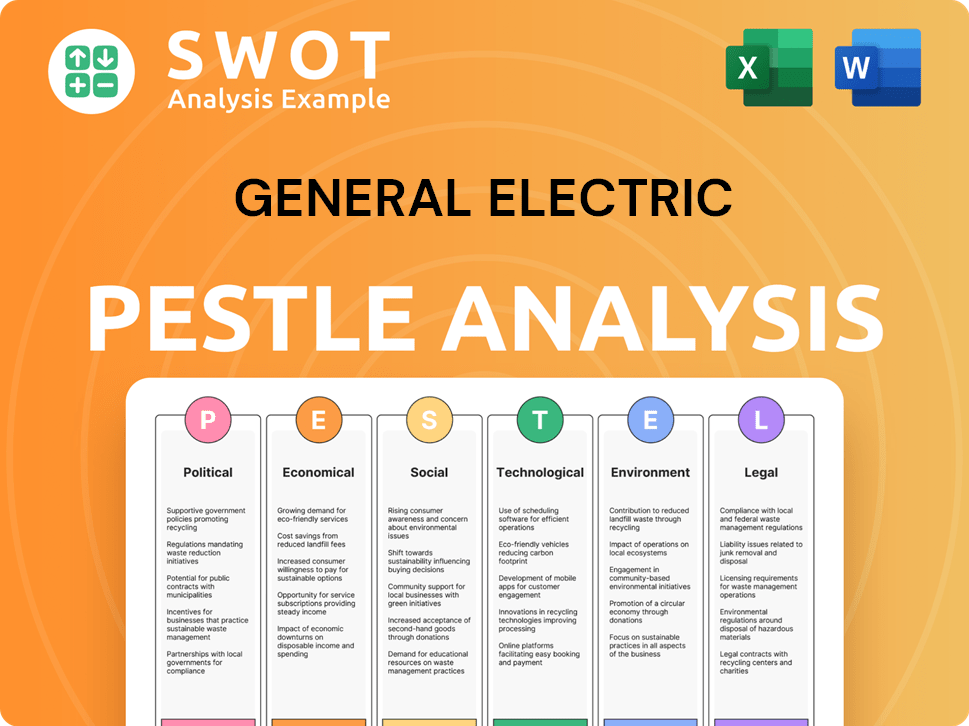

General Electric PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is General Electric’s Growth Forecast?

The financial outlook for General Electric (GE) has been significantly reshaped by its strategic portfolio restructuring. This restructuring culminated in the spin-off of GE Vernova in April 2024. The remaining entity, GE Aerospace, is now positioned as a focused aviation leader with a strong financial profile.

For the first quarter of 2024, GE Aerospace reported robust performance, with revenue increasing by 15% organically to $8.1 billion. Adjusted profit margins expanded significantly during this period. The company also reported strong free cash flow of $1.7 billion, indicating healthy operational efficiency and financial management.

GE Aerospace projects continued growth, driven by strong demand in the commercial aviation and defense sectors. The company anticipates full-year 2024 revenue growth in the low double-digit range and adjusted operating profit between $6.2 billion and $6.6 billion. Free cash flow is expected to be between $5 billion and $5.5 billion. These projections reflect the company's confidence in the aviation market recovery and its operational efficiency improvements.

GE's growth strategy focuses on its core aviation technologies. The company is investing in innovation and new product development to maintain its competitive edge. This includes advancements in engine technology and aviation services.

GE's financial performance is underpinned by a strong backlog and aftermarket services. These provide a stable revenue base, supporting long-term financial goals. The company's focus on disciplined capital allocation is crucial.

GE Aerospace's financial strategy emphasizes disciplined capital allocation. This includes reinvestment in core aviation technologies, debt reduction, and returning capital to shareholders. This approach supports sustainable growth.

With the spin-off of GE Vernova, GE Aerospace has strengthened its market position. The company is now a pure-play aviation leader, allowing for focused strategic initiatives. This strategic shift enhances its competitive advantages.

Future investments will likely focus on technological advancements and expanding service offerings. GE plans to strengthen its position in both commercial and defense aviation. These investments are key to long-term growth.

GE faces challenges such as supply chain disruptions and economic uncertainties. However, the strong demand in aviation presents significant opportunities. The company is well-positioned to capitalize on these opportunities.

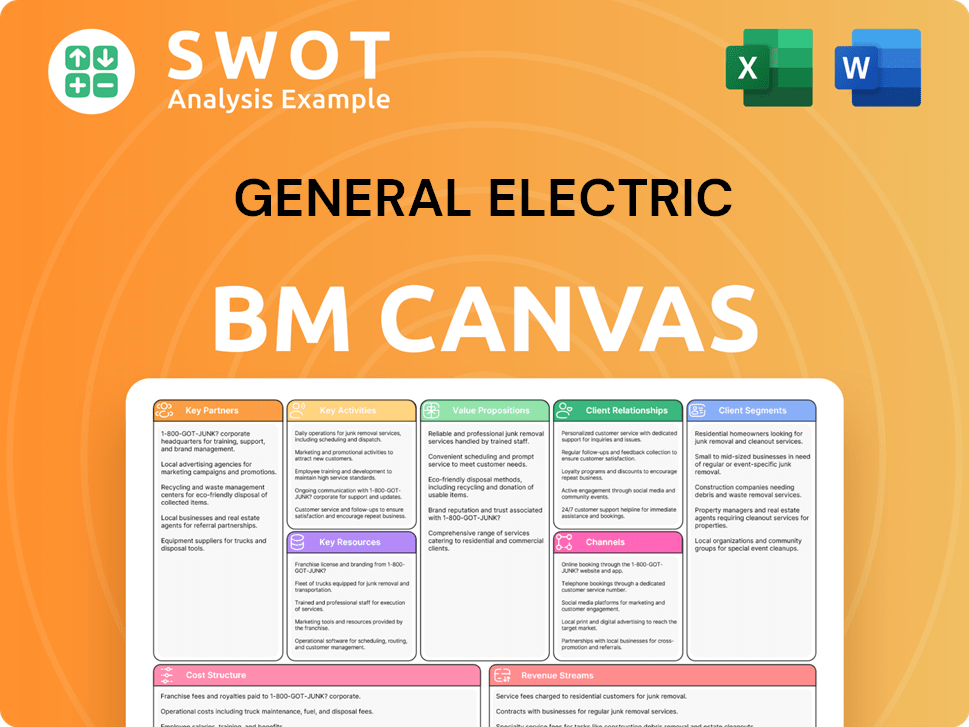

General Electric Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow General Electric’s Growth?

Even with a focused approach, GE Aerospace faces potential risks. Competition in the aerospace sector remains fierce, requiring constant innovation to stay ahead. External factors such as supply chain issues and regulatory changes also pose challenges to the company's growth strategy.

Technological disruptions, like advancements in alternative propulsion systems, could reshape the industry landscape. GE's ability to mitigate these risks will be crucial for achieving its future prospects. Understanding and addressing these challenges is key to evaluating the long-term growth potential of General Electric.

GE Aerospace mitigates these risks through diversified product offerings within the aviation sector, a robust risk management framework that includes scenario planning for various market conditions, and strategic investments in cutting-edge technologies like sustainable aviation. For instance, the company is actively working to de-risk its supply chain by diversifying suppliers and building stronger relationships with key partners. Furthermore, GE Aerospace's strong customer relationships and long-term service agreements provide a degree of stability against short-term market fluctuations. The company's focus on operational excellence and cost control also helps to buffer against potential economic downturns or unexpected cost increases.

The aerospace industry is highly competitive, with major players constantly vying for market share. Companies like Boeing and Airbus are significant rivals, continuously innovating in aircraft design, engine technology, and service offerings. This intense competition necessitates ongoing investments in R&D to stay ahead.

Disruptions to the global supply chain can impact GE's ability to source critical components and materials. These disruptions can lead to production delays, increased costs, and reduced profitability. The company must proactively manage its supply chain to mitigate these risks.

Changes in regulations, particularly those related to environmental standards and aviation safety, can significantly impact GE. Compliance with these regulations often requires substantial R&D investments and modifications to product development. The company must adapt to evolving regulatory landscapes.

Rapid advancements in areas like alternative propulsion systems (e.g., electric and hybrid-electric aircraft) and new manufacturing techniques (e.g., additive manufacturing) could disrupt the industry. GE must invest in these technologies to remain competitive and capitalize on emerging opportunities. The Target Market of General Electric will be affected by these disruptions.

Economic downturns can lead to reduced demand for new aircraft and services, impacting GE's financial performance. The company needs to be prepared to navigate economic cycles and maintain profitability during periods of reduced activity. Diversification and cost control are crucial strategies.

Geopolitical events, such as trade wars or conflicts, can disrupt supply chains, impact demand, and introduce uncertainty. GE must monitor geopolitical risks and develop strategies to mitigate their potential effects on its operations and financial results. These factors can influence General Electric's strategic plan.

GE Aerospace employs several strategies to address these risks. These include diversifying its product offerings within the aviation sector, maintaining a strong risk management framework, and making strategic investments in advanced technologies. The company focuses on operational excellence and cost control to buffer against economic downturns.

In recent years, GE has shown improved financial performance, but challenges remain. The company's financial results are closely tied to global economic conditions and industry-specific factors. GE's financial performance is a key indicator of its success.

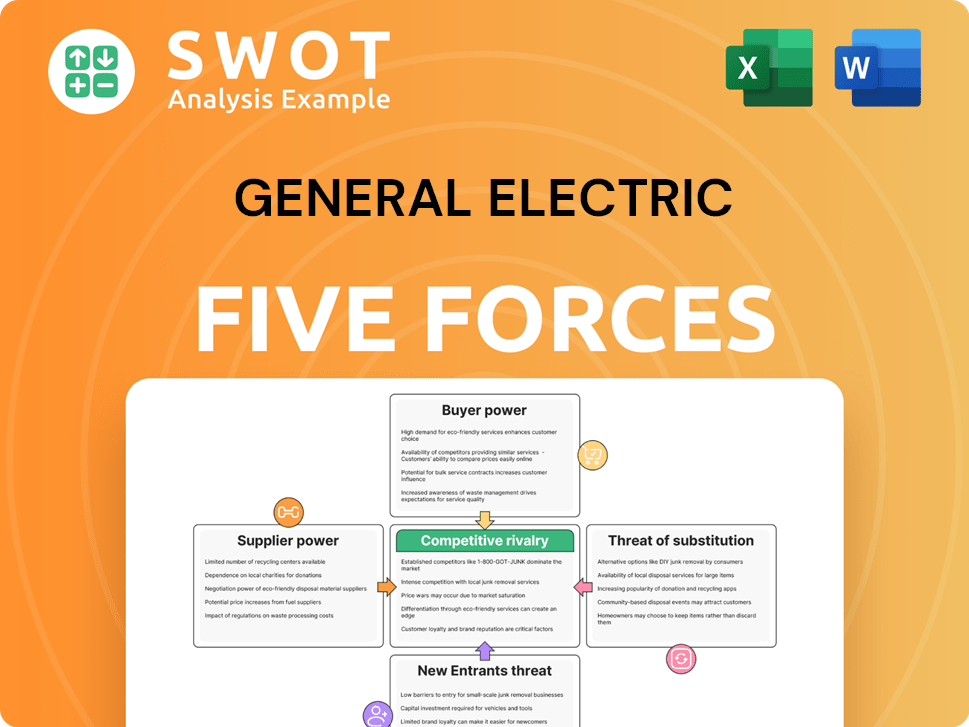

General Electric Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of General Electric Company?

- What is Competitive Landscape of General Electric Company?

- How Does General Electric Company Work?

- What is Sales and Marketing Strategy of General Electric Company?

- What is Brief History of General Electric Company?

- Who Owns General Electric Company?

- What is Customer Demographics and Target Market of General Electric Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.