Heidelberg Materials Bundle

Can Heidelberg Materials Cement a Sustainable Future?

Heidelberg Materials recently made a bold move, signaling its commitment to revolutionizing the Heidelberg Materials SWOT Analysis and the broader construction sector. Founded in 1873, the company has evolved from a local cement maker to a global leader in building materials. This article dives deep into Heidelberg Materials' strategic roadmap, exploring its ambitious plans for expansion, innovation, and financial prowess in the face of evolving industry dynamics.

This in-depth analysis will dissect Heidelberg Materials' growth strategy, examining its future prospects within the context of shifting Cement Industry Trends and the Construction Materials Market. We'll explore the company's sustainability initiatives report, including its investment in green cement and carbon capture technology, alongside its strategic acquisitions and mergers. Furthermore, we'll evaluate Heidelberg Materials' financial performance analysis and digital transformation strategy to understand its long-term business goals and impact on global infrastructure.

How Is Heidelberg Materials Expanding Its Reach?

The expansion initiatives of the Heidelberg Materials Company are multifaceted, focusing on both market diversification and sustainable solutions. This strategy includes entering new markets and strengthening its presence in existing ones through organic growth and strategic acquisitions. The company's approach is driven by the evolving demands of the construction materials market and the need to reduce its environmental impact.

A key element of their expansion strategy involves increasing their renewable energy portfolio. The company aims to source 80% of its electricity needs from renewable sources by 2030. This initiative supports both operational expansion and sustainability goals, demonstrating a commitment to reducing its carbon footprint. This commitment is reflected in their investments in low-carbon and circular building materials.

Product innovation is a major focus, particularly in low-carbon and circular building materials. The company is actively developing and launching new products, such as EvoBuild, their new brand for sustainable building materials. This includes cement with a reduced carbon footprint and recycled aggregates. These efforts are aligned with the goal of offering carbon-neutral concrete by 2050 at the latest. Furthermore, the company is investing in carbon capture utilization and storage (CCUS) technologies.

The company is expanding its global footprint by entering new markets and strengthening its presence in existing ones. This includes strategic acquisitions and organic growth initiatives to increase market share. The focus is on regions with high growth potential and increasing demand for construction materials.

Heidelberg Materials is heavily investing in sustainable construction practices. This includes the development of low-carbon products and the implementation of carbon capture technologies. The goal is to reduce the environmental impact of its operations and meet the growing demand for green building materials.

The company is focusing on product innovation, especially in low-carbon and circular building materials. This includes the development of new cement formulations and the use of recycled aggregates. These innovations are essential for maintaining a competitive edge in the evolving construction materials market.

Heidelberg Materials is investing in advanced technologies, such as carbon capture utilization and storage (CCUS). This includes the construction of large-scale carbon capture plants. These investments are crucial for reducing carbon emissions and achieving long-term sustainability goals.

The company's expansion strategy encompasses several key areas, including geographic expansion, product innovation, and sustainability initiatives. These efforts are designed to capitalize on market opportunities and address the challenges posed by the evolving construction materials market.

- Entering new markets with high growth potential.

- Developing and launching low-carbon building materials.

- Investing in carbon capture technologies.

- Increasing the use of renewable energy sources.

Heidelberg Materials SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Heidelberg Materials Invest in Innovation?

The company is strategically leveraging innovation and technology to fuel its growth, with a strong focus on digital transformation and decarbonization. This approach is central to its long-term strategy, aiming to enhance efficiency, create new business models, and reduce its environmental footprint. The company's commitment to research and development, both internally and through collaborations, is a key driver of its progress in the construction materials market.

A core element of the company's strategy involves the adoption of digital technologies across its operations. This includes the use of artificial intelligence (AI) and the Internet of Things (IoT) to optimize various processes. The 'Digital @ Scale' program is a prime example of this effort, designed to improve efficiency and foster new business models. This digital transformation is crucial for maintaining a competitive edge in the evolving cement industry trends.

The company is also heavily invested in sustainable building materials and carbon capture technologies, showcasing its dedication to environmental responsibility. This includes developing low-carbon cement and concrete products and exploring alternative raw materials and fuels. These initiatives are vital for meeting the growing demand for sustainable construction solutions and contributing to global efforts to reduce carbon emissions. The company's focus on innovation positions it well to capitalize on future opportunities within the construction materials market.

The company's 'Digital @ Scale' program is a key initiative, integrating AI and IoT to optimize production, logistics, and customer engagement. This digital transformation strategy enhances efficiency and opens doors to new business models.

Significant investments in research and development are made both internally and through collaborations. These efforts focus on developing cutting-edge solutions, including sustainable building materials and carbon capture technologies.

The company is a pioneer in developing low-carbon cement and concrete products. It is also exploring alternative raw materials and fuels to reduce its environmental footprint and meet the demands of sustainable construction.

The company is investing in carbon capture technologies, such as the industrial-scale plant in Brevik, Norway, which is expected to capture 400,000 tonnes of CO2 annually from 2025. This initiative is crucial for reducing carbon emissions in the cement industry.

The company is actively involved in industry-leading research initiatives. These initiatives are aimed at achieving carbon neutrality and developing innovative concrete solutions.

The company holds numerous patents related to sustainable cement production. This demonstrates its commitment to innovation and its role in shaping the future of the construction materials market.

The company's approach to innovation is multifaceted, encompassing digital transformation, sustainable materials, and carbon capture. These strategies are designed to drive growth and address the challenges and opportunities in the construction industry.

- Digital Transformation: Implementation of AI and IoT to optimize processes, enhance efficiency, and create new business models.

- Sustainable Materials: Development of low-carbon cement and concrete, alongside exploring alternative raw materials and fuels.

- Carbon Capture: Investment in carbon capture technologies, such as the Brevik plant, to reduce emissions. This is a key aspect of the Marketing Strategy of Heidelberg Materials.

- Research and Development: Continuous investment in R&D, both internally and through collaborations, to develop cutting-edge solutions.

Heidelberg Materials PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Heidelberg Materials’s Growth Forecast?

The financial outlook for Heidelberg Materials is robust, driven by its strategic initiatives and focus on sustainability. For 2024, the company anticipates solid growth in both revenue and profitability. This positive trajectory is supported by strategic investments in key areas like decarbonization and digital transformation, critical for long-term success in the competitive landscape.

Heidelberg Materials is targeting a significant increase in free cash flow, aiming for over €1 billion. This demonstrates strong financial health and operational efficiency. The company's commitment to sustainability, including its goal of carbon neutrality by 2050, is expected to create new market opportunities and strengthen its competitive position within the construction materials market.

The company's financial strategy is centered on optimizing its portfolio and reducing operational costs through digitalization. This, combined with investments in sustainable solutions, points to a positive financial trajectory. The company's forward-looking financial narrative is crucial for underpinning its strategic plans and maintaining investor confidence, which is essential for achieving its long-term business goals.

Heidelberg Materials projects growth in revenue and profitability for the fiscal year 2024, reflecting its strategic focus and operational improvements. This growth is supported by its investments in sustainable solutions and digital transformation.

The company aims for a free cash flow exceeding €1 billion, indicating strong financial performance and efficient operations. This target underscores the company's ability to generate cash and reinvest in strategic initiatives.

Substantial capital is allocated to projects like carbon capture technologies and sustainable product development. These investments are crucial for achieving its carbon neutrality goal by 2050 and enhancing its competitive position.

Heidelberg Materials is actively reducing operational costs through digitalization. This strategic move improves efficiency and supports its long-term financial goals, contributing to its Heidelberg Materials Growth Strategy.

Heidelberg Materials' financial strategy includes optimizing its portfolio, reducing operational costs, and investing in high-growth sustainable solutions. These initiatives are designed to support the company's strategic plans and boost investor confidence. The focus on innovation in concrete technology and new product development is also critical for its long-term success.

The company's financial outlook is strengthened by its strategic investments and sustainability efforts, which are key to its Heidelberg Materials Future Prospects.

- Revenue and Profitability: Expecting growth in revenue and profitability in 2024.

- Free Cash Flow: Targeting over €1 billion in free cash flow.

- Strategic Investments: Focused on decarbonization and digital transformation.

- Sustainability Goals: Aiming for carbon neutrality by 2050.

Heidelberg Materials Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Heidelberg Materials’s Growth?

The growth strategy and future prospects of Heidelberg Materials are subject to several potential risks and obstacles. The company operates within a competitive market, where both global and regional players vie for market share in the construction materials sector. Furthermore, the construction materials market is influenced by regulatory changes, especially regarding environmental protection and carbon emissions, necessitating significant investments and adjustments.

Supply chain disruptions, including raw material availability and price volatility, present another layer of operational risk. Technological advancements and the emergence of alternative materials could also challenge traditional building solutions, requiring constant innovation and adaptation. Internally, the company faces challenges related to resource constraints, such as skilled labor shortages or the capital-intensive nature of decarbonization projects.

Heidelberg Materials' ability to navigate these challenges will significantly impact its future performance. The company's proactive strategies, including diversification, robust risk management, and a focus on sustainability, will be crucial in mitigating these risks. As highlighted in a recent analysis of the Target Market of Heidelberg Materials, understanding and adapting to these market dynamics are essential for sustained growth.

The construction materials market is highly competitive, with numerous international and regional players. This competition can impact pricing, market share, and profitability for Heidelberg Materials. The company must continuously innovate and differentiate its products and services to stay ahead of the competition.

Environmental regulations and carbon emission standards are constantly evolving. These changes require significant investments in new technologies and processes. Heidelberg Materials must adapt to these regulations to avoid penalties and maintain its market position. For example, the EU's Emissions Trading System (ETS) impacts cement production costs.

Disruptions in the supply chain, including raw material shortages and price fluctuations, can significantly impact operations. The company needs to manage these risks through diversified sourcing and efficient logistics. Recent geopolitical events have highlighted the vulnerability of global supply chains, underscoring the importance of resilience.

The construction industry is undergoing rapid technological advancements. New materials and alternative construction methods could challenge traditional solutions. Heidelberg Materials needs to invest in research and development and embrace digital transformation to stay competitive and meet evolving customer demands. The rise of 3D printing in construction is an example.

Skilled labor shortages and the high capital expenditure required for decarbonization projects pose internal challenges. Managing these constraints requires strategic workforce planning and efficient capital allocation. The transition to sustainable practices demands significant investments in new technologies and infrastructure. For instance, carbon capture projects require substantial upfront costs.

Economic downturns and fluctuations in construction activity can negatively impact demand for construction materials. Heidelberg Materials' financial performance is closely tied to global and regional economic conditions. Diversifying its geographic presence and product portfolio can help mitigate the impact of economic cycles. The volatility in the housing market can also create uncertainty.

Heidelberg Materials' growth strategy includes expanding its presence in key markets, particularly in North America and Asia. The company focuses on strategic acquisitions and mergers to increase market share and diversify its product offerings. Investment in innovation, such as green cement and carbon capture technologies, is a core element of its long-term strategy. The company aims to increase its revenue by 5% annually through these initiatives.

The future prospects of Heidelberg Materials are closely linked to the global demand for construction materials and its ability to adapt to industry trends. The company is well-positioned to benefit from the growing demand for sustainable construction solutions. Investment in digital transformation and sustainable solutions will drive future growth. The company anticipates a 10% increase in demand for green cement by 2026.

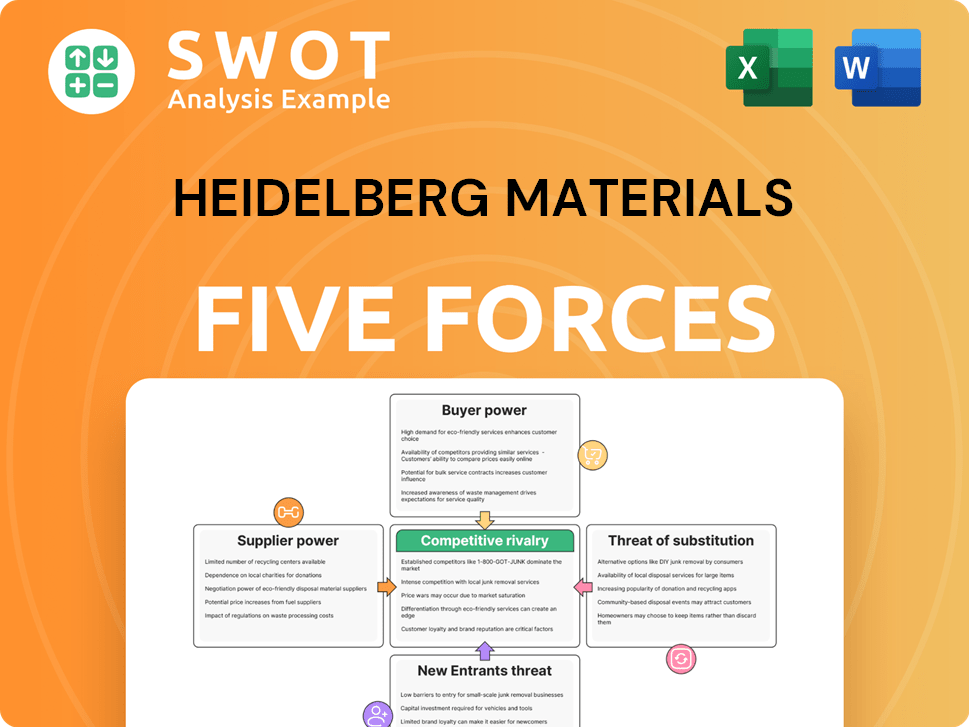

Heidelberg Materials Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Heidelberg Materials Company?

- What is Competitive Landscape of Heidelberg Materials Company?

- How Does Heidelberg Materials Company Work?

- What is Sales and Marketing Strategy of Heidelberg Materials Company?

- What is Brief History of Heidelberg Materials Company?

- Who Owns Heidelberg Materials Company?

- What is Customer Demographics and Target Market of Heidelberg Materials Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.