Heidelberg Materials Bundle

How Does Heidelberg Materials Thrive in a Changing World?

Heidelberg Materials, a global powerhouse in the building materials sector, is a company that has showcased impressive financial results, even in the face of market fluctuations. With a focus on sustainability and digital transformation, the Heidelberg Materials SWOT Analysis can provide a deeper dive into its strengths and weaknesses. The company's commitment to innovation is reshaping the construction industry.

This exploration into the Heidelberg Materials company will dissect its core operations, from cement production to its global footprint. We'll examine how this building materials company leverages its strategic initiatives, including its sustainability efforts and its focus on innovation in construction, to maintain its leading position. Understanding Heidelberg Materials' financial performance and its approach to the future is essential for anyone seeking insights into the construction materials market.

What Are the Key Operations Driving Heidelberg Materials’s Success?

The core operations of the Heidelberg Materials company revolve around the production and distribution of essential building materials. This includes cement, aggregates, ready-mixed concrete, and asphalt. These materials are crucial for a wide range of construction projects globally, serving diverse customer segments.

Heidelberg Materials business operates across the entire value chain, from sourcing raw materials to manufacturing and distribution. The company emphasizes efficient resource utilization and is committed to sustainable practices, including concrete recycling and reducing reliance on non-renewable resources.

The company's value proposition lies in its ability to provide high-quality construction materials while prioritizing sustainability and innovation. This approach positions Heidelberg Materials as a leader in the building materials industry, especially in the transition to a circular economy.

Heidelberg Materials products and services include cement, aggregates (like sand and gravel), ready-mixed concrete, and asphalt. These are fundamental for various construction projects, from residential buildings to large-scale infrastructure.

The company operates in over 50 countries with nearly 3,000 production sites. This extensive global footprint allows Heidelberg Materials to serve customers worldwide and adapt to regional market demands.

Heidelberg Materials sustainability initiatives include carbon capture and storage (CCS) technologies and the use of recycled materials. These efforts aim to reduce the environmental impact of cement production and other operations.

Collaborations, such as the one with Volvo CE, drive innovation in construction and promote sustainable solutions. These partnerships are crucial for adopting new technologies and reducing carbon emissions in the supply chain.

Heidelberg Materials has a significant global presence, with over 51,000 employees. The company's commitment to sustainability is evident through investments in projects like the Brevik CCS project in Norway, which is expected to capture up to 2.2 million tons of carbon dioxide annually. The company is also focused on reducing its carbon footprint through various initiatives.

- The company's focus on Heidelberg Materials environmental impact is a key differentiator in the building materials company sector.

- Heidelberg Materials is actively involved in concrete recycling to reduce the consumption of primary raw materials.

- The company is investing in digital solutions and electrified vehicles to optimize site performance and reduce emissions in collaboration with partners like Volvo CE.

- For more details on the company's market positioning, see Target Market of Heidelberg Materials.

Heidelberg Materials SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Heidelberg Materials Make Money?

The Heidelberg Materials company generates revenue mainly from selling essential building materials. In 2024, the group's revenue was a substantial €21.2 billion. This revenue stream is diversified across various product families, reflecting the company's broad market presence in the construction sector.

The company's monetization strategies involve core product sales, price adjustments, and cost management to counteract market volatility. A notable focus is on expanding its low-carbon product portfolio, which is becoming an increasingly important revenue source. This strategic shift towards sustainable products highlights Heidelberg Materials' commitment to environmental responsibility and innovation within the construction materials industry.

Geographically, the revenue distribution is diverse, with North America being the best-performing region in 2024, contributing €5.31 billion. Europe is a significant market, with Germany, the United Kingdom, and France contributing substantially to sales. Other key regions include Australia, Indonesia, Canada, and Italy. The 'Transformation Accelerator' initiative, launched in November 2024, aims to boost the yearly result by €500 million by the end of 2026.

The primary revenue streams for Heidelberg Materials come from the sale of construction materials. The company's focus on sustainable products is also growing, as seen by the increase in sustainable revenue within the cement business line. This diversification and strategic focus help to maintain financial performance. For more insights, you can explore the Marketing Strategy of Heidelberg Materials.

- Cement accounted for 44.9% of net sales in 2024.

- Ready-to-use concrete and asphalt contributed 23.6% of the revenue.

- Aggregates made up 21.3% of the total sales.

- Other products, including lime, bricks, and mortar, accounted for 10.2%.

Heidelberg Materials PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Heidelberg Materials’s Business Model?

Heidelberg Materials has undergone significant transformations, particularly in its commitment to sustainability and operational efficiency. A pivotal strategic move was the rebranding to Heidelberg Materials in September 2022, reflecting a focus on innovative and sustainable building materials. The company's performance in 2024 demonstrates its resilience and strategic foresight.

In 2024, Heidelberg Materials reported stable group revenue of €21.2 billion and a record result from current operations (RCO) of €3.2 billion. The company is strategically positioned to lead in decarbonizing the cement industry, with its carbon capture and storage (CCS) projects making significant progress. These initiatives underscore the company's commitment to reducing its environmental impact and fostering sustainable practices within the construction materials sector.

Heidelberg Materials continues to adapt to new trends, as seen in its digital transformation initiatives, such as selecting SAP Ariba Sourcing in 2024 to enhance its sourcing processes. This demonstrates the company's ongoing efforts to optimize its operations and maintain a competitive edge in the market. The company's dedication to sustainable practices and operational excellence is further detailed in Growth Strategy of Heidelberg Materials.

The rebranding to Heidelberg Materials in September 2022 marked a strategic shift towards sustainable building materials. In 2024, the company achieved stable group revenue of €21.2 billion and a record RCO of €3.2 billion. The mechanical completion of the world's first industrial-scale CCS facility at its Brevik plant is on track for late 2024.

A key strategic move was the launch of the 'Transformation Accelerator' initiative in November 2024, aiming to contribute €500 million annually by the end of 2026. Securing up to US$500 million for the CCUS project at the Mitchell plant in Q1 2024 was also significant. The selection of SAP Ariba Sourcing in 2024 shows a commitment to digital transformation.

Heidelberg Materials' competitive advantages include its broad geographic footprint and leading market positions. Its brand strength is reinforced by being the first in the construction materials sector to adopt group-wide policies for species protection. The company's focus on sustainable solutions and digital transformation further enhances its position.

In 2024, Heidelberg Materials reported stable group revenue of €21.2 billion. The record result from current operations (RCO) reached €3.2 billion. The company's financial health is supported by strict cost management and positive price momentum despite market challenges.

Heidelberg Materials faced operational challenges, including declining volumes in certain regions due to weak construction demand. Despite these headwinds, the company maintained profitability through strict cost management. The launch of the 'Transformation Accelerator' initiative is projected to contribute significantly to future earnings.

- Stable group revenue of €21.2 billion.

- Record result from current operations (RCO) of €3.2 billion.

- Progress on CCS projects, including the Brevik plant.

- Launch of the 'Transformation Accelerator' initiative.

Heidelberg Materials Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Heidelberg Materials Positioning Itself for Continued Success?

Heidelberg Materials, a leading building materials company, holds a prominent position in the global market. The company is a major player in cement production, aggregates, and ready-mixed concrete, with operations spanning over 50 countries. Its robust performance is evident in its 2024 revenue of €21.2 billion, demonstrating its resilience in a fluctuating market.

The future outlook for Heidelberg Materials hinges on its ability to navigate several challenges. The company faces risks from the construction sector's volatility, particularly in Europe, and the fluctuating costs of energy and raw materials. Furthermore, geopolitical tensions, stricter environmental regulations, and concerns about labor practices add to the complexities. Despite these challenges, Heidelberg Materials is focusing on strategic initiatives to ensure sustainable growth.

Heidelberg Materials is one of the world's largest integrated building materials companies. It has a strong global presence, operating in over 50 countries. The company's market position is bolstered by its diverse product portfolio and geographical reach.

Key risks include volatility in the construction sector, especially in Europe. Cost fluctuations in energy and raw materials also pose challenges. Additionally, geopolitical tensions and stricter environmental regulations are significant factors.

Heidelberg Materials anticipates a result from current operations (RCO) between €3.25 billion and €3.55 billion in 2025. The company is focused on cost management, price optimization, and operational efficiency to sustain profitability. Strategic initiatives include the 'Transformation Accelerator' program.

The company is expanding its low-carbon product portfolio, with the first deliveries of evoZero® cement expected in 2025. The share buyback program, with the second tranche planned for Q2 2025, reflects a focus on shareholder return. The company's commitment to sustainability is evident in its decarbonization efforts.

In 2024, Heidelberg Materials reported stable revenue of €21.2 billion, highlighting its strong standing in a challenging market. North America was a key driver of growth, with revenue increasing by 1.8% to €5.31 billion. The company's focus on cost management and price optimization is crucial for sustaining profitability.

- The 'Transformation Accelerator' program aims for a €500 million annual result contribution by the end of 2026.

- The planned share buyback in Q2 2025 reflects a focus on shareholder returns.

- The company is committed to decarbonization, with the first deliveries of carbon-captured evoZero® cement expected in 2025.

- For a deeper understanding of the competitive environment, consider exploring the Competitors Landscape of Heidelberg Materials.

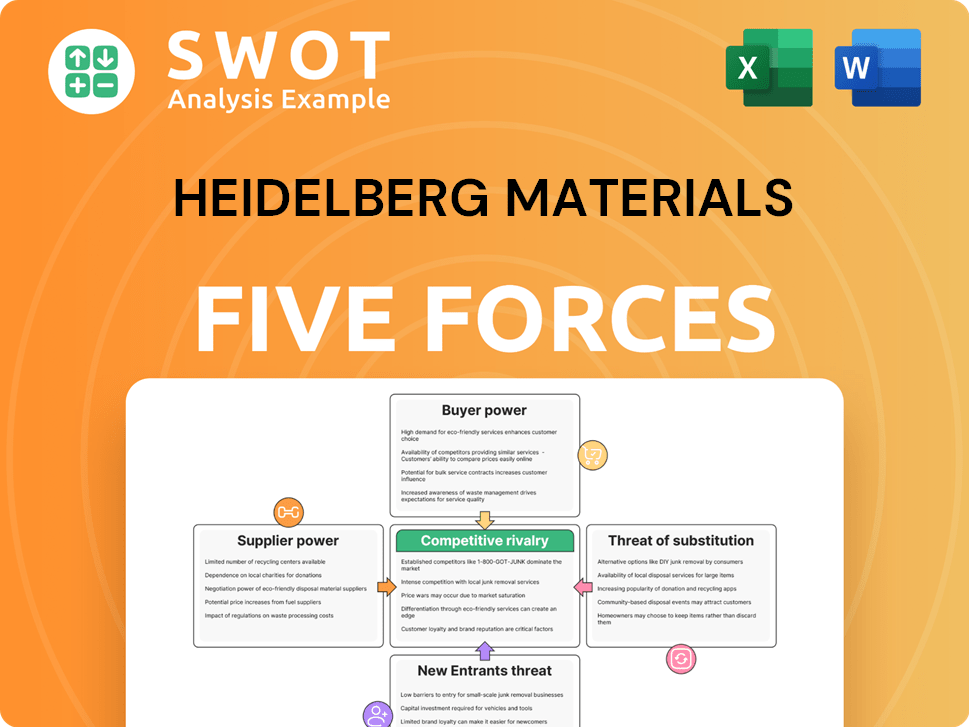

Heidelberg Materials Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Heidelberg Materials Company?

- What is Competitive Landscape of Heidelberg Materials Company?

- What is Growth Strategy and Future Prospects of Heidelberg Materials Company?

- What is Sales and Marketing Strategy of Heidelberg Materials Company?

- What is Brief History of Heidelberg Materials Company?

- Who Owns Heidelberg Materials Company?

- What is Customer Demographics and Target Market of Heidelberg Materials Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.