Holcim Bundle

Can Holcim Cement a Strong Future?

Holcim's recent strategic moves, including the significant divestment of its North American operations, signal a bold new chapter for the global building materials giant. This shift towards core markets and sustainable solutions demands a deep dive into Holcim's growth strategy. Understanding the Holcim SWOT Analysis is crucial to grasp the company's current position and future potential.

This analysis will explore Holcim's future prospects, examining its business model, financial performance, and strategic initiatives for 2024 and beyond. We'll dissect Holcim's market position, including its cement market share analysis, and its expansion plans in emerging markets. Furthermore, we'll delve into the impact of ESG on its business, its innovation in green building materials, and its long-term growth strategy, providing a comprehensive Holcim company analysis.

How Is Holcim Expanding Its Reach?

The growth strategy of Holcim is centered on market consolidation and diversification into sustainable building solutions. This dual approach allows the company to strengthen its presence in high-growth markets while optimizing its portfolio in mature regions. A key aspect of this strategy involves strategic mergers and acquisitions to expand its footprint and capabilities.

Holcim's expansion initiatives are designed to capitalize on emerging opportunities in the construction industry. The company is actively pursuing mergers and acquisitions to expand its footprint in areas like roofing and insulation. Holcim's commitment to sustainable building materials is also a core element of its expansion strategy, aligning with the growing demand for environmentally friendly construction practices.

The company's strategic moves are driven by a vision to become a global leader in innovative and sustainable building solutions, aiming for 30% of its net sales to come from Solutions & Products by 2025. This focus on sustainable solutions and strategic acquisitions positions Holcim to navigate the evolving demands of the construction industry effectively.

Holcim focuses on strengthening its presence in attractive growth markets. Simultaneously, it optimizes its portfolio in mature regions. This involves divesting from certain operations to reallocate capital towards higher-growth opportunities.

Holcim actively pursues mergers and acquisitions to expand its footprint. A notable example is the acquisition of Duro-Last, a leading U.S. commercial roofing systems manufacturer. This strategy aims to broaden the range of solutions and products.

Holcim is expanding its product categories beyond traditional cement and aggregates. This includes low-carbon cement, recycled aggregates, and green concrete solutions. The company invests in new plants for sustainable materials.

Holcim aims to have 30% of its net sales from Solutions & Products by 2025. It targets expanding its global market for sustainable building solutions to CHF 5 billion in net sales by 2025. These goals reflect a shift towards sustainable and innovative products.

Holcim's strategic initiatives are designed to enhance its market position and drive future growth. The company's focus on sustainable building materials is a key differentiator. Holcim's expansion plans in emerging markets and its mergers and acquisitions strategy are critical for its long-term growth strategy.

- The acquisition of Duro-Last, valued at $1.295 billion, is a prime example of Holcim’s mergers and acquisitions strategy.

- Holcim is investing CHF 100 million in a new plant in Germany to produce sustainable insulation materials, with production starting in 2026.

- The company aims for 30% of its net sales to come from Solutions & Products by 2025, reflecting its commitment to sustainable solutions.

- Holcim's strategic initiatives, including the focus on sustainable construction, are well-aligned with evolving industry demands, as discussed in Marketing Strategy of Holcim.

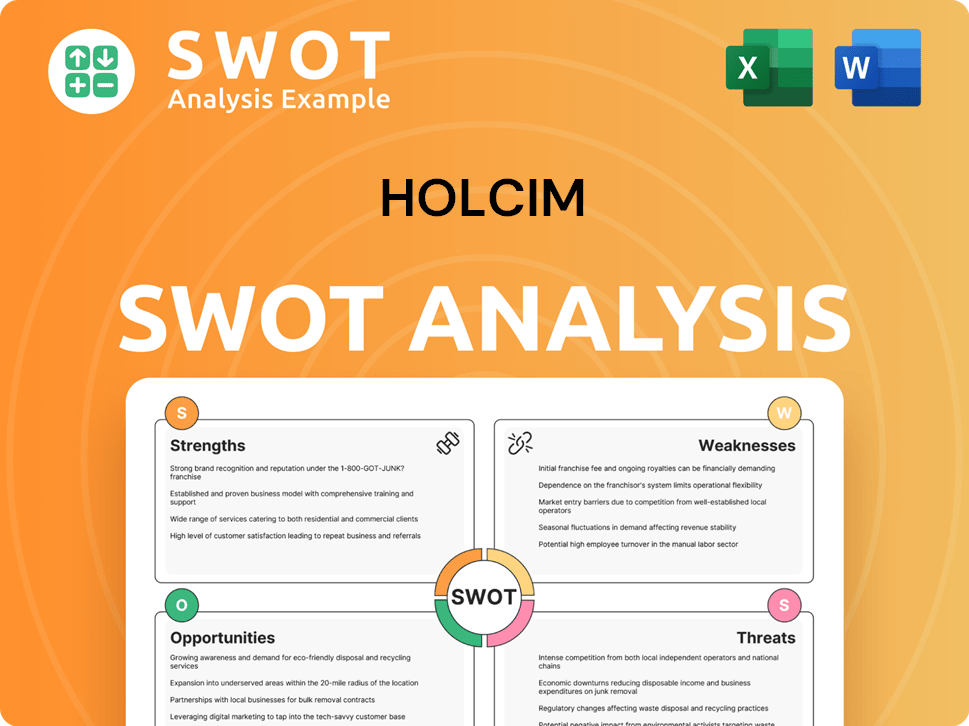

Holcim SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Holcim Invest in Innovation?

The company's innovation and technology strategy is central to its long-term growth, focusing on sustainability and digitalization. This approach is designed to meet evolving customer needs and preferences in the construction industry, which are increasingly geared towards eco-friendly materials and efficient, technologically advanced solutions. This strategy directly supports the company's Owners & Shareholders of Holcim by creating new revenue streams and enhancing operational efficiency.

The company's commitment to research and development is significant, both internally and through collaborative efforts. This investment accelerates the development of low-carbon building materials and circular construction solutions. This focus on innovation helps the company maintain its competitive edge and meet the growing demand for sustainable building practices.

The company’s digital transformation strategy is a key element in optimizing operations and improving customer experience. By leveraging advanced analytics, AI, and IoT, the company aims to streamline processes, enhance efficiency, and provide better services. This digital focus is crucial for adapting to the rapidly changing market and maintaining a leadership position in the industry.

The company is heavily invested in developing sustainable products like ECOPact and ECOPlanet. These products help reduce the carbon footprint of construction projects.

Digitalization includes using advanced analytics, AI, and IoT to improve operations and customer experience. This includes digitalizing the supply chain and optimizing production processes.

The company is making strides in carbon capture, utilization, and storage (CCUS) technologies. Projects like the 'Carbon2Business' initiative aim to capture significant amounts of CO2 annually.

AI-powered solutions are deployed to improve energy efficiency in cement plants. Drone technology is used for quarry management.

ECOPact is available in 27 countries and ECOPlanet in 40 countries, demonstrating a global reach.

These innovations contribute to growth by creating new revenue streams, enhancing operational efficiency, and strengthening the company's position in the net-zero built environment.

The company's strategic initiatives include a strong focus on sustainable construction and digital transformation. These initiatives are supported by significant investments in R&D and strategic partnerships.

- Development and scaling of low-carbon products like ECOPact and ECOPlanet.

- Implementation of AI and IoT for operational optimization and customer engagement.

- Carbon capture projects to reduce environmental impact.

- Use of drone technology for efficient quarry management.

- Expansion of sustainable product offerings across global markets.

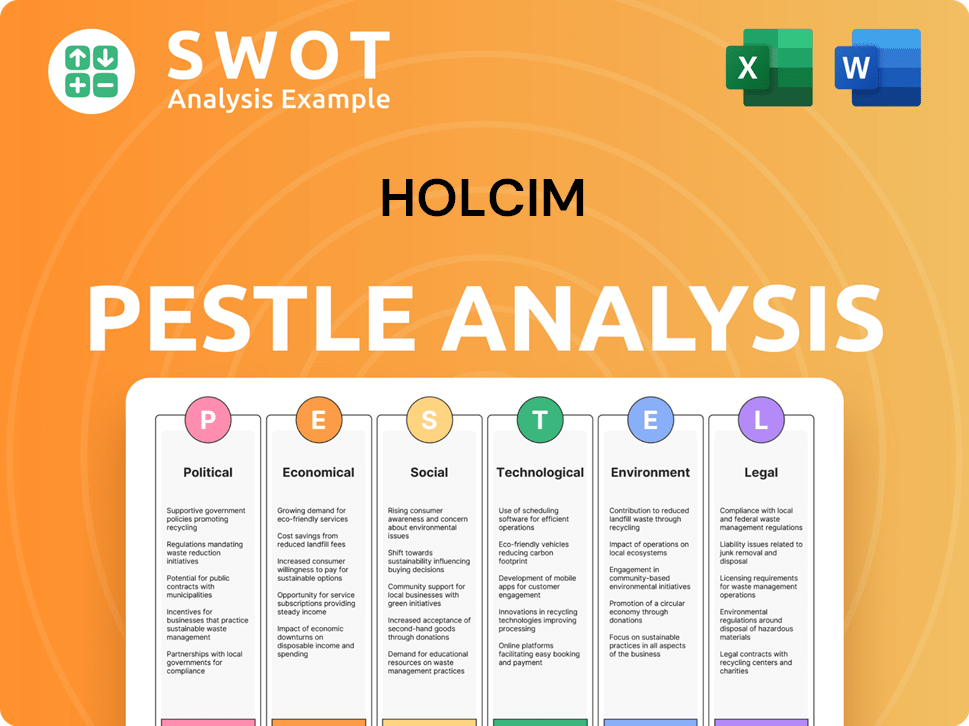

Holcim PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Holcim’s Growth Forecast?

The financial outlook for the company reflects a strategic shift towards higher-value, sustainable building solutions. The company's Holcim growth strategy is centered on optimizing its portfolio and reallocating capital. This approach is designed to enhance profit margins and provide more stable revenue streams, aligning with its long-term goals.

For 2024, the company anticipates like-for-like net sales growth of 4% to 6% and a recurring EBIT margin above 16%. The company is targeting an increase in recurring EBIT of more than 10% on a like-for-like basis for 2024. These projections are supported by a strong performance in 2023, where the company reported record net sales and recurring EBIT, demonstrating robust profitability despite challenging market conditions. This indicates a positive trajectory for the company's Holcim future prospects.

The company's strategic initiatives include divestments and a focus on the Solutions & Products segment. This segment is expected to contribute 30% of net sales by 2025. The company's commitment to returning value to shareholders is evident through its proposed dividend of CHF 2.80 per share for 2023, representing an increase from the previous year. For more insights into the Holcim business model, consider reading Revenue Streams & Business Model of Holcim.

In 2023, the company achieved record net sales of CHF 27,004 million. Recurring EBIT reached CHF 4,758 million, demonstrating strong profitability. These figures highlight the company's robust financial health and ability to perform well in various market conditions.

The company maintains a strong financial position with a net debt of CHF 8,767 million as of December 31, 2023. The net debt to recurring EBITDA ratio is 1.4x, indicating healthy leverage. This financial stability supports the company's strategic plans for sustainable growth.

The company proposed a dividend of CHF 2.80 per share for 2023, reflecting its commitment to returning value to shareholders. This increase from the previous year underscores the company's financial success and confidence in its future performance. This is a key indicator of Holcim investor relations and stock performance.

The company aims for like-for-like net sales growth of 4% to 6% in 2024. It also targets a recurring EBIT margin above 16% and an increase in recurring EBIT of more than 10% on a like-for-like basis. These targets demonstrate the company's ambition for sustained financial improvement.

The company's financial strategy focuses on sustainable building solutions and disciplined capital allocation. These are the key points:

- Record net sales in 2023: CHF 27,004 million.

- Recurring EBIT in 2023: CHF 4,758 million.

- Net debt to recurring EBITDA ratio: 1.4x.

- Dividend per share for 2023: CHF 2.80.

- Targeted net sales growth for 2024: 4% to 6%.

- Targeted recurring EBIT margin for 2024: above 16%.

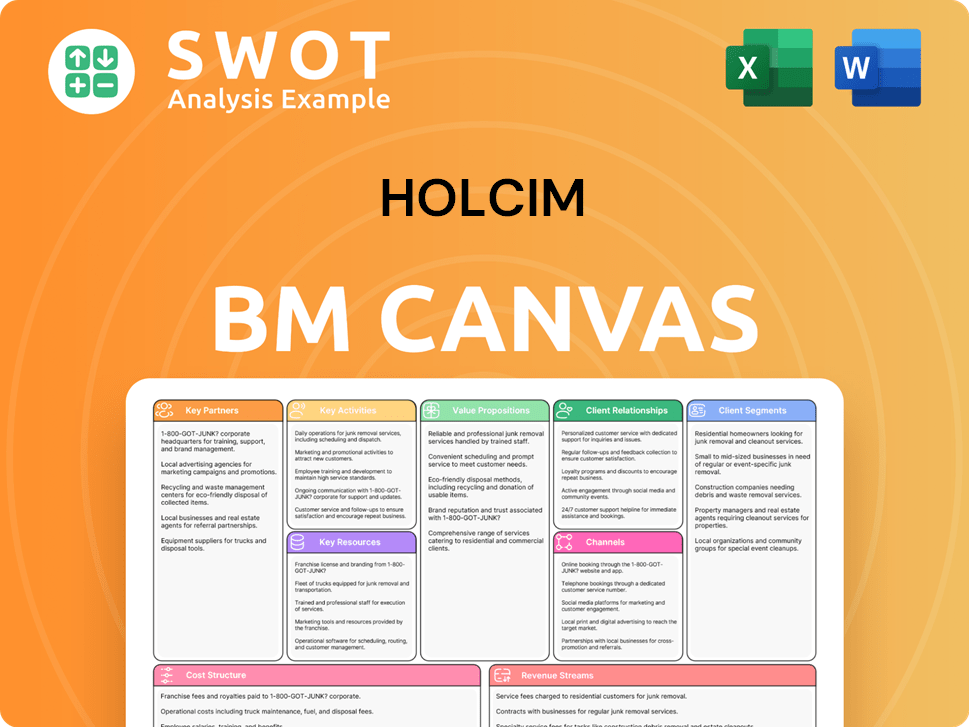

Holcim Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Holcim’s Growth?

The path to growth for Holcim faces several risks and obstacles that could impact its Holcim future prospects. These challenges range from intense market competition to the cyclical nature of the construction industry. The company must navigate these hurdles strategically to maintain its Holcim market position and achieve its long-term objectives.

Regulatory changes, especially those related to carbon emissions and environmental standards, present both opportunities and challenges for the company. Additionally, supply chain vulnerabilities and geopolitical instability add to the complexity of its global operations. Adapting to these evolving conditions is critical for Holcim company analysis and long-term success.

Holcim's growth strategy is also influenced by technological advancements and the increasing importance of ESG (Environmental, Social, and Governance) factors. The company must continuously innovate and adapt to maintain its competitive edge. Robust risk management and strategic planning are crucial to mitigate potential disruptions and ensure sustained financial performance.

The building materials sector is highly competitive, with numerous established players and new entrants. This competition can affect pricing and market share. The rise of sustainable building solutions adds another layer of complexity, requiring continuous innovation and adaptation.

Changes in environmental regulations, particularly regarding carbon emissions, can significantly impact operations. While these regulations can drive innovation, they may also increase compliance costs. Stringent standards necessitate significant capital investments for plant upgrades to meet new requirements.

The construction industry is inherently cyclical, with demand fluctuating based on economic conditions. Economic downturns can directly impact the demand for building materials, affecting revenue and profitability. This requires careful financial planning and flexibility in operations.

Disruptions in the supply chain, including raw material shortages or transportation issues, can impede production and delivery. Geopolitical instability and trade protectionism further complicate supply chain management. A resilient supply chain is crucial for maintaining operations.

The rapid pace of technological change requires continuous investment in research and development. Failure to innovate can lead to disruption from new materials or construction methods. Holcim must stay at the forefront of innovation to maintain its competitive edge.

Increasing scrutiny of ESG performance can impact investor sentiment and access to capital. Effective management of environmental, social, and governance factors is essential for long-term success. Strong ESG performance is increasingly important for attracting investment.

Holcim mitigates these risks through portfolio diversification, with emphasis on its Solutions & Products segment for more stable revenue streams. The company employs robust risk management frameworks, including scenario planning, to assess and prepare for potential disruptions. For instance, during global crises, Holcim has adapted its supply chain, leveraging its global network to minimize disruptions. This also involves investment in Holcim sustainable construction strategy and Holcim innovation in green building materials.

To understand the Holcim financial performance, it's useful to examine recent data. In 2024, Holcim reported strong financial results, driven by its focus on sustainable solutions and operational efficiency. The company’s strategic initiatives, including investments in green building materials and digital transformation, are expected to contribute to its Holcim long term growth strategy. For a detailed analysis, refer to the Holcim investor relations and stock performance data.

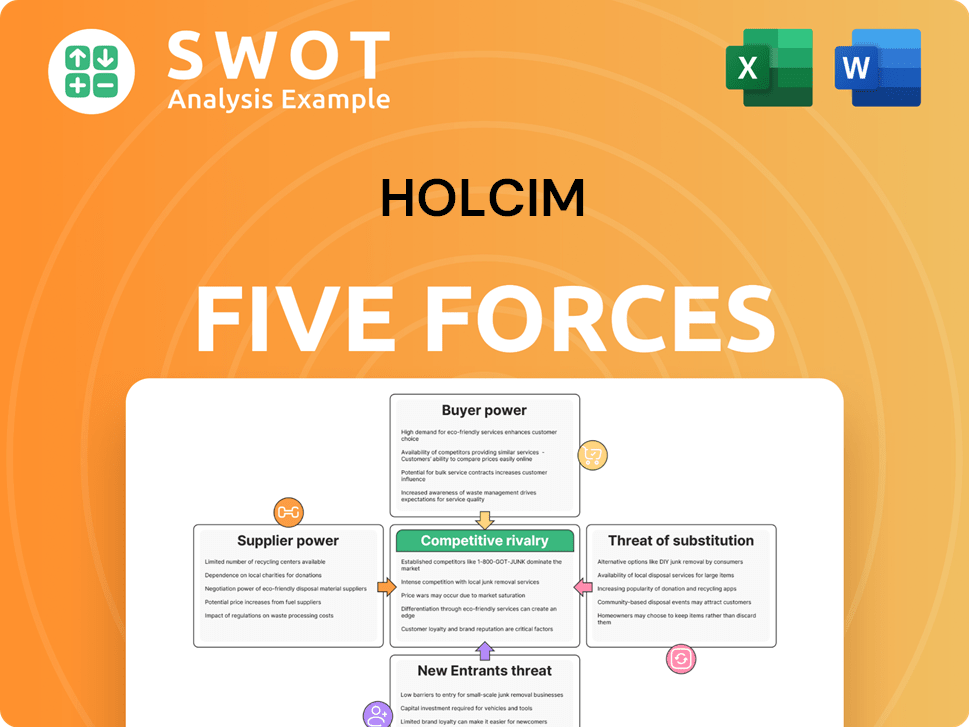

Holcim Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Holcim Company?

- What is Competitive Landscape of Holcim Company?

- How Does Holcim Company Work?

- What is Sales and Marketing Strategy of Holcim Company?

- What is Brief History of Holcim Company?

- Who Owns Holcim Company?

- What is Customer Demographics and Target Market of Holcim Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.